Executive Summary

Banks plays vital role in the economy of the country. Countries development greatly depends on the activities of the banks. Commercial banks take deposit & give away loans. This loan build on industrialization’s Commercial Bank helps in savings. Savings create investment. Investment contributes the GDP. Finally the commercial banks play on important role in import of country through opening of bank L/Cs. It helps to earn foreign currency by helping the exporters in export.

This report is prepared on the basis of my three months practical experience at Bangshal Branch, Shahjalal Islami Bank Limited. The internship program helped me to learn about the practical situation of a financial institution. This program helped me to implement my theoretical knowledge into practical & realistic work environment.

In the age of modern civilization bank is playing its spending role to keep to the economic development wheel moving. The co-operation of the bank is needed in every economic activity. Bank provides means & mechanisms of transferring command over resources from those who have an excess of income over expenditure to those who can make use of the same for adding to the volume of productive capital. There are a large number of small savers with small amount of savings who are generally reluctant to invest their surplus income because of their lack of adequate knowledge about complicated investment affairs. The bank provides them with the safety, liquidity and profitability by means of different savings media offering varying degrees of a mix of liquidity return and safety of savings. The saving banks use as their key of business. They invest the savings in higher degree of return and maximize their profit in business Shahjalal Islami Bank Limited is a scheduled Islamic commercial bank registered by the Bangladesh Bank. Shahjalal Islami Bank follows the rules and regulations prescribed by the Bangladesh Bank for Scheduled commercial banks. The functions of the bank cover a wide range of banking and functional activities to individuals, firms, corporate bodies and other multinational agencies.

Brief Introduction of the Study:

Banks plays vital role in the economy of the country. Countries development greatly depends on the activities of the banks. Commercial banks take deposit & give away loans. This loan build on industrialization’s Commercial Bank helps in savings. Savings create investment. Investment contributes the GDP. Finally the commercial banks play on important role in import of country through opening of bank L/Cs. It helps to earn foreign currency by helping the exporters in export. In the age of modern civilization bank is playing its spending role to keep to the economic development wheel moving. The co-operation of the bank is needed in every economic activity.

Rationale of the Study:

The long drawn struggle to establish a Shajalal Islami Bank Limited in Bangladesh becomes a reality when Shajalal Islami Bank Limited was established in 10 May 2001 with a clear manifesto of demonstrating the operational meanings of participatory economy banking and financial activities as an integral part of an Islami code of life and Shajalal Islami Bank limited. Basically SJIBL is an Islami Bank based on “Islami Shariah” It has already established its 64 branches in different district in Bangladesh. It follows the alternative concept of Islami Banking, which represents unique human approach to credit and banking based on profit-oriented economy avoid of interest. In this regard SJIBL has introduced a number of income generating programs for the millions of urban and rural poor. With that objective in view SJIBL has formulated a profitable investment option for the rich to invest.

Objectives of the Study:

Board Objective:

Recommend for overall Activities of Shahjalal Islami Bank Ltd., by analyzing the present investment system, policies and practices of the Shahjalal Islami Bank Ltd.

Specific Objectives:

- To get the real life exposure in the Banking sector.

- To make a bridge between the theories and practical procedures of banking day-to-day operations.

- To comply with the banking procedures of Shahjalal Islami Bank Foreign Exchange Branch.

- To analyze the present overall activities of the Shahjalal Islami Bank Ltd.

- To know how far development activities of Shahjalal Islami Bank Limited (SJIBL) are operating through Islamic viewpoint, which is base on shariah.

Methodology of the Study:

Source of Data

Sources of information for writing this report are:

- Personal experience gained by visiting different desks.

- Study of old files.

- Personal investigation with bankers.

- Different circulars sent by Head Office of Shajalal Islami Bank Limited Ltd..

- Annual Report.

- Internet browsing (Background of the bank).

There are many process and techniques of data collection. And we know data collection is the primary task of any study. Mainly, there are two methods of data collection. . These are: Primary Data & Secondary Data.

Primary Data

The primary data are those, which are collected a fresh and for the first time and thus happen to be original in character. We know there are several methods of collecting primary data. The main methods are:

a) Observation method

b) Personal communication

c) Through Questionnaires

d) Through schedules and

Now in our study we emphasis on the following two methods;

a) Observation method

b) Personal communication

a) Observation Method

It is the most commonly used method. In a way we all observe things around us specially our related field. In my study, I have visited Midford Branch of Shahjalal Islami Bank Ltd., for observed and collect data.

b) Personal communication

It is the important methods of collecting primary data. It is very effective method. I have gathered data through personal discussion with the officers of different level of employees of The Shahjalal Islami Bank Ltd., Midford Branch; they provide information about banking operations. Other information has been collected by personal discussion with the Manager.

Secondary Data

Secondary data means data that are already available i.e. they refer to the data, which have already been collected and analyzed by someone else. We know there are many sources of secondary data. It may be published or unpublished; the published data are available in:

- Various publications of central,

- Various publications of foreign governments,

- Technical trade journals,

- Books, magazines and newspapers,

The sources of unpublished data are many; they may be found in diaries letter, unpublished biographic and autobiographies and also may be available with scholars and other public/ private individuals and organizations.

However in our study, we have mainly gathered the secondary data from the following sources:

a) Annual report of SJIBL,

b) Circular letter and journals

c) Published papers on loans and advances of SJIBL,

d) Other published and historical documents of SJIBL;

The present study is concerned with the analysis of Overall practice of Shahjalal Islami Bank Ltd., Bangshal Branch. The approach adopted here is basically analytical and interpretation in nature considering the objectives of the study.

Literature Review

Background of the Bank

It is very much difficult to mention that word ‘Bank’ is derived from which word. There are different opinions in this regard. According to some authors, the word ‘Bank’ was derived from the words Banco, Bancus, or Banque, all of which means a bench. There are others, who thought that the word “Bank” is originally derived from the German word ‘Back’ means a joint stock fund.

The Banking Companies Ordinance was promulgated on the 7th June 1962. This has been adopted in Bangladesh and is applicable to the banking companies only. Nothing of this ordinance shall apply to a co-operative Securities Act (1912). The main forms of Business of Banking Companies:

- Borrowing, raising or taking up money.

- The lending or advancing of money either upon or without security.

- Dealing in securities and investments.

Bank is a service-oriented financial institution. It provides financial services to the economy by mobilizing fund from surplus unit to deficit unit. Bank mobilizes funds by introducing various financial products. Efficient & effective fund mobilization depends on individual bank’s capability of designing financial products. The Shahjalal Islami Bank Limited is also trying to design the financial product efficiently, nevertheless. Vision may differ from the reality.

Shahjalal Islami Bank Limited has a vision and mission to improve the financial sector of Bangladesh i.e. economic condition of Bangladesh by providing effective and innovative banking and financial product in financial market. However, in every economy of the world financial sector is highly regulated sector. Therefore, financial products of every bank are almost same as same law & regulations regulate them.

So we can say that

- Bank is an intermediary institution

- Collects the fund from the surplus units

- Keeps the money as deposits

- Creates the weapon of loan

- Uses the fund to earn interest or profit

- Provide withdrawn facilities on necessity.

Evolution of Banking Business

1) Ancient ages (5000BD-2000BD)

2) Vaidic ages (2000BD-1150AD)

3) Moughal Regime (1150AD-1757AD)

4) British Regime (1757AD-1947AD)

5) Partition of India and Pakistan Regime (1947AD-1971AD)

6) Partition of Pakistan and During Bangladesh time (1971AD-till date)

Categories of the Bank

Banking system of today’s Bangladesh is composed of several categories. They may be categorized from functional, ownership and location point of view. The main types of Banks are:

1. Central Bank.

2. Commercial Banks

- Nationalized commercial Banks

- Private Commercial Banks

- Foreign Banks

3. Specialized Banks/Development Banks

4.Specialized Financial Institution.

(1) Central Bank:

Bangladesh Bank is the successor Bank of the State Bank of Pakistan, which was established in 1948. Reserve Bank of India was established as the central Bank in 1935, which was nationalized by government of India in 1948.

Up to 1935 Imperial Bank used to act as the Central Bank, which was established in 1921 by amalgamating Presidency Bank of Bengal (1806), Presidency Bank of Bombay (1840) and Presidency Bank of Madras (1843). The function of Bangladesh Bank is a wholly government owned Bank.

(2) Commercial Banks:

Commercial Banks, as the very name indicates, function primarily as deposit takers and lenders to trade and commerce. But through a historical process, these Banks are now also engaged in long medium and short term industrial lending, agricultural financing including development financing. Commercial Banks are of three types Nationalized, Local Private and Foreign Commercial Banks.

(3) Specialized Bank:

The specialized banks like Bangladesh Krishi Bank (BKB), Rajshahi Krishi Unnayan Bank, and Grameen Bank (GB) are specialized in financing agriculture and land-less people. BKB was formerly known as agriculture development Bank. These Banks are specialized in financing the agriculture sector, which includes long, medium and short term agriculture lending including crop financing. Grameen Bank has been specially created to finance the rural and land-less people of the country who cannot offer any collateral security. This is not a scheduled commercial Bank.

(4). Specialized financial Institution:

These are the financial institutions created for specific purposes, mainly for financing development and development needs. In this group comprise Bangladesh Shilpa Bank, Bangladesh Shilpa Rin Shangstha, Investment Corporation of Bangladesh.

Definition of commercial Bank

Bank (Commercial bank) is a real financial institution which receives deposit from a group of people and leading it to other group of people.

The financial institution which earns profit through accepting of deposit, extending credit, issuing notes and check, receiving and paying interest is called commercial bank.

Some New General Banking Service introduced by commercial Bank in Bangladesh

In Bangladesh there around fifty four commercial banks are exist and five new are in the process to come in the market. More of less all the banks are provide same general banking services but some new services are introduce by the banks for their clients are as follows:

- On-line Banking services

- Credit card services

- Cash card services

- Quick cash services (Q-cash)

- E-cash

- Evening Banking

- ATM services

- Locker services

Islamic Banking Concept

(A) Islamic Banking

The definition of Islamic Bank as approved by the General secretarial of the OIC is stated in the following manner. “An Islamic Bank is a financial institution whose status, rules and procedures expressly state its commitment to the principle of Islamic shariah and to the banning of the receipt of and payment of interest on any of its operations.”

Dr. shawki Ismail shehta viewing the concept from the perspective of an Islamic economy and the prospective role to be played by an Islamic bank to incorporate in its functions and practices commercial investment and social activities, as an institution designed to promote the civilized mission of an Islamic economy.

Dr. Ziauddin Ahmed says, “Islamic Banking is essentially a normative concept and could be defined as conduct of banking in consonance with the ethos of the value system of Islam.”

It appears from the above definitions that Islamic banking is a system of financial intermediation that avoids receipt and payment of interest in its transactions and conducts its operations in a way that it helps achieving the objectives of Islamic economy. Alternatively, this is a banking system whose operation is based in Islamic principles of transactions of which profit and loss sharing (PLS) is a major feature ensuring justice and equity in an economy. That is why Islamic banks are often known as PLS-banks.

(B) Concept of Islamic Banking:

Conventional banking is essentially based on debtor-creditor relationship between the depositors and the bank in the one hand, and between the borrowers and the bank on the other. Interest is considered as the price of credit, reflecting the opportunity cost of money.

Islam on the other hand, considers loan to be given or taken, free of charge, to meet any contingency and that the creditor should not take any advantage of the borrower. When money is lent out on the basis of interest, more often it happens that it leads to some kind of injustice. Thus, financial relationship in Islam has been participatory in nature. Several theorists suggest that commercial banking in an interest-free system should be organized on the principle of profit and loss sharing. The institution of interest is thus replaced by a principle of participation in profit and loss. That means, a fixed rate of interest is replaced by a variable rate of return based on real economic activities. The distinct characteristics, which provide Islamic banking with its main points of departure from the traditional interest-based commercial banking, are:

- The Islamic banking system is essentially a profit and loss sharing system and not merely an interest (riba)-free banking system; and

- Investment (loans and advances in conventional sense) under this system of banking must serve simultaneously both the interest of the investors and those of the local community. The financial relationship as pointed out above is referred to in Islamic jurisprudence as mudarabah.

Goals of Islamic Bank

- To eliminate riba from all sectors of economy

- To establish Baiya (Trade, Com. & Industry)

- To mobilize savings for productive purposes.

- To earn reasonable profit through Halal transaction.

- To create more employment opportunities by increasing economic activities.

- To ensure equitable distribution of resources.

- To safeguard the excess money lying idle in the hands of customers.

- To contribute towards economic development.

- To establish balanced trade and welfare.

- To develop human resources and self-assessment.

- To prevent allowing of concentration of wealth.

- To establish justice and humanity.

- To serve all classes of people in general and specially to favor the weaker classes.

- To establish good and eliminate evils.

The Distinct Features of the Islamic Banking System

- Islamic bank do not transact on credit.

- The relation between Islamic bank and its customer is not that of a debtor and creditor but one of participation in profit and loss.

- Islamic banks segregate capital funds from deposits firm.

- Islamic bank mobilize resources to use for development not only for profit.

- Islamic bank is a multipurpose bank.

- Investment in Halal Business.

- Investment based on profit sharing or profit and loss sharing.

- Prohibition of Interest.

- Halal Paths and procedure is a precondition for deposit and investment.

- Islamic bank never becomes bankrupts.

- Islamic bank does not create credit.

The distinguishing between Islamic banks VS Conventional Banking Compared

| ISLAMIC BANK | CONVENTIONAL BANK |

| The functions and operating modes of Islamic banks are based on Islamic Shariah | The functions and operating modes of Conventional banks are based on man-made principles. |

| IB promotes risk sharing between provider of capital and the entrepreneur. | The investor is assured of a predetermined rate of interest. |

| Maximizing profit should not be objective of an IB. | It aims of maximizing profit without any restriction |

| IB banks collect and distribute Zakat | It does not deal with Zakat. |

| Participation in partnership business is the fundamental function of the Islamic banks. | Lending money and getting it back with interest is the fundamental functions of CB |

| Wider scope of activities compared to a conventional bank. A multi-purpose bank. | Narrower scope of activities when compared with an Islamic bank. |

| The IB has no provision to charge any extra money from the defaulters. | It can charge additional money (compound rate of interest) in case of defaulters. |

| It gives importance to the public interest. Its ultimate aim is to ensure growth with equity. | Bank’s own interest becomes prominent. It makes no effort to ensure growth with equity. |

| For Islamic banks, it is comparatively difficult to borrow money from the money market. | Borrowing from the money market is relatively easier. |

| Since it shares profit and loss, the Islamic banks pay greater attention to developing project appraisal and evaluation. | Since return from loan is fixed, it gives little importance to project appraisal and evaluations. |

| Islamic banks give greater emphasis on the viability of the projects. | CB gives greater emphasis on credit-worthiness of the clients. |

| The status of Islamic bank in relation to its clients is that of partners, investors and trader. | The status of a conventional bank, in relation to its clients, is that of creditor and debtors. |

Limitations of the Study

Every work has some limitations. The internship training has also been faced some problems. The main restrictions of the study are as follows:

a) Lack of Sophisticated Knowledge

As a new practitioner in job field I have no practical experience in data collection, processing, analyzing, interpreting, and presenting.

b) Time Lack

There was very short time to complete this study program properly. So, I had to conduct with all functions within short time.

c) Fund Unavailability

To operate thus study program, there was no availability of fund. That is, there was no source for financial support. So, I could not able to interview with more respondent.

d) Unavailability and inefficiency to input secondary data

From the secondary sources I do not get available relevant data. Moreover, I have no proper knowledge I this regard.

e) Lack of co-operations

I received co-operation from the concerned officials who are not always able to give me much time as they were busy with their own business.

f) Conservatism

Some respondents were conservative and they did not express their opinion freely.

g) Limited sample area

The study period covers only five years, which are not sufficient enough for scientific and comprehensive decision making.

Background of Shahjalal Islami Bank Limited

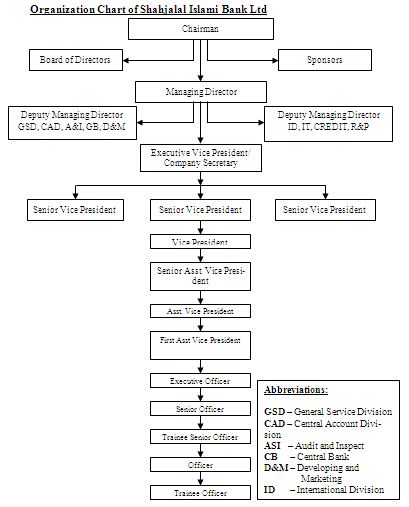

Shahjalal Islami Bank Limited (SJIBL) commenced its commercial operation in accordance with principle of Islamic Shariah on the 10th May 2001 under the Bank Companies Act, 1991. During last 10 years SJIBL has diversified its service coverage by opening new branches at different strategically important locations across the country offering various service products both investment & deposit. Islamic Banking, in essence, is not only INTEREST-FREE banking business, it carries deal wise business product thereby generating real income and thus boosting GDP of the economy. Board of Directors enjoys high credential in the business arena of the country, Management Team is strong and supportive equipped with excellent professional knowledge under leadership of a veteran Banker Mr.Abdur Rahman Sarkar.

Shahjalal Islami Bank Limited is a scheduled Bank under private sector established under the ambit of bank Company Act, 1991 and incorporated as a Public Limited Company under Companies Act, 1994 on April 01, 2001. The Bank started commercial banking operations effective from May 10, 2001. During this short span of time the Bank had been successful to position itself as a progressive and dynamic financial institution in the country. The Bank had been widely acclaimed by the business community, from small entrepreneur to large traders and industrial conglomerates, including the top rated corporate borrowers for forward-looking business outlook and innovative financing solutions. Thus within this very short period of time it has been able to create an image for itself and has earned significant reputation in the country’s banking sector as a Bank with vision. Presently it has fifty one branches in operation.

Shahjalal Islami Bank Limited has been licensed by the Government of Bangladesh as a Scheduled Bank in the private sector in pursuance of the policy of liberalization of banking and financial services and facilities in Bangladesh. In view of the above, the Bank within a period of 3 years of its operation achieved a remarkable success and met up capital adequacy requirement of Bangladesh bank.

It has been growing faster as one of the leaders of the new generation banks in the private sector in respect of business and profitability as it is evident from the financial statements for the last 4 years.

The Bank has made a significant progress within a very short period of its existence and occupied an enviable position among its competitors after achieving remarkable success in all areas of business operation.

Mission of SJIBL

Shahjalal Islami Bank Ltd. aims to become one of the leading Banks in Bangladesh by prudence, flair and quality of operations in their banking sector. The bank has some mission to achieve the organizational goals. Some of them are as follows as:

- To provide high quality service to customers.

- To set high standards of integrity.

- To make quality investment.

- To ensure sustainable growth in business.

- To ensure maximization of shareholders’ wealth.

- To extend our customers innovative services acquiring state-of-the-art technology blended with Islamic principles.

- To ensure human resource development to meet the challenges of the time.

Vision

To be the unique modern Islamic bank in Bangladesh & to make significant contribution to the national economy and enhance customers’ trust & wealth, quality investment, employees’ value and rapid growth in shareholders’ equity.

Credit Rating

Shahjalal Islami Bank Limited was rated by Credit Rating and Information Services Limited (CRISL). In their report on April 2010, they rated the Bank as AA for long term and ST-2 for short term. The gradation in long term rating has been done in consideration of its good capital adequacy, appropriate asset quality, increased non funded business and sound liquidity position. The short term rating indicates high certainty with regard to the obligators capacity to meet its financial commitments.

Objectives of SJIBL

From time immemorial Banks principally did the functions of moneylenders or “Mohajans” but the functions and scope of modern banking are now a days, very wide and different. They accept deposits and lend money like their ancestors, nevertheless, their role as catalytic agent of economic development encompassing wide range of services is very important. Business commerce and industries in modern times cannot go without banks. There are people interested to abide by the injunctions of religions in all sphere of life including economic activities. Human being is value oriented and social science is not value-neutral. Shahjalal Islami Bank believes in moral and material development simultaneously. “Interest” or “Usury” has not been appreciated and accepted by “the Tawrat” of Prophet Moses, “the Bible” of Prophet Jesus and “the Quran” of Hazrat Muhammad (sm). Efforts are there to do banking without interest Shahjalal Islami Bank Limited avoids “interest” in all its transactions and provides all available modern banking services to its clients and wants to contribute in both moral and material development of human being. No sustainable material well-being is possible without spiritual development of mankind. Only material well-being should not be the objective of development. Socio-economic justice and brotherhood can be implemented well in a God-fearing society.

The objectives of Shahjalal Islami Bank include:

- To conduct interest-free and welfare oriented banking business based on Islamic Shariah.

- To implement and materialize the economic and financial principles of Islam in the banking arena.

- To contribute in sustainable economic growth.

- To help in poverty alleviation and employment generations.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To earn and maintain a ‘Strong’ CAMEL Rating

- To introduce fully automated systems through integration of information technology.

- To ensure an adequate rate of return on investment.

- To maintain adequate liquidity to meet maturing obligations and commitments.

- To play a vital role in human development and employment generation.

- To develop and retain a quality work force through an effective Human Resources Management System.

Goals of SJIBL

Shahjalal Islami Bank Ltd. will be the absolute market leader in the number of loans given to small and medium sized enterprises throughout Bangladesh. It will be a world-class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the world.

Performance of Shahjalal Islami Bank Limited

Background Performance of the Shahjalal Islami Bank Limited

Shahjalal Islami Bank Limited, a Shariah Based Commercial Bank in Bangladesh was incorporated as a Public limited company on 1st April, 2001 under Companies Act 1994. The bank commenced commercial operation on 10th May, 2001 by opening its 1st branch, i.e. Dhaka Main Branch at 58, Dilkusha, Dhaka obtaining the license from Bangladesh Bank, the Central Bank of Bangladesh. Its corporate head office is situated at 10, Dilkusha commercial Area, Jibon Bima Bhaban, Dhaka-1000, and Bangladesh. The bank opened 2(two) branches in 2001, 6(six) branches in 2002, 2(two) branches in 2003, 2(two) branches in 2004, 4(four) branches in 2005, 5(five) branches in 2006, 5(five) branches in 2007, 5(five) branches in 2008 & 20(Twenty) branches in 2009. Total number of branches stood at 64 in 2010 and some more branches are likely to be opened in important business locations of the country during 2011-2012 subject to the approval of Bangladesh Bank.

Operational Performance

Net asset value per share:

Net asset value per share has increased by 19.70 in 2010 from 17.98 in 2009. It was 14.90 in 2007. It gives a clear picture of its strong operational performance.

Earning Per Share:

Another indicator of better performance is Earning per Share. In 2010, SJIBL has achieved a tremendous growth of Earning Per Share which was 6.05. But in previous year it was only 3.91.

Return On Asset:

In 2010, Return on asset has increased to 3.01% which was 2.08% in 2009. It indicates high profitability of Shahjalal Islami Bank Limited.

Net Income Ratio:

Net income ratio has reached to 21.79 in 2010 from 15.04 in 2009.this growth proved that SJIBL is going to right direction to achieve its goals.

Economic Value Addition:

Economic Value Addition indicates the true economic profit of the company. In 2010, the amount of EVA is 1854.54 million taka. It was only 715.46 million taka in 2009.

Deposits

Deposit is the “life- blood” of a bank. Bank has given utmost importance in mobilization of deposit introducing a few popular and innovative schemes. The mobilized deposits were ploughed back in economic activities through profitable and safe investments:

- Monthly Deposit Scheme (MDS)

- Millionaire Scheme (MIS)

- Monthly Income Scheme (MIS)

- Double Benefit Scheme (DBS)

- Multiple Benefit Scheme (MBS)

- Hajj Palan Scheme

- Housing Deposit Scheme

- Cash Waqaf Deposit Scheme

- Lakhopati Deposit Scheme

- Mohor Deposit Scheme

- Marriage Deposit Scheme

- Education Deposit Scheme

- Small Business Deposit Scheme

- Special Term Deposit Scheme

Banking Operation in Computer

Automation in Banking Operation

Shahjalal Islami Bank is an Industry standard, Islamic Shariah & latest technology based modern bank. The bank is equipped with state-of-the-art technology and committed to provide technology based modern banking solutions to its valued customers.

OnLine Banking

To provide better services to the valued customers using the latest technology and electronic media competing with other private banks to set and establish full automated, on-line, centralized banking systems interfacing (connecting software) with all delivery channels. Like: ATMs (Automated Teller Machine), POS (point of sale-Fund transfer machine for purchasing at any shop/service center etc.) Any branch banking, home banking, tele banking, Internet banking etc. online banking/ any branch banking is a system where transactions, query and system where transactions, query and statements of any client of a certain branch may be carried out from another branch of the bank.

SJIBL Visa Card

Card is considered as a new dimension of product resulting from technological development in the banking arena. In line with our affiliation with VISA International for VISA ATMs and POS, the following two products are launched broadening service products of the bank to the clients:

- VISA Electron (SJIBL VISA Debit card-Local)

- VISA Prepaid (SJIBL VISA Prepaid Card)

- SJIBL VISA Prepaid Card-Local

- SJIBL VISA Prepaid Card –International

- SJIBL VISA Prepaid Card-Dual

Features

- Sense of satisfaction of having an International brand

- Anywhere anytime banking

- 24 hours and 7 days a week banking

- Directly linked to Cardholders Account

- Convenient Cash Withdrawal at ATMs

- Acceptability at huge number of Q-cash ATMs around Bangladesh.

- Accepted at all VISA terminals locally & globally

- Local & International transactions with the same card (for Dual Cards)

- Balance Inquiry

- Mini Statement

- PIN Change

- Shopping at a large number of Q-cash POS terminals around Bangladesh

- Payment of utility Bills

- Avoid pressure at counters of bank

- Minimizing risk of carrying cash

Pull Push Service

Benefit of SMS-

- A new technology based service will attract new client base.

- Clients will be facilitated with Cell phone based banking service.

- Enhanced and extended customer services levels on a collaborative basis.

- Will reduce teller quest.

- Services- Balance inquiry,

- Cheque book request,

- Cheque leaf status,

- FC rate information,

- Cheque stop payment instruction, statement request by e-mail, last three transaction statement, help inquiry & PIN change.

Personnel Management Information Systems (PMIS)

In Head Office PHIS system is going to be implemented in full phase with the following features-

Employees’ recruitment, posting, personal, leave, increment, promotion, training, retirement, attendance, payroll, PF, Tax etc should be controlled by PMIS. This system should be run in LAN & WAN environment and centrally controlled data of all employees. Employees ID, Biometric Image with signature will remain be enrolled in the software.

SWIFT

Shahjalal Islami Bank Limited is a member of the society for Worldwide Inter Bank Financial Telecommunication (in abbreviation S.W.I.F.T). SWIFT is the industry-owned co-operative supplying secure, standardised messaging services and interface software to nearly 8,100 financial institutions in 207 countries and territories. SWIFT members include banks, broker-dealers and investment managers. The broader SWIFT community also encompasses corporate as well as market infrastructures in payments, securities, treasury and trade.

REUTERS

The bank has also established liaison with the facility of REUTERS, through which the bank received regular, latest information about the exchange rate, etc and other price sensitive information to take prompt and correct decision.

Relationship between customer & banker

Banker & Coustomer Relationship

The Banker Customer relationship is essentially a debtor-creditor contractual relationship. This relationship may be divided into two categories.

- Legal relationship

- Behavioral relationship.

After the contractual relationship is established between the banker and customer, they have to avoid by some implied conditions of the contract as well as practices of the bank.

Some of the condition and practices are as follows:

Customer is to use checkbook while demanding payment from his account.

Customer should keep checkbook in his safe custody.

Customer must inform the bank on time for any loss of check leaf or checkbooks.

Customer while depositing money or presenting check, they must do that during business hour of the bank.

Bankers also should give necessary banking advice and help the customer in various banking activities.

Termination of Banker’s & Customer’s Relationship

The legal relation between banker and customer may be terminated with a notice given by both of them with a view to close the account. Besides, there are some reasons for termination of legal relationship. Some of these are stated below: –

- After the death of a customer.

- When a customer declared insolvent by the court.

- When a customer becomes lunatic etc.

- When the bank signifies as bankruptcy by the law.

Remittance Sector

The commercial bank remittance facilities to it’s customer is to enable them top avoid risk rising out of profit or loss in cash carrying cash money to one place to another or making payment to someone in another places. Bank take this risk remit the fund on behalf of the customer to save them from any keyword happening through the network of their branches and ensure payment to the beneficiary in exchange of a little bit benefit known as commission. There are four mode of remitting money from one place to another.

Pay Order (PO)

PO is a written order, issued by branch of Bank to pay a certain amount to a specific person or organization. Whose favor we issue PO is called Payee. Some time PO is sold to individual on payment of value, and then the individual is called the purchaser. A pay order has three parts such as:

- One part for preserve of Bank.

- One part for preserve of Customer.

- The largest part to whom it payment on behalf of customer.

- As a customer you have to insure that two authorized officer signature consist on the Pay order

- Otherwise the pay order will return. A pay must have-

- Date

- Not over only amount

- Branch sill

Demand Draft

DD is a written order from one branch to another branch of the same Bank. It is not payable to bearer of the instrument. In practice, we can not issue DD between Branches within the same city. We need to complete the following steps for issuing a DD.

Telegraphic Transfer

TT is one kind of telegraphic/Telephonic message order to pay some one the fund between two Branches of the same Bank. It is the quickest & easiest way to transfer fund from one place to another place.

The charges for issuing of DD & TT of our Branch

DD/TT 0.10% of the total DD/TT Amount

Telex Charge TK. 40 fixed

VAT 15% of Commission amount

Electronic Fund Transfer

Electronic Fund Transfer refers to the computer-based system used to perform financial transactions electronically. EFC is getting more popular in these days due to quickness of its operation.

Feature of EFT

- EFC is a very fast service.

- It requires some formalities, as beneficiary does not need to maintain an account with the bank.

- The use of EFT is increasing very fast.

- Sometimes it may not be secured.

Bills

Bank collects the bills through clearing in both inward and out ward.

Clearing is one of the important jobs of a bank. To run the banking business smoothly and to provide serve to customer, every bank has to collect cheques, POs, Drafts, etc which are drawn on other Bank on behalf of their A/c holder.

On the other hand, every Bank has to pay against his A/c holder’s Instrument, which are received from other Banks. In a word, we can say, the bank needs to collect or pay money on behalf of its A/c holder against A/c payee instruments. The process by which way the bank collects or pays the money is called clearing.

Clearing House

Clearing House is a place where various Banks’ representatives gather with their Clearing Instrument and settle each other’s claims. Normally, clearing house sits in the Central Bank. Where there is no branch of Central Bank, the clearing house sits in a general place selected by the Central Bank. Clearing is held under the supervision of the Central Bank. In our country, Bangladesh Bank controls the clearinghouse.

Bangladesh Bank has divided the whole country in various clearing zones such as, Dhaka, Chittagong, Khulna, Barishal etc. Some where Sonali Bank arranges & controls the clearing house as a representative of Bangladesh Bank.

Every Bank does not get the clearing facility. To avail the clearing facility every bank and its branches need to become a member of the Clearing House.

Our SJIBL Foreign Branch is a member of Dhaka Clearing House and our clearinghouse sits in Bangladesh bank. We cannot do our clearing jobs directly. We do our clearing jobs through our Head office at Dilkusha C/A, Dhaka.

There are two kinds of Clearing as:

- Outward Clearing

- Inward Clearing

Outward clearing

The A/c holders of our Branch deposit other Bank’s instrument in their A/c for collection. We collect it through Outward Clearing and credit the proceeds in their A/c.

Description of Outward Clearing

Bank does not involve in clearing house directly. They make their clearing through Head office, Dilkusha. They just prepare the Instrument and send it to clearing department of Head Office for collection.

On the other hand, the A/c Holder of our Branch gives our Branch’s instrument to their party who is not our A/c holder as payment. The party deposits the following instruments in their A/c for Collection through clearing house. We receive those instruments from Clearing house and make payment on behalf of our A/c holder. This is called Inward Clearing.

Except Clearing Instrument the Clearing Department also Collect the following instruments on behalf of their customer.

LBC Cheques

LBC Stands for Local Bills Collection. LBC is a process of collection of instrument, which is held between the two different Branches of the Same Bank in the Same Clearing House. For example, if any A/c holder of our branch deposited a cheque which is drawn on our Babu Bazar Branch. In this case we will collect the proceeds through LBC.

OBC Cheques

OBC stands for Out Wards Bills Collection. Like LBC it is a process of collection of instrument which is held between the two different Branches of the Same Bank in the Different Clearing House/Different City. For example if any A/c holder of our branch deposited a cheque which is drawn on our Agrabad Branch Chittagong. In this case, we collect the proceeds through OBC.

Commission of OBC of our Branch

Below Tk. 1 Lac 0.15%

Above Tk. 1 Lac 0.10%

Postage Charge Tk. 10.00

IBC (Inward Bills Collection)

We collect the instrument on behalf of our customer through LBC/OBC which is drawn on other Branches of our Bank. Like this collection we also make payment on behalf of our customer against LBC/OBC instrument, which are received from other Branch but drawn on our Branch. For example if any A/c holder of our Branch gives a cheque to his customer who maintains a/c with our Babu Bazar Branch & deposited the Cheque in his A/c. Babu bazar Branch will send the said Cheque to our Branch through LBC for collection. Receiving of this kind of Instrument is called IBC.

Online any Branch Banking

We have set up Wide Area Network using Radio, Fiber-Optics & other available communication systems to provide any branch banking to our customers.

Customer of one branch is now able to deposit and withdraw money at any of our branches except Barishal Branch. Our Barishal Branch will be included in our Wide Area Network shortly.

No TT/DD or cash carrying will be necessary.

Online branch banking service is designed to serve its valued clients. Under

By this system, you shall be able to do the following type of transactions.

- Cash withdrawal from your account at any branch of the Bank.

- Deposit in your account at any Branch of the Bank.

- Transfer of money from your account to any other account with any Branch of the Bank.

Accounts Opening: General Rules & Procedures in (Shahjalal Islami Bank Limited) SJIBL

Different Types of Account (opening Procedure):

Account opening is the starting point of binding relationship between banker & customer.

The rules and regulations of Bangladesh, usual customs and procedures common to banks in Bangladesh are applicable to govern the conduct of the account of SJIBL.

The process of opening Mudaraba saving & Al-Wadiah Current Account of SJIBL is discussed in below.

Mudaraba Savings Account

The depositor is the Shahib Al- Mal (owner of the fund) and the bank is the Mudarib (organizer /Manager). The bank is authorized to invest the Mudaraba funds at the risk of the Shahib Al-Mal (depositor). Minimum balance that should be deposited in this account is Tk.2000.The account holder can deposit money at any time during the month. The lowest balance of the account within first six days of the month will be considered as the deposit of the month. Maximum 4-times withdrawal in a month is permissible for distribution/calculation of profit. On a single instance, maximum withdrawing should be one fourth of the balance in the account or Tk.25000 whichever is lower; violation of it will bar distribution of profit. Seven days prior notice to be given for withdrawal of any amount exceeding Tk.25000 and in that case profit may be allowed on the balance amount. However, the Account holder needs to maintain the requisite minimum balance throughout the month to receive the profit. Required information & documents which are needed for opening private individual accounts / Single accounts / joint account are-

- Application form

- Specimen Signature card

- Photograph of the account holder

- Photograph of the Nominee (for each nominee)

- Letter of authority (if required)

- Joint account opening form with minor participant

- Photocopy of passport/Certificate of chairman or commissioner/Voter ID card/Employer certificate

- TIN certificate if available

- KYC & TP

Al-Wadiah Current Account

This account can be open for Individual/ Joint account, Private firms, Limited companies, Club/Societies/Educational institution etc.

Nature of Account

Al-Wadiah Current Account is one of the deposit accounts in practice in Islamic Banking Deposits are accepted in Al-Wadiah Current Account by the bank in the normal banking traditions, the only difference is SJIBL obtains consent of the depositors by accepting the rules of account opening form to use their funds in amalgamation with other funds of the bank, at bank’s own risk. It is a non-profit/ loss sharing account, guaranteed by the bank for full repayment less bank’s charges if any.

Shariah Principles:

The operation of the Al-Wadiah current Account is primarily guided by the principles of Al-Wadiah which means the banks receives money from the clients for safe custody. It is under obligations to return the money on demand by the customer either through cheque or by any other means as stipulated.

Who can open an Al-Wadiah Current Account

Any individual, Proprietary concern, Partnership concern, Limited Companies etc. can open an Al-wadiah Current account. Charitable Institutions, Provident and other funds of benevolent nature of the local bodies, Autonomous corporations, Associations, Educational institution etc can also open such accounts.

Introduction of account

No account shall be opened without having suitable introduction from a respectable party known to the bank or Al-Wadiah Current Account holder. Mudaraba Deposit Account holder shall not be accepted for Al-Wadiah Current Account except particular cases.

Admittance of signature and manager’s approval

The “Signature admitted” shall be affixed in the account opening form and specimen signature card.

Minimum Balance

Minimum balance to be maintained in Al-Wadiah Current Deposit is Tk.5000.

Profit Payment

Deposits of Al-Wadiah current Deposit Account is accepted as per Al-Wadiah Principles. Clients will not be entitled to receive any profit against the Al-Wadiah Current Deposit Account.

Documents

Required information & documents for opening this account are-

Individual/ Joint Account:

- Application form

- Specimen Signature card

- Photograph of the account holder

- Letter of authority (in case of operation by other person)

- Current Account Survivorship form

- Current a/c either or sur5vivorship agreement for OD (in case of 2 persons)

- Photocopy passport/Certificate of employer/Certificate of Chairman or commissioner/ Voter ID card

- TIN certificate if available

- KYC & TP

Private Firms accounts (Proprietorship):

- Application form

- Specimen Signature card

- Letter of authority (in case of operation by other than Proprietor)

- Up to date Trade License

- Partnership deed, the deed should be notarized or registered. Power of attorney in case of operation of account by manager or agent.

- Partnership letter in case of partnership firm if partnership deed is not submitted.

- Photograph of the operator

- Firm seal

- Photocopy of passport/Certificate of chairman or Commissioner/Voter ID Card.

- KYC & TP.

Opening and operating the account

After the above formalities are over, the banker opens an account in the name of applicant. Generally the minimum amount to be deposited initially is Taka 5000/= for opening a current account. Then the bank provides the customer with:

A pay-in –slip/ Deposit Book: With a view to facilitate the receipt of credit items paid in by a customer, the bank will provide him/her pay-in-slip either loose or in a book form. The customer has to fill up the pay-in-slip at the time of depositing the money with the bank. The cashier with his/her initial and stamps will return the counterfoil to the customer on the receipt of the money.

Chequebook: To facilitate withdrawal and payment to third parties by the customer, the bank will also provide a chequebook to the customer. Nevertheless, it is noted that to get a chequebook, the customer had to dully fill the cheque requisition slip to the banker.

Mudaraba Short Notice Deposit/Time Deposit:

Shahjalal Bank also receives term deposit from the clients.The term deposit, of course, altogether different from that of the interest-based banks. Fixed term deposits while received by Islamic Bank as termed as “Term Mudaraba Deposit”. Like this SBL collect “Mudaraba Short-Notice Deposit” or (MSND). It is also a Time Deposit account.

The formalities for opening of this account are similar to those required for Al-Wadeah Current Account. The only difference is that seven- (7) day notice is required for withdrawal of any sum and profit is paid. The rate of profit for this account is 6.5%. If the withdrawal on demand is desired, it may be paid subject to the for-feature of profit for the period of notice or the expired period of notice.

Different types of deposit scheme

The Shahjalal Bank limited containing:

- Monthly Deposit Scheme (MDS)

- Mudaraba Term Deposit Receipt (MTDR)

- Millionaire Scheme (MIS)

- Monthly Income Scheme (MIS)

- Double Benefit Scheme (DBS)

- Multiple Benefit Scheme (MBS)

- Hajj Palan Scheme

- Housing Deposit Scheme

- Cash Waqaf Deposit Scheme

- Lakhopati Deposit Scheme

- Mohor Deposit Scheme

- Marriage Deposit Scheme

- Education Deposit Scheme

- Small Business Deposit Scheme

- Special Term Deposit Scheme

Some of these are described in following-

Mudaraba Term Deposit Receipt (MTDR): It is like a fixed deposit in the conventional banking system but it does not receive or accept interest rather, this account give profit and collect deposits. In this mode Tk1000/- or above can be deposited against client will get non-transferable instrument of equal amount. The depositor will not receive any chequebook for this account. If a customer withdraws his or her money before one month s/he will not get any kind of profit. On the other hand, after the matured if client don’t withdraw his/her money it will be auto renewed with imposed profit for the next days. In case of one year or more than that, if a depositor does not withdraw his capital it will work as a primary deposit for the next year. If a depositor would like to withdraw his profit after six months s/he will get the profit accordance with previous years profit rate. After the announced yearly profit or loss, if bank felt in loss position then the depositor bound to incur the loss. In absence of account holder the selected nominee will get the money. If the accountholder does not mention any nominee, in that case, the inheritance of the depositor will enjoy the profit accordance to inheritance certificate. Any kind of tax or excise duty can be cut down according to government circular.

Monthly Deposit Scheme (MDS): It is like a deposit pension scheme. A depositor can open a MDS account for depositing of Tk500, Tk1000, Tk2000, Tk10000, Tk5000, and Tk25000, Tk.50000/- for 5 years or 8years or 10years. The installment will be paid within first 25 days of the month. If the 25th of month is off day, then the installment will be paid on next working day. The deposit of installment can be paid by cheque. In the case of cheque, clearing date of the cheque will be the actual deposited date.

The depositor can pay installment from his account through prior permanent instruction. In this term, the accountholders(s) are bound to pay Tk.25 for fine charge. If the account is close before the maturity then profit will be calculate according to savings rate. If a depositor fails to pay consecutive four installments then the account will be closed automatically and profit will be calculate as Savings rate. But for first six-month no profit will be calculate. Nominee will enjoy the profit in absence of the accountholder.

Monthly Installment | Return after | Return after | Return after |

TK. 500/- | TK 20,627 | TK 37,896 | TK 70,849 |

TK. 1,000/- | TK.41,255 | TK. 95,791 | TK 1,41,697 |

TK 2,000 | TK 82,510 | TK 1,51,583 | TK 2,83,394 |

TK 3,000 | TK 1,23,765 | TK 2,27,374 | TK 4,25,091 |

TK 4,000 | TK 1,65,020 | TK 3,03,166 | TK 5,66,788 |

TK 5,000 | TK 2,06,274 | TK 3,78,957 | TK 7,08,485 |

TK 10,000 | TK 4,12,549 | TK 7,57,914 | TK 1,41,6970 |

Monthly Income Scheme (MIS): It is the scheme for profit earning. In this account depositor can deposit minimum amount of 50,000/- and above. Depositor will get 500/- against 50,000/-. But depositors have to deposit the amount for 5 years. If accountholder close his or her account before maturity then s/he will receive the profit accordance with savings rate. In the absence of accountholder, the specified nominee will get the amount.

Double Profit Mudaraba Savings Scheme (DPMSS): In this scheme depositors can deposit more than 10,000/- for 6years and after the maturity accountholder will receive double than his deposited amount. If depositor want to close his account before maturity then he is bound to receive at the savings rate. For opening this account applicant need one copy of recent photograph and one copy photograph of nominee (if any).

Millionaire Scheme (MS15, MS20& MS25): Normally, it is the account for children or inheritance. Here, applicants are the selected people for operating the account on behalf of the accountholder. The depositor should to deposit the account within first 15 days of the month; neither will s/he be designated as debtor to the bank. If 15th date is the off day then the next working day will be schedule date. The installment can be paid through cheque. No chequebook will be issued for this account, but the bank will provide deposit book.

Special Term Deposit Scheme (STDS)

For most of the people on fixed income the opportunity to supplement their monthly earning is a golden one. And SJIBL Special Deposit Scheme gives a customer just that.

Under this scheme, customers can deposit money for a term of 5 years. The deposited money is fully refundable at the expiry of the term. At the same time, during the term period they can enjoy a monthly profit corresponding to their deposited amount. As for instance, under this scheme a deposit of Tk, 55,000/- gives a monthly income of Tk.500/-

Deposited Amount | Monthly Benefit |

Tk. 55,000/- | Tk. 500/- |

Tk. 1,10,000/- | Tk. 1,000/- |

Tk. 1,65,000/- | Tk. 1,500/- |

Tk. 2,20,000/- | Tk. 2,000/- |

Analysis & Findings

Shahjalal Islami Bank Limited (SJIBL) is named from the name of a saint Hajrat Shahjalal who dedicated his life for the cause of peace in this world and hereafter and served the humanity. The prime objective of Shahjalal Islami Bank is to serve the people for attainment of their economic goal and success in life here and hereafter.

I have tried to represents a concrete view of this bank and find out the following major concerns:

- The authorized capital of the Bank is Tk. 6,000 million as on 31 December 2010 but was in 2008 at tk. 4.000 million.

- Paid up capital of the Bank stood at Tk. 3425 million as on 31 December 2010 but it was 2246 million in the previous year.

- The total equity (capital and reserves) of the Bank as on December 31, 2010 stood at Tk. 7747 million that was increased from tk. 4069 million in the previous year.

- Total Income in 2010 is tk. 9509 million in compare with tk. 5285 million in the previous year.

- Net profit After Tax in 2010 is tk. 2072 million increases from tk. 818 million in the year 2008.

- The number of branches has increased from 51 in 2009 to 64 in 2010.

- Also, Total Manpower has increased 167 in 2010 from 1299 in 2009.

- The bank performs corporate social responsibility with proper manner.

- According to CRISL, the bank has achieved AA for long term and ST-2 for short term.

- The bank has achieved an acceptable place to the customers and Government of Bangladesh by complying rules and regulations.

- The bank has taken a 5 year plan from 2007-2012 to make a flexible and comfortable services to its clients.

- As the process of sanctioning loan is loan manually, it takes a long time to process a loan.

- Lack of attractive and new loan products for the customer.

- Political influence is one the major problems in Bangladesh. Due to political influence bank has to provide loans in most of the cases, which are rarely recovered.

- The loan and advances department takes a long time to process a loan because the process of sanctioning loan is done manually.

- SJIBL tries to make familiar, Visa Debit Care to all classes of clients. But most of the clients of Shahajalal Islami Bank limited, Bangshal branch feel fear to use it.

- From the clients view introducer is one of the problems to open an account . it is general problem to all commercial bank

- Lack of update products is also a drawback of the general banking area of the SJIBL bank .the bank provides only some limited traditional services.

- SJIBL has introduced its ATM service. But it’s not so popular like other banks such as DBBL, Brac etc.

- Lack of sufficient financial data and other information in SJIBL’s own website.

- The software that the bank is still using for its database management is not the latest one and has some complications to work on it.

Strength of SJIBL:

Strength is a resource skill or other advantage relative to competitors & the needs of the markets a firm serves or expects to serve.

- Modern Equipment: SJIBL Bank has adequate physical facilities & equipment’s to provide better service to the customers. The bank has computerize banking operation Counting machine in the teller counter has been installed for speedy & secured service at the cash counter.

- Experienced Management System: Experienced Management System & competing workforce of the bank is also a major strength for the SJIBL & contributed heavily towards the growth & development of the bank. The top management officials all have had reputed of banking experience, skill & expertise.

- Computerized System: Computerized statements for the customers as well as for the internal use of the banks are also available.

- Telex, fax & internet facilities: All the branches of SJIBL are equipped with telex, fax & internet facilities.

- Group work: Many jobs are performed in groups of two or three in order to reduce the workload & enhance the process of completion of the job.

- Relationship with Customer: SJIBL developed smooth relationship with their clients & corporate business holders.

- Capturing capacity: By following the rules of Bangladesh Bank they have operated handsome banking activities throughout the country. Sometimes Government has impose some new rules regarding private banking operation, SJIBL easily copes up the given rules.

- Quality: In case of service offered by private banks in our country, SJIBL has maintained high quality.

- Disciplined human resource: Well organized of human resource then other banks.

- Contribution to GDP: They also contribute to the country’s GDP.

- New customer: Some loyal customer always bring new customer.

- Relationship with top management: Good interaction of the employees with the top, management.

- Increasing Profit: The bank is making profit every year at a steady rate. The rate of deposit collection as well as the rate of giving advance every year is increasing at a positive rate.

- Internal environment: The environment within the organization is very helpful, positive & also formal.

Weakness of SJIBL:

A weakness is a limitation of deficiency in resource skills or capabilities that seriously impedes a firm’s effective performance. SJIBL’s weaknesses are as follows;

- Incomplete information: To open an account sometimes people have given incomplete information which will become a very acute when any dispute arises.

- Void circumstances: Because of good relationship some time branch manager authenticated the account with introducer, sometimes it is very difficult for the employee to void such circumstances, which in turn brings questions.

- Introducer problem: When a client tries to open an account he must have to need an introducer, sometime it may create problem for the new clients.

- Stay for check book: For getting a new check book incase of opening a new account or a new book for old account holder he/she have to wait seven days.

- ATM card service: There is no available card service.

- Lowest no of employee: On the counter service is sometimes unsatisfactory because of not having enough employees for the counter sector.

- High interest rate: In case of advances in different project, the interest rate is too high.

- High maintenance cost: Though it is a private bank its maintenance cost is higher than any other Government bank.

- Pressure for loan: Most of the time parties are creating some sort of pressure to get the loan.

- Mortgage problem: There are some mortgage problem such as, acquisition & proprietorship, problem of asset.

- Security against loan: In case of method of granting security against loan, hypothecation is much risky as compared with other charging security, but it is being used massively in SJIBL.

- Different interest rate: Interest rates for different types of loan & advances vary to different customers. A prospective customer is allowed to take credit facilities at a lower interest rate. Again, the interest is charged at a higher rate to a customer who is not so prospective, but I think that there should be a transparent interest policy that will be prospective for the bank, the borrower & the country.

Opportunity of SJIBL:

- SMS Banking: User can get information about bank using this service.

- Internet Banking: If National Bank using Internet then user or account holder can get more benefit.

- Money Transferring:Mobile balance can be use as money by using these types of service.

- Utility service: SJIBL can launch various types of utility service like phone bill, current bill, gas bill, current bill etc.

- Using call center: By using call center SJIBL increase its sales.

Threats of SJIBL :

- Multinational Bank: The rapid expansion of multinational bank poses a poetical threat to the new private commercial banks. Due to the booming energy sector, more foreign banks are expected to operate in Bangladesh. Science the foreign banks have tremendous financial strength; it will pose threat to local banks to a certain extent in terms of grabbing the lucrative clients.

- Upcoming Banks: The upcoming private local banks can also pose a threat to the bank. It is the expected that in the next few years, many of the local private banks may emerge. If that happens the intensity of competition will rise further & banks will have to develop strategies to compete these banks.

- Contemporary Banks: The contemporary banks of SJIBL like Prime bank, Social Islami Bank Ltd, First Security Islami Bank Ltd, DBBL, Southeast Bank, MTBL.NCC Bank Limited is its major rivals. They are carrying out aggressive comparing to lucrative, corporate clients as well as long time depositors. SJIBL should require vigilant absent the step taken by these banks, as these will in turn affect SJIBL strategies.

Findings:

While I was working at SJIBL, Bijoynagar Branch, I had attained to a newer kind of experienced regarding activities in the work. After collecting and analyzing the data for MBA internship report purpose. I have got some findings about the SJIBL those are given below:

As the process of sanctioning loan is loan manually, it takes a long time to process a loan.

Sometimes the securities taken against the loan are deliberately overvalued by the employee to unlawfully help the client. As a result if he fails to repay the loan , the bank authority cannot collect even the principal money invested by the selling those assets.

Usually banks are responsible to provide loan to those who are legible for the loan. But in reality, small investors do not get the loan easily. They have to fulfill more terms and condition than those who have greater influence in the business community.

Political influence is one the major problems in Bangladesh. due to political influence bank has to provide loans in most of the cases, which are rarely recovered.

The banking system is impaired by a wed of weak balance sheets, weak demand from creditworthy borrowers and heavy reliance on liquid asset –based lending.

SJIBL bank uses manually system to verify specimen signature of clients it consumes a lot of time.

From the clients view introducer is one of the problems to open an account. it is general problem to all commercial bank

Lack of update products is also a drawback of the general banking area of the SJIBL bank .the bank provides only some limited traditional services.

They face troubles with those clients who have not any knowledge in banking transaction and banking rules.

Bank has no office assistance that’s why officer of bank transfer papers and also clients

SJIBL banks number of customers is also very small in compared to other banks in the market.

The number of branches is not sufficient to cover the country most.

Besides all these findings , there are one major point that has been found regarding SJIBL, that is it (SJIBL) has own training institution for its employees, so it doesn’t require to train them in other training institution , it’s really a good sign in their recruitment system.

Recommendation

Taking into consideration of the conclusion experiences from working in the Foreign Exchange branch, the following recommendations can be inferred:

Though the performance of general customer services is very good, it has some problem of efficiency.

SJIBL tries to make familiar, Visa Debit Care to all classes of clients. But most of the clients of Shahajalal Islami Bank limited, Foreign Exchange branch feel fear to use it. So, SJIBL should introduce Visa Debit Card to clients and then the use & using procedure of this card should be informed to the clients and important thinks is visa Debit card chares so high so if they may not minimize the charge, clients fear will not overcome.

SJIBL should establish new and own ATM Booths at least where there are their own branches or network.

To minimize or reduce the charge of using the DBBL Booth (Par transaction 10 TK).If this charge will not reduce clients not use in SJIBL ATM card.

As borrower selection is the key to successful lending SJIBL should focus on the selection of true borrower selection does not mean that SJIBL has to adopt conservative landing policy but rather it means that compliance with the KYC/ to ascertain the true purpose of the loan . Loan monitoring is a continuous task and requires expert manpower. Therefore it is suggested that SJIBL should set up a separate loan monitoring cell, which will be responsible for monitoring its total loan portfolio with special care to the problem loan.

SJIBL must provide proper and most recent information on its website as and when it is available. This helps the uses of the information on the web. Also should bring out the latest software technology to make database networking and management faster.

It was observed that the officers of SJIBL bank have to spend more time in preparing vouchers; this can be avoided by the automation.

SJIBL have to more conscious about the promotional activities. They pursued advertisement campaign in order to build a strong image among the people. They should carry out aggressive marketing campaign to attract clients. They can give advertisements in newspaper and magazine, television.

The rapid growing of the Shahjalal bank limited is contributing both socially and economically through creating employment opportunity and sharing to the GDP of the total economy. It is very good, very attractive and Islam related Bank giving a new horizon in the banking system. That’s why the SJIBL has to open some new branch in different areas of Dhaka city. I feel need to open a new branch in Khilgaon area, because the number of Private Islami Bank in that area is only one, which is not sufficient for fulfilling the demand of that areas people. Except this some new industries & garments are growing in this area and Malibag Market, Taltola Market. Khilgaon Railgate Bazar is very well established business center of this area. So, I think this area will be very much prospective area to make profitable business and to achieve the organizational goal.

Shahjalal Islami Bank Limited, Foreign Exchange branch is very well organized in the view of working environment. To joining here, I had lot of chances to work and enhance my experience in the banking sector. The management system of SJIBL is very efficient.

Indeed, I am very happy and lucky to carrying my internship in the Shahjalal Islami Bank Limited and wish immense progress of the SJIBL in near future.

Conclusion

Shahjalal Islami Bank Limited has formulate “Business Policy and Six Years Perspective Plan” to attain the financial strength, sustainable growth and operational efficiency. To protect the interest of the stakeholders, bank has formulated the 6(six) years perspective plan for consolidation of the growth and profitability. During the period of perspective plan, bank has the main objective to attain the highest operational excellence and consolidation to turn the bank into a dynamic Islamic Bank in the country.

During the period from 2007 to 2012, new & potential avenues of business in all areas of operation to be explored and expanded through the network of existing 51 branches and more new branches to be opened gradually during the plan period subject to permission of Bangladesh Bank. The bank ensures optimum utilization of bank’s invested fund/ deposit to be mobilized in future in an organized way to maximize banks profit consolidating the financial strength of the bank and to achieve the overall objective, mission & vision of the bank as a whole.

It is great pleasure for me to have practical exposure in Shahjalal Islami Bank Limited, Foreign Exchange Branch. Because without practical exposure it could not be possible for me to compare the theory with practice, and it is well established that theory without practice is blind. I have completed my internship in Foreign Exchange Branch of Shahjalal Islami Bank Limited. During the practical orientation, I have observed the function of General Banking, and overall banking activities like cash department, clearing section, investment division& various laws that comply with the sound business operations of Shahjalal Islami Bank of Bangladesh.

The general Banking, which is customer oriented fully. Its performance specially based on prompt and swift services is busier than other department of Shahjalal Islami bank Limited of Foreign Exchange Branch. The more and more are coming in the branch through this department resulting deposit of the branch is increasing day to day

On the other hand, for the concept of Islamic system most valuable, affluent, wise and religious client are step forwarding to the corridor of the Shahjalal Bank Limited. As a result, the Accountholder & liability of the bank is growing time to time, which will help to makes proper investment. That is why the number of account is opening more than previous year, which signifies the positive sign for our developing economy.

In a word, the performance of Shahjalal Islami Bank Limited, Foreign Exchange branch is growing rapidly and the volume of remittance is increasing effectively.

At last it can be said that, Shahjalal Islami Bank Limited will be turned into a dynamic Islamic Bank in the country and will expand its Banking Business all over the country to provide the banking services to the groups including the deserving Economic groups of the society who have no easy access to the banking channel. This will help for alleviation of the poverty, income generation, creation of employment opportunity, up-gradation of the standard of living of the lower economic groups, which will also contribute to the emancipation of national economy of the country.

The bank follows the Bank Companies Act 1991, the Companies Act 1994, the Negotiable Instrument Act 1881, the Foreign Exchange Regulation Act 1973 and many more to make the banking business in Bangladesh lawfully.