The major objective of this report is to analysis Loan and Advances of the Janata Bank Limited. General objectives of this reports are to make an overview of JANATA Bank Limited, to study the socio-economic backgrounds and other characteristics of the Bangladesh, to identify the Products and Services offered by Janata Bank Limited, to identify problems related to General Banking, deposit, loan of JBL in Janata Bhaban Corp. Branch and to suggest appropriate policies for the development of entrepreneurs with view of alleviating poverty through JANATA Bank Limited finance in Bangladesh.

OBJECTIVES OF THE STUDY

The overall objective of the study will be to evaluate the banking system of JANATA Bank Limited in light of development of the people. The specific objectives of the study are as follows: –

- To make an overview of JANATA Bank Limited.

- To study the socio-economic backgrounds and other characteristics of the Bangladesh.

- To identify the Products and Services offered by Janata Bank Limited

- To identify problems related to General Banking, deposit, loan of JBL in Janata Bhaban Corp. Branch.

- To suggest appropriate policies for the development of entrepreneurs with view of alleviating poverty through JANATA Bank Limited finance in Bangladesh.

Financial Performance of Janata Bank limited

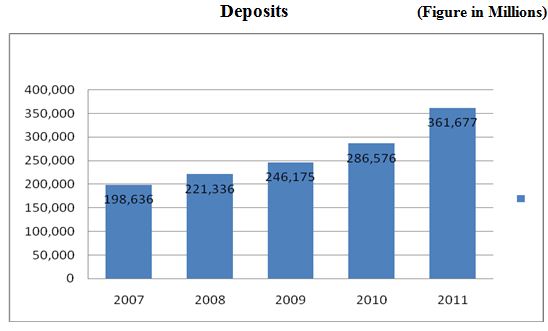

DEPOSIT

At the end of December 2011, the deposit of the Bank was Tk 361677 million compared to Tk 286,567 million at the end of previous year leading to a year-over-year growth of 26.21 percent. This growth rate was a remarkable achievement, considering the adverse economic scenario of the global economy. In the prevailing market mobilization of deposits has become very competitive and costly. The Bank has laid particular emphasis on procuring of low cost fund.

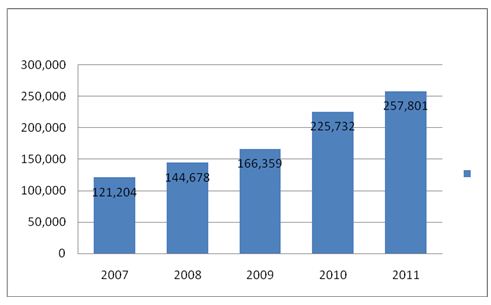

LOANS AND ADVANCES

The loans and advances of the Bank registered an impressive growth during the year 2011. The total loans and advances as on 31 December 2011 stood Tk. 257,801 million compared to as against Tk. 225,732 million at the end of previous year, showing a growth of 14.21 percent

The advance portfolio of the Bank is well diversified and covers breaking a wide spectrum of small & medium enterprises, business and industries including agro-based and agro-processing, ship scrapping, steel & engineering, paper & paper products, chemicals, construction, real estate and loans under consumers credit schemes, various trading business businesses, service-holders loan and women entrepreneurs of the country.

CAPITAL AND EQUITY

The paid up capital of the bank was Tk. 8,125 million as on December 31, 2011 which comprised of 81.25 million ordinary shares of Tk.100 each. Right shares to the tune of Tk. 3,125 million were issued in the year 2011 in favor of the government of Bangladesh. The total equity of the Bank has risen to Tk 30,152 million as December 31, 2011 against Tk. 20,390 million of the preceding year.

Loan and advance and credit rating of Janata bank

LOAN AND ADVANCES

Loan and Advances occupy a very important position in modern banking. A bank is a business enterprise of the country. It is a profit-seeking concern as any other commercial and industrial organization. A bank cannot be benefited only by taking deposits from public with finding proper avenues for investing them in profitable venture. Because it has to pay interest timely on major part of its deposits. Besides it has to meet up the administrative and other costs of the institution. So it is necessary to invest them. So it is clear that profitability of a bank always depends on the table manner and the avenues in which its resources are employed to get the maximum income. A general business concern will explore the various ways in which it can obtain its resources, like additional capital, floatation of debentures, bank borrowings, credit on purchase.

Basically there are three types of Loan

- Revolving credit

- Enterprise loan

- Clean loan

Revolving credit

Renewable after Certain period – 6month, 1 year.

There are two types of loan –1. Call loan 2. Term loan

In call loan bank will give this for short term and pay will only for one time such as-COD, LOD, LTR. Loan against Export & Import products.

In term loan maturity 1-10 years. This type of loan bank give industry ya ngo for project

Enterprise loan

Maturity 1-10 years.

Clean loan

It also part of call loan but this loan gives without mortgage.

Concept about Advance:

In the case of advance client can windrow his or her money in any amount .bank contract with this person at a fixed amount. In this case party can payment her loan in one year. In case of advance client pay the interest only for the loan amount. Here also those amounts will do repayment this payment can windrow. In advance interest rate is high than normal Loan.

The bank’s resource is slightly different as it will, to a large extent, depend upon the mobilization of deposits. Bank’s resources usually comprise of:

- Paid up capital

- Reserves and undistributed profit

- Deposits from the public from various accounts

- Borrowing from Bangladesh Bank and other banks.

Lending is the most important function of a bank. It comprises a very large portion of a bank’s total assets and form the backbone of the banks, structure. The strength of the bank is thus adjudged by the soundness of its advances the main source of advance come from the deposits of the public. A wise and prudent policy in regard to advances is considered an important factor inspiring the confidence in the depositors and the prospective customers of the bank.

At present Janata Bank Limited is trying to be very cautious and prudent in disbursing loan taking into consideration a number of factors such as feasibility of the project, timing, risk, profitability etc. Because after 2007, being registered with the Companies Act 1994, it is pursuing the corporate culture in formulating its policies regarding business. During the nationalization period, most of its loans and advances were disbursed under pressure either from the public or from the government or influential persons of the society. But the situation has been a little changed. But it has been the realization of the bank that advances not only play an important part in gross earnings of banks, but also promote the economic development of the country.

SLR & CRR–

Like any other commercial banks, Janata Bank Limited cannot disburse all the amount of deposit collected from the public. It has to keep 18% of its total deposit as Statutory Liquidity Reserve with Bangladesh Bank, the central bank of the country. Of this 18%, 6% has to be kept as cash reserve and the rest 13% has to be kept in other forms such as deposits with other banks, securities and bands. After deducting this 18% from the total deposit, the rest 42% is investible fund for the bank.

While investing its assets, Janata Bank arranges its investible fund in order of rising profitability and diminishing liquidity. The process of such arrangement of the disposable fund is called the line of defense. Our lines of defense are under:

- Cash- Cash kept in the vault

- Money at call and short notice- Call market investment

- Bank’s Investment- Investment in Government Promissory Notes/Treasury Bills, Government loan etc.

- Bills- Bills purchased and discounted from the first class parties. Advances- The fifth line of defense consists of general advances comprising loan, overdraft, cash credit to different types of customers,

Different Industries and profession, small borrowers, trade, agriculture, Government and semi government organization etc.

Principles of sound lending:

Every branches or disbursement unit of loan and advances of Janata Bank Limited follows some principles for sound lending which are as follows:-

- Safety- Safety first is the guiding principles of Janata Bank Limited. Bank is in the business to make money. Like any other banks, Janata Bank mainly uses depositor’s money as a means of its earnings, but safety is never sacrificed for profitability. The money of the depositors being repayable on demand or after a short notice, determines the capacity of the bank as to the period for which he can safely lend it out without any uncalculated risk. So it is the declared principle of Janata Bank Limited to make such advance which is expected to come back in the normal course, that is, bank may not have to resort legal action or to sell the securities to liquidate the advance.

- Liquidity- Janata Bank stresses on the liquidity of the advance it makes. Liquidity means the availability of the Bank Funds on short notice. The liquidity of an advance means its repayment on demand on due date or after a short notice. The loans stand fair chances of repayment according to the repayment schedule. Otherwise the liquidity position of the bank will be endangered. Liquidity also signifies that the assets should be saleable without any loss. Even in the case of fully secured advances, if it is feared from the very beginning that advances would only be recovered by selling the securities, it is not considered a good advances. It must always therefore will be ensured that the advance will be repaid from sources other than the securities pledged. Keeping this in view, Janata Bank always prefers to lending to working capital and trading loan.

- Purpose- As a prudent banker, Janata Bank does not want to through money in the water. So before granting loans to the borrower, it thinks twice on what purpose it is lending. Whether the purpose for which the loan is being granted is in line with the guidelines and directions of the Central Bank of the country.

- Profitability- Banking is essentially a business which aims at earnings a good profit. No business organization can run successfully, without profit. If the banks cannot earn profit, it will not be in a position to pay the depositor’s due in time. Bank has also to meet its establishment and other charges/expenses. Interest earned by a bank on its advances is the main source of its income. The difference between the interest received on advances and the interest paid on deposits constitutes the major portion of the banker’s income.

- Spread- The advances made by Janata Bank Limited are broad based and are in keeping with the deposit structure. The advances are not in any particular direction or to one any particular industry. In this regard Janata Bank maintains a very good portfolio in maintaining balance in different sectors. It makes targets of disbursing loan on sector and product basis and disburses the loan accordingly. At this risk is greatly minimized.

- National Interest- Janata Bank plays a significant role in the economic development of our country. As a fully state-owned Bank, we generally lend in the sectors if the purpose of the advance is for overall national development plans necessitating flow of credit to priority sector in the large national interest. Sometimes, the need of the borrower may be considered so essential for the benefit of the national economy that despite heavy risks involved the advance is granted. For example: Agricultural loan. We have to disburse it for the national interest, not for profit. Because the interest we receive on this type of loan is far below the cost of fund. Yet we have to disburse it for ensuring the optimum level of food production.

- Forms of advances sanctioned and disbursed: – Advances are made in different forms such as loans, overdrafts, cash credits, bills purchased and discounted etc.

- Loans: – When an advance is made up in a lump sum repayable either in fixed monthly/quarterly/otherwise installments or in lump sum and no subsequent debit is ordinarily allowed except by way of interest, incidental charges, etc. it is called a loan. Loans are allowed to those parties who have either fixed source of income or who desire to pay it in lump sum. The whole amount or installment is debited to the customer’s loan account in the ledger and is paid to the borrower either in cash or by way of credit to his current /savings account. After creation of the loan, there will be only repayment by the borrower. A loan once repaid by in full or in part, cannot be drawn again by the borrower.

- Overdraft: The overdraft is a kind of advance always allowed on a current account operated upon by cheques. The customer is sanctioned. A certain limit upon which, he can overdraw his current account within a stipulated period. It is a continuous loan. In an overdraft account the balance may fluctuate day-to-day. It may increase by drawing of cheques by the customers and may decrease by the payment into the account.

- Cash Credit: Cash Credit is the favourite mode of borrowing by the traders, industrialists for meeting their working capital requirement. The goods hypothecated against this type credit can be easily being converted into cash and hence it is called cash credit. It may be of two types:

- Cash Credit-Hypothecation: In a manufacturing company or in trade whose stock in trade fluctuate frequently and it is difficult for the bank to control such changes, the bank allows hypothecation cash credit.

- Cash Credit- Pledge: In pledge, the possession and right of the goods are kept with the bank. Deliveries of the goods are made on the strength of delivery orders issued by the bank. Bills purchased and discounted: The banker makes loan by way of purchasing bills from the customers. In the case of purchase and discounting of bills, the banker credits the customer’s account with the amount of the bill after deducting his charges or discounts.

Janata Bank Janata Bhaban branch has disbursed loans on the following heads the overall position of which are as follows:

| Sl. no | Particulars | Figure in Taka(lacs) | ||

| 01. | Secured Overdraft{Financial obligation) | 8.64 | ||

| 02. | Secured Overdraft( Real Estate) | 217.00 | ||

| 03. | Staff House Building Loan | 431.00 | ||

| 04 | General loan | 1972 | ||

| 05 | Loan Against Provident Fund | 14.57 | ||

| 06. | Cash Credit | 96.00 | ||

| 07 | Loan against General House Building | 123.00 | ||

| 08 | Loan against Rural Credit | 25.26 | ||

Though loan against Rural Credit shows a figure of Taka 25.26 yet it is not agricultural loan. Various types of loans which do not fall under the traditional category mentioned in the Statement of affairs, have been incorporated under this head such as NGO Loan, Poverty alleviation loan, Doctors loan, Women loan, Service holder’s loan itc.

Major Agricultural Product

A vast majority of the Bangladeshis live in the rural areas and their main source of income is agriculture and agro-business. Janata Bank Limited has opened branches in rural areas to cater to the banking needs of rural people. Apart from accepting deposits from the rich and moderately well-off villagers, Janata Bank Limited encourages the poor people to make small savings through different mechanisms. As a fully state owned Commercial bank, Janata Bank Limited has got some social responsibility and obligation to the society. And form that viewpoint it invests money in the Agricultural sector which in monetary term is not apparently profitable. Because where its cost of fund is around 9%, it invests money in disbursing the crop loan which yields a return @ 8%. Other field of Rural Credit ranges from 9% to 14% interest on an yearly basis.

Objective

- To increase agricultural production and improvement its quality.

- To gear up socio-economic activities among rural people.

- To create employment opportunities among rural people through providing economic support.

Janata Bank Limited

As per the criteria set by the Bangladesh Bank Janata Bank Limited Janata Bhaban Branch is not vested with the responsibility of disbursing the agricultural loan as a rule, but it can disburse and does disburse some special type of loans related to poverty alleviation and agriculture. The example of such loans are Tadaraki loan (Supervised Credit), Service Holders loans Women entrepreneur loan etc. Besides this, with the prior approval of the Head Office, this branch can sanction/disburse Agriculture-based project loans at the rural areas within its command area if it is possible for the branch to supervise the loan in that area.

Micro Credit Program

The Micro Enterprise & Special Program Division (MESPD) is responsible for implementing of (i) Micro Credit Programs related with the poverty reduction, (ii) Special credit programs related with employment generation and (iii) Financing of agro-based industries.

Bank has different micro-credit programs of its own & in collaboration with other agencies. For successful implementation of these credit programs especially poverty reduction credit programs it requires close supervision and monitoring.

Considering Bank’s manpower/field staff it is not always possible to ensure intensive supervision at the grass root level. To make the micro credit programs time & cost effective bank has initiated linkage program using intermediaries/collaborating agencies (GOs & NGOs). Collaborating agencies are responsible for organizing the target groups (conducting survey, formation of groups, providing training etc. Including supervision and recovery of credit.

The General Credit Line

The main focus of Janata Bank Limited Credit Line/Program is financing business, trade and industrial activities through an effective delivery system.

Janata Bank Limited offers credit to almost all sectors of commercial activities having productive purpose.

The loan portfolio of the Bank encompasses a wide range of credit programs covering about 200 items.

Now It is seen from the Credit Line of Janata Bank Limited that Janata Bank Ltd disburses loan and advance in almost all the sector of Bangladesh. As a business Organization it aims at maximizing profit, but as a State owned Commercial Bank its main purpose is to bring maximum social benefit commensurate with the Monetary policy and social and economic target of the society as well as that of the state.

Export Financing

To boost up country’s Export, Janata Bank Limited has been providing different kinds of assistance to exporters. Some of which are as under:-

- Providing Pre-Shipment and Post-Shipment Finance, Export Guarantee and bonding facility etc.

- Concessional rate of interest for exports Finance.

- Back to Back L/C under bonded Warehouse facility

- Sight & Unasked L/C against Firm Contract for import of raw materials.

- Sight L/C under EDF

- Exporter’s Retention Quota A/C both interest bearing and non-interest bearing.

- Export incentive Program.

- Banking at Export Processing Zone

- Scope for establishment of export oriented industry by 100% foreign investment and by joint-venture

- The sole bank to disburse Government Export Promotion Fund against export of Computer Software & Data Entry Processing

- Undergone to an agreement with Bangladesh Bank to obtain fund from Government EEF (Equity & Entrepreneurship Fund) to build up entrepreneur’s equity.

- Providing services to the exporter by utilising most modernised technology like Swift, Reuters, Internet, Fax etc. Consultancy and advisory services by an expert group of officials.

- Special export financing program towards computer software data entry and service export.

Import Financing

Through quite a good number of Authorized Dealer Branches and 1198 nos. foreign correspondents world wide Janata Bank Limited has been extending full range import and relevant finance facilities.

Facilities Offered:

Janata Bank Limited

Janata Bank extends the Import Financing facilities to the importers. Mainly machinery parts are imported by the local merchants mainly from India, Pakistan and China. The volume of import through this branch by the local importer is around 25 crore Taka.

In Janata Bhaban corporate Branch

Customer balance list in static

Cash credit (hypo): Total A/c no -14=9512581.20

Overdraft (od) secured against financial obligation

(Balance as on: 30dec, 2010)

(Report date: 30dec, 2010)

Total =863737.74

Loan against general house building balance – 30dec, 2010

Total a/c no-12287058.29

Loan against commercial real estate: balance as on 30dec, 2010

Total a/c no -3=33937217

Loan against rural credit – 30dec, 2010

Total a/c no 52= 262587203 Tk

Loan general (other than MCI) – Total=194814949.00

Loan against staff house building =Total amount =43122520

Loan against provident fund – Total=1456979.00 Tk

Loan general (car loan) = 10, 01,000.00Tk

Loan general (MCL) Total=14, 02,549.00Tk

Staff computer loan =455,654.00Tk

30, Dec, 2009

Bridge finance =0.00

Loan against Rural credit =27, 1054, 123Tk

Loan against transport =0.00

Loan against general house building =140, 28,878.00

Loan general =26, 14,458.26

Loan against foreign bills =0.00

Loan against staff house building=26769732.04Tk

Loan against commercial real estate =6329931.00

Staff computer loan =542,988.00Tk

Total= 5819, 3725.15/=

Advance – overdraft: Odclean -0.00

TOD -11.00

OD secured -23, 82,227.74

Cash credit -83, 23,211.20

31 Jan, 2011

Loan against rural credit = 262574794.00 (interest rate for staff=13%or NGO=10%)

Loan against staff house building = 4, 10, 29062.7 (interest rate 13%)

Loan for general people =169663235 (here interest rate is more than 2% for FDR, DPS, SAVINGS interest rate)

Loan against staff house building = 4, 10, 29062.7 (interest rate 5%)

Loan against provident fund =1424971.00 (interest rate 5%)

Staff computer loan = 4, 39,328.00 (interest rate 5%)

Loan against commercial real estate =280, 30,159.00 (interest rate 13.5%)

Advance overdraft

| TOD | 11.00 |

| OD SECURED | 574453 |

| Cash credit | 103,53,649 |

| Total | 109,30,115.00 |

| Advance discount foreign documentary bills (for purchase ) | 47,56,375.76 |

Amount of the Credit of the Janata bank LTD

In Janata Bhaban cor. branch (30March, 2011)

| Particular | Amount |

| Rural credit | 26,25,68,270.00 |

| General house building | 1,18,15,628.00 |

| Transport | 00.00 |

| General | 16,98,37,659..00 |

| Staff house building | 4,15,14,028.79 |

| Provident fund | 14,17,56200.00 |

| Staff computer loan | 4,20,528.00 |

| Commercial real estate | 3,17,80,159.00 |

| Od secured | 5,74,590.74 |

| Cash credit | 91,62,045.20 |

| Foreign documentary bill | 47,56,375.00 |

ANALYZING THE FINANCIAL PERFORMANCE AND VARIOUS RATIO IN JBBL

Analyzing the financial performance (also called financial analysis) is so much essential for each and every business institution as well as for the Banking institutions. Financial analysis typically is associated with ratio analysis. Ratio analysis involves the methods of calculating and interpreting the financial ratios to analyze the firm’s relative financial performance. The main purpose of this analysis is to analyze and monitor the firm’s financial performance, so, that the interested parties (both the external and internal) can realize the firm’s actual performance easily, which is so much essential for the parties. There are several ratios that help a particular analyst to analyze the past performance of a particular firm and to diagnose the various relevant variables, which are important for improving the future operation of that firm. The financial ratios, those are useful for analyzing the past financial performance of a financial institution, such as – Bank, can be divided into five broad categories for convenience and they are enumerated below

Liquidity Ratio

Operating Efficiency Ratio

Profitability ratio

Liquidity Ratio: It measures a firm’s ability to meet up or satisfy its short term obligations, as they become due. The commonly used liquidity ratios are-

Net-working Capital: Net working Capital although not actually a ratios, is a common measure of firm’s overall liquidity. It measures a particular firm’s liquidity by measuring the excess of current assets over the current liabilities. So, it is calculated by using the following formula-

Net-working Capital=Total Current Asset – Total Current Liabilities

Table: x Net-working Capital ratio:

| name of ratio | years | ||||

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Net-working Capital | 56.651 | 106.307 | 26.924 | 68.930 | 95.844 |

Interpretation: We know that net-working capital measures a firm’s ability to serve its short term obligations as they become due, by measuring the excess of current assets over the current liabilities and the higher the ratio, the higher the liquidity of the firm. So after observing the above graph, we can say that the net working capital and as well as the liquidity of JANATA Bank is fluctuating year to year, which is risky for the company and the Bank had highest of liquidity in the year 2005 and lowest level of liquidity in year 2006 but the Bank’s liquidity is increasing at an increasing rate form the year of 2006 to 2008, as they have maintained a steady level of current liabilities, which is favorable for the Bank.

Current Ratio: A measure of liquidity, calculated by dividing the current assets by current liabilities. It shows the level of current assets that a particular firm has against per Taka of current liabilities of that firm. So the equation becomes-

Current ratio = Current assets / Current liabilities

| name of ratio | years | ||||

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| Current Ratio | 1.60 | 1.78 | 1.13 | 1.17 | 1.25 |

Interpretation: We know that, the current ratio measures a firm’s liquidity by measuring the portion of its current asset relative to its current liabilities and the higher the ratio, the higher the liquidity of the firm. So, after observing the graph shown above, I would like to say that the company’s current ratio is fluctuating year to year and Bank’s current ratios are always below the standard level (2), which is not good and risky for the firm – JANATA Bank. But from the year 2006 to 2008 Bank’s current ratio as well as the liquidity is increasing at slow rate, which is good for the Bank and the Bank should try to maintain or improve the liquidity of the Bank

Operating Cost to Income Ratio: It measures a particular Bank’s operating efficiency by measuring the percent of the total operating income that the Bank spends to operate its daily activities. It is calculated as follows:

Operating Cost to Income Ratio = Total Operating Cost/Total Operating Income

Table: Operating Cost to Income Ratio

| name of ratio | years | ||||

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Cost to Income Ratio (%) | 34.24 | 33.06 | 31.00 | 27.04 | 31.54 |

Interpretation: We know that this ratio measures the operating efficiency of a particular Bank my measuring the portion of the total operating costs relative to the total operating income of that Bank and the higher the ratio, the lower the operating efficiency and vice-versa. So, after observing the figure drawn above, I am able to say that, during the time period between the years 2005 to 2008, the operating efficiency of the JANATA Bank was increasing, which was a good sign of the Bank but in the year 2006, the ratio started to increase, which indicates that the Bank is incurring more costs than that of previous years and this is not a good sign for the Bank. So the Bank should give a close eye on this matter to improve its efficiency

Total Asset Turnover: Total Asset Turnover indicates the efficiency with which the firm uses its assets to produce operating income. It is calculated by using the following formula:

Total Asset Turnover = Total Operating Income /Total Assets

Table: Total Asset Turnovers

| name of ratio | years | ||||

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Total Asset Turnover | 0.052 | 0.047 | 0.05 | 0.047 | .048 |

Interpretation: We know that this ratio measures the return from per unit of total assets and the efficiency of the Bank in using its total assets to generate operating income and the higher the ratio, the higher the efficiency of the Bank in using its assets. So, after observing the given graph, we are able to say that the return from per unit of total asset, as well as the Bank’s efficiency in generating income is fluctuating from year to year and the Bank generated the maximum turnover in year 2005 and lowest turnover in the following year 2006 but from the year 2008 the return from per unit of asset is increasing, which is a good sign for the Bank and the Bank should try to maintain this performance.

Fixed Asset Turnover: It measures the return per unit of fixed assets. It is calculated by using the following formula –

Fixed Asset turnover = Total Operating Income/Net Fixed Assets

Table: Fixed Asset turnovers

| name of ratio | years | ||||

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Fixed Asset Turnover | 5.3 | 6.581 | 8.032 | 9.651 | 11.287 |

Interpretation: We know that this ratio measures the return from per unit of fixed assets as well as the Bank’s efficiency in using the fixed asset to generate return and the higher the ratio, the higher the efficiency of the Bank in using its fixed assets. So, after observing the given graph, I am able to say that the return from per unit of net fixed assets is increasing from year to year, which is a good sign for the company – JANATA Bank and the Bank should try to maintain the current level of performance for its future betterment.

Investment to Deposit Ratio: It shows the operating efficiency of a particular Bank in promoting its investment product by measuring the percentage of the total deposit disbursed by the Bank as loan & advance or as investment. The ratio is calculated as follows:

Investment to Deposit Ratio = Total General Investment/Total Accumulated Deposit

Table: Investments to Deposit Ratio

| Name of ratio | Years | ||||

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| Investment to Deposit Ratio (In percent) | 79.98 | 80.62 | 101 | 91.97 | 93.18 |

Interpretation: As we know that the ratio measures the Bank’s efficiency in promoting its investment product the customer and in using its funds collected from the customers to by measuring the percentage of total deposit that the Bank has disbursed as loan & advances and the higher the ratio the higher the Bank’s efficiency and vice-versa. So, from the figure drawn above, we are able to say that, the Bank’s investment to deposit ratio is fluctuating from year to year and in the year 2007 the Bank has disbursed the highest amount of loan & advances, which is above 100% of the total amount of deposit collected by the Bank in the same year and after the year 2007 the Bank has disbursed on an average of above 91% of the total deposit collected by the Bank in each year, which is good for the Bank

Classified Investment to Total Investment Ratio: It measures the level of classified investment (includes all those investment facilities where the irregularities have occurred in terms of repayment of the investment) as percent of the total investment, which is loan & advances. It is calculated as follows:

Classified Investment to Total Investment Ratio = Total Classified Investment/Total InvestmentTable: xvi Classified Investment to Total Investment Ratio

Table: Gross Classified Investment Ratio

| NAME OF RATIO | YEARS | ||

| 2005 | 2006 | 2007 | |

| Gross Classified Investment Ratio (%) | 2.20 | 1.89 | 1.80 |

Classified Investment to Total Investment Ratio

Interpretation: As this ratio measures the level of classified investments, which are problem loan for a particular Bank and the lower the ratio, the higher the efficiency of the Bank in loan management. So after having a close eye on the figure drawn above, we are able to say that the Bank’s efficiency is increasing year to year as the level of classified investment is decreasing from year to year. So the Bank has a good hand in loan management and should try further to reduce the level of classified investment more, which will help them to increase their value in the mark

Profitability Ratios: These ratios help us to evaluate the firm’s profits with respect to sales, assets, or equity. These ratios tell a story about where the firm has been, not where it is going. Ratios are:

Net Profit Margin: It measures the percentage total operating income, that remains after all the costs and expenses have been paid. It is calculated as follows-

Net Profit Margin = Net Profit after Tax/Total operating Income

Table: Net Profit Margin

| name of ratio | years | ||||

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Net Profit Margin | 34.24% | 30.31% | 31.52% | 34.46% | 32.29% |

Interpretation: we know that this ratio shows us the portion of total operating income that remains after deducting all the costs and expenditure for particular period of time. From the above graph, we can say that the company’s net profit margin is fluctuating from year to year or over the time and the Bank has generated maximum amount of net profit margin in the year 2008, which is 34.46% and lowest amount of margin in 2006 which is 30.31%. So I can conclude that the Bank generates net profit in each year on an average rate of above 31% of the total operating income.

Return on Total Assets (ROA): It is also called Return on Investment (ROI) and it measures the overall effectiveness of management in generating profit with its available assets. It is calculated as follows

ROA = Net Profit after Tax / Total Assets

Table: Return on Total Assets (ROA)

| name of ratios | years | ||||

| 2005 | 2006 | 2007 | 20068 | 2009 | |

| ROA or ROI (%) | 1.78 | 1.42 | 1.57 | 1.65 | 1.56 |

Interpretation: After having a careful view on the graph we are able to say that the Bank’s effectiveness to generate return by using its available assets is fluctuating from year to year and the Bank has generated maximum amount of ROE in the year of 2004and due to lack of efficiency in utilization of assets the Bank’s ROE falls in the minimum level in the year of 2007 and after the year 2007 the Bank’s ROE started to increase at a slow rate up to the year of 2009 but in the year 2006 the Bank’s ROE again started to fall, as the Bank has introduced some new branches which has increased the Bank’s non-interest expense

Return on Equity (ROE): It measures the return earned by the funds invested by the common stockholders. It is calculated as follows:

ROE = Net Profit after Tax/Shareholder’s Equity

Table: Return on Equity (ROE)

| name of ratios | years | ||||

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| ROE (%) | 36.53 | 34.53 | 27.27 | 29.04 | 20.90 |

Interpretation: The Company’s return on equity is decreasing over the time, which is not good for the Bank. The JANATA Bank has generated maximum amount of ROE in the year 2006, which is 36.53% but after that, the Bank’s ROE is decreasing from year to year, which is not favourable for the EXIM Bank. The ROE is decreasing from the year 2007 to year 2009 as the amount of proposed dividend and paid up capital of the Bank has increased lot during this period of time but compare to that the amount of net profit is not increasing that much for its higher provision.

Conclusion

Janata Bank Limited is the fastest growing State-owned Commercial Banks in Bangladesh. For its outstanding performance it has won international award for a number of times and consecutively for three years. In this report I briefly discussed loan and advance. Loan and Advances occupy a very important position in modern banking. A bank is a business enterprise of the country. It is a profit-seeking concern as any other commercial and industrial organization. A bank cannot be benefited only by taking deposits from public with finding proper avenues for investing them in profitable venture now to boost up its standard of service, it is putting much more emphasis on automation and new technology based product such as ATM, Ready Cash, Instant Cash, etc. The bank is tremendously advancing in the field of import and export financing. It is also financing the textile and jute sector and shrimp culture etc. But one alarming thing is that as the bank do not ensure better salary and emolument to it’s employees in comparison to the employees of the private banks, the trained manpower of the bank go out in the hope of better salaries and other benefits. This practice should be stopped by providing them with competitive salaries and other benefits and training facilities. If the bank goes for further expansion in the profitable places with profitable product such as merchant banking, the bank will be able to earn more profit. It is mention worthy that in the year 2010 it has turned out to the highest profit maker in Bangladesh by earning before tax profit of Taka 860 crore and it is the expectation of all that the bank will be able to continue this trend in the coming years. We wish Janata Bank Limited all the best.