Principle of objective of this report is to analysis General Banking activities of EXIM Bank Limited, Elephant Road Branch. Other objectives are to have exposure to the functions of general banking section and identify the strengths and weaknesses of the overall banking in EXIM bank. Finally draw SWOT analysis and make recommendations regarding the Bank’s activities.

OBJECTIVE OF THE STUDY:

The objectives of the study are as follows:

Broad Objective

- To learn about General Banking activities of EXIM Bank Ltd, Elephant Road Branch.

General Objectives

- To develop knowledge about working process in financial institutions.

- To apply theoretical knowledge in the practical field.

- To have exposure to the functions of general banking section.

- To identify the strengths and weaknesses of the overall banking in EXIM bank.

- To make recommendations regarding the Bank’s activities.

HISTORICAL BACKGROUND OF EXIM BANK LTD.:

EXIM Bank Limited was established under the rules & regulations of Bangladesh bank & the Bank companies’ Act 1991, on the 3rd August 1999 with the leadership of Late Mr. Shahjahan Kabir, founder chairman. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined in EXIM Bank. Among them, Mr. Nazrul Islam Mazumder became the honorable chairman after the demise of the honorable founder chairman.

From its inception, EXIM Bank Bangladesh limited was known as B EXIM Bank, which stands for Bangladesh Export Import Bank Limited. But for some legal constraints the bank renamed as EXIM Bank, which means Export Import Bank Bangladesh Limited. The bank starts it’s functioning from the 3rd August 1999 with Mr. Alamgir Kabir, FCA as the advisor and Mr. Mohammad Lakiotullah as the Managing Director. Both of them have long experience in the financial sector of our country. By their pragmatic decision and management directives in the operational activities, this bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management.

The Bank started Islamic Shariah base commercial banking operations on July 01, 2004 after obtaining approval from Bangladesh Bank. During the span of time the Bank has been widely acclaimed by the business community, from small entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers for forward-looking business outlook and innovative financing solutions. With a view of the company’s activities and program on the basis of Islamic Shariah, within this period of time it has been able to create an image of responsibility for itself and has earned significant reputation in the country’s banking sector. As a matter of policy, the bank conducts its business on the principles of Mudaraba, Murabaha, Bai-Muazzal & Hire Purchase transaction approved by Bangladesh Bank. The Bank is one of the interest-free Shariah-based Banks in the country and its modus operandi is substantially different from those of other commercial banks. It is a great pleasure that by the grace of Almighty Allah, Exim Bank has migrated at a time all the branches from its conventional banking operation into Shariah based Islami banking operation without any trouble. Lot of uncertainties and adversities were there into this migration process. The officers and Executives of Exim Bank motivated the valued customers by counseling and persuasion in light with the spirit of Islam especially for the non-Muslim customers. Their IT division has done the excellent job of converting and fitting the conventional business processes into the processes based on Shariah. It has been made possible by following a systematic procedure of migration under the leadership of honorable Managing Director.

CORPORATE MISSION OF EXIM BANK LTD.:

- To provide high quality financial services in export and import trade

- To be the finest bank in the banking arena of Bangladesh under the Shariah guidelines.

- To provide excellent quality customer service

- To maintain corporate and business ethics

- To become a trusted repository of customers’ money and their financial advisor

- To make stock superior and rewarding to the customers/share holders

- To display team spirit and professionalism

- To have a sound capital base.

CORPORATE CULTURE OF EXIM BANK LTD.:

This bank is one of the most disciplined Banks with a distinctive corporate culture. Here we believe in shared meaning, shared understanding and shared sense making. Our people can see and understand events, activities, objects and situation in a distinctive way. They maintain their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to us. The people in the Bank see themselves as a tight knit team/family that believes in working together for growth. The corporate culture we belong has not been imposed; it has rather been achieved through our corporate conduct.

SOCIAL COMMITMENT OF EXIM BANK LTD.:

The purpose of banking business is, obviously, to earn profit, but the promoters and the equity holders are aware of their commitment to the society to which they belong. A chunk of the profit is kept aside and/or spent for socio-economic development through trustee and in patronization of art, culture and sports of the country. The institution wants to make a substantive contribution to the society where it operates, to the extent of its separable resources.

PRODUCT & SERVICE:

Investment / Finance:

- Corporate Finance

- Industrial Finance

- Project Finance

- Syndicate Investment

- Mode of Investment

- Murabaha

- Bai Muazzal

- Izara Bil Baia

- Wazirat Bil Wakala

- Quard

- Local Documentary Bill Purchased

- Foreign Documentary Bill Purchased

Deposit:

- Al-Wadia Current Deposit

- Mudaraba Savings Deposit

- Mudaraba Short Term Deposit

- Mudaraba Term Deposit

- One Month

- Three Months

- Six Months

- Twelve Months

- Twenty Four Months

- Thirty Six Months

Other Services

EXIM Bank emphasizes on non-fund business and fee based income. Bid bond/ bid security can be issued at customer’s request.

This Bank is posed to extend L/C facilities to its importers / exporters through establishment of correspondent relations and Nostro Accounts with leading banks all over the world.

Moreover, Consumers can deposit their Telephone bill of Grameen Phone in all the branches except Motijheel and the consumers of Palli Buddut somity of Gazipur can deposit their electricity bill to Gazipur branch.

AN OVERVIEW OF EXIM BANK LTD.:

Export and Import Trade Handling and Financing:

As a commercial Bank, EXIM Bank Ltd performs all traditional Banking business including the wide range of savings and credit scheme products, retail banking with the support of modern technology and professional Excellency. But its main focus is, on export and import trade handling and the development of entrepreneurship of private sectors.

Sources and Uses of Fund:

The compositions of sources of banks fund are paid up capital, reserve, customer deposit and call loan from different banks. The bank used major portion of this fund for investment in loans and advance. The bank also invested in securities and shares. The surplus fund was applied in call money market to earn satisfactory returns.

Deposit:

The total deposit of the bank increased to Tk. 15,242.97 million as on December 31, 2006 from Tk. 9945.23 million as at the end of the previous year indicating an increase of 53.27% than the previous year. The EXIM Bank remains committed to increasing its deposit base on lowering the banks over all cost of fund.

Investment and Advance in EXIM Bank Limited:

During the year 2006, total loans and advances increased by tk.4334.56 million, 54.49% growth over the preceding period. This is due to increased commercial and trade financing, term leading and working capital support. The classified loan position is almost nil. This was achieved by rendering due attention and monitoring high-risk advance. As a result classified advance is amounted to Tk. 298.03 million in 2006. The bank is trying to operate its credit activities with the target of achieving Zero classified loans.

Investment of EXIM Bank Limited:

The size of investment portfolio of the bank as on December 31, 2006 stood at Tk. 2377.073 million against Tk. 1419.00 million in the previous year showing an increase of 67.52%. The notable investment represents deployment in Treasury bills and Shares, Prize bond & others.

Import Business:

The total import business handled by the EXIM Bank during the year 2006 was Tk. 19,260.01 million as compared to Tk. 13,152.50 million in the previous year showing an increased rate of 46.44%. The significant items of imports were industrial raw materials, consumer goods, machinery, Fabrics and accessories etc.

Export Business:

The total volume of export handled by the bank during 2006 was TK. 15,124.60 million compared to TK. 10,088.30 Million in the previous year are showing an increased rate of 49.92%. The export trade continuous to be a major growth area for the bank and the bank intends to concentrate in this of business in the coming years.

SWIFT Service:

The SWIFT services helped the bank in sending and receiving the messages and instructions related to its NOSTRO account operations and L/C related matters. The Bank has brought 8 of its branches under SWIFT network.

PERFORMANCE OF EXIM BANK LTD.:

Within a short time period EXIM Bank Ltd has been successful to position itself as a progressive and dynamic financial institution in the country. The Bank widely acclaimed by the business community, from small business/entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers from forward-looking business outlook and innovative financing solutions. The bank achieved satisfactory progress in all areas of its operation and earned a positive operating profit almost in every year.

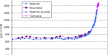

GROWTH OF BANK:

| Growth of Bank | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Figure in Crore | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

HIGHLIGHTS OF OVERALLL ACTIVITIES of EXIM BANK LTD.

| Serial No. | Particulars | 2007 |

| 1. | Paid up capital | 1713757500 |

| 2. | Total capital | 3467368068 |

| 3. | Surplus/Shortage of capital | 551245578 |

| 4. | Total assets | 41793540962 |

| 5. | Total deposits | 35032024625 |

| 6. | Total investment | 32641270316 |

| 7. | Total contingent liabilities and commitments | 18994087363 |

| 8. | Ratio on investments and deposits | 93.18% |

| 9. | Ratio on classified investments and total investments | 1.80% |

| 10. | Profit after tax and provisions | 650292342 |

| 11. | Classified investments for the year | 588173168 |

| 12. | Provision held against classified investments | 90887038 |

| 13. | Surplus/(Shortage) of provision | 6950000 |

| 14. | Cost of fund | 9.17% |

| 15. | Profit earning assets | 35161475381 |

| 16. | Non-profit bearing assets | 6632065581 |

| 17. | Return on investment (shares & bonds) | 6.55% |

| 18. | Return on assets (after tax) | 1.73% |

| 19. | Income on investment (shares & bonds) | 121460342 |

| 20. | Earnings per share | 43.48 |

| 21. | Net income per share | 37.95 |

| 22. | Price earning ratio (times) | 7.74 |

Launching of Islamic Banking:

Considering the inherent desire of the religious Muslims, EXIM Bank has launched Islami Banking system and inaugurates two Islami Banking Branches in the year 2002. Export Import Bank of Bangladesh Limited is also the 1st bank in Bangladesh who has converted all of its operations of conventional banking into Shariah-based banking since July/2004.

The Islami Banking branches perform their activities under the guidance and supervision of a body called “SHARIAH COUNCIL”. The Board of directors has formed a Sharia Supervisory Board for the Bank. Their duty is to monitor the entire Bank’s transactional procedures, & assuring its Sharia compliancy. This Board consists of the following members headed by its Chairman.

The tasks of the Sharia supervisor in summary is replying to queries of the Bank’s administration, staff members, shareholders, depositors, & customers, follow up with the Sharia auditors and provide them with guidance, submitting reports & remarks to the Fatwa & Sharia Supervision Board and the administration, participating in the Bank’s training programs, participating in the supervision over the AlIqtisad Al Islami magazine, & handling the duty of being the General Secretary of the Board.

SWIFT service:

SWIFT stands for Society for Worldwide Inter-Bank Financial Telecommunication. The SWIFT services helped the bank in sending and receiving the messages and instructions related to NOSTRO account operations and L/C related matters. EXIM Bank Ltd. has 11 of their Branches under SWIFT network. Other Branches will come under the network hopefully by the year 2006.

Functions of EXIM Bank limited:

- To maintain all types of deposit A/Cs.

- To make investment.

- To conduct foreign exchange business.

- To conduct other Banking services.

- To conduct social welfare activities.

- To work for continues business innovation and improvements.

- To value open and honest communication.

CAPITAL & RESERVE FUND:

The EXIM Bank Limited started its voyage with an authorized Capital of Tk.1, 000 million while its initial Paid up Capital was Tk.225.00 million subscribed by the sponsors in the year 1999. The Capital and Reserve of the Bank as on December 31, 2006 stood at Tk.3, 111.68 million including paid up capital of Tk.1713.75 million. In the year 2006 the bank has issued right share to strengthen its capital base. In this course the bank has greater an amount of TK. 571.25 million. The bank also made provision on unclassified investments which is amounted to TK> 351.41 million.

Analysis of capital structure:

Capital structure of EXIM Bank has changed from year to year. The components of the capital structure are paid-up capital; proposed issue of dividend, share premium, statutory reserve, proposed cash dividend, retained earnings and other reserve.

Table :- Authorized and paid up capital of EXIM Bank Ltd.:

| Authorized Capital (TK) In Million | Year | Paid Up Capital (Tk) In Million |

| 1000 | 2007 | 1713.75 |

| 1000 | 2006 | 878.85 |

| 1000 | 2005 | 627.75 |

| 1000 | 2004 | 313.88 |

| 1000 | 2003 | 253.13 |

| 1000 | 2002 | 225.00 |

| 1000 | 2001 | 225.00 |

| 1000 | 2000 | 225.00 |

DEPOSIT:

Deposit is one of the principal sources of fund for investment of commercial banks and investment of deposit is the main stream of revenue in banking business. The total deposit of the EXIM Bank Ltd. Stood at Tk. 35,032.02 million as on December 2006 against Tk.19, 078.18 million of the previous year which is an increase of 48.44%.

| Year | Amount Of Deposit (Tk In Million) |

| 2007 | 35,032.02 |

| 2006 | 28,319.20 |

| 2005 | 19,078.20 |

| 2004 | 15,243 |

Table- Deposit Position of EXIM Bank Ltd:

| Items | Percentage (%) |

| Current and others | 9.89% |

| Term deposit | 84.15% |

| Savings deposit | 4.81% |

| Bills payable | 0.90% |

| FC deposits | 0.25% |

Table– Deposit mix of EXIM Bank

GENERAL BANKING ACTIVITIES & LEARNING PARTS

OBSERVATION

EXIM Bank, Elephant Road branch conducts all types of commercial banking operations. The core business of the bank comprises of trade finance, term finance, working capital finance and corporate finance. The bank is also providing personal credit; services related to local and foreign remittances and several products related services. The scheme of the Bank, which is designed to help the fixed income group in raising standard of living is competitively priced and has been widely appreciated by the customers.

The Bank has achieved success in all sectors and the achievement has been possible because of the able leadership, dedicated and committed services provided by all levels of management and staff and all the trust and confidence that the valued client had reposed in the Bank.

Export Import Bank of Bangladesh Limited is a third-generation private commercial bank in the country with commendable operating performance. Directed by the mission to provide prompt and efficient services to clients, EXIM Bank has successfully celebrated its wide range of commercial banking services. The Bank has achieved success among its peer group within a short span of time with its professional and dedicated team of management having long experience, commendable knowledge and expertise in convention with modern banking.

As an internee, I have worked in all of the Bank’s division. In this learning part I have explained that what I have learned in the General Banking Division as their day-to-day activities.

GENERAL BANKING DIVISIONS:

The division of general banking plays an important role in all commercial banks. It’s mainly a liability side. EXIM bank facilitates sections and facilities of general banking.

ACCOUNT OPENING SECTION

One who want to open an account, he has to fill up an account opening form. This form is a legal contract between the bank and prospective customers. The rules and regulations for opening of an account vary from customer to customer, if he wants to open different types of accounts. First of all various types of customers such as individual, joint, proprietorship, partnership, private limited company, public limited company, associations, clubs, societies, trusts etc. can open their various types of accounts as their requirements which are mentioned below:

NECESSARY PAPER/ DOCUMENTS REQUIRED FOR THE OPENING ACCOUNT:

Individual Accounts:

| 01 | Introduction of Account. |

| 02 | Two Photographs of the signatories duly attested by the introducer. |

| 03 | Identity copy (copy of passport) / Nationality certificate. |

| 04 | Joint Declaration Form (for joint A/C only). |

| 05 | Employee Certificate (in case of service holder). |

| 06 | KYC, TP, From. |

| 07 | Nominee form and photo duly attested by account holder. |

| 08 | TIN Certificate, VAT Certificate (if have any or transaction amount 5 lac). |

Joint Account:

| 01 | Introduction of Account. |

| 02 | Two Photographs of the signatories duly attested by te introducer |

| 03 | Identity copy (copy of passport) / Nationality certificate. |

| 04 | Joint Declaration Form (for joint A/C only). |

| 05 | Employee Certificate (in case of service holder). |

| 06 | KYC, TP, From |

| 07 | Nominee form and photo duly attested by account holder. |

| 08 | TIN Certificate, VAT Certificate (if have any or transaction amount 5 lac). |

Partnership Account:

| 01 | Introduction of Account |

| 02 | Two Photographs of the signatories duly attested by the introducer. |

| 03 | Partnership account letter duly singed by all partner. |

| 04 | Identity copy (copy of passport) / Nationality certificate. |

| 05 | Registration (if any). |

| 06 | Rubber stamp. |

| 07 | Updated Trade license. |

| 08 | KYC, TP, ML, From |

| 09 | Nominee form and photo duly attested by account holder. |

| 10 | TIN Certificate, VAT Certificate (if have any or transaction amount 5 lac). |

Proprietorship Account:

| 01 | Introduction of Account |

| 02 | Two Photographs of the signatories duly attested by the introducer. |

| 03 | Updated Trade license. |

| 04 | Rubber stamp. |

| 05 | Identity copy (copy of passport) / Nationality certificate. |

| 06 | TIN Number Certificate (if any). |

| 07 | Permission letter DC/ Magistrate (in case of news paper). |

| 08 | Sole proprietorship Declaration. |

| 09 | KYC, TP, ML, From |

| 10 | Nominee form and photo duly attested by account holder. |

| 11 | TIN Certificate, VAT Certificate (if have any or transaction amount 5 lac). |

Public/Private Limited Company:

| 01 | Introduction of Account |

| 02 | Two Photographs of the signatories duly attested by the introducer. |

| 03 | Updated Trade license. |

| 04 | Rubber stamp (Seal with designation of case person). |

| 05 | Board Resolution of opening A/C duly certified by the Chairman. |

| 06 | Certificate of Incorporation. |

| 07 | Certificate of commencement (in case public company.) |

| 08 | Certificated (joint stock) true copy of memorandum and article of association of the company duly attested by Chairman/ Managing Director. |

| 09 | List of Director along with Designation & Specimen Signature. |

| 10 | Latest certified copy of from xii (to be certified by register of joint stock companies) (in case of Directorship change). |

| 11 | Identity copy (copy of passport) / Nationality certificate. |

| 12 | Certificate of Registration. |

| 13 | KYC (Every Director) |

| 14 | TP, ML Form signed by Operative person. |

| 15 | TIN& VAT Certificate. |

Club/ Societies Account:

| 01 | Introduction of Account |

| 02 | Two Photographs of the signatories duly attested by the introducer. |

| 03 | Board Resolution of opening A/C duly certified by the President/Secretary. |

| 04 | List existing Managing Committee. |

| 05 | Registration (if any). |

| 06 | Rubber stamp |

| 07 | By lay. |

| 08 | Permission Letter from Bureau of N.G.O. (in case of N.G.O A/C). |

Various Types Of deposit account:

EXIM Bank offers following types of deposit account:

- Current Account

- Fixed Deposit Receipt Account

- Savings Account

- Short term Deposit Account

General procedure of openings account:

Step 1: Bank provides account opening form to the prospective customer or applicant.

Step 2: Applicant fills up the form.

Step 3: Application submits the form dully signed by an introducer and along with.

Step 4: The authorized officer examine the application form.

Step 5: If they are satisfied, they will open the account,

Step 6: They issue deposit slip and deposit must be made it.

Step 7: After deposition one checkbook is issued.

Step 8: Bank preserves the specimen signature card to verify the signature of the client.

Step 9: Account is opened.

CURRENT ACCOUNT:

Current account facilitates the account holder to draw money at any times but no interest is given to the current account deposited money. Current accounts can be opened by any individual or joint or any name of proprietorship business, private limited company or public limited company, association, clubs, societies, trusts etc. Generally, current account is opened for businessman and traders for easy transaction. By taking this liability, EXIM Bank takes service charge 100/- for six months.

MUDARABA TRAM DEPOSIT RECIVED (MTDR):

Its look like Fixed Deposit in general banking but in Islamic Banking it’s called MTDR. It’s a certain period deposited system, which is not repayable before the maturity date of a fixed period. EXIM Bank offers higher rates of interest on such deposits. Usually customers are allowed to open this account for a certain period and the rate of interest varies in accordance with the terms of the deposit. The features of FDR are as follows: Minimum balance: TK 10000.00

| 3 months | 6 months | 1 year | |

| Profit | 12.25% | 12.30% | 12.75% |

SAVINGS ACCOUNT:

To maintain smooth and certain life in future Savings account is very suitable for middle class groups. The attributes of Savings Account are:

- 500/- is the minimum amount of initial deposit.

- Client can not withdraw money more than twice a week,

- The interest rate is 8% against S.B. Account.

For opening of this type of accounts following requirements are necessary:

a) The introducer must be attested photograph.

b) The introducer must be account holder of SB and CD of EXIM Bank Bangladesh Ltd.

SHORT TERM DEPOSIT (STD):

Short Term Deposit has following attributes:

- 6% interest rate against STD.

- No restriction over withdrawal of money

- 50000/- is the minimum balance.

EXIM Bank extends some special schemes or products for clients:

- Monthly Savings Scheme (MSS)

- Multiply Savings Scheme (MPSS)

- Monthly Income Scheme (MIS)

- Super Savings Scheme (SS)

Monthly Savings Scheme (MSS)

It’s a sure investment for a steady return. It can be opened for 5, 8, 10, or 12 years for Tk.500, Tk.1000, Tk.2000, and Tk.5000. The savings amount is to be deposited within the 10th of every month. If the depositor has a separate account in the bank for which a

Standing instruction can be given to transfer the monthly deposit in the scheme’s account. Incase of failure to make the monthly installment in the schedule time 5% on overdue installment amount will be charged. The lowest charge will be Tk. 10 and this will be added with the following month’s installment. After 3 years of savings in this schemed the depositor is eligible for a loan up to 80% of his deposited amount.

Highlights of the Scheme:

1) Higher monthly income for higher deposit

2) This scheme is for a 5, 8, 10, 12 year of period.

3) 5007- is the minimum deposit

4) Monthly income will be credited to the depositor’s account on the 10th of each month.

| Term | Monthly Installment | Monthly Installment | Monthly Installment | Monthly Installment |

| 500.00 | 1000.00 | 2000.00 | 5000.00 | |

| 5 Years | 41400.00 | 82800.00 | 165000.00 | 414000.00 |

| 8 Years | 81800.00 | 163600.00 | 327200.00 | 818000.00 |

| 10 Years | 118450.00 | 236400.00 | 472800.00 | 1184500.00 |

| 12 Years | 165993.00 | 331986.00 | 663973.00 | 1659932.00 |

Conditions of the Scheme:

- By filling up a form an account is opened.

- A non-transferable deposit receipt will provide to the customer after opening the

- If the deposit is withdrawn before a 5-year term, then saving interest rate will be applicable and paid to the depositor. However, no interest will be paid if the deposit is withdrawn within 1 year of opening the account and Monthly Income paid to the customer will be adjusted from the principal amount.

- This scheme will be credited to the loan account until liquidation of the loan amount inclusive of interest. A depositor can avail loan up to 80% of the deposit amount under this scheme.

Multiples Savings:

Savings works as the very foundation of development. Savings is the prime source of business investment in a country. So it helps to build up capital. To create more awareness and motivate people to save, EXIM Bank offers Multiples Savings Scheme.

Conditions of the Scheme:

- The deposit can be made in multiplies of TK. 10000.00.

- This is 11 years period deposit. But the deposit can be withdrawn at any year with interest. As an example, if deposit is withdrawn after completion of 1 year but before 2 years then deposit with interest will be paid for 1 year only. The same rule will apply for other years. If deposit is withdrawn before 1st year then no interest will be paid,

- The depositor can avail loan up to 80% of the deposit under this scheme.

Monthly Income Scheme:

This scheme is opportunity for the people who try to save their excess money. In this scheme minimum deposit is Tk. 25000. Deposit will be high in case of higher monthly income. The scheme is for a five-year period. Monthly Income will be credited to the depositor’s account on the 5th of each month. If the deposit is withdrawn before a five-year term, the saving interest will be applicable and paid to the depositor. No interest will be paid if the deposit is withdrawn within one year of opening the account and monthly income paid to the customer will be adjusted from the principal amount. A depositor can avail loan up to 80% of the deposit amount under this scheme. In this case interest will be charged against the loan as per bank’s prevailing rate. During the tanner of the loan, the monthly income will be credited to the loan account until liquidation of the loan amount inclusive of interest.

| Deposit Amount (Tk.) | Monthly Income (TK.) |

| 2500.00 | 250.00 |

| 5000.00 | 500.00 |

| 100000.00 | 1000.00 |

| 20000.00 | 2000.00 |

| 50000.00 | 5000.00 |

| 100000.00 | 10000.00 |

Super Savings Scheme:

Capital is the prime source of business investment in a country. For this reason savings helps to build up capital to motivate the foundation of development. To create more awareness and motivate people to save, EXIM Bank offers Super Savings Scheme.

Conditions of the scheme:

- Any individual, Company, Educational institute may keep their savings under this scheme.

- The deposit can be multiplies of TK. 10000.

- The period of deposit is for eight years.

- Any customer can open more than one account in a branch in his name or in joint names. A deposit receipt will be issued at the time of opening the account.

- If the deposit is withdrawn before seven years term, then saving profit rate +1% will be supplied before the payment is made.

- A depositor can avail loan up to 80% of the deposited amount under this scheme.

- In case of issuing a duplicate deposit receipt the rules of issuing duplicate of Term Deposit will be applicable

Some examples are given below:

| Deposit | Term | Payable at maturity | Payable Amount |

| 10000.00 | 8 years | Double | 20000.00 |

| 20000.00 | 8 years | Double | 40000.00 |

| 50000.00 | 8 years | Double | 100000.00 |

| 100000.00 | 8 years | Double | 200000.00 |

| 200000.00 | 8 years | Double | 400000.00 |

| 500000.00 | 8 years | Double | 1000000.00 |

CLEARING SECTION:

The main function of clearing section is to operate with safety and security of financial transaction of financial instrument like DD, PO, check etc. on behalf of the customers through Bangladesh Bank Clearing House, Outside Bank Clearing (OBC), Inter Branch Clearing (IBC). This section examines in the following way:

- Whether the paying bank within the Dhaka city.

- Whether the paying bank outside the Dhaka city. Then these checks can be cleared by OBC, OBC stands for Outward bill for collection.

- Whether the paying is their own branch. These checks can be cleared by LBC, LBC stands for Local Bill for Collection.

Clearing Instruments

Inward Clearing:

When the checks of its customer are received for collection from other banks, the following should be checked very carefully;

- The check must be crossed.

- The check should not carry a date older then the receiving date for more than months.

- The collecting bank must check whether endorsement is done properly or not.

- The amount both in words and figures in deposit slip should be same and also it should be in conformity with the amount mentioned in words and figures in the checks.

Outward Clearing:

When the financial instruments like P.O.D.D. and Checks collected by specific branch within the Dhaka city and not of their own branch then the Outward clearing will be functioned. The procedures of Outward Clearing are followed:

- The instruments with schedules to the main branch of EXIM Bank Bangladesh With issuing an Inter Branch Debit Advice (1BDA).

- Clearing stamps are affixed on the instruments.

- Checked for any apparent discrepancy.

- The authorized signature endorses instruments.

- Particulars of the instruments and vouchers are recorded in the ‘Outward Clearing’ register

- The clients receive the duty signed instruments and also branch code number affixed on the instruments.

Essential elements for Clearing:

There are three essential elements are required for clearing the Instruments:

- Clearing Seal,

- Crossing Seal.

- Endorsement Seal.

REMITTANCE SECTION:

The word ‘Remittance’ means sending of money from one place to another place through post and telegraph. Commercial banks expose this facility to its customers by means of receiving money from one branch of the bank and making an easier arrangement for payment to another branch within the country.

Considering this quick transaction, the modes of bank remittance are categorized as under:

Payment Order (P, O):

Payment Order is a process of money transfer from payer to payee within a certain clearing area through banking channel. It’s an order of local payment on behalf of the bank or its constitution. A customer can purchase different modes of payment Order such as pay order by cash and pay order by check. EXIM Bank charges different amount of commission on the basis of payment order amount.

Demand draft (D.D):

Demand Draft is a most popular instrument of money transfer from one corner of the country to another. A customer from a particular bank’s branch of the same bank to pay a fixed sum of money to a certain person or order on demand can issue this. Its may be paid in cash to the payee on proper identification or the amount may be credited to his account (in case of A/C holder of the bank). EXIM Bank charges commission for DD is 0.15% of the principal amount

How DD works:

- The applicant is an A/C holder in an EXIM Bank

- Applicant files up the relevant form with a credit voucher for the Bank

- DD is handed over to the customer where paying bank is mentioned and payment will be made from another branch.

- An IBCA along with photocopy of DD is sent to the paying bank

- If DD comes to the bank on which it is drawn, the bank honors it.

Telegraphic Transfer (TT):

Telegraphic Transfer is the most rapid and convenient but expensive method. There are different modes of telegraphic transfer such as Fax, Mobile, Telephone Telex, and Telegram.

If an applicant wants to transfer money quickly to the pay in another city or district he /she may request the banker to send it by TT.

CASH SECTION:

Cash section plays a vital role in the general banking procedure. Because it deals with most liquid asset. This section receives cash from depositors and pays cash against checks, drafts, and pay order and in slip over the counter. This branch also facilitates electronic counting machines to the customers for a huge amount of cash money can be counted within a few minutes.

Cash receiving procedure:

Depositors deposit cash, checks, drafts, pay order etc. In these types of deposits, the depositors must be written the following way:

- Date of the instrument.

- The title of the account and its number.

- The amount in figure and in words as same.

- The signature of the depositors.

After writing all these things the teller will accept cash, check, draft, pay order etc against deposit slip. The teller will place signature and affix ‘cash received’ rubber stamp seal and record in the cash received register book against the account number. After finishing all these procedure, the cash officer passes the deposit slip by posting in the computer section and returns the customer’s copy.

Cash Payment Procedure:

Before honoring a check, the paying banker has to observe the check in the following way:

- Whether a check is an opened or crossed check, it must be looked.

- Whether the check is drawn on his/her branch, it must be observed. If the check is postdated then it must not be paid.

- If the check is mutilated materially altered then the officer must not honor that check

- The officer must verity the regulatory of the endorsement.

- The officer must compare the signature of the check with the signature on the specimen signature card.

Passing the Check:

After verifying all these documents the officer passes it to the computer section for more verification. By putting ‘pay cash’ seal, the officer gives the cash amount to the holder and record in the paid register.

Dishonor of Check:

EXIM Bank’s Banker can dishonor a check in the following situations:

- Insufficient fund.

- Check is post dated.

- Crossed check must be presented through a bank.

- Clearing stamp required cancellation.

- Check crossed “Accounts pay only”.

- Collecting bank’s discharge irregular.

- Payment stopped by drawer.

- Effect not clear on the check.

- Full over not received.

- Payee’s endorsement irregular.

- Drawer signature differs.

FINDINGS OF THE STUDY:

The followings have been identified during the period of my internship at EXIM Bank Limited

- Political influence is one of the major problems in Bangladesh. Due to political intervention the bank becomes obliged to provide loans in most of the cases, which are rarely recovered. Bank has to face this in convenience situation almost every year.

- Sometimes the employee to unlawfully help the client deliberately overvalues the securities taken against the loan. As a result if the client fails to repay the loan the bank authority cannot collect even the principal money invested by the selling those assets. It is also a very important factor that leads to loan default.

- CIB report is not readily available from Bangladesh Bank.

- Loan recovery process is very complex.

- The bank is not still technologically updated. There are no online banking facilities; the bank should have its own data communication facilities for better customer service and security.

- The working procedure of the bank along with the office setup could be more organized.

- Efficient work force along with proper division of work is vital for the success of any bank, EXIM Bank has the scope to consider this factor to enhance and sustain it growth.

- The bank wholly converted in to Islami banking system during the year 2004, so there is scope to promote this new banking system, by making people aware of these new banking phenomena.

- There is scope to introduce the most modern customer services like: ATM, Credit card, Debit card, etc.

- Since the works are done mostly manually, the investment section takes long time to process loans.

- Foreign exchange department could provide better service through computerization of all its operations.

- The cash counter and the whole general banking section as I found at the Elephant Road, branch is congested and the procedures are also traditional.

RECOMMENDATION:

- Try to avoid giving loan the political person who had bad reputation of loan repaying.

- Evaluate the securities value properly to avoid the risk of loan recovery. The punishment System should be established to discourage the unlawful activities of employee

- Bangladesh Bank should more active to provide CIB report.

- Make easier loan recovery process.

- The bank should consider the issue of better customer service more sincerely, and in this regard it may introduce various customer-oriented services, should automate the operations and introduce online banking facilities.

- The bank should consider the system of introducer and other lengthy procedure of opening and maintaining accounts.

- Computerization of the overall system will help in correcting any error in a better way and also this would be a good source to detect any fraud and forgery.

- The bank should ensure fare and quality recruitment process, as well as proper training facilities for its recruited and existing employees; this will work in multiple ways to promote the overall performance of the bank.

- As the way of promotion the bank may carryout various social welfare activities, through the EXIM Bank Foundation.

- The bank should provide online banking and various other specialized services, which will turn it in to a leading banking company in the country.

- Training program should be taken more seriously and more often. Officers should be sent for training for betterment of service.

- In the credit department, strict supervision is necessary to avoid loan defaulters, the bank official should do regular visit to the project.

- It may be a fair deal if the high-risk borrowers and the low risk borrowers should not have to pay the same interest rate. Interest rate could be arranged according to the sum they borrow.

CONCLUSIONS:

EXIM Bank Ltd. is a new generation Bank. It is committed to provide high quality financial services/products to contribute to the growth of G.D.P of the country through stimulating trade and commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and overall sustainable socio-economic development of the country. The is not so far when it will be in a position to overcome the existing constraints and it may be expected that by establishing a network over the country and by increasing resources this bank will be able to play a considerable role in the portfolio of development of financing.

From the learning and experience point of view I can say that I really enjoyed my internship at EXIM Bank Ltd. from the very first day. I am confident that this 02 (Two) months internship program at EXIM Bank Ltd will definitely help me to realize my further carrier in the job market. Eight years is a very short span of time and the organization that can establish itself as one of the most reputed Private Commercial Bank in the country within this short period deserves special credit and with their able leaders, EXIM Bank will reach the highest level of success very shortly. I wish every success of that bank.