Banking Overview of International Finance Investment and Commerce Bank Limited

International Finance Investment and Commerce Bank Limited (IFIC Bank) is banking company incorporated in the People’s Republic of Bangladesh with limited liability. It was set up at the instance of the Government in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial institutions aboard. In 1983 when the Government allowed banks in the private sector, IFIC was converted into a fully fledged commercial bank. The Government of the People’s Republic of Bangladesh now holds 32.75% of the share capital of the Bank. Directors and Sponsors having vast experience in the field of trade and commerce own 8.62% of the share capital and the rest is held by the general public.

The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central banks, 4 nationalized commercial banks (NCB), 5 government owned specialized banks, 30 domestic private banks, 10 foreign banks and 28 non-bank financial institutions. The Financial system also embraces insurance companies, stock exchanges and co-operative banks. In our country Bangladesh Bank (BB), as the central bank, has legal authority to supervise and regulate all the banks. It performs the traditional central banking roles of note issuance and of being banker to the government and banks. Commercial banks and domestic private banks are the profit-making institution that holds the deposits of individuals & business in checking & savings accounts and then uses these funds to make loans. Both general public and the government are dependent on the services of banks as the financial intermediary. We have chosen IFIC Bank Limited as a representative of other private banks. We have learned so many things in our course and here we tried to relate the theories with real life situation and also find out the similarities.

Bank’s Mission

Our Mission is to provide service to our clients with the help of a skilled and dedicated workforce whose creative talents, innovative actions and competitive edge make our position unique in giving quality service to all institutions and individuals that we care for.

We are committed to the welfare and economic prosperity of the people and the community, for we derive from them our inspiration and drive for onward progress to prosperity. We want to be the leader among banks in Bangladesh and make our indelible mark as an active partner in regional banking operating beyond the national boundary. In an intensely competitive and complex financial and business environment, we particularly focus on growth and profitability of all concerned.

Banking system of Bangladesh has through three phases of development Nationalization, Privatization and lastly Financial Sector Reform. IFIC Bank Limited has started its journey as a private commercial bank on June 24, 1983.

The whole working process of Federation Branch, IFIC Bank is divided into three sections-1) General Banking Section 2) Credit Section 3) Foreign Exchange Section. I was assigned on credit Sections for three (03) months. So my report is based on Credit, its risk and assessment system.

General banking is the starting point of all the operations. It is the department, which provides day-to-day services to the customers. It opens new accounts, remit funds, issue bank drafts and pay orders etc. provide customer through quick and sincere service is the goal of the general banking department.

Foreign exchange department plays significant roles through providing different sorts of L/C services like L/C opening, quicker delivery of goods L/C through SWIFT to the advising bank. Bank credit is an important means for bringing about economic development in a country. IFIC Bank Limited, being one of the private commercial bank of the country, has some prejudice to finance directly on priority basis to agriculture, industry and commerce sector. Hence, it is very clear that IFIC Bank plays an important role to move the economic wheel of the country.

Milestones in the development of IFIC BANK

- 1976-Established as an Investment & Finance Company under arrangement of joint venture with the Govt. of Bangladesh.

- 1980-Commenced operation in Foreign Exchange Business in a limited scale.

- 1982-Obtained permission from the Govt. to operate as a commercial Bank, Set up its first overseas joint venture (Bank of Maldives Limited) in the Republic of Maldives (IFIC’s share in Bank of Maldives limited was subsequently sold to Maldives Govt. in 1992)

- 1983-Commenced operation as a full-fledged commercial bank in Bangladesh.

- 1985-Set up a joint venture Exchange Company in the Sultanate of Oman, titled Oman Bangladesh Exchange Company (Subsequently renamed as Oman International Exchange, LLC)

- 1987-Set up its first overseas branch in Pakistan at Karachi

- 1993-Set up its second overseas branch in Pakistan at Lahore

- 1994-Set up its first joint venture in Nepal for banking operation, titled Nepal Bangladesh Bank Ltd.

- 1999-Set up its second joint venture in Nepal for lease financing, titled Nepal Bangladesh Finance & Leasing Co. Ltd. (Which was merged with NBBL in 2007)

- 2003-Set up a new Bank in Pakistan, NDLC-IFIC Bank Ltd. (Subsequently renamed as NIB Bank Ltd.) and the Overseas Branches of IFIC and a local leasing company, NDLC were amalgamated with and into it.

- 2005-Acquired MISYS solution for real time online banking application-Core Risk Management implemented

- 2007-Launched VISA branded Credit Card (completed full range of Cards i.e. Debit, Credit & Prepaid by 2010)

- 2010-Set up Offshore Banking Unit (OBU)

- 2011-Established a fully owned subsidiary exchange company named IFIC Money Transfer (UK) Ltd.

- 2012-Inauguration of 100th Branch at Tejgaon-Gulshan Link Road in Dhaka

Management Structure:

The thirteen members of the Board of Directors are responsible for the strategic planning and overall policy guidelines of the Bank. Further, there is an Executive Committee of the Board to dispose of urgent business proposals.

Besides, there is an Audit Committee in the Board to oversee compliance of major regulatory and operational issues.

The CEO and Managing Director, Deputy Managing Director and Head of Divisions are responsible for achieving business goals and overseeing the day to day operation.

The CEO and Managing Director are assisted by a Senior Management Group consisting of Deputy Managing Director and Head of Divisions who supervise operation of various Divisions centrally and co-ordinates operation of branches.

Key issues are managed by a Management Committee headed by the CEO and Managing Director. This facilitates rapid decisions.

There is an Asset Liability Committee comprising member of the Senior Executives headed by CEO and Managing Director to look into all operational functions and Risk Management of the Bank.

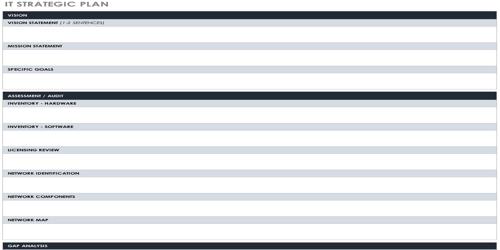

IFIC Bank at a glance:

Financial highlights: As at December 31, 2011

Main Services of IFIC Bank

The main services that are offered by IFIC bank are given below,

1) Corporate Banking: It includes

- Working Capital Finance

- Project Finance

- Term Finance

- Trade Finance

- Lease Finance

- Syndication Finance

2) Retail Banking:

- Consumer Finance

- Deposit Products

- Credit Card

- Debit Cards

- Pre paid Cards

- NRB Account

- Student File

- SME Banking

3) SME Banking

- Easy Commercial Loan

- Retailers Loan

- Transport Loan

- Commercial House

Building Loan

- Possession Right Loan

- Contractor’s Loan

- Bidder’s Loan

- Working Capital Loan

- Project Loan

- Trade Finance

- Muldhan

- Women Entrepreneur’s Loan

4) Treasury and Capital Market

- Money Market

- Forex Market

- Brokerage House

5) Agriculture Credit

- Krishi sharonjam rin

- Shech soronjam rin

- Phasali rin

Job Description

As an internee my I have performed numerous activities. My main task was to assist officers and executives in every aspects of their daily work. It includes every activity that the officials performed like dealing with posting customers, computer, document analysis etc.

Specific responsibilities of the job

- Dealing with customers

- Assisting employees in their day to day operations

- Maintaining different registers

- Computer posting of transactions

- Sorting of Cheque, vouchers

Different aspects of job performance

- It helped me to learn banking activities

- It has enhanced my knowledge

- I was able to complete almost every task successfully

Critical observation

- Working environment was excellent

- Employees were very much helpful

- I learned a lot of things in a short time

FOREIGN EXCHANGE DEPARTMENT OF IFIC BANK

One of the largest businesses carried out by the commercial bank is foreign trading. The trade among various countries falls for close link between the parties dealing in trade. The situation calls for expertise in the field of foreign operations. The bank, which provides such operation, is referred to as rending international banking operation. Mainly transactions with overseas countries are respects of import; export and foreign remittance come under the preview of foreign exchange transactions. International trade demands a flow of goods from seller to buyer and of payment from buyer to seller. In this case the bank plays a vital role to bridge between the buyer and seller.

Foreign Exchange Department is an international department of the bank. It deals with globally and facilitates international trade through its various modes of services. It bridges between importers and exporters. Bangladesh Bank issues license to scheduled banks to deal with foreign exchange. These banks are known as Authorized Dealers. If the branch is authorized dealer in foreign exchange market, it can remit foreign exchange from local country to foreign country. This department mainly deals with foreign currency. This is why this department is called foreign exchange department.

Some national and international laws regulate functions of this department. Among these,Foreign Exchange Act, 1947 is for dealing in foreign exchange business, and Import and Export Control Act, 1950 is for Documentary Credits. Governments’ Import and Export policy is another important factor for import and export operation of banks.

Banking system of Bangladesh has through three phases of development Nationalization, Privatization and lastly Financial Sector Reform. IFIC Bank Limited has started its journey as a private commercial bank on June 24, 1983.

The whole working process of Federation Branch, IFIC Bank is divided into three sections-1) General Banking Section 2) Credit Section 3) Foreign Exchange Section. I was assigned on credit Sections for three (03) months. So my report is based on Credit, its risk and assessment system.

General banking is the starting point of all the operations. It is the department, which provides day-to-day services to the customers. It opens new accounts, remit funds, issue bank drafts and pay orders etc. provide customer through quick and sincere service is the goal of the general banking department.

Foreign exchange department plays significant roles through providing different sorts of L/C services like L/C opening, quicker delivery of goods L/C through SWIFT to the advising bank. Bank credit is an important means for bringing about economic development in a country. IFIC Bank Limited, being one of the private commercial bank of the country, has some prejudice to finance directly on priority basis to agriculture, industry and commerce sector. Hence, it is very clear that IFIC Bank plays an important role to move the economic wheel of the country.

The financial system of Bangladesh consists of Bangladesh Bank (BB) as the central banks, 4 nationalized commercial banks (NCB), 5 government owned specialized banks, 30 domestic private banks, 10 foreign banks and 28 non-bank financial institutions. The Financial system also embraces insurance companies, stock exchanges and co-operative banks. In our country Bangladesh Bank (BB), as the central bank, has legal authority to supervise and regulate all the banks. It performs the traditional central banking roles of note issuance and of being banker to the government and banks. Commercial banks and domestic private banks are the profit-making institution that holds the deposits of individuals & business in checking & savings accounts and then uses these funds to make loans. Both general public and the government are dependent on the services of banks as the financial intermediary. We have chosen IFIC Bank Limited as a representative of other private banks. We have learned so many things in our course and here we tried to relate the theories with real life situation and also find out the similarities.

Recommendations

Banking is a service –oriented marketing, the business profit depends on its service quality. That is why the authority always should be aware about their service.

- Strict Supervision must be adapted in case of high risk borrowers. Time to time visit to the projects should be done by the bank officers.

- The average number of days required for sanctioning and disbursement of credit against specific loan proposal should be reduced.

- The performance evaluation system is not updated. The organization should follow the 360-degree performance evaluation system. In this case, the superior executives will not be much rude to the subordinates because the top-level employees’ performance will be evaluated by the subordinates.

- Selection of borrower shall be made as per rules and procedures of the advances and after making proper assessment of business establishment, respectability, creditability, actual requirement of fund repayment capacity etc. Appraisal of feasibility and viability of the projects shall be done in proper manner examining all the factors by an efficient and qualified appraiser so that no difficulties are faced at any stage of the project from construction to production stage.

- The bank should not always be very much sensitive of recovery of loans and will not bring necessary pressures for recovery provided the borrowers are incorrigible and habitual defaulters. The lenders shall not resort to any hasty decision and take legal action against the borrowers if there is any scope for recovery of the dues on compromise terms even by allowing some concession of interest and rescheduling the repayment program by allowing reasonable time to the borrowers.

- Problem of the borrower’s projects or business, which have turned sick unavoidable circumstances of unforeseen events, shall be looked into sympathetically by the lending bank. If necessary, bank shall not hesitate to allow further finance to revive the sick unit to ensure safe recovery of the loan in future for which a suitable repayment schedule may be prepared in consultation with borrowers.

- The lenders shall take legal action against the incorrigible defaulting borrowers who are avoiding payment on flimsy grounds without bonafide intention to square up their dues without wasting of time. Money suits & criminal cases filed against the bad borrower shall be closely followed up for early decision of the court and immediate steps shall be taken for satisfaction of the decrees against the judgment debtors.

- Alertness and education amongst the sub-conscious about their obligation to return bank’s money in time and utilization of funds of funds only for productive purpose of motivation and education field assistants of the lending bank may play vital role.

- Highly efficient employee should take responsibility for loan and advance section.

- CIB report should maintain properly.

- Documentation about loans should maintain properly.

- The lenders shall sanction and disburse loan to the borrowers in proper time of investment. They will see that no delay is caused in completing formalities and processes which may create problem to the borrowers to divert funds elsewhere or want of scope for investment and thus the funds become stuck up ultimately. So loans should always be sanctioned & disbursed in proper time of investment to ensure recovery of the loan in time from the borrowers.