Conceptual framework of Accounting:

Conceptual framework -Coherent set of rules and standards for comparability and consistency. On the other hand, Conceptual frameworks are a type of intermediate theory that have the potential to connect to all aspects of inquiry (e.g., problem definition, purpose, literature review, methodology, data collection and analysis). Conceptual frameworks act like maps that give coherence to empirical inquiry. The frameworks are linked to particular research purposes (exploration, description, gauging, decision making and explanation/prediction). When purpose and framework are aligned other aspects of empirical research such as choice of methodology (survey, interviews, analysis of existing data, direct observation, focus groups etc) and type of statistical technique become obvious.

Conceptual framework of accounting “seeks to identify the nature, subject, purpose and broad content of general-purpose financial reporting and the qualitative characteristics that financial information should possess”. (Deegan, 2005, p.1184). Development of framework: not universally accepted nor static

Purpose of Conceptual framework of Accounting:

A. Define the boundaries of accounting by providing:

1. The basic objectives and users

2. Definitions of key terms

3. Establish fundamental concepts

B. Assist the FASB in standard setting by providing a basis for developing new and revised standards.

C. Provide a description of current practice and a frame of reference for new issues.

D. Assist accountants and others in selecting between acceptable accounting alternatives.

Moreover, conceptual framework serves –

–As an aid in developing more useful, consistent standards.

–As an aid in solving practical problems by reference to an existing framework of basic theory.

–In combination with good judgment, a sound body of theory will help accountants focus on logical and consistent solutions to accounting problems as they arise.

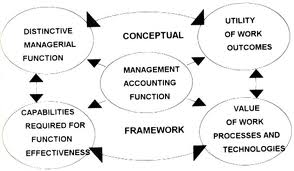

Components of the Conceptual framework:

FASB has issued (from 1976 on) 5 Statements of Financial Accounting Concepts (SFAC) for business enterprises. These are as follows:

SFAC No. 1. “Objectives of Financial Reporting by Business Enterprises” presents the goals and purposes of accounting.

SFAC No. 2. “Qualitative Characteristics of Accounting Information” examines the characteristics that make accounting information useful.

SFAC No. 6. “Elements of Financial Statements,” defines the broad classifications of items found in financial statements and replaces SFAC No. 3, expanding its scope to include not-for profit organizations.

SFAC No. 4. “Objectives of Financial Reporting for Non business Organizations” provides guidelines for not-for-profit and governmental entities.

SFAC No. 5. “Recognition and Measurement in Financial Statements of Business Enterprises” giving guidance on what information should be formally incorporated into financial statements and when. That is,

– Fundamental recognition criteria on what should be incorporated into the financial statements.

– Assumptions, principles and constraints