Executive Summury

Harmonization of the rules relating to company law and corporate governance, as well as to accounting and auditing, is essential for creating a Single Market for Financial Services and products. In the fields of company law and corporate governance, objectives include: providing equivalent protection for shareholders and other parties concerned with companies; ensuring freedom of establishment for companies throughout the EU; fostering efficiency and competitiveness of business; promoting cross-border cooperation between companies in different Member States; and stimulating discussions between Member States on the modernization of company law and corporate governance. This report is a diagnostic assessment of the corporate governance regulations and practices in Bangladesh. The assessment is measured against international norms and current practices as recognized by the OECD Guidelines on Corporate Governance. The report identifies critical areas where institutions, regulations, or other economic factors in the corporate sector could be strengthened to improve corporate governance (CG). As such, the authors identify strengths and weaknesses of legal requirements, regulations, and corporate practices. To identify the current strengths and weaknesses, the authors drew heavily on a review of laws and a survey of businesses organisations carried out by the research team as well as a series of interviews with key stakeholders. This analysis will serve as a basis on which further study can build. In fact, this report comprises the first stage of a three-stage project; Stage 2 will frame detailed recommendations to strengthen corporate governance in Bangladesh and Stage 3 will formulate implementation strategies. The Companies Act 1994 (the Act) defines the rights of both majority and minority shareholders. Shareholders are not intended to, and do not in practice get involved in the day-to-day management of a company. However, the Act provides for certain supervisory functions to be undertaken by the shareholders in the form of these rights to attend meetings, appoint and remove directors and to obtain financial information as well as approve the balance sheet annually. The law also provides for various mechanisms for shareholders to enforce these rights, the principal among them being a suit for minority protection under Section 233 of the Act.

Lord justice lindley defines a company as follows: By a company is meant an association of many person who contribute money or money’s worth to a common stock and employ it for a common purpose. The common stock so contributed is denoted in money and is the capital of the company. The people who contribute it or to whom it belongs are member. The proportion of capital to which each member is entitled is his share

Company is a voluntary association of persons formed for the purpose of doing business having a distinct name and limited liability. It is a juristic person having a separate legal entity distinct from the members who constitute it, capable of rights and duties of its own and endowed with the potential of perpetual succession. The Companies Act, 1956, states that ‘company’ includes company formed and registered under the Act or an existing company i.e. a company formed or registered under any of the previous company laws.

However, company is not a citizen so as to claim fundamental rights granted to citizens.

A voluntary association formed and organized to carry on a business. Types of companies include sole proprietorship, partnership, limited liability, corporation, and public limited company.

A legal entity, allowed by legislation, which permits a group of people, as shareholders, to apply to the government for an independent organization to be created, which can then focus on pursuing set objectives, and empowered with legal rights which are usually only reserved for individuals, such as to sue and be sued, own property, hire employees or loan and borrow money.

INTRODUCTION

In this term paper we will discuss the dictum derived from Lord Halsbury’s judgement in Salomon v Salomon what are the pros and cons of the dictum, the reasoning why the House of Lords reached their conclusion reversing what the Court of Appeal said in relation to the agency point. The assessment of the limited liability doctrine which was originally intended to encourage passive investors to contribute to encourage trade and commerce, the most fundamental criticism to this doctrine, group of companies and when the court will lift the veil between the parent and its subsidiary .A mention must be made of shareholders as the owners of the company and creditors ’interest who lend the company money which directors have to take into consideration when they are conducting the affairs of the company.

Company

Definition

The term company is used to describe an association of a number of person , formed for some common purpose and registered according to the law relating to companies .Section 3(1)(i) of the companies act , 1994 states that a company means , A Company formed and registered under this actor an existing company.

Lord justice lindley defines a company as follows: By a company is meant an association of many person who contribute money or money’s worth to a common stock and employ it for a common purpose. The common stock so contributed is denoted in money and is the capital of the company. The people who contribute it or to whom it belongs are member. The proportion of capital to which each member is entitled is his share

Company is a voluntary association of persons formed for the purpose of doing business having a distinct name and limited liability. It is a juristic person having a separate legal entity distinct from the members who constitute it, capable of rights and duties of its own and endowed with the potential of perpetual succession. The Companies Act, 1956, states that ‘company’ includes company formed and registered under the Act or an existing company i.e. a company formed or registered under any of the previous company laws.

However, company is not a citizen so as to claim fundamental rights granted to citizens.

A voluntary association formed and organized to carry on a business. Types of companies include sole proprietorship, partnership, limited liability, corporation, and public limited company.

A legal entity, allowed by legislation, which permits a group of people, as shareholders, to apply to the government for an independent organization to be created, which can then focus on pursuing set objectives, and empowered with legal rights which are usually only reserved for individuals, such as to sue and be sued, own property, hire employees or loan and borrow money.

Essential features of a company

1. Registration:

A company comes into existence only after registration under the Companies Act. But a Statutory Corporation is formed and commence business as notified or stated in the Act and as passed in Legislature. In case of partnership, registration is not compulsory.

2. Voluntary Association:

A company is an association of many persons on a voluntary basis. Therefore a company is formed by the choice and consent of the members.

3. Legal Personality:

A company is regarded by law as a single person. It has a legal personality. This rule applies even in the case of “One-man Company.”

4. Contractual Capacity:

A shareholder of a company, in its individual capacity, cannot bind the company in any way. The shareholder of a company can enter into contract with the company and can be an employee of the company.

5. Management

A company is managed by the Board of Directors, whole time Directors, Managing Directors or Manager. These persons are selected in the manner provided by the Act and the Articles of Association of the company. A shareholder, as such, cannot participate in the management.

6. Capital

A company must have a capital, otherwise it cannot work.

7. Permanent Existence

The company has perpetual succession. The death or insolvency of a shareholder does not affect its existence. A company comes into end only when it is liquidated according to provision of the Companies Act.

8. Registered Office

A company must have a registered office.

9. Common Seal

A company must have a Common Seal. The company being an artificial person cannot sign its name on a contract. The common seal is used as a subsititute for its signature. The common seal bears the name and place of the company, and date of its incorporation engraved on it.

10. Limited Liability

The liabilities of shareholder of a company are usually limited. The creditors of a company are not creditors of individual shareholders and a decree obtained against a company cannot be executed against any shareholders. It can only be executed against the assets of the company.

11. Transferability

The shareholder of a company can transfer its share and ordinarily the transferee becomes a member of the company.

12. Statutory Obligations

A company is required to comply with various statutory obligations regarding management, e.g., filing balance sheets, maintaining proper account books and registers etc.

13. Not a Citizen

A company is an artificial person, not a natural person. Therefore a company is not a citizen, although it may have a Domicile

14. Residence

A company has a residence (for taxation and other purpose). A company does not posses any fundamental rights.

15. Social Objective

The present view as regard the legal nature of Company Law is that the Company is a social institution having duties and responsibilities toward the community, its workers, the national economy and progress.

16. Centrally Administrated

The administration of company Law is entrusted to the Central Government.

Types of company

There are two types of companies –

- Private Limited Company

2. Public Limited Company

Private Limited Company

Section 3(1) (iii) defines a private company as one which:-

a) has a minimum paid-up share capital of Rs.1 Lakh or such higher capital as may be prescribed; and

(b) by its Articles Association:

1. restricts the right of transfer of its share;

limits the number of its members to 50 which will not include:-

A. members who are employees of the company; and

B. members who are ex-employees of the company and were members while in such employment and who have continued to be members after ceasing to be employees;

3.prohibits any invitation to the public to subscribe for any shares or debentures of the company; and

4. Prohibits any invitation or acceptance of deposits from persons other than its members, directors or their relatives.

This goes to say that a private company, in addition to the earlier conditions, shall have a minimum paid-up share capital of Rupees One Lakh or such higher capital as may be prescribed and its Articles shall prohibit invitation or acceptance of deposits from persons other than its members, directors or their relatives. In case of such companies, public interest is not involved.

The basic characteristics of a private company in terms of section 3(1)(iii) of the Act do not get altered just because it is a subsidiary of a public company in view of the fiction in terms of section 3(1)(iv)(c) of the Act that it is a public company. May be it is a public company in relation to other provisions of the Act but not with reference to its basic characteristics. In terms of that section, a company is a private company when its articles restrict the right of transfer of shares, restrict its membership to 50 (other than employees shareholders) and prohibits invitation to public to subscribe to its shares. Therefore, all the provisions in the articles to maintain the basic characteristics of a private company in terms of that section is restriction on the right to transfer and the same will apply even if a private company is a subsidiary of a public company.

Public Limited Company

… a decision was made to give the company a public limited status to …

The standard legal designation of a company which has offered shares to the general public and has limited liability. A Public Limited Company’s stock can be acquired by anyone and holders are only limited to potentially lose the amount paid for the shares. It is a legal form more commonly used in the U.K. Two or more people are required to form such a company, assuming it has a lawful purpose.

A company whose securities are traded on a stock exchange and can be bought and sold by anyone. Public companies are strictly regulated, and are required by law to publish their complete and true financial position so that investors can determine the true worth of its stock (shares). Also called publicly held company. Public limited company and its abbreviation Plc are commonly used in the UK in the way that corporation and Inc. is used in the United States.

The Company defined under section 3(1)(iv) of the Companies Act, 1956 is a public company which-

- is not a private company;

- has a minimum paid-up capital of Rs. 5 lakhs or such higher capital as may be prescribed;

- is a private company but subsidiary of a public company.

Memorandum of Association:

The Memorandum of Association is the constitution of the company and provides the foundation on which its structure is built. It is the principal document of the company and no company can be registered without the memorandum of association. It defines the scope of the company’s activities as well as its relation with the outside world.

According to Lord Macmillan, “The purpose of the memorandum is to enable the shareholder, creditors and those who deal with the company to know what is permitted range of enterprise.”

In the words of Charles Worth, “the memorandum of association is the company’s charter and defines the limitations of its powers. Its purpose is to enable shareholders; creditors and those who deal with the company, to know what its permitted range of enterprise is. It is the document which informs all persons dealing with the company, what the company is formed to do. How capital will it raise its nationality is? It regulates the company’s external affairs, while the articles of association regulate its internal affairs.” This is an exhaustive definition which explains the nature and scope of memorandum.

Section 2 (28) of the Companies Act defines a memorandum as “the memorandum of association of a company as originally framed or as altered from time to time in pursuance of any previous Company Law or of this Act.” The contents of the memorandum are explained in Section B of the Act.

Purpose

The main purpose of the memorandum is to explain the scope of activities of the company. The prospective shareholders know the areas where company will invest their money and the risk they are taking in investing the money. The outsiders will understand the limits of the working of the company and their dealings with it should remain within the prescribed scope.

Importance of Memorandum

Memorandum is the fundamental document of a company which contain conditions upon which the company is incorporated. This document is important for the following reasons.

- Memorandum defines the limitations on the powers of the company established under the Act.

- The whole structure of the company is built upon memorandum.

- It explains the scope of activities of the company. The investment knows where their money will be spent and outsiders also know the nature of activities the company is authorized to take up.

- It is a basic document of the company with regard to its constitution

- It is a charter of the company which sets out its written goals.

Clauses of Memorandum

The memorandum of association contains the following clauses:

The Name Clause

A company being a separate legal entity must have a name. A company may select any name which does not resemble the name of any other company and it should not contain the words like king, queen, emperor, government bodies and the names of world bodies like UNO, WHO, World Bank etc. The name should not be objectionable in the opinion of the government. The word ‘limited’ must be used at the end of the name of a Public and ‘Private Limited’ is used by a Private Company. These words are used to ensure that all persons dealing with the company should know that the liability of its members is limited. The name of the company must be painted outside every place where business of the company is carried on.

If the company has a name which is undesirable or resembles the name of any other existing company, this name can be changed by passing an ordinary resolution.

Registered Office Clause

Every company should have a registered office, the address of which should be communicated to the Registrar of Companies. This helps the Registrar to have correspondence with the company. The place of registered office can be intimated to the Registrar within 30 days of incorporation or commencement of business, whichever is earlier.

A company can shift its registered office from one play to another n the same town with intimation to the Register. But if the company wants to shift its registered office from one town to another town in the same state, a special resolution is required to be passed. If the office is to be shifted from one state to another state it involves alteration in the memorandum.

Object Clause

This is one of the important clauses of the Memorandum of Association. It determines the rights and powers of the company and also defines its sphere of activities. The object clause should decide carefully because it is difficult to alter this clause later on. No activity can be taken up by the company which is not mentioned in the object clause Moreover, the investors i.e., shareholders will not mentioned in the object clause. Moreover, the investors i.e., shareholders will know the sphere of activities which the company can undertake. The choice of the object

clause lies with the subscribers to the memorandum. They are free to add anything to it provided it is not contrary to the provisions of the Companies Act and other laws of the land.

The Companies (Amendment) Act 1965 requires that in cause of companies formed after this amendment, the memorandum must state separately (a) main objects, and (b) other objects. Main objects will include objects to be pursued by the company on incorporation and objects incidental or ancillary to the attainment of the main objects. Other objects will include all other objects which are not included in the main objects.

The object clause offers protection to the shareholders by ensuring that the funds raised for the undertaking are not going to be risked in any other undertaking. The creditors also feel protected by this clause. By confining the activities within a specified field, it serves the public interest also.

The object clause can be changed to enable a company to carry on its activities more economically, or by improved means to carry on some business which under existing circumstances may conveniently by combined with the object clause.

Liability Clause

This clause states that the liability of the members is limited to the value of shares held by them. It means that the memes will be liable to pay only the unpaid balance of their shares. The liability of the members may be limited by guarantee. It also states the amount which every member will undertake to contribute to the assets of the company in the event of its winding up.

Capital Clause

The clause states the total capital of the proposed company. The division of capital into equity share capital and preference share capital should also be mentioned. The number of shares in each category and their value should be given. If some special rights and privileges are conferred on any type of shareholders, mention may also be made in the clause to enable the public to know the exact nature of capital structure of the company.

Association Clause

This clause contains the names of signatories to the memorandum of association. The memorandum must be singed by at least seven persons in the cause of public limited company and by at least two persons in the case of private limited company. Each subscriber must take at least one share in the company. The subscribers declare that they agree to incorporate the company and agree to take the shares stated against their names. The signatures of subscriber are attested by at least one witness each. The full addresses and occupations of subscribers and the witnesses are also given.

Alteration of a Memorandum of Association

Memorandum of Association is a basic document of the company. Any change in various clauses of memorandum may have an adverse effect on any of the parties connected with the company. Company Law has prescribed a particular procedure for making a change in the memorandum. The procedure provided for different clauses varies. The following procedure is followed for carrying out a change in the memorandum:

Name clause (Section 25)

the Central government. If the company is registered with an undesirable name then it can change it with an ordinary resolution with the approval of the Central Government. The Central Government can also direct the comapny within 12 months of its registration to change its name and this will have to be done within three months. The change in name will be effective when it is resisted with the Registrar.

Registered Office (Section 17)

The change in registered office place from one state to another requires a change in memorandum. This change affects the interests of shareholders, investors, creditors, employees etc. This change can be affected only with the approval of Company Law Board. Earlier this power was vested with the court but the Company Law (Amended) Act, 1974 has transferred it to Company Law Board.

Object Clause (Section 17)

The object clause is the most important clause in the memorandum; its change may affect the activities of the company. This clause is a limitation on the company beyond which it cannot carry its activities. The object clause can be changed by passing a special resolution and by getting the permission of the Company Law Board. A copy of the resolution should be field with the Registrar within 30 days of passing the resolution. A petition is also made to the Company Law Board for issuing a confirmation. When this change is allowed by the Board, then printed copy of the Memorandum as altered must be field with the Registrar within three months of the order.

The change in situation and objects clause is allowed only under certain situations. It will be allowed when it necessary for any of the following reasons:

- The change is necessary to allow the company to carry on its business more economically or efficiently.

- The company will be able to attain its objectives by new and improved means.

- The company may enlarge the local area of its operations.

- The company is enabled by change to carry on some new business with convenience and advantage.

- To restrict or abandon any of the objects specified in the memorandum.

- To sell whole of part of the company’s property.

- To amalgamate with any other company or body of persons.

Liability clause:

If articles so permit, the liability of the Directors Managing Directors or Manager can be made unlimited by passing a special resolution. The officer concerned should also accord his consent for making the liability unlimited.

Capital Clause

A change in capital clause involving an increase in the authorized capital can affected by passing an ordinary resolution in the general Meeting.

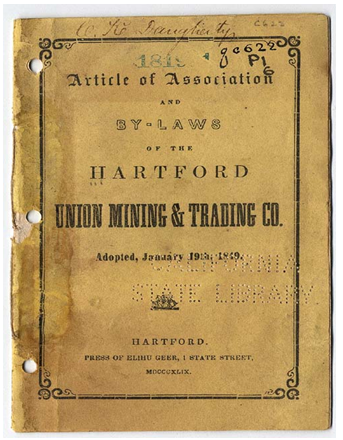

Article of Association

The rules and regulations which are framed of the internal management of the company are set out in a document named Articles of Association. The arties are framed to help the company in achieving its objectives set out in a memorandum of association. It is a supplementary document to the memorandum. According to Section 2(2) of the

Companies Act, “Articles of association of the company as originally framed or as altered from time to time in pursuance of any previous companies’ law or of this act.”

The private companies limited by shares, companies limited by guarantee and unlimited companies must have their articles of association. A public company limited by shares may or may not have its own Articles. As per Section 26 of Companies Act, it is not obligatory on the part of a public company limited by shares to prepare and register Articles of Association along with Memorandum of Association. However, such a company may adopt all or any of the regulations contained in the model set of Articles given in table A in the Schedule I of the Act. It means the company can partly frame it sown articles and partly incorporate some of the regulations in Table A. Unless the company prepares its own articles then regulations of Table A shall be applicable in the same manner as if they were contained in its own registered articles.

The articles cannot contain anything contrary to the Companies Act and also to the memorandum of association. If the document contains anything contrary to the Companies Act or memorandum, it will be inoperative. When articles are proposed to be registered, they must be printed, divided into paragraphs and numbered consecutively. Each subscriber to the memorandum must sign the articles in the presence of at least one witness.

- The nature of Articles may be explained as follows:

- Articles of association are subordinate to memorandum of association.

- The articles are controlled by memorandum.

- Articles help in achieving the objectives laid down in the memorandum.

- Articles are only internal regulation over which members exercise control.

- Articles lay down the regulations of governance of the company.

Contents

Some of the contents of articles of association are follows:

- The amount of share capital issued, different types of shares, calls on shares, forfeiture of shares, transfer and transmission of share and rights and privileges of different categories of shareholders.

- Powers to alter as well as reduce share capital.

- The appointment of directors, powers, duties and their remuneration.

- The appointment of manager, managing director, etc.

- The procedure for holding and conducting of various meetings.

- Matters relating to maintaining of accounts, declaration of dividends and keeping of reserves, etc.

- Procedure for winding up the company.

Alteration of Articles of Association

- The articles of association can be altered by assign a special resolution. Certain restrictions are imposed on the nature and extent of the alternation that may be made.

- The change should not be violating the provisions of the Companies Act.

- It should not be contrary to the provisions of the memorandum of association.

- The alteration must not have anything illegal.

- The alteration should not adversely affect the minority shareholders.

Prospectus of a Company

Prospectus

Prospectus

After the receipt of certificate of incorporation, if the promoters of a public limited company wishes to issue shares to the public, he will issue a document called prospectus. It is an invitation to the public to subscribe to the share capital of the company. The companies Act, 1956 defines prospectus as any document described or issued as a prospectus and include any notice, circular, advertisement or other documents inviting deposits from the public or inviting offer from the public for the subscription of shares. It is circulated among the public in printed pamphlets.

It gives all necessary information about the company so that the prospective shareholders may fully understand the objectives and the plans of the company.

… or a published prospectus. 148 companies listed on the Frankfurt Stock …

After getting the company incorporated, promoters will raise finances. The public is invited to purchase s A document containing detailed information about the company and an invitation to the public subscribing to the share capital and debentures is issued. This document is called ‘prospectuses. Private companies cannot issue a prospectus because they are strictly prohibited from inviting the public to subscribe to their shares. Only public companies can issue a prospectus. Section 2 (36) of the Companies Act defines prospectus as, “A prospectus means any document described or issued as prospectus and includes any notice, circular, advertisement or other documents invent deposits from public or inviting offers from the public for the subscription or purchase of any shares in or debentures of a body corporate.”

The prospectus is not an offer in the contractual sense but only an invitation to offer. A document constructed to be a prospectus should be issued to the public. A prospectus should have the following essentials.

- There must be an invitation offering to the public.

- The invitation must be made on behalf of the company or intended company.

- The invitation must to be subscribed or purchase.

- The invitation must relate to shares or debentures.

A prospectus must be field with the Registrar of companies before it is issued to the public. The issue of prospectus is essential when the company wishes the public to purchase its shares or debentures.

If the promoters are confident of obtaining the required capital through private contacts, even a public company may not issue a prospectus. The promoters prepare a draft prospectus containing required information and this document is known as ‘a statement is lieu of prospectus.’ A prospectus duly dated and signed by all the directors should be field with Register of Company before it is issued to the public.

A prospectus brings to the notice of the public that a new company has been formed. The company tries to convince the public that it offers best opportunity for their investment. A prospectus outlines a detail the terms and conditions on which the shares or debentures have been offered to the public. Every prospectus contains an application from on which an intending investor can apply for the purchase of shares or debentures. A company must get minimum subscription within 120 days from the issue of prospectus. If it fails to obtain minimum subscription from the members of the public within the specified period, then the amount already received from public is returned. The company cannot get a certificate of commencement of business because the public is not interested in that company.

Contents

The following important matter are included in the prospectus:

- The prospectus contains the main objectives of the company, the name and addresses of the signatories of the memorandum of association and the number of shares held by them.

- The name, addresses and occupation of directors and managing directors.

- The number and classes of shares and debentures issued.

- The qualification share of directors and the interest of directors for the promotion of company.

- The number, description and the document of shares or debentures which within the two preceding years have been agreed to be issed other than cash.

- The name and addresses of the vendors of any property acquired by the company and the amount paid or to be paid.

- particulars about the directors, secretaries and the treasures and their remuneration.

- The amount for the minimum subscription.

- If the company carrying on business, the length of time of such businesses.

- The estimated amount of preliminary expenses.

- Name and address of the auditors, bankers and solicitors of the company.

- Time and place where copies of balance sheets, profits and loss account and the auditors report may be inspected.

- The auditor’s report so submitted must deal with the profit and loss of the company for each year of five financial years immediately preceding the issue of prospectus.

- If any profit or reserve has been capitalized, the particulars of such capitalization will be stated in the prospectus.

- Name and full address of the company.

- Full particulars about the signatories to the memorandum of association and the number of shares taken up by them.

- The number and classes of shares. The interest of shareholders in the property and profits of the company.

- Name, address and occupations of members of the Board of Directors or proposed Directors.

- The minimum subscription fixed by promoters after taking into account all financial requirements at the beginning.

- If the company acquires any property from vendors, their full particulars are to be given.

- The full address of underwriters, if any, and the opinion of directors that the underwriters have sufficient resources to meet their obligations.

- The time of opening of the subscription list.

- The nature and extent of interest of every promoter in the promotion of the company.

- The amount payable on application, allotment and calls.

- The particulars of preferential treatment given to any person for subscribing shares or debentures.

- Particulars about reserves and surpluses.

- The amount of preliminary expenses.

- The name and address of the auditor.

- Particulars regarding voting rights at the meeting of the company.

- A report by the auditors regarding the profits and losses of the company.

- These are some of the contents which every prospectus must include. The prospectus is an advertisement of the company, so the company may give any information which promotes its interest. Any information given in the prospectus must be true, otherwise the subscribe can beheld guilty for misrepresentation.

Statement in Lieu of Prospectus

A public company raises its capital from the public and it issues prospectus for this purpose. Sometimes, the promoters of a company decide not to approach the public for raising necessary capital. They are hopeful of raising funds from the friends and relations or through underwriters. In that case a prospectus need not be issued but a Statement in Lieu of Prospectus must be field with the registrar at least three days before the first allotment of shares. Such a statement must be singed by every person who is named therein as a director or proposed director of the company. This statement will be drafted strictly in accordance with the particulars set out in a part I of Schedule III of the Act.

General Meetings 1994

General meetings of a company are the fora where shareholders can raise their concerns and make their influence felt over the management of a company. A company must hold at least one general meeting of its shareholders, normally called the annual general meeting (AGM), in every calendar year. If an AGM is not duly called, then the RJSC or the Court may authorize the holding of the meeting out of time. In some circumstances, holders of at least 10% of the shares of a company can require an extraordinary general meeting to be called and held.

For a general meeting (AGM or EGM) to be valid all members of the company must be served with the notice of the meeting. The location of the meeting is decided by the directors, but should normally be at the registered office of the company, so that all the books and records are at hand. In Bangladesh, space constraints mean that general meetings are often held other than in the registered office of the company.

The quorum requisite is generally provided in the articles. There are usually no veto provisions regarding company meetings. Unless otherwise specified in the Act or the articles, decisions are by a simplemajority.

In an AGM, the agenda must include the following items, and may include other items as necessary:

• Approval of the annual report and audited accounts of the company

• Appointment of auditors

• Resignation by rotation and appointment of directors (as required)

Special majorities of three-fourths of the shareholders present and voting are required for passing special and extraordinary resolutions. These special majorities give a measure of protection to shareholders, particularly in widely held companies, in that there is a lower possibility of decisions being forced through by brute majority.

A special resolution is required for the following reasons, among others:

• To change provisions of the objects clause of the memorandum of the company

• To alter or add to the articles of association of the company

• To reduce share capital

• To reserve capital

• To remove a director from office

• To remove an auditor before the expiry of his term

• On winding up through the Court

An extraordinary resolution is required for the following reasons

Conclusion

As is documented in this report, failings in institutions, government agencies, legal enforcement, and market behaviour have resulted in weak corporate governance in Bangladesh. The report is designed as a diagnostic tool from which a consensus will emerge regarding the way forward for Bangladesh. The authors hope that this report will start a dialogue amongst stakeholders about specific measures that can be taken to improve the transparency and accountability of the corporate sector and streng then institutional support for good corporate governance. At this stage, only very broad recommendations are

Provided, identifying institutions or sectors that should be studied further. Specific recommendations will

Be framed in subsequent stages of this project.

Corporate Governance is a term that describes the interaction of government regulators, shareholders,

Boards of directors, independent observers, auditors, accountants and managers to provide quality

Information to shareholders, the market, and society at large. Each stakeholder plays an important part to

Creating an environment where transparency and accountability are encouraged, enforced, and rewarded.

For Bangladesh, the first step in strengthening the role of stakeholders in corporate governance is raising

Their awareness regarding these issues. This report attempts to start that process. For companies to have

Sufficient motivation to disclose information and improve governance practices, the relevant stakeholders

Must place a value on that information and there must be consequences for corporate governance

Practices.