This report mainly focused on the evaluation of E Banking system in Bangladesh, here focus on Dutch Bangla Bank Limited. Other objectives are analysis E-Banking Activities from an organizational perspective and identify the activities served by Dutch-bangle bank to perform the “Electronic Banking Activities”. Report also discuss on the operations of ATM machine and analysis the basic requirement of the bank for providing e-banking facilities for the customers.

OBJECTIVES OF THE STUDY

- To get a broader overview of Electronic Banking,

- Importance of E-Banking Activities from an organizational perspective,

- To identify the activities served by Dutch-bangle bank to perform the “Electronic Banking Activities”.

- To know the types of services which DBBL provides electronically.

- To learn the operations of ATM machine.

- To learn the basic requirement of the bank for providing e-banking facilities for the customers.

METHODOLOGY

In order to make the study more meaningful and presentable, two sources of data and information will be used widely. The sources of data are as follows-

The Primary Sources:

- Face-to-face conversation with the respective officials & clients.

- Informal conversation as well as a direct interview with officials of DBBL

- Relevant file study as provided by the officers concerned.

The Secondary Sources:

- Annual report and periodical publications.

- Different publications, Newspapers and Journals.

- The internet will also be used as a theoretical source of information

The activities performed under “Electronic Banking Activities” were identified through informal interviews with the officials and from different publications.

DEFINITIONS OF TERMS USED IN E-BANKING

E-Banking

Electronic banking is an umbrella term for the process by which a customer may perform banking transactions electronically without visiting a brick-and-mortar institution..

E–Money

E-money includes electronic debit and credit system, smart card. The smart card has been defined many ways, but is generally defined as “portable data storage device with intelligence (chip memory) and provision for identity and security.”

Smart Cards

“Portable data Storage device with intelligence (Chip Memory) and provisions for identity and security” (Barbara A. Good, 1997).

Automated Teller Machine (ATM)

An ATM is simply a data terminal with two input and four output devices.

ATM has two input devices- card reader and keypad. An ATM has four output devices- Speaker, Display screen, Receipt printer, cash dispenser.

SMS Banking

SMS- Banking is developed to provide transactions related to client’s card account via SMS.

Tele-banking

Tele-banking is a form of remote banking which is essentially the delivery of branch financial services via telecommunication devices.

Online Banking

Online banking (Internet banking) is a term used for performing transactions, payments etc. over the internet through a bank’s secure website.

Call Center

Call center is a streamlined customer interface and offers a range of banking services through its call center agents.

Scenario regarding the E- Banking in Bangladesh

- The main Limitation of this report is that it’s not possible to disclose all data and information for the reason of confidentiality.

- The bank’s employees were very much busy in banking hour. So it was very difficult to have them for equitable long time.

- In some cases they could not able to providing me about my topics related data for preparing a more depth research study.

- I carried out such a study for the first time, so inexperienced is one of the main constraints of the study.

Scenario regarding the E- Banking in Bangladesh

BRAC Bank Ltd

BRAC Bank deployed a layer of security system for its Internet Banking. These measures extend from data encryption to firewalls. BRAC Bank uses the most advanced commercially available Secure Socket Layer (SSL) encryption technology to ensure that the information exchange between the customer’s Computer and BRACBank.com over the internet is secure and cannot be accessed by any third party.

Arab Bangladesh Bank Ltd.

AB bank Ltd. is the first private bank of Bangladesh with a long standing experience in domestic and international banking. Its 153 branches in all the major commercial centers of the country and 152 correspondents worldwide provide proficient e-banking services to its customers.

Standard chartered Bank Ltd

Standard Chartered offers the client a comprehensive range of Cash Management services. Electronic Banking provides various types of support through a wide range of operating systems, sweeping transaction accessories with the provision of reporting features or other special functions.

Bank Asia Ltd

Bank Asia symbolizes modern banking with innovative services in Bangladesh. It has centralized Database with online ATM, SMS and Internet query service. Bank Asia has 21 ATMs as a member of ETN along with eleven other banks. Bank Asia is maintaining its Online Banking Software and modern IT infrastructure.

BACKGROUND OF DBBL

Dutch-Bangla Bank Limited is a scheduled commercial bank. The Bank was established under the Bank Companies Act 1991 and incorporated as a public limited company under the Companies Act 1994 in Bangladesh with the primary objective to cary on all kinds of banking business in Bangladesh. The Bank is listed with Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. DBBL- a Bangladesh European private joint venture scheduled commercial bank commenced formal operation from June 3, 1996. The head office of the Bank is located at Senakalyan Bhaban (4th, 5th and 6th floor), 195, Motijheel C/A, Dhaka, Bangladesh. The Bank commenced its banking business with one branch on 4 July 1996.

Dutch Bangla Bank Limited (DBBL) is a public limited company by shares, incorporated in Bangladesh in the year 1995 under companies Act 1994. With 30% equity holding, the Netherlands Development Finance company (FMO) of the Netherlands is the international co-sponsor of the Bank. Out of the rest 70%, 60% equity has been provided by prominent local entrepreneurs and industrialists & the rest 10% shares is the public issue.DBBL’s focus is to provide one counter service to clients covering: Commercial Banking (Deposit Accounts), Consumer Banking (Retail Baking) – Traveler Cheques- Foreign & Inland Remittances, Financial Services, Corporate Banking, Asset & liability management, Liquidity & capital Resources Management, Information technology, Human Resources. DBBL Internet banking enables customer to access his/her personal or business accounts anytime anywhere from home, office or when traveling.

Dutch-Bangla Bank Ltd. came into existence with joint venture as a public limited company incorporated in Bangladesh on June 26, 1995 with the primary objectives to carry on all kinds of banking business in and outside of Bangladesh. DBBL has started its business with foreign bank. DBBL commenced its business as scheduled bank with effect from July 04, 1995 with one branch-Motijheel Branch, Dhaka, with a motto to grow as a leader in the banking arena of Bangladesh through better counseling and effect service to clients and thus to revitalize the economy of the country. All the branches are currently providing truly On-Line banking facility. DBBL resumed its operational activities initially with an authorized capital of Tk.4000 million and paid up capital of Tk.2000 million.

Vision

Dutch Bangla Bank dreams of better Bangladesh, where arts and letters, sports and athletics, music and entertainment, science and education, health and hygiene, clean and pollution free environment and above all a society based on morality and ethics make all our lives worth living. DBBL’s essence and ethos rest on a cosmos of creativity and the marvel magic of a charm life that abounds with sprit of life and adventures that contributes towards human development.

Mission

Dutch Bangla Bank engineers enterprise and creativity in business and industry with a commitment to social responsibility.” PROFIT ALONE” does not hold a central focus in the bank’s operation; because “man does not live by brain and butter alone “.

Core Objectives

Dutch-Bangla Bank believes in its uncompromising commitment to fulfill its customer needs and satisfaction and to become their first choice in banking.

- To establish relationship banking and improve service quality through development of Strategic Marketing Plans.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To introduce fully automated systems through integration of information technology.

- To ensure an adequate rate of return on investment.

- To keep risk position at an acceptable range (including any off balance sheet risk).

PRODUCT AND SERVICES OF DBBL

Products and services offered by DBBL

- Retail Banking

- Remittance and collection

- Import and export handling and financing

- Corporate Banking

- Project Finance

- Investment Banking

- Consumer credit

- Agriculture Loan

- Real time any branch banking

- 24 Hours Banking through ATM

- DBBL-NEXUS ATM & Debit card

- DBBL-Maestro/Cirrus ATM & Debit card

- DBBL Credit card

- Internet Banking

- SMS Banking

- On line Banking through all Branches

Banking Products

- Savings Deposit Account

- Current Deposit Account

- Short Term Deposit Account

- Resident Foreign Currency Deposit

- Foreign Currency Deposit

- Convertible Taka Account

- Non-Convertible Taka Account

- Exporter’s FC Deposit(FBPAR)

- Current Deposit Account-Bank

- Short Term Deposit Account-Bank

Loan & Advances

- Loan against Trust Receipt

- Transport Loan

- Consumer Credit Scheme

- Real Estate Loan (Res. & Comm.)

- Loan Against Accepted Bill

- Industrial Term Loan

- Agricultural Term Loan

- Lease Finance

- Other Term Loan

- FMO Local currency Loan for SME

- FMO Foreign currency Loan

- Cash Credit (Hypothecation)

- Small Shop Financing Scheme

Foreign Trade

DBBL extends finance to the importers in the form of:

- Opening of L/C (Foreign/Local)

- Credit against Trust Receipt for retirement of import bills.

- Short term & medium term loans for installation of imported

Import Finance

DBBL extends finance to the importers in the form of:

- Opening of L/C

- Credit against Trust Receipt for retirement of import bills.

Export Finance

Pre-Shipment Finance Pre-Shipment finance in the form of:

I) Opening of Back-to-Back L/C

II) Export Cash Credit

Post-Shipment Finance

Post-Shipment finance in the form of:

I) Foreign/Local Documentary Bills Purchase

II) Export Credit Guarantee

III) Finance against cash incentive

Foreign Remittance DBBL provides premium quality service for repatriation and collection of remittance with the help of its first class correspondents and trained personnel. By introducing on-line banking service and becoming a SWIFT Alliance Access Member, which enable its branches to send and receive payment instruction directly, which helps provide premium services. Remittance services provided by DBBL are:

- Inward Remittance: Draft, TT

- Outward Remittance: FDD, TT, TC and Cash (FC)

Electronic Banking Activities of DBBL

About DBBL E-Banking

Dutch-Bangla Bank Limited (DBBL) is a technology driven institution and a fully online banking organization. It caters to progressive clients who are accustomed to high levels of technology use and innovation. DBBL strives to provide its customers the latest in banking technology and delivery channels to make banking the most seamless task for its customers. DBBL’s technology vision is centered on the view that a high-end technology service is the innate right of the customer. A customer has the right to do seamless banking from any location they please and it is completely within their rights to expect this service uniformly through any medium. This vision leads to DBBL undertaking a comprehensive Information Technology (IT) project in 2003 where the entire system was automated at a cost of Tk. 1 billion.

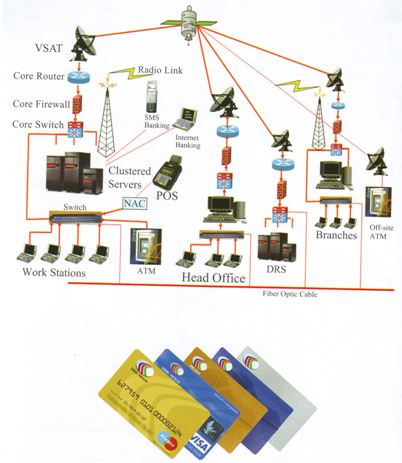

REQUIREMENTS ANALYSIS:

Keeping the security and reliability in mind, the management of the bank identified some hardware and software components for the project. Among hardware installations were the multi-processor clustered servers, ATM, POS Terminal, Card Personalization System, High Capacity UPS, Host Security Module, Networking Equipment, and among the software installation were the Core Banking Software, Internet Banking Software, SMS & alert banking software, switching software, database and operating systems.

BACKGROUND OF E-BANKING OF DBBL

For case studies and acquiring technical knowledge about these hardware and software, a management team visited in different banks in Srilanka and India in January 2003. There after the bank selected state – of – the – art technologies optimizing the cost for the project. Besides this, the bank has setup the largest and modern data center and online-synchronized Disasters Recovery Site (DRS) in Bangladesh to safe – guard the customers’ interest. A set of servers, networking equipments and UPS identical to the data center is installed at DRS. In case the data center is destroyed for any reason, the DRS will take over the control of branches, ATMs, POS Terminal, Internet Banking, SMS & alert banking systems. DRS is a crucial system for any bank and is standard for all leading worldwide banks, as the success of a bank after any disasters depends highly on its DRS. The implementation of the automation project started with formation of a core team. A team of 22 members, which included 14 members from the business and 8 members from the IT, took an eight weeks long extensive training on the project implementation issues.

After completion of all necessary formalities, such as floating of international tender’s, evaluation of tender documents the board of Directors of DBBL formally approved the project at a cost of Taka 250.00 million in September, 2003. The main components of the project were the world renowned, robust and tested banking software FLEXCUBE from ‘I-flex solution limited India world famous server from IBM USA switching software form oasis technology, Canada, world renowned Die bold ATM machines and Hyperion POS Terminals. The project also included an online disaster recovery site (DRS), first of its kind in Bangladesh to have effective disaster management system in place.

In February 2004, the User Acceptance Test (UAT) started in the data centered of the bank. The core team and networking team started installation of the servers, networking equipments and software, and customization of the same to adopt the prevailing banking rules and regulations of the country. Side by side, the switching team started installation of ATMs and POS Terminals and testing of their performance with the switching software.

After UAT was over, the roll – out of the branches from the old system to the newly installed system began. The IT division rolled – out one branch at every weekend and installed ATM under the respective branches. On 18 December 2004 the roll – out of all the branches of the bank was completed. The year – end operation of the bank has completed successfully on 30 December 2004, centrally at the data centre.

Figure: DBBL Networking Systems

This is the real communication channel of DBBL online banking system. All the components are connecting with fiber optical network. And the head office of DBBL’s IT department can control any of the branch computers by this network. And they can provide any types of solution by sitting the head office.

COLLABORATING WITH OTHER BANKS FOR A COMMON GOAL

Even after servicing the numerous clients, DBBL decided to help member banks in their automation services. DBBL extended its support and expertise for reaching a common end goal of both DBBL and the partnering bank – serving the customer. To extend the ATM facilities to the suburban and rural areas where there is no DBBL – branches, DBBL has taken an initiative to install ATMs at the premises and nearby sites of other bank branches. Mutual Trust Bank has signed an agreement to this effect. First Security Bank Limited is the first bank that signed with DBBL to avail these services. DBBL introduced new economical services cards and host the card information.

At the end of 2010, DBBL continues to have the largest ATM network by a significant margin.Banks that has signed agreements to share DBBL’s ATM network.

- Citibank (locally known as “Citibank NA”)

- Standard Chartered Bank (SCB)

- Commercial Bank of Ceylon

- Mutual Trust Bank

- Bank Asia

- National Credit and Commerce Bank Limited (NCC Bank)

- Prime Bank

- United Commercial Bank Limited (UCBL)

- Southeast Bank Limited (SEBL)

- The City Bank (locally known as “City Bank” to differentiate between “Citibank NA”)

- First Security Bank

- Trust Bank

- Mercantile Bank

- Q-Cash network Banks (1. Janata Bank 2. Eastern Bank 3. IFIC Bank 4. AB Bank 5. Shahjalal Islami Bank 6. Basic Bank 7. Jamuna Bank 8. Mercantile Bank 9. National Bank 10. National Credit and Commerce Bank 11. Pubali Bank 12. Sonali Bank 13. Trust Bank 14. Uttara Bank 15. State Bank of India 16. The City Bank 17. Social Islami Bank)

- Dhaka Bank

- EXIM Bank

DBBL DEBIT CARD

Dutch-Bangla Bank Limited (DBBL) commenced its Debit card operation in August 2004. Initially DBBL has issued only DBBL NEXUS classic cards to the accountholders. At present there are over 150,000 + cards in the hands of the customers. At the moment, the total card market size (approx.) in Bangladesh is 7 lac. Among these, DBBL is having around 20% market share with 150,000+ DBBL NEXUS cards.

DBBL Debit card products are:

- DBBL NEXUS Classic Card ;

- DBBL NEXUS Maestro card;

- DBBL NEXUS VISA Electron card

This most secure, convenient, and reliable forms of payment that enable consumers to freely conduct withdrawal of cash from 1715 DBBL ATM network and purchase at DBBL 2000 POS Terminals.

To get a DBBL-NEXUS debit card, one has to open account in any branch of DBBL. After opening the account (SB/CD) the customer receives a DBBL NEXUS classic Card free of charge. To get a DBBL NEXUS Maestro or VISA Electron card, the customer has to inform the respective branch and then the desired card is issued to the applicant with a minimal fee.

DBBL CREDIT CARD

With a vision of rendering services through new financial products, Dutch-Bangla Bank Limited has started issuance of DBBL-NEXUS Gold and Silver Credit Card facility since June 2006. With this card, the cardholders can avail an OD facility from Tk.10, 000/- (ten thousand) up to Tk.2, 000,000/-(twenty lac) depending on credit worthiness.

DBBL Credit card products are:

- DBBL NEXUS Silver OD card (credit);

- DBBL NEXUS Gold OD card (credit);

- DBBL NEXUS VISA credit card (in phases);

Eligibility for Credit Cards: The applicant has to be an accountholder of Dutch-Bangla Bank Limited.

They should belong to any of the following categories:

(a) Employees of different corporate bodies that have salary account with DBBL;

(b) Government service holders;

(c) Valued clients of DBBL;

(d) Employees of Banks, Financial Institutions, Multinational Companies, Telecommunication Companies, University / College/ School/ Autonomous Companies, Pharmaceuticals Companies, Professionals, Defense, VIP;

(e) DBBL borrowers, SB or CD account holders.

USER OF DBBL ATM CARD

The following persons generally use the DBBL ATM card-

- Retailers,

- Students,

- Professional peoples,

- Service Holders & many more.

PROCEDURE OF INTERBANK FUND TRANSFER

DBBL is the unique name of true Electronic Banking. All branches of DBBL is in one network. One can get all types of facilities from any branch of Bangladesh wherever the branch he has maintaining his account. When any client of DBBL provides any cheque to another person who has also an account in DBBL then he can get this money instantly without any procedure of clearing house. When the person submit the cheque of another person to transfer the fund to his own account then he needs to write a deposit sleep where he will be write his name, account number, cheque number, cheque date, the cheque amount, and also his signature. After getting the cheque along with the deposit sleep the banks at first will cheek the payees balance from where the fund will be transferred. Then the signature on the cheque with the specimen signature he provided to the bank. If these are ready then the authorized officer will make a phone call to the cheque holder for the conformation of this cheque. Sometimes he would be asked different types of tactical questions like his date of birth provides by the banks database and any other questions for identifying the real person. After conformation the officer will write down the details of the conformation that he got from the phone call. Then he will input the details of the cheque and the receivers account number into the software. When the amount exceed 20,000 (thousand) then its need the authorization of manager or 2nd manager. After verifying all the things the top level officers will grand this authorization request. At last the officer will submit the fund transfer request that is granted by his superior. And instantly the fund will be transferred to the parties’ accounts.

UPCOMING INITIATIVES

The normal bankcard was introduced 40 years ago and has failed to keep up with the rapid technology and security development that has been taking place in the industry. Its inherent problems caused competitors Visa and MasterCard to collaborate and create a next generation bankcard that will keep up with rapid security developments called EMV.North America has started the transformation process in 2005 and has set the finishing deadline to 2016, where the entire continent will have upgraded to next-generation EMV technology.

DBBL keeps track of the latest security developments internationally and strives to give the same level of service to its local clients. To give more peace of mind to its customers along with more security, the Bank has also decided to implement EMV (Euro Pay, MasterCard and Visa) cards (both debit and credit) and acquiring of EMV compliant ATMs and POS terminals. DBBL for the first time in this region is going to offer a complete EMV (both in issuing and acquiring for both the Visa and MasterCard) solution for its customer with an investment of another Taka 60 million (in addition to its IT investment of Taka 1 billion).

DBBL is currently scheduled to be the first and only bank in SAARC to offer the full EMV solution (and only second in South East Asia). The entire transformation is scheduled to be completed by year 2011. The solution requires that the entire system (including POS, ATMs and cards) be upgraded.

DBBL also taking the strong initiatives to get the update version of FLEXCUBE software to provide their customers faster services. This procedure will be completed within 2011.

SERVICE PROVIDED BY ON-LINE OF DBBL

Through ATMs:

Account balance enquiryBy using the DBBL’s own ATM booths anywhere in the country, the valued customers of the bank can perform the following functions at any time-

- Mini statement printing

- Statement request

- PIN (Personal Identification Number) change

- Request for Cheque Book

- Fund transfer within his/her own accounts

- Cash withdrawal – 24 hours a day, 7 days a week, 365 days a year

- Cash deposit to some designated number of ATM’s any time

- Payment of mobile/T&T phone, Gas, Electricity, Water, Internet, Credit Card bills from customer’s Savings/Current account.

Through Internet:

Through the Internet Banking of DBBL, the following can be performed:

- Checking of account balance

- Print-out of account statement for a particular period.

- Transfer of found within the customer’s own accounts

- Payment of mobile/T&T phone, Gas, Electricity, Water, Internet bills from customer’s account.

- Payment of School/College/University fees by debiting one’s account

- Purchase of activation number for mobile/internet pre-paid cards.

- Deposit of loan installments

- Stop Cheque payments

- Opening of an FDR (Fixed Deposit Receipt) account by debiting one’s Savings/Current/STD (Short Term Deposit) account

- Submission of L/C (Letter of Credit) application on-line

- Foreign Currency Exchange rates and interest rates enquiry.

The development of the DBBL’s ATM and other key

E-banking services

DBBL is a technology driven institute. DBBL had undertaken a comprehensive IT project in the year 2003 in order to make the banking system automated..After the successful implementation and testing of that project DBBL introduces the ATM and POS system on 30th December, 2004. Initially bank installed 32 ATM centers in different branches.

| In 2004 ( At year end) | After the successful implementation and testing of that project DBBL introduces the ATM and POS system. Initially bank installed 32 ATM centers in different branches. |

| In 2005 | DBBL has started to issue MasterCard’s debit product-Maestro and cirrus cards. And also accept the MasterCard’s entire product range including MasterCard credit card and Maestro and cirrus credit cards. |

| In 2006 | DBBL has started to issue Visa debit products-visa electron & Plus cards and accepting the visa card’s entire product range including the visa debit card, visa credit card, visa electron and plus. |

| In 2007 | DBBL extended its ATM service with other prominent commercial banks of Bangladesh. |

| IN 2008 | DBBL introduced SMS alert in E-Banking. |

| In 2009 | DBBL starts the mobile ATM service which increases the service availability. |

| In 2010 | DBBL starts MOBILE banking systems to increase the service availability of customers.

|

Source: www.dutchbanglabank.com

This Section of the report focuses on the growth of ATM system by DBBL in the divisional level and show how rapidly DBBL increasing its coverage of this ATM system. Another major aspect this section focuses is the year to year growth of the ATM system and the development of the DBBL’s other key e-banking services along with the collaboration of World class e-banking service providing Corporation.

CONCLUSION

The present status of e-banking is not satisfactory in case of virtual banking, call center and SMS banking. The main concern is security. So, data confidentiality, integrity, proof of origin peer entity authentication, non-repudiation must be ensured.

E-banking, the latest generation of electronic banking transactions, opened up new window of opportunity to the existing banks and financial institutions

Another important issue in extending the internet banking services throughout the country was gaining popularity. In Bangladesh most of the people were illiterate and obviously they were technology ignorant. But among the literate portion many of them had computer phobia. So these people could not trust on the internet banking services. To gain the confidence on internet banking the overall computer literacy must be developed.

However, with banking customers growing increasingly comfortable with the digital lifestyle, but Bangladeshi customers were not aware about e-banking.

ICT OPERATIONAL GUIDELINES AND ITS COMPLIANCE BY DBBL

The Banking and Financial Industry has undertaken changeable degrees of revolution by stirring their operating systems to platforms.To address this necessity Bangladesh Bank has taken the initiative to provide the industry with a guideline of ‘minimum’ security standards. Let’s check out the guidelines of BB and how DBBL complies with those:

Table: The ICT guidelines by BB and compliance of DBBL

| Guidelines of BB | Compliance by DBBL |

IT Management:

| DBBL has the largest IT budget in Bangladesh. DBBL maintains the state-of-the-art Electronic-Banking Division. The Electronic-Banking Division oversees and maintains DBBL’s investment as well as implementing upcoming projects. |

A. Internal IT Audit:

| DBBL maintains the state-of-the-art Electronic-Banking Division. This e-banking division has the richest IT expertise and resources for internal audit. This division of DBBL internal it audit 4 times in a year, that means on quarterly basis. |

B. Training and Insurance:

Operating and security procedures. | In DBBL E-banking division, some of the major personnel are well trained from abroad on IT and its application in banking. They provide proper training to the newly recruited employees. |

C. Fire prevention:

| DBBL’s ATM booths are well-prepared and those can resist small fire exposures. Moreover, fire suppression equipments are kept in most of the ATM centers. DBBL maintain quality Electric cables in the Data Centre so that possibility of sparking is minimize. |

| Information Security Standard:

| DBBL’s ATM card password pose at least 4 characters, combination of uppercase, lowercase, numbers & special characters and client can change the password if he/she thinks it is not safe anymore. Each user of ATM has a unique User ID and a valid password The User ID will be locked up after 3 unsuccessful login attempts. DBBL e-banking division software does not allow the same person to be both the maker and checker of the same transaction. Unauthorized access and Electronic tampering is controlled strictly by DBBL e-banking division. Anti-Virus installed in each server and it is connected to LAN or not by DBBL. Virus auto protection mode is enabled. |

Analysis, Findings and Problem Identifications on E-Banking

Growth of ATM system by DBBL (Regional level):

DBBL is providing the maximum number of ATM support to its clients and as well those banks clients who have collaboration with DBBL. The following chart gives an overview of DBBL ATM network in 7 divisions in Bangladesh.

Table 6.1: Growth of ATM system by DBBL (Regional level)

| Division | Dhaka | Chittagong | Khulna | Sylhet | Rajshahi | Barisal | Rangpur |

| Num of ATMs | 1110 | 205 | 88 | 156 | 76 | 28 | 52 |

Source: www.dutchbanglabank.com

We see, Main focus is on Dhaka division in which DBBL established 1110 ATMs. The second largest ATMs holding division is Chittagong which is widely known as “port city” of Bangladesh. In Chittagong, DBBL puts 205 ATM booths. In Sylhet, 156 ATM booths are located. In Khulna, Rajshasahi, Barisal and Rangpur respectively 88, 76, 28 & 52 ATMs are located. There has been given a chart for understanding of the regional growth of ATM system by DBBL:

Source: www.dutchbanglabank.com

Growth of ATM system by DBBL (Year to year increase):

DBBL is the pioneer of all banks in Bangladesh to initiate and develop ATM system in a much wider way and provide World class ATM services at quite affordable cost to the of our country.

Table: Growth of ATM system by DBBL (Year to year increase)

| year | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 (target) |

| Num of ATMs | 32 | 85 | 210 | 350 | 700 | 1000 | 2000 |

Source: Financial Statements of DBBL.

Here, we see, after the initial establishment of 32 ATMs at the beginning of 2005, DBBL’s effort to establish wide number of ATMs from year to year increases. And we see, from year 2009 to 2010, DBBL installed 1000 new ATMs in just one year and it has targeted to establish 2000 ATMs at the year end of 2011.

Let see the Growth of ATM system by DBBL from the point of view of Year to year increase in chart for better understanding of the trend of increase

Index Analysis

Use of index number to present the Growth of deposit along with the growth of ATM system by DBBL:

We know from our previous discussion that in 2005 DBBL for the first time installed 32 ATMs, before that year that means, from 2004 to before; there were no ATMs in Bangladesh by DBBL. In this part of the report, index number is to be used to find out the rate of increase of “Deposit” in DBBL by assuming 2004 as the base year (just the previous year before the initiation of ATMs by DBBL) and to figure out the rate of change in deposit of DBBL in relation to that base year when no ATMs were installed.

The following table shows the deposits amount of DBBL from 2004 (in that year no ATMs were installed) to 2010. The table also contains the num of ATMs in corresponding years and Index numbers considering 2004 as the base year.

The following table shows the deposits amount as the base year:

Table: Fixed base index number (2004= base year) of deposit.

| Year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Num of ATMs | 0 | 32 | 85 | 210 | 350 | 700 | 1000 |

| Deposit Tk.(in million) | 21107.56 | 27241.11 | 40111.54 | 42110.15 | 51576 | 80000 | 92000 |

| Index Number (2004=100) Base year | 100 | 129 | 190 | 199 | 244 | 379 | 435 |

Shows the fixed based index number of deposits where 2004=100, as it is the base year. In 2004, index number is 100 as it’s the base year. In 2005, index number is 129, which means, there was a 29 % increase in deposit amount of DBBL from the base year in 2005. In 2006, index number is 190 which mean there was a 90% increase in deposit in respect to base year 2004. And so on in the next years.

Let’s see the index numbers in graph and see how the growth of ATM system has enhanced the growth of Deposit in DBBL:

Figure: Indicates the rate of increase in deposits in relation to the base year (2004). In 2004, num of ATMs by DBBL was “Zero”, in 2005, DBBL installed 32 ATMs and then the expansion of ATM system was very rapid and so is the growth of deposits by DBBL. Noticeable point is that, in 2008 and 2009, the growth of ATMs was very high (350 ATMs in 2008, 700 ATMs in 2009). The rate of change in Deposits is also very high in these years (Almost 144% increase in 2008 279% increase in 2009 and 294% increase in 2010 from the base year 2004 when there was no ATM). This scenario shows how intensely the growth of ATM system contributes to the increase in amount of deposits of DBBL, and increased deposit would surely increase the profitability of DBBL.

Profit Analysis

Growth of ATM system and its effect in profitability of DBBL:

Banks are, like any other business organizations, profit oriented. And like any other commercial banks, DBBL’s one of the major missions is to make profit.This true to some extent because the quality of ATM and other e-banking service that are provided by DBBL world class by standard but the charge they take for it is quite lower in respect to other developed countries’ banks whose service quality is of that standard.

They are not charging high for E-banking services, but this automation indirectly increases the overall profitability of DBBL. The discussion from the previous section, we can easily understand that how the growth of ATM system positively effect the growth of deposits of SDBBL. This increases deposits, of course, in effect increase the overall profitability of DBBL. Not only deposits, there are some other major aspects which are being accelerated by this huge development of e-banking services by DBBL and which are, altogether, contributing significantly to increase the profitability of DBBL.

The following table shows the growth of profit of DBBL and after the initiation of ATM system in 2005, how profitability trend increased:

Table: The growth of Profit in DBBL over the years

| Year | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Amount (TK. in million) | 162.81 | 177.60 | 210.16 | 236.35 | 367.82 | 362.18 | 479.81 | 821.67 | 1137.70 | 1770.38 |

| Growth | 9.09% | 18.33% | 12.46% | 55.63% | -3.98% | 32.47% | 71.25% | 38.46% | 55.61% |

Source: Financial statements of DBBL.

The “Bold” amounts show the profit amount of DBBL from 2005 to 2010 after the initiation of ATM system. From 2001, the profit trend shows that there was an steady growth of profitability of DBBL but in the year 2005, it jumped to BDT 367.82 million from 236.35 million, and the growth at that stage is huge, almost 55.63%. And after that, the trend of increase did not hamper significantly, rather, in 2007, 08, 09 and 10, it increased much significantly. This indicates that the overall profitability of DBBL is quite sound now and very much satisfactory and the implementation of E-banking investment is contributing to this increased profitability, that’s for sure.

Let’s see the growth trend of profitability of DBBL before and after the initiation & development of ATM system—

Source: Financial statements of DBBL.

Figure: Here, we see the “Blue” bar shows the growth of profit before 2005, that is, before the initiation of ATM system by DBBL. From 2004 to 2005, the profit jumped to a higher level and the “Dark red” colored bar shows the rapids increase in profitability by DBBL after the initiation and continuous development of e-banking services.

Deposit Analysis

Growth of ATM system by DBBL and its impact in increased deposit:

DBBL is one of the leading commercial Bank in Bangladesh ands the amount of deposits from public, it ids holding is quite handsome in amount compared to other banks in Bangladesh. As the banking habit and the demand for banking services are increasing day by day at huge rate, the amount of deposit in banks is also increasing in a sound rate in Bangladesh. Now the point is that, after the implementation and the development of ATM system by DBBL, How this is contributing to increase the overall deposit level of DBBL. Let’s check it out in this section—the following table shows the year end deposit amount of DBBL in last 10 years

Table : Growth of ATM system by DBBL and its impact in increased deposit

| Year | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Amount (TK.in million) | 11457 | 15975.4 | 17133.8 | 21107.5 | 2721.1 | 40111.5 | 42110.1 | 51576 | 80000 | 106400 |

| Growth | 39.4% | 7.25% | 23.1% | 29.0% | 47.2% | 4.98% | 22.48% | 55.11% | 33% |

Source: Financial statements of DBBL.

Let see the trend of the growth of deposit of DBBL in those years

Source: Financial statements of DBBL.

In figure; we can see that, the growth of deposit in DBBL is in increasing trend. From the year 2001 to 2004, there was a steady growth of deposit and the “Red” bars shows them in the chart. After the initiation of ATMs in 2005, the growth of deposit jump to another level and the after then increase is significant, and we can see the “teal” bars shows them.

SWOT ANALYSIS OF DBBL

SWOT Analysis:

SWOT analysis is a widely used technique through which managers create a quick overview of a company’s strategic situation. SWOT stands for a company’s internal Strength & Weaknesses and its environmental Opportunities & Threats.. It is based on the assumption that an effective strategy derives firm a sound “fit” between a firm’s internal resources (strengths and weaknesses) and its external situation( Opportunities and Threats). A good fit maximizes firm’s strengths and opportunities and minimizes its weaknesses and Threats. The Dutch-Bangla Bank’s SWOT analysis matrix can be as follows:

| Strengths | Weaknesses |

|

|

| Opportunities | Threats |

|

|

Findings

The broad spectrum of electronic banking services, a subset of e-finance, is available in Bangladesh with various degree of penetration. Credit card and POS services are provided by 23 percent of banks. Several thousands of POS terminals have been set in major cities of the country. Tele-banking is second most penetrated e-baking service in Bangladesh. ATM is expanding rapidly in major cities. A group of domestic and foreign banks operate shared ATM network, which drastically increase access to this type of electronic banking service. The network will gradually be extended to other parts of the country. Credit card is also becoming very popular service in major cities of Bangladesh; during 2005-2010 the growth of credit card market is more than 100 percent. Some foreign banks provide electronic fund transfer services. Microchips embedded Smart Card is also becoming popular in the country, particularly for utility bill payment.

Last couple of years shows dramatic improvement in the awareness situation in the banking community regarding the comprehensive application of ICT. The experts forecast that ICT penetration in the banking sector will improve dramatically by 2015. Majority of banks is planning to introduce ICT for integration of banking services and new e-finance services, which will play a vital role in bringing efficiency in the financial sector. Among the banks surveyed 75 percent of banks have strategic plan to implement ICT and internet banking.

Bangladesh Bank is now moving to the era of technological advancement. Bangladesh Bank is planning to have Automated Clearing House (ACH) which will automate the processing of checks by MICR coding. This shows the intention of Bangladesh Bank to the betterment of the services.

By using e-banking trend index of ATM and profit deposit are increased rapidly day by day. This will eventually lead to internet banking to a requirement for all banks in the near future. With all the strategies we have set for us we can enter into a new world of internet banking.

PROBLEMS IDENTIFICATION REGARDING ELECTRONIC BANKING SERVICES OF THE DBBL

On the basis of the study of the overall e-banking activities of DBBL, we can say that for the following reasons the overall online services of the bank cannot be expanded rapidly –

- The infrastructure of e-banking in Bangladesh is inefficient so DBBL cannot maintain their e-banking with other banks in Bangladesh.

- In my experience I found that every day in pick hour the software was very slow and that always creating problem in times of transaction and any other work for the bank.

- Though DBBL is trying to give the online service of their customers but there is also some lack of adequate knowledge about the e- banking.

- I think DBBL has the lack of proper strategic plan that is why they cannot gain and retain a big portion of market share among many other online banks.

- In Bangladesh there is a lack of international standard communication channel that is hampering DBBL’s e-banking.

- Improper inter –district telecommunication systems and country wide data communication system, that is why the bank is not able to provide its online services to the country wide.

- Branch offices cannot be linked efficiently with the head office through single networking based on online real time basis.

- Lack of attractive remuneration to the technocrats. This motives them to go abroad for higher remuneration.

- Lack of integrated plan between the DBBL and the Bangladesh bank authority.

- Inefficient corporate clearing house facilities of the bank. Though the bank now started their Automated Clearing house but that is not fully implemented.

- The bank’s branches network is only the number 79 over the country and most of the branches are located in the Dhaka city, in the Chittagong commercial area and in the others large commercial area of Bangladesh. For the reasons the people of these areas only get the banks overall services. That is most of the people of the country cannot get the banks services because they live in the rural area or at the zonal level

- Only ATM service & pos service of the DBBL are better than the other online banks of Bangladesh but home-banking services wire transfer services are not yet swift in comparison of standard chartered bank, the HSBC.

- The bank cannot provide online services frequently due to the insufficient electricity facilities in Bangladesh.

- In addition, DBBL credit card has not yet so much popular in the market.

- Only retail e-banking services are provided rather than corporate e-banking services.

Survey on different E-Card of DBBL

About Customer Satisfaction

Kotler (2000) defined satisfaction as: “a person’s feelings of pleasure of disappointment resolution from comparing a product are perceived performance (or outcome) in relation to his or her expectations”. Hoyer and Maclnnis (2001) said that satisfaction can be associated with feelings of acceptance, happiness, relief, excitement, and delight.

There are many factors that affect customer satisfaction. According to Hokanson (1995), these factors include friendly employees, courteous employees, knowledgeable employees, helpful employees, accuracy of billing, billing timeliness, competitive pricing, service quality, good value, billing clarity and retention.

Evaluate Customer satisfaction level of DBBL ATM Service:

This part of the report has been completely on the basis of the eleven outcomes that have been discovered from the questioner survey. This chapter deals with “customer satisfaction level of DBBL ATM services”. The data have been collected by survey at Dhanmondi Branch. However the following six outcomes have been analyzed through pie chart.

| No. of Respondents | Male | Female |

| 200 | 66% | 34% |

Gender range of the Respondent

Figure: Gender range of the Respondent

In this study, my Respondent depend on gender, male are 66%, and female are 34%.

Age range of the Respondent

| Total number of respondents | 20-24 | 25-29 | 30-34 | 35-39 | 40-44 | 45-49 | Above 50 |

| 200 | 34% | 20% | 22% | 10% | 2% | 9% | 3% |

Figure: Age range of the Respondent

In this study, my Respondent depend on age, 20-24 are Respondent 34%, 25-29 are Respondent 20%, 30-34 are Respondent 22%, 35-39 are Respondent 10%, 40-44 are Respondent 2%, 45-49 are Respondent 9% and above 50 are Respondent 3%. So, here the maximum Respondent depends on age are 20-24 (34%), and minimum Respondent 40-44 (2%).

Occupation of the respondent

| Occupation of the Respondent | ||||

| Total no of respondents | Student | Service holder | Business | Housewife |

| 200 | 51% | 16% | 19% | 14% |

Figure: Occupation of the respondent

In this study, my Respondent depends on occupation, Students are 51%, Service people are 16%, and Business-persons are 19% and house-wife are14%. So, here the maximum Respondent depend on occupation are Student (51%) and minimum Respondent house-wife (14%).

Family Income Level of the Respondent

| Family Income level of the Respondent | ||||||

| Total number of respondents | Below 10000 | 10000-20000 | 20000-30000 | 30000-40000 | 40000-50000 | Above 50000 |

| 200 | 4% | 10% | 44% | 12% | 17% | 13% |

Figure Family Income Level of the Respondent

In this study, my Respondent depend on family income level, the maximum Respondent which family income level are 20000-30000 and Respondent 44%, and minimum Respondent which family income level are below 10000 and Respondent 4%.

Card users of the Respondent

| Card Users | |||

| No. of Respondents | Debit Card | Credit Card | Both |

| 200 | 93% | 0% | 7% |

Figure Card users of the Respondent

In this study, my Respondent depend on card users, the maximum Respondent are debit card users are 93% and moderate are both card users (debit and credit card) are 7%, only credit card users are 0%.

Using rate of DBBL Card.

| Using rate of DBBL Card | |||

| Total no of respondents | Regularly | Frequently | Very Frequently |

| 200 | 70% | 27% | 3% |

Figure: Using rate of DBBL Card

In this study, my Respondent depend on using rate of DBBL card, the maximum Respondent are using card regularly are 70% and the minimum Respondent are using card very frequently are 3%.People’s response is satisfactory. In this part, I have given a detail description of it. For my study purpose, I have taken 200 people as sample. Five points rating scale is also used here for attitude measurement. The attitudes of people towards the existing performance of DBBL ATM service is expressed in below.

Debit card makes your life easier and it’s easily accessible.

49% strongly agree and 39% agree and 10% moderately agree that DBBL Debit card make their life easier and giving them flexibility at withdrawing money. On the2% strongly disagree because they think that this service makes them puzzle. They are not use to with this service.

| Variable | Respondent | Percentage of respondent |

| Strongly Agree | 98 | 49% |

| Agree | 78 | 39% |

| Moderate | 20 | 10% |

| Disagree | 0 | 0% |

| Strongly Disagree | 4 | 2% |

Figure: Debit card makes your life easier and it’s easily accessible

Analysis: Here I see that the majority people are thinking that ATM service makes their life easier, and very few percent of people are not taking these facilities. While the surveying period I have found that students and service holder are strongly agree and agree that ATM service makes their life easier. But the customer who uses this card very frequently like house wives, they are moderately agreed and the business person who are using card regularly they have to face some problems and dissatisfied with the service. Mainly they think that this service is not sufficient to make their life much easier.

Service charge is reasonable

10% strongly agree and 32% agree that compare with other bank DBBL yearly service charge is lower than compare with other bank. And 26% moderately agree and 38% disagree and 13% strongly disagree with this opinion.

| Variable | respondent | Percentage of respondent |

| Strongly Agree | 20 | 10% |

| Agree | 64 | 32% |

| Moderate | 52 | 26% |

| Disagree | 38 | 38% |

| Strongly Disagree | 26 | 13% |

Figure: Service charge is reasonable

Analysis: In my survey almost 42% of total respondent are agreed that the service charge is lower. Because DBBL has no per transaction charge but other banks have. And also DBBL yearly service charge for card is only 400 and first year totally free. But 26% are moderately agreed and 38% of customer is disagreed about this statement. On the other hand some of the customers are totally strongly disagree with this statement. Because they the maximum are student. They think ATM charge should reduce.

Power supply is Available

In this point, 7% respondents are strongly agreed, 8% are agree, 15% are moderate, 13% are disagree and 57% are strongly disagree with this statement.

| Variables | Respondent | Percentage of Respondent |

| Strongly Agree | 14 | 7% |

| Agree | 16 | 8% |

| Moderate | 30 | 15% |

| Disagree | 26 | 13% |

| Strongly Disagree | 114 | 57% |

FigurePower supply is Available

Analysis: In my survey I find that majority customer strongly disagree that power supply is available in the ATM Booth. Because they face power failure situation when they withdraw money from ATM Booth. On the other hand only poor customer think that power supply is available in the ATM Booth and they don’t any power failure problem or they think this problem is considerable in our country.

Security is sufficient

23% respondents are strongly agreed, 36% are agree, 24% are moderate, 14% are disagree and 3% are strongly disagree with this statement.

| Variable | Respondent | Percentage of Respondent |

| Strongly Agree | 46 | 23% |

| Agree | 72 | 36% |

| Moderate | 48 | 24% |

| Disagree | 28 | 14% |

| Strongly Disagree | 6 | 3% |

Figure Security is sufficient.

Analysis: In the security view point most of the customer is satisfied. They fill always secured when they withdraw money from the ATM Booth. Some customers are filling unsecured because they regularly withdraw handsome amount from the Booth.

Don’t face any network, cash jam and time out problem

6% respondents are strongly agreed, 10% are agree, 15% are moderate, 14% are disagree and 55% are strongly disagree with this statement.

| Variable | Respondent | Percentage of Respondent |

| Strongly Agree | 12 | 6% |

| Agree | 20 | 10% |

| Moderate | 30 | 15% |

| Disagree | 28 | 14% |

| Strongly Disagree | 110 | 55% |

Figure: Don’t face any network, cash jam and time out problem

Analysis: I find that most of the customers who are using ATM Booth regularly are complain that they not getting money from ATM Booth. The point shows that network, cash jam and time out problem of DBBL is a paining situation. It indicates that customers are always facing this type of problem. They are suffering network, cash jam, time out even fake note problem. That’s why customers are so disagree with this statement.

Service quality of DBBL ATM services.

32% respondents are strongly agreed, 39% are agree, 19% are moderate, 8% are disagree and 2% are strongly disagree with this statement.

| Variable | Respondent | Percentage of Respondent |

| Strongly Agree | 64 | 32% |

| Agree | 78 | 39% |

| Moderate | 38 | 19% |

| Disagree | 16 | 8% |

| Strongly Disagree | 4 | 2% |

Figure: Service quality of DBBL ATM services.

Analysis: Although there are some problems in the ATM Booth, customer perception about Service quality of DBBL ATM services is good, because here most of the respondent are strongly agree and agree because they use the ATM service with positive attitude about ATM service and they think this type of problem is considerable. On the other hand some respondent think this type of problems are increasing bad image about ATM service of DBBL ATM services.

Analysis: In my survey, I find that most of the customers are thinking that overall service quality of DBBL is good because 25% respondents are strongly agreed 39% are agree, 24% are moderate about this statement, this percentage shows the service quality of DBBL is good and customer is satisfied.

Scale

| S.L. | Statements | SA | A | M | D | SD | Mean |

| 1 | Debit card makes your life easier and it’s easily accessible | 98 | 78 | 20 | 0 | 4 | 4.33 |

| 2 | Service charge is reasonable | 20 | 64 | 52 | 38 | 26 | 3.07 |

| 3 | Power supply is Available | 14 | 16 | 30 | 26 | 114 | 1.95 |

| 4 | Security is available | 46 | 72 | 48 | 28 | 6 | 3.59 |

| 5 | Don’t face any network , cash jam and time out problem | 12 | 20 | 30 | 28 | 110 | 1.97 |

| 6 | Service quality of DBBL | 64 | 78 | 38 | 16 | 4 | 3.91 |

Total sample: 200 respondents

[Strongly Agree SA =5, Agree A =4, Moderate M =3, Disagree D =2, Strongly Disagree SD =1,]

Grand Mean = 3.14

From the above attitudes measurement, I found that the satisfaction levels of ATM services are positive for DBBL. But Bank has to improve its service quality& power supply. Customers are not very satisfied by using ATM machines of DBBL.

RECOMMENDATIONS

To improve the e-banking services of DBBL, I have the following suggestions for the bank-

- DBBL should provide adequate training and technological support to develop the manpower or personnel working in the e-banking section.

- DBBL should have a strong strategic plan for automated market development.

- The bank should develop integrated e-banking software within a short period of time. Because I think excess load will be the cause of a big damage for the existing software.

- A specialized, self-owned organization can be established by the bank so that they can develop the infrastructure of e-banking in Bangladesh that will also be the social responsibility for them.

- Clearinghouse operations are demanded to be fully automated. If it could be implemented, then banks will be motivated to implement in front services counter of electronic bank.

- To meet the demand of current and prospective clients, banking software to be produced in such that the coordinated effort can supply all information from the front desk.

- The bank requires systemic and planned budget for expanding e-banking.

- To provide the nationwide & countrywide services, the bank should expand the number of branches of ATM booth at zonal level so that the most of the people of the country can get the benefit, which live in zonal level, rural level.

- To take initiative for implementing automated financial sector by coordinate effort of the central bank along with the commercial bank.

- Credit card services should be implemented rapidly. And the restriction for getting the credit card should reduce.

- DBBL should increase their branch so that they can pick up most of the market share among the other online bank.

- DBBL have to build up their customer services desk and call center for the betterment of their services.

- Maintain a Vulnerability Management Program

- Use and regularly update anti-virus software

- Develop and maintain secure systems and applications

- Regularly Monitor and test Networks

- Track and Monitor all access to Network resources and cardholder data.

- Regularly test security systems and processes

- Implement Strong Access Control Measures

- Restrict access to cardholder data by business need-to- know

- Assign a unique ID to each person with computer access

CONCLUSION

Electronic banking is relatively a new concept for Bangladesh. It is not long ago when people wait in queue for long time with token in hand and collects money. But today the scenario is a little different at least in the urban areas. With the blessing of modern banking facility, people can enjoy 24 hours banking facility without going to the bank physically even from client’s residence through Internet Banking or through ATM, POS terminals. At the same we need to be very careful about the fraud. This can be done through proper education on information technology & sufficient software & hardware support. Proper implementation of online banking will create a positive impact on economy. Dutch-Bangla Bank Limited is the leader in the Electronic banking among the private banks of Bangladesh. It has employed almost all types of modern day banking facilities to provide convenience to its customers. All automated delivery channels are providing round the clock service through the mentiond hardware and software. DBBL contributes 5% of its profit for helping the destitute to develop their standard of living and earn a respectable way to keep up with their everyday activity. Considering the issues discussed earlier we may conclude that the Dutch-Bangla Bank Ltd. is not only a profit making organization, it is also a perfect “Corporate Citizen” who always carry out its duties of corporate social responsibilities. As banking sector is service oriented, therefore, banks of Bangladesh must move towards fully online banking. This will enable them to provide round the clock services through all the service channels without deployment of much manpower thus saving time & money and most important of all ensuring transaction security.