Cash Department is the most important part of General Banking. Cash department should be placed in a branch from where manager can watch everything from his table either clients or the vault. It is the most important department of the bank since from desk cash department has direct interaction with customers. Usually cash department receives and pays cash directly which work as a media to communicate with the clients. In the Islami Banking Branch I have got acquainted with cash receiving and cash payment procedures. Some register books uses in the cash department are mentioned bellow:

- Receiving Cashier’s Book

- Payment Cashier’s Book

- Cash Balance Book

- Vault Register or safe–in and safe-out Register

- Key Register

- Remittance Registers.

In addition, I have also learnt the procedure of cash-in and cash-out from the vault. We have also got acquainted with systematic procedure of cash receiving through different vouchers as well as payment procedure by different cheque and vouchers. Science the branch is fully computerized, it does not maintain token, scroll etc.

Cash Receive:

Cash is the blood of a branch. It is the life of a bank. Cash may be received by-

- Cash Receiving by Pay Slip

- Cash Receiving of Bills

- Cash Receiving by TT, DD, Pay-Order, MTDR.

Cash Receiving by Paying-Slip:

By paying slip we receive cash of CD or MSD account. When we receive cash by paying slip, officers check the paying slip if there is any discrepancy, if everything is found to be in order, then they make entry of the amount in the scroll register and put receiving seal on paying slip.

Cash Receiving of Bills:

Two kinds of bills (DESA & Grameen Phone) are received in drench. When officers receive cash bill, h/she check the bill’s copy to see whether is any discrepancy. If everything is found alright, then h/she makes entry of the amount in the scroll register. And h/she put receiving seal on bills paper.

Cash Receiving by TT, DD, Pay-Order, MTDR:

At first the form filled up by the party should be checked to verify whether is any discrepancy, if everything is found to be in order, then officers make entry of the amount in the scroll register and put receiving seal on the respective form.

Cash Payment:

Usually cash is paid against cheque, pay-slip, pay-order, DD and debit voucher. While paying cash against any instrument, officers first verity whether there is any material alteration on the instrument. He also check the instrument if it is in holder in due course and holder in due time. Then he verifies the signature of payee. If everything is in order, he pays the amount to the respective payee.

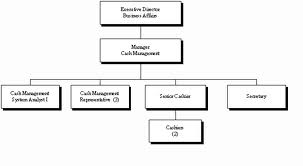

Position of the Cash Department

The position of the cash department is very important. The cash department should be at a safe place. If should be at the middle position of the branch. The cash counter and vault should be a close to cash department. The cash position of the Islami Banking Branch is in the front side of the branch and its safe and vault is at the back side of cash department.

Duties and Responsibilities of Cash in Charge

- Holds the key of cash safe.

- Receive cash from other bank/Branch and acknowledge, where necessary. Opens the cash safe before commencement of business along with other personal holding the key.

- Supervise receipt and payment of cash.

- Supervise the carrying of the cash to the cash Department.

- Delivers cash to the paying cashier against receipt on a memo.

- Countersigns the credit vouchers if he is an attorney.

- Arranges sending cash to other Branch.

- Check the receiving cashier’s and paying cashier’s receipt/payment sheet and collect cash from them.

- Writes the cash balance book and cash position memo and signs them

- Maintains record of stamped forms.

- Investigate and inform the manager about excess or shortage of cash.

- Gets books and cash checked by manager or authorized officer.

- Supervise the custody o f cash in the safe and books in the strong room. Checks the drawers of the cashiers before leaving the office.