Consumer Investment and Services to the Customer of

Islami Bank Bangladesh Limited

Islami Bank Bangladesh Limited is a Joint Venture Public Limited Company engaged in commercial banking business based on Islamic Shari’ah with 63.09% foreign shareholding having largest branch network (246 Branches & 30 SME/Krishi Branches i.e. total 276 Branches) among the private sector Banks in Bangladesh. It was established on the 13th March 1983 as the first Islamic Bank in the South East Asia. It is listed with Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd. Authorized Capital of the Bank is Tk. 20,000.00 Million ($ 250.47 Million) and Paid-up Capital is Tk. 12,509.64 Million ($ 156.66 Million) having 60,302 shareholders as on 31st December 2012.

Objective of the Study:

- To know the process and steps of giving consumer investment of IBBL

- To identify differences between IBBL & Conventional Banks Consumer Investment.

- To explore the effective impact of CIS on developing life style and total economic growth.

- To determine the profitability of CIS.

- To evaluate CIS services and benefits to the clients.

- To identify reasons for choosing IBBL’s CIS then that of other banks.

- To identify the future plans of IBBL regarding CIS

Methodology of the Study:

Different data and information are collected from various sources, such as primary and secondary which is given below:

Primary sources of data:

- Personal inspection

- Face to face interview to Officers and clients

- Work experience at different desk of the Bank

- Questionnaire for Officials.

Secondary sources of data:

- Financial report of Islami Bank Bangladesh Ltd.

- Different circulars issued by the head office and Bangladesh Bank

- Journals and Articles

- Internet

- CIS brochure

- Bank Document

Particulars in Attainment of IBBL:

As recognition of good performance IBBL won the following awards:

- IBBL has been selected as the only Bank from Bangladesh in top 1000 banks in the world by a UK based century old financial magazine, ‘The Banker’ published the list in its July 2012 issue.

- The institute of Chartered Accountants of Bangladesh (ICAB) awarded IBBL the first prize of SARRC Anniversary Award for Corporate Governance.

- South Asian Federation of Accountants (SAFA) awarded IBBL as joint Winner in the Corporate Governance Disclosure Award-2010.

- South Asian Federation of Accountants (SAFA) also awarded IBBL with Certificate of Merit in Banking Sector in the Annual Report for the year 2010.

- The Institute of Cost and Management Accountants of Bangladesh (ICMAB), awarded IBBL as the ICMAB National Best Corporate Award-2007 (First Position, Local Bank) and ICMAB Best Corporate Performance Award – 2008 (Second Position, Private Commercial Bank).

- The Institute of Chartered Accountants of Bangladesh (ICAB) awarded IBBL with 3rd position under the catergory-1, Banking in the best published accounts and reports for the year 2010, the Certificate of Appreciation for the year 2001 & 2010 and Certificate of Merit for the year 2008.

- The Global Finance, a reputed U.S.A. based quarterly Financial Magazine, awarded IBBL as the best Islamic Financial Institution of the country for the years 2008, 2009, 2010 & 2011.

- The Global Finance also awarded IBBL as the best bank of the country for the year 1999, 2000, 2004 and 2005.

- ICICI Bank, Hong Kong, awarded IBBL as “The Quality Recognition Award-2009” for U.S. Dollar Clearing (2009).

- Bankers’ Forum awarded IBBL as the Best Bank for Corporate Social Responsibility for 2008 and 2009.

- The Bank-Bima Patrika, a Fortnightly Magazine, awarded IBBL as the Best Islami Banking Award 2007.

- Exclusive economic weekly “The Industry” awarded IBBL as the Best Rated Bank Award- 2010.

- The Citi Bank NA awarded IBBL as the “Largest Contributor” in Foreign Trade Operations in Europe- Bangladesh corridor in 2009.

- The UAE Exchange awarded IBBL for mobilizing around 30% of total foreign remittance of the country.

IBBL is committed to provide banking service that is purely based on Islamic Shari’ah, transparent and efficient. We would like to express our heartfelt thanks and gratitude to Almighty Allah, our customers, patrons, shareholders, print & electronic media, regulatory authorities and employees whose support and confidence has made us worthy of these great recognitions by the experts like the Global Finance, the Institute of Cost and Management Accountants of Bangladesh (ICMAB), the Institute of Chartered Accountants of Bangladesh (ICAB), the BankBima Patrika, the weekly Industry, The Citi Bank NA and The UAE Exchange.

OVER ALLCONSUMER INVESTMENT ANALYSIS:

Investment analysis is the key to any sound portfolio-management strategy. It As my report is based on Consumer Investment of IBBL so here I like to show investment analysis on that particular investment practice of IBBL through comparing with a conventional bank’s (Pubali Bank Ltd) consumer financing policy. is a look back at previous investment data and the thought process of making the investment decision. Key factors should include investment ceiling, expected time horizon, and reasons for making the decision at the time.

Consumer Investment/Financing policy:

Bangladesh is a developing country. Maximum persons are of limited income. In the era of globalization scope of consuming has been increased in a greater extend and that is varieties form. To meet the need of the consumer, IBBL and Pubali Bank Ltd both start consumer investment or financing. In today’s banking products are not only just part of consumer banking proposition, but a part of one’s daily life. Life is full of surprises. Any persons often tumble into unforeseen cost that leaves them specially fixed income people unprotected. Health, education, housing, transport, audiovisual amusement, social obligations even like marriage is part of basic necessities of life. To face these unpredictability in life both bank have introduced consumer investment scheme with wide vision to cover all the necessities of live through easy terms ensuring promote services.

Household Durables Scheme (HDS):

Household Durables Scheme is a personal invest scheme for the consumers which supports the purchase of various consumer products like Television, Refrigerator, computer and other household products. Bank helps the consumers to buy these products by providing money through investments.

The detail of this scheme and as it is a common investment scheme of IBBL and Pubali Bank Ltd. I will try my best to show the comparison between these two banks, profitability, risk factors/ risk level, process of giving investments, debt burden ratio and facilities.

Car investment Scheme (CIS):

CIS is one of consumer investment scheme of IBBL as well as Pubali Bank Ltd. In this section we try our best to show the comparison on CIS between IBBL and Pubali Bank Ltd to identify IBBL’s processes, position, condition, profitability, advantages and risk factors. It also determines overall performance of bank.

Both IBBL and Pubali Bank Ltd agree to sanction investment for any Bangladeshi individuals who has the means of capacity to repay the investment. In specific terms, these could be salaried executives of multinational and middle to large size local corporate, Govt. officials, officials working in reputed NGOs, international aid agencies & UN bodies, any tax paying businessmen of repute, any employed/self employed taxpaying individual having a reliable source of income for reconditioned/brand new Private car/Micro/Jeep/Auto Rickshaw etc against vehicle + personal Guarantee/ corporate Guarantee maintaining 33% Debt Burden Ratio.

Period of investment:

Payback period in capital budgeting refers to the period of time required for the return on an investment to “repay” the sum of the original investment. Payback period intuitively measures how long something takes to “pay for itself.” All else being equal, shorter payback periods are preferable to longer payback periods.

Age limit:

Although Car is a luxuries product and IBBL never promote luxurious life style where most of the people stand below the poverty line in our country nevertheless IBBL render investment to large group of target people starts from 21 years to 65 years age limit who are eagerly needed by the car and fulfill the requirements of IBBL. This attempt increases the scope and trade in terms of money circulation and push up overall economic growth than that of other banks.

Rate of Return (RR):

According to study we can reach the decision that IBBL use Average Rate of Return Method than Pubali Bank Ltd. This may involve comparing very different types of investments, from stocks and bonds to real estate, commodities and foreign currencies. The average rate of return method is one way for IBBL to learn about their options before deciding to commit money to a particular investment. Although the average rate of return method doesn’t account for an investment’s risk. Instead it focuses on actual returns, or earnings, from the same investment in the past but only for average RR method many clients like to take investment from IBBL thus IBBL ultimately gain more profit than that of other banks by using Average Rate of Return Method.

Banks participation on investment:

As because of IBBL is fully Shari’ah based bank and Islamic Shari’ah never allow investment for luxuries. So IBBL would like to make investment only for who are eagerly needed by the car. That is why IBBL invest comparatively low for CIS than that of Pubali Bank Ltd.

Ceiling:

The maximum level permissible in a financial transaction. Ceiling refers to the highest price, the maximum interest rate, or the largest of some other factor involved in a transaction. So according to the study, high ceiling refers most investment power of IBBL than Pubali Bank Ltd.

Modes of Investment:

IBBL render CIS to the clients HPSM, under this mode Bank may supply implements/ equipment/goods on rental basis. The ownership of the implements/equipment/goods will be with the Bank and the client jointly and the portion of the client will remain to the Bank as mortgage until the closure of the investment account, but the client will be authorized to possess the equipment for certain period. The client, after completion of the installments, will be the owner of the implements/ equipment/goods. Where in case of conventional banking (Pubali Bank Ltd), vehicle is hypothecated to the bank only.

HOUSING INVESTMENT SCHEME:

The bank has introduced this scheme to ease the serious housing problem in the urban areas and to make arrangement for comfortable accommodation of the fixed income group such as: officials of the defense services, permanent officials of government, semi government and autonomous organizations, faculty members of the established universities, university college & medical colleges, graduate engineers, doctors and established professionals, international financial organizations, donor agencies, foreign embassies etc, officials of reputed local public limited companies. At present the most demandable product is housing investment scheme of IBBL.

Calculation of profit rate:

It is calculated by reducing balance method.

Profit rate:

Profit rate of Housing Investment Scheme is 16%.

Procedures for granting investment to the consumers:

- Application form for HPSM.

- Valuation certificate (certificate issued by the bank by investigating the validity of documents/papers providing by the client).

- Inspection report (report about the enquiry of client’s property i.e. total cost, floor area, TIN).

- TIN certificate by the National Revenue Board (NRB).

- Statement of monthly Income & Expenditure.

- Written agreement.

- Family bio-data.

Step against defaulter:

- Call the defaulter

- Give the final notice after letter issue

- Cancellation of the agreement

- Legal notice through lawyer

- On 31 days the bank files case against the defaulter

- Under the economic court law, bank has been permitted to sell the mortgage property of defaulter

Difference between Islami bank and conventional bank on the basis of housing investment scheme:

To show the difference between Islami bank and conventional bank on the basis of house investment scheme we have chosen Pubali bank as the conventional bank.

Competitive Strategy:

IBBL does not follow any specific strategy to beat their competitors because they believe by applying the rules & conduct of Islamic Shari’ah completely they will hold their no.1 position in Banking Industry. So what they do is just trying to implement the rules of Shari’ah with their utmost sincerity.

Bargaining power:

The consumers cannot bargain about the rules of Shari’ah and the rate of return. It will be fixed by the bank and they have to accept it. But they have bargaining power on the disbursement amount, time of repayment, and penal interest rate. After sanctioning the investment, the consumer can take the sanctioned investment amount in installments in different time. The consumers can increase their time of payment through bargaining with the bank officers. After the repayment of total overdue investment amount the consumer can apply for the withdrawal of the penal interest amount to the head office of the bank.

Concept of Future Analysis:

Islami Bank Bangladesh Limited is a Joint Venture Public Limited Company engaged in commercial banking business based on Islamic Shari’ah having largest branch network among the private sector Banks in Bangladesh for pursuing a welfare oriented banking system and also ensure equity and justice in the field of all economic activities, achieve balanced growth and equitable development in through diversified investment operations particularly in the priority sectors and less developed areas of the country. They always try to keep themselves at highest position among the competitors whether it is established or new comer in the banking industry.

Nevertheless, as IBBL based on Islamic Shari’ah, they cannot promote/practice those policies which are forbidden by Islamic Shari’ah. According to our report topic, most of the consumer investment schemes are kind of luxurious items which are discouraged in Islam. So IBBL try to discourage CIS, but at the same time, they promote & appreciate RDS & URDS to encourage socio-economic upliftment and financial services to the less-income community particularly in the rural areas.

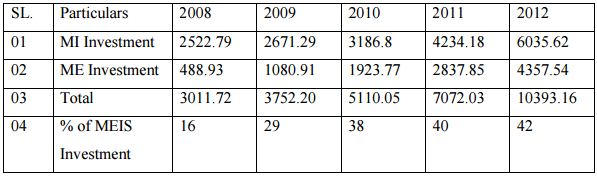

All of the information regarding RDS & URDS is presented below through theoretical and graphical representation.

RDS

Rural Development Scheme (RDS) was introduced in 1995 to meet investment need of agriculture and rural sector and create opportunity for employment graduation and raise income of rural poor to alleviate poverty. So far out of 276 branches, 197 carry out RDS activities in 61 districts of the country.

UPDS:

The Bank launched another micro-investment scheme for urban poor in 2012 in the name of “Urban Poor Development Scheme (UPDS)” on pilot basis under its 10 branches.

These two schemes enable IBBL to achieve financial inclusion of poor women of rural & urban areas.

The investment position of RDS & UPDS from 2008 to 2012 is presented below-

Under both RDS & UPDS, three types of investment facilities are provided to the beneficiaries namely a) Micro-investment (Collateral-free investment maximum tk. 50,000/- provided to the poor in different income generating activities); (b) Micro-enterprise Investment (collateralized investment maximum tk. 300,000/- provided to the graduated and other micro-clients and (c) Quard Program (cost-free loan maximum tk. 10,000/- provided to the distressed & hardcore poor for rehabilitation and water & sanitation.

Social Safety –net (welfare Activities) Program under RDS:

As poverty alleviation needs a combination of financial and non-financial programs, different welfare services are conducted under RDS in the area of

1) Education

2) Training

3) Health

4) Relief & Rehabilitation

5) Environment.

In this respect a welfare Fund has been developed by segregating 1% profit against RDS investment. An amount of Tk. 82.98 million has so far been spent for social safety-net programs under RDS during the year 2012.

In view of the above, Branches of the Bank have been encouraged to invest their deposits in their respective areas and in particular for the economic uplift of the rural people.

Findings:

Here we applied the SWOT Analysis of Consumer Investment & Services.

Strength:

- Process of giving investment is good.

- Amount of investment in Car Investment Scheme is increased by 13.2 million.

- Recovery power of Car investment is increasing with satisfactory level.

- In case of HBIS the rate of return is comparatively low than its competitors & installment system is easier.

- Amount of outstanding in HDS & HBIS is decreased than previous years which are a good sign.

- Profit is increased to 1million in Car Investment in 2013.

Weakness:

- Amount of outstanding in Car investment is increasing gradually as amount of investment is increasing.

- The number of HDS & car investment is decreased in 2013 because of the circular of the Bangladesh Bank where it made the investment ratio into 30:70.

- Amount of profit is decreased in HDS & HBIS than previous years.

- No specific competitive or promotional strategy.

Opportunity:

- Since they give less return on deposit they may take less return on investment. It will help them to increase the number of investment.

- Rules & procedures are very restricted. So they may make them a little bit flexible to encourage their customers in taking consumer investment from them.

- They should do the further inspection before & after giving the investment more sincerely to avoid outstanding investment which would lead them to the profit.

Threat:

- Bangladesh Bank may introduce new policy or give new circular on Consumer Investment any time which can negatively affect IBBL’s Consumer Investment.

- Conventional banks may apply flexible rules & give more return on Consumer Investment to attract more customers which may affect the business policy of IBBL’s Consumer Investment.

- Other Islami Banks may defame Islamic Banking if they violate any sort of Shari’ah rules in their practical application of banking activities whether it is about Consumer Investment or others.

Recommendation:

- Strict Rules & procedures can be made a little bit flexible to encourage the customers for taking consumer investment from them.

- The bank does not follow any marketing strategy, but in this competitive and new era this bank need to follow marketing strategy to attract more customers.

- This bank should introduce more promotional and motivational program for the clients on Islami banking.

- As the amount of car investment outstanding increasing IBBL should give proper training to its employees to make them efficient in recovery of the investment.

- As the amount of profit of HDS is in a steady position so they can promote this sector by introducing a special rate for student.

- The bank should open more ATM booths.

- The bank should make aware the clients about its internet banking and also update their I-banking system.

Conclusion:

Islam is a complete code of life where the detailed regulation for maintaining a proper economic life is given. Therefore Islami Bank Bangladesh Ltd. (IBBL) is trying to establish the maximum welfare of the society by maintaining the principles of Islamic Shari’ah which is based on Quran and Sunnah. Both Islam and Bangladesh bank discouraged luxurious lifestyle. Therefore, in terms of consumer investment IBBL also discourages luxurious lifestyle, and always tries to give investment only to those consumers who really need it. As a result, at a time it reduces the extensive usage of luxurious products and also upgrades the lifestyle of society by serving the deserved people.

Islami Bank Bangladesh Ltd. is the pioneer of the welfare activities in Bangladesh. It is emphasize equally in developing the rural areas of the country. The special feature of the Investment Policy of the Bank is to invest on the basis of profit-loss sharing system in accordance with the tenets and principles of Islamic Shari’ah. Earning of profit is not the only motive and objective of the Bank’s Investment Policy rather emphasis is given in attaining social goal and objective in creating employment opportunities.

Having been considered the pro-efficiency character of Islamic banking and its beneficial impacts on the economy, government policy in Muslim countries should be in favor of transforming conventional banking system into Islamic banking.