Jamuna Bank Limited (JBL) provides commercial banking services in the Bangladesh. The Bank primarily engages in corporate Banking, trade finance, project finance, retail Banking, small enterprise finance, consumer finance, and syndication. Its range of service offerings include cash management services, payments and clearings, safe deposit locker services, employee benefits, collection services, treasury services, asset management, services and SWIFT for foreign trade. Jamuna Bank has an investment of 1711.88 million taka in its business.

Location

Registered office & corporate Head Office at Chini Shilpa Bhaban 3, Dilkusha C/A, Dhaka-1000. Its branches are situated at all the major cities of the country except 09 which are situated at rural area. The number of bank branches stood at 71 on December 2011. The bank has a plan to open more branches over the next several years at different important commercial places of the country.

Historical Background of Jamuna Bank Limited

Jamuna bank limited (JBL) is a banking company registered under the companies Act. 1994. Its Head office located at Chini Shilpa Bhavan (2nd, 3rd, & 8th floor), 3, Dilkusha, C/A, Dhaka-1000. Bangladesh. Operation of this bank started from 3rd June, 2001.

JBL is a highly capitalized new generation bank started its operation with an authorized capital of TK. 1600 million as of December 2001 Paid-up capital of Tk. 1072.50 million. As of December, 2006, authorized capital increased and stood at 4000 million as of December, 2009 and paid up capital is 1711.88 million.

JBL undertakes all the types of banking transactions to support the development of trade and commerce in the country. JBL’s services are also available for the entrepreneurs to set up new ventures and BMRE of industrial units. The bank gives special emphasis on Export, Import, Trade Finance, SME Finance, Retail Credit and Finance to the Women Entrepreneur.

Jamuna Bank Ltd. the only Bengali named new generation private commercial bank was established by a group of winning local entrepreneurs conceiving an idea of creating a model banking institution with different outlook to offer the valued customers, a comprehensive range of financial services and innovative products for sustainable mutual growth and prosperity. The sponsors are reputed personalities in the field of trade, commerce and industries.

The scenario of banking business is changing day by day, so the Bank’s responsibility is to device strategy and new products to cope with the changing environment. Jamuna Bank Ltd. has already achieved tremendous progress within only ten years. The bank has already ranked at top of the quality service providers & is known for its reputation.

Jamuna Bank offers different types of Corporate and Personal Banking Services involving all segments of the society within the purview of rules and regulations laid down by the Central Bank and other regulatory authorities. As per the provisions of Bangladesh Bank license, the Bank has offered initially its shares to public by Pre – IPO and subsequently sold shares to the public through IPO in the year 2004. The shares of the Bank are listed with both Dhaka Stock Exchange Ltd. & Bangladesh Stock Exchange Ltd.

JBL has established wide corresponded banking relationship with local and foreign banks in order to provide services to its clients in respect of international trade. JBL is attempt to covering major trade and financial interest home and abroad from the starting time stage.

Ownership structure

Leading industrialists of the country having vast experience in the field of trade and commerce own 52.84% of the share capital and the rest is held by the general public. JBL’s board currently consists of 19 (nineteen) Directors. Authorized capital is Tk.10000.00 million and paid up capital is Tk.2230.09 million as of 31st December 2010.

Management team

JBL is managed by highly professional people. The present Managing Director of the bank is a forward-looking senior banker having decades of experience and multi discipline knowledge to his credit both at home and abroad. He is support by an educated and skills professional team with diversified experience in finance and banking. Jamuna bank limited has already achieved tremendous progress within a short period of its operation. The lists of management structure are given in bellows:

Corporate Vision and Mission

Vision of JBL

To become a leading banking institution by playing a significant role in the development of the country.

Mission International Islamic of JBL

The bank is committed to satisfying diverse needs of its customer through an array of products at a competitive price by using International Islamic of the art technology and providing timely service, so that a sustainable growth, reasonable return and contribution to the development of the country can be ensured with a motivated and professional work force.

Corporate Culture

Employees of JBL share certain common values, which helps to create a JBL Culture

- The Clint comes first.

- Search for professional excellence.

- Openness to new ideas & new methods to encourage creativity.

- Quick decision- making.

- A sense of professional ethics.

Corporate Objective and strategies

Objective of JBL

To establish relationship banking and improve service quality through development of strategies marketing plans.

To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

To introduce fully automated system through integration of information technology.

To ensure an adequate rate of return on investment.

To maintain adequate liquidity to meet maturing obligation and commitments.

To maintain a healthy growth of business with desired image.

To maintain adequate control systems and transparency in procedure.

To develop and retain a quality work force through an effective Human Resources Management system.

To ensure optimum utilization of all available resources.

To pursue an effective system of management by ensuring compliance to norms, transparency and accountability.

Strategies of JBL

To identify customers credit and other banking needs and monitor their perception towards our performance to meeting those requirements. To review and update policies, procedures and practices to enhance the ability to extend better services to customer.

To strive for customer satisfaction through quality control and delivery of timely services.

To train and develop all employees and provide adequate resources so that customer needs can be responsibly addressed.

To manage and operate the bank in most efficient manner to enhance financial performance and to control the cost of fund.

To promote organizational effectiveness by openly communicating company plans, polices, practices and procedures to all employees in a timely fashion.

To cultivate a working environment that fosters positive motivation for improved performance.

To diversify portfolio both in the retail and wholesale market.

To increase direct contract with customers in order to cultivate a closer relationship between the bank and its customers.

Strategic Business Plan

Though Jamuna Bank is engaged in conventional banking it also considers the inherent desire of the religious Muslims, and has launched Islami Banking system and established one Islami banking Branch in the year 2003, the Islami Banking Branch is performing its activities under the guidance and supervision of a body called “SHARIAH COUNCIL”.

The operations of the JBL are computerized to ensure prompt and efficient services to the customers.

The bank is committed to continuous research and development so as to keep pace with modern banking.

The bank has introduced camera surveillance system (CCTV) to strengthen the security services inside the bank site.

The bank has introduced customer relation management system to assess the needs of various customers and resolves any problem on the spot.

The bank has also introduced full online banking facility to the client.

As a BBA student I have completed my internship from Jamuna Bank Limited. I have work with General Banking Department. Jamuna Bank is almost a new player in the banking sector and is committed to provide high quality services to its stakeholders. It contributes to the GDP of a country through different financial product and profitable utilization of fund.

From the findings it can be observed that JBL trying it level best to maintaining the sustain growth level of customer satisfaction. Although its growth rate is continuously increasing. Based on the previous performance and the proper utilization of resources, hope that JBL will be able to achieve its goal and would become a finest corporate citizen’s in the Banking industry.

Corporate Social Responsibilities of Jamuna Bank Limited

As a part of the society all types of organization have the responsibility towards society. Jamuna Bank perceived its social corporate responsibility. So it always exercises its responsibility to the society. In the backdrop of profound success the board of directors considered the formation of JBL foundation through which some social welfare activities can be rendered to the society. Last few years they are consistently expanding their social welfare activities. During different calamity or disaster time period they have distributed relief to the affected people. They have International Islamic scholarship program to the meritorious student who are not financially solvent. The authority also contributes to the Muktijoddha Jadughar and AtishDipankarUniversity for education purpose.

Financial performance of Jamuna Bank Limited

Authorized capital and Paid up Capital

Authorized capital of the bank remains unchanged at TK. 4000.00 Million in the year 2009and the paid up capital of the Bank is TK. 1711.88 million, in 2010 the authorized capital is 10000 and paid up capital is 2230.09, ordinary shares of TK. 100 each. The data table with graph is given below:

Table 01: Authorized and Paid up Capital of JBL

Year | Authorized Capital in (TK.) Million | Paid Up Capital (TK.) in Million |

2005 | 1600 | 429 |

2006 | 1600 | 1072.50 |

2007 | 4000 | 1072.50 |

2008 | 4000 | 1313.27 |

2009 | 4000 | 1711.88 |

2010 | 10000 | 2230.09 |

Figure 01: Authorized and Paid up Capital of JBL

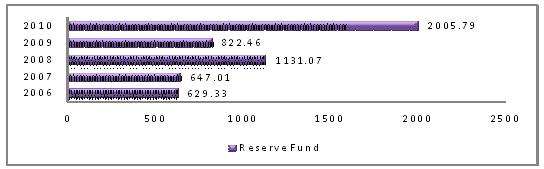

Reserve fund and other reserve

The total reserve was TK. 1131.07 million in the year 2008; in 2009 it was decreased on TK. 822.46 million so the difference is 308.61 million and in 2010 it is 2005.79 Here we can say that reserve fund of JBL is increasing gradually. Data table along with graph are given below:

Table: Reserve fund of JBL

Year | Amount (TK. In Millions) |

2005 | 487.46 |

2006 | 719.33 |

2007 | 647.01 |

2008 | 1131.07 |

2009 | 822.46 |

2010 | 2005.79 |

Figure:Reserve fund of JBL

Deposit of JBL

Deposit is one of the important aspects of banking sector. It is termed as the life blood of a commercial banking. It was able to collect a total deposit of TK. 27307.94 million in year 2008. Year 2009 it collected total deposit of TK. 42356.20 million. Year 2010 deposit collection is 60273.57. The performance of deposit collection is improving gradually. To present this situation table along with graph are given below:Table : Deposit position of JBL

Year | Amount of Deposit (TK. In Millions) |

2005 | 14454.13 |

2006 | 17284.81 |

2007 | 17491.34 |

2008 | 27307.94 |

2009 | 42356.20 |

2010 | 60273.57 |

Investment position of JBL

The total amount of investment in 2007 is TK. 2550.59 million. In 2008 the total amount of investment becomes TK. 42.38.63 million. In 2009 it increase and become 8503.44 million. In 2010 investment also increased to 10891.03. The investment portfolio comprising Government Treasury bills etc. contributed mainly towards fulfillment’s of Statutory Liquidity Requirements.

Investment position of JBL

The total amount of investment in 2007 is TK. 2550.59 million. In 2008 the total amount of investment becomes TK. 42.38.63 million. In 2009 it increase and become 8503.44 million. In 2010 investment also increased to 10891.03. The investment portfolio comprising Government Treasury bills etc. contributed mainly towards fulfillment’s of Statutory Liquidity Requirements.

Table 04: Investment position of JBL

Year | Tk. (Million) |

2005 | 2037.84 |

2006 | 2552.67 |

2007 | 2550.59 |

2008 | 4238.63 |

2009 | 8503.44 |

2010 | 10891.03 |

Human resources of Jamuna Bank Limited

Human resources are one of the key elements of success in case of any kind of business. Banking sector is not exceptional. So the authority believes that investment in human resources will ultimately return high dividend and also consider as intellectual property of the bank. The bank offer competitive complete package to the employees. They also identify the importance of well trained professional staff whose skill and commitment will help the bank to achieve the goal. They also recognize the importance of employee’s participation in standardization and general well being of the company. They believe that their success depends on employees who are working for together in the interest of the client. The authority have follow the below policies for the development of human resources.

The bank committed to nurturing the employee relationship by continuous development of innovative rewards and incentive programs that focus on long and short term operational and strategic goals.

Give emphasis on team work, training and philosophy of internal promotion to enhance the empowerment of employees.

For free exchange of positive ideas within the workplace a policy is adopted for open, honest and two way communication.

For maintaining human resources they reward them with performance bonus, overseas trip, promotions and increments reasonably.

Besides developing the human resources professionally with the view of Jamuna Bank Limited has established a library where all sorts of books including professional books are available so that the officers and executives can sharpen and updated their knowledge.

Training Division

Providing training facilities to its executives or employees the authority has set up a training institute. This institution was established in September, 2006. This institute has already conducted a number of foundation and specialized courses. For specialize training purpose a number of officers were sent to Bangladesh Institute of Bank Management and other training institutes at home and abroad.

Internal Control and Audit System

To reviewing and evaluating internal control system the bank has an Internal Control & Compliance Division managed by experienced and efficient personnel. There are three departments under the Division namely:

- Audit and Inspection Department

- Compliance Department and

- Monitoring Department.

Appointment of Auditors

‘AKNABIN’, ‘A’ graded firm of Chartered Accounts as identified by Bangladesh Bank was appointed as external auditor for the bank in the 9th Annual General Meeting.

Correspondent Relationship

Jamuna Bank Limited has established correspondent relationship with leading International Banks in 117 countries through 152 correspondents to cover all important financial centers of the globe. It activities to increase its network of correspondent relationship with Prime International Banks and Financial Institutions in order to help satisfy the expanded needs of its customer globally efforts are being made of established drawing arrangements with the overseas exchange house to bring home bound remittance into the country through the banking channels.

Information Technology

For providing prompt service to its customer information technology is important specially in banking sector. They have a strong conviction of applying information technology in their operation for ensuring prompt but accurate service to its customer. All of the branches are connected with online. They have established 45 ATM machines. They have already introduced direct debit card, credit card in limited range and tele banking.

Online Banking

Jamuna Bank Limited has introduced real-time any branch banking on April 05, 2005. Now, customers can withdraw and deposit money from any of its 71 branches. Valued customers can also enjoy 24 hours banking service through ATM card from any of Q-cash ATMs located at Dhaka, Bangladesh, Khulna, Sylhet and Bogra.

Key features:

- Centralized Database

- Platform Independent

- Real time any branch banking

- Internet Banking Interface

- ATM Interface

- Corporate MIS facility

Prevention of Money Laundering

The provision of Money Laundering Prevention Act 2002 and Bangladesh Bank instruction and guidance JBL has strengthen Anti Money Laundering activities. By creating awareness among the valued customers, the bank has organized a number of training programs for its officials.

Competitors

Other commercial banks are the competitors of Jamuna Bank Limited. It can be public or private bank and financial institution such as lease companies or insurance companies etc. main branch of JBL is situated in Dilkusha Commercial area which is the main commercial place in Bangladesh and maximum financial institution are situated in this area. So the bank has to face lots of competition in case of operating business.

Future Thrust

JBL has some plan for its future years. To achieve its goal it has some future thrust. These are given below:

SMS Banking

Merchant Banking

Full duplex on-line Banking

Innovation and introduction of new liability and asset products

Internet Banking

Disaster Recovery Site (DRS)

Expansion of business at home and abroad

Enhancing in-house training facilities

Modernizing the Training Institute

Opening new branches at new location

Three themes for growth

- Introducing card network and electronic banking.

- Expanding personalize services

- Building strong presence in the market with reputation

Foreign Remittance

Remittance services are available at all branches and foreign remittances may be sent to any branch by the remitters favoring their beneficiaries. Remittances are credited to the account of beneficiaries instantly through Electronic Fund Transfer (EFT) mechanism or within shortest possible time. Jamuna Bank Ltd. has correspondent banking relationship with all major banks located in almost all the countries/cities. Expatriate Bangladeshis may send their hard earned foreign currencies through those banks or may contact any renowned banks nearby (where they reside/work) to send their money to their dear ones in Bangladesh.

To facilitate sending money in Bangladeshi Taka directly, Jamuna Bank Ltd. has Taka Drawing Arrangement with many banks/exchange companies in different countries. The expatriate Bangladeshis may send their money in BDT through the branches/subsidiaries of Jamuna Bank Ltd.

Trading of Government Treasury bond & Other Govt. Securities

Jamuna Bank Limited has been nominated as a Primary Dealer by the Bangladesh Bank for trading 5 years & 10 Years Treasury Bonds and other Government Securities.

Eligibility criteria:

- Individuals and institutions resident in Bangladesh, including provident funds, pension funds, bank and corporate bodies shall be eligible to purchase the BGTBs.

- Individuals and institutions not resident in Bangladesh shall also be eligible to purchase the BGTBs, with coupon payment and resale/redemption proceeds transferable abroad in foreign currency subject to fulfillment of conditions as mentioned in the Bangladesh Govt. Treasury Bond Rules-2003.

Loan facility:

JBL offers loan up to 95% of the present value of the bond/other securities against lien of the above instrument for their customers.

Products or Services offerd by Jamuna Bank Limited

Products of Jamuna Bank Limited can be divided into two parts.They are asset and liability products.Generally liability product means deposits of maney kinds that are payable to parties.On the other hand,assets product are the product which clints are liable to pay to bank.Different types of undertaking by the bank to the clints or on behalf of the clints are also a type of liability to bank.On other hand a different type of promises makes by the clints to bank is considerd as banks assets.The products or services can be classifying in two ways and those are

Deposits Products or Services

Corporate Banking

Personal Banking

Online Banking

Monthly Savings Scheme

Monthly Benefit Scheme

Double Benefit Scheme

Marriage Scheme

Education Scheme

Lakhpati Deposit Scheme

Q-Cash ATM

Account Services

Internet Services

Lending/Investment Products or Services

Hi-her Purchase

Lease Finance

Personal Loan for Woman

Project Finance

Loan Syndication

Consumer Credit

Import and Export Handling Financing

The Services of Jamuna Bank Limited and Individual Analysis of these Services:

01.Account Services

02. Deposit Schemes

03.Loan Services

04 Q-Cash ATM Card Services

O5 Export and Import Services

06. Internet Services

Account Services:

Questionnaire:

which questionnaire are used to find out the problems of account services in Jamuna Bank Limited.Those are given below:

- Do you face any problems in account services of Jamuna Bank Limited?

- What are the problems in account services of Jamuna Bank Limited?

Problems are given below:

- Yes.there are some problems in account services of Jamuna Bank Limited.

- Lack of setting arrangement for the waiting customers.

- Sometimes it seemed to me that charges and other fees are very high compared to other private banks. It frequently creates customer dissatisfaction.

- Sometimes the Customer Service Officers were so busy that it creates delay to the customer service. And at the end of the day the closing were also delayed.

- Charges of statement or certificates are very high.

- Jamuna Bank Limited also hasn’t proper monitoring system.

- Branches are very much enthusiastic to provide more service to the clients. General Banking Division is an efficient department. They are very much prompt to give decision to their valued client. Head Office Credit committee sits regularly on weekly basis. They never keep any things pending.

- Lack of good cooperation is identified among the work procedures and among the employees of the bank, which results in lengthiness and ineffective service. The employees of the bank can not provide effective and efficient services to the customers because of lack of computer facility.

Questionnaire:

which questionnaire are used to find out the problems of Deposit Schemes in Jamuna Bank Limited.Those are given below:

- Do you face any problems in Deposit Schemes of Jamuna Bank Limited?

What are the problems in Deposit Schemes of Jamuna Bank Limited?

Problems are given below:

- Yes.there are some problems in Deposit Schemes of Shahjalal Islami Bank Limited.

- Huge procedure.

- Deposit interest rate is low between the other banks.

- After maturity In fixed deposit they deducted some other charges.

- Long procedure to withdraw interest.

- It is not so much well-known Bank.

- The investment of the branch is too low in comparison to the total deposits of the branch.

- Limited Market Share.

Loan Services:

Questionnaire:

which questionnaire are used to find out the problems of Loan Services in Jamuna Bank Limited.Those are given below:

- Do you think there has any problems in Loan Services of Jamuna Bank Limited?

- What are the problems in Loan Services of Jamuna Bank Limited you think?

Problems:

Problems are given below:

- Yes.there are some problems in Loan Services of Jamuna Bank Limited.

- High interest rate.

- Long Procedure.

- They want huge papers for loan processing.

- Without mortgage nobody can not get more amount of money.

- There some limitation of companies who are not allow to get loan.

- The Bank has given less emphasis on long-term financing.

- Jamuna Bank Limited has lack of strong supervision for which loans are defaulted.

- In terms of repayment large loan has performed better than small sized loan.

- Dependent on fixed deposits.

- Limitation in ages of the client.

Cash ATM Card Services:

Questionnaire:

which questionnaire are used to find out the problems of ATM Card Services inJamuna Bank Limited.Those are given below:

Do you face any problems in ATM Card Services of Jamuna Bank Limited?

- What are the problems in ATM Card Services of Jamuna Bank Limited?

- What kind of problems is more affected in this bank you think?

Problems:

Problems are given below:

- Yes.there are some problems in Q-Cash ATM Card Services of Jamuna Bank Limited.

- More charges between some other bank.

- Not more ATM both.

- Most of the time there were problem with the ATM machine. In ATM, It sometimes remained out of order, some time out of cash and sometimes customer face the problem of cash and credit capture.

- Cash withdrawal limit (total time).

- Cash withdrawal limit (amount).

Import and Export Service

Questionnaire:

which questionnaire are used to find out the problems of import and export Services in Jamuna Bank Limited.Those are given below:

Have you faced any problems in import and export Services of Jamuna Bank Limited?

- What are those problems in import and export Services of Jamuna Bank Limited that you faced?

Problems:

Problems are given below:

- Yes.there are some problems in import and export Services of Jamuna Bank Limited.

- Use of huge formalities

- Charges of import and export Service are very high.

Internet Services:

Questionnaire:

which questionnaire are used to find out the problems of Internet Services in Jamuna Bank Limited.Those are given below:

- Do you face any problems in Internet Services of Jamuna Bank Limited?

- What are the problems in Internet Services of Jamuna Bank Limited?

Problems are given below:

- Yes.there are some problems in Internet Services of Jamuna Bank Limited.

- This bank started on-line service newly. As a resulted customers are not getting the full service by the on-line service. Sometimes they have to face problem with on-line account.

- The number of human resources in the Computer section is really insufficient to give services to huge number of customers.

- Absence of an upgraded website.

Account Services

Finding the account services I get below points:

- Lack of setting arrangement for the waiting customers.

- Sometimes it seemed to me that charges and other fees are very high compared to other private banks. It frequently creates customer dissatisfaction.

- Sometimes the Customer Service Officers were so busy that it creates delay to the customer service. And at the end of the day the closing were also delayed.

- Charges of statement or certificates are very high.

- Jamuna Bank Limited also hasn’t proper monitoring system.

- Branches are very much enthusiastic to provide more service to the clients. General Banking Division is an efficient department. They are very much prompt to give decision to their valued client. Head Office Credit committee sits regularly on weekly basis. They never keep any things pending.

- Lack of good cooperation is identified among the work procedures and among the employees of the bank, which results in lengthiness and ineffective service. The employees of the bank cannot provide effective and efficient services to the customers because of lack of computer facility.

Deposit Schemes

Findings the deposit scheme services I get below points:

- Huge procedure.

- Deposit interest rate is low between the other banks.

- After maturity in fixed deposit they deducted some other charges.

- Long procedure to withdraw interest.

- It is not so much well-known Bank.

- The investment of the branch is too low in comparison to the total deposits of the branch.

- Limited Market Share.

Loan Services

Finding the loan services I get below points:

- High interest rate.

- Long Procedure.

- They want huge papers for loan processing.

- Without mortgage nobody can not get more amount of money.

- There some limitation of companies who are not allow to get loan.

- The Bank has given less emphasis on long-term financing.

- Jamuna Bank Limited has lack of strong supervision for which loans are defaulted.

- In terms of repayment large loan has performed better than small sized loan.

- Dependent on fixed deposits.

- Limitation in ages of the client.

Cash ATM Card Services

Finding the q-cash ATM card services I get below points:

- More charges between some other bank.

- Not more ATM both.

- Most of the time there were problem with the ATM machine. In ATM, It sometimes remained out of order, some time out of cash and sometimes customer face the problem of cash and credit capture.

- Cash withdrawal limit (total time).

- Cash withdrawal limit (amount).

Export and Import Services

Finding the export and import services I get below points:

- Use of huge formalaties.

- Charges of Export and import Service are very high.

Internet Services

Finding the internet services I get below points:

- This bank started on-line service newly. As a resulted customers are not getting the full service by the on-line service. Sometimes they have to face problem with on-line account.

- The number of human resources in the Computer section is really insufficient to give services to huge number of customers.

- Absence of an upgraded website.

Account Services

- Customer service should be faster than that of some other banks.

- As authorized dealers JBL must follow of rules regulation regarding to currency transactions in all aspects. It should time to time provide all necessary information to officers of all department for adequate knowledge about applying rules and regulations in every related transaction.

- Giving better customers service.

- To arrange more employee for reducing the pressure.

- The employees must give enough time to the customers while talking with them. Otherwise, the customer may feel they are not that much cared. If a customer asks anything again and again, the employees should keep patience and answer.

- Yearly charge should be lower.

- Individual attention should be given to customers in order to better understand their needs and better satisfy them.

- Statement or certificates charges should be reduces.

Deposit Schemes

- JBL has to ensure employee satisfaction.

- The recording procedures and documents keeping process of in this department must be improved through sequential effort system and for all type recoding of this department should be computerized to get this improvement.

- Customer of this department should be offered occasional gifts and discounts, attractive incentives that can make service more attractive and keep consumer delight.

- New investment schemes should be introduced to meet customer demands.

Loan Services

- The process opening documentary credit and steps followed by JBL to settlement of documentary credit should be liberalized as much as possible.

- Investment department of JBL should provide adequate computerized network facilities that will ultimately provide supports to all officers of this department and as well as improve quality of customer service by increasing swiftness of activity.

- JBL have kept huge number of files regarding to export and import. As the huge volume of files is kept so it’s not all time possible for officers to keep proper format of those files so all officers of this department should try to reduce these irregularities.

- Provide more credit facilities for SME.

- Provide more credit facilities without securities.

Cash ATM Card Services

- JBL provide a lot of ATM booth for there client but problem is that some time technical problems are occurring. So they should look after it carefully.

- ATM Facility should be increased.

- Cash withdrawal limitation (total time) should be increase.

- Cash withdrawal limitation (amount) should be increase.

Export and Import Services

- JBL should improve its technological support by using different advance technological support system.

- The should reduce systematic cost.

- Employee trainings and workshops should be administered in order to give them knowledge and professionalism in customer interactions.

Internet Services

The website of JBL should upgrade regularly.

- Introducing high technology in banking sector and provide training facilities for banker.

- I want to recommend to Bangladesh Bank, that they should Emphasize Online banking for both of Private and public banking. Because this is the way that the banking sector can reach the optimistic level.

- As above those all incentives that are necessary to improve the quality of service of the foreign exchange department of SJIBL must be taken. JBL as service providing organization provides services through all its departments so quality of services must be increased to attract and extend customers.

Conclusion:

The modern business world is on the fastest flow of competition which is growing wider and wider. To have sustainability in this competitive world the organization are formulating new strategies and business plan with maximum efficiency levels in all sectors. Due to competition it is very difficult to build a strong base for the bank and to uphold the image of bank. Banking is becoming more and more vital for economic development of Bangladesh. in mobilizing capital and other resources. Jamuna Bank, being a third generation bank, is also extending such contributions as to the advancement of the socioeconomic condition of the country. JBL has some problems but it is encouraging that they are trying to overcome these obstacles. It should take necessary steps & spread over their products all over the country. Without a strong footing of deposit it is not possible to grant huge amount of loans and advance that is one of the major sources of income of a bank and without huge amount it is not possible to attract the major portion that enjoys credit facilities. It will more justify for JBL to concentrate on corporate banking than consumer banking i.e. the major portion of the profit will be generated from corporate sector not from consumer section.

As a BBA student I have completed my internship from Jamuna Bank Limited (Gulshan Branch). I have work with General Banking Department. Jamuna Bank is almost a new player in the banking sector and is committed to provide high quality services to its stakeholders. It contributes to the GDP of a country through different financial product and profitable utilization of fund.

From the findings it can be observed that JBL trying it level best to maintaining the sustain growth level. Although it could not reach the highest position but it growth rate is continuously increasing. Based on the previous performance and the proper utilization of resources, hope that JBL will be able to achieve its goal and would become a finest corporate citizen’s in the Banking industry.