Introduction:

Dutch-Bangla Bank Limited (the Bank) is a scheduled commercial bank. The Bank was established under the Bank Companies Act 1991 and incorporated as a public limited company under the Companies Act 1994 in Bangladesh with the primary objective to carry on all kinds of banking business in Bangladesh. The Bank is listed with Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited.

DBBL- a Bangladesh European private joint venture scheduled commercial bank commenced formal operation from June 3, 1996.

Mission:

Dutch-Bangla Bank engineers enterprise and creativity in business and industry with a commitment to social responsibility. “Profits alone” do not hold a central focus in the Bank’s operation; because “man does not live by bread and butter alone”

Vision

Dutch-Bangla Bank dreams of better Bangladesh, where arts and letters, sports and athletics, music and entertainment, science and education, health and hygiene, clean and pollution free environment and above all a society based on morality and ethics make all our lives worth living. DBBL’s essence and ethos rest on a cosmos of creativity and the marvel-magic of a charmed life that abounds with spirit of life and adventures that contributes towards human development

Core Objectives

Dutch-Bangla Bank believes in its uncompromising commitment to fulfill its customer needs and satisfaction and to become their first choice in banking. Taking cue from its pool esteemed clientele, Dutch-Bangla Bank intends to pave the way for a new era in banking that upholds and epitomizes its vaunted marques “Your Trusted Partner”.

Dutch

Theory aspect of Ethics and Business Ethics

Ethics:

- A Branches of philosophy

- Deals fundamentally with the rules of Human Conduct from Moral point of view ( Whether it is in Business, politics or private life)

- Explains why some behavior is morally good or praise worthy and why another behavior.

Philosophy:

Different Meanings of Philosophy

i.Philosophy is a Love of knowledge. Two Greek words “philos” , “Sophia”

‘Philos’-love & ‘sophia’- knowledge. So philosophy is a love of knowledge.

ii. Philosophy is an activity.

- A mental activity of thinking about life.

- Not a panacea for the problems for the men but emerges out of life.

iii. Philosophy is a comprehensive picture of the universe.

- Offer an organized and systematic knowledge of the universes.

- Science of all science.

iv. Philosophy is guide.

- Offers a design for living.

Examples: Muslim philosophy, Hindu philosophy, Buddhism, etc

Philosophy practice in Dutch Bangla Bank Limited

Moral perspective:

There are many moral philosophies & each one is complex. The most common and basic concepts & philosophies win be discussed which are needed to help one understand the ethical decision making process in Dutch Bangla Bank Limited in Bangladesh.

The different types of moral philosophies:

The Dutch Bangla Bank Limited follows the three types of moral philosophies such as –

- Teleology

- Deontology

- Relativist

Teleology:

It refers to moral philosophies in which an act is ~6i~dered morally right or acceptable if it produces some desired results for example pleasure, knowledge, career growth, realization of self- interest, or utility. It assess the moral worth of behavior by looking at its consequences. It refers to those theories as consequentially. The two most important teleology philosophies that often guide decision making in business are Egoism and Utilitarianism.

Egoism:

It defined right or acceptable actions or behavior as those that maximize a particular persons self interest as defined by individually of Dutch Bangla Bank Limited.

Utilitarianism:

It as defines right or acceptable actions behavior as those that maximize total utility or the greatest good for the greatest number of people.

Deontology:

It refers to moral philosophies that focus on right of individual & on the intentions which are associated with a particular behavior rather than on its consequences. The fundamental to Deontological theory is the idea that equal respects most be given to all persons. The Deontologists believe that there are something which one should not do even if it maximizes the utility. Deontological philosophies regard certain behaviors as inherently right and the determination of rightness focuses on the individual actor not society, thus these perspectives are sometimes referred to as non-consequential, ethical formalism, and the ethics of resects for persons.

Relativist perspective:

It evaluates ethicalness subjectively on the basis of individual & group experiences. The relativist uses themselves or the people around as their basis for defining ethical standards.

The relativist observes the action of members of some relevant group and attempts to determine the group consensus on a given behavior.

Business Ethics:

The concept has come to mean various things to various people, but generally its coming to know what it right or wrong in the workplaces and doing what right this is in regard to effects of products or services and in relationships with stakeholders. Business ethics is now a management discipline. Business ethics has come to be considered a management discipline, especially since the birth of the social responsibility movement in the 1960s.

Business ethics is a form of the art of applied ethics that examines ethical rules and principles with in commercial context, the various moral or ethical problems that can arise in a business setting any special duties or obligation that apply to persons who are engaged in commerce.

Business ethics has two board areas one is, Managerial mischief and other is Moral mazes.

Managerial mischief:

It includes “illegal, unethical, or questionable practices of individual managers or organizations, as well as the cause of such behaviors and remedies to eradicate them”. There has been a great deal written about managerial mischief, leading many to believe that business ethics is merely a matter of preaching the basics of what is right or wrong. More often, through business ethics is matter of dealing with dilemmas that have no clear indication of what is right or wrong.

Moral mazes:

The other broad area of business ethics is moral mazes of management and includes the numerous ethical problems that managers must deal with on a daily basis such as potential conflicts of interest, wrongful use of resources mismanagement of contract and agreement etc.

Ethics, Etiquette and Morality:

The terms ethics, etiquette and morality have been widely used in the study of business ethics. There are two extremes of thinking in this regard. One school suggests there is hardly any difference between hems. Another extreme is of the opinion that they are not synonymous in the applied sense of the term. We now discuss their differences.

Garret Thomas says that ethics is concerned primarily with the relationship of business goals and objectives to specifically human ends. It studies the implications of acts on the goods on the individuals, the firms, the business community and the society. Thus business ethics studies the special obligations which a man accepts when he becomes a part of business. For example, philosophical, ethics, religious ethics, social ethics, business ethics and above all normative and professional ethics.

Morality on the other hand, is concerned with establishing and maintaining relationship amoung employers and employees, producers, clients and competitors, firms and government and so on. Some say that morality is a term used to cover those practices that are considered right or wrong. It also refers to the understanding of value that are embedded, fostered and pursed by those practices. The means, morality teaches how human treat each other to promote welfare, growth and development. Examples of common morality include respect for others, mutual assistance, restraint on arming others, mutual cooperation team, spirit, fraternity, fellow feeling and the like.

Finally etiquette refers to any special code of behavior or courtesy in our society. For example, it is considered bad etiquette to talk loudly in front of seniors. Also it is thought of good to respond someone’s help by saying “Dhonnobad”. Good business etiquette typically calls writing follow up letters after meetings, returning phone calls and dressing in official attire.

Corporate Social Responsibility

Corporate social responsibility in business refers to an organization, to obligation to maximize its positive impact on society and to minimize its negative impact.

Carroll’s pyramid of corporate social responsibility:

The Dutch Bangla Bank is following the Carroll’s pyramid of corporate social responsibility. This pyramid is following:

PHILANTHROPIC Responsibilities Be good corporate citizen Contribute resource To the community; Improve quality of life |

ETHICAL Responsibilities Be ethical Obligation to do what is right; just & fair Avoid harm |

LEGAL Responsibilities Obey the law Law is society’s codification of right or wrong Play by the rules of the game |

ECONOMIC Responsibilities Be profitable The foundation upon which all others rest

|

Source: Archie B. Carroll “the pyramid of corporate social responsibility” Towards the moral management of organ stakeholders” Business Horizons, July-Aug, 1991.

3. Profiles of Dutch Bank Limited:

3. A) Management Aspects:

Name | Designation | Division |

Mr. Md. Yeasin Ali | Managing Director | |

Mr. A. H. M. Nazmul Quadir | Additional Managing Director | |

Mr.K. Shamsi Tabrez | Deputy Managing Director (Administration) | |

Mr. Ghulam Kabir | Deputy Managing Director (Operation) | |

Mr. Muhammad Shahidul Islam | Senior Executive Vice President | Credit Division |

Mr. Abul Kashem Md. Shirin | Senior Executive Vice President | Information Technology Division |

Mr. Khan Tariqul Islam | Senior Executive Vice President | Accounts Division |

Mr. Khan Tariqul Islam | Company Secretary | Board Secretariat |

Mr. Ali Ahmed Dewan | Executive Vice President | Credit Monitoring & Recovery Division |

Mr. Ali Ahmed Dewan | Executive Vice President | General Service Division |

Mr. Moyen Uddin Ahmed | Executive Vice President | Card Division |

Mr. A. K. M. Shah Alam | Senior Vice President | Marketing & Development Division |

Mr. A. K. M. Shah Alam | Senior Vice President | Treasury Division (Front Office) |

Mr. Abul Munim Khan | Senior Vice President | Corporate Banking Division |

Mr. Iqbal Amin | Senior Vice President | Credit Administration Division |

Mr. Md. Shams-uddin Ahmed | Senior Vice President | Human Resource Division |

Mr. Md. Harun Azad | Senior Vice President | Internal Control & Compliance Division |

Mr. Md. Kamruzzaman | Vice President | Retail Banking Division |

Mr. Hossain Akhtar Chowdhury | Vice President | International Division (Treasury Back Office) |

3. B) Financial Aspects:

Working capital financing requirements

Types of loan facilities under corporate banking facilities are as follows

1. Credit line

2. Invoice Finance

3. Trade finance

4. Overdraft facilities

5. Account facilities

6. Multiproduct loan facility

7. Loans for checks submitted for collection, for payment orders & discounting of promissory notes.

8. Loans for (pre) financing exports

9. Agricultural loans

Term loans

1. Commercial Mortgage

2. Fixed Rate Loans

Equity Financing

Structured Finance

1. Debt venture

2. Leveraged Finance

3. Project & export finance

4. Energy 5. Housing finance

6. Infrastructure

7. Mining and Metals

8. Syndications

Corporate & Institutional Services

1. Credit Research

2. Long term Instruments

3. Money markets operations

4. Research

Trade services

1. Purchase

2. Guarantees

3. Letters of Credit

Large Corporate Groups who wish to centralize the management of capital, who has a strong demand in real-time consistency between corporate financial information and Bank’s account, who place importance in working efficiency and have installed financial software system. Our lending solutions are customized to cover the financing gaps of the companies thus enabling them to have the necessary liquidity to manage daily operations or to complete their investment plans

3.C) Marketing Aspect

DBBL’s ATM:

You can find DBBL ATMs beside your home, in your office premise, nearby market, kacha bazar, university, college & school premises, Airport, Railway stations etc., throughout the country. All the ATMs can accept DBBL-NEXUS ATM / POS card, DBBL-Maestro/Cirrus Debit card and DBBL Credit card

- Account balance enquiry

- Cash withdrawal – 24 hours a day, 7 days a week, 365 days a year

- Cash deposit to a certain number of ATMs any time

- Mini statement printing

- Statement request

- PIN (Personal Identification Number) change

- Request for Cheeks Book

- Fund transfer within your own accounts

- Payment of mobile/T&T phone, Gas, Electricity, Water, Internet, Credit Card bills from your savings/current account

- Payment of School/College/University fees by debiting your savings/current account

Purchase of activation number for Mobile/ Internet pre-paid cards

Credit facility: DBBL Credit Card offers you free credit facility up-to 45 days & minimum 15 days without any interest,. You can also pay 8.33% of your billing amount or current dues every month and thus have the flexibility to plan your payments.

Saving Account: It is a sound saving for retail customer. We give the major facilities and services to out customer through 77 branches allover in Bangladesh with our skilled manpower. Minimum balance: Taka 5, 00/- Interest Rate: Yearly 5.50 % Current Deposit Account: Our current account meets the needs of individual and commercial customers through our schedule benefit. Minimum balance Taka 5, 00.00 Interest Rate: Nil Fixed Deposit Receipt:

Period of Scheme: Can be opened for a term of 1 month, 3 months, 6 months or 12 months. Installment size: Any handsome amount. Resident Foreign Currency Account: Specially designed foreign currency account for resident Bangladeshis .Offers wonderful opportunity to build a deposit base in foreign currency. Helps make payment for overseas commitments and dues like credit card bills, traveling expense etc.

Payment Mode: Entire financed amount along with interest and charges would be recovered by equal monthly installments.

Lease Deposit: A minimum deposit equivalent to 3 (three) months lease rentals is required which shall be refunded/adjusted on expiry of the lease term.

Insurance: Have to take insurance coverage on bank stipulated insured value for the entire lease term at own cost (Year to year basis).

Maintenance: Have to maintain the leased items in usable condition throughout the whole lease period at cost; and shall be solely responsible for any damage or loss although insurance will cover most of the abnormal risks.

Prompt Service: Process of appraisal and documentation is simple and faster as compared to those of other financial institutions, which ensure quicker disbursement.

Off-Balance Sheet Facility: can acquire the asset for use without recording the lease obligations as liability in books of accounts since the CBL owns the asset. This will improve financial performance as will be revealed from financial ratio analysis.

Tax Benefit: Organization will enjoy more tax benefits, as payments of lease rentals by are entirely revenue expenditure and thus deductible for tax purposes.

Sales Aid Device: If a Manufacturer/ Dealer, may utilize leasing as a sales promotion tool for achieving sales target.

On-line banking: All branches under online banking system will be able to do banking practices using a common server (which is centralized) from where only the branches will be able to enter using a common password.

Internet Banking: Any one including any client or any branch from any direction will be able to enter in the system to do banking transactions.

Internet Banking Services: Check account balance

Take print out of account statement for a particular period

Transfer fund within your own account

Make payment of mobile phone bill

Recharge your mobile phone as well as others from your account

Enquire foreign exchange rate

Enquire currency exchange rates.

Acquire information on all our products.

Every transaction report will be sent to client’s e-mail account.

Can change the password, pin code and respective mobile number (GP & City Cell).

SMS Push service: When any amount is debited or credited from client’s account then within 5-10 seconds he will get a message. The message includes the beginning balance, the amount debited or credited and the last balance. This facility is only available for Grameen Phone and City cell subscribers.

SMS Pull service: Every registered Grameen Phone and City cell subscribers can check their account balance through this service. They can get a mini statement of last five transactions of their account.

Monthly Benefit Plus

MB+ is a 5-year scheme that lets the customer earn monthly benefit of Tk. 850/- or its multiple by minimum initial deposit of Tk. 100,000 or its multiple. Features of this product are: MB+ is a 5-year scheme that lets the customer earn monthly benefit of Tk. 850/- or its multiple by minimum initial deposit of Tk. 100,000 or its multiple. Features of this product are:

One can start with the MB+ deposit scheme by depositing Tk. 100,000 initially or it’s multiple for 5 years and after maturity the deposited principal amount is refundable.

Monthly interest is transferred automatically to the Savings Account.

Deposit and monthly payment matrix

Ethical practice in Dutch Bangla Bank Limited:

The ethos of DBBL for pursuing its activities in social arena has got further momentum with your enthusiasm and support. Dutch-Bangla Bank Foundation (DBBF) is consistently pursuing its objective of being active in those social areas where it is needed most. The Foundation carries out diverse social and philanthropic activities in the field of education, health, conservation of nature, creation of social awareness, rehabilitation of distressed people and such other programs to redress human sufferings. It also promotes different socio-cultural and sports activities. Your Board of Directors in order to discharge its corporate social responsibilities in a greater perspective continued its contribution amounting to 5.00% of Bank’s profit after charging loan loss provision to Dutch-Bangla Bank Foundation (DBBF).

It is important that citizens of a society enjoy the full benefits that society offers. A society, in turn, flourishes when its citizen can contribute their fullest potential. The well-being of individuals is jeopardizing when normal developmental processes are interrupted by personal crisis, poverty, unemployment, poor health and inadequate education. Dutch-Bangla Bank Limited (DBBL) is the first Bangladeshi-European joint venture bank in Bangladesh addresses social concerns that threaten the structure of society and redress social conditions that adversely affect the well-being of people and society. DBBL practice thus encompass the professional activities of helping individuals, families, groups, organizations, and communities to enhance or restore their capacity for optimal social functioning and of .creating societal conditions favorable to this goal. Dutch-Bangla Bank Foundation (DBBF) was established on 3rd June, 2001 to perform humanitarian works like rehabilitation of the destitute and neglected portion of the society especially grassroots level poor in right track. Aim and objectives of DBBF are as bellow.

| Deposit amount (In Taka) | Monthly interest amount |

| 100,000 | 850 |

| 200,000 | 1700 |

| 300,000 | 2550 |

| 400,000 & onwards | 3400 & onwards |

| 100,000 | 850 |

Aim an Dutch-Bangla Bank Foundation has adopted various programs to make fruitful the aims and objectives

Health

Education

Information Technology

Disaster

Donation

Recognition for DBBL’s CSR

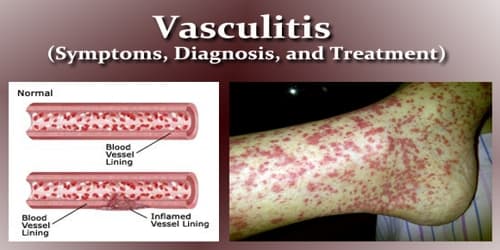

Health

DBBL distributes the Treatment Cards to 50 HIV/AIDS positive patients

HIV/AIDS Assistance ProgramSmile Brighter Program/Support to ACID & Dowry Victims

Vesico Vaginal Fistula (V.V.F) operation to improve women reproductive health

DBBL donates a DNA detection machine to Bangabandhu Sheikh Mujib Medical University

DBBL has donated an amount of Tk. 9.36 core to Diabetic Association of Bangladesh

DBBL stands by disabled and underprivileged children

DBBL has donated an Endoscope machine to National Medical College & Hospital

DBBL Smile-Brighter program starts in Dhaka City

DBBL provides medical supports to HIV/AIDS patients

DBBL has organized a 4 day-long plastic surgery operation in Faridpur

DBBL distributes the Treatment Cards to 50 HIV/AIDS positive patients

As a part of Corporate Social Responsibility, Dutch-Bangla Bank Limited has been extending medical facilities and other support to 50 HIV positive patients since 2004. In continuation of this program, DBBL organized a “Treatment Card” distribution program among the HIV positive patients on June11, 2007 in Hotel Purbani International, Dilkusha, and Dhaka. Major General (Rtd.) Dr. ASM Matiur Rahman, Honorable Advisor, Ministry of Health & Social Welfare, Water Resources and Religious Affairs, Govt. of the People’s Republic of Bangladesh was present as the chief guest and distributed the Treatment Cards to 50 HIV/AIDS positive patients while Mr. Md. Yeasin Ali, Managing Director of the bank presided over the function. WProfessor Nazrul Islam, Head of Virology Department, Bangabandhu Sheikh Mujib Medical University (BSMMU) and Dr. Md. Shahzahan Biswas, Director General (Health Services), Health Directorate were present as special guests. Among others, Mr. K. S. Tabrez, Deputy Managing Director (Administration), Mr. Ghulam Kabir, Deputy Managing Director (Operation) and Senior Executives of the bank were also present at the function.

DBBL donates a DNA detection machine to Bangabandhu Sheikh Mujib Medical University:

Dutch-Bangla Bank Limited (DBBL) donated a DNA detection machine at a cost of Tk. 50.00 lack to Bangabandhu Sheikh Mujib Medical University for setting-up a Genetic Laboratory to prevent Thalassemia Syndrome in the country. The Chairman of Dutch-Bangla Bank Foundation Mr. M. Shahabuddin Ahmed unveiled the plaque of the Genetic Laboratory at Pediatric Hematology & Oncology Department of Bangabandhu Sheikh mujib Medical University on June 03, 2006.

DBBL has donated an amount of Tk. 9.36 core to Diabetic Association of Bangladesh

As a part of Corporate Social Responsibility, Dutch-BangIa Bank Limited has donated an amount of Tk. 9.36 core to Diabetic Association of Bangladesh Mr. M. Saifur Rahman, Honorable Minister for Finance & Planning, Government of the People’s Republic of Bangladesh was present as the Chief Guest and handed over the Letter of Commitment of DBBL to Professor A.K. Azad Khan, Secretary General of Diabetic Association of Bangladesh for modernization and expansion of lbrahim Cardiac Hospital & Research Institute at a simple ceremony held at Dhaka Sheraton Hotel on September 24, 2006. Dr. Salehuddin Ahmed, Governor, Bangladesh Bank and Md. Yeasin Ali, Managing Director of Dutch-Bangla Bank Limited were present at the function.

DBBL stands by disabled and underprivileged children

Dutch-Bangla Bank Limited has extended financial assistance amounting to Tk. 18.5 lack to 17 NGOs engaged in rehabilitation of the disabled children of Bangladesh. Mr. Md. Yeasin Ali, Managing Director of the bank handed over the payment orders to the representatives of the organizations at a simple ceremony held at the Bank’s Training Institute on June 05, 2006.

DBBL has donated an Endoscope machine to National Medical College & Hospital

Dutch-Bangla Bank Limited (DBBL) donated Tk. 15.00 lack for purchasing a Video Endoscope Machine to National Medical College & Hospital. Mayor of Dhaka City Corporation Mr. Sadek Hossain, MP, received a payment order of Tk. 15,00 lack in favor of National Medical College & Hospital from Mr. Md. Yeasin Ali, Managing Director of Dutch-Bangla Bank Limited at a simple ceremony held at National Medical college Hospital on June 10, 2006.

DBBL Smile-Brighter program starts in Dhaka City

Under the DBBL “Smile-Brighter” program, Dutch-Bangla Bank has organized a plastic surgery operation campaign at bank’s own cost in Dhaka City for the poor cleft-lipped boys and girls to bring back the endearing smile on their faces. The 4 day –long operation campaign started at South View Hospital at Mirpur of the city on June 11, 2006 and will continue till June 14, 2006. A plastic surgery team consisting of eight members headed by eminent plastic surgeon Dr. A. J. M. Salek has been conducting the operation.

DBBL provides medical supports to HIV/AIDS patients

Dutch-Bangla Bank Limited organized a program for providing medical supports to the HIV positive patients at Hotel Purbani International, Dilkusha, and Dhaka on June 22, 2006. Major General (Rtd.) Dr. ASM Motiur Rahman, Chairman, Technical Sub Committee, National AIDS Committee was present as the chief guest and distributed the Treatment Cards to 50 HIV/AIDS positive patients while Mr. Md. Yeasin Ali, Managing Director of the bank presided over of APON – a volunteer organization working with addicted street children of the country the function. Brother Ronald Drahozal, CSC, Executive director also spoke as Special Guest

DBBL has organized a 4 day-long plastic surgery operation in Faridpur

Under the DBBL Smile-Brighter Program, Dutch-BangIa Bank Limited organized a 4 day-Iong plastic surgery operation, during September 06 – 09, 2006 in Faridpur for the poor cleft-lipped boys and girls at the bank’s own cost to bring back enduring smile on their faces. The operations were performed at Faridpur Diabetic Association Hospital by a surgery team header by eminent plastic surgeon Prof Dr. A.J.M. Salek. Managing Director of the Bank Mr. Md Yeasin Ali and Medical Consultant of Dutch-Bangla Bank Limited Dr. Mozammel Hossain Khan are seen to visit two cleft-lipped patients just after operation.

Education

- DBBL has awarded scholarship to 200 meritorious and needy students

- Scholarship program for the meritorious and needy students

- Blind Education and Rehabilitation Organization (BERDO)

- DBBL donates books for Bangabandhu Sheikh Mujib Medical University

- DBBL has donated a Pick-up Van to Bangladesh Agricultural University

- DBBL has donated books for Dhaka University Central Library

- DBBL awards scholarships to the meritorious and needy Students

- International Mathematical Olympiad-2006

- DBBL has awarded scholarship to 200 meritorious and needy students

DBBL has awarded scholarship to 200 meritorious and needy students

Under the DBBL-Scholarship Program, Dutch-Bangla Bank Limited awarded scholarship to 200 meritorious and needy students including 10 physically challenged students who passed HSC Examination in 2006 and studying at graduate level in different universities/colleges of the country. Dr. A. B. Mirza Md. Azizul Islam, Honorable Adviser, Ministry of Finance, Planning, Commerce and Post & Telecommunication, Govt. of the People’s Republic of Bangladesh was present as the Chief Guest and gave away the Scholarship Awarding Letters to the recipients at a simple ceremony held at Osmani Memorial Auditorium, Dhaka on June 17, 2007. Mr. Md. Yeasin Ali, Managing Director of Dutch-Bangla Bank Limited presided over the function. The Chief Guest, Managing Director and Additional Managing Director Mr. AHM Nazmul Quadir are seen with the scholarship awardees in the picture.

DBBL donates books for Bangabandhu Sheikh Mujib Medical University

Dutch-Bangla Bank Limited (DBBL) donated Tk. 15.00 lack for purchasing academic reference books for Bangabandhu Sheikh Mujib Medical University (BSMMU). The Managing Director of Dutch-Bangla Bank Limited Mr. Md. Yeasin Ali handed over a payment order of Tk. 15.00 lack to Professor M. A. Hadi, Vice Chancellor of BSMMU held on June 8, 2006 at the latter’s office in a simple ceremony

DBBL has donated a Pick-up Van to Bangladesh Agricultural University

Dutch-Bangla Bank Limited has donated a Toyota Hi-Lux Pick-up Van to the Department of Crop Botany of Bangladesh Agricultural University (BAU). Mr. Md. Yeasin Ali, Managing Director of the bank handed over the Key of Pick-up van to Professor M. Amirul Islam, Vice Chancellor of BAU at a simple ceremony held at Bank’s Head Office, Dhaka on June 7, 2006.

DBBL has donated books for Dhaka University Central Library:

Under the DBBL-Scholarship Program, Dutch-Bangla Bank Limited awarded scholarship to 150 meritorious and needy students including 6 Blind students who passed HSC Examination in 2005 and studying at graduate level in different Universities/Colleges of the country. Dr. Fakhruddin Ahmed, Managing Director, Palli Karma Sahayok Foundation (PKSF) was present as the Chief Guest and gave away the

Scholarship Awarding Letters to the recipients at a simple ceremony held at Osmani Memorial Auditorium, Dhaka on June 27, 2006. Mr. Md. Yeasin Ali, Managing Director

Of Dutch-Bangla Bank Limited presided over the function.

International Mathematical Olympiad-2006

Dutch-Bangla Bank – Prothom Alo and Bangladesh Mathematical Olympiad (BMO) committee jointly organized the International Mathematical Olympiad-2006 on July 8, 2006. Managing Director of Dutch-Bangla Bank Md Yeasin Ali speaks at a reception ceremony for the Bangladesh team members who will take part in the 47th International Mathematical Olympiad. General Secretary of BMO committee Munir Hasan, Vice President Prof. Dr. Zafar Iqbal, Joint Editor of Prothom Alo Abdul Quaiyum and presents of the contestants were present on the occasion.

Information Technology

Dutch-Bangla Bank Limited (DBBL) undertakes a project with BASIS (Bangladesh Association of Software and Information Services) to award the best IT uses by Bangladeshi companies.

DBBL and BASIS organized IT award-giving ceremony in this regard. The award Ceremony was held on 30th November 2005, which was the day before last day of BASIS SOFfEXP02005 (November 27-December 01, 2005). This was a gala evening (with dinner and cultural program) attended by around 700 dignitaries including government high officials & policy makers, corporate heads, representatives from development agencies, IT policy makers, academicians and the IT industry members.

In this regards, DBBL’s contribution in supporting this event was 50% of the estimated cost with Tk. 6.25 Lac.

Disaster

DBBL has donated Tk. 25 lack for the victims of devastating landslides in Chittagong

Mr. Md. Yeasin Ali, Managing Director of the Bank handed over a Payment Order of Tk. 25.00 lack (Taka Twenty Five Lac) to the Honorable Adviser Major General (Rtd.) M. A. Matin at Chittagong Circuit House on June 13, 2007 for victims due to a devastating landslides following torrential rains lashed down in Chittagong city and its adjacent areas.

DBBL donates 130 bundles of GCI sheets to Noakhali District

Dutch-Bangla Bank Limited (DBBL) donated 130 bundles of GCI sheets worth Tk. 5.60 lack for rehabilitating the homeless people affected by river-erosion of Ramgoti Upazila under Noakhali District on August 14, 2005.

DBBL donates 700 bundles of high grade GCI sheets to Gaibandha and Rangpur districts

Dutch-Bangla Bank Limited donated 700 bundles of high grade GCI sheets worth of Tk. 29.00 lack for rehabilitating the standard people of the four Upazilas of Gaibandha and Rangpur districts. Dr. Mozammel Hossain Khan, Co-ordination, DBBL is seen handing over GCI sheets to Mr. Tapan Chandra Mazumdar, Deputy Commissioner of Gaibandha district.

Donation:

Donation to different organization

a. Tk.4 core for setting up a modem cancer hospital to Ahsania Mission Cancer Society. b. Tk.1 core for setting up a modern cancer hospital to Bangladesh Cancer Society.

c. Tk.1.20 core for setting up a pediatric hospital to provide service to low income people whose 30% will be free and rest will be at low cost.

d. Tk.90 lack to kidney foundation for setting up Operation Theater.

Beside this DBBF also provides financial aid with different organizations that engages relentlessly to work with destitute women and children. Very recently DBBF has donated Tk. 15, 00,000/= to Rotary Club of Metropolitan Dhaka to purchase a modern equipment for the hearing impaired children. In 2003 approximately Tk.12, 10,986 (taka twelve lack ten thousand nine hundred eighty six) only and in 2004 approximately Tk40, 51,000.00 (taka forty lack fifty one thousand)only and in 2005 approximately Tk31,55,000 (taka thirty one lack fifty five thousand) only is given as donation to different organization and person to mitigate their purpose.

Diabetic Hospital: DBBL donates Tk.1, 00, 00.00 per month to bear operational expenses of Narayangonj Diabetic Hospital since October, 2001.

Rural Health Care: DBBL has established Rural Health Center at its rural branches to render free medical services to the rural and destitute people of the adjoining areas.

On the other hand, the need base donations and subscriptions are extended to those areas, where it is needed most. Some of the activities in this category are:

1. Tk.40, 000,000.00 (Taka forty million) to Dhaka Ahsania Mission to set up a Ahsania Mission Cancer Hospital

2. Tk.10, 000,000.00 (Taka ten million) to Bangladesh Cancer Society to set up a modern cancer hospital.

3. Tk.12, 000,000.00 (Taka twelve million) to Shishu Sasthya Foundation to construct two floors of proposed 15 storied building of the Foundation.

4. Tk.9,000,000.00 (Taka Nine million) to Kidney Foundation to setup two operation theatres and a kidney transplantation ICU with a view to provide low cost services to poor kidney patients.

5. TK.1, 500,000.00(Taka one million five hundred thousand) to Rotary Club of Metropolitan, Dhaka to help the disadvantaged children with hearing impairment.

6. Tk.500, 000.00 (Taka Five hundred thousand) to Md. Atiqur Rahman Hridoy, a meritorious student of BUET who has been suffering from Blood Cancer.

7. Tk.100, 000.00 (Taka one hundred thousand) to Md. Mokhlesur Rahman, a meritorious student of Economics Department of Dhaka University who has been suffering from Hepatities-B.

8. Tk.350, 000.00 (Taka Three hundred Fifty Thousand) to Bangladesh Neonatal Forum for improving neonatal health as well as reducing neonatal Mortality rate in Bangladesh.

9. Tk.350, 000.00 (Taka Three hundred Fifty Thousand) donated for sinking 25 shallow tubewells in 25 spots of Angorpota Dahagram enclaves.

10. Tk.300, 000.00 (Taka Three hundred thousand) to Saleh Child Development Disability Management Centre to provide support to the mentaly retarded and disabled children.Tk300, 000.00 (Taka Three hundred thousand) to Bangladesh Thalassaemia Hospital to setup modern equipments for reducing sufferings of poor Thalassaemic patients.Tk.200, 000.00 (Taka Two hundred thousand) to Health Promotion Limited for setting up private Chamber for Community Maternity Practitioner (CMP) Students.

11 Tk.180, 000.00 (Taka One hundred Eighty Thousand) to Nirapad Sarak Chai for helping 12 families, victims of road accidents

12. Tk. 150,000.00 (Taka One hundred Fifty Thousand) only to APON for organizing a training program on Therapeutic Community.

13. Tk.100, 000.00 (Taka One hundred thousand) only to Society for the Welfare of the 14.Intellectually Disabled, Bangladesh for training and rehabilitation of the mentally retarded and disabled children.

15. Tk.100, 000.00 (Taka One hundred thousand) to SIED TRUST, Bangladesh for rehabilitation of underprivileged intellectually disabled children.

16. Tk.100, 000.00 (Taka One hundred thousand) to Street Children Partner Bangladesh to develop the condition of street children.

17. Tk.100, 000.00 (Taka One hundred thousand) to EKMATTRA for making a short length feature film named “Je Shohor Chorabali.

DBBL has donated G.C.I. sheets among the victims of river erosion and tornado affected people of Bogra, B. Baria, Netrokona, Mymensingh, Gaibandha, Rangpur and Ramgoti at a cost of Tk. 10 million.

DBBL has distributed blankets among the cold affected people of the country. So far the bank has distributed 1, 50,000 pieces of blankets at a cost of Tk. 37.50 million.

The DBBF has very recently chalked out an elaborate program to undertake few more programs. Such as- Donation of books to the library of different Universities, Donation of a DNA detection machine to Bangabandhu Sheikh Mujib Medical University (BSMMU) for preventing Thelasaemia, Repair of Prolapse uterus / V.V.F., Repair of club foot, Prevention of Drug Abuse etc. We hope with the blessings of Almighty Allah, DBBF shall continue all such altruistic activities for betterment of the society, which we all belong to.

DBBL donated a roundtrip air ticket to a physically handicapped employee of BRAC Dutch-Bangia Bank Limited (DBBL) donated a roundtrip air ticket (Dhaka-Bangkok-Stockholm-Bangkok-Dhaka) to Ms. Sharmin Akbari – a physically handicapped employee of BRAC for pursuing higher studies in Public Health in Sweden. The Managing Director of Dutch-Bangia Bank Limited Mr. Md. Yeasin Ali is seen handing over the air ticket to Ms. Sharmin Akbari at a simple ceremony held at Bank’s Head Office recently.

DBBL has donated two modern ambulances to Anjuman Mufidul Islam

Dutch-Bangla Bank Limited (DBBL) has donated two modern ambulances imported from Japan to Anjuman Mufidul Islam.

DBBL Recognition

DBBL has received Asian CSR Award-2005

Dutch-Bangla Bank Limited has won Asian CSR Award-2005 for its outstanding program on Corporate Social Responsibility (CSR). Mr. Yeasin Ali, Managing Director, DBBL is seen receiving Asian CSR Award-2005 from the Chief Guest, Dr. Juwono Sundarsono, the Honorable Minister for Defense, the Republic of Indonesia at a ceremony held on September 09, 2005 in Jakarta.

Dutch-Bangla Bank Limited has been again nominated for the Asian CSR Awards 2006. DBBL has decided to participate in the category of

i. EDN- Support and Improvement of Education ii. POV-Poverty Alleviation iii. Concern for Health

Problem or Unethical work in DBBL:

- Disclose the secrecy of Account: the prime relationship of a bank is to maintain the secrecy of account. That is not t disclose or share the customer information with any body. Sometime the bankers share such information with competitors.

- Availing undue advantage from the customers.

- Tempering customers financial information for emphasis own performance.

- Vague certification from the bank providing account information such as solvency certificate.

- Delay in cascading important information circular to the customer.

- Sometime Bribery practice for sanctioning large amount of loan.

- Taking benefit from the supplies. Helping customer lending.

- Sometime create illegal environment congenial to loan recovery.

- Do not proper evaluation of invoice to cash trial of sales ledger.

- Recommendation:

- Do not disclose the secrecy of account and financial information.

- Avoid the bribery practices for sanctioning larger amount of loan.

- Create a legal environment congenial to loan recovery.

- Loans collection and provides by the ethical aspect.

- Proper security of invoice.

- Legal action.

- Proper evaluation of invoice to cash trait of sales ledger.

- Appropriate and enforceable documentation (factoring agreement, demand promissory note, directors personal guarantees, power of attorney etc)

- Recommend recourse to client or enforcement of security for recovery of bad depts..

Conclusion

Ethical and social responsibility of business is matter of serious concern in modern discussions of the policy planner, management circles and government quarters. However, western civilization has failed to provide a solid basis for the development of an ethical and moral code of conduct for business. Its ethical values are largely utilitarian, highly relative, and situational in nature and devoid of any spiritual sanctioning power. Contrary to it, Islam offers a unique and ideal perspective of business ethics. It considers business as a part of one’s worship, provided that it is conducted in accordance with the commands of Allah and the moral code of conduct prescribed by Islam.

The fundamental Islamic principles of ethics such as truthfulness, honesty, trust, sincerity, brotherhood, science and knowledge and justice provide the general background for business ethics. These principles have far-reaching consequences for the business ethics. The focus of Islamic ethics is on changing the attitude, mentality and behavior of people. The real implementation force behind Islamic ethics is the belief in Allah and Akhirah.

Ethics is modern society has attention of all people from different cultures and different countries. Violations of ethical code have taken place in almost every segment of human endeavor. The effort to overcome such problem in the area of business, both nationally and internationally, has been under taken by the legal and educational systems, and by professional and business corporations.

Business ethics has emerged as a separate and distinctive discipline, largely drawing on moral philosophy but often using a case study approach developed in management schools to illustrate the ethical dilemmas which business decision makers face. The literature on Islamic business ethics is much restricted, yet Islam has its own code of business, which has both similarities and differences with the practices. Businessmen in the Muslim world should apply their beliefs in their commercial dealings. At the same time, non- Muslims operating in the Islamic world need to be aware of what those beliefs are and their business implications.