Job evaluation is concerned with a process of establishing the value of different jobs. It is the process of establishing the value of jobs in a job hierarchy. Job values may be determined by negotiation or fixed on the basis of broad assumptions about market rates and internal relativities. It provides a basis for ranking or grading different jobs and developing a pay structure for them. It is the process of describing the duties, authority relationships, skills, the condition of work, and other relevant information related to jobs.

Methods of job evaluation in Bangladesh

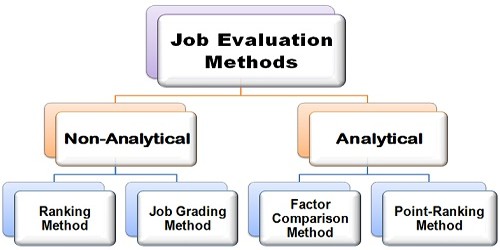

Methods of job evaluation: There are different methods of job evaluation. Major methods using compassable factors are as follows –

Point method: Lott recognized that the 15 compassable factors he identified for measuring job differences were not of equal importance or value. After deeming the weights of each factor, he used benchmark jobs to establish a 10-point interval scale.

Factor comparison method: After assigning a wage rate to each benchmark job, it is possible to develop a wage rate or monetary scale for each of Benge’s five universal factors. By establishing a monetary scale for each universal factor, all other jobs in the organization can be evaluated.

Multiple regression-based job evaluation: Although multiple regressions have been used in the job evaluation process since the 1950s the developer of PAQ recognized in the 1970s that, by combining certain items in their scored 194-item questionnaire with multiple regression, the PAQ could be used to predict rates of pay. By the 1980s numbers of consulting firms were promoting their own diet rates of pay. By the 1980s a number of consulting firms were promoting their own particular methods.

Graphics rating scale method: Graphic rating scale method is a scale that lists a number of traits and a range of performance for each. The employee is then rated by identifying the score that best describes his or her level of performance for each trait.

Ranking method: Alternation ranking method is a method of ranking employees from best to worst on a particular trait. The manager or employee who gets the highest number is placed in the top rank. Similarly, the manager or employee who gets the lowest number may be ranked last. These locations in the pay structure may be determined.

Management by objectives (MBO): MBO methods involve setting specific measurable goals for each employee and then periodically reviewing the progress made. After furnishing all reasonable facilities, monitoring result regularly and taking necessary measures to avoid the lapses, the employees involved may be evaluated and placed at the appropriate levels of say scale.