INTRODUCTION:

Social Investment Bank Ltd. is a concept of 21st Century participatory three sector banking model. Targeting poverty, Social Investment Bank Ltd (SIBL) intends to demonstrate the operational meanings of participatory economy, banking and financial activities as an integrated part of code of life. It is an alternative concept of Islamic Banking with a unique human face approach to credit and banking based on interest-free economic transactions, mutual participation and sharing of profit and loss through various modes of finance and humanism as reflected in its general name. In the context of labor-surplus economy of Bangladesh, it represents a comprehensive alternative concept and an operational model meant to combine together: (a) real material benefits, (b) visible social advantage and (c) clear spiritual vision-all three in one package to the benefit of not merely its clients and shareholders but also to the advantages of vast poor masses at the grass root level. The management of such a bank would mainly be participatory in nature so that employees feel that the organization belongs to them.

The program of this bank would include commercial, agricultural, small industrial, educational, health and grass-root level social banking activities. They will be designed in a manner so as to make finance, production, marketing, training and moral suasion in one package. While basic human endowments and God-loving or God-fearing criteria will be used as fundamental collateral, in all operations of this Bank, it will give particular emphasis on program dealing with the problem of absolute rural and urban poor, the various mechanics of partnership, equity based and profit sharing operations (i.e. Mudarabah, Musharaka, Murabaha) and other tools will be operationalized in a manner so that economic, human and moral dimensions are clearly manifested in order to give them a distinctive character of Islamic finance. The uniqueness of the program lies not merely only in integrating these socio economic dimensions but also in controlling their results and directing their consequences to attain a higher level of social consciousness and concern for others

SIBL Memorandum and Structure:

The Bank was incorporated in Bangladesh on the fifth day of July 1995 as a Bank Company under the Companies Act, 1994. The Bank within the stipulations laid down by Bank Companies Act, 1991 and directives as received from Bangladesh Bank provides all types of commercial banking services from time to time. Besides as a matter of policy the Bank conducts its business on the principles of Mudarabah, Musharaka, Murabaha, Bai-Muazzal and Hire Purchase transaction approved by Bangladesh Bank. The Bank is one of the interest-free shariah based Banks in the country and its modus operandi are substantially different from those of other Commercial Banks.

CAREER LADDER IN SIBL:

MANAGING DIRECTOR

DEPUTY MANAGING DIRECTOR

EXECUTIVE VICE PRESIDENT

SENIOR VICE PRESIDENT

VICE PRESIDENT

SINIOR ASSISTANT VICE PRESIDENT

ASSISTANT VICE PRESIDENT

FRIST ASSISTANT VICE PRESIDENT

CHIEF OFFICER

SENIOR OFFICER

OFFICER

JUNIOR OFFICER

ASSISTANT OFFICER

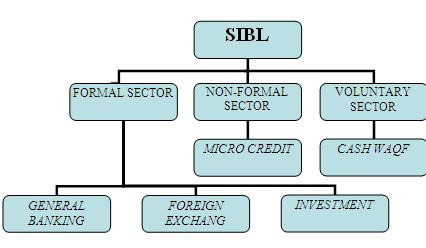

Three Sector Banking Analyses:

Social Investment Bank Ltd. is indeed a concept of 21st Century participatory three sector banking model. In the Formal Sector, it works as an Islamic participatory Commercial Bank on the basis of profit and loss sharing; in the Non-formal Banking Sector, it works with the poor non-corporate sector dealing with informal finance and credit package that is intended to empower the real poor families and create local income opportunities and discourage internal migration. Clearly, this Bank intends to operate much beyond the scope of conventional market economics. Where Market Economy ends, Participatory and Negotiated Economy begin. In the Voluntary Sector, the bank provides support for social benefit organizations- by way of mobilizing funds, social services, to the above target sector. Notable instruments are CASH WAQF CERTIFICATES, & Management of WAQF & MOSQUE Properties.

In the formal corporate sector, this Bank would, among others, offer the most up-to date banking services through opening of various types of deposit and investment accounts, financing trade, providing letters of credit, collection of bills, effecting domestic and international transfer, leasing of

equipments and consumer durables, hire purchase and installment sale for capital goods, investment in low cost housing and management of real estates, participatory investment in various industrial, agricultural, transport, educational and health project and so on.

In the Non-formal non-corporate sector, it would, among others, involve in opening and introducing various savings and micro-credit investment and custom-tailored group programs, designed for small entrepreneurs, marginal farmers, land less laborers, unemployed educated youth/semi-skilled people, etc.

In the voluntary/third sector, it involves in Cash Waqf Certificate and development and management of WAQF and MOSQUE properties, and Trust funds & properties.

Operational Strategies:

This Banks program will be directed mainly to uplift the socio- economic conditions of rural and urban poor with a view to eventual elimination of poverty. In the process, this Banks intends to empower the family as a basic unit of the society. Thus investment program of this Bank will be geared to generate profits, a percentage of which will be set aside to support social projects on a non-profit basis. Thus all activities of the Bank will be subject to Social Assignments, thereby making social and moral preferences transparent and revealed in all its financial and economic operations. The concept of social welfare will then have a different meaning. Here rights will be kindled to duties. The operational strategies of the Bank would, therefore, involve, mobilization and utilization of –

a. Local resources at the grass-root level mainly form within;

b. Surplus labor wherever possible ‘

c. Human and money capital of beneficiaries of earlier programs;

d. Unemployed and underemployed in the informal sector;

e. Islamic voluntary sector and voluntary labor for social capital accumulation and welfare;

f. Adoption of class-harmony extended family approach to industrial relations through employment by participation; and

g. Participation of women, minorities, and people or other religions to operationalize the concept to brotherhood of man and humanism.

Target Groups and Their Role:

At a grass-root village and local level, the Bank’s program is directed towards landless laborers, marginal farmers, fishermen, small artisans (e.g., blacksmith, carpenter, potter and handicraft producer), urban unemployed, small traders, small and rural industries, small and medium-scale business enterprises. This Bank’s interest-free finance activities tend to be different both in their form and substance as their motivational properties are fundamentally different. In an important sense, it is also an investment option for the relatively richer section of Bangladesh society. There is a built-in Islam for obligatory transfer of funds from rich to poor. Formal sector involvement is therefore necessary.

Poor must contribute to poverty alleviation. Charity and Islamic tools of re-distribution of income will be institutionalized and linked to income-generating activities of the poor. Thus, this Bank intends to provide a comprehensive package of commercial investment, financial services and linked them with interest-free loan and grant to the poor for-

a) Sustaining their minimum level of consumption (i. e, Managing Marginal Propensity to Consume (MMPC).

b) Raising their level of savings, (i. e Managing Marginal Propensity to save (MMPS).

c) Creating opportunities for their investment, (i. e, Managing Marginal Propensity to Invest (MMPI)

Conceptual Features:

At the conceptual level, seven distinctive features of this Bank are as follows:

- To develop an alternative human face approach to credit and finance based on participation and sharing of profit and loss.

- To implement projects, targeting absolute poor on a priority basis.

- To involve the poor and all beneficiaries of the program in the recycling process for mitigating the poverty of relatively less fortunate people around him through contribution into a “Social Fund”.

- To foster the notion of sharing and participatory management designed to raise the level of self-respect and mutual reliance rather than self-reliance likely to promote individualism.

- To raise the level of human qualities and potentialities of the participants of the program through required de-education, re-education, new-education and programs for non-formal training on- the- job.

- To provide a clear sense of economic, social and moral purpose to teach of the participants of the Bank’s programs.

- To design and implement programs that conveys life in its totality with a view to developing a sense of humanism and a caring society.

Operational Features:

At the operational level, this Bank has ten unique operational features, which are given below:

a) To develop a built-in provision for a contribution to a “Social Fund” in all financial contracts and transactions with the Bank’s clients either on individual or group or family basis as well as to operational the notion of integration between secular economic and non-secular activities.

b) To involve local public and workers in the decision-making process in the management of cottage, small and medium scale industries. The poor will be placed at the focal point of an integrated package. Mere direct timely access to credit without collateral which is it self-unconventional and unorthodox is not considered enough to uplift the socio economic condition of the poor. This facility this facility needs to be synchronized by linking credit to production management, relevant training program and suitable marketing services coupled with a provisioning for social investment.

c) To develop training program for generation and updating the required skill of the employees.

d) To develop training program for generation and updating the required skill of the employees.

e) To identify and execute finance and business programs/deals involving absolute poor and destitute people having no physical asset as collateral.

f) To organize door-to-door mobile banking.

g) To develop income-generating programs specially suited for woman and disadvantaged groups of minority too.

h) To design programs for utilizing surplus labor as well as voluntary labor services in rural and urban areas.

i) To organize program

PRODUCTS & SERVICES OF SIBL:

SIBL is a three sector Islamic bank. Services, which provided by SIBL, are shown bellow:

SECTION-I Formal Sector of SIBL:

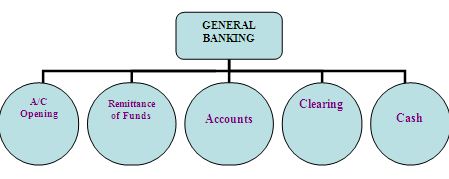

General Banking:

“General Banking” is one of the major areas of Formal sector. Through this section bank receive and disburse money, to develop banker customer relationship by opening different types of account and providing prompt services to the customers. It is called the nerve center of the bank. The officers/staffs engaged in the department not merely deal with cash but they also take important role rendering the better customer services. So cash officers should be well experienced and should behave well towards the valued customers by offering prompt services, receipt and payment of cash with always presenting smiling face. Since bank makes profit by investing people’s money so it needs to collect money from customer by various way and has to ensure best service for attracting customers.

The commercial banks of Bangladesh deal with various products and services keeping pace with the changing situation. The globalization and its impact on banking are immense. Nevertheless, try revolution in IT has posed a great challenge for banking services. They are now facing much more competition for its existence not only within the country but also from global arena. In the changed scenario banks of Bangladesh could not yet equipped them to offer the IT based services. Their main products still remains on the traditional based. However, the multinational banks and some local private banks are appearing in the money market with their newer products.

DEALING PRACTICES:

The dealing practices of banking in Bangladesh have developed on the customs, convention and usages based upon the relevant laws of the land. The Negotiable Instrument Act of 1881, Banking Company’s acts and other prudential regulations are the source of banking practices in Bangladesh.

The Government of Bangladesh with the technical and financial assistance of the World Bank undertook FSRP and CBRP to develop the efficiency, financial soundness, discipline and working practices to make the banking sector capable to work in a competitive situation.

The whole activity of “General baking” in SIBL is classified in five areas.

A/C Opening and Deposit Mobilization:

By deposit mobilization, we mean bringing of potential deposit or idle savings of the people to the banking channel, in a wider sense, it may also mean bringing potential savings of the people to the banking channel. Deposit is the money kept by the customers, which are repayable on demand and withdraw able by cheques, drafts, pay order or using other acceptable instrument. Bank gives profit to depositor for keeping the money in the bank, it also cut service charge from client. From this deposit bank invests and earns profit from borrower. As more and more deposits are mobilized by a bank its entire activity enlarges and the bank starts making higher returns making profitable returns. Total process of deposit mobilization is showing in following diagram:

Remittance of Funds:

Bank has branches throughout the entire country and therefore, they serve as best medium for remittance of funds from one place to another. This service is available to both customers as well as non-customers of the Bank. The followings are some of the important modes of transferring funds from one to another trough Banks. Functions of Remittance Section:

- Handling of all incoming and outgoing foreign and local remittance is the major function of this department.

- Handling of incoming and outgoing T.T

- Outstation cheque collection

- Outstations cheque purchase

- Demand draft handling

Different types of account in SIBL:

Al-Wadiah Current Account:

It is almost similar to current account of conventional banks. The owner of the fund does not enjoy any profit nor bear any loss. But the bank obtains the permission from the depositor so that the bank has the option to use the fund whenever necessary, for the interest of the bank.

Mudarabaha Savings Deposit Account:

Its mechanism is almost similar to the savings account of the conventional banks. The basic difference in this case is that profit from the investment will be shared by the bank and the owner of the owner of the fund specifics a particular type of business for the purpose of investment

Mudarabaha Term Deposit Account:

This arrangement is the combination of the Term Mudarabah and special Mudarabah Account Under this arrangement the owner of the fund agrees keep the deposit remain with the bank for a particular time period (3 months/6 months/one year/two years /three years) specifics a particular type of business for the purpose of investment

Mudarabaha Short Notes Account:

□ Any company, business entity, dept. of the govt. organization and trust or any person can open this account.

□ This account is operated under Mudaraba principle.

□ Any amount can be withdrawn or transferred to al-wadiah current account or any other accounts after placing a notice of seven days.

Cheaue books are provided for these accounts. Because of the facility of withdrawing money at a short notice the profit rate is comparatively lower for this account.

Hajj Savings Deposit Account:

A person intended to perform Hajj within 10 years can open this account for a period at his convenience.

□ A year is divided into 12 installments.

□ Profit is given for the daily balance based on a weight age of 1.1 %.

□ There is no provision for withdrawal

Mudaraba Monthly Saving Deposit Account:

Under this system the procedure of deposit is like the DPS of conventional banking system. A person has to deposit a certain amount of money per month. After the maturity of the account accountholder gets his money with profits.

PAPERS/DOCUMENTS REQUIRED FOR OPENING DIFFERENT ACCOUNTS:

For opening an AL-WADIAH Deposit Account the following papers/documents shall be submitted in addition to photographs, specimen signature card. Nationality certificate and Account Opening From:

A: For Sole Proprietorship

i) Trade License

B: For Partnership

i) Partnership Deed

ii) Trade License

C. For Joint Stock Company

i) A certified copy of the Memorandum and Articles of Association duly attested by the signatory of the account

ii) Certificate of Incorporation.

iii) Certificate of commencement of business

iv) Copy of the latest Balance Sheet

v) List with name, designation and specimen Signature of person(s) authorized to operate the account duly certified by the Chairman, Minutes of Board of Directors meeting authorizing the opening of account with the bank duly certified by Chairman \ Managing Director

vi) List of Directors with address

vii) Trade license

D. For Association, Committees and Societies etc.

- Minutes of the committee meeting authorizing the opening of account with the bank duly certified by the Secretary and Chairman/ President

- A copy of the Constitution

- A copy of the Resolution of the Committee authoring specific Signatories to the Account.

Clearing Department:

In the Clearing department the work is to clear the cheques and pay order through Bangladesh Bank that are submitted for cash collection Everyday clearinghouse takes a place in Bangladesh Bank once in the morning called morning house (1st house) another in the evening called return house (2nd house). In the house representatives of all the banks sit together and settle all the cheques of other banks to clear the paper and transfer the money to their particular account.

There are two types of clearing:

Inward clearing: The cheques or instruments of own bank that are submitted to other banks to collect are called inward clearing.

Outward Clearing: The cheques of other banks that are submitted to own bank for collection are called outward clearing.

Cash:

Cash department is another part of general banking Cash department is the main part of any bank and the main work of it, is to Receive and to Pay Cash to different clients it also takes different utility bills IPO form of different company.

A. DEPOSIT PRODUCTS:

1 Savings Bank Deposit

2 Current Deposits

3 Special Notice Time Deposit

4 Fixed Deposits

5 Sundry Deposits

6 Call Deposits

7 Deposit Pension Scheme

B. LENDING PRODUCTS:

1 Rural Credits & Micro Credits

2 Weavers Credit

3 Industrial Credits

4 Loans – House Building Loans, Transport Loan, etc.

5 Overdraft & SOD

6 Cash Credit (Working Capital & Com. Lending)

Packing Credit

LIM

PAD

C. SERVICE PRODUCTS:

Collection of Bills (Local S Foreign)

Issuance of LC, LG, PO, DD, TT, MT, etc.

Payment of Military Pension

Payment of Female Students Stipend & Collection of various Utility bills

CUSTOMERS:

With the escalation of financial activities the definition of customers also are being changed. Now the people having or using the services of the banks in any form are termed as customers. The customers of banks in Bangladesh are persons or institutions of various classes. Right from an illiterate farmer in rural areas to highly qualified persons in urban areas are the customers of the bank. The customers of the banks are broadly categorized in the following way:

The mass people -Students, Teachers, Farmers, Workers The class people -Traders, Industrialists, Importers, Exporters Institutions – Govt. & Private Sector.

Foreign Exchange:

Foreign exchange refers to the process or mechanism by which the currency of one country is converted into the currency of another country. Foreign exchange is the means and methods by which rights to wealth in a country’s currency are converted into the rights to wealth in another country’s currency. In banking when we talk of foreign exchange, we refer to general mechanism by which a bank converts currency of one country into that of another. Foreign trade gives rise to foreign exchange. Foreign trade is transacted either in the currency of the exporter’s country or that of the importers country. Or that of a third country acceptable to both to both the exporter.

The foreign exchange regulation Act 1947 as adopted in Bangladesh defines- Foreign Exchange means foreign currency including any instrument draw, accepted, made or issued under clauses 13 of article 16 of Bangladesh bank order 1972 all deposits, credits and balances payable in any foreign currency and any drafts, traveler” cheque, letter of credit and bill of exchange expressed or drawn in Bangladesh currency but payable in any foreign currency.

Bangladesh Bank in exercise of the power conferred by section 3 of foreign exchange regulation Act 1947 issued licensed to schedule bank to deal in foreign exchange

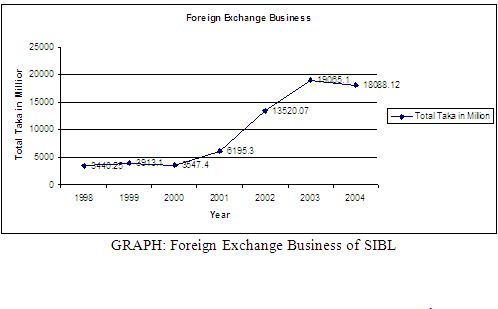

SIBL Foreign Exchange Business stood at Taka 18088.12 million in 2004 against Taka 19065.10 million in 2003. The break up of this foreign exchange as under:

Particulars | Import | Export | Remittance | Total |

| 1998 | 1364.35 | 42.90 | 35.00 | 3440.25 |

| 1999 | 1718.60 | 139.80 | 55.70 | 3913.10 |

| 2000 | 2983.20 | 530.80 | 33.40 | 3547.40 |

| 2001 | 4723.40 | 1440.20 | 31.70 | 6195.30 |

| 2002 | 11124.85 | 2287.64 | 107.57 | 13520.07 |

| 2003 | 14908.90 | 4035.90 | 120.30 | 19065.10 |

| 2004 | 13363.07 | 4500.23 | 224.82 | 18088.12 |

| Growth rate | -10.37 % | 11.50 % | 86.88 % | -05.12 % |

Investment:

Investment:

Investment is the action of deploying funds with the intention and expectation that they will earn a positive return for the owner (Brokinglon 19-36, p6S) Funds may be Invested in either real assets or financial assets When resources are used for purchasing fixed and current assets in a production process or for $ trading purpose, then it can be termed as real investment The establishment of a factory or the purchase of raw materials and: machinery for production purposes are examples of this. On The other hand, the purchase of a legal right to receive income in the form of capital gains or dividends would be indicative of financial investments.

Specific examples of financial investments are: Deposits of money in a bank account, the purchase of Mudaraba Savings Bonds or stock in a company. Ultimately, the savings of investors in financial assets are invested by the respective company into real assets in the form of the expansion of plant and equipment. Since Islam condemns hoarding savings and a 2.5 percent annual tax (Zakat) is imposed on savings, the owner of excess savings, if he is unable to invest in real assets, has no option but to invest his savings in financial assets.

When money is deposited with an Islamic Bank, the bank, in turn, makes investments in different forms approved by the Islamic Shariah with the intent to earn a profit. Not only a bank, but also an individual or organization can use Islamic modes of investment to earn profits for wealth maximization. Some popular modes of Islamic Investment are discussed below. A comparison is also attempted between the Islamic Modes of Finance and these of conventional banks.

Current Scenario:

SIBL investments stood at Tk. 12,887.27 million in various sectors as at 31st December, 2004 against Tk.10, 059.11 million of 2003 registering a growth by 28.12% which signifies the confidence of the clients having on their bank. At the same time, we are concentrating our efforts to increase fee based and Exchange based investments to facilitate the earnings of the Bank.

SIBL MODES of FINANCE:

At the beginning it is better to give a clear definition of “Islamic Modes of Finance”. The word “Modes” literally means “methods”, or in other words, it refers to systematic and detailed rules, stipulations and steps to be followed for accomplishing a specific thing. The thing that needs to be accomplished in this context is, however, the subject matter of each of the said modes, i.e. any of the different types of investment activities (trade, leasing, real estate, manufacturing, agriculture, agriculture production etc., or, using Shariah expressions Murabaha, Mudaraba, Musharaka, Ijarah, Istisna, etc.). The word “Finance” in one of its different meanings refers to the supply of money capital or credit, provided by either a person (household), or an organization (private or public – financial or non financial). The word “Islamic” is inserted in the above expression to restrict the type of rules that can govern different modes of finance to the Shariah rules. A complete definition for the term “Islamic Modes of Finance”‘ may be given as follows:

BAI-MURABAHA:

Meaning of Murabaha:

The terms “Bai-Murabaha” have been derived from Arabic words Bai and Ribhun. The word ‘Bai’ means purchase and sale and the word ‘Ribhun’ means an agreed upon profit “Bai-Murabaha” means sale for an agreed upon profit Bai-Murabaha may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods permissible under Islamic Shariah and the Law of the land to the buyer at a cost plus an agreed upon profit payable today or on some date in the future in lump-sum or by installments. The profit may be either a fixed sum or based on a percentage of the price of the goods.

Types of Murabaha:

1) Ordinary Bai-Murabaha, and

2) Bai-Murabaha Order

1) Ordinary Bai-Murabaha: It is a direct transaction between a buyer and a seller. Here, the seller is an ordinary trader who purchases goods from the market in the hope of selling these goods to another party for a profit In this case; the seller undertakes the entire risk of his capital investment in the goods purchased. Whether or not he earns a profit depends on his ability to find a buyer for the merchandise he has acquired.

2) Bai-Murabaha order on and Promise: Bai-Murabaha order on and Promise involves three parties – the buyer, the seller and the bank. Under this arrangement, the bank acts as an intermediary trader between the buyer and the seller. In other words, upon receipt of an order and agreement to purchase a certain product from the buyer, the bank will purchase the product from the seller to fulfill the order.

However, it should be noted here that the Islamic Bank acts as a financier in this transaction. This is the case, not in the sense that the bank finances the purchase of goods by the consumers; rather it is a financier by deferring payment to the seller of the product Thus, there is a chance that this transaction could resemble nothing more than a loan for which interest (Riba) is earned, which is contrary to Islamic beliefs.

Therefore, to avoid this potential misuse of the Bai-Murabaha relationship, the bank should purchase the goods on behalf of the bank from the seller and sell the goods to the buyer, receiving payment on behalf of the bank as well. In this way, the profits generated by the transaction to each of the parties involved cannot be misconstrued as interest or (Riba) profits.

Steps of Bai-Murabaha:

There are certain steps to accomplish a deal of Bai-Murabaha as shown below:

First Step: The client submits a proposal regarding his requirements of the bank. The client sends a proposal with the specifications of the commodity to be acquired from the bank. The proposal also indicates details regarding the date, time and place of delivery as well as price and form of payment information. The bank responds by sending a counter proposal either accepting the buyer’s price or stipulating a different price.

Second Step: The client promises to buy the commodity from the bank on a Bai-Murabaha basis, for the stipulated price. The bank accepts the order and establishes the terms and conditions of the transaction.

Third Step: The bank informs the client (ultimate buyer) of its approval of the agreement to purchase. The bank may pay for the goods immediately or in accordance with the agreement. The seller expresses its approval to the sale and sends the invoice(s).

Fourth Step: The two parties (the bank and the client) sign the Bai-Murabaha Sale contract according to the agreement to purchase.

Fifth Step: The Bank authorizes the client or its nominee to receive the commodity. The seller sends the commodity to the place of delivery agreed upon. The client undertakes the receipt of the commodity in its capacity as legal representative and notifies the bank of the execution of the proxy.

Rules of Bai-Murabaha:

It is permissible for the client to offer to purchase a particular commodity, deciding its specifications and committing itself to buy it on Murabaha for the cost plus the agreed upon profit

2. MUSHARAKA (PARTNERSHIP):

Meaning of Musharaka:

The word Musharaka is derived from the Arabic word Sharikah meaning partnership. Islamic jurists point out that the legality and permissibility of Musharaka is based on the injunctions of the Qura’n, Sunnah, and Ijma (consensus) of the scholars. It may be noted that Islamic banks are inclined to use various forms of Shariakt-al-lnan because of its built-in flexibility. At an Islamic bank, a typical Musharaka transaction may be conducted in the following manner.

One, two or more entrepreneurs approach an Islamic bank to request the financing required for a project The bank, along with other partners, provides the necessary capital for the project All partners, including the bank, have the right to participate in the project They can also waive this right The profits are to be distributed according to an agreed ratio, which need not be the same as the capital proportion. However, losses are shared in exactly the same proportion in which the different partners have provided the finance for the project (Hussain1986, p.61).

Types of Musharaka:

Musharaka may take two forms:

1) Permanent Musharaka

2) Diminishing Musharaka.

1) Permanent Musharaka:

In this case, the bank participates in the equity of a company and receives an annual share of the profits on a pre-rate basis. The period of termination of the contract is not specified. This financing technique is also referred to as continued Musharaka.

The contributions of the partners under this mode may be equal or unequal percentages of capital for the purpose of establishing a new income-generating project or to participate in an existing one. In this arrangement, each participant owns a permanent share in the capital structure and receives his share of the profits accordingly. This type of a partnership is intended to continue until the company is dissolved. However, one can exit the partnership by selling his share of the capital to another investor.

Permanent Musharaka is used by Islamic Banks in many income-generating projects. They can provide financing to their customers, in exchange for ownership and profit sharing in the proportion agreed upon by both parties. In addition, the bank may leave the responsibility of management to the customer-partner and retain the right of supervision and follow up.

Application of Permanent Musharaka:

Permanent Musharaka is helpful in providing financing for large investments in modern economic activities. Islamic banks can engage in Musharaka partnerships for new or established companies and activities. Islamic banks may become active partners in determining the methods of production cost control, marketing, and other day-to-day operations of a company to ensure the objectives of the company are met On the other hand, they can also choose to either directly supervise or simply follow up on the overall activities of the firm. As part of the agreement, Islamic banks will share in both profits and losses with its partners or clients in operations of the business

Diminishing Musharaka:

Diminishing or Digressive Musharaka is a special form of Musharaka, which ultimately culminates in the ownership of the asset or the project by the client. It operates in the following manner.

Steps of Diminishing Musharaka:

1. Participation in Capital: The bank – tenders part of the capital required for the project in its capacity as a participant and agrees with the customer/partner on a specific method of gradually selling its share in capital back to the partner.

2. The partner – tenders part of the capital required for the project and agrees to pay the agreed upon amount in return for the ultimate full ownership of the business.

3. Results of the Projects: The intent of the project is capital growth. The project may be profitable or lose money.

4. The distribution of the Wealth accrued from the Projects. In the event of loss each partner bears his share in the toss in his exact proportionate share of capital. In the event that the project is successful profits are distributed between the too partners (the bank and me customer) in accordance with me agreement

5. The bank sells its Share of Capital: The bank expresses its readiness in accordance with the agreement, to sell a specific percentage of its share of capital.

The partner pays the price of that percentage of capital to the bank and the ownership is transferred to the partner. This process continues until the bank has been fully compensated for its capital share of the business. In this way the bank has its principal returned plus the profit earned during the partnership and vice versa.

In the first Conference of the Islamic banks in Dubai, the conferees studied the topic of partnership ending with ownership [decreasing partnership) and they decided that this type of business relationship may take one of the following forms.

The First Form: In this form, the bank agrees with the customer on the share of capital and the conditions of partnership The Conference decided that the bank should sell its shares to the customer after the completion of the partnership. Furthermore, they determined that the selling of the banks interest to the partner should be done under an independent contract

The Second Form: In this form, the bank participates in financing all or part of the capital requirements in exchange for sharing in the prospective earnings. In addition, the bank gains the right to retain the remainder of the income for the purpose of applying it towards the capital provided by the bank.

Rules for Diminishing Musharaka: In addition to all the legal rules that apply to the permanent partnership which also apply to the decreasing partnership, the following rules also must be observed.

Application of Diminishing Musharaka:

The decreasing Musharaka is suitable for the financing of industrial businesses that have regular income. It can be considered to be the appropriate mode to finance collective investment. In this arrangement, the bank earns periodic profits throughout the year and it encourages the partner to participate in the joint investment. In addition it fosters individual ownership by allowing the partner to gradually buy the bank’s ownership interest. In terms of society as a whole it corrects the course of the economy by developing a mode of positive partnership instead of the negative relationship of indebtedness. In addition, it assists in the equitable distribution of society’s wealth.

Concluding Remark:

Financing through a Musharaka partnership is investment-based. The capital provider has full control in the management of the business. In addition, he shares proportionately in both the profits and losses of the business. Therefore, the rate of return is uncertain and can be either positive or negative. The cost of capital is also uncertain and there exists perfect correlation between the relationship of cost of capital and rate of return on capital

3. MUDARABA:

Definition of Mudaraba:

The term Mudaraba refers to a contact between two parties in which one party supplies capital to the other party for the purpose of engaging in a business activity with the understanding that any profits will be shared in a mutually agreed upon. Losses, on the other hand, are the sole responsibility of the provider of the capital. Mudaraba is also known a Qirad and Muqaradah (Shirazi 1990, p.31).

Mudaraba is a contract of those who have capital with those who have expertise, where the first party provides capital and the other party provides the expertise with the purpose of earning Halal (lawful) profit which will be shared in a mutually agreed upon proportion. This type of business venture serves the interest of the capital owner and the Mudarib (agent).

The capital owner may not have the ability or the experience to run a profitable business. On the other hand, the agent (the Mudarib) may not have adequate capital to invest in a business or project. Therefore, by entering into a contract of Mudaraba each party compliments one another, allowing a business venture to be financed.

Steps of Mudaraba:

The bank provides the capital as a capital owner. The Mudarib provides the effort and expertise for the investment of capital in exchange for a share in profit that is agreed upon by both parties.

1. The Results of Mudaraba: The two parties calculate the earnings and divide the profits at the end of Mudaraba. This can be done periodically in accordance with the terms of the agreement subject to the legal rules that apply.

2. Payment of Mudaraba Capital: The bank recovers the Mudaraba capital it contributed before dividing the profits between the two parties because the profit is considered

collateral for the capital.

3. Distribution of wealth resulting from Mudaraba: In the event a loss occurs, the capital owner (the bank) is responsible for the entire loss. In the event of profits, they are divided between the two parties in accordance with the agreement between them, subject to the capital being recovered first.

Application of Bai-Salam:

Salam sales are frequently used to finance the agricultural industry. Banks advance cash to farmers today for delivery of the crop during the harvest season. Thus banks provide farmers with the capital necessary to finance the cost of producing a crop

Salam sale are also used to finance commercial and industrial activities. Once again the bank advances cash to businesses necessary to finance the cost of production, operations and expenses in exchange for future delivery of the end product In the meantime, the bank is able to market the product to other customers at lucrative prices. In addition, the Salam sale is used by banks to finance craftsmen and small producers, by supplying them with the capital necessary to finance the inputs to production in exchange for the future delivery of products at some future date.

Thus as has been demonstrated, the Salam sale is useful in providing financing for a variety of clients, including farmers, industrialists, contractors and traders. The proceeds in a Salam sale may be used to cover the finance of operation costs and capital costs.

Concluding Remark:

The Bai Salam agreement is a combination of debt and trading. The capital provider has no control over the management of capital provided. However the capital provider takes all of the risk as profits cannot be determined until the commodity is delivered and the final sale price is determined. In addition the capital provider incurs the opportunity cost associated with the capital outlay. Like the other three previously discussed modes of finance there is no certain rate of return. In addition the cost of capital is uncertain ex-ante. Also, there is no correlation in the relationship of cost of capital and rate of return on capital

QARD HASAN (Benevolent loans):

Qard Hasan is a contract in which one of the parties (the lender) places into the ownership of the other party (the borrower) a definite parcel of his property, in exchange nothing more than the eventual return of something in the same value of the property loaned.

Ausaf Ahmad (1998, p.49) mentioned that since interest on all kinds of loans is prohibited in Islam, a loan that is to be given in accordance with the Islamic principle, has to be, by definition, a benevolent loan (Qard Hasan) i.e. a loan without interest It has to be granted on the grounds of compassion, i.e. to remove the financial distress caused by the absence of sufficient money in the face of dire need. Since banks are profit driven organizations, it would seem that there is not much opportunity for the application of this technique. However, Islamic banks also play a socially useful role. Hence they make provisions to provide Qard Hasan besides engaging in income generating activities.

There may be slight variations among different Islamic banks in the use of this technique. The Faisal Islamic Bank of Egypt provides interest-free benevolent loans to the holders of investment and current accounts, in accordance with the conditions set forth by its board of directors. The bank also grants benevolent loans to other individuals under conditions decreed by its Board. On the other hand, the Jordan Islamic Bank Law authorizes it to give “benevolent loans (Qard Hasan) for productive purposes in various fields to enable the beneficiaries to start independent lives or to raise their incomes and standard of living (Ibid, pp.49-50). Iranian banks are required to set aside a portion of their resources out of which interest free loans (Qard Hasan) can be given to small producers, entrepreneurs and farmers who are not able to secure financing for investment or working capital from other alternative sources, and needy customers. It should also be noted that Iranian banks are permitted to charge a minimum service fee to cover the cost of administering these funds.

Finally, in Pakistan, Qard Hasan is part of the bank’s normal financing activities. Qard Hasan loans are granted compassionate basis and no service charges are imposed on the borrower. While these loans are considered loans of compassion, they are expected to be repaid when it is possible for the borrower to do so. Furthermore in Pakistan, Qard Hasan operations are concentrated in the head office of each bank. Branch offices are not permitted to extend these loans.

Some Observations:

This type of financing by the bank is considered to be more risky than the other Islamic modes of investment previously discussed. Therefore, the application/proposal for Bai-Muajjal investment must be reviewed very carefully to ensure the client can ultimately make payment. The following steps may be taken to ensure the Bai-Muajjal Investment is a good proposition for the bank:

1. The bank may meet with the prospective client regarding his investment needs and business experience prior to an application /proposal is submitted.

2. The bank may review the clients past performance and other financing arrangements he may have had with the bank in the past.

3. The bank may review its current investment policy regarding this type of financing arrangement to ensure the proposal meets bank guidelines.It should be remembered that if the Bai-Muajjal investment is not secured by first class collateral securities, it becomes more risky than investments under other modes of Islamic banking.

The following points should receive attention before making any investment decision under Bai-Muajjal:

1 Whether the goods that the client intends to purchase are marketable and have steady demand in the market.

2 Whether the price of the goods is subject to frequent and violent changes.

3 Whether the goods are perishable in short or in long-term duration.

4 Whether the quality and other specifications of the goods as desired by the client can be ensured.

5 Whether the goods are available in the market and the bank will be in a position to purchase the Goods in time and at the negotiated price.

6 Whether the sale price of the goods is payable by the client at the specified future date in lump sum or in Installments as per the agreement.

HIRE PURCHASE:

Hire Purchase under Shirfcatul Meik has been developed through practice. Actually, it is a synthesis of three contracts: (a) Shirkat; (b) Ijarah, and (c) Sale. These may be defined as follows:

Definition of Shirkatul Melk: ‘Shrkaf means partnership. Shirkatu! Melk means share in ownership. When two or more persons supply equity, purchase an asset and own the same jointly and share the benefit as per agreement and loss in proportion to their respective equity, the contact is called Shirkatul Melk. In the case of Hire Purchase under Shirkatu! Melk, islamic banks purchase assets to be leased out jointly with client under equity participation, own the same and share benefit jointly till the full ownership is transferred to the client

Definition of Ijara: The term ‘Ijara’ has been defined as a contract between two parties, the lessor and the lessee, where the lessee enjoys or reaps a specific service or benefit against a

specified consideration or rent from the asset owned by the lessor. It is a lease agreement under which a certain asset is leased out by the lessor or to a lessee against specific rent or rental for a fixed period.

Definition of Sale contract: This is a contract between a buyer and a seller under which the onwnership of certain goods or asset is transferred by the seller to the buyer against agreed upon price paid by the buyer, in the case of Hire Purchase under ShirkatuI Melk, the lessor bank sells or transfers its title to the asset under a sale contract on payment of sale price.

Thus in Hire Purchase under ShirkatuI Melk mode, both the bank and the client supply equity in equal or unequal proportion for purchase of an asset like land, building, machinery, transports, etc., purchase the asset with that money, own the same jointly, share benefit as per agreement and bear the loss in proportion to their respective equity. The share/part or portion of the asset owned by the bank is leased out to the client partner for a fixed rent per unit of time for a fixed period. Lastly, the bank sells and transfers the ownership of its share/part/portion to the client against payment of price fixed for that part either gradually part by part or as a whole within the lease period or on expiry of the lease agreement Hire-Purchase under Shirkatu! Melk contract is to a great extent similar to the contract of Ijarah Montahia Bil Tamiek as termed by Accounting and Auditing Standards Board of the Account and Auditing Organization of Islamic Financial Institutions (AAOIFI)

Stages of Hire Purchase

Hire Purchase under ShirkatuI Melk Agreement has got three stages:

- Purchase of asset under joint ownership of the lessor and the lessee.

- Hire, and

- Sale and transfer of ownership by the lessor to the other partner – lessee.

Important Features of Hire Purchase:

1. In case of Hire Purchase under ShirkatuI Melk transaction the asset/property involved is jointly purchased by the lessor (bank) and the lessee (client) with specified equity participation under a ShirkatuI Melk contract in which the amount of equity and share in ownership of the asset of each partner (lessor bank and lessee client) are clearly mentioned. Under this agreement the lessor and the lessee become co-owners of the asset under transaction in proportion to their respective equity.

2. In Hire Purchase under ShirkatuI Melk Agreement the exact ownership of both the lessor (bank) and lessee (client) must be recognized. However, if the partners wish and agree the asset purchased may be registered in the name of any one of them or in the name of any third party clearly mentioning the same in the Hire Purchase ShirkatuI Melk Agreement.

3. The share/part of the purchased asset owned by the lessor (bank) is put at the disposal possession of the lessee (clients) keeping the ownership with him for a fixed period under a hire agreement in which the amount of rent per unit of time and the benefit for which rent to be paid along with all other agreed upon stipulations are clearly stated. Under this agreement the lessee (client) becomes the owner of the benefit of the asset not of the asset itself, in accordance with the specific provisions of the contract that entities the lessor (bank) the rentals.

4. As the ownership of leased portion of asset lies with the lessor (bank) and rent is paid by the lessee against the specific benefit, the rent is not considered as price or part of price of the asset.

5. In the Hire Purchase under Shirkatul Melk agreement the Lessor (bank) does not sell or the lessee (client) does not purchase the asset but the lessor (bank) promise to sell the asset to the lessee only if the lessee pays the cost price/equity price of the asset as fixed and as per stipulations on which the lessee also gives undertakings.

6. The promise to transfer legal title by the lessor and undertakings given by the lessee to purchase the ownership of leased asset upon payment part by part as per stipulations are affected only when it is actually done by a separate sale contract

7. As soon as any part of lesssor’s (bank’s) ownership of asset is transferred to the lessee (client), that becomes the property of the lessee and hire contract for that share/part and entitlement for rent thereof lapses.

8. In Hire Purchase under Shirkatul Melk Agreement, the Shirkatul Melk contract is affected from the day the equitTy of both parties deposited and the asset is purchase and continues up to the day on which the full title of lessor is transferred to the lessee.

Information and Communication Technology (ICT) :

ICT has an important and great bearing over the policies and procedures of an organization towards management of bulk amount of data, facts and figures. MIS and information processing as well. Tt has just been introducing some new means of developed operating system in day-to-day operation of an organization especially of a Bank. To keep track on recent development of ICT and adjustment thereon could enable a Bank to use the ICT in an effective and efficient way. SIBL is also not behind of using ICT like other contemporary Banks. Introduction of Islamic Banking Version Integrated PcBANK2000 software at SIBL enables to provide better service to our valued clients. We facilitate our customers Online Banking Facilities through intranet using V-SAT and Radio Link Connectivity. Out of 24 Branches, we have already brought 20 Branches under the network and within 2005 we would be able to bring rest of the 4 branches under online. Moreover, using of SWIFT at 9 nos. of our AD branches has added something new and improved means of overseas communication system. To expand the area of services towards the customers, SIBL has joined the ATM network under the management contracl of M/S Electronic Transaction Limited (ETN). There are 20 ATM booths situated at metropolitan city of Dhaka, Chitlagong & Sylhet and the customers are able to enjoy 24 hours remote banking facilities through using of SIBL ATM Debit Card. Above all, Management of SIBL is very keen to facilitate its customers IT based banking services like Remote Banking facilities, EFT (Electronic Fund transfer) Service i.e. SMS Banking, Phone Banking etc., and considering the present and upcoming setup of IT, we have established a separate ICT Department staffed with some experienced computer professionals, who are directly responsible for the overall management of ICT within the bank and to explore the ideas of future innovation.

NON-FORMAL SECTOR of SIBL

Family empowerment credit programs come under Non-formal Banking Non-formal Banking deals with finance in non-corporate sector. The popular view of non-formal sector activities are primarily those of petty traders, street hawkers, shoeshine boys and confined to employment peri-urban and urban areas, SIBL’s target areas are however determined by following criteria: (1) ease of entry, (2} reliance of indigenous resources; (3) family ownership of enterprises; (4) small scale of operation; (5) labor intensive and adapted technology; (6) skills acquired the formal school system; (7) unregulated and competitive markets.

It is to be recognized that development of the top income groups of the working poor would result in a new types of labor-intensive investments in both urban and rural areas. This should not only generate demand for the products of the non-formal sector but also encourage new innovations and techniques in the sector. This is where Islamic Bank must make conscious and planned interventions. The difference of wealth and income between urban and rural area draws migrants towards the urban concentrations and if we succeed in creating the trend of development in the rural areas this migration will also stow down. It is to be mentioned here that a small farmer or a small entrepreneur having no access to institutionalized source of credit, normally establishes semi-permanent relations with suppliers and buyers, frequently at the expense of his profit and become hesitant to innovate, particularly in agriculture for the inherent fear of failure.

Credit transfers Powers: The family is a basic foundation of human society. The foundation of a family is laid through marriage and relationship between husband and wife and is viewed in Islam as that of a piece of cloth and its weaver; it is a civil contract, imparting mutual rights and duties. This is also true in Christianity. In Hinduism it is a sacrament. The fact is that the family remains a bedrock of and society. So the management of Micro-Credit and Micro-Enterprise Financing has a profound impact on Micro-economic sociology of the family, involving each individual in the family, organization and activity within the family and the relationship among family. Macro-economic sociology of the family is also linked together with other social structure in extended family, neighborhood, villages, communities and kinship groups. The family performs a vital part of the function essential and group life. Thus empowering family by way of micro-credit & micro-enterprise helps in many ways. SIBL will intent to intensify its activity following this route. However, we must be careful of the fallout of credit transfer as such may also transfer power to powerless, it can also reinforce power of the powerful and help in concentration and inequitable distribution of income and thus aggravating poverty.

Evidence suggests that in many cases, family unit of the society is threatened due to the very nature of credit program, which is directed towards destabilization of the family for its eventual disintegration. Seen from this perspective, family empowerment through micro-credit does represent a significant shift in paradigm. A change in paradigm refers to a “discontinuous leap” a change of set of old premises and conventions. This linking credit to social values will have far reaching theoretical and operational conventions. Thus linking credit to social values will have far reaching theoretical and operational implications at the level of microeconomics. In Bangladesh, there are at least 15 million families living below poverty line. They can hardly enter into any credit market. Non-formal Banking of SIBL, therefore, will create enormous scope for these families and their and their societies to alleviate poverty.

Criteria of selection:

The activities of the program can be operated within a radius of 15 k.m. of the concerned branch of the Bank. This area can be expanded in special cases, considering the importance of the Project. The more suitable Micro-Credit Programs will be selected at the first instance. Following aspects are to be considered in selecting the areas for Micro-Credit Program:

1. The activities of the Program will be expanded gradually from the peripheral areas of

the concerned branch to the distant areas.

2. Communication facilities will be kept in view for selection of areas.

3. The areas where people are not covered by the credit facilities of the Govt. and Non-Govt. organizations will be given priority

4. The areas where sufficient scope exists for employment and income generation for the poor lower and middle-income families will be given priority.

5. Neglected cottage industries, small industries, handicrafts and local traditional industries will be given priority for their reorganization and rehabilitation. Other factors not covered the above but helpful to the poor and neglected will be given priority, provided they have their residence in the concerned areas.

Target Group:

Family Empowerment Micro-Credit Program is directed towards landless laborers, marginal farmers, fishermen, small artisans (blacksmith, carpenter, potter and handicrafts producer), rural and urban unemployed, small traders etc. These target groups are classified into three types of family clusters namely Green, Blue and Yellow on the basis of the financial position and savings ability of the members- Main features of these clusters are as under:

Green Family Cluster:

No Floors & ceiling:

1 Landless farmers /laborers having no doweling house of their own.

2 Physically capable manual labors.

3 Ability to save up to Tk. 25/- (max) weekly.

Blue Family Cluster:

Marginal farmer or a person having own dwelling house and land up to 50 decimal or equal amount of asset.

Ability to save: Tk. 26.00 to Tk. 50.00 (max) weekly

Yellow Family Cluster:

Maximum possession of 100 decimal land including dwelling house or equal amount of assets.

Ability to save: Tk. 50.00 and above weekly.

Formation of Family Cluster:

Each sub Family Cluster to be formed consisting of 5 members preferably of similar area or professions.

Each Family Cluster to be formed with minimum two and maximum four sub-family cluster comprising of minimum 10 and maximum 20 members.

»To conduct the activities of Family Cluster, the members will form an Executive

Committee consisting of 05 (five) members either by election or by selection.

»Persons capable to work within the age limits of 18 to 60 years will be eligible to be a member of the Family Cluster.

»A member of other credit institution will not be eligible to become o member or the Family Cluster without obtaining clearance certificate from the organization or institution.

»A loan defaulter against whom there is a suit at the court will not be qualified for a membership of the Family Cluster.

»A person known to be involved in ant-social and immortal activities will not be allowed to be a member of the Family Cluster.

»Selected members will apply for membership of Family Cluster by filling in admission form (s) duly recommended by the Bank officers and approved by the concerned Branch.

Mode and procedure of mobilization of savings:

□ Each Family Cluster must compulsorily open mudaraba savings deposit account to

build up their savings.

□ No cheque book shall be issued against such account. After adjustment of the liability, the members may draw their savings from the A/C.

□ Collected savings from the Family Cluster to be deposited in the concerned account of

the Family Cluster within 24 hours and profit will be given on the deposited savings as per profit rate of the Mudaraba Savings deposit account.

□ Profit in proportion to the savings of the member (s) will be distributed at the end of the

hear crediting their respective accounts

Procedure of Investment

1. After completing all the formalities as per relevant principles and depositing savings regularly for minimum of 8 weeks, the members of Family Cluster may apply for investment.

2. In a Family Cluster consisting of 20 members, first investment will generally be allowed to maximum 10 members, while in case of a family cluster consisting of 10 members, not more than 5 members will be allowed investment at a time.

3. Next investment (s) may allow after every one month subject to regular repayment of installments and the proper compliance with the rules & regulations of Family Cluster.

4. Borrowers will be required to have a minimum 5% personal savings deposit against the investment applied for the first time and for each subsequent period of investment personal savings at an accelerated rate of 5% has to be deposited.

5. A borrower will not be allowed to withdraw his personal savings unless installment of investment is fully paid he will not be allowed to adjust investment with his own savings.

Mode of Investment:

The following modes may be selected depending upon the purpose of investment

Bai-muajjal

Mudaraba

Murabaha

Musharaka

Hire Purchase

Shirkatul Bai-Salam

Melk(HPSM) or Leasing

Profit and other Charges:

Rate of Profit 11% per annum (approximate) Risk Fund 1% per annum on the net Investment

Security:

1 Under this program, collateral securities in the form of Mortgage against properties and or 3rd party personal guarantee is needed.

2 In case of investment upto Tk. 50,000/- , goods (raw materials/finished goods/machineries) will be treated as security.

3 In case of investment exceeding Tk. 50,000/- , collateral security in the form of equitable Mortgage shall be obtained as per Banks rule, a In all cases clients must sign bank charge documents i.e. promissory note etc.

Purpose of investment:

Client will have the liberty to choose the purpose (s) relating to small and medium Enterprises either from the following projects or any other suitable projects under Family Empowerment Micro Enterprise Program objectives:

1 Agricultural projects

2 Poultry & livestock projects

3 Fishery projects

4 Processing manufacturing projects

5 Transport and manufacturing projects

6 Trading projects

7 Different types of small trading projects

8 Shop keeping projects

9 Readymade garments projects

10 Medicine shop keepers projects

11 Sewing machine projects

Recovery of Investment:

Generally the repayment of the investment shall be made on monthly installment basis. However, in special cases, repayment shall start depending on the nature of investment subject to recommendation of the branch giving specific reasons.

Voluntary Sector of SIBL

This bank has a special program for the development of various religious and social service institutions. Under this program Mosque, Maktab, Waqf, Charitable organization etc. are funded to operate their regular functions and to modernize themselves. To fulfill this program S.I.B.L introduced Cash waqf certificate for the first time in banking history.

CASH WAQF CERTIFICATE:

In this voluntary sector, SIBL has also introduced Cash Waqf Certificate, a new product for the first time in the history of Banking. Together, a new beginning can be made for a participatory economy. This scheme has been well received by the public in general for its unique feature. The guidelines for operation of this scheme are stated below:

1 Cash waqf is an endowment in conformity with shariah. Bank manages the the waqf on behalf of the waquif.

2 Waqfs are done in perpetuity and the A/c is opened in the Title given by the waquif.

3 Waquif have the liberty to choose the purpose(s) to be server either from the list of 32 purpose identified by the bank covering (a) family empowerment credits (b) Human resource development (c) Health and sanitation and (d) Social utility services or any other purpose (s) permitted by shariah.

4 Cash waqf amount earns profit at the highest rate offered by the bank from time to time.

5 Cash waqf amount remain intact and only the profit amount is spent for the purpose(s) specified by the waquif. Unspent profit amount and earn profit to grow over the time.

6 Waquif can also instruct the Bank to spend the entire profit amount for the purpose specified by him/her.

7 Waqif have the opportunity it create cash waqf at a lime. Otherwise he/she may declare the amount he/she intends to build up and may start with a minimum deposit of Tk. 100/ (one hundred) only. The subsequent deposits may also be made in hundred or in multiple of hundred.

8 Waquif have the right to give standing instruction to the bank for regular realization of cash waqf at a rate specified by him/her from any other A/c maintained with SIBL.

Cash waqf is accepted in specified endowment Receipt voucher and a certificate for the entire amount is issued as and when the declared amount is built.

Particulars | 2004 | 2003 |

| Nos. of Cash Waqf Account (Opened) | 1156 | 1089 |

| Amounts (Thousand) | 12037 | 9222 |

RULES OF CASH WAQF ACCOUNT:

- Cash waqfs shall be accepted as endowment in conformity with the Shariah. Bank will manage the waqf on behalf of the Qaqif.

- Waqfs are done in perpetunity and the account shall be opened in the title given by the Waqif.

- Waqif will have the liberty to choose the purpose (s) to be served wither from the list 32 purposes mentioned below identified by SLBL as given below or any other purpose(s} permitted by the shariah.

- The amount deposited in the Cash Waqf A/Cs will be invested as per Bank’s own decision in conformity with the shariah and the Cash Waqf amount will earn profit at the highest rate offered by the Bank from time to time.

- The waqf amount will remain intact and only the profit amount will be spent for the purpose(s) specified by the Waqif. Unspent profit amount will automatically be added to waqf amount and earn profit to be grown over the time. No cheque book will be issued in this account.

- Waqif may also instruct the Bank to spend the entire amount for the purpose specified by him/her.

- Waqif has the opportunity to create cash waqf at a time. Otherwise he/she may declare the amount he/she intends to build up and may start with a minimum deposit of Tk.1000/- (one thousand) only (or equivalent foreign currency). The subsequent deposits shall also be made in thousand or in multiple of thousand.

- Waqif shall also have the right to give standing instruction to the bank for regular realization of cash waqf at a rate specified by him/her from any other a/c maintained with SIBL.

- Cash waqf shall be accepted in specified endowment Receipt Voucher and a certificate for the entire amount shall be issued as and when the declared amount is built.

- Account of Cash Waqf are maintained in a separate ledger and necessary bank charges are deducted therefrom.

- In case of any change of address of the Waqif must inform the Bank immediately.

- Bank reserves the right to regret to open any Cash Waqf Account or to close any account opened earlier without showing any cause.

- The rules of Cash Waqf Account are subject to amendment in conformity with the shariah at any time by the Bank.

The Four Major Purposes Areas of Cash Waqf:

Family Rehabilitation:

- Improving the conditions of absolutely poor living below the poverty line.

- Rehabilitation of physically handicapped and disadvantaged.

- Rehabilitation of beggars.

- Rehabilitation of destitute women.

- Upliftment of urban slum dwellers.

Education and Culture:

- Educations Culture:

- Education of orphan’s i.e. supplying books free of cost

- Expansion and development of appropriate education for skill development.

- Informal education facilities of children at home (i.e. mother’s educational program, children literature)

- Physical education and sports facilities.

- Supporting local culture and heritage and art promotion.

- Conducting Dawah activities.

- Supporting education of deserving students in the form of scholarship.

- Supporting education vocational education in general.

Health & Sanitation:

- Village health care and sanitation.

- Supplying pure drinking water (to households, schools, mosques, slums etc.)

- Establishing hospitals, clinics, health care programs specially for the poor.

- Health research grant, Research in particular disease.

Social Utility service:

- Settling disputes {e.g. Village litigation)

- Providing legal aid to deserving women to establish their lawful rights.

- Assist in arranging dowey-less marriages of poor girls.

- Maintenance of public roads and tree plantation in the village.

- Providing assistance to peace loving non-Muslims and solving their problems.

- Creating social awareness to prohibit gambling and other social vices such as theft and other anti-social activities.

- Construction, installation and development of public utility services.

- Maintenance of specific mosques (s) with an income generation project(s).

- Maintenance of a specific graveyard with an income generating project

- Maintenance of a specific Eidgah(s) with an income generating projects

LIQUIDITY:

Liquidity maintained in the form of Balance with Bangladesh Bank, Sonali Bank (as the agent of Bangladesh Bank) and cash in hand including foreign currency notes stood at Tk. 1308.54 million as at 31st December 2004 against Tk. 1168.14 million of last year to maintain cash & statutory liquidity requirement of Bangladesh Bank. The Bank has always tried to maintain the required balance in managing asset & liability portfolios in order to maximize the profit.

Risk Management:

SIBL is much concerned about the business risk and its proper management so that the risk and return could be optimized. Now-a-days, in the very complex and unstable finance market; regular tracking on undiversiable risk and in-depth analysis on diversifiable risk is a must especially in the banking sector. Bangladesh Bank has undertaken a project to install Core Risk Management System in every Bank to defeat the risk factors that seriously affect return and accordingly SIBL has already taken some initiative as a part of its integrated Core Risk Management System around the Bank at its both operational and Managerial level and many other steps are underway to be considered for adoption. Our “Management Committee”. “Assets Liability Committee” and “Anti-Money Laundering Committee” ensure that the senior management shall pay special attention to many qualified issues of the bank, which shall ultimately reduce our risk to an acceptable level. Besides that, prudent control over bank’s assets and asset monitoring system on regular interval, Maturity grouping analysis of assets and liabilities, limiting of Investment exposure and clients. Internal Audit Department, Board Audit Cell and above all, regular holding of Board Meeting etc. shall enable us to plan for an effective Risk Management inside the Bank.

Corporate Governance:

Corporate Governance ensures to bring transparency, accountability and professionalism in the Management system of a corporate body that enhances the credibility and acceptability to the shareholders, employees, potential investors, customers, lenders, governments, society at large and all other stakeholders. Under a good Corporate Governance system, goals are sets by the Board, review the result by the Board on regular interval, business decision taken by the Board and the Member of the Board discharge their duties for the best interest of the Company

Performance of the Bank

Capital: The authorized capital of the Bank is Taka 1000 million. The paid-up capital and equity of the Bank stood at Taka 585 million and taka 915.5 million respectively as at 31st December 2004.

The Bank achieved the Tk. 1.00 Billion capital requirement ahead of the deadline set by the Bangladesh Bank

(Fig in million Taka)

Particulars | 2004 | 2003 |

| Paid up capital | 585.00 | 260.00 |

| Statutory Reserve | 256.09 | 225.60 |

| Retained Earnings | 53.76 | 52.40 |

| Proposed Bonus Share 2001 | — | 52.00 |

| Proposed Bonus Share 2002 | — | 78.00 |

| Proposed Bonus Share 2003 | — | 195.00 |

| 1% Provisions on Unclassified Investment | 114.74 | 93.79 |

| Investment Loss Off-Setting Reserve | 8.15 | 8.15 |

| Exchange Equalization | 6.12 | 6.12 |

| Total | 1023.86 | 971.06 |

Capital Adequacy Ratios | 2004 | 2003 |

| Tier-1 Capital Ratio (Req-4.50%) | 6.58% | 8.34% |

| Risk Weighted Capital Adequacy Ratio (Req-9%) | 7.53% | 9.39% |

| Shareholders Fund to Investment | 7.10% | 8.86% |

OPERATING RESULT

| Particulars | 31.12.2004 | 31.12.2003 | Growth Rate |

| Income on Investment | 1787.95 | 1690.95 | 5.74% |

| Profit paid to Depositor | 1372.08 | 1288.08 | 6.52% |

| Net Investment Income | 415.87 | 402.87 | 3.23% |

| Commission, Exchange & other income | 254.42 | 292.02 | -12.88% |

| Total Operating Income | 670.30 | 694.89 | -3.54% |

| Operating Expenses | 255.31 | 194.35 | 31.37% |

| Profit before Provision | 414.99 | 500.54 | -17.09% |

| Provision against Investment &others | 262.12 | 112.50 | 133.35% |

| Profit before Tax | 152.47 | 338.04 | -54.90 |

| Particulars | 2004 | 2003 |

| Net Investment Income Margin (NIIM) | 3.62% | 4.59% |

| Cost to Income (efficiency) | 37.12% | 26.28% |

| Return on Assets (ROA) | 0.71% | 1.83% |

| Return on Equity (ROE) | 16.65% | 43.55% |

| Earning Per Share | TK.143.00 | TK.331.00 |

| Return on Investment | 14% | 13.50% |

| Price Earning Ratio-Times | 26 | 7 |

Findings:

- Increased Classified Investments, reductions of lending rate & single party exposure limit and increasing inflationary trend reduces the SIBL’s profit by 17.09% from previous year 2003.

- Although customer deposit increased but overall deposit decrease due to decrease in Bank deposit.

- SIBL investment stood at Tk. 12887.27 million in 31st December 2004 and registering a growth by 28.12% from previous year 2003. But asset quality of the Bank has deteriorated which has resulted in provisional shortfall of Tk. 302.88 million as on 31.12.2004 against classified loan.

- Although export and remittance of the Bank increased from previous year 2003 but huge decrease in import section causing to decrease in overall Foreign Exchange Business by 5.12%.

- Profit will remain a constraint in various operations of SIBL. Maximizations of profit regardless of social consideration will not be the goal.

Recommendation

As per earnest observation some recommendation for the improvement of the overall situation of SIBL are given below:

1. To attract more clients SIBL has to create a new marketing strategy, which will increase the total export-import business.

2. Effective and efficient initiatives are necessary to recover the default loan.

3. Attractive incentive package for the exporter will help to increase and accordingly it will diminish the balance of payment gap of SIBL.

4. Segregation of international trade transaction from the existing situation that is credit aspect to be looked after by credit analyst in that department.

5. SIBL can provide foreign market reports, which will enable the exporter to evaluate the demand for their products in foreign counties.

6. Long-term training very much required for the employees.

7. In our country financial problem is a great constraints in foreign trade. SIBL is very conservative for post shipment finance. If it stays in liberal position the exporters can easily overcome their financial constraint.

Conclusion:

Social Investment Bank (SIBL) action program is directed towards development of an authentic participatory Economy beyond Market Economy. The family empowerment credit program of SIBL is gaining ground at the grass root level in Bangladesh. Family empowerment micro Credit and micro enterprises program has been designed in a manner so as to make finance, production, marketing, trading, local specific survey and research as well as moral suasion in one package. In SIBL credit conveys the totality in life and clearly linked to social context and cultural setting in conformity with Shariah. There is a built in provision vertical social mobility with provisioning for social subsidy. It is thus felt that the linking credit to social goals and assignments will have far-reaching implications for development of an alternative concept of new participatory economics in the 21st Century and thereby laying the foundation of new theories of income, output and employment.

This Bank begins from the understanding that 120 million people are Bangladesh’s most precious resource. It is rooted in the confidence that cultural heritage and legacy of Bangladesh can be reactivated for motivating people to work that earn Bangladesh a living coupled with necessary finance, training and the backing of a government that is committed to encouraging new initiatives, enterprise, innovation and change, thereby making Bangladesh more efficient, less dependence on aid, more socially just and compassionate.