Dimensions of productive activity promotion by Islamic Banks:

Islamic banking assists in the promotion of productive activities in may dimension.

An Islamic bank financing investment, confronts five types of productivity challenges in teems of its ability to affectivity provide financing to society.

- Investment opportunity utilization test.

- Project efficacy test.

- Loan recovery test.

- Profit maximization test.

- Test of elasticity in financing.

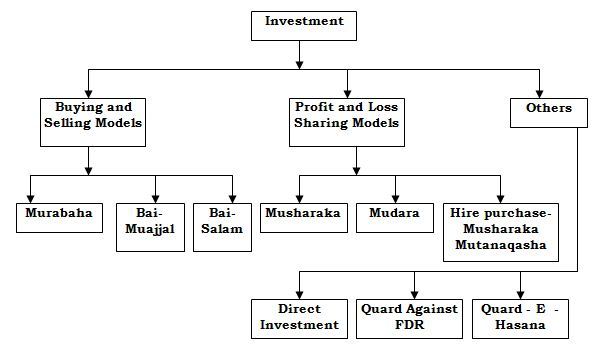

Mode of Investment

To facilitate investment the following models shall be resorted to:

a) Murabaha d) Mudraba g) Quard against FDR

b) Bai- Muajjal e) MUsharaka h) Quard-E-Hasana

c) Bai- Salam f) Hire purchase (M.M) i) Direct Investment.

Murabaha

Bai-Murabaha have devived from Arabic words bai and Ribhun. Bai-means purchase and sides the ribhen meas agreed upon project.

Murabaha means a mode of finanace under which a commo dity is purchased at the request of client as per his specification from the third part. i.e. other than the client (at whose request the commodity is purchased) or from his sister/allied concern with the clear understanding and prior contract. To sell the same to his at a marked up profit over an above the original price at which the bank purchased it. In addition, delivers the same on taking possession at least for one second and there after keeping the goods as baille, Under pledge of the bank as security to facilitates lifting by the clients on making cash payment of the price of commodities at a fixed future date either in installment or in lumps.

Interpret of Murabaha

- There must be three parties; a) Bank, b) Client, c) Seller of commodities. In no circumstance goods shall be purchased form the client or its sister / allied concerns since that will constitute buy back which is not compatible with Islamic Shariah principle.

- Bank & Client should know the original purchase price & mark up profit. Possession of the goods must come to bank even for a moment after purchase & the same shall be taken into custody by the bank for pledge as security immediately after delivery to the client.

- The marked up period should usually be for one year and the mark up rate may be comensuruting with the prevailing market rate.

- The ownership of the pledged goods shall be with the client and bank shall hold it as bailee.

- Commodity should be socially desirable i.e. Halal.

- The Murabaha goods may be purchased by engaging the clients as Buying Agent by a separate agreement and payment may be paid directly to supplier or through the client on receipt of the goods as security under pledge and control of the bank duly authorized by the seller in the cash memo or through enlisted whole seller agents or by the bank official direct along with the customers.

- Rebate on marked up profit may be allowed in lumps for early adjustment in order to attract quick recycling.

- Compensation/liquidated damage at marked up profit rate may be imposed in case of failure to lift the goods within the marked up period. Moreover, the same is to be kept in a separate income A/C Compensation Recoverable or Recovered as the case may be for charitable purpose.

Precautions

- The marketability of the goods is to be verified along with price there of so that the client does not become reluctant to lift the same on payment to the Bank after taking the same into pledge rather feel encouraged to adjust the investment speedily.

- To protect the above risk, sufficient cash security to be converted into goods security are to be obtained considering the risk and marketability involved.

- The quantity & quality of the goods are to be ensured.

- The price of the goods must be competitive.

- Lifting of the goods, either in installment or lumps within the fixed determined period is to be ensured.

- In case of failure to lift the goods with in the pre-determined period the same is to be disposed off within the reasonable time ensuring peak period or six months whichever is less.

- The client must be dealer of the commodity to be purchased and have experience in the line of trade.

- Collateral may be obtained for uncommon items.

- The feasibility of the proposal shall be ascertained as is done in usual course of Banking.

Bai-Muazzal

Bai-Muazzal is defined as a mode of investment under which the goods are sold to the clients at a cost plus price payable in a deferred basis either in lumps or in installment at a fixed future date on purchasing the same as that of Murabaha. This system could be of considerable use in financing current input requirements of industry and agriculture as well as on the financing of domestic and import trade and income generating activities.

Interpret of Bai-Muazzal

a) All features of Murabaha shall exist in Bai-Muazzal except the following:

- Unlike Murabaha the purchase price is not required to be disclosed to the client but the marked up price must be disclosed.

- The possession of the goods shall be delivered and client will take it for sale without making instant payment i.e. on deferred payment basis.

- The investment against the goods is repayable either before due date i.e. immediately after sale of the stock or at fixed date of repayment which ever is earlier.

- Generally, collateral securities are to be obtained in respect of Bai-Muazzal Investment.

Bai-Salam

It is defined as a investment under which purchase of commodity/product is made making advance payment by the Bank on execution of a written contract clearly mentioning the specification/size of the commodity and the time of delivery at a fixed future date. Generally, agricultural land industrial products are purchased in advance under the above mode to infuse finance so that production is not hindered for want of fund.

Interpret of Bai-Salam are as follows:

- Generally, the purchase price is paid in full/part instantly in advance after execution of contract.

- The description of commodity, quality, size utility, time and place of delivery is giving clearly in the contract.

- If described in the contract delivery can be taken in installment.

- To ensure delivery in right time the bank may take counter guarantee/performance guarantee from the seller, On the other hand, bank can also obtain collateral security from the client to whom the Bai-Salam investment is made to ensure delivery of the same.

- Bai-Salam is the only exceptional mode in Islamic Sharia in which goods can be sold without having goods in possession & existence.

Mudaraba

It is a mode of investment between two parties according to which one of them pays the other a specific amount of money (capital) to invest at an agreed ratio of profit and the other shall give labor. Here the Bank shall pay capital to the client and the client will conduct business by putting his labor and judgement.

- All capital shall come from one party & the labor (management) shall come from the other party.

- The first party is called the capital owner (Sahebal-mal) and the second is called the ‘Mudarib ‘(Manager).

- The net profit is divisible between them according to ratios agreed upon in advance in the in the contract.

- All financial Loss is borne by the capital owner alone unless it is resulted from the negligence or will full act of the Mudarib.

- This is absolutely a risky mode of investment & as such selection of Mudrib shall have to be done with most care. Collateral may also be obtained for recovery of loss incurred will fully or negligently.

Musharaka

Musharaka is an investment mode of financing. Under this mode Bank shall participate with the client as a partner of an enterprise. The Islamic Sharia principle of Musharaka shall be ‘Shirkatul Inan’ which means profit is divisible as per agreed ratio irrespective of capital contribution where as loss is borne strictly on the basis of capital contribution of the parties involved.

Interpret:

Features of Musharaka

- The entrepreneur will manage the enterprise.

- Capital/Equity shall be invested by the by the bank & Client as mutually agreed upon.

- The Bank shall take part in the policy and decision making as well as oversee the operation of the enterprise.

- Profit shall mean profit without deduction of administrative cost and overhead expenses as well as before payment of income tax but after deduction of allowable expenses as defined in the rules and the same shall be devisable and shared by the bank and client as per equity as per equity ratio, while the loss if any shall also be borne on the basis of equity ratio. Since the business shall be managed by the clients (s) the bank may provide the client (s) management fee at a ratio mutually agreed upon. The management fee shall fee fixed up in such a manner so that the Banks share of profit does not fall bellow the projected rate of profit (PRP) fixed by the Bank.

- Equity participation in any limited company by way of owing shares, the Bank shall earn divided income as declared by the company from time to time.

- The client(s) must not borrow from any other source beyond the knowledge and written consent of the Bank.

- Firms having interest bearing loans/advances shall not be considered for Musharaka investment.

- Musharaka investment clients may also avail investment facilities under any other modes on investment from the same branch.

- A written agreement incorporating all terms and conditions shall be executed by the parties involved.

- Collateral may be obtained to ensure recovery of invested amount or to loss caused willfully & negligently.

Hire Purchase under Musharaka Muanaqasha (HP_MM)

It is a mode under which the bank invests to enable purchase of machinery, equipment’s transport or other durable articles by the clients on obtaining initial equity & fixing up rate or rent to be charged on the outstanding to pay off the principal & accrued rent in installments at a fixed period.

Features

- Initial equity shall be obtained from the client & the same shall be appropriated to HP-MM A/C thereby reflecting, the outstanding equity of the Bank.

- Rent shall be charged rate on outstanding equity only to avoid compounding or rent.

- Ownership of the asset shall be with the bank until full payment of the dues.

- Collateral may be obtained.

Quard Against Term Deposit

Quard against term deposit may be allowed by creating loan account and profit upon loan is not to be recovered. Simultaneously profit on term deposit for the like amount is not to be paid. The Bank however, may recover an amount of service charge for the job.

Direct investment in Real Estate & Housing

Investment may be made for purchasing land for development subsequent disposal or for construction of flats and for disposal of the same for gainful purpose. The bank under joint ownership with the client may also develop housing estate, buildup multistoried building and dispose of the same subsequently for gainful purpose.

Investment in Socio-Economic and Humanitarian Advancement under Different Schemes.

Schemes are as follows may be adopted:

- Rural Investment scheme;

- Small traders Investment scheme;

- Doctor’s Investment scheme;

- Small transport Investment scheme;

- Transport scheme;

- Credit for small scale industries;

- Credit for in cottage industries;

- Scheme for credit to hawkers.

- Scheme for credit in Household/Consumer durable;

- Scheme for credit in rural House Building;

- Scheme for credit in Mosque based development.