UTTARA BANK LTD Foreign Exchange Branch has no authority to open FCA. This Branch is depended on Dhaka Main Branch. Convertibility of Taka in current account transactions symbolized a turning point in the country’s exchange management and exchange rate system. Now the operations of foreign currency accounts have been more liberalized. Funds from this A/Cs are freely remittable to any county according to the needs of A/C holder. Foreign Remittance is classified into two way-Outward Remittance and Inward Remittance.

Outward Remittance:

On March 24, 1994 Bangladesh Taka was declared convertible for current account international transaction. As a result remittance becomes more liberalized. Outward remittance include sale of Foreign Currency by T.T, M.T, Draft, T.C or in cash for private, official and commercial purpose.

Outward:

| SL. | TYPES OF SEssRVI CES | NATURE | RATE OF COM. / CHARGES | Remarks |

27 a) | Issuance ofi) T.C. ii) Cash iii)Endorsement in passport | Com. & charges | i) 1.00 % ii) – – – iii) Tk.250/= | |

b) | Issuance of FDD on our foreign correspondent | Com. / SWIFT charge | i) Up to USD 2,000= $5/= or eqv. Tk.ii)USD(2001 – 5000)=$15/= or eqv. Tk. iii) USD (5001– 10,000) =$25/= or eqv. Tk. iv) Above USD10,000 = $40/= or eqv. Tk. Min Tk. 350/= plus SWIFT charges if any at actual | |

c) | Issuance of T.T./EFT (F.C.) through foreign correspondents | Com./ | Tk.1,000/= per T.T. plus SWIFT charges if any at actual | |

d) | Cancellation of FDD | Com. SWIFT charge | Tk.500/= per DD At actual |

Present Limit for outward Remittance:

A) Private Remittance

1. Family Maintenance:

Foreign nationals working in Bangladesh may remit 50% of salary and 100% of leave salary as also actual saving and admissible pension benefits for their family maintenance.

Moderate amount of Foreign Currency for maintenance abroad of family members (spouse, children, parents) of Bangladesh nationals are allowed.

2. Member ship/Registration fees etc.: ADS are allowed to remit membership fees of foreign professional and scientific institutions and fees for application, registration, admission, examinations in connection with admission into foreign education institute, supported by demand notice letter of the concerned institution.

3. Education: ADS may release foreign exchange favoring Bangladeshi students studying abroad or willing to proceed abroad for study according to the following drill:

Application by the student as per prescribed formant.

Admission letter issued by the concerned institution.

Estimate relating to Tuition Fee, Lodging and Incidental Expenses issued by the concerned institution.

Attested copies of Education Certificates.

Valid passport.

4. Travel: Private travel quota entitlement of Bangladesh national is set at USD 3000 per year for visit to countries other than SARC member countries and Myanmar. Quota for SARC member countries and Myanmar is USD 1000 for travel by Air and USD 500 for travel by Overland route.

5. Health & Medical: The ADS may release up-to USD 10,000 for Medical Treatment abroad on the basis of the recommendation of the Medical Board.

6. Foreign Nationals: The ADS may issue T.C to foreign nationals without any limit & currency notes up-to USD 300 against surrender of equivalent Foreign Currency.

7. Remittance for Hajj: ADS may release F.C to the intending pilgrims as per instructions circular to be issued by the Bangladesh bank each year.

Official and Business Travel:

Official Visit: For official or semi-official visits abroad by the officials of Govt. autonomous/semi-autonomous institutions etc. ADS may release foreign exchange as per entitlements fixed by the ministry of Finance from time to time. In such cases, the applicant for foreign exchange shall be required to submit the sanction letter and the component authority’s order/notification/circular authorizing the travel.

Travel Quota for New Exporter: ADS may release up-to USD 6000 to a new exporter for Business Travel abroad against recommendation EPB.

Travel Quota for Importer: Subject to annual upper limit of US$ 5000 importers are entitled to a Business Travel quota @ 1% of their imports settled during the previous financial year. Local producers are also entitled to Business travel quota as above.

Exporters Retention Quota: Merchandise exporters may retain up-to 40% realized FOB value of their export. It is 7.5% for export of goods having high import content.

Travelers Cheque (TC):

Travelers Cheque (TC) is an instrument for a specific amount of widely accepted foreign currencies, issued in favor of Travelers/Visitors to carry foreign exchange for meeting their expenses in abroad. Travelers cheque may be in different currencies, such as US$, Pound Starling, Japanese Yen, Saudi Real, Canadian Dollar, French Frances, German Marks, Swiss Frances, etc.

Procedure of T.C Issue:

a) Insure that the intending traveler is a client of the Authorized Dealer (AD) Bank or is sufficiently well known to the AD Bank.

b) The intending travelers must come to the Bank with the following documents to have the T.C.

ü Valid Passport.

ü Confirmed Valid Air Ticket.

c) Verification of the Passport & Air Ticket regarding validity, Illegibility, status etc. of the same.

d) Filling up the T/M form by the purchaser and signing on that T/M.

e) Realization of required fund.

f) Fill up the purchase Agreement Form (PAF) regarding the name, address etc.of the purchaser, T.C series no. Date of issue, amount etc, and give endorsement on the passport.

g) Be sure that purchaser signed all cheques in the upper left side of the cheque, only one person may sign any cheque.

h) Use original P.A.F. for settlement and retain duplicate for records.

i) Two sets of Photographs of Passport and Air Ticket to be obtained.

Procedure of Encashment:

Travelers Cheques (T.C) to be Encashment Observing the following Formalities,

Compare the counter signature with the original signature. Cheque will not be honored if signatures differ.

Additional signature may be obtained if the signature differs.

Blank cheque-should not be Encashed.

Previously counter signed cheques not be Encashed.

Be aware of large Encashment & take caution against hurry.

Check the passport endorsement, purchase contract of the purchaser if available.

If the dealing Officer is satisfied regarding the genuineness of the purchaser and the T.C. then he can pay equivalent Local Currency to the customer. And record the T.C. in inward Remittance Register.

Inward Remittance:

The term inward remittance includes not only purchase of Foreign Currency by TT.MT. Draft etc. but also purchase of Bills, purchase of Traveler’s Cheque. Utmost care should be taken while purchasing currency, Notes, T.C, DD, & similar instrument for protecting the Bank from probable loss as well as safety of the Bank officials concerned.

Dealing rates to customer:

SELLING | BUYING | |||||

TT & OD | B.C. | CURRENCY | T.T. CLEAN | TT (DOC) | OD SIGHT (EXP.) | OD TRANSFER |

69.4000 | 69.4500 | USD | 68.4500 | 68.420 | 68.3503 | 68.1550 |

88.5470 | 88.6102 | EUR | 86.5532 | 86.4502 | 86.3050 | 86.2351 |

0.7557 | 0.7562 | JPY | 0.7279 | 0.7275 | 0.7252 | 0.7249 |

104.0970 | 104.1716 | GBP | 101.7380 | 101.6754 | 101.3403 | 101.3496 |

56.0280 | 56.0682 | CAD | 54.8225 | 54.7885 | 54.6146 | 54.5955 |

44.4686 | 44.5005 | AUD | 43.4608 | 43.4183 | 43.3020 | 43.2849 |

18.5625 | 18.5759 | SAR | 18.1971 | 18.1891 | 18.1283 | 18.1183 |

57.7386 | 57.7802 | CHF | 56.7634 | 56.7386 | 56.5592 | 56.5184 |

45.7124 | 45.7452 | SGD | 44.6124 | 44.6015 | 44.4531 | 44.4296 |

9.0029 | 9.0094 | HKD | 8.7950 | 8.7926 | 8.7056 | 8.6669 |

236.8555 | 237.0252 | KWD | 231.4950 | 231.4037 | 230.6871 | 230.4844 |

19.0007 | 19.0143 | AED | 18.5715 | 18.5634 | 18.5110 | 18.5012 |

19.1914 | 19.2052 | MYR | 18.7452 | 18.7394 | 18.6793 | 18.6741 |

1.9524 | 1.9538 | THB | 1.8986 | 1.8975 | 1.8914 | 1.8871 |

3.46.2 INWARD REMITTANCE:

25. a) | Purchase of FDD, Cheques, T.C. drawn abroad. (FBP)(O.D.Transfer buying rate to be applied) | Com./ charges | Tk.0.20% per USDTk.0.30% per GBP + exchange earnings .(In all other currency at per with USD) | |||

Courier/ SWIFT | At actual | |||||

b) | Payment of any foreign taka draft which are drawn on our bank | Com. | Free | |||

c) | Encashment of any foreign T.T. in Taka. at our counter | Com. | Free | |||

d) | Encashment of F.C.Draft / M.T. | Handling charge | Foreign Bank /SWIFT charges at actual plus service charge Tk.300/= | |||

e) | Issuance of FC Draft under remtt. arrangement drawn on Bangladesh Bank | Com/ Charges | Free | |||

f) | Issuance of FC Draft drawn on Bangladesh Bank | Com./ Charges | USD 10/= flat plus VAT if any | |||

h) | Purchase of FC Cash | Com./ Charges | As per daily Exch. Rate Circular | |||

Purchase of Foreign Currency Notes T.C and DD:

Following General observations are required to purchase the above:

Currency notes to be checked very carefully so as to avoid risk of purchasing counterfeit notes.

While purchasing T.C signature of the holder to be obtained on the Travelers and should be verified with the signature of the holder given at the time of issuance of T.C passport of the seller as well as purchase contract of the T.C to be asked for to ensure genuineness.

Draft should not be purchased unless the holder is a regular customer of the Bank. Indemnity bond to be obtained for recovering the amount paid to the holder in case of dishonor.

Private cheque should not be purchased without prior approval of head office.

Opening of FC Account:

The Authorized Dealership may without prior approval of Bangladesh Bank open Foreign Currency Account in the name of:

Bangladeshi nationals residing abroad.

Foreign nationals or firms residing/operating in Bangladesh or abroad.

Foreign missions and their expatriate employees.

Exporters.

Diplomatic Bonded Ware House (Duty free shops) licensed by custom Authorities.

Local and joint venture contraction firms employed to execute projects by foreign donors/international donor agencies.

Bangladeshi nationals working with the Foreign/International organization operation in Bangladesh if salary is paid in Foreign Currency.

Bangladeshi nationals who are ordinarily resident in Bangladesh may open FC account will Foreign Exchange brought in at the time of their return to in Bangladesh from visit abroad.

Documents Required For Opening A/C:

a) For Bangladeshi Nationals:

Opening Form i.e.: Application, Signature Card, Nomination Form If Any, to be duly filled in and signed by the applicant and the nominee.

Original passport to be submitted for the verification and photocopy of first seven pages to be submitted for preservation.

Two copies Passport size photographs of both the account holder and the nominee are to be submitted, photograph of nominee to be attested by the A/C holder and account holder photo to be attested by the authorized officer of the Bank.

Service contract in English or Bengali version to be submitted with the account opening form.

If the intending person desire to open A/C forms abroad the necessary papers are to be sent duly attested by authorized officials of Bangladesh EBB Assay working there. All signatures are to be same that of passport

b) For Foreign Nationals/Company/Firms:

Two copies of photographs of account holder.

Copies of relevant pages of Passport.

Copy of service contract/appointment letter/work permit etc.

Copies of Registration in Bangladesh with Board of Investment for Foreign/Joint venture firm.

Copies of memorandum and Articles of Association/Laws/Bye Laws etc. or joint venture Agreement.

Loans and Advances:

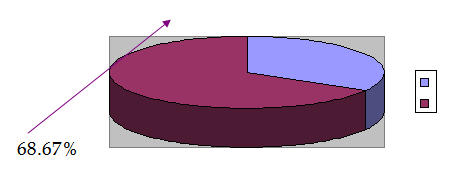

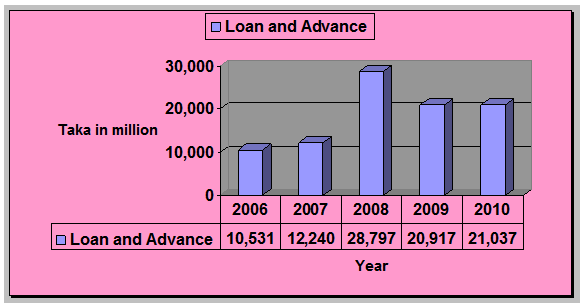

Loan and advance is the largest items of Bank assets. This is almost 68.67% of the total value of bank’s asset. A bank’s loan account typically is broken down into several groups of similar types of loans. In 2008 prime bank ltd. has a total amount of Tk. 21,036.86 million loan.

|

UBL was in constant efforts to explore different areas of credit operation and could raise the credit portfolios to Tk. 2106.86 million in 2009 with an increase of Tk. 4419.41 million (26.59%) over that of the preceding year. The total credit was on 31.12.07 was Tk. 16617.45 million. From the year previous the amount of loans and advances is increasing respectively. Here it is shown by a graph.

Taka in million

| Year 2006 | Year 2007 | Year 2008 | Year 2009 | Year 2010 | |

Loan and Advance | 6,723 | 11,012 | 12,797 | 16,617 | 21,037 |

Loan Administration and Monitoring:

1. For this purpose, UBL have in place, a full fledged Division at Head Office, where all the credit functions are constantly supervised and closely monitored, not only to keep the existing portfolio in sound footing but also for recovery/ regularization of overdue/ classified loans and advance.

2.The executive committee of the board, in order to ensure perfection of credit documentation has instructed the management to get all the mortgage documentation counter vetted and checked by a second legal adviser enlisted with the bank other than the lawyer who vetted it originally. Finally, to help smooth functioning of the audit committee of the board, the boards of directors have decided to appoint a reputed chartered accountancy firm in addition to the existing external auditors to conduct special audit and report on quarterly basis in order to monitor and supervise the internal operations of the bank more frequently. This is expected to bring absolute transparency and accountability, as well as strengthening bank’s internal control procedure.

End Result:

We believe our risk management system is functioning quite effectively, which is amply illustrated from the fact that the position of classified loans has reduced to 0.36% in the year 2003 from 0.60% in 2002.however, your board of directors would like to assure the future also to upgrade and strengthen the risk management and control methodology of the bank.

Credit and Risk Management (CRM):

Credit risk is the possibility of failure f a bank borrower or counterparty to meet its obligations in accordance agreed terms. The major causes of serious banking problems continue to be directly related to lack of credit standards for borrowers and counterparties, poor portfolio risk management, or a lack of attention to change in economic or other attention to change in economic or other circumstances that can lead to deterioration in the credit standing of a bank’s counterparties. The goal of credit risk management is to maximize a bank’s risk- –adjusted rate of return by maintaining credit risk exposure within acceptable levels. The effective management of credit risk is a critical component of a comprehensive approach to risk management and essential to the long term success of any banking organization. The Basel Committee is encouraging bank to promote sound practices focus on the flowing aspects:

- Establishing an appropriate credit risk monitoring environment.

- Operating under a sound credit- granting process.

- Maintaining an appropriate credit administration, measurement and monitoring process, and

- Ensuring adequate controls over credit risk.

Uttara Bank Limited is keenly aware of the need to identify measure, monitor and control credit risk as well as to hold adequate capital against these risks for adequate compensation of risks incurred since exposure to credit risk continues to be the leading sources of problems in banks world – wide. In this respect, following the system as per Guidelines of Bangladesh Bank. The Bank has also adopted a policy to the whole system from time to time to copy with the multifarious of credit risk.

Credit recovery and legal division is engaged in vigilant monitoring of the total credit classification of the bank, managing all classified and special Mention Accounts to regularize for maximization of recovery and ensuring appropriate loan loss provision timely. By dint of special attention, Bank could reduce the percentage of classified portfolio from 5.06% to 2.84% in 2008 through substantial amount of loan recovery and regularization.

Inter bank transaction in foreign exchange:

1) Applicant name and address to be mentioned and to be signed by the authorized signatory.

2) Date & place shipment. Expiry and present action period to be mentioned.

3) Beneficiary

4) Mode of advice

5) Transferable or not

6) Confirmation

7) Amount

8) by deferred payment-does, without draft

9) by acceptance-does, with draft.

10) Availability

11) by sight payment –dose, with/or without draft.

12) by negotiation-does, with draft.

13) Port of Loading/Place of’ taking in charee and port place of delivery.

14) Partial shipment.

15) Transshipment

16) Transport details

17) Mode of Transport

18) Country o origin

19) Goods description along with H. S. Code number.

20) Trade term C & F etc.

21) Documents to be stipulated

22) Additional Instructions

23) Signature of the Applicant (Authorized signature)

Movement of monthly averages of USD/BDT exchange rate:

Performance of Principle

Remittance:

The growth of the export business has significantly been increase by 20.67%. It stood at TK 55790.42 million as of December 31, 2010against TK. 46233.87 million of the previous year.

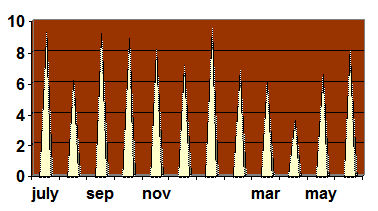

Earning from outward Remittance of Principle Branch :

As on July 2009 to June2010

Month | Amount (Taka) (Fig in Lac) |

| July09 | 10.17 |

| August09 | 9.90 |

| September 09 | 11.10 |

| October 09 | 9.05 |

| November 09 | 8.22 |

| December 09 | 7.07 |

| January 10 | 10.43 |

| February 10 | 9.73 |

| March 10 | 8.07 |

| April 10 | 9.52 |

| May 10 | 9.50 |

| June 10 | 10.95 |

Local Money Market:

After introduction of Report auction in the year 2009the local money market witnessed appearance of another indirect monetary policy tools in the form of reverse Report auctions to facilitate day-to-day liquidity management to meet ant temporary and unexpected adversities in the supply for and demand of money.

The call money rates during the year 2010ose in the month’s of February and may, caused by increase in demand during eid and during the period of the transitional adjustment of taka on a market based exchange rate regime. The call money interest rates varied between 1.50% to 43.00% for lending and 1.25% to 30.05% for borrowing.

Category wise position of inter bank FX transaction:

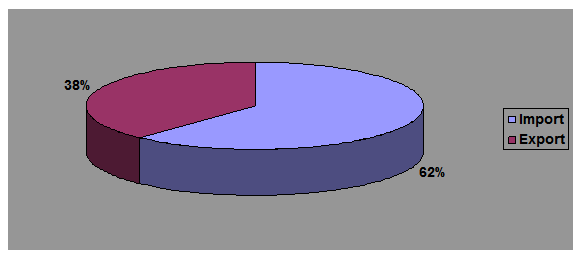

Total Foreign Exchange Business handled during the year 2010 was Tk.48, 929.14 million as against Tk. 36,182.17 million of 2009 registering an increase of Tk.12, 746.97 million, i.e. 35.23% growth. The particulars of Foreign Exchange Business are given below:

| Particulars | Amount in Million Taka | Percentage of Total |

| Import | 30,311.71 | 61.95% |

| Export | 18,617.43 | 38.05% |

| Total | 48,929.14 | 100.00% |

Composition of Foreign Exchange Business of 2010:

Foreign exchange Department:

Foreign Exchange is a process which is converted one national currency into another and transferred money from one country to another country. According to Mr.H.E.Evitt “Foreign Exchange is that section of economic science which deals with the means and method by which right to wealth in one country currency is converted into rights to wealth in terms of another country currency”. It involved the investigation of the method by which the currency of the country is exchanged for that of another, the causes which rented such exchange is necessary the forms which exchange may take and ratio or equivalent values at which such exchange are effected.

Foreign exchange means the exchange of currency in terms of goods from one country to another. This is the most well know and well-organized business uniform in world business. Foreign exchange mainly has two parties:

(a) Exporter

(b) Importer

Foreign Exchange means foreign currency and includes:

- Traveler’s cheques, letter of credit and bills of exchange, expressed or drown in Indian currency but payable in any foreign currency.

- All deposits, credits and balance payable in any foreign currency and any drafts.

- Any instrument payable, at the option of the drawer or holder thereof or any other party thereto. Either in Indian currency or in foreign currency or partly in one and partly in the other. Thus the foreign exchange includes foreign currency.

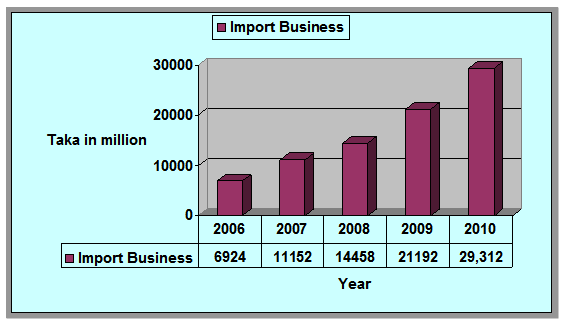

Import Business:

The total import handled by the bank in 2010 was Tk. 30311.71 million compared to Tk. 22191.84 million in the preceding year registering a rise f Tk. 8119.87 million being 36.59 percent. A sizeable L/C’s were also opened by the bank in the year under review. The import items included industrial raw materials, machinery, consumer goods, fabrics, accessories etc

Export Business:

The bank handled export business worth Tk. 18617.43 million in the year under report. In 2009 total export business handled by the bank was Tk. 13990.33 million. Thus there was an increase of Tk. 4627.10 million in export business handled by the bank, being 33.07 percent over the preceding year. The major export item was Readymade Garments. Here the last 5 years export business of JBL is presented by a graph:

Definitions of 26 financial ratios:

Bank profitability ratios:

1. ROA=return on assets=NI /ATA=net income/ average total assets

2. ROE=return on equity=NI /SE=net income/ average stockholders’ equity

3. PM=profit margin=NI /OI=net income/ operating income

4. ROD=return on deposits=NI /ATD=net income/ average total customer deposits

5. ROSC=return on shareholder capital=NI /SC=net income/ shareholder contributed capital

6. NOM=net operating margin=OI /IN=operating profit or income/ interest income

Bank efficiency ratios:

7. IEE=interest income to expenses= (IN−IE) /ATLA= (interest income−interest expenses) / average total

Loans and advances

8. OEA=operating expense to assets=OE/ATA=operating expenses/ average total assets

9. OIA=operating income to assets=OI /ATA=operating income/ average total assets

10. OER=operating expenses to revenue=OE/OI=operating expenses/ operating income (revenue)

11. ATO=asset turnover=IN/ATA=interest income/ average total assets

12. NIM=net interest margin= (IN−IE) /ATA=(net interest income−net interest expenses) / average total assets

13. NNIM=net non-interest margin= (NIN−NIE)/ATA=(net non-interest income−net non-interest expenses) /average total assets

Asset-quality indicators:

14. PEA=provision to earning assets=PLL/ATLA=provision for loan losses / average total loans and advances

15. APL=adequacy of provision for loans=ALL/ATLA=allowance for loan losses at the end of the year / average total loans and advances

16. WRL=write-off ratio=WR/ATLA=write-off of loans during the year / average total loans and advances

17. LR=loan ratio=ATLA/ATA=average total loans and advances / average total assets

18. LTD=loans to deposits=ATLA/ATD=average total loans and advances / average total customer deposits

Liquidity ratios:

19. CTA=cash to assets=C/ATA=cash / average total assets

20. CTD=cash to deposits=C/ATD=cash / average total customer deposits

Risk ratios

21. DTA=deposits to assets=ATD/ATA=average total customer deposits / average total assets

22. EM=equity multiplier=ATA/SE=average total assets / average stockholders’ equity

23. ETD=equity to deposits=SE/ATD=average shareholders’ equity / average customer total deposits

24. TLE=total liabilities to equity=TL/SE=average total liabilities / average stockholders’ equity

25. TLSC=total liabilities to shareholder capital=TL/SC=average total liabilities / shareholder contributed capital

26. RETA=retained earnings to total assets=RE/ATA=retained earnings / average total assets

Ratio Analysis:

Profitability ratio:

It measures the income or operating success of an enterprise for a given period of time. Profitability is a frequently used as the ultimate test of management’s operating effectiveness.

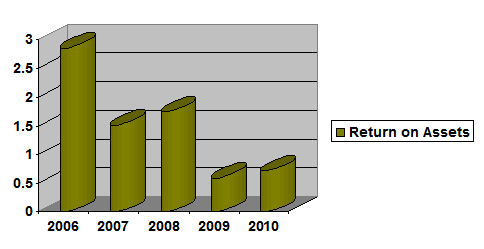

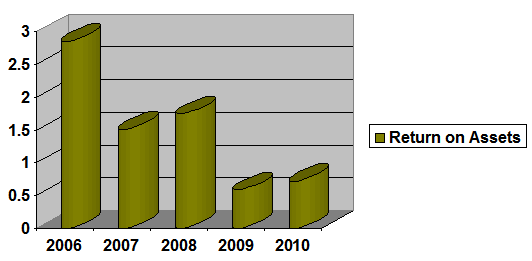

Return on Assets:

An overall measure of profitability is return on assets. This is computed by Net income divided by Average assets.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Return on Assets | 2.85% | 1.52% | 1.75% | 0.58% | 0.71% |

Comments:

Uttara Banks Return on assets decreased from 2006 but in 2008 it is slightly increased. So its return on assets situation is not satisfactory.

Return on Equity:

This ratio shows how many taka of net income were earned for each taka invested by the owners

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Return on Equity | 1.70% | 34.34% | 32.05% | 10.69% | 12.71% |

Comments:

Uttara Banks return on equity of 2010 is substantially higher than 2009.Again in 2010, its return on equity (12.71%) is higher then its return on assets (0.71%) The reason is that City Bank has made effective use of leverage or trading on the equity at a gain. It earns more on its borrowed funds than it has to pay in the form of interest. Thus the return to stockholders exceeds the return on the assets, benefiting from the positive leverage.

Earning Per share:

It is a measure of the net income earned on each share of common stock.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Earning Per Share (Taka) | 5.61 | 79.22 | 75.13 | 20.20 | 28.91 |

Comments:

From the chart we can see that in 2007 & 2008 EPS increased in compare to other years. The reason is that net profit after tax had been increased in those times

Price-Earning Ratio:

This ratio reflects investor’ assessments of a companies future earnings. It is computed by dividing the market price per share of the stock by earnings per share.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Price Earning ratio (Times) | 40.55 | 11.08 | 10.24 | 19.31 | 25.09 |

Comments:

In 2010 each share of Uttara Banks stock sold for 25.09 times the amount that was earned on each share. Company’s price earning ratio is higher then previous year

Solvency Ratio:

It measures the ability of the company to survive over a long period of time. It includes the following ratio:

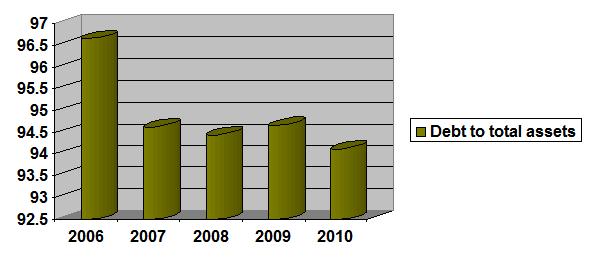

Debt to Total Assets Ratio:

It measures the percentage of the total assets provided by creditors. It is computed by dividing total debt by total assets.

| Year | 2006 | 2007 | 2008 | 2009 | 2010 | |

| Debt to Total Assets | 96.64% | 94.63% | 94.45% | 94.67% | 94.10% | |

Comments:

The higher the percentage of debt to total assets, the greater the risk that the company may be unable to meet its maturing obligation. In 2010 a ratio of 94.10% means that creditors have provided 94.10% of Uttara Banks total assets.

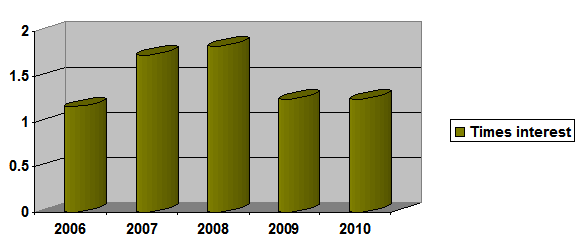

Times Interest Earned:

It provides an indication of the company’s ability to meet interest payments as they come due. It is computed by dividing income before interest expense and income taxes by interest expense

| Year | 2006 | 2007 | 2008 | 2009 | 2010 |

| Times Interest Earned(times) | 1.17 | 1.74 | 1.83 | 1.25 | 1.25 |

Comments:

This represents the amount available to cover interest. Uttara Banks interest expense is well covered at 1.25 times in 2010.

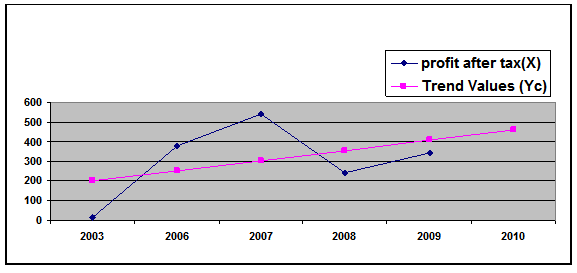

Introduction:

To conduct the Analysis part two techniques of analysis are used. These are Least Squares method for Time Series Analysis and Regression Analysis. By using time series data a straight-line trend is drawn for the actual and trend value

LEAST SQUARES METHOD FOR STRAIGHT LINE TREND

The table, the calculated steps and the results for the year 2010’s estimated profit are given below-

Fitting the straight line trend by using Least Squares method

| Year | Profit after Tax (Million Tk.) (Y) | Deviations From Middle Year(X) | XY | X2 | Trend Values(Yc) |

| 2006 | 13.46 | -2 | -26.92 | 4 | 199.48 |

| 2007 | 380.26 | -1 | -380.26 | 1 | 251.46 |

| 2008 | 540.00 | 0 | 0 | 0 | 303.44 |

| 2009 | 240.02 | 1 | 240.02 | 1 | 355.42 |

| 2010 | 343.46 | 2 | 686.92 | 4 | 407.4 |

N=5 | ∑Y=1517.2 | ∑X=0 | ∑XY=519.76 | ∑X2=10 | ∑YC=1517.2 |

Here,

The equation of straight line is-

Yc = a +bX;

Where, Yc =The trend (computed) values to distinguish them from the actual Y values,

a= The Y intercept on the value of the Y variable when X=0,

b= Slope of the line or the amount of change in Y variable.

Since,

∑X=0,

a = ∑Y/N

= 303.44

b = ∑XY/∑X2

= 519.76/10

= 51.98

Here,

The Equation of straight line trend is –

Yc = 303.44 +51.98X

Now,

For X=-2, Yc = 303.44 +51.98(-2)

= 199.48

X= -1, Yc = 303.44 +51.98(-1)

=251.46

X= 0 , Yc = 303.44 +51.98(0)

=303.44

X= 1 , Yc = 303.44 +51.98(1)

=355.42

X= 2 , Yc = 303.44 +51.98(2)

=407.4

For Year 2010, X would be +3. Putting X=+3 in the equation-

X= 3 , Yc = 303.44 +51.98(3)

= 459.38

Hence, a likely Profit after Tax for 2010 is 459.38 million Tk

GRAPHICAL PRESENTATION OF THE STRAIGHT LINE TREND:

REGRESSION ANALYSIS:

The regression analysis is drawn on total amount of scheme deposits, total

number of employees and number of branches. Here

The regression equation of Y on X1 and X2 for the regression line will be-

Y = a + b1X1 + b2X2

Where,

Y = Total amount of scheme deposits,

a = The intercept (constant),

b1= Slope of line, change in scheme deposits for change in no. of employee,

b2= Slope of line, change in scheme deposits for change in no, of branches,

X1= No. of employees,

X2 = No of branches.

Data table for this regression analysis is given below-

Scheme Deposits | Employees | Branches |

3714.45 | 1692 | 76 |

3954.43 | 1803 | 77 |

4870.48 | 1829 | 77 |

5435.24 | 1989 | 77 |

5580.14 | 1997 | 84 |

OUT PUT OF THE REGRESSION ANALYSIS:

RESULTS OF THE REGRESSION ANALYSIS:

- The regression equation of Y on X for the regression line will be-

Y = a + b1X1 + b2X2

From the table of Co-efficient, we can find that

Y = -523+ .335X1 + 8.478X2

In this equation, b1 = .335 indicates that if the no of employees increases by 1 percent, the amount of scheme deposits increases by .335 million Tk. provided no of branches remains unchanged.

In this equation, b2 = 8.478 indicates that if the no of branches increases by 1, the amount of scheme deposits increases by 8.478 million Tk. provided no of employees remains unchanged.

- The Explanatory power of the independent variable can be assed with the help of Coefficient of determination, R2.

From the table of Model Summary we can find that-

R2 = .898

R2 = .898 indicates that 89.8% of the scheme deposits can be explained by the no. of employees and no of branches.

- The relative importance of the independent variables can be indicated with the help of Beta coefficient.

From the table of Coefficient (Standardized) we find that

ßno of employee .926> ßno of branch .033

From this we may conclude that no of employees exerts more influence on collection of scheme deposits.

Problem of Multicolinearity:

Multicolinearity arises if

- Correlation coefficient between the independent variables is higher than that of dependent variable and any other independent variable.

From the table of Correlation Matrix-

remployee, branch = .654>rbranch, scheme = .639

or, remployee, branch = .654<remployee, scheme = .948

From first correlation coefficient there is multicolinearity problem but from the second relation there is no multicolinearity.

- Correlation coefficient between independent variables is greater than .8

remployee, branch = .654 < .8

So, the problem of multicolinearity is not existed from this point of view.

- Test the significance of the result

From the table of ANOVA, we can find that the regression model is statistically significant because-

The significance level .046 < .05 level.

From the table of coefficient we can see that b1 is statistically significant. Because-

The significance level of b1, .128< .05 level

From the table of coefficient we can see that b2 is statistically significant. Because-

The significance level of b2, .003< .05 level

SWOT Analysis of the Uttara Bank Ltd:

SWOT Analysis is an important tool for evaluating the companies Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and can scan the macro environment, which is turn would help the organization to navigate in the TurbulenceOcean of competition. Following is given the SWOT analysis of the Uttara Bank Ltd:

From my practical observation I get the following Strength opportunity, weakness and threat (SOWT).

Strengths:

Sponsors:

UBL has been founded by a group of outstanding entrepreneurs. The sponsors, directors, chairman belongs to large industrial conglomerates and philanthropist of Bangladesh

Company Reputation:

UBL has created standing in the banking organization which has goodwill in the upcoming and new built banking organization. Uttara Bank has created a good reputation in the banking industry of the country. It tries to give the best services. The popularity of this bank is increase day by day in the general public area.

Top Management:

The strength of the Uttara Bank lies on the top management of the company and the financial soundness of the sponsors, as they are all well reputed personalities in the Bangladesh. This impressive lay of Bank Ltd. helps to have a good image

Modern Facilities and Computer:

From the very beginning The Uttara Bank tries to furnish their work surroundings with modern equipment and facilities. For speedy service to the customer, The Bank had installed money-counting machine in the teller counter. The bank has computerized banking operation under software called FINACLE. More over computer printed statements are available to internal use and occasionally for the customers. The Bank is equipped with telex and fax facilities.

Stirring Branches:

From the formative stage of The Uttara Bank tried to furnish their branches by the impressive style. Their well-decorated branches gets attention of the potential customer, this is one kind of positioning strategy.

Interactive Corporate Culture:

The corporate culture of The Uttara Bank is very much interactive compare to other local organization. This interactive environment encourages the employee to work attentively. Science the banking jobs is very much routine work oriented and lovely environment boots up the work capability of the employees.

High quality of Services:

Services is so much important that way UBL provide online banking facility and after ten minute provide remittance in customer With a team of bankers that comprises of experience as well as vigor of youth, the Bank strives for a customer-oriented banking culture, with prudent lending and attractive deposit schemes and new restructure of banking system with Business Matrix. While keeping on expanding its reach, Uttara Bank aims at maintaining the high quality of services it has already achieved.

We have identified some important aspect about Uttara Bank Ltd such this strength like as…

It has well reputation in the market

Not engaged in unfair business practice.

Concentrated market.

Officers are highly educated.

Executives are highly qualified and experienced.

Bank has many attractive deposit schemes.

Well-furnished and Air-conditioned Bank.

Efficient management practice in the Bank.

Provide online banking.

After ten minute provide customer remittance.

Weaknesses:

Limitation of information System:

They have always face problem in software system that way customer face hazard. The software used by the UBL-“Financial” is not updated. It is easy to handle but contains some flaws.

Time Consuming:

The top-level management consumes much time in taking fervent decision, i.e. decision-making experiences a debacle of unnecessary time passing. This phenomenon becomes vivid in case of changing interest rate on Fixed Deposit.

The decision undertaken by the management is sometimes self centered i.e. the market competitiveness is often ignored to give priority on their own capability and resources

Advertising and Promotion:

The bank does not effectively carry out advertising and promotion. This lacking makes a steady situation for the external banking services and effects largely in the all system.

There is another weakness for The Uttara Bank is advertisement. Their media coverage is so much low that people do not know the bank thoroughly. The marketing strategy adopted by the bank is effective but not efficient. The appearance of the bank in the printing media and electronic media has become a matter of fortune. General people take time to index Uttara Bank; Most of the time they disregard it with other Bank.

Lack of full scale automation:

Even through UBL is providing online banking services and ATM cards but it should use more advanced technology to compete with the multinational banks lack of ATN booth or etc.

There are also some other weaknesses of the Uttara Bank such as…

Deposit is lower than advance.

Officer has limited experience and not enough trained.

Long-term credit is not sufficient.

Small market shares in Banking-business.

Opportunities:

Diversification:

The management cans diversity the business into issuance or leasing business. They also easily divers each place to other place because it’s online system.

Uttara Bank can pursue diversification strategy in expanding its current line of business. They can serve not only the Specific person but also the general people.

Training Center:

Bank can introduce a training center for its employees to make the employees more helpful and efficient.

Some point related in this opportunity…

Can increase the advertising of the Bank.

Private Banks becomes more reliable to local public.

Threats:

Upcoming Banks:

Upcoming bank like Eastern Bank, The City Bank, Prime Bank, Dutch-Bangle Banks are the major competitors of UBL. The contemporary banks of The Uttara Bank like: Dhaka Bank, Dutch Bangla Bank, National Bank, Brac Bank, Prime Bank are its major rivals. They are carrying out aggressive campaign to attract lucrative clients as well as big time depositors. Uttara Bank should remain vigilant about the steps taken by these banks, as these will in turn affect The Uttara Bank strategies.

Multinational Bank:

The Rapid expansion of multinational bank poses a potential threat to existing commercial Bank. Due to the booming energy sector, more foreign banks are expected to operate in Bangladesh. Moreover, the existing foreign banks such as HSBC, AMEX, CITI N.A, and Standard Chattered are now pursing an aggressive branch expansion strategy. Since the foreign banks have tremendous financial strength, it will pose a threat to local bank to a certain extant in terms of grabbing the lucrative clients.

Default Culture:

Default culture is very much familiar in our country. However as the bank grows older it might become big problems. In these senses Uttara Bank has to be careful.

Competitor Analysis:

The competitors also focus on market segments where they can meet customer needs in a superior way and command a price premium. Foreign currency business is one of the most competitive sector or almost every commercial bank. . The consumer credit scheme is very much conductive to the limited income citizen. Because these type of schemes are mainly based on flexible terms and conditions and subject to installment based payment. In recent times the overall demand and prospect of these type of credit service has increased a lot. Now various commercial banks are providing this service but nine banks are the best service included Mercantile Bank.

Mercantile Bank:

Mercantile Bank in a good position from its image perspective. It has a good profit since 1999. Compared the other new bank which is start their work since 1999 in that sense MBL is in a market good position.

The bank considers savings and deposits as lifeblood of the bank. Mort the deposit greater is the strength of the bank. So they intend to launch various new savings schemes with prospect of higher return duly supported by a well-orchestrated system of customer services. Technologies such as computer, ATM, ‘fete-communication etc. all would be harmonized and adapted to the system in order to provide found the clock and any branch services to the clients.

The Authorized capital of the Bank is TK. 800 million and the Paid-up capital of the Bank is Tk.276.85 million as of December 31, 2001. The Authorized Capital of the Bank is Tk.800.00 million of 8,000,000 ordinary shares of Tk.100 each.

The issued, subscribed and paid-up capital of the Bank is Tk.276.85 million of 2,768,500 ordinary shares of Tk. 100 each fully paid-up in cash in 2001

Islamic Bank:

Islami bank is the pioneer in this sector. This bank is mainly activated and regulated by Islami sharia. They first introduced this type of scheme under title of household durable investment scheme in January 1993. Presently 73 out of 103 branches of Islami bank are under this project. The amount of loan disbursement is 91 crore 11 lac Taka so far. The highest loan amount of household durables investment schemes is one lac. The equity is 25% and the profit rate is 13%. Beside these, one percent is for risk fund and two percent is for supervisory organization. The responsibility of overall supervision of this scheme has given to three companies by Islami bank. Their duties include client selection, investment, disbursement, collection and overall supervision. The companies are Ibne Sina Investment Company Limited, Faisal Investment Foundation and Anudip Services Private Limited.

Prime Bank:

The prime bank limited has introduced this consumer credit scheme in July 1995. In beginning, it was only introduced in motijheel branch. But for having very positive feed bank from the clients within one year, now the service is being provided by other more branches also. The supply rate is 11.90 percent of total disbursement and the recovery rate is 98.41%. But the scheme is slightly exceptional from other banks scheme. There are two categories under this scheme. The first one is car investment project. The credit amount is up to three lac. The equity is 50% for recondition car and 30% for now car. The second one is household durables scheme and the loan amount is one lac. The equity is 20% against the loan. The time limit for repayment is three years for recondition car and four years for new car. For others the time limit is two years.

Pubali Bank:

In private sector Pubali bank has also adapted this scheme in mid July 1996. Primarily nineteen branches of DhakaCity are providing the services. But soon four branches in Chittagong and two branches in sylhet will provide the services. The credit limit is one lac and 20% equity. The rare of interest is 12%. The service charge rate is 2.75%. There are two supervisory organization, S.F. service private limited and Advance Technology. So far the no. of client is seven hundred ninety seven and the amount of disbursement is 2 crore 75 lac 15 thousand and 75 taka. The supply rate is 1.80% and the recovery rate is hundred percent.

Southeast Bank:

Presently sixteen branches of southeast Bank are under its consumer credit scheme. So far the no. of clients under this scheme is two hundred thirty one. The total amount of disbursement is 4 crore 49 lac 59 thousand taka. The overall recovery rate of southeast Bank is hundred percent. The supply rate is 2.99 percent of the total disbursement.

Al Arafah Islami Bank:

Presently fourteen branches of Al Arafah Islami bank are under its consumer credit scheme. SO far the no. of clients under this scheme is four hundred four. The total amount of disbursement is 1 crore 10 lac 99 thousand Taka. The overall recovery rate of Al Arafah Islami Bank is 97.5%. The supply rate is .74 Percent of the total disbursement.

Eastern bank:

The practice of consumer credit scheme is not very much wide spread in Eastern Bank. So far the no. of client is four hundred thirteen. The recovery rate is hundred percent and the supply rate is .018 percent.

Others Analysis:

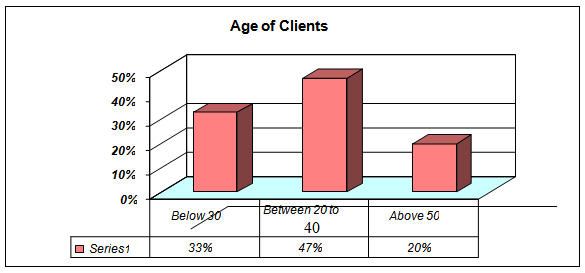

Age Limit of the Client:

According to the survey, most of the clients are carrying out cards whose ages are between 20 to 40. It has been found that few clients are on above 50.

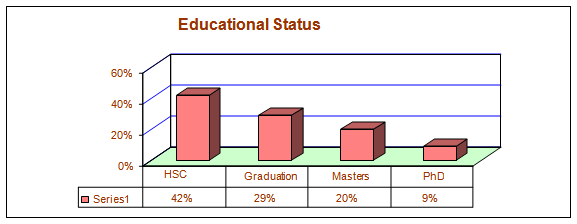

Educational Qualification of the Clients:

It can be state that the educational qualifications of the most clients are educated at this business level in our country. Most clients have passed HSC and some completed Graduation or Masters. In terms of their higher educational background might help long run decision-making business.

Business Commencement:

As an intern of this division, it should be mentioned that client has to maintain the card at least one. So by carrying out day-to-day activities clients should carry at least one card for his/her interest.

RECOMMENDATION AND CONCLUSION

Recommendations:

Uttara Bank Limited tries to give the best customer support, the have some lake and linkage compare to other bank of the same generation such as the way……..

- Employee may need advance training

- Policy may be revised from time to time

- Customized software may be implemented

The bank has to increase their advertisement and also increase their social activity

The interest rate in Uttara Bank Limited is now 18%, which is very high for the customers. Interest rate should be reduced to attract more customers and raise the satisfaction level significantly.

The employees of RFC especially the MIS division should be more cooperative with the customers over phone when applicants are looking for the necessary information.

A new internal division can be opened for information deliver in RFC.

HR should be more concerned about to train the sales team.

The disburse time in the Uttara Bank Limited is very lengthy. It should be reduced and the customers should get their service at a shortest possible time.

The application process time is very lengthy. The time required for the applications should be reduced as well.

Debt burden ratio should be relaxed especially in case of highly potential and successful business personnel.

The specific and board recommendations of the study are as follows:

The authority should recruit more employees to serve the customers. The can recruit experienced employee as well as fresh graduate.

The bank should introduce more products based on the market demand.

The bank should reduce their minimum balance to attract more customers.

The salary of the worker need to be rise, as a result experienced people from other bank will be attract to join Uttara Bank Limited Limited.

The bank can open more branches to reach to more customers.

The bank can open branches or foreign booth because many people send money from abroad every year to Bangladesh.

The bank should finance to the consumer goods, because many people in the country wants to buy consumer goods from bank loan.

The marketing department of the bank should more efficient to reach at the hart of the customer.

For the success of any organization, employee satisfaction is one of he most important factor and DBBL authority have to look about it.

The bank should be more profit concern as well as took part to the economics development of the country.

The departments of the bank should more efficient to make profit by satisfying customers.

The bank should use printed instruments like cheque, pay orders etc.

Being a clear transparent the bank can provide the best support to the customer as earn profit.

The loan processing fee should be reduced.

Conclusion:

It is revealed from the above presentation that in 2010, the bank has achieved remarkable success in various financial activities as well as in bank’s business. During the year under report the bank has earned commendable operating profit and also attained capital adequacy. Substantial amount has been recovered from classified loan because of appropriate action in this regard.

UBL Bank contains an important part in overall operation of the Bank. Our industrial sector that are operating their business in different countries getting a good benefit from this department. Although there have some limitation in total operation process including online disturbance, management process, code fore, d authorization, technical problem etc. Bank now trying their best to improve such problem and to enhance their operation and customer services. For more facilities UBL bank have a good step to serve in rural areas. They made a deal with an ego, which facilitates them for more service in this sector. Moreover they have taken steps to open more branches in different area for wide operation. Due to clear and transparent operation bank have introduces Corporate Governance where board reviews and approves various policies for compliance by the management. The Board/ Executive committee reviews the polices / guidelines issued by the Central Bank regarding operation of the Industry. The Board / executive committee of the board approves the credit proposal as per approved policy and Bangladesh Bank guidelines/regulations. Due to maintaining different level of transparency bank are now receiving more profit in every year.

Needless to mention that continuous support and extended by our valued clients, shareholders, sponsors, business associates and well wishes played a vital role behind these operating results and the Board of Directors express felicitation to them in this regard. New CEO has joined to existing team and in 25th silver jubilee celebration a new logo with utterly new concept is introduced. Consequently, the directors acknowledge with gratitude the valuable guidance and co-operation received from the Ministry of Finance, Bangladesh Bank and Securities and Exchanges Commissions. The directors place on record their depreciation for the dedicated services rendered by the executives, officers and staff members of the bank.

As borrower selection is the key to successful retail lending, Uttara Bank Limited should focus on the selection of true borrower. At the same time it must be taken into account that right borrower selection does not mean that Uttara Bank Limited has to adopt conservative lending policy but rather it means that compliance with the KYC or Know Your Customer to ascertain the true purpose of the loan.

Uttara Bank Limited is bank of new generation. Though I tried to include at my report about deposit, customer service and general banking, I followed their rules and regulation and tried to use them in my report to prepare this report with my best effort.

Though all departments and sections are covered in the internship program, it is not possible to go to depth of each activities of branch because of time limitation. Bank is an institution, which acts as a financial intermediary. Since bank collect deposit from various source by paying interest to them and grant loan to some other parties at high rate to interest then the interest paid to the depositor, the differences between the two interests is termed as the profit.

Since Uttara Bank Ltd. Credit limit increased by taka 9907 core or 18.10% to tk. 64553.10 core during 2008-2009 as compared to increase of 10.30% in the preceding year, Uttara bank Ltd. Should pay more attention to loan and advance which not only increase it’s profit position but also alleviate poverty level of Bangladesh by providing loan to the capital seeker, increase standards of living.

Some More Parts :

Internship Report On An Overall Banking System Of Uttara Bank Limited (Part 1)

Internship Report On An Overall Banking System Of Uttara Bank Limited (Part 2)

Internship Report On An Overall Banking System Of Uttara Bank Limited (Part 3)