HISTORY AND HERITAGE

National Bank Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. Established as the first private sector bank fully owned by Bangladeshi entrepreneurs, NBL has been flourishing as the largest private sector Bank with the passage of time after facing many stress and strain. The members of the board of directors are creative businessmen and leading industrialists of the country. To keep pace with time and in harmony with national and international economic activities and for rendering all modern services, NBL, as a financial institution, automated all its branches with computer networks in accordance with the competitive commercial demand of time. Moreover, considering its forth-coming future, the infrastructure of the Bank has been rearranging. The expectation of all class businessmen, entrepreneurs and general public is much more to NBL. At present we have 145 branches under our branch network. In addition, our effective and diversified approach to seize the market opportunities is going on as continuous process to accommodate new customers by developing and expanding rural, SME financing and offshore banking facilities. We have opened 10 branches and 5 SME/Agri branches during 2010.

The emergence of NBL in the private sector is an important event in the Banking arena of Bangladesh. When the nation was in the grip of severe recession, Govt. took the farsighted decision to allow in the private sector to revive the economy of the country. Several dynamic entrepreneurs came forward for establishing a bank with a motto to revitalize the economy of the country. NBL was born as the first hundred percent Bangladeshi owned Bank in the private sector. From the very inception it is the firm determination of NBL to play a vital role in the national economy. We are determined to bring back the long forgotten taste of banking services and flavors. We want to serve each one promptly and with a sense of dedication and dignity.

The then President of the People’s Republic of Bangladesh Justice AhsanuddinChowdhury inaugurated the bank formally on March 28, 1983 but the first branch at 48, Dilkusha Commercial Area, Dhaka started commercial operation on March 23, 1983. The 2nd Branch was opened on 11th May 1983 at Khatungonj, Chittagong. At present, NBL has been carrying on business through its 130 branches and 15 SME / Agri Branches (total 145 service locations) spread all over the country. Since the very beginning, the bank has exerted much emphasis on overseas operations and handled a sizable quantum of home bound foreign remittance. It has drawing arrangements with 415 correspondents in 75 countries of the world, as well as with 37 overseas Exchange Companies located in 13 countries. NBL was the first domestic bank to establish agency arrangements with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate Bangladeshi nationals. This has meant that the expatriates can remit their hard-earned money to the country with much ease, confidence, safety and speed.

NBL was also the first among domestic banks to introduce international Master Card in Bangladesh. In the meantime, NBL has also introduced the Visa Card and Power Card. The Bank has in its use the latest information technology services of SWIFT and REUTERS. NBL has been continuing its small credit programmes for disbursement of collateral free agricultural loans among the poor farmers of Barindra area in Rajshahi district for improving their livelihood.

NBL focused on all key areas covering capital adequacy, maintaining good asset quality, sound management, satisfactory earning and liquidity. As a consequence, it was possible to a record growth of 175.51 percent with Tk. 8,809.40 million pre tax profit in the year under review over the preceding year. The net profit after tax and provision stood at Tk. 6,860.34 million which was Tk. 2,070.47 million in the previous year registering a 231.34 percent rise. The total deposits increased to Tk. 102,471.83 million being 33.37 percent increase over the preceding year. Loans and advances stood at Tk.92,003.56 million in the year under report which was Tk. 65,129.289 million representing 41.26 percent rise over the preceding year. Foreign trade stood at Tk. 144,255.00 million in 2010 compared to Tk. 115,939.00 million, increased by 24.42 percent compared to that of the previous year. During 2010, the bank handled inward remittance of Tk. 49,145.30 million, 10.73 percent higher than that of the previous year. Return on Equity (ROE) registered a 77.84 percent rise over the preceding year.

NBL stepped into a new arena of business and opened its Off Shore Banking Unit at Mohakhali to serve the wage earners and the foreign investors better than before.

National Bank, since its inception, was aware of complying with Corporate Social Responsibility. In this direction, we remain associated with the development of education, healthcare and sponsored sports, and culture and during the times of natural disasters like floods, cyclones, landslides we have extended our hand to mitigate the sufferings of victims. The bank established the National Bank Foundation in 1989 to remain involved with social welfare activities. The foundation is running the NBL Public School & College at Moghbazar where present enrolment is 1140. Besides awarding scholarship to the meritorious children of the employees, the bank has also extended financial support for their education. It provided financial support to Asiatic Society of Bangladesh at the time of their publication of Banglapedia and observance of 400 years of Dhaka City.

Transparency and accountability of a financial institution is reflected in its Annual Report containing its Balance Sheet and Profit & Loss Account. In recognition of this, NBL was awarded Crest in 1999 and 2000, and Certificate of Appreciation in 2001 by the Institute of Chartered Accountants of Bangladesh.

A team of highly qualified and experienced professionals headed by the Managing Director of the Bank who has vast banking experience operates bank and at the top there is an efficient Board of Directors for making policies.

A PURE COMMERCIAL BANKING UNIT AS THE NATIONAL BANK LIMITED

NBL was licensed as a scheduled bank; it is engaged in pure commercial banking and providing services to all types of customers ranging from small and medium enterprises to large business organizations. It is working for the economic welfare by transferring funds from the surplus economic unit to those who are in deficit.

MISSION, VISION AND GOAL OF THE NATIONAL BANK LIMITED

Vision:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

Mission:

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Goal:

National bank’s goal is to become a leading provider of integrated financial services for small and medium-sized enterprises (SMEs), industrial investors and high net-worth individuals in Bangladesh.

TARGET CUSTOMERS OF THE NATIONAL BANK LIMITED

Due to the predecessor company’s involvement financing sector of the country the bank inherited its top corporate customers. Moreover the bank is involved in import trade financing. Bulk importers of consumer durable, food grains industrial raw materials are its customers. The bank has financed in textile and apparels sectors. The bank has a trend of choosing customers from diversified groups. The bank has first class customers in the construction sectors involved in high-rise building, heavy construction and roads and high-way construction.

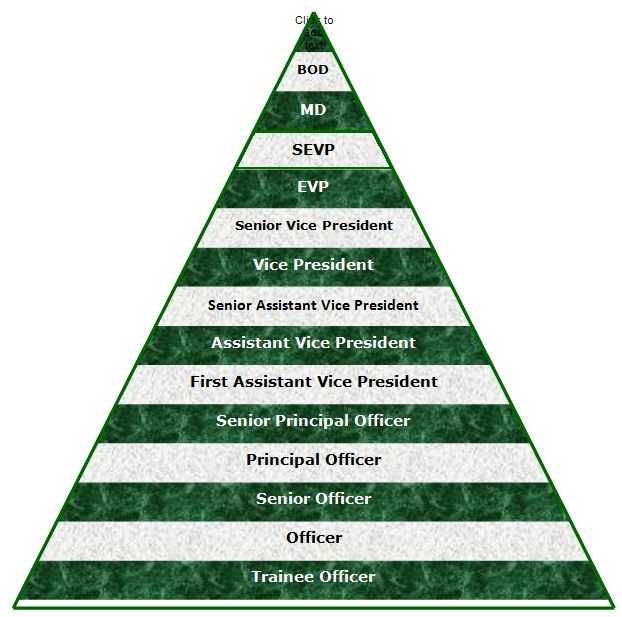

ORGANIZATION AND MANAGEMENT STRUCTURE OF NATIONAL BANK LTD

National Bank Ltd. was incorporated in Bangladesh as a public limited company with limited liability as on March 15, 1983, under the Companies Act 1913 to carry out banking business. It obtained license from Bangladesh Bank for carrying out banking business on March 22, 1983. The bank has been carrying out its banking activities through its one hundred and six branches over the country. The bank is listed with both Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. Organizational setup of AB Bank Limited is consisting of four organizational domains in following-

First: Board of Directors

The board of management of the bank depends on the Board of Directors, for over all supervision and directions on policy matters. The power of general supervision and control of the affairs of the bank is exercised by the President and the Managing Director of the bank who is the Chief Executive. The board consists of 14 members.

Second: Top Level Management

The Managing Director and the Senior Executive Vice President, major responsibilities of this are to take central decision and transmit it to the second step.

Third: Executive Level Management

Executive Level Management, which contains Executive Vice President, Senior Vice President, Vice President and Assistant Vice President. Major responsibilities of this part are to supervise and control division/department.

Fourth: Branch Operation Management

Branch operation management, which contains branch management and other/lower level management. Major responsibilities of this part of the 106 branches of this bank are to report to the head Office from time to time

The Managerial Hierarchy of National Bank Limited

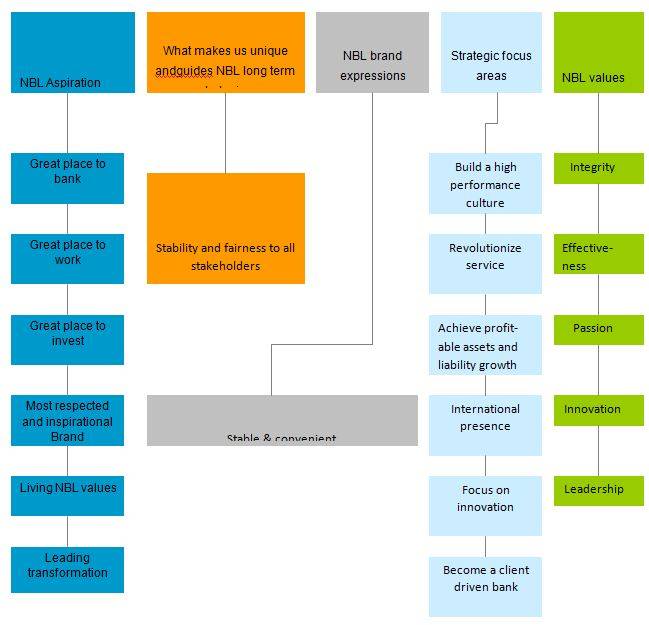

STRATEGIC DIRECTION AND THE CHALLENGES OF THE NBL

The strategic direction of the bank is critically reviewed by the management as well as by the Board at the time of preparing and approving the corporate plan and the budget. In keeping with the vision and mission statement of the bank, the strategic direction has been clearly identified and laid down in the corporate plan. It detailed out SWOT analysis of the corporate banking, personal banking, treasury, information technology, human resources management and Bangladesh operations of the bank. Besides, it spells out goals and objectives of these main segments along with detailed action plans with specific time frames to achieve them.

The corporate plan and the budget incorporate highly ambitious targets for the planned period. Undoubtedly, the corporate plan and the budget have immensely contributed in guiding the organization to its present level. Further, it has contributed to building up the target driven culture across the organization and leading to record superlative performance and to maintain the preeminent position in the banking industry.

CORE VALUES OF THE NATIONAL BANK LIMITED

NBL creates new value by forming teams of specialists in various fields and providing optimal services to customers. The NBL’s core values consist of six key elements. These values bind NBL’s people together with an emphasis that people are essential to everything being done in the bank.

Integrity:

NBL protects and safeguards all customer information, treats everyone in an equitable and consistent manner, and creates an environment which earns and maintains customer trust.

Open communication:

NBL builds customer relationships based on integrity and respect, offers a full line of products and excellent service, and is committed to the prosperity of the customers and shareholders.

Performance driven:

In National Bank Limited, customers and employees are judged in terms of their performance.

Continuous self improvement:

Continuous learning, self-challenge and strive make ways for self improvement of workforce at National Bank Limited.

Quality:

National Bank Limited offers hassle free better service timely, and builds-up quality assets in the portfolio.

Teamwork:

Interaction, open communication, and maintaining appositive attitude reflect NBL’s commitment to a supportive environment based on teamwork.

DELIVERING GROWTH OF THE NATIONAL BANK LIMITED

Managing knowledge smartly enabled the bank to remain as one of the leading private bank and given the edge over competitors. Integrating human resources with the bank’s systems, processes, know-how, experience and organizational memory has helped the bank deliver optimum value to customers, employees, shareholders and the nation. Knowledge has been an important driver of value creation over the years.

Discussing knowledge management strategy is part of endeavor to report as transparently as possible on all aspects of operations including those aspects which are less visible such as knowledge generation, retention and application. The role that knowledge plays in the generation of the bottom line is often underreported and a view to curing this deficiency there provides a flow chart describing how NBL is delivering growth-

Flow chart: how NBL Is Delivering growth

PRINCIPAL ACTIVITIES OF THE NATIONAL BANK LIMITED

The principal activities of NBL are to provide a comprehensive range of financial services, personal and commercial banking, trade service, cash management, treasury and security, and custody services. Other activities are:

National Bank Limited provide a comprehensive range of financial services; personal and commercialbanking, trade service, cash management, treasury, security and custody services.

Offshore Bank is a Bank located outside the country of residence of depositors, typically in the low tax jurisdiction (or tax haven) thatprovides financial and legal advantage. Offshore Banking Unit (the Unit) a separate business unit of National Bank Limited, governedunder the Rules and guideline of Bangladesh Bank. The Bank obtained the Offshore Banking permission vide letter No. BRPD/(P-3)744(97)/2008-2005 dated 01 June 2008 from Bangladesh Bank. The unit commenced its operation from September, 2008 and itsoffice is located at 9, Mohakhali, Dhaka.

HIGHLIGHTS ON THE OVERALL ACTIVITIES OF NBL AND ITS OFFSHORE UNIT

Offshore Bank is a Bank located outside the country of residence of depositors, typically in the low tax jurisdiction that provides financial and legal advantage. The offshore banking unit a separate business unit of National Bank Limited, governed under the rules and guidelines of Bangladesh Bank. The unit commenced its operation from September 2008 and its office is located at 9, Mohakhali, Dhaka.

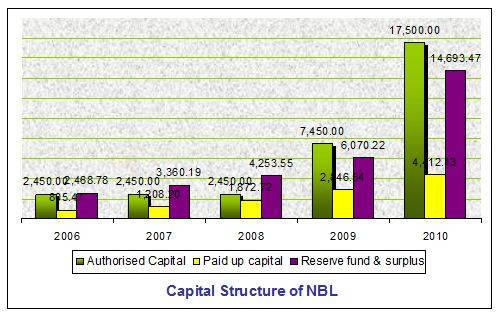

CAPITAL STRUCTURE OF THE NATIONAL BANK LIMITED

In 2010, 55.00 percent stock dividend was declared which increased the amount of paid-up capital to Tk. 4,412.13 million in 2010. Reserve and surplus was enhanced by 142.06 percent consisting of statutory reserve, general reserve, retained earnings and other reserve. Total shareholders’ equity as on December 31, 2010 stood Tk. 19,105.60 million.

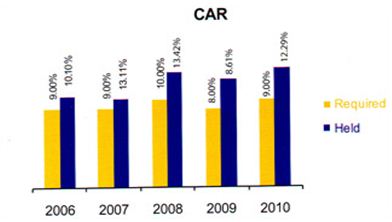

CAPITAL ADEQUACY RATIO OF THE NATIONAL BANK LIMITED

Capital Management of the Bank is to maintain an adequate capital base to support the projected business and regulatory requirement. NBL always maintain a prudent balance between Tier- 1 and Tier-2 capital. Total capital as on Decemder 31, 2010 was Tk. 19,190.79 million and capital adequacy ratio was 12.29%.Maintenance of adequate capital enhanced the Bank’s single borrower’s exposure limit up to a high level to cope with the corporate customers demand.

figure: Capital adequacy ratio

TECHNOLOGY USED IN NATIONAL BANK LIMITED

Innovation has been called the most precious capability that any organization in today’s economy must have and nurture. Without a constant flow of new ideas- not only for new products and services, but also for new ways of doing things- an organization is doomed to obsolescence or even worse, failure. Automation is a technological change that replaces certain tasks done by people with machines. Probably the most visible technological changes in recent years are computerization.

Most organizations of developed countries now have sophisticated information systems. E-business is a comprehensive term describing the way an organization does its work by using electronic linkages with its key constituencies (employees, managers, customers, and partners) in order to efficiently and effectively achieve its goals. Managing in an e-world, organization requires new insights and perspectives.

National Bank is the private sector bank to realize the importance of technology for Bangladesh market and introduced on-line banking. Due to various obstacles the IT development process slowed down in the past few years. However, to meet the customers demand in this competitive market, NBL management, once again, turned their focuses on the IT sector. Under the guidance of the management, the IT Division of the bank designed a plan and engaged the resources in the implementation of the IT projects at various segments of the banking business. Following is the list that details the work of ongoing IT projects:

At first, the management has decided to build communication infrastructure for the institution and advised the IT division to bring all its branches under one communication network. Without communication network, centralization of information is virtually impossible. Today, we are proud to disclose that 61 of our 106 branches are connected under one network. Twenty-four hours banking service is increasingly getting popular among the customers of all ages. Witnessing such facts, National Bank has launched Q-Cash ATM service at various locations within Dhaka and Chittagong for its customers. Detail information of the service is discussed below.

Customers, nowadays, demand to access their account information and transact from any branch regardless of its location. To implement the concept, proper communication network, centralized customer accounts, and modern banking software is a must. In order to meet customer’s requirements, Management, together with the IT division of the bank is searching for reputed banking software to support all the services provided by modern banks. In addition to any branch banking, the new software will allow many other services including phone or Internet banking. The concept “One profile per National Bank Limited customer all over Bangladesh” is now the reality.

All the above ongoing projects will have an instant and positive impact on the ways our customers currently do banking with us. In addition to that there are many other computer-based services that are being implemented in all the departments of the organization to increase the work efficiency. Thus, IT division of the bank is effortlessly working toward improving the customer service quality and training of the NBL staffs and executives.

Conclusion

Now-a-days banking sector is more competitive. To achieve a proper reward about performance, it is essential to satisfy its customer by providing them different valuable and dynamic services. Because a satisfied customer will talk to others about the services those he/she is very justifiable enjoying and a satisfied customers statement is more effective than a thousand of commercial advertisement. People depend on the people – is the mode of human civilization. Therefore, the importance to satisfy customer is increasing day by day in the private commercial sector especially in the private banks.