Performance of the Bank

The Shahjalal Islami Bank Limited (SJIBL) was incorporated as a public limited company on April 01, 2001 under Companies Act. 1994. The bank started commercial banking operations effective from May 10, 2001. During this short span of time the bank of time the Bank had been successful to position itself as a progressive and dynamic financial institution in the country. The Bank had been widely acclaimed by the business community from small businessmen / entrepreneurs to large traders and industrial conglomerates, including the top rated corporate borrowers for forward-looking business outlook and innovative financing solutions. The operating profit of the Bank in the year 2003 was appreciable compared to the loss of last year.

SJIBL has been able to achieve appreciable progress in all areas of its operations during the year 2001 and but the Bank incurred loss of Tk. 88.42 crore in foreign exchange dealing business. The Board Audit Team and Bangladesh Bank Inspection Team detected the issue of loss in early 2004 and thereafter the total loss was ascertained and determined by the Bank and conveyed to Bangladesh Bank seeking their guidance.

Pursuant to the direction of Bangladesh Bank in this regard vide their letter dted 19th August 2004, the aforesaid loss was accounted for and the sponsor shareholders of the bank has infused additional capital of Tk. 48.75 crore within 31st December 2004 which has since been increased by Tk. 21.77 to Tk. 70.52 crore raising the total share capital to Tk. 93.58 crore and total apparent capital to Tk. 102.39 crore.

The Authorized Capital of the Bank remains changed at Tk. 80.00 crore to Tk. 200.00 crore. 46,68,250 fully paid ordinary shares of Tk. 100 each subscribed and paid-up by the sponsor Shareholders. Issued for cash: 4,412,000 shares of Tk. 100 each and issued other than cash 256,250 shares of Tk. 100 each.

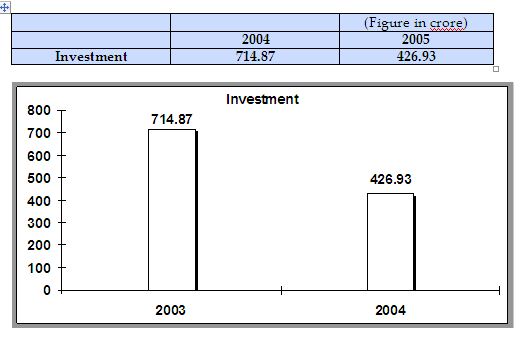

The total loans and advances made by the Bank amounted to Tk. 7,148,683,655 as on December 31, 2005 against Tk. 4,269,321,820.

SWOT Analysis

SWOT Analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help the organization to navigate in the turbulent ocean of competition.

Company Reputation

SJIBL has already established a favorable reputation in the banking industry of the country particularly among the new comers. With in a period of seven years, SJIBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have leaded them to earn a reputation in the banking field.

Sponsors

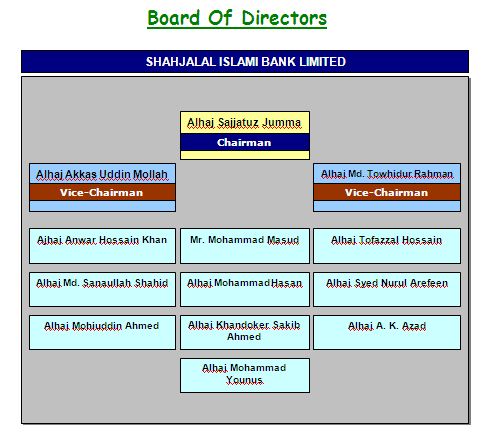

SJIBL has been founded by a group of eminent entrepreneurs of the country having adequate financial strength. The sponsor directors belong to large industrial conglomerates of the country. The Board of Directors headed by its Chairman Mr. Alhaj Sajjatuz Jumma has years of experience and has earned the reputation of being a successful businessman. Other directors include Mr. Alhaj Akkas Uddin Mollah, who is also built a wide field in garments sector and Alhaj Mohammad Faruque, Chairman of the Perfumery & Chemical Industries of

Bangladesh who is also the owner of the country’s largest perfumery projects. Therefore, SJIBL has a strong financial strength and is built upon a strong foundation.

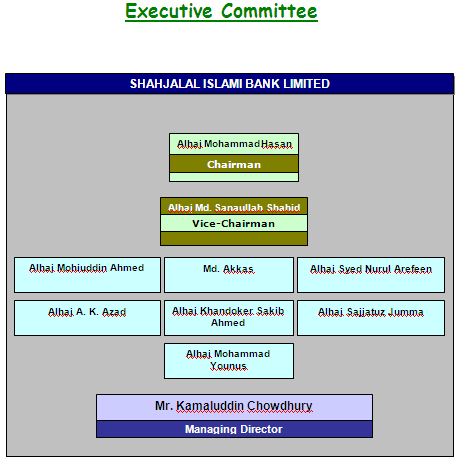

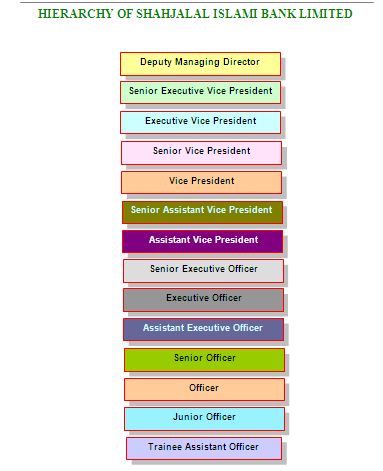

Top management

Like the CEO and DMD the top management of the bank is also a major strength for the SJIBL and has contributed heavily towards the growth and development of the bank. The top management officials have all worked in reputed banks and their years of banking experience, skill, and expertise will continue to contribute towards further expansion of the bank. At SJIBL, the top management is the driving force and the think tank of the organization where policies are crafted and often cascaded down.

Market share profitability

As already mentioned earlier, SJIBL has established a fin-n footing among the new comers in the banking industry of Bangladesh. They have already achieved a high growth rate accompanied by an impressive profit growth rate in 2003. The number of deposits and the loans and advances are also increasing rapidly.

Strong financial resources

Shahjalal Islami Bank Limited has strong financial resources to run the banking business. In the year 2004 the capital fund of the bank including paid up capital, reserves, retained earnings stood at around Tk 46.68 crore. It is expected that in the near future the banks financial resources will get much stronger.

Facilities and Equipment

SJIBL has adequate physical facilities and equipment’s to provide better service to the customers. The bank has computerized banking operations under the software called PC Bank. Counting machines in the teller counters have been installed for speedy service at the cash counters. Computerized statements

for the customers as well as for the internal use of the banks are also available. All the branches of SJIBL are equipped with telex or fax facilities. The Head Office and the Dhaka & Chittagong based branches also have Internet facilities.

Impressive Branches

SJIBL has earned a reputation in the banking sector for establishing impressive branches. The Mitford Branch, Gulshan Branch, Dhanmondi Branch, Foreign Exchange Branch and the Agrabad Branch are the most lavish and impressive branches of SJIBL. This creates a positive image in the minds of the potential customers and many people get attracted to the bank. This is also an indirect marketing campaign for the bank for attracting customers. The other branches of the bank are also impressive and are compatible to foreign banks.

Interactive Corporate Culture

SJIBL has an interactive corporate culture. Unlike other local organization, SJIBL’s working environment is very friendly, interactive and informal. There are no hidden barriers or boundaries while interactive among the superior or the subordinate. The environment is also lively and since the nature of the banking job itself is monotonous and routine, SJIBL’s lively work environment boosts up the sprit and motivation of the employees. At the same time, music system in the office also plays a key role in making the environment lively.

Team work at mid level and lower level

At SJIBL’s mid level and lower level management, there are often team works. Many jobs are performed in-groups of two or three in order to reduce the burden of the workload and enhance the process of completion of the job. People are eager to help each other and people in general are devoted to work.

SWOT Analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help the organization to navigate in the turbulent ocean of competition.

Company Reputation

SJIBL has already established a favorable reputation in the banking industry of the country particularly among the new comers. With in a period of seven years, SJIBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have leaded them to earn a reputation in the banking field.

Sponsors

SJIBL has been founded by a group of eminent entrepreneurs of the country having adequate financial strength. The sponsor directors belong to large industrial conglomerates of the country. The Board of Directors headed by its Chairman Mr. Alhaj Sajjatuz Jumma has years of experience and has earned the reputation of being a successful businessman. Other directors include Mr. Alhaj Akkas Uddin Mollah, who is also built a wide field in garments sector and Alhaj Mohammad Faruque, Chairman of the Perfumery & Chemical Industries of

Bangladesh who is also the owner of the country’s largest perfumery projects. Therefore, SJIBL has a strong financial strength and is built upon a strong foundation.

Top managemen

Like the CEO and DMD the top management of the bank is also a major strength for the SJIBL and has contributed heavily towards the growth and development of the bank. The top management officials have all worked in reputed banks and their years of banking experience, skill, and expertise will continue to contribute towards further expansion of the bank. At SJIBL, the top management is the driving force and the think tank of the organization where policies are crafted and often cascaded down.

Market share profitability

As already mentioned earlier, SJIBL has established a fin-n footing among the new comers in the banking industry of Bangladesh. They have already achieved a high growth rate accompanied by an impressive profit growth rate in 2003. The number of deposits and the loans and advances are also increasing rapidly.

Strong financial resources

Shahjalal Islami Bank Limited has strong financial resources to run the banking business. In the year 2004 the capital fund of the bank including paid up capital, reserves, retained earnings stood at around Tk 46.68 crore. It is expected that in the near future the banks financial resources will get much stronger.

Facilities and Equipment

SJIBL has adequate physical facilities and equipment’s to provide better service to the customers. The bank has computerized banking operations under the software called PC Bank. Counting machines in the teller counters have been installed for speedy service at the cash counters. Computerized statements

for the customers as well as for the internal use of the banks are also available. All the branches of SJIBL are equipped with telex or fax facilities. The Head Office and the Dhaka & Chittagong based branches also have Internet facilities.

Impressive Branches

SJIBL has earned a reputation in the banking sector for establishing impressive branches. The Mitford Branch, Gulshan Branch, Dhanmondi Branch, Foreign Exchange Branch and the Agrabad Branch are the most lavish and impressive branches of SJIBL. This creates a positive image in the minds of the potential customers and many people get attracted to the bank. This is also an indirect marketing campaign for the bank for attracting customers. The other branches of the bank are also impressive and are compatible to foreign banks.

Interactive Corporate Culture

SJIBL has an interactive corporate culture. Unlike other local organization, SJIBL’s working environment is very friendly, interactive and informal. There are no hidden barriers or boundaries while interactive among the superior or the subordinate. The environment is also lively and since the nature of the banking job itself is monotonous and routine, SJIBL’s lively work environment boosts up the sprit and motivation of the employees. At the same time, music system in the office also plays a key role in making the environment lively.

Team work at mid level and lower level

At SJIBL’s mid level and lower level management, there are often team works. Many jobs are performed in-groups of two or three in order to reduce the burden of the workload and enhance the process of completion of the job. People are eager to help each other and people in general are devoted to work.

Mission:

- To establish and develop a market drives leadership and lays great emphasis on securing of quality business.

- Through pragmatic and market friendly policies to continue increase in volume of business.

- Product / Service expansion.

- Maintaining internal quality management through training to its employees.

Vision:

“To build an institution that can stand the test of time and one day emerges as world class Bank by the year 2010”

Long-term objective:

To be the market leader both in terms of deposits and good loans among private commercial banks by 2010.

Short-term objective:

- To increase current market shares at least 2% by 2008.

- To increase it’s number of branches to 20 by 2008.

Goals:

- Become the most profitable bank.

- Provides highest level of satisfaction to customers.

- Enhance the value of shareholders investments and optimize return on their investment.

Strategic Intent:

Bring out new financial products and to ensure that customers receive a consistent standard quality of service.

Business Strategies:

- Achieve business vision through quality and customer acceptance by providing financial services.

- Maintain highest ethical standards in every aspect.

- Customer focus – a perspective of quality throughout:

- The entire organization or each department and bank.

- All processes, systems and services.

- Compliance – with regulatory requirements.

- Added value – through continuous improvements to benefit customers and the bank.

Product

The bank introduced three new products within last one year. All present products of the bank were introduced earlier.

Price

Many deposit products of the bank are paying almost same interest rate like other players. Though it is helping the bank to lower its cost of fund but at the same time the bank should think about increasing interest rate. By doing so the bank can win its competitors’ customers.

Place

Since the bank has only 17 branches its limited geographical coverage resulted in lost sales. However, existing branch network produced satisfactory results.

Promotion

The bank published its advertisement in the newspapers and magazines only. It did not sponsor any event like sports or seminars so far. The bank should have some promotional plan in this competitive age.

Research and Development

Shahjalal Islami Bank Limited has a sound R&D department, which is very essential for the growth of a bank. Without doing rigorous research it is not possible to develop innovative financial products. Customers are waiting for new products. As banking industry in Bangladesh is very competitive,

Shahjalal Islami Bank Limited is working ceaselessly with its experienced research team to develop new strategies and products.

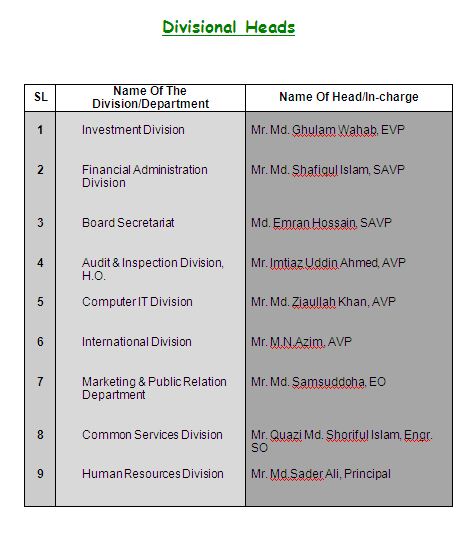

Human Resource Practices

As before Shahjalal Islami Bank Limited continues to extend its unstinted support to the development of its Human Resources since as a service-oriented industry with undifferentiated products, it has to depend to a very large extent on its Human Resources. Paramount importance is therefore given towards its development. The Bank with the assistance of Bangladesh Institute of Bank Management (BIBM) and a few other professional institutions, organized regular training and orientation courses to update and enhance the professional skills and knowledge of the officers and staff.

Since the problems are interrelated I am not categorizing them into strategic, financial, and operating problems. The main problems for Shahjalal Islami Bank Limited are as follows:

Absence of strategic planning

Business environment is changing is very fastly with globalization and fast change of technology which created enormous potentiality as well as threat for the whole business. But to arrest / exploit the potentiality most of the financial institution does not have any strategic planning in terms of human resources, business policy, market segmentation, and application of technology. Southeast Bank is no exception of that.

Highly centralized lending authority:

One of the major problems of Shahjalal Islami Bank Limited is its highly centralized lending authority. Market environment is becoming highly competitive as well as volatile which requires instant decision making to exploit business potentiality. Inspite of globalization of economy, business opportunity on region basis also has been created which demands decentralized making process.

Interference of the sponsors in the daily affairs

Private sponsor’s directors, whose outlook is yet to be professional for running a sophisticated business like banking, run most of the Banks under private sectors. They frequently make undue interference, which hampers day-to-day operation of business. The sponsors’ directors of Shahjalal Islami Bank Limited also make undue interference in the day-to-day operation of the Bank.

Absence of structured marketing and credit policy

The increasingly competitive and fast changing business environment requires a clear policy guidelines; structured marketing and credit policy. But the banks do not have such policy. Banks are run by thumb rule which may ultimately leads to wrong decision.

Highly subjective judgment in lending decision making

Another major problem of Southeast Bank Limited is using highly subjective judgment in lending decision making. Due to lack of forward looking structuring policy banks resort to subject to judgment based on current situation.

Poor Human resource management

In order to cope with the fast changing scenario and technology human resource should be treated as best asset, but Shahjalal Islami Bank Limited do not have any forward looking policy guidelines to recruit, develop and trained their manpower.

Poor fund management

Globalization of the economy is creating enormous opportunity for worldwide free flow of fund, to ensure economization of fund, but Shahjalal Islami Bank Limited does not have such policy guidelines.

Lack of co ordination among the branches and Head Office

Another major problem of Shahjalal Islami Bank Limited is lack of co- ordination among the branches and Head Office. Coordinated approach has to be developed among the branches as well as Head office for ensuring proper utilization of fund, business opportunity and avoiding threats. In this regard Information Technology and Training, seminar may utilize properly.

Limited branch network:

Shahjalal Islami Bank Limited covers only three districts out of sixty-four districts of Bangladesh with 21 branches. That is not enough for their customers.

Concentration of loans:

Shahjalal Islami Bank Limited provides sophisticated services to their big corporate clients mainly. They need to introduce many innovative and enterprising schemes to support small investors and budding entrepreneurs.

Balance Sheet

As at 30th june, 2006

At 30.06.2006 | At 31.12.2005 | |||||||

| Note | Taka | Taka | ||||||

| PROPERTY AND ASSETS | ||||||||

| Cash | ||||||||

| Cash in hand (Including Foreign Currencies) | 3 | 143,605,061 | 114,993,795 | |||||

| Balance with Bangladesh Bank & Sonali Bank | ||||||||

| (Including Foreign Currencies) | 4 | 1,010,178,622 | 761,985,278 | |||||

1,153,783,683 | 876,979,073 | |||||||

| Balance with other Banks and Financial Institutions | ||||||||

| Inside Bangladesh | 2,532,159,715 | 2,165,050,957 | ||||||

| Outside Bangladesh | 239,040,194 | 111,375,940 | ||||||

| 5 | 2,771,199,909 | 2,276,426,897 | ||||||

| Investments in Securities | ||||||||

| Government | 300,000,000 | 200,000,000 | ||||||

| 6 | 300,000,000 | 200,000,000 | ||||||

| Investments | ||||||||

| Murabaha, Bai-Muajjal etc. | 11,995,292,937 | 10,211,090,674 | ||||||

| Bills Purchased and Discounted | 805,236,812 | 379,179,485 | ||||||

| 7 | 12,800,529,749 | 10,590,270,159 | ||||||

| Fixed Assets Including Premises, Furniture and | ||||||||

| Fixtures etc | 8 | 90,260,511 | 82,999,505 | |||||

| Other Assets | 9 | 272,010,859 | 246,734,207 | |||||

| Deferred Tax Asset | 10 | – | 174,311,590 | |||||

| Non Banking Assets | – | – | ||||||

| Total Assets | 17,387,784,711 | 14,447,721,431 | ||||||

| LIABILITIES AND CAPITAL | ||||||||

| Liabilities | ||||||||

| Financing (Borrowings) from other Banks, | ||||||||

| Financial Institutions and Agents | 11 | 945,000,000 | 1,125,000,000 | |||||

| Deposits and Other Accounts | ||||||||

| Al-Wadiah Current Deposits & Other Accounts | 1,467,851,880 | 925,604,924 | ||||||

| Bills Payable | 160,619,581 | 181,388,686 | ||||||

| Mudaraba Saving Deposits | 982,699,419 | 1,039,882,525 | ||||||

| Mudaraba Term Deposits | 8,157,604,109 | 6,846,747,092 | ||||||

| Other Mudaraba Deposits | 4,279,590,688 | 3,211,001,942 | ||||||

| 12 | 15,048,365,677 | 12,204,625,169 | ||||||

| Other Liabilities | 13 | 433,776,814 | 376,399,524 | |||||

| Total Liabilities | 16,427,142,491 | 13,706,024,693 | ||||||

| Capital/Shareholders’ Equity | ||||||||

| Paid-up Capital | 14 | 935,825,000 | 935,825,000 | |||||

| Statutory Reserve | 15 | 189,508,632 | 109,616,818 | |||||

| Retained Earnings/(Loss) | 16 | (164,691,412) | (303,745,080) | |||||

| Total Shareholders’ Equity | 960,642,220 | 741,696,738 | ||||||

| Total Liabilities & Shareholders’ Equity | 17,387,784,711 | 14,447,721,431 | ||||||

Profit and Loss account

For the half year ended 30 June 2006

| 6 Months to 30.06.2006 | 12 Months to 31.12.2005 | |||

| Note | Taka | Taka | ||

| Profit on Investment | 18 | 946,421,028 | 1,350,879,819 | |

| Less: Profit paid on Deposits | 19 | 620,792,545 | 944,162,282 | |

| Net Investment Income | 325,628,483 | 406,717,537 | ||

| Income from Investment in securities | 20 | 3,725,000 | 6,000,000 | |

| Commission, Exchange and Brokerage | 21 | 168,372,110 | 221,441,759 | |

| Other Operating Income | 22 | 30,536,731 | 42,960,061 | |

202,633,841 | 270,401,820 | |||

| Total Operating Income | 528,262,324 | 677,119,357 | ||

| Salaries and Allowances | 23 | 46,498,313 | 72,909,475 | |

| Rent, Taxes, Insurances, Electricity etc. | 24 | 15,321,135 | 29,925,978 | |

| Legal Expenses | 25 | 138,809 | 308,238 | |

| Postage, Stamps, Telecommunication etc. | 26 | 7,473,381 | 10,252,421 | |

| Stationery, Printings, Advertisements etc. | 27 | 7,570,158 | 9,656,975 | |

| Managing Director’s Salary and allowances | 28 | 1,745,000 | 2,390,000 | |

| Directors’ Fees and Meeting Expenses | 29 | 282,300 | 1,989,450 | |

| Auditors’ Fees | 50,000 | 185,000 | ||

| Depreciation & Repairs of Bank’s Assets | 30 | 8,831,977 | 16,230,408 | |

| Other Expenses | 31 | 18,392,181 | 31,434,634 | |

| Total Operating Expenses | 106,303,254 | 175,282,579 | ||

| Profit before Provision | 421,959,070 | 501,836,778 | ||

| Specific provision for Classified Investments | – | (1,000,000) | ||

| General Provisions for Unclassified Investments | (22,500,000) | (35,000,000) | ||

| Total Provisions | 32 | (22,500,000) | (36,000,000) | |

| Total Profit/ ( Loss) before Provision for Taxation | 399,459,070 | 465,836,778 | ||

| Deferred tax expenses/(benefit) | 33 | 173,662,769 | 210,249,191 | |

| Current Tax Expenses | 13.2 | 6,850,819 | – | |

180,513,588 | 210,249,191 | |||

| Net Profit after Taxation | 218,945,482 | 255,587,587 | ||

| Appropriations | ||||

| Statutory Reserve | 15 | 79,891,814 | 93,167,356 | |

| Retained Earnings/(Loss) | 16 | 139,053,668 | 162,420,231 | |

218,945,482 | 255,587,587 | |||

| Earning Per Share (EPS) | 34 | 46.79 | 33.63 |

In SJIBL the board of directors has been conceived as the sources of all power headed by its chairman. It is legislative body of the bank board can delegate its power and authority to professionals, but cannot delegate, relinquish or avoid their responsibilities. The board of directors of the bank consists of 13 members who are reputed business personalities and leading industrialists of the country.