How Goodwill is Created?

In many jurisdictions throughout the United States, family law courts require valuation professionals to delineate between personal (professional) goodwill and enterprise (practice) goodwill when determining the value of businesses held by parties to a divorce action. These states operate under the principle that personal goodwill is not a marital asset subject to distribution, but rather future earning potential associated with an individual’s personal attributes. Thus, any value associated with said personal attributes should be excluded from the marital estate to prevent a double burden (i.e., a property settlement and maintenance/alimony) to an individual’s prospective income. Further, while this principle can be applied to businesses of any nature, it is most widely applied to businesses operating in the professional services arena.

In order to effectively separate personal goodwill from total goodwill, it is important to understand what efforts and characteristics of individuals give rise to personal goodwill and whether those individuals are adequately compensated for those attributes. From this understanding follows whether or not personal goodwill can be measured and transferred.

The Nature of Personal Goodwill

Several organizations have offered definitions of goodwill from a business valuation perspective (i.e., not strictly from an accounting perspective). A common resource defines goodwill as “an intangible asset category usually composed of elements such as name or franchise reputation, customer patronage, location, products, and similar factors.”1 Notable within this definition is the lack of causality. That is, the definition fails to provide an explanation as to why these intangible assets – unlike others – are a part of goodwill.

Goodwill is a collection of intangible assets that generate earning power superior to that which would be generated by a business’ tangible and separately identifiable intangible assets (e.g., patents, trade names, customer lists, etc.). Intangible assets contribute to, and are thus attributed to, goodwill if by their very nature they cannot (or cannot without great difficulty), be separately identified for purposes of quantification.

Intangible assets, therefore, fall under the umbrella term “goodwill” by virtue of either the significant degree of difficulty required in their measurement or their inability to be measured. Despite the difficulty in separately quantifying any individual intangible asset within the collection termed goodwill, goodwill itself can be broadly separated into two main categories: personal and enterprise goodwill.

The proportion of this goodwill attributed to personal goodwill has been appropriately defined as “goodwill that attaches to the persona and personal efforts of an individual.”2 A prerequisite in broadly separating goodwill into personal and enterprise components is an understanding of what efforts and characteristics of individuals attach goodwill in such a manner.

What Creates Personal Goodwill?

Understanding the potential sources (e.g., the efforts and characteristics of individuals) of personal goodwill facilitates the identification of specific goodwill characteristics. Many articles have been authored discussing a hodge podge of potential personal goodwill characteristics such as the age, health, and work habits of the business owner or the strength of the company’s staffing and brand name. However, without first determining the underlying sources of personal goodwill, the risk of missing specific personal goodwill characteristics may increase.

Personal goodwill derives from the past, present, or future expected efforts and characteristics of an individual or group of individuals. The potential sources of personal goodwill can be loosely categorized into four main groups:

- Relationships. Personal relationships with customers, suppliers, employees, or even competition may enhance the earning power of a company. If an attorney leaves a law firm, will key clients leave as well – regardless as to the quality of service and work they would receive if they stayed? The landmark 1998 Tax Court case of Martin Ice Cream v. Commissioner noted the existence of personal goodwill due to the ice cream distributor’s relationships with supermarkets (customers).3Relationships may be related to more than just customers. For example, a personal relationship with a supplier may allow price breaks or quicker delivery, employees may opt to stay with a company due to the personal charisma of its Chief Executive Officer, or competition may be less cutthroat as both business owners know each other and operate “as gentlemen.”

- Skill. Personal goodwill may exist as skill. Skill may be physical as in the case of surgeons with expertise over-and-above that of their peers. Alternatively, skill exists in intellectual capacities such as the star hedge fund manager. Skill may be both physical and intellectual; for example the mark of a great chef involves manual dexterity in food preparation as much as creativity in developing recipes. Regardless as to the type, skills may develop through rigorous training programs and study, be innate to an individual, or both.

- Knowledge. Knowledge can be defined as the unique possession of information, or the unique ability to analyze information, by and within an individual.4 The unique possession of information may derive from years of research and development or training. Alternatively, knowledge may manifest itself as judgment (i.e., the unique ability to analyze information).

- Reputation. The reputation of a company may derive in whole or in part from personal goodwill and typically derives from relationships, skill, or knowledge. The value of reputation arises outside of marital dissolution proceedings. For example, the disputed issues from the recent bankruptcy dispute of Trump Entertainment Resorts Inc. included the value of Donald Trump’s continued association with the company. Reputation deriving from personal goodwill may exist regardless as to whether or not the company utilizes the individual’s name. How much goodwill would dissipate from a famous restaurant like Alinea or Nobu if Grant Achatz or Nobu Matsuhisa themselves left? To use an example from a different industry, how far would Berkshire Hathaway Inc. stock fall if Warren Buffet suddenly retired or died?

How Can Personal Goodwill Be Measured?

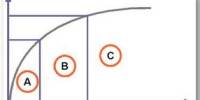

The enterprise value of an entity incorporates the value of its total invested capital, including both debt and equity capital. Alternatively, the enterprise value of an entity may also be expressed as the collective value of its individual assets, including net working capital, tangible assets, and intangible assets. This concept is illustrated in the adjacent graphs.

Allocating a company’s enterprise value to each of its separate working capital and tangible asset categories yields the value attributable to the company’s intangible assets, which is determined on a residual basis. In other words, to the extent that the company’s enterprise value exceeds the market value of net working capital and tangible assets, it is indicated that an element of intangible asset value exists. Taking this concept one step further, to the extent that the intangible asset value of the company exceeds the value of identifiable intangible assets (e.g., patents, assembled workforce, customer list, trade name, etc.), unidentifiable intangible assets (i.e., goodwill (personal and/or enterprise)) exist.

If it is determined that goodwill exists, total goodwill may then be separated into personal and enterprise components. The determination of whether goodwill is attributable to that of a particular person or that of an enterprise may require an investigation as to the source of the goodwill, as well as an analysis of the compensation paid to said individual(s). Do customer surveys reveal that their continued patronage results from a company’s location (an indication of enterprise goodwill) or from the reputation of a renowned employee or salesperson? Did the company, due to its size and pay scale, outmaneuver its competition in recruiting new talent, or did the company acquire top recruits from the efforts and charisma of its leader? Moreover, are the key executives or individuals (e.g., the renowned salesperson or charismatic leader) of the business adequately compensated for these personal efforts and contributions?

Once the source of the goodwill has been analyzed and assigned to either personal goodwill or enterprise goodwill, the associated economic impact must be assessed. Various methods may be employed depending upon the nature of the personal goodwill. If more timely service and better prices are received from suppliers due to personal goodwill, then can the economic impact of having to retain higher inventories (in order to prevent stock-outs from untimely delivery) or paying higher prices be modeled and its effect upon value quantified? If employee turnover were low because of the personal goodwill of the Chief Executive Officer, what would be the economic impact of paying higher salaries, offering better benefits, or hiring recruiters to compensate for the loss of the magnetic leader? If the key executives or individuals of the company are not being adequately compensated for their personal efforts that give rise to the superior performance of the business, what would be the economic impact of an increase in executive compensation to market levels?

The Compensation-for-Contribution Method

As an alternative to allocating total goodwill to personal and enterprise categories, the valuation professional can apply a methodology which effectively removes any personal goodwill from the valuation determination. One such methodology includes the Compensation-for-Contribution Method (“CCM”).5 The CCM theorizes that to the extent the level of compensation paid to a business owner is commensurate with the ‘value’ (i.e., the increased performance and success of the business attributable to the owner’s personal skill, reputation, experience, knowledge, relationships, etc.) the owner is generating through his or her personal contributions to the business, any remaining earnings (after consideration of this compensation) can be assumed to be generated solely by the assets of the business (i.e., its net working capital, tangible assets, and intangible assets other than personal goodwill).

For example, in addition to his or her normal duties, the owner of a company may maintain a number of skills on a personal level that potentially contribute to the performance and success of the company. Without the contributions of such an owner, it is likely that the profits, and commensurately the value, of the company would be diminished. As this additional value inherent in the company is related to the owner’s personal contribution to the business, this value reflects personal goodwill. Thus, to the extent that the cash flow of the company is reduced by the level of remuneration adequate to compensate said owner for these contributions, the resulting value of the company indicated by these cash flows would be attributable solely to tangible and intangible assets other than personal goodwill. In effect, personal goodwill will have been removed from the indicated value of the company.

Can Personal Goodwill Be Transferred?

As previously discussed, personal goodwill is often defined as goodwill that attaches to the personal efforts of an individual. As such, personal goodwill is generally considered to be nontransferable. Under this definition, most (if not all) transferable goodwill must then be enterprise in nature. Accordingly, answering the question of transferability may serve as a litmus test in the analysis of personal versus enterprise goodwill.

The question “can personal goodwill be transferred?” is really another method of asking, “can personal goodwill be transformed into enterprise goodwill?” The answer to these questions is: possibly – it depends on the form of personal goodwill. In certain circumstances, it may be possible for personal goodwill to be transformed into enterprise goodwill, and thus transferred, through effective internal controls and contractual obligations. The aforementioned categories provide examples whereby personal goodwill may or may not be transformed and transferred.

- Relationships may or may not be transformed and transferred. For example, goodwill associated with customers who frequent a restaurant because the owner is likeable and takes particularly good care of them will probably not be transferable. On the other hand, suppliers who provide special price breaks, timely delivery, or selection (because they have been dealing with each other for a number of years) may be transferable, particularly if the former owner is able to codify the agreement in a contract before selling the business.

- Skill such as that possessed by a renowned surgeon is unlikely to be transferred. Skill developed either prior to employment or during employment (but not as a result of internal training processes) will likely suggest personal goodwill. However, if internal training creates individuals with personal goodwill, then, while the personal goodwill of any given employee may not be transferred, the future ability to create personal goodwill is transferable and properly categorized as enterprise goodwill. An example of this situation may be the management program of General Electric Co. or the U.S. Marine Corp.

- The likelihood of transforming knowledge depends upon the nature of the knowledge. If the knowledge consists of information, such as R&D processes/results or recipes developed, then adequate internal controls (e.g., the proper documentation of procedures, steps, etc.) can transform knowledge from that of the person to that of the enterprise. However, if knowledge consists of judgment derived from experience (i.e., the wisdom of how to deal with certain situations, develop and train personnel, etc.), then knowledge is unlikely to be transferred.

- Reputation can often be transferred, or at least attempts to do so may often be performed. When the famed mutual fund manager Michael Price sold his Mutual Series funds to Franklin Resources in 1996, he agreed to continue his employment for an indefinite duration (Price eventually ended day-to-day fund management in 1998). In so doing, Price facilitated the retention of clients loyal to himself. In effect, Franklin Resources was able to purchase (at least partially) the personal goodwill of Price through employment agreements.

Conclusion

Business valuation in the context of a marital dissolution often presents difficult issues. This is especially so in states that recognize a difference between personal and enterprise goodwill. In conjunction with a detailed review of executive compensation, determining whether or not the reputation, relationships, skill, and/or knowledge of an individual contributed to the value of a business facilitates the quantification of personal goodwill. It should again be noted that inherent to any value of personal goodwill (with the exception of that which could be partially transferable) is the assumption of continued contribution (without adequate compensation) by the person to whom the goodwill is attached. This is an especially important consideration for divorce matters in jurisdictions which endeavor to exclude “future efforts” from the quantification of the marital estate.

1 Shannon P. Pratt and Alina V. Niculita, Valuing a Business: The Analysis and Appraisal of Closely Held Companies, 5th ed. (New York: McGraw-Hill, 2008), 1072.

2 James R. Hitchner, Financial Valuation, 2nd ed. (Hoboken, New Jersey: John Wiley & Sons, Inc., 2006), 824.

3 Martin Ice Cream Company vs. Commissioner of Internal Revenue; 110 TC 189 (1998).

4 The term “within an individual” means such information or analytical ability exists within an individual’s mental capacity and has not, or has not been effectively, transmitted into another media (i.e., documented).

5 For a discussion of the CCM and its application in divorce matters, please see Compensation-for-Contribution: An Alternative Method for Handling Personal Goodwill in Divorce Matters, in the Family Law Publications section of the SRR website.