Executive Summary

Internship program is the pre-requisite for the graduation in BBA. Class room discussion alone cannot make a student perfect in handling the real business situation; therefore, it is an opportunity for the students to know about the real life situation through this program. A report has to be built for the university and organization requirement. The main purpose of the report becomes very clear from the topic of the report. The report discussion about the different “Customer service Quality Assurance of Dhaka Bank Limited”. This report is broadly categorized. Internship part and Organization Overview are discussed. The main objectives of the report are identifying the Customer service Quality Assurance of “Dhaka Bank Limited”. Project Part including origin, objectives, scope of the study, methodology, limitation, of DBL. Outside regular activities Dhaka Bank also takes part in different community services and environmental management programs. Report focuses on the products and services of DBL. It includes offered products services of banking sector based on departments like- deposits schemes, accounts opening and its procedures, rate of interest, charges, tenures, and other rules, retail banking, remittances and foreign exchange, personal banking, Islamic banking, different loan categories, and credit analysis, loan review and handling problem loans, procedure of sanctioning credit, loan documentation and execution, stamping witness and other legal formalities, development activities done by Dhaka Bank Limited. I’ve tried to shown the profit, paid up capital, deposits and advances of the recent years. Contains the literature review- customer service & managing quality, quality parameter through different questions to the customers and comparison of the Dhaka bank’s service with other banks. Highlights the TQM of Dhaka Bank Ltd. and various dimensions of Quality Management and their applications to different departments of commercial bank. Banking services such as Account Opening, Remittances (inward and outward), Clearing and Collection (inward and outward), Accounts and Safe Custody, Cash Handling (receipts and withdrawals), Customer Services and Professional Advisory. Services, International Trade (imports and exports), Credit Operations and Term Deposits were covered. The quality aspects associated with these services have also been highlighted. The proposed approach might be helpful in the development of a tool that is helpful in assessing the level of quality in banking services. The finding & analysis of Dhaka Bank Management is very conscious to satisfy very need of their customers. In this part, SWOT analysis for DBL is also focused. At the end a very qualified and dedicated group of officers and staffs are working in the different divisions of Dhaka Bank, Dhanmondi branch and are always trying to support by their best performance to achieve the DBL goal.

Origin of the Report

Internship program is the pre-requisite for the graduation in BBA. Classroom discussion alone cannot make a student perfect in handling the real business situation; therefore, it is an opportunity for the students to know about the real life situation through this program.

So, in order to enhance the understanding of the core concept, we are required to prepare a report on practical situation to understand the operation of banking business especially “Dhaka Bank Limited.” with rapid growing competition among nationalized, foreign and private commercial banks as to how the banks operates its operation and how customer service can be made more attractive and effective as the expectation of customers has immensely increased.

This report is prepared according the well directed and effective direction of the honourable supervisor Mr. Syed Md. Shamsul Arifeen, Lecturer, Department of Business administration, Dhaka City College. The topic of the report is “An Internship Report on Customer Service Quality Assurance of Dhaka Bank Limited.”

Objective of the Report

Broad Objective

The broad objective of this report is to understand the general banking activities of Dhaka Bank Limited along with how efficiently the bank is providing services to its customer and also main focus on the depth of the customer service and to understand the quality assurance of the Dhaka Bank Limited.

Specific Objective

- To discover the opportunity of customer satisfaction.

- To indicate the problem between the banker and customers.

- To determine about the quality assurance.

- To specify the relationship between management perception and customer expectation.

Scope of the study

The significance of the report is multi-dimensional. This kind of research is pretty much applicable for all. I would be benefited by gaining a firsthand experience into the corporate world and learning how to measure something so abstract like quality. Also engaging in conversation with the corporate people as well as the customers will definitely improvise on my interaction capability that is of so much importance to any business graduate. Gained knowledge about corporate world, bankers and different customers. The internship program helped me to understand how to meet the needs and expectations of different customers and how to satisfy them. All in all, anyone in the society who is interested in this arena should find my research interesting and something to learn from as I would try my level best to make it a qualitative work.

Methodology

The study requires a systematic procedure from selection of the topic to final report preparation. To perform the study data sources are to be identified and collected, they are to be classified, analyzed, interpreted and presented in a systematic manner and key points are to be found out.

- Nature of study: The nature of the study will be informative and based on those information found while investigating the company activities, it will explore some significant changes in the small scale industries. The report will be prepared based on the guidance and instruction to be provided by organizational supervisors with the consultation of academic supervisor.

- Identify data sources: Essential data sources both primary and secondary are identified which will be needed to complete and workout the study. To meet up the need of primary data are used and the study also requires interviewing the officials and staffs where necessary.

- Collection of data: To collect the different dates’ I have gone through annual reports, web browsing, and information from bankers and different clients.

Classification, analysis, interpretation and presentation of data: To classify, analyze, interpret and presentation of data I used some arithmetic and graphical tools to understand them clearly.

- Finding of the study: After scrutinizing the data problems of the study are pointed out and they are shown under concerned heads. Recommendations are suggested thereafter to overcome the problems.

- Final report preparation: On the basis of the suggestions of our honorable course teacher some deductions and additions are made and final report is prepared thereafter.

Limitation

Some limitations are yet present there:

- It is difficult to collect some of the important data and information due to the banker’s pressure of work.

- There is some information very secret and the Bank didn’t want to provide this information. But this information may help to build a good report.

- I didn’t get some updated data of recent years which could be more helpful.

- Financial Statements only portray the figures/numbers and their break down but do not clarify the justification in most of the time.

Organizational Overview:

Dhaka Bank Limited was incorporated as a public limited Company on 6th April 1995 under the company act. 1994 and started its commercial operation 0n June 05, 1995 as a private sector bank. The Philosophy of the bank is “EXCELENCE IN BANKING”. This is the bank’s commitment and guiding principle. Outside regular activities Dhaka Bank also takes part in different community services and environmental management program

To facilitate the daily clientele requirements, DHAKA BANK LTD. has started its business

with all the features of a corporate bank and the products of both corporate and retail banking system. Among all of its products Credit is one of the most important financial-tool in modern banking sector. Though DHAKA BANK is always trying to improve their services in this field, but in today’s competitive business world, banks need to offer additional concentration to the clients’ requirement in order stay at the top.

Mission Statement of DBL:

To be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking.

Vision of DBL:

DBL team is committed to assure a standard that makes every banking transaction a pleasurable experience. The endeavour of DBL is to offer customers razor sharp sparkle through accuracy, reliability, timely delivery, cutting edge technology and tailored solution for business needs, global reach in trade and commerce and highly yield on investments.

People of DBL, products and processes are aligned to meet the demand of discerning customers. The goal of this bank is to achieve a distinction like the luminaries in the sky. The prime objective is to deliver a quality that demonstrates a true reflection of vision – Excellence in Banking.

Values of DBL:

- Customer Focus.

- Integrity.

- Team Work.

- Respect for Individual.

- Quality.

- Responsible Citizenship.

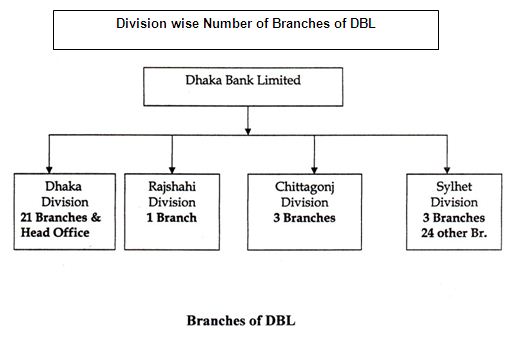

Branches of DBL:

The Bank has 52 Branches, 6 SME Service Centres, 6 CMS Units, I Offshore Banking Unit across the country and a wide network of correspondents all over the world. The Bank has plans to open more Branches in the current fiscal year to expand the network. Branches are shown by using the following flow chart:

Departments of DBL:

The whole operations of DBL have been divided into different divisions for the optimal performance of the workforce. The roles of each division are well defined. The divisions have got interrelations between them and many tasks are spanned in more than one division. The different divisions of Dhaka Bank Limited are as follows:

- Credit Division.

- Treasury & Financial Institution Division.

- Operations Division.

- Finance & Accounts Division.

- Personal Banking Division.

- Credit Division

- Investment Division.

- Human Resources Division.

- Information Technology Division.

- Audit & Risk management Division.

- Dhaka Bank Training Institute.

Dhaka Bank is one of the leading private sector banks in Bangladesh and they offer a wide range of personal, corporate, international trade finance, Foreign Exchange, Lease Finance, Capital Market Service.

A PRODUCTS & SERVICES REGARDING GENERAL BANKING

A CHECKING ACCOUNTS

Dhaka Bank offers the following checking accounts to the customers:

• Current Account

• Saving Account

• Short Term Deposit Account

• Excel Account

Current Account

The client can enjoy maximum flexibility and convenience when he/she opens a Current account with Dhaka Bank. This is a non-interest bearing account.

Savings Account

The Savings account allows the client to have interest income on his/her deposit whilst the account can be used for other transaction purposes. He/she can draw a maximum number of two cheques per week; exceeding this number will forfeit the interest or the month. DEL offers a competitive interest rate (4.00%) on the account on a daily basis provided that the balance of the account is minimum Tk. 10,000.00 at the end of business that day. Interest is applied to the account on half-yearly rests.

Short Term Deposit Account

DBL Short Term Deposit Account is a unique blend of flexibility and high return on public deposit. The client can use this account like a current account whilst s/he earns interest on the account when the stipulated minimum balance is maintained in the account. DBL offers a very competitive interest rate (2.00%) and the interest is calculated on a daily product basis. The prime features of these DBL accounts

Any number of transactions a day (except savings)

No minimum balance fee

Statement of account at your desired frequency

Any branch banking facility

Phone banking

E-Cash 24 Hours banking

DEPOSIT SCHEMES.

Various types of Deposit schemes available with Dhaka Bank Limited are:

• Fixed Deposit Receipt (FDR)

• Deposit Pension Scheme (DPS)

• Double Deposit

• Special Deposit Scheme/Income Unlimited

• Smart Plant

• Gift Cheque

Fixed Deposit Receipts

Clients can open Fixed Deposit accounts for 1 month, 2 months, 3 months, 6 months, 1 year and 2 years. DBL offers competitive interest rates. Clients can place their deposit under lien with DBL and take a loan, buy shares or open an overdraft account to meet their cash requirements. Interest rates on deposits vary from time to time.

Deposit Pension Scheme

Deposit Pension Scheme is one of the most profitable deposit schemes that are available at Dhaka Bank. This is a special type of savings scheme designed for the fixed income group. A certain amount is deposited every month in an account which is accumulated over a specified period of time along with interest accrued during that period. Upon maturity the total amount

(monthly accumulated deposits & accrued interest) is made available to the DPS account holder.

Eligibility for Opening a DPS Account with Dhaka Bank Limited:

Should be a Bangladeshi National;

Should be an adult (above 18 years old);

Should be person of sound mind;

Any other general condition(s)/requirement(s) that is applicable for opening a savings account.

Size of Monthly Instalments

Fixed monthly instalment sizes are: Tk. 500.00, and its multiple up to a maximum of Tk. 20,000.00.

Tenure

4 years, 5 years, 8 years, 10 years and 12 years.

Modus operandi

An applicant can open DPS accounts in his/her own name, in his/her spouse’s name or in the name of his/her children. The maximum number DPS account from a single family cannot exceed five.

Monthly instalments will be automatically realized from the applicants savings account linked with the DPS account.

DPS account holder can nominate one or more person(s) as legal heir. If there are multiple heirs, account holder must mention specifically the portion to be received by each heir;

Limitations/Penalties for this type of Account

Instalment size and tenure is not alterable;

Maximum monthly instalment is Tk. 20,000.00 and maximum tenure is 12 years.

Any benefit from the DPS may come under purview of Income Tax or any other levy as decided by the Government of Bangladesh.

In the event of failure to pay monthly instalment on or within next ten days of due dates, it will be sole responsibility of the account holder to settle the arrear instalment(s) before or along with the next deposit due through a written instruction to the Bank. In such case, there will be a penalty of 5% on the instalment amount to be paid with subsequent instalment.

Product Features

Deposit Min Tk 50,000 (singly or jointly) with multiples of Tk 10,000 Max Tk 20,00,000 Amount (in single name) Tk 35,00,000 (in joint name)

Tenure: 6 years

If any client chooses to withdraw the deposit before the tenure, then s/he will Premature only be entitled to prevailing interest rate on savings account in addition to the Encashment initial deposit. However, withdrawal of the deposited amount before one year will not earn any interest to the depositor(s).

money deposited will be doubled in 6 years.

Open an Account

Clients must have or open a savings account through which initial deposit will be collected. The monthly interest accrued on the deposit will be disbursed to the client through this savings/current account.

Interest payout mode

Interest payout mode should be transfer to savings account.

Premature encashment

If any client chooses to withdraw the deposit before the tenure, then s/he will only be entitled to prevailing interest rate on savings account in addition to the initial deposit.

However, withdrawal of the deposited amount before one year will not earn any interest to the depositors). Amount already paid to the clients monthly along with the Tax should be adjusted accordingly.

Smart Plant

Smart Plant offers to multiply the initial cash deposit to 10 times in 6 years. One is required to deposit at least Taka 10,000 or multiple of it to avail the opportunity. In single name one can deposit maximum Taka 50, 00,000. Dhaka Bank shall contribute 4 times of the deposited amount to build up a fund for issuance of Smart Plant.

Matured value

The total Smart Plant amount (client deposit + Bank Contribution) will double in 6 years. For example; if you deposit Taka 10,000, bank shall contribute Taka 40,000, altogether the Smart Plant amount will be Taka 50,000. On maturity (after 6 years) the Smart Plant amount will be Taka 1,00,000.

Repayment of bank contribution

One has to repay the bank contribution amount in 72 equal instalments. After repayment of all instalments the matured value will be credited in his/her savings account.

Late payment fee on equal monthly instalment

If one fails to pay the instalment within the due date, a late payment fee of 2% per month of the instalment amount will be charged.

Age limit for availing this opportunity

A Bangladeshi with an age more than 18 years and not exceeding 54 years, can avail Smart Plant.

Discontinuation of Smart Plan

Yes, one can discontinue the Smart Plant subject to the following.

• Before the 1st year, no interest

• After 1st year, prevailing savings rate.

• Closing fee is 1% of your deposited amount or subject to minimum Taka 500.

If one dies before Smart Plant maturity

The nominee shall get matured value of Smart Plant if the account holder demises prematurely before completing Smart Plant period. However, death from Self-inflicted injury, Suicide during the first year of insurance coverage, AIDS and HFV related disease, Abuse of alcohol or drugs, War, or riot, or civil commotion, Illegal act/criminal activity, Death due to any reason within the first 3 months of coverage except for accidental death, Natural Disaster viz. Earth Quake, Tsunami etc.

Securitization of Assets

A powerful and effective means of generating funds for a certain category of institutions, Securitization of Assets is still in its infancy in The need however for such a service is great and there is a lot of support from multilateral financial institutions, such as the World Bank and the Asian Development Bank, for such activities to be developed further in this country.

Dhaka Bank intends to take up this challenge and play a significant role in ensuring that Securitization of Assets becomes a normal part of the range of financial instruments available for organizations who can count on a steady, but piecemeal, flow of revenue and want to translate this stream into cash resources with which to carry out further lending activities to new customers. Some practical issues still need to be settled such as those concerning pricing, or the legal framework, but it is expected that, as Dhaka Bank and other institutions pursue more such Securitization activities these will be resolved.

Finance & Advisory Services

Given the needs of its large and varied base of corporate clients Dhaka Bank will be positioning itself to provide investment banking advisory services. These could cover a whole spectrum of activities such as Guidance on means of raising finance from the local Stock markets, Mergers and Acquisitions, Valuations, Reconstructions of Distressed companies and other expert knowledge based advice. By this means Dhaka Bank hopes to play the role of strategic counselor to blue-chip Bangladesh companies and then move from the level of advice to possible implementation of solutions to complex financing problems that may arise from time to time. This would be an extra service that would complement the normal financing activities that Dhaka Bank already offers to corporate business houses.

Syndication of Funds

There has been a surge in the number of syndication deals closed in the last few years. 2004 was an exceptionally good year for syndicated deals for the local commercial banks also for the foreign banks. The total number of syndications in 2004 exceeded 10 totaling over Tk. 10 billion. This rise in the number of syndications can be primarily attributed to the prudential lending guidelines of the Bangladesh Bank. A commercial bank may provide funded facilities up to a maximum of 25% of its equity. Due to this reason, projects with sizeable costs need to approach more than one bank for their debt requirements and therefore the demand for syndications exist. Credit risk diversification has led many international companies to introduce credit derivatives that are actively being traded. Securitization of assets is one such credit risk derivative that allows financial institutions to diversify their portfolios.

PRODUCT & SERVICES REGARDING RETAIL BANKING

A. Dhaka Bank Credit Card

Dhaka Bank Limited brings Everyday Credit Card in the shortest possible time. DBL recognize that clients need card every day. That is why it has developed processes to guarantee delivery of their card in just 7 days when they apply for a fully secured card; for an unsecured card it will be ready in just 10 days.

B. Personal Loan

Personal Secured Loan facility offers installment loan or overdraft limit against client’s deposit or investments. When a person requires cash to finance purchase of consumer durables,

House renovations, marriages in the family, advance rental payments, emergency medical needs, travel or higher education abroad you do not have to break your savings – let it continue to earn the interest whilst the Personal Secured Loan / Overdraft facility will provide him the required cash flow to meet his needs.

C. Foreign Currency Accounts

Most branches of Dhaka Bank Limited have Authorized Dealership license to deal in transactions in foreign currency and open private foreign currency accounts. Current or Fixed Term accounts in US Dollar or Pound Sterling accounts may be opened in the name of:

- Bangladeshi nationals residing abroad.

- Bangladeshi nationals ordinarily resident in Bangladesh.

- Foreign nationals residing abroad or in Bangladesh.

- Foreign firms registered abroad and operating in Bangladesh or abroad.

- Foreign missions and their expatriate employees

D. Hire Purchase

Hire Purchase Scheme has been introduced for individuals with regular monthly income to facilitate purchase of household items including computers, VCD, or even a car of with minimum equity participation. Clients can choose repayment schedule from the options ranging from 12 months to 48 months depending on their convenience and budget. The monthly installments must be paid by the 7th day of the following month. The amount of monthly installment shall not exceed ‘50% of the monthly take home pay of the applicant in case of service holders.

SERVICE REGARDING INTERNATIONAL TRADE & FOREIGN EXCHANGE

International Trade is an important constituent of the business portfolio of the Bank. The key branches of DBL in Dhaka, Narayanganj, Chittagong and Sylhet are staffed by personnel experienced in International Trade Finance. These offices are the focal point for processing Import and Export transactions for both small and large corporate customers.

The Trade Finance activity at the DBL is the main banking activities done under credit division. In the year 2009 Dhaka Bank Limited remains highly active in the arena of international trade finance by offering a broad spectrum of services name

- Issue, advising and confirmation of Documentary Credits.

- Arranging forward exchange cover.

- Pre-shipment and post-shipment finance.

- Negotiation and purchase of Export Bills.

- Discounting of Bills of Exchange.

- Collection of Bills.

- Insurance Cover / Assist customers to insure all risks.

- Advising of Export L/C

- Purchase and Negotiation of Export Bills

- Documentary Collections

- Remittance Disbursement activities etc.

In case of DBL, Dhanmondi branch there is no foreign exchange division for being non-AD branch.

PERSONAL BANKING

The consumer- banking sector of the Bank deals with number of tasks related to various services. Transaction account, savings schemes or loan facilities also provides a rare blend of conveniences & unparalleled secure quality services. The products that are recently being offered by the bank are as follows-

- Consumer Credit

- Industrial Loans

- Any Branch Banking

Though these are some product of the consumer banking but there is some further more discretion in these products. These products include some more tasks, which are performed by the General Banking sector. Such as-

- Pay Order (PO)

- Demand Draft (DD)

- Telegraphic Transaction (TT)

- Checks Deposit

- Account Opening

- Check Book issue

- Statement

CORPORATE BANKING:

Providing a tailored solution is the essence of DEL’s Corporate Banking services. Dhaka Bank recognizes that corporate customers’ needs vary from one to another and a customized solution is critical for the success of their business. Corporate banking deals with both the Local and Multinational corporate clients offering trade, treasury, investment, transaction and other banking activities. The Bank offers a wide range of services to these clients

@ Tailored advisory services

@ Project finance

@ Term loan

@ Trade finance.

@ A working capital requirement for a foreign currency transaction.

Whether it is project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transaction, Corporate Banking Managers will offer the right solution to the clients. A customer will find top-class skills and in-depth knowledge of market trends in DBL’s corporate banking specialists, speedy approvals and efficient processing fully satisfying the requirements – altogether a rewarding experience.

A Type of Bank Loans:

Banks are the principle source of credit (loan able fund) for millions of households (individuals and families) and for most local units of government. When the business and consumers need financial information and financial planning, it is the bankers to whom they turn most frequently for advice and counsel.

Worldwide, banks grant more instalments loans to consumers than any other financial institution. Banks are among the most important source of short-term working capital for Businesses and have become increasingly active in recent years in making long-term business loans for new plant and equipment.

This multiplicity of bank services and functions has led to banks being labelled “financial department stores”.

Bank loans may be divided into the following broad categories of loans, delineated by their purpose:

1. Real Estate Loans, which are secured by real property-land, buildings, and other structures- and include short-term loans for construction and land development and longer-term loans to finance the purchase of farmland, residential, and commercial structures etc.

2. Financial institution Loans, including credit to banks, insurance companies, finance companies, and other financial institutions.

3. Agricultural Loans, extended to farm and ranch operations to assist in planting and harvesting crops and to support the feeding and care of livestock.

4. Commercial and Industrial Loans, granted to business to cover such expenses as purchasing inventories, plant, and equipment, paying taxes, and meeting payrolls and other operating expenses.

5. Loans to Individuals, including credit to finance the purchase of automobiles, homes, appliances and other retail goods to repair and modernize homes, cover the cost of medical care and other personal expenses, either extended directly to individuals or indirectly through retail dealers.

6. Lease Financing Receivables, where the bank buys equipment or vehicles and leases them to its customers. Among the categories, the largest volume is in the real estate loans. The next largest category is commercial and industrial loans.

7. Asset-based Loans, loans secured by a business firm’s assets, particularly accounts receivable and inventory.

8. Instalment Loans, credits those are repayable in two or more consecutive payments, usually on a monthly or quarterly basis.

9. Letter of credits, a legal notice in which a bank or other institution guarantees the credit of one of its customers who is borrowing from another institution.

10. Retail Credit, smaller-denomination loans extended to individuals and families as well as to smaller business.

11. Term loans, credit extended for longer than one year and designed to fund longer-term business investments, such as the purchase of equipment or the construction of new physical facility. Term Loans are designed to fund long- medium-term business investments, such as the purchase of the construction of physical facilities, covering a period longer than one year Usually the borrowing firm applies for a lump-sum loan based on the budgeted cost of its proposed project and then pledges to repay the loan in a series of instalment.

12. Working Capital loan, provide businesses with short-run credit, lasting from a few days to about one year. Working Capital Loans are most often used to fund the purchase of inventories in order to put goods on shelves or to purchase raw materials; thus, they come closest to the traditional self-liquidating loan described above. Frequently the Working Capital Loan is designed to cover seasonal peaks in the business customer’s production levels and credit needs.

Credit Analysis

The division of the bank responsible for analyzing and making recommendations on the fate of most loan applications is the credit department. This department must satisfactorily answer three major considering factors regarding each loan application:

1. Borrower Creditworthiness

The factor must be dealt with before any other is whether or not the customer can service the loan- that is, pay out the credit when due, with a comfortable margin for error. This usually involves a detailed study of six aspects of the loan application-

Character

Capacity

Cash

Collateral

Conditions

Control.

All must be satisfactory for the loan to be a good one from the lender’s point of view.

2. The loan agreement be properly structured and documented so that the bank and depositors are adequately protected and the customer has a high probability of being able to service the loan without excessive strain

This requires, first, the drafting of a loan agreement that meets the borrower’s need for funds with a comfortable repayment schedule. The borrower must be able to comfortably handle any required loan payments. So, the bank’s loan officer must be a financial counsellor to customers as well as a conduit for their loan applicants.

A properly structured loan agreement must also protect the bank and those it represents-principally its depositors and stockholders-by imposing certain restrictions on the borrower’s activities when these activities could threaten the recovery of the bank funds. The process of recovering the bank’s funds-when and where the bank can take action to get its fund retuned-also must be carefully spelled out in a loan agreement.

3. the bank perfect its claim against the assets or earnings of the customer so that, in the event of default, bank funds can be recovered rapidly at low cost and with low risk

Reasons for Taking Collateral.

- If the borrower cannot pay, the pledge of collateral gives the lender the right to seize and sell those assets designated as loan collateral, using the proceeds of the sale to cover what the borrower did not pay back.

- Secondly, collateralization of a loan gives the lender a psychological advantage over the borrower. Because specific assets may be at the stake, a borrower feels more obligated to work hard to repay his or her loan and avoid losing valuable assets.

C Loan Review

Banks today use a variety of different loan review procedures; nearly all banks follow a few general principles. These include:

1) Carrying out reviews of all types of loans on a periodic basis- for example, every 30, 60, or 90 days the largest loans outstanding may be routinely examined, along with a random sample of smaller loans.

2) Structuring the loan review process carefully to make sure the most important features of each loan are checked.

3) Reviewing most frequently the largest loans

4) Conducting more frequent reviews of troubled loans, with the frequency of review

Increasing as the problems surrounding any particular loan increase.

5) Accelerating the loan review schedule if the economy slows down or if the industries in which the bank has made a substantial portion of its loans develop significant problems.

D Handling Problems of Loans.

Some loans on a bank’s books will become problem loans. Usually this means the borrower has missed one or more promised payments or the collateral pledged behind a loan has declined significantly in value.

1) Unusual or unexplained delays in receiving promised financial reports and payments or in communicating with bank personnel.

2) For business loans any sudden change in methods used by the borrowing firm to account for depreciation, make pension plan contributions, value inventories, account for taxes, or recognize income.

3) For business loans, restructuring outstanding debt or eliminating dividends, or experiencing a change in the customer’s credit rating.

4) Adverse change in the price of a borrowing customer’s stock and many more.

E Procedures of Sanctioning

Loan Application:

• Branch will obtain Loan Application’s duplicate from the customer on bank’s prescribed form signed by the proprietor/partners/directors.

• Branch will outright reject the proposals, which are restricted by Bangladesh Bank and in conflict with Head Office guidelines.

• Branch in-charge/credit anchorage will have to visit the business site of the customer.

• Verify the particulars furnished in the application and ascertain customers

Honestly, integrity and business dealing, through other sources also.

• Branch will obtain credit report of borrower and its sister concerns from the credit Information Bureau(CIB) of Bangladesh Bank.

• Obtain credit report from local banks and financial and credit institutions.

After obtaining clean credit report and satisfied regarding

- land, building, and other asses/ properties to be mortgaged or hypothecated and prima-facie genuineness and correctness by scrutinizing the documents, title deeds and other relevant papers,

- Branch will sanction the credit and issue sanction letter in duplicate Incorporation all terms and conditions to the customer with a copy of letter to Head Office.

- If the sanctioning of Loan is within the discretionary power of the Branch,

They will issue the sanction letter incorporation all terms and conditions to the

Customer with endorsement of a copy of letter to Head Office.

- If the limit is beyond the Manager’s Power they will forward the proposal to

Head Office giving specific comments and recommendation for approval.

Issuance bank guarantee

Following types of guarantee are issued by DBL:

- Bid-Bond/Security deposit

Performance Guarantee

- Advance Payment Guarantee (APG)

- Shipping Guarantee

- Customs and Excise Guarantee

- Investment Bank Guarantee

- Guarantee on Account of Foreign Correspondent

LEASE FINANCE –

Lease financing scheme another convenient product of the bank and is backed by prompt service from a team of dedicated personnel. The rental payable under lease financing is treated as revenue expenditure, which is deductible for tax purposes. Lease terms may vary to suit the clientele need but not exceeding the period as detailed below:

- Capital machinery or equipments – maximum 5 years.

- Computers or medical equipments – generally 3 years.

- Automobiles – Maximum 4 years (new), 3 years (reconditioned).

DEVELOPMENT SERVICE ACTYIVITIES:

A. Investment:

Dhaka Bank has diversified its investment portfolio through Lease Financing, Hire Purchase, and Capital Market Operations besides the investment in treasury bills and Prize Bonds. The emphasis on high quality investment has ensured the bank to maximize its profit.

Dhaka Bank Limited is a member of the Dhaka Stock Exchange and Chittagong Stock Exchange. A specialized unit of the Bank, the Investment Division manages the Bank’s portfolio and actively participates in the screen-based on-line trading of both the Stock Exchanges. The investment portfolio made up of Government Securities and Shares & Debentures of different listed companies stood at Tk. 6133 million as against TK.3926 million making a growth of 56% over the last year.

B. Customer Service:

Customer is in the core of everything a service-oriented company does. Accuracy,

Reliability and timely delivery are the key elements of the Dhaka Bank’s service. Dhaka Bank Limited is manned by well-qualified and experienced officials always prepared to provide efficient, personalized and quality service. They also tailored solutions for business needs, global reach in trade and commerce and high yield on investments backed by state-of-the-art technology for both customers and for internal use have rendered Dhaka Bank a position in the top tier of the industry. The banks prime objective is to provide high quality product and services to the customers. The bank also performs according to the needs of its corporate clients and provides a comprehensive range of financial services to national and multinational companies

C .Branch Expansion:

Dhaka Bank has opened new branches in different Cities, Places and areas over the years. This shows the banks commitment to provide services to the valued their customers through an extensive branch network at all commercially important places across the country. The bank has already 52 branches in different places in Dhaka and also in Chittagong, Sylhet, Narayangonj, Norshingdi, Cox’s Bazar, Rajshahi and Savar. They also have planned to open more branches in the sort coming year. These branches are well decorated and well secured with the new technologies.

D. Human Resources & Training:

The driving force behind Dhaka Bank has always its employees. The bank recognizes that professional development of its people is vital to establishing workers as a provider of quality service. In this regard, the bank have expanded its training facilities and set up a full-fledged training institute at Motijheel. In 2009, the institute has conducted 29 courses attended by 780 participants this year. Besides, 6 Executive Development programs were held during the year and 8 Officers had attended overseas programs on invitation.

E. Environmental Management Program:

Sustainable economical, ecological and social development of our surroundings is a key element of Dhaka Bank’s business decisions. The Bank promotes sustainable development to meet the needs of the present without compromising the ability of the future generations to meet their own needs. The Bank’s Environmental Management Program stipulates adherence with environmental, health and safety regulations and guidelines, refraining from business that impairs the ability of future generations to meet their own needs, assessing an mitigating risks concerning environment, health and safety issues that the bank undertake. The Bank’s policies with regard to safety, health and environment management are being observed in the bank’s lending decisions. Several measures have also been introduced within the Bank ranging from declaring all Dhaka Bank branches and offices as Smoking Free Zones to conservation of energy.

Customer Service:Customer service means to provide customers with good services in order to earn profit along with customer satisfaction. Successful customer service companies focus their attention on both their customers and their employees .They understand the service profit chain, which links service firm profits with employee and customer satisfaction .This chain consists of five links:

• Internal service quality: Superior employee selection and training, a quality work environment, and strong support for those dealing with customers.

• Satisfied and productive service employees: More satisfied, loyal and hard working employees.

• Greater Service Value: More effective and efficient customer value creation and service delivery.

• Satisfied and loyal customers: Satisfied customers who remain loyal, repeat purchase and refer other customers.

• Healthy service profits and growth: Superior service firm performance.

From the above discussion it can be said that well managed customer service companies share a number of common virtues regarding customer service .Successful service companies are “Customer Obsessed”, and set high service quality standards.

Managing Service Quality

Quality may be defined as meeting or exceeding the expectations of the customers. Service firm’s ability to hang onto its customers depends on how consistently it delivers value to them. Like product marketers, service providers need to identify’ the expectations of target customers concerning service quality .A service firm may win by delivering consistently higher quality service than competitors and exceeding customer’s expectations. These expectations are formed by their past experiences, word of mouth and advertising. After receiving the service, customers compare the perceived service with the expected service. If the perceived service falls below the expected service, customers loose interest in the provider. If the perceived service meets or exceeds their expectations, they are apt to use the provider again. Researchers formulated a service quality model that highlights the main requirements for delivering high service quality. The model, shown in the figure below, identifies five gaps that cause unsuccessful delivery.

- Gap between consumer expectation and management perception:

Management doesn’t always perceive correctly what customers want. A Bank authority may think that clients want prompt service but clients may be more concerned with more responsiveness. - Gap between management perception and service-quality specification:

Management might correctly perceive the customers’ wants but not set a specified performance standard. A bank may tell the officers to give fast service without specifying it quantitatively. - Gap between service -quality specifications and service delivery:

The personnel might be poorly trained, or incapable or unwilling to meet the standard or they may be held to conflicting standards, such as talcing time to listen to customers and serving them fast. - Gap between Service delivery and external communications:

Customer expectations are affected by statements made by company representatives and advertisements. - Gap between perceived service and expected service:

This gap occurs when the consumer misperceives the service quality. The Banker may keep visiting the valued clients but the client may interpret this as an indication that something really is wrong.

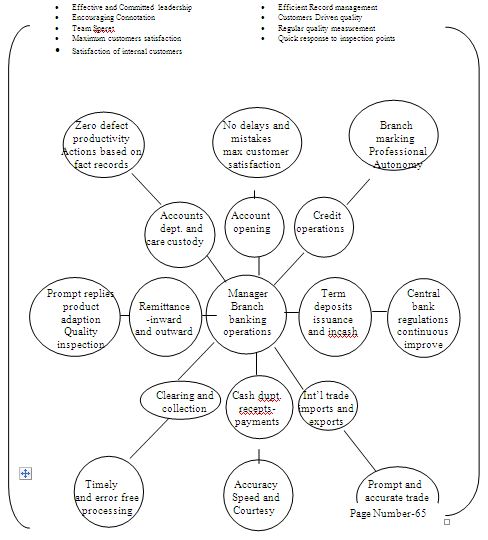

EXCELLENCE OF BANKING SERVICES-TQM OF DHAKA BANK LIMITED

Multidimensional Approach:

Banks being financial intermediaries are the backbone of any economic system involve in channelling funds from those having surplus to those having its shortage. The objective of this fund channelling is to earn profit. In order to reach maximum customers, banks develop a network of branches. Branches are the points where banks offer their products. Banking products are almost the same in a country, but what matters is the way the product is offered and the quality aspects associated with those products.

Total Quality Management (TQM), a buzzword phrase of the modern age is based on the assumption that quality can be managed that every business entity tries to get into. Total Quality Management is viewed as virtually a new organizational culture and a way of thinking. So the approach has an intense focus on customer satisfaction, accurate measurement of every critical variable in business operations, continuous improvement of products, services and processes and on work relationships based on mutual trust and teamwork.

Total Quality Management is a structured system for satisfying internal and external customers and suppliers by integrating the business environment, continuous improvement, and breakthroughs with development, improvement, and maintenance cycles while changing the whole organizational culture. This is the comprehensive approach towards quality management covering all areas of business.

Banks are not left behind in quality race. In today’s highly competitive environment, success of banking is based upon the satisfaction of both internal and external customers. The philosophy of Total Quality Management guides towards this direction i.e. satisfaction of both internal and external customers that is the best sales people around. In order to achieve that objective, there is a need to develop a Total Quality Management Model of Commercial Branch Banking Operations guiding the bank manager to indicate the areas to make bank-wide improvement in quality performance.

Like other industries, quality improvement is taking place at a revolutionary pace in banking sector too. Keeping in view the competitive environment in banking sector where bank officers are trying their best to offer high quality services to their customers, there is a need to develop a TQM model of commercial branch banking operations highlighting different departments in commercial branch banking and applications of TQM principles to such departments. At present, guide lines covering the application of TQM principles to branch banking in general are available in the body of knowledge and trainers in banks develop their own training modules on the basis of such guide lines and impart training. There is no such comprehensive model available in the body of knowledge covering all departments of commercial branch banking and TQM principles related to these departments.

Discussion of the Model

One of the main objectives of the study was to develop and propose a Quality Model for Commercial Branch Banking Operations generally applicable to any banking set up. The model developed for the research is an original contribution to the body of knowledge has numerous applied aspects. Literature review indicates that whatever model is available in order to measure quality implementation is either about management and employees or quality issues related to customer services. And they are general in nature. The proposed model combined simultaneously:

Department—wise Application of the TQM 4odcl to Commercial Branch Banking Operations

The Leadership in Commercial Branch Banking

Branch Manager the leader is, responsible for the smooth running of day to operations and also for the business growth at branch level. He/she should present himself as a dedicated and committed role model to be followed by other staff members. He should be able to

• motivate staff for quality services;

• encourage innovation;

• promote group decision making; and

• supervise the satisfaction level of both internal and external customers.

Account Opening Department

The Officer In charge of Account Opening Department is responsible of opening new accounts and activating the dormant ones. He/she should be able to

• Serve the customers promptly

• Make the account opening process the pleasant experience;

• Exercise relationship marketing;

• Leave no stone unturned to satisfy customers;

• Efficient record keeping; and

• Error free processing.

Accounts Department

The Officer In charge of Accounts Department is responsible for book keeping (profit I loss accounts, accruals, depreciations etc.) of the branch transactions and also for budgetary aspects. He/she should be able to

• Base his work on facts which means having more realistic approach towards branch activity and business growth;

• Develop procedures resulting full monitoring and control over branch activity; and

• Manage records efficiently.

Cash Department

The Officer In charge of Cash Department is responsible for cash receipts and payments. He should be able to

• Serve customers with smiling face and due courtesy;

• Process cash receipts and withdrawals accurately and efficiently;

• Make additional arrangements on cash tills in case of long queue; and

• Dispose off excess cash on hand as per the laid down policy of the bank converting the non performing asset into a profit generating one.

Recommendations:

The survey results have given valuable information as to where improvements are necessary to improve the customer services quality of DBL. Now it is recommended the following major things, which will be helpful for DBL:

- Banking is a service-oriented business. Its business profit depends on its service quality. That’s why the authority always should be aware about their service quality.

- Modern banking today is introducing various kinds of services, which attract different types of target customers. DBL should diversify its banking services and add new features in its services so that it can attract customers from all groups of people. Financial researcher of DBL should be innovative in developing new banking services, which will attract customers and also reduces cost.

- Bank should offer more facilities to the customers such as ATM machine service.

- Now a day’s world is going very fast. Now most of the banks open online customer service system. So in order to compete in the competitive market they should adopt real time online banking system in every branch.

- Supportive Management. Management can play a great role to increase the customer service.

- As for deposit schemes, DBL has innovative products but it can do product extension and increase its deposit base by introducing more variety in the maturity of the schemes.

- Long-term and before job training is very much required for the employees.

- Many branches can be opened to reach the bank’s services in remote locations.

- In all departments it is necessary to implement modern banking process instead of traditional system. It should be more computerized.

- Flexible working hour. If the working hour is flexible enough for the employee then it will help them to work in a proper way and the work will not become a load for them. As a result it will increase the service that provides to the customers.