Management Accounting Practice at Beximco Pharmaceuticals Ltd:

A Review of Costing Function

The report is based on Management Accounting Practice At Beximco Pharmaceuticals Ltd: A Review Of Costing Function’. The purpose of this report is to understand how the cost elements of materials are being determined and to identify the factors which affect the costing procedure. .

Beximco is part of the Beximco Group of Companies. The history of pharmaceutical business of the company dates back to the early 70s, when it started to import market and distribute medicines from world renowned companies like Upjohn Inc. of USA and Bayer AG of Germany. Since the very beginning, the company was highly successful in generating increased demand for its products which eventually justified local production. Accordingly a pharmaceutical manufacturing facility was designed and constructed in 1980 under the technical supervision of Upjohn Inc. of USA, to manufacture their products under license.

Products made under license of Bayer AG of Germany followed. BPL has now grown to become one of Bangladesh’s leading pharmaceutical companies, supplying more than 10% of country’s total medicine need. Today Beximco Pharma manufactures and markets its own branded generics for several diseases including AIDS, cancer, asthma, hypertension, and diabetes for both national and international markets.

Management Accounting is concerned with the provisions and use of accounting information to managers within organizations, to provide them with the basis in making informed business decisions that would allow them to be better equipped in their management and control functions. Listed below are the primary tasks performed by management accountants generated by different cost accounting tools that are as follows: Variance Analysis, Rate & Volume Analysis, Product Profitability, Cost Analysis & Cost Benefit Analysis, Cost-Volume-Profit Analysis, Life cycle cost analysis, Capital Budgeting, Strategic Planning Strategic Management Advise, Internal Financial Presentation and Communication, Sales and Financial Forecasting & Annual Budgeting, Cost Allocation and Resource Allocation and Utilization.

Basically, Cost accounting information — and, more generally, accounting information – has three basic roles in organizations:

- Financial reporting,

- Operational control and improvement, and

- Decision making and planning.

Costing procedure of a Pharmaceuticals company is very important and vast thing. It needs to update in a regular basis. Moreover, all Pharmaceuticals firms try to keep this information secret in this competitive market. Like all other pharmaceuticals company Beximco follows standard costing method for medicine productions. The unit price of each medicine is calculated by batch wise. About 70-80 percent of all manufacturing materials are purchased from the foreign county. Only 20- 25 percent of the total are collected from the local markets.

Beximco purchases more than 600 items of raw materials and more than 3,000 packaging materials for manufacturing of medicine.

Major reasons for which the price of the materials is affected are-LC opening charge, Demurrage charge, Inflation, Exchange rate changes and C & F commissions, etc. Yearly increment of salary is one of the major issues of labor rate increasing. Beximco Pharma provides salary increment every year. Therefore, the cost of direct labor is increased. The reasons for increasing the overhead cost are- Markets rates of utilities like gas, electricity and water, Repair and the maintenance costs, Insurance premiums etc. are increased due to reducing the life of the machines. Product development costs are increased due to highly competition in the medicine markets both home and abroad.

Pharmaceuticals sector of Bangladesh like all other industries is going to face new challenges. Rising price of materials in the international market and higher domestic inflation is going to be a big issue. Besides, competition in the local pharmaceuticals market is expected to intensity further. Beximco has to be aware of those issues to become a market leader in the industry. Though the sales revenue has decreased in the last year due to various reasons, it has the ability to regain its glorious pasts and advanced further.

Objective of the report:

The objectives of the report are as follows:-

Major objective of this report is to show what are the major functions or the chain works of Costing and Budgeting section of Accounts and Finance Departments at Beximco Pharmaceuticals Ltd. After reading this report learners will know the following issues:

- To have an idea about the background of Beximco pharmaceuticals Ltd.

- To get an introduction about the organizational structure & how co-ordination among different set of activities is made..

- To set a general idea about operating procedures and functions of Accounts and Finance Department of BPL

- To explore the specific costing procedure followed by the Beximco Pharmaceuticals Limited

- To get idea about LC & Local purchase documentation & payment procedures;

- To identify the factors which affect the costing procedure

- To relate the theoretical learning with the real life situation.

- How the chain works are completing.

Methodology of the report:

The following methodology was followed throughout the study .The study is based on both primary as well as secondary data.

Data regarding the organization profile collected in the following ways:

Primary Source

- Careful observation of various activities of related section of that particular department,

- Discussions with the officials of Accounting and Finance department.

Secondary Source

- Organizational Brochures/ Annual Reports.

- Online information.

- Different BPL publications.

- Other relevant written materials.

Data Collection Techniques:

- Some of the primary data were collected by observing others doing their jobs.

- Much of the primary data were collected by the informal interviewing of the company officials.

- Most of the secondary data were collected by the review and study of relevant reports and documents.

Historical background:

Beximco Pharmaceutical Ltd. is a leading edge pharmaceutical company based in Dhaka, Bangladesh and is a member of the Beximco Group. The history of pharmaceutical business of the company dates back to the early 70s, when it started to import market and distribute medicines from world renowned companies like Upjohn Inc. of USA and Bayer AG of Germany. Since the very beginning, the company was highly successful in generating increased demand for its products which eventually justified local production. It completed its registration in 1976 and started its operation in 1980 by manufacturing and marketing licensee products of Bayer AG of Germany and Upjohn Inc. of USA. After its initial years of struggle it broke ground with the launching of its own products in 1983. In 1985 BPL was listed in Dhaka Stock Exchange (DSE) as a Public Limited Company. The journey continued and barrier after barrier were crossed, challenges were faced and overcome to transform BPL into what it is at present. Now it has grown to become nation’s one of the leading pharmaceutical companies, supplying more than 10% of the country’s total medicine need. In the process, it was enlisted in Chittagong and London Stock Exchange. Today Beximco manufactures and markets its own `branded generics’ for almost all diseases from AIDS to cancer, from infection to asthma, from hypertension to diabetes for both national and international markets.

It manufactures a range of dosage forms including tablets, capsules, dry syrup, powder, cream, ointment, suppositories, large volume intravenous fluids, metered dose inhalers etc. in several world-class manufacturing plants, ensuring high quality standards complying with the World Health Organization (WHO) approved current Good Manufacturing Practices (cGMP). Beximco also contract manufactures for major international brands of leading multinational companies. Beximco has a strong market focus and is anticipating continued future growth by leveraging business capabilities and developing superior product brands and markets. In particular it is very interested in developing a strong export market in USA and Europe. To meet the future demand it has invested over US 50 million dollar to build a new state-of-the-art manufacturing plant, confirming to USFDA and UK MHRA standards. This new plant will also offer contract manufacturing facility to leading pharmaceutical companies, especially from Europe and US.

International Market:

Beximco Pharma continues to explore export opportunities and to reinforce its footprint on a global scale, which currently covers five different continents. Alongside the continuous endeavour to strengthen the position in existing markets, BPL attempts to achieve dynamic growth worldwide.

Beximco Pharma commenced its international operations with the export of API to Hong Kong in 1992 and formulation products to Russia in 1993. The company has received the ‘National Export Trophy’ (Gold) for an impressive three times. Since then, BPL has taken greater strides over the years to increase its footprints in international markets.

In 2010, BPL successfully ventured into several new countries including South Africa (via contract manufacturing) and Netherlands Antilles, and registered 45 products in overseas markets. The company achieved export revenues of Tk 330.54 million, up 21.47% over 2009.

The current expansion of this overseas portfolio includes prioritizing and directing marketing operations to focus more on highly regulated markets such as the European Union (EU), USA, Australia and GCC member countries for value added generics.

As of 2010 Beximco Pharma has 322 products registered in Asia, 91 in Africa, five in Central and Latin America, and 22 in Middle East, while we are actively taking measures to register our products in attractive branded generic markets such as the CIS states and the EU countries. BPL’s products are highly trusted for their quality by physicians and consumers at home and abroad. With this acclamation BPL is supplying different formulations from its portfolio to renowned hospitals and institutions including Raffles Hospital, Healthway Medical Group & K. K. Women and Children Hospital in Singapore; Asthma Drug Facility (ADF) in France; CENABAST in Chile; and MEDS and Kenyatta National Hospital in Kenya. BPL is constantly investing in its state-of-the-art manufacturing facilities to significantly expand its capabilities to meet the regulatory requirements of developed countries. BPL has pursued approvals from different drug regulatory authorities, e.g. TGA (Australia), GCC (Gulf Council), ANVISA (Brazil) and INVIMA (Colombia), which highlights BPL’s credentials as it explores new opportunities in the export arena.

INTRODUCTION OF MANAGEMENT ACCOUNTING

Definition of Management Accounting

Management Accounting is concerned with the provisions and use of accounting information to managers within organizations, to provide them with the basis in making informed business decisions that would allow them to be better equipped in their management and control functions. Unlike financial accountancy information, management accounting information is used within an organization “typically for decision-making” and is usually confidential and its access available only to a select few.

According to the Chartered Institute of Management Accountants (CIMA), Management Accounting is ” The process of identification, measurement, accumulation, analysis, preparation, interpretation and communication of information used by management to plan, evaluate and control within an entity and to assure appropriate use of and accountability for its resources. Management accounting also comprises the preparation of financial reports for non-management groups such as shareholders, creditors, regulatory agencies and tax authorities” (CIMA Official Terminology).

The American Institute of Certified Public Accountants(AICPA) states that management accounting as practice extends to the following three areas:

- Strategic Management—Advancing the role of the management accountant as a strategic partner in the organization.

- Performance Management—Developing the practice of business decision-making and managing the performance of the organization.

- Risk Management—Contributing to frameworks and practices for identifying, measuring, managing and reporting risks to the achievement of the objectives of the organization.

The Institute of Certified Management Accountants(ICMA), states “A management accountant applies his or her professional knowledge and skill in the preparation and presentation of financial and other decision oriented information in such a way as to assist management in the formulation of policies and in the planning and control of the operation of the undertaking.”

Management accounting practice helps an organization to survive in the competitive, ever changing world, because it provides an important competitive advantage for an organization that guides managerial action, motivates behaviors, supports and creates the cultural values necessary to achieve an organization’s strategic objectives.

Management Accounting Techniques

Management decisions are basically based on some measures/techniques traditionally designed based on quantitative data. However, in recent past to cope with global business environment, change in business, increase in competition and complexity of decision making some advanced quantitative techniques like Activity – based Costing and Target Costing and some improved programs like Just-in-Time (JIT), Total Quality Management (TQM), Process Reengineering and Theory of Constraints (TOC) have been introduced for application.

Management Accounting Functions

Management accounting is a financial method that helps senior managers and department heads analyze business performance. Management accounting functions relate primarily to budgeting and cost analysis, internal financial reporting and monitoring of cost controls.

Actually, Management accounting may be said to include all activities connected with collecting, processing, interpreting and presenting information to management. The management accounting satisfies the various needs of management for arriving of appropriate business decisions. They may be described as modification of data, analysis and interpretation of data, facilitating management control, formulation of business budgets, use of qualitative information, and satisfaction of informational needs of management.

Listed below are the primary tasks performed by management accountants generated by different cost accounting tools. The degree of complexity relative to these activities is dependent on the experience level and abilities –

- Variance Analysis

- Rate & Volume Analysis

- Product Profitability

- Cost Analysis & Cost Benefit Analysis

- Cost-Volume-Profit Analysis

- Life cycle cost analysis

- Capital Budgeting

- Strategic Planning Strategic Management

- Advise Internal Financial Presentation and Communication

- Sales and Financial Forecasting & Annual Budgeting

- Cost Allocation

- Resource Allocation and Utilization

Relationship between Cost Accounting, Financial Accounting, Management Accounting and Financial Management

Cost Accounting is a branch of management accounting, which has been developed because of the limitations of Financial Accounting from the point of view of management control and internal reporting. Financial accounting performs admirably, the function of portraying a true and fair overall picture of the results or activities carried on by an enterprise during a period and its financial position at the end of the year. Also, on the basis of financial accounting, effective control can be exercised on the property and assets of the enterprise to ensure that they are not misused or misappropriated. To that extent financial accounting helps to assess the overall progress of a concern, its strength and weaknesses by providing the figures relating to several previous years. Data provided by Cost and Financial Accounting is further used for the management of all processes associated with the efficient acquisition and deployment of short, medium and long term financial resources. Such a process of management is known as Financial Management. The objective of Financial Management is to maximize the wealth of shareholders by taking effective Investment, Financing and Dividend decisions. Investment decisions relate to the effective deployment of scarce resources in terms of funds while the Financing decisions are concerned with acquiring optimum finance for attaining financial objectives. On the other hand, Management Accounting refers to managerial processes and technologies that are focused on adding value to organizations by attaining the effective use of resources, in dynamic and competitive contexts. Hence, Management Accounting is a distinctive form of resource management which facilitates management’s ‘decision making’ by producing information for managers within an organization.

Cost Accounting Information in Decision Making:

Decision making is central to the management of an enterprise. The manager of a profit making business has to decide on the manner of implementation of the objectives of the business, at least one of which may well relate to allocating resources so as to maximize profit. All organizations, whether in the private or the public sector, take decisions, which have financial implications.

Decisions will be about resources, which may be people, products, services, or long term and short term investment. Decisions will also be about activities, including whether and how to undertake them. Where the owners are different persons from the manager (for example, shareholders of a company as separate persons from the directors), the managers may face a decision where there is a potential conflict between their own interests and those of the owners.

In such a situation cost considerations may be evaluated in the wider context of the responsibility of the managers to act in the best interests of the owners.

For making decision by using cost accounting information cost accountant usually follow some specific models. They use different decision model for different courses of action. Management accountants work with manager by analyzing and presenting relevant data to guide decisions.

For example, if any organization wants to reduce its existing manufacturing costs it must identify the alternatives then it will analyze the alternatives by using only relevant data i.e., which can influence the decisions.

Cost Accounting Information in Corporate Reporting:

The main purpose of cost accounting information is to help managers in decision making. Such information is provided for the internal purpose only. There are some guided rules and regulations about the information in the reports. According to IAS 1 (Presentation of Financial Statements), paragraph 117, “ An entity shall disclose in the summary of significant accounting policies:

(a) the measurement basis (or bases) used in preparing the financial statements, and

(b) the other accounting policies used that are relevant to an understanding of the financial statements.”

It is important for an entity to inform users of the measurement basis or bases used in the financial statements (for example, historical cost, current cost, net realizable value, fair value or recoverable amount) because the basis on which an entity prepares the financial statements significantly affects users’ analysis. When an entity uses more than one measurement basis in the financial statements, for example when particular classes of assets are revalued, it is sufficient to provide an indication of the categories of assets and liabilities to which each measurement basis is applied. According to paragraph 125 of the same IAS, “An entity shall disclose information about the assumptions it makes about the future, and other major sources of estimation uncertainty at the end of the reporting period, that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year. In respect of those assets and liabilities, the notes shall include details of:

(a) their nature, and

(b) their carrying amount as at the end of the reporting period.

An entity presents the disclosures in paragraph 125 in a manner that helps users of financial statements to understand the judgments that management makes about the future and about other sources of estimation uncertainty. The nature and extent of the information provided vary according to the nature of the assumption and other circumstances. Examples of the types of disclosures an entity makes are:

(a) the nature of the assumption or other estimation uncertainty;

(b) the sensitivity of carrying amounts to the methods, assumptions and estimates underlying their calculation, including the reasons for the sensitivity;

(c) the expected resolution of an uncertainty and the range of reasonably possible outcomes within the next financial year in respect of the carrying amounts of the assets and liabilities affected; and

(d) an explanation of changes made to past assumptions concerning those assets and liabilities, if the uncertainty remains unresolved.

Other IFRSs require the disclosure of some of the assumptions that would otherwise be required in accordance with paragraph 125. For example, IAS 37 requires disclosure, in specified circumstances, of major assumptions concerning future events affecting classes of provisions. IFRS 7 requires disclosure of significant assumptions the entity uses in estimating the fair values of financial assets and financial liabilities that are carried at fair value. IAS 16requires disclosure of significant assumptions that the entity uses in estimating the fair values of revalued items of property, plant and equipment.

There are also some guidelines for reporting cost accounting information in IAS 2: Inventories.

The objective of this Standard is to prescribe the accounting treatment for inventories. A primary issue in accounting for inventories is the amount of cost to be recognized as an asset and carried forward until the related revenues are recognized. This Standard provides guidance on the determination of cost and its subsequent recognition as an expense, including any write-down to net realizable value. It also provides guidance on the cost formulas that are used to assign costs to inventories.

MATERIALS- CONTROLLING AND COSTING

Materials Management

An effective materials management is essential in order to

(1) provide the best service to customers,

(2) produce at maximum efficiency, and

(3) manage inventories at predetermined levels to stabilize investments in inventories.

Successful materials management requires the development of a highly integrated and coordinated system involves

- Sales Forecasting,

- Purchasing,

- Receiving,

- Storage,

- Production,

- Shipping,

- And Actual Sales.

The stages of material management may be enumerated as follows:

- Procedures of materials acquisition

- Cost of materials acquisition

- Product costing and cost allocations

Materials Acquisition Procedure

Materials:

In Beximco Pharma Material is divided into two parts. These materials are the direct material for the product. The classification of materials is as follows:

- Raw material.

- Packing material.

Before going to the report part, let’s have a look that what are the steps are involved in case of purchasing raw and packing materials from local and abroad.

Both types of materials are purchased in two forms such as:

- Local purchase.

- Import of materials.

Local Purchase of Raw & Packing Materials:

The domestic purchase of raw material and Packing Material include following business functions;

- Processing purchase order

- Receiving goods, material and services

- Recognizing the liability

- Processing and recording cash disbursement

Processing Purchase Order

The procedure begins with need recognition. The respective department identifies its need, gets approval of the departmental head and with the approval an authorized person sends purchase requisition to purchase department to initiate purchase. In case of raw or packing materials, the planning department determines the quantity and timing of raw materials. This department informs the purchase department when to buy materials.

When the purchase department got the requisition, it calls for quotation or tender. After receiving the quotation or tender, supplier has been selected. The supplier may be local or international. If the terms and conditions are in favor of both BPL and the selected supplier, the purchase order is issued by the factory.

Receiving Material, Goods and Services

Generally the goods and services are received by the user department who has issued the purchase requisition or in some cases by the authorized department. In case of Materials, Materials are received by Quality Assurance Department (QAD) in the factory. After receiving materials, MRR (Material Receiving Report) is issued for material and other than material (goods) a GRR (Goods Receiving Report) is issued by receiving department to purchase department.

Recognizing the liability

The purchase department compares the invoice/bill and MRR/ GRR/ QC with the purchase order. If everything has been complied, the amount payable to supplier is approved by the purchase department. There is a seal on the invoice named ‘Approved By’ with the signature of purchase manager. It means the purchase department is satisfied with the information mentioned in the bill.

Processing and Recording Check/ Cash Disbursement

After a certain period of time when the date becomes matured for the liability the payment is made by BPL. The matured date has been calculated in the aged payable report for each vendor. The mode of payment is usually per numbered check. In most cases the payment is made by A/C payee only check. In some cases the payment may be made by cash or by bearer check or paid in advance fully or partly.

Materials Acquisition Cost

The cost of inventories comprises of expenditure incurred in the normal course of business in bringing the inventories to their present location and condition. As a result, the costs of purchase of inventories comprise the purchase price, import duties and other taxes (other than those subsequently recoverable by the entity from the taxing authorities), and transport, handling and other costs directly attributable to the acquisition of finished goods, materials and services.

Trade discounts, rebates and other similar items are deducted in determining the costs of purchase. Actually, the focal point of this report is to put light on the cost of acquiring of raw and packing material from local and foreign sources and related accounting conduct.

In case of imported materials,

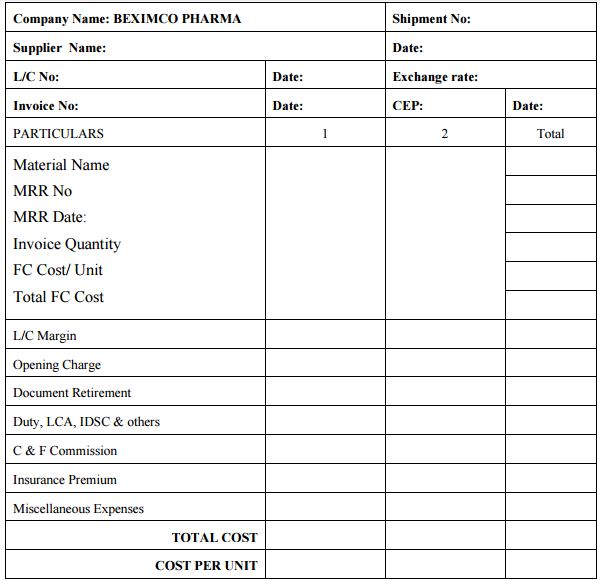

L/C Costing:

The costing procedures of the imported material’s (Raw/Packing) Landed cost. To calculate the unit cost of the imported material’s (Raw/ Packing) the term L/C costing is used.

L/C opening process:

The purchase dept. first collects a form of application for the opening of letter of credit from a bank. An LCA form (in quintuplicate) is also collected. After filling up these forms, they are submitted to the bank along with the pro forma invoice approved by the Block list of Drug Administration and IMP form of Bangladesh Bank. The L/C margin (a certain percentage of L/C amount), bank charges and commissions for opening the L/C, insurance payment (if made at that time) etc. are also made. The insurance covers all risks from the beginning of transit.

The Cost Sheet:

This is the most important report prepared on the import procurement process of raw materials. Cost sheets are prepared for individual raw and packing material items, as well as spares and capital machinery. Cost sheet is generated by the MAPICS software. It is the summary of entries debited through the journal voucher of L/C. It is used for costing and pricing decisions. The cost sheets include the following:

Through this cost sheet Beximco Pharma determines per unit landed cost of imported Raw material and Packing material.

Material Costing:

In case of imported materials some important formulas are as follows:

- Assessable Value= Invoice Value X Exchange Rate X 1.01(Insurance) X 1.01 (Landed Charge)

- Customs Duty= Assessable Value X Customs Duty Rate (from Bill Of Entry)

- Supplementary Duty= (Assessable Value + Customs Duty) X SD Rate (from Bill Of Entry)

- Pre-Shipment Inspection(PSI)= (Invoice Value X Exchange Rate) X PSI rate (from Bill Of Entry)

- Regulatory Duty= If CD% is greater than or equal to 25% then Assessable Value X 5% Landed Cost = C&F Amount + CD amount +SD amount + PSI amount + RD amount + Others expenses (C&F Commission, Insurance premium, Opening Charge, Misc. Exp.)

In case of Locally Procured Materials:

In case of locally procured materials the landed cost is Purchase order rate or Invoice rate.

Contemporary cost accounting methods and techniques used by Beximco Pharma:

Total quality management:

Total Quality Management refers (TQM) to the process of continuous improvement to achieve the full customer satisfaction. Rather than waiting to inspect items at the end of the production line or striving to stay within acceptable tolerance limit, TQM’s goal is eliminating all waste. In Beximco Pharma, quality is maintained with great care. As it is a pharmaceutical company, it is mandatory to keep up with the quality level with the other companies. As a result, they have received GMP Clearance from Therapeutic Goods Administration (TGA) of Australia and from Gulf Central Committee for Drug Registration, Executive Board of the Health Ministers’ Council for Gulf Cooperation Council (GCC) states (representing Saudi Arabia, Kuwait, Bahrain, United Arab Emirates, Qatar and Oman). The company is also in the process of obtaining approvals from several other regulatory authorities including National Health Surveillance Agency (ANVISA) of Brazil, Medicine and Healthcare Regulatory Agency of United Kingdom (UK MHRA), US FDA etc.

Life Cycle Costing:

Life cycle costing tracks and determines the cost attributed to each product and service from its initial research and development to development to final marketing to customer. In Beximco Pharma , as I discussed that this type activities is done in mainly in the Strategic Brand Management (SBM) Department. The activities of SBM are:

- Market research

- Selection of new product

- Design and testing of product (DTP)

- Sample store (logistics) management

- Making strategy

With the SBM departments, Beximco Pharma determines the Life Cycle of the products.

Target Costing:

Target costing is an approach which determines what a product or service should cost based on its sales price less a target profit. Basically, it is a tool for decision making. Unlike traditional costing for making up cost, it is a market driven way of examining the relationship of price and cost. In Beximco Pharma, the use of Target Costing is very common to make the target for the cost of the product.

Activity-Based Costing

Activity-based costing (ABC) developed to provide more accurate ways of assigning the costs of indirect and support resources to activities, business processes, products, services, and customers(Kaplan and Atkinson, 2001:97). Activity-based costing is a method of assigning costs that calculates a more accurate product cost by identifying all of an organization’s major operating activities. The goal of ABC is not to allocate common costs to products but to measure and then price out all the resources used for activities that support the production and delivery of products and services to customers. For this why, ABC is important to activity-based management. In Beximco pharma, although the ABC system is not fully implemented, still it tries to follow the methods of this innovative costing process along with the Standard costing.

Just because, the y found many major cost drivers in case of manufacturing the goods, which needs a careful attention to determine manufacturing overhead. Some of the examples of such cost drivers are as follows;

- Research And Development Cost

- Direct Labour

- Labour Hour

- Types Of Product

- Number Of Batch

- Batch Size

- Process Of Production

Factors That Affects The Costing Procedure At Beximco Pharma

The Major reasons for which the price of the materials affected are identified below: LC opening charge: The LC opening charge increases with the amount of LC opened. It will affect the actual price of the materials.

Insurance premium: For the safety of the materials it is necessary to give insurance premium for that material. Numbers of insurance companies are interest to open insurance for the firm. But this also affects the material price.

Demurrage charge: It has to be given to the port authority by the BPL in case of delaying in material receive.

Inflation: Due to inflation rate material price can also be increased which has impact on purchasing of materials. The company would have nothing to do if there is occurred high inflation in the imported country.

Exchange rate changes: material price can also be affected by the exchange rates changes. In spite of, the unchanged material price the cost of it can be increased by the change in foreign exchange rates.

C & F commissions: Clearing and forward commissions are charged by the agents which are works for the Beximco. There are number of agents who receive the goods, pay all types of duty charges to the government and bring the materials to the factory storehouse.

The C & F commissions include:

- Documentation

- Customs duty and taxes

- Super urgent delivery expenses

- Wharf rent and removal

- Pay order commissions

- Cooly wages for loading and unloading

- Transport

- Agency commission

All the above items of C & F commissions are added with the cost of the material. Therefore the actual price of the material is increased.

Miscellaneous expenses: Besides the above factors some other costs are incurred in case of material import. These costs are also included with the material price.

Exchange Rate: Basically, 70-80 percent materials are purchased from outside of the country. So payments for the imported goods are made in dollars maximum time. So the increase in the exchange rate would increase the prices of the materials. According to the survey data the, it was found that 66 percent employee that that the exchange rates affects moderately and 33 percent employee thought that the exchange rates has less effects. The reason behind such opinions was that for the last numbers of months dollar is stable against taka. Furthermore, the payment was made in dollar maximum time. Another thing was the exchange exercised by the customs was almost fixed for number of months. So, when the exchange rates changes abruptly only then there would be a high impact over price of the materials.

Yearly increment of salary: This is one of the major issues of labor rate increasing. Beximco Pharma provides salary increment every year. Therefore, the cost of direct labor is increased.

Increase in market labor rate: This is due to inflation rate of a country. The market rate of labor payment has been increasing for last two or three years. So, this has also a great impact on direct labor cost.

Other benefits of the labor: Besides the monthly payments, the labors are provided some other benefits which also affect the costing. At Beximco factory, there are labor unions which deal with the management about their needs and benefits.

The reasons for increasing the overhead cost are-

- Markets rates of utilities like gas,

- electricity and water,

- Repair and the maintenance costs,

- Insurance premiums etc. are increased due to reducing the life of the machines.

FINDINGS

Working on the costing procedure of Beximco Pharmaceuticals Limited was an interesting issue. The following findings are made on the basis of research work:

- The employees of departments of Beximco Pharma are very much co-operative and interdependent to each other.

- The cycle or chain of performing all functions is very well-organized.

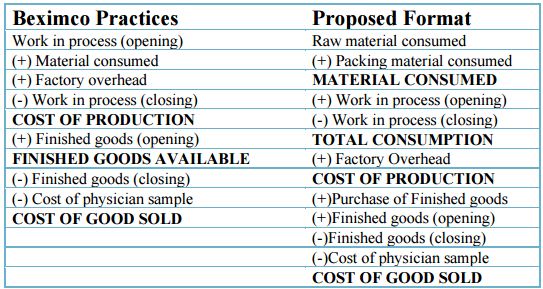

- Beximco Pharma uses conversion cost concept for reporting cost of goods sold and preparing cost sheet.

- Beximco Pharma follows the batch costing method and collocate their factory overhead on the basis of the total production of the batches.

- Beximco Pharma uses pre determined factory overhead for determining factory overhead early for costing purpose.

- Beximco Pharma does the variance analysis comparing actual and budgeted amount.

- Beximco Pharma tries to control overhead through the budgetary control.

- Beximco Pharma also prepares cost report for managerial purpose.

- They use standard cost sheet for measuring their performance properly.

- Beximco Pharma doesn’t fully apply Activity based costing but they try to use the concept of ABC in allocating overhead.

- Beximco Pharma follows the absorption costing method to prepare cost sheet.

- Major reasons for which the price of the materials is affected are-LC opening charge, Demurrage charge, Inflation, Exchange rate changes and C&F commissions, etc.

- Yearly increment of salary is one of the major issues of labor rate increasing. Beximco Pharma provides salary increment every year. Therefore, the cost of direct labor is increased.

- The reasons for increasing the overhead cost are- Markets rates of utilities like gas, electricity and water, Repair and the maintenance costs, Insurance premiums etc. are increased due to reducing the life of the machines.

RECOMMENDATION

Beximco Pharma tries to ensure better quality and better management. The staffs demonstrate their knowledge and experience with sheer professionalism. Despite these efforts some shortcomings may remain and there is always an opportunity to overcome those. Trough out my study I have found that they have some opportunity that they can take being taking proper steps. On the basis of my understanding and observation I am proposing the following recommendation to the Beximco Pharma:

Cost of Goods Sold:

Beximco Pharma may improve their Cost of Goods sold reporting for better understanding. Though it is not contradictory with the IAS/BAS. To make user friendly BPL may change this format.

Factory Overhead, Selling and Administrative overhead:

Factory overhead, selling and administrative overhead is increasing year to year. The increasing trend is totally straight. Company should control the overhead properly. We know that company has no direct control over raw material prices. In the increasing raw material every company will be sufferer but company can properly control the overhead.

The control of overhead is totally under the decision of the management. Management should proper analysis of the overhead cost on the basis of this analysis they should prepare budget. Company should not prepare the budget on the basis of the requirement of the department demand. Cost manager should have proper knowledge about the all departments’ functions and activities properly.

Petty Cash Expenses:

Beximco distributes their goods through I & I services. I &I services gets commission for their activities. I&I service takes their expenses from daily cash collection for expenses of distribution.

With the working with the petty cash section I have shown that depot of the I&I services overstate their expenses. For these activities the overhead cost is increasing day by day. Proposed Policy: Beximco Pharma should make budget for the daily expenses. Through proper budgetary control and research on that will minimize the expenses. BPL should set out daily allowance of the depot of I&I services on the basis of the proper study and observation.

Negotiation with the Insurance Company:

In Beximco Pharma there are many insurance companies. BPL always does insurance of their material. The management should negotiate with them to reduce their insurance premium charges. One or two company will be allowed to do all kinds of insurance.

Through this negotiation BPL will be able to reduce the expenses. Expansion of the Shuktara Printers, BAIL, Prarmateck and I&I services:

Shuktara Printers is the supplier of the printing and packaging materials of the BPL. Shuktara printer is the related party of the BPL but they are not able to supply all the printing and packing materials. BPL has to purchase printing materials from other sources. If BPL is able to manage all packing and printing materials from Shuktara then will be cost effective. If possible Shuktara will be able to sell other company for surplus.

For BAIL, Pharmateck and I&I services, I also recommend expansion policy in the same way. May these company will be leading company in the respective field like BPL, If management takes the appropriate decision.

CONCLUSION

Beximco Pharmaceuticals Ltd. is a leading edge pharmaceutical company and is a member of the BEXIMCO Group, the largest private sector industrial conglomerate in Bangladesh. Beximco Pharma is also the largest exporter of pharmaceuticals from Bangladesh, spreading its presence in many developing and developed countries across the globe. Recently, BPL has successfully made its footmark in the global market when it made its debut on the London Stock Exchange as the first Bangladeshi company to be listed in the world’s most prestigious bourse. This milestone event has widened the responsibility, accountability and transparency of the company beyond geographical border. This was an added challenge to all the accounting staffs as the listing the accountability of the organization has gained a global reach. The ever expanding export trade also indicates greater responsibility to the world. The Finance and Accounts department took the challenge and prove their mettle by the timely publication of 2005 Annual Financial Reports globally. Each and every section in the department deserves to be complemented for their endeavor. From raw material import to the bringing of smile for the society, on every level, professionalism and dedication is the key to this success.

In this report, we have tried my level best to identify management accounting techniques and procedures used by Beximco Pharma. What and how Beximco Pharma use cost accounting information for decision making and external financial reporting along with describing the procedure and systems of using cost accounting information. In this report, we imply our acquired knowledge from cost accounting course and try to comply with the techniques procedure and systems followed by the company.

In today’s complex yet highly competitive business environment management needs quality information for decision making purpose. Beximco believes that quality and control should be ensured and these can be ensured by using proper cost accounting information. Relevant and reliable cost information can be ensured by implementing by using effective cost accounting methods. And they do the best one fit in the context of Bangladesh.