The main purpose of this report is to analysis Consumer Credit Scheme of Prime Bank Limited. Other objectives are to give an overview on Prime Bank and its services and detail about the Consumer Credit Scheme and its Consumer Credit Operation System. Finally finding out the shortcomings of the Bank in its CCS operations and providing some Recommendation to solve the problems over Consumer Credit Scheme of Prime Bank Limited.

Objective Of the Study

- To o give an overview on Prime Bank Ltd. and its services.

- To detail the Consumer Credit Scheme (CCS) Of PBL and its Consumer Credit Operation System.

- To perform a comparative analysis on CCS of PBL and those other private banks.

- Finding out the shortcomings of the Bank in its CCS operations and providing some Recommendation.

Methodology of the study

This research of which major objective is to describe the comparative study of customer service quality and how well the customers are accepting the services, is a single cross sectional design where preliminary information is gathered only from the existing clients (account holder) of Prime Bank Limited, The Premier Bank Limited, Dutch Bangla Bank Limited, National Bank Limited and BRAC Bank Limited to whom the quality of services is provided.

Primary Sources of Data Collections are:

- Face to face conversation with the bank officers.

- Some Questionnaire survey with the customers is made at Prime Bank Limited, The Premier Bank Limited, Dutch Bangla Bank Limited, National Bank Limited and BRAC Bank Limited.

- Observing various organizational procedures.

Secondary Sources of Data Collections are:

- Annual Report and website of Prime Bank Limited.

- Different publications regarding banking functions.

It has been preferred simple random sampling technique in this research. The sample size of this research is 100. Each responding is given a questionnaire to fill in. the survey method used in this study is primary data collection tool. Certain objectives are examined using secondary data.

Historical Background of PBL

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs conceived an idea of floating a commercial bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, Prime Bank Ltd. was created and commencement of business started on 17th April 1995. The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy etc.

As a fully licensed commercial bank, a highly professional and dedicated team is managing Prime Bank Ltd. with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition.

Prime Bank Ltd. has already made significant progress within a very short period of its existence. The bank has been graded as a top Class bank in the country through internationally accepted CAMEL rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation.

Prime Bank Ltd. offers all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, and real state to software.

The bank has consistently turned over good returns on Assets and Capital. During the year 2005, the bank has posted an operating profit of Tk.1520.34 million and its equity funds stood at Tk. 2808 million. Out of this, Tk. 1400 million consists of paid up capital and Tk. 1055.98 million represents reserve fund. The bank’s current capital adequacy ratio is 9.96%. In spite of complex business environment and default culture, quantum of classified loan in the bank is very insignificant and stood at less than 0.96%.

Prime Bank Ltd., since it’s beginning has attached more importance in technology integration. In order to retain competitive edge, investment in technology is always a top agenda and under constant focus. The past performance gives an indication of strength.

Whatever the transaction and customers need, PBL has tried to build long-term relationship. It is through these relationships that PBL has come to understand its customers and build value for them. Special counters are usually opened to meet the service demand of customers during heavy customers flow. Prime Bank limited believes that it gives its customers a world-class banking service through an IT based network of 47 branches.

Objective of the Bank

Prime Bank limited is designed to provide commercial investment bank services to all type of customers ranging from small entrepreneurs to big business firms. In this regard, it gives emphasize on the priority sector of the economy like industry, housing and self- employment. Besides, the bank aims to provide different customer friendly deposit and loan products to fulfill the banking needs of the individual customers.

The Vision of the Bank

To be the best Private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity.

Mission of the Bank

- To build Prime Bank Limited into an efficient, market driven, customer focused institution with good corporate governance structure.

- Continuous improvement in business policies and procedures through integration of technology at all levels.

The Strategic Priorities of the Bank

To have sustained growth, broaden and improve range of products and services in all areas of banking activities with the aim to add increased value to shareholders investment and offer highest possible benefits to the customers.

Core Values of the Bank

- For the customers: To become most caring Bank – by providing the most courteous and efficient service in all area of business.

- For the Employees: By promoting the well – being of the members of the staff.

- For the Shareholders: By ensuring fair return on their investment through generating stable profit.

- For the Community: By assuming the Bank’s role as a socially responsible corporate entity in a tangible manner through close adherence to national policies and objectives.

History of CCS of Prime Bank Limited

Consumer credit is the credit which is provided to people having fixed but regular income for acquiring consumer durables and other assets for personal use to service from their monthly income. Consumer Credit is a collateral free credit and backed by the monthly income of the loanees and guarantors acceptable to the bank.

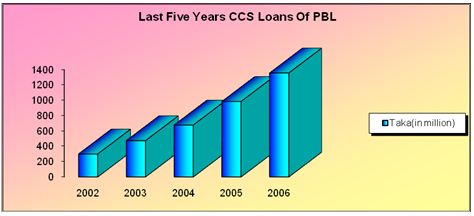

Consumers Credit Scheme(CCS) is very helpful to limited income group. Prime Bank Limited want sustainable growth and continue to meet social obligations. For this they introduce Consumers Credit Scheme(CCS).Prime Bank Limited started Consumers Credit Scheme(CCS) since its inception in the year 1995.

The above graph shows last five years allocation in Consumer Credit Scheme of Prime Bank Limited. It evident that day by day the number of consumers loan in Prime Bank limited is increasing. It is a clear indication of popularity and potentiality of this scheme. It becomes very popular to people especially to limited income group. It has been possible to reach this height of the market image and reputation of the bank because of this CCS. This covers wide range of people belonging to fixed income group.

Objectives of the Scheme

- To broaden the base of credit portfolios.

- To ensure access to credit by mass people as far as possible.

- To introduce and carry on collateral free credit operation.

- To diversify the credit portfolio so as to minimize the extent of delinquency.

- To improve the standard of living of the fixed income bracket people.

- To take part in the socio-economic development of the country.

- To enhance the purchasing power of the people by providing credit.

- To arrest delinquency rate which is one of the major problems in the banking sector of the country.

- To establish a participatory economic system in the country

- To enhance the base of beneficiaries of banking services.

Salient Features of CCS

- This is the loan which is provided to people to acquisition of goods for personal use

- This is collateral free loan

- This is loan which is based on personal guarantee against collateral security in case of general loan.

- This loan is provided to fixed income group of people.

- Security against this loan is personal guarantee and post dated cheques.

- This is a term loan repayable in installments convenient to customers.

Target customers:

The following are customers who are targeted to be marketed for CCS

- The officers of different public bodies.

- The executives and officers of nationalized commercial banks.

- The officers and executives of private commercial banks.

- The officers and executives of non-banking financial institutions and insurance companies.

- The officers and executives of multinational companies.

- The officers and executives of public limited companies, conglomerates of good repute acceptable to bankers.

- The self-employed persons acceptable to bankers.

- The professionals namely doctors, engineers, accountants, lawyers etc. However, Accountants and lawyers should be discouraged as far as possible.

Eligibility of Consumers

The above people who have fixed and regular monthly income with sufficient take home salary to repay the loan.

Following employees can get loan under CCS if he/she is within the age limit :

- Self employed persons who have regular and monthly fixed income with repayment capacity .

- Non-officers are also considerable on case to case basis to get CCS loan.

Consumer or personal credit is comprised of advances made to individuals to enable them to meet expenses or to purchase, on a deferred- payment basis, goods or services for personal consumption.

Such credit may be used not only to obtain consumer goods or services but to refinance debts which originated when such purchases were made. Consumer credit includes all credit granted for these purposes, whether it is extended by various financial, institutions, retail merchants, manufacturers, or by other service organizations.

This definition does not include mortgage credit on real estate or other types of investment credit which may be retired by regular investment payments.

Age Limit for being a consumer of CCS

- Minimum Age : 25 years

- Maximum Age : 60 years

Discouraged list of loanees:

The following are the people who should be discouraged in extending credit facilities under this scheme:

- The employees whose jobs are frequently transferable.

- The employees of enterprises which are not of good repute.

- Employees having take home pay less than Tk.10, 000 per month.

- Lawyers should be avoided.

Scope of consumer credit operation:

Consumer credit scheme is limited to the Section of people which has a fixed but regular monthly income to service the loan there from in easier installments. As a matter of fact, the people who are in the employment in public and private organizations having salary and allowances sufficient to service the loans in monthly installments are provided consumer credit. However, self-employed people are also provided this credit facility as per judgment of the bankers.

Eligible Items

Prime Bank Limited gives loan under Consumer Credit Scheme (CCS) to buy following items:

- Car Loan

- Doctors Loan

- Household Durable Loans

- Marriage Loan

- Any Purpose Loan

- Education Loan

- Hospitalization Loan

- Advance Against Salary

- Travel Loan

- CNG Conversion Loan

Credit Limit

Loan amount is different for different people. Loan is given for 80% of the given quotation. Amount of credit shall be allowed keeping in view the repayment capability of the customer. The amount of credit shall be determined in such a manner that monthly installment does not exceed 50% of the disposable income (take home salary/ income) of the customer. The monthly installment size will not exceed one third of the take home salary for non- officers only so as to enable the customer to repay the loan easily. Installment size also depends on the loan amount of concerned consumer.

Loan limit, down payment and period of loan of different items are presented in the following table:

| Name of Item | Loan Limit | Head office Credit Committee | Period Of Loan (Maximum) |

| Car (new) | Tk.20,00,000.00 | Up to 15.00 lac | 4 Years |

| Car (reconditioned) | TK.20,00,000.00 | Up to 15.00 lac | 4 Years |

| Household durables (Other items) | TK. 5,00,000.00 | 5.00 lac | 2 Years |

| Doctors Loan (Specialist) | TK.1,00,000.00 | 10.00 lac | 2 Years |

| Doctors Loan (General) | TK.5,00,000.00

| 5.00 lac | 2 Years |

| Salary | Tk.3,00,000.00 | 3.00 lac | 2 Year |

| Any Purpose | Tk.1,50,000.00 | — | 2 Year |

| Education | Tk.3,00,000.00 | 3.00 lac | 2 Year |

| Travel | Tk.2,00,000.00 | 2.00 lac | 2 Year |

| Marriage | Tk.3,00,000.00 | 3.00 lac | 2 Year |

| Hospitalization | Tk.3,00,000.00 | 3.00 lac | 2 Year |

| CNG | Tk.60,000.00 | — | 2 Year |

Further Loan

After repayment of 75% of the credit allowed to a customer, he/she will be eligible for fresh credit under the scheme but the total amount of credit shall not exceed the ceiling under any circumstances.

Rate of interest & charges:

Simple interest rate is 16% and service charge is 1%. Apart from these, there is risk fund on total amount of loan at the time of disbursement of loan. Though simple interest rate is 16% effective interest rate is lower than this. As installment is paid interest rate reduces because interest is charged on the residual amount. So, higher interest rate is charged at initial stage and lower interest rate at later stage.

In following table rates of interest, service charge, risk fund and cost of stamp are present

Particulars | Rate | Mode of Recovery |

| Service Charge | 1% of Loan amount | 16% P.A. |

| Risk Fund | 1% on loan amount | Cash deposit at the time of disbursement |

| Cost of Stamps | Tk.600/- | Cash deposit at the time of disbursement |

Service charge, risk fund and stamp charges have to be paid at the time of disbursement of loan. Monthly installment has to be paid within 7th day of each month. All branches transfer their entire outstanding balance in risk fund on regular basis to Financial Administration Division, Head Office at the end of every month through IBCA along with a statement as per existing practice.

If there is any license fee, registration fee, insurance charge etc. then customer will bear those. Customer will bear the expenses for necessary repair and maintenance of the articles during the period of loan. The articles shall remain in sole control and custody of the customer who will not let out, lend, resell or transfer the possession or rights of the same to a third party under any circumstances.

Mode of Repayment

Repayment will start from the following month of the disbursement of loan. Repayment of loans including accrued interest will be made by equal monthly installments. Before disbursement of loan, the customer will deposit crossed cheque covering the total number of monthly installments in favor of the bank which will have to be presented for collection on the due dates. Installments will be paid within 7th day of each month. Default in payment of 3(Three) consecutive installments shall render the client liable to handover the articles to the bank. Pre-payment is allowed. The client may repay the entire outstanding amount in lump sum before expiry of validity period of the loan.

Rebate

If customer repays the loan installments regularly as per schedule of payments of loan then he is allowed to get 5% rebate on the interest charged. Branch may refund the calculated rebate amount at the time of adjustment of the loan.

Rules for Application

Interested clients will have to apply for the credit in bank’s printed application form, which will be available in respective branch or any other authorized agent on payment of fifty taka only. Clients will submit the application form duly filled-in with one photograph and signed along with quotation(s) for purchase of desired articles.

The customer’s name/other name(s) including nickname, if any, should be mentioned in every loan application.

Processing of Application

First Phase:

Branch examines the credibility of the customer. On proper scrutiny of the application, branch will take the initial decision. Customers have to give a quotation of the product from the supplier. This initial decision is to be informed to the applicant within 3(Three) working days from the date of receiving application by branch CCS cell. After this second phase comes.

Second Phase :

In second phase branch will provide additional papers to the applicants whose applications are accepted for processing as following:

- Particulars of Guarantor form ;

- Letter of Guarantee ;

- Personal Net-Worth Statement for Businessman/Professionals.

Applicants will submit the above forms duly filled-in with the following additional papers

- Salary Certificate for service holder ;

- Trade license and TIN Certificate(if any) for Businessman ;

- TIN Certificate of applicants for vehicle loan ;

- Attested photocopies of current Tax Receipt, Electric bill etc. & lease agreement (if any) when the source of income o house rent as a landlord.

For proper scrutiny, branch will inspect the given information. This is needed to find out eligibility, feasibility and security. After completion of all necessary formalities, branch shall disburse the loan or decline the proposal within 7(Seven) working days from receiving the additional papers.

Customers have to give a quotation of the product to the branch. 20% have to be borne by the customer and 80% is given as loan under CCS. Price of the items (Down payment + Loan amount) should be given to the respective supplier through payment order after completion of necessary documentation.

Security Measures

Before disbursement of loan, the customer will deposit crossed cheque covering the total number of monthly installments in favor of the bank which will have to be presented for collection on the due dates. For security purpose customers have to give some personal guarantee/Bank guarantee/ Insurance guarantee.

The customer will provide following personal guarantee/Bank guarantee/ Insurance guarantee according to the Bank’s prescribe forms/financial instruments:

| Nature of Security | Number/ Quantity | Particulars |

| Personal Guarantee | 01

| For Employees of Govt. Semi-Govt. & Corporate Organization. |

| 02 | For Businessman and Employees of Non Corporate Private Organization. | |

| Financial Instruments | 50% | Personal Guarantee will be waived. |

| Bank Guarantee | 100% | Personal Guarantee will be waived. |

| Insurance Guarantee | 100% | Personal Guarantee will be waived. |

| Ownership for Vehicles | In the name of the Bank. | |

| Insurance for Vehicles | Comprehensive coverage from insurance companies (acceptable to Bank) | |

| Corporate Guarantee | For Corporate arrangement with Head Office approval. |

After that the bank/insurance guarantee should be authenticated to the satisfaction of the Branch Manager and financial instruments (FDR, PSP etc.) shall be duly discharged by the holder in favor of the bank. The articles procured under the scheme shall remain hypothecated to the bank as security.

To avoid embarrassment where the guarantor is the Head of the institution/office, his particulars shall be verified solely by an officer of the bank. The fact & circumstances should be recorded in the file.

Guarantor’s photograph will be obtained from each guarantor. If the guarantor is a senior government official/company executive, the condition for collection of photographs from such official/executive be relaxed and reasons therefore should be noted in file.

Documents to be Obtained

At the time of disbursement of loan, customer will have to execute some documents.

The documents are:

- Demand Promissory Note ;

- Letter of Authority ;

- Letter of Guarantee ;

- Loan Agreement under Consumer Credit Scheme ;

- Letter of Hypothecation ;

- Letter of Disbursement ;

- Agreement/Arrangement ;

- Undertaking ;

- Declaration;

- Insurance Policy (Applicable for Car)

Central CCS Unit

Consumers Credit Scheme (CCS) becomes very popular to people especially to limited income group. It is comparatively more remunerative to the bank. There is ample scope to expand the credit under the scheme. CCS becomes very much beneficial to certain people, for which it is not possible to buy goods at a time. If they can get loan they can buy the product on installment basis and can increase their standard of living. For this reason the number of consumers increases day by day. In order to boost up the Credit portfolio under “Consumers Credit Scheme(CCS)” , it has been necessitated to re-organize the “CCS” activities and reconstitute a “ Central CCS Unit ” at Head Office with a view to ensure the following :

- Prompt decision/approval of loan under CCS ;

- To reduce the burden of the branches for marketing and sanctioning CCS loan ;

- To make special efforts for recovery of stuck up loans and

- To strengthen the monitoring drive as well as supervision for recovery of Bank’s dues and thereby strengthen the Credit Portfolio.

Consumers Credit Schemes(CCS) of PBL

Prime Bank Ltd is the pioneer of CCS in Bangladesh. Considering the demand, popularity of the customer Finance products and to diversify the risk portfolio of the management of PBL reviewed and amended some of the then existing terms and conditions of Consumer Loan Products at 8th February 2005. The re-engineering consumer financing guidelines with its features, terms and conditions are discussed below:

- Personal Loan (Secured)

- Personal Loan (Unsecured)

Personal Loan (Secured):

- Eligibility: Any person having a Current Deposit (CD), Short Term Deposit (STD), or Savings (SB) account.

- Margin: Best effort basis. Accrued interest to be serviced quarterly.

- Limit: As per delegation of power circulated by the Bank from time to time.

- Security: Lien on FDR and any other saving instruments duly discharged with letter of authority to encase of default.

- Rate of Interest: In case of FDR 2-3% above FDR interest rate. In case of other deposit 15% p.a. with quarterly interest rate.

- Period: Maximum 12 (Twelve) months.

Personal Loan (Unsecured):

The Consumer Credit Schemes that PBL provides are of following categories:

- Household durable loan.

- Car loan.

- Doctors loan.

- Advance against salary.

- Any purpose loan.

- Travel loan.

- Education loan.

- Marriage loan.

- CNG loan.

- Hospitalization loan.

Household Durable Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%

Down Payment: 25%

Income: Minimum 10,000 for salaried individuals and 40,000 for businessman.

Stamp: TK. 600.

Features: Under this head, loans are sanctioned against guarantee of third parties acceptable to the bank or pledge of FDR, Savings instrument of banks and assignment of salary where applicable.

Disburse Mode: One time disbursement, but through issuing Pay order toward the seller of the household products to the customer who is getting loan from the bank.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Car Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: Nill

Down Payment: 25%

Income: Minimum 10,000 for salaried individuals and 40,000 for businessman.

Stamp: TK. 600.

Features: Under this head, loans are sanctioned against Registration of the vehicle in the name of the Bank. Instead of down payment, the customer have option to avail loan against their FDR or any other savings instrument up to 90% of the loan amount.

Disburse Mode: One time disbursement, but through issuing Pay order toward the seller of the automobile retailer..

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Doctors loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%

Down Payment: 25%

Income: Minimum 10,000 for salaried individuals and 25,000 for self employed.

Stamp: TK. 600.

Features: Under this head, loans are sanctioned against Registration of the vehicle in the name of the Bank. Instead of down payment, the customer have option to avail loan against their FDR or any other savings instrument up to 90% of the loan amount.

Disburse Mode: One time disbursement, but through issuing Pay order toward the seller of the Medical equipment..

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Advance Against Salary:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%

Down Payment: Nill.

Income: Minimum 10,000 for salaried individuals and 25,000 for businessman.

Stamp: TK. 600.

Features: Under this head, if loans to be sanctioned, a letter of introduction including name, father’s name, designation, date of birth, date of joining, place of posting, date of last promotion, date of retirement, basic salary, total emolument, total in PF, take home salary etc. will be required.

Disburse Mode: One time disbursement.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Any Purpose Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%

Down Payment: Nill.

Income: Minimum 10,000 for salaried individuals and 25,000 for businessman.

Stamp: TK. 600.

Features: This scheme is to meet the emergency need for fund by fixed income group of salaried person in Bangladesh. Under this head, if loans to be sanctioned, a letter of introduction including name, father’s name, designation, date of birth, date of joining, place of posting, date of last promotion, date of retirement, basic salary, total emolument, total in PF, take home salary etc. will be required.

Disburse Mode: One time disbursement of money.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Education Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%

Down Payment: 10%.

Income: Minimum 12,000 for salaried individuals and 25,000 for businessman.

Stamp: TK. 600.

Now –a-days, to build a career for us, we need the best education or to get higher degree either at home or abroad. and this requires a substantial amount of finance. To relieve the customers this burden, PBL offers “Education Loan” that uninterrupted study flow of cash.

Disburse Mode: The sanctioned loan amount is deposited to the client’s account with the bank from where the client can withdraw money according to his requirement.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Travel Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%

Down Payment: 10%.

Income: Minimum 12,000 for salaried individuals and 25,000 for businessman.

Stamp: TK. 600.

When planning an overseas vacation or making trip to a chosen exotic location, financing may be the key issue. PBL has taken over that worry of their customers by offering “ Travel Loan “.

Disburse Mode: The sanctioned loan amount is deposited to the client’s account with the bank from where the client can withdraw money according to his requirement.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Marriage Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%

Down Payment: 10%.

Income: Minimum 10,000 for salaried individuals and 25,000 for businessman.

Stamp: TK. 600.

Tying the marital knot is an event of a life time, and its celebration and memories should last forever. With this view PBL has tailored Marriage loan that enable its customers to organize and celebrate the marriage in style. This loan is only for the Bangladeshi citizens.

Disburse Mode: The sanctioned loan amount is deposited to the client’s account with the bank from where the client can withdraw money according to his requirement.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

CNG Conversion Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: Nill

Down Payment: 10%.

Income: Minimum 12,000 for salaried individuals and 25,000 for businessman.

Stamp: TK. 600.

Through CNG Conversion Loan, PBL provides its environment conscious customers an easy financing to convert their vehicles into CNG driven vehicles.

Disburse Mode: One time disbursement, but through issuing Pay Order toward the CNG Conversion Station.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Hospitalization Loan:

Interest Rate: 16%

Service charge: 1%

Risk Fund: 1%l

Down Payment:

Income: Minimum 12,000 for salaried individuals and 25,000 for businessman.

Stamp: TK. 600.

Disburse Mode: One time disbursement, but through issuing Pay Order toward the Hospital authority.

Repayment Method: The repayment method is installment basis. The customer has to pay equal monthly installment within the loan period.

Recovery of CCS loans

After disbursement of loans, CCS unit shall diarise the date of payment of monthly installment. Before 10 days of due date of installment, they shall give reminder to the customers. If any customer fails to deposit on due date 2nd reminder shall be given. After 7 days 3rd reminder shall be given. If installment is not deposited , CCS unit shall arrange for visit the customer personally. The unit shall sanction loan very judiciously and shall maintain very effective & strong follow-up and persuasion to ensure that no new loan sanctioned by them is defaulted. The unit shall also take necessary step to recover the stuck-up old loans of different branches. The chronic defaulter loans classified Bad and Loss shall be referred to Recovery Agent for recovery. They shall ensure 100% recovery of new loans. Old classified loans should also be recovered so that the portfolio under old loan is fully liquidated within 2007.

PRODUCT TYPE COMPARISON

According to different types of Consumer Credit Schemes the comparison among the observed Banks are given below:

| Loan Type | PBL | DBL | BRAC Bank | FSBL | SCB |

| 1. Household durable loan | YES | NO | NO | YES | NO |

| 2. Car loan | YES | YES | YES | YES | NO |

| 3. Doctors’ loan | YES | NO | YES | NO | YES |

| 4. Advance against salary | YES | NO | YES | NO | NO |

| 5. Any purpose loan | YES | YES | NO | YES | YES |

| 6. Education loan | YES | NO | YES | NO | YES |

| 7. Travel loan | YES | NO | YES | NO | YES |

| 8. Marriage | YES | NO | NO | NO | YES |

| 9. CNG conversion loan | YES | NO | NO | NO | NO |

| 10. Medical loan | YES | NO | NO | NO | YES |

| 11. Teachers loan | NO | NO | YES | NO | NO |

| 12. Credit Card loan | NO | NO | YES | NO | NO |

| 13. Top Up loan | NO | NO | YES | NO | NO |

Different banks have different types of schemes and most of the schemes are not common in all banks. Among these five banks PBL offers the maximum ten variety of Consumer Credit Schemes while DBL offers the minimum two types of Consumer Credit Schemes. On the other hand BRAC Bank provides eight types of Consumer Credit Schemes, SCB offers six types of Consumer Credit Schemes and FSBL provides three types of Consumer Credit Schemes. Offerings of PBL appears to be encouraging to the customers because of its variety in Consumer Credit Schemes. As a result, Compared to other Banks, PBL is definitely showing much better performance in this sector.

INTEREST RATE COMPARISON

Different banks have different types of schemes and most of the schemes are not common in all banks. So pricing comparison is performed based on the average interest rate of CCS of the banks.

| Banks | Interest Rate |

| PBL | 16% |

| SCB | 16.5% |

| BRAC Bank | 17% |

| DBL | 18% |

| FSBL | 18% |

Considering interest rate of all the Consumer Credit operations of the five banks, PBL offers the least interest rate. It is surely encouraging to the customers.

LOAN LIMIT COMPARISON

| Banks | Loan Limit (Max) | Loan Limit (Min) |

| PBL | TK. 10,00,000 | TK. 20,000 |

| SCB | TK. 5,00,000 | TK. 25,000 |

| BRAC Bank | TK. 10,00,000 | TK. 40,000 |

| DBL | TK. 5,00,000 | TK. 25,000 |

| FSBL | TK. 10,00,000 | TK. 20,000 |

Note: This Table does not contain car loan limit of PBL (TK. 40 lac) and Aroggo loan of BRAC Bank (TK. 30 lac)

From the above graph it is Clear that Like FSBL and BRAC Bank, PBL is also offering the maximum loan limit of ten lac taka. On the other hand SCB and DBL are offering maximum limit of Five lac taka. So it is evident that PBL is one of the maximum loan limit offering banks among these five banks.

Comparison Based On Loan Period

| Banks | Loan Period (Max) | Loan Period(Min) |

| PBL | 4 Years | 2 Years |

| SCB | 5 Years | 1 Years |

| BRAC Bank | 5 Years | 1 Years |

| DBL | 4 Years | 1 Years |

| FSBL | 4 Years | 1 Years |

From the above graph, we see that SCB and BRAC Bank offering the same loan period while DBL and FSBL offering the same loan period. But PBL offers the unique Loan period which is more convenient to customers.

COMMON FEATURES OF CCS

Because of the severe competition and substantial number of rival’s different private banks diversify their Consumer Credit Schemes by types, different aspects, and different terms. Even so, there are several features of CCS where all the observed banks are found more or less similar. These are as follows:

- The eligibility of the customers is common for similar schemes of different banks.

- Disbursement mode of the loan amount is through issuance of Payment Order to the vendor (when the loan is sanctioned to purchase consumer goods) or through depositing the loan amount to the client’s account with the bank (when the loan is to be used for some other purpose or to purchase service).

- Repayment method is either lump sum cash deposit or installment basis. The customer can repay the loan amount by Lump sum cash deposit within the validity or by equal monthly installments over the loan period.

- Some of the documents, that are to be obtained by the banks to sanction the loan, are common for all of them. Some other documents are not required for all schemes but are common for similar schemes of almost all the observed banks.

- Though some of the schemes of BRAC Bank don’t require any security but rest of its schemes and all the CCSs of other banks require same types of securities from the clients.

Findings

Findings from Comparative Analysis:

From my comparative analysis I have found the problems associated with the Consumer Credit Schemes and their operations of prime Bank Ltd. in two categories. These are

- Major Problems

- Minor Problems

These two types of problems are discussed in brief as under:

Major Problems Associated With Prime Bank Ltd.:

Weakness in Marketing:

Though there is marketing department in PBL, but the activities of that particular department can’t be able to take any significant role in the bank’s operation of CCS. The bank is concentrating on serving the clients for CCS rather than undertaking any promotional activity to create new clients.

High Interest Rate:

As a lot of private banks are operating in Bangladesh and most of them are providing CCS to people, the power of supplier is moderate to high. Clients want a low interest rate on their loan amount. PBL has more long term deposit than short term deposit, and due to competitive market PBL has to incur higher cost on their deposits. As consumer credit is sanctioned against short term deposits, the bank has to charge comparatively high interest rate than some of its rivals.

Limited Number Of Branches:

Prime Bank Ltd. has only 51 branches. It is a fewer in number considering those of many other private banks. There are some very important places in Bangladesh where PBL doesn’t have their branch. Few branch means limited geographic coverage, which ultimately means limited number of clients taking CCS of the bank. The more branches PBL has the more customers it can serve through CCS, the more income it can generate.

Insufficient Number Of Employees:

The number of employees at PBL is significantly low. At Banani Branch of PBL only 30 employees are providing the whole banking service where only 3 persons serve the CCS. There is only one Assistant Vice president at Credit Division who is providing and managing the entire CCS. He is over loaded with his responsibilities and so not being able to provide service to the customer in efficient manner.

Minor Problems Associated With Prime Bank Ltd.:

Absence of Effective Training Policy:

PBL don’t have any effective training policy. Though it has a training institute but they are not using this institution properly. Consumer Credit Policy and rules are critical enough to understand. Even so, the officers of the bank are not being properly trained in this sector of Banking.

Lack of Flexibility of CCS:

The loan limit both upper and lower under CCS of PBL not enough standard and flexible to the client’s. Upper limit is only 5 lac (except car loan), where FSBL provides 10 lac as loan under CCS. The minimum loan amount also doesn’t provide any competitive advance to the bank.

Excess Requirement of Documents:

The client’s are bound to submit a lot of documents to the bank to avail Consumer Credit under any of the 11 CCS of PBL. The Bank is overloading the clients by charging so much documents and papers which seems to the clients being harassed by the relevant officer.

Recommendations

Prime Bank Limited (PBL) should consider the following recommendations:

- PBL can pursue to Government high officials and can make a better relationship with them to get government fund in order to keep cost of fund low. Moreover, the Bank should attract more short-term deposits from the depositors against which it can provide CCS to the clients at a lower interest rate.

- PBL can open some more branches in strategically important place and by doing that they can achieve more geographical coverage and enhance their business volume under CCS.

- PBL has 5 (five) Islamic Banking Branch (IBB). All of these 5 branches are doing very good business and have public acceptability. Consumer Credit Schemes involve Interest that the clients are to pay to the Bank. As Bangladesh is an Islamic country and Islamic Banking is a popular concept PBL can go for more Islamic Banking Branches through which it can operate its CCS activities with less doubt in the mind of people.

- The Bank should diversify its loan portfolio and client portfolio. PBL should launch new schemes under CCS that will be affordable for lower income group of the society. Moreover the Bank should launch special schemes under CCS for teachers and for Health & Treatment Facility of people.

- PBL should take some marketing officer and an Executive in marketing Division who has some experience regarding marketing of Consumer Credit Products. PBL also should go for some promotional activities through its Public Relation Department and use advertising and field level personal selling for its CCS products.

- PBL should concentrate on bringing extra features considering other Banks similar schemes. These are:

- Interest under CCS should be half yearly compound.

- Upper loan limit of CCS should be fixed at Tk. 10 lac.

- Lower loan limit of CCS should be fixed at Tk. 10,000.

- Choice of repayment should be made flexible up to 60 months under each scheme of CCS.

- The higher authority of the Bank should promote eligible and expert employees at higher rank. This will reduce the employee turnover rate.

Conclusion

Consumer Credit is a type of loan provided by banks to its customers. Where Credit is an important input in the production process of a country as well as in the income generation activities of an individual, Consumer Credit improves the standard of living of individuals. The demand for Consumer Credit in a developing country like Bangladesh is much higher than its supply.

The word ‘Credit’ comes from the Latin word “CREDO” meaning ‘I believe’. Consumer Credit is lender’s (i.e. the Bank’s) trust in a person’s ability to repay the loan amount, which the client takes to purchase consumer goods / services, at some specified time in the future.

Credit is power. For a Bank, Consumer Credit is a significant source of profit and on the other hand, wrong use of Consumer Credit would bring a disaster not only for the Bank but also for the economy as a whole. Wright or wrong judgment while extending Consumer Credit under any Scheme means success or failure of a Bank.

All the Private Banks those I’ve observed provide CCS to their clients within the policy guidelines of the respective Banks and the Bangladesh Bank.

Prime Bank Ltd. is the pioneer of and a leading Bank in Consumer Credit Scheme in Bangladesh. The CCS of the Bank aims to help the fixed income group in raising standard of living and has been widely appreciated. The rate of recovery under the Scheme is 96%.

The main purpose of this report is to study the CCS of PBL and some other Private Sector Banks and to make a comparison between CCS of PBL and those of other Banks. Considering all the Consumer Credit operations of the five banks, performance of PBL appears to be encouraging. Compared to other Banks, PBL will definitely show much better performance in the near future. But it requires amendment of some terms of CCS of the Bank such as documentation, client portfolio, interest rate, quality of service etc.