The primary objective of this report is to gather information and related data in order to combine them based on Modern Banking System on the basis of NCC Bank Limited. Other objectives are review how NCC Bank perform their activities and know the products and services offered by NCC bank. Here explain overall the departments of the bank and observe the actual work done and explain see how the loans and advances are provided to the borrowers. Finally focus on foreign exchange system of the bank and make SWOT analysis.

Introduction

Now a day, it has become essential for every person to have some idea on the bank and banking procedure. As our educational system predominantly text based, inclusion of practical orientation program is an exception to the norm. From practical knowledge, we will be able to know real life situations and start a career with some practical experience. In such state of affairs the present aiming at analyzing the experience of practical orientation related to an appraisal of NCC Bank Limited and my report topic has been selected as “Modern Banking System on the basis of NCC Bank Limited.”

Banking constitutes an important segment of the financial infrastructure of any country. Generally, banking means deposit mobilization and development of those deposits into advances or investments in different sectors. That’s means bank collect deposit at lowest possible interest and provide loan and opportunity at highest interest. Between the two interests is the profit for bank. There are two type of banking that was commercial banking and another is investment banking. Commercial bank rise fund by collecting deposits from customer and business that use to make loan and customer at high interest for maximize profit. NCC bank is one of the most popular and profitable commercial bank in Bangladesh.

Objectives of the Study

Primary objective

The primary objective of this report is to gather information and related data in order to combine them based on the report Name “Modern Banking System on the basis of NCC Bank Limited”

Secondary objectives

The study was conducted to achieve the following secondary objectives-

- To review how NCC Bank perform their activities.

- To know the products and services offered by NCCBL.

- To get through all the departments of the bank and observe the actual work done

- To see how the loans and advances are provided to the borrowers

- To acquire knowledge about the foreign exchange system of the bank

Methodology of the Study

In this study, exploratory research was undertaken to gain insights and understanding of the overall banking industry and also to determine some of the attributes of service quality in Banks. Data needed for conducting the study have been collected from the following sources:

Primary sources:

- Face-to-face conversation with the respective officers in the branch.

- Observation while working in different desks

- Informal discussion with professionals

- Study of different files of different section of the bank

- Some access to the database

- Informal conversation with the clients

Secondary sources:

Secondary sources are the permanent and printed sources of information. This are-

- Annual reports of NCCBL

- Desk report of related department

- Brochures of National Credit and Commerce Bank limited

- Different reference books

- Banker’s training book

- Unpublished data from the branch

- Study of related books, seminar paper, training papers, Publication of statements

- Internet was also used as a theoretical source of information.

National Credit and Commerce Bank Ltd.

National Credit and Commerce Bank limited came to reality through the “National Credit Limited”. Prior to conversion into a scheduled commercial bank, National Credit Limited (NCL) was incorporated as an investment company on 18th November 1985. It made its journey on 25th November 1985 at its registered office and first branch at 7-8 Motijheel Commercial Area, Dhaka-1000 with initial authorized capital of Tk. 30 cores. It was mostly involved in collecting suitable resources and making profitable investments. But within a very short period of time this investment company turned into a scheduled commercial bank. It was turned into a bank because it faced many restrictions in both collection and disbursement of funds while it was operating as an investment company. While this turnover was going on all types of transactions were closed for about fourteen months from April 22nd, 1992. After that, with the permission from the government and Bangladesh Bank, NCL was converted in a full-fledged commercial bank and started its banking operation on 17th May 1993, in the name of National Credit and Commerce Bank Limited. It has been registered under the company act-1913, as a private commercial bank with paid up capital of Tk.39 cores to serve the nation along with 16 branches. However, NCCBL runs as per company rule, free from government intervention. Year 1994 & 1995 were the full operation year of the bank. During this period gave emphasis on considering the affairs of the institution as well as expansion of business work. During last 15 years if its operation NCCBL has acquired commendable reputation by providing sincere personalized service to its customers through a technology based environment.

Objectives of NCC Bank

The main objective is to maximize profit through customer satisfaction which very much reflects the idea of marketing concept. NCCBL has been ensuring maximum profit by providing best and improved customer service along with other corporate objectives mentioned below:

- To provide excellent customer service to its clients, so that they choose NCCBL first for their banking.

- Ensure high return on investment and services with different service products.

- Making profitable investment and grow in annual profit ma

- To remain as the market leader through diversification of business and automation of banking operations.

Corporate Vision

To become the Bank of choice in serving the Nation as a progressive and Socially Responsible financial institution by bringing credit & commerce together for profit and sustainable growth.

Corporate Mission

To mobilize financial resources from within and abroad to contribute to Agricultures, Industry & Socio-economic development of the country and to pay a catalytic role in the formation of capital.

Functions of NCC Bank Ltd.

The functions of the NCC Bank Ltd. are given here:

Deposit

- Current Account

- Savings Bank Deposit Account

- Term Deposit Account

- Premium Term Deposit Account

- Special Savings Scheme

- Special Fixed Deposit Scheme

- Money Double Program

Loans and Advance

- Working Capital Financing

- Commercial and Trade Financing

- Long Term (Capital) Financing

- House Building Financing

- Retail and Consumer Financing

- SME Financing

- Agricultural Financing

- Import and Export Financing

Remittance

- Special Interest Rate on Savings and Term Deposits

- Wage Earners Welfare Deposit Pension Scheme

- Loans for Real Estate (Land Purchase and House Building/Renovation)

- Advance Against Regular Remittance

Deposit

The deposited amount and its trend tells how the bank is performing in the banking business and how much attractive the bank is to the general customers. The followings are the deposit condition of NCCBL in recent years.

| Year | Taka (In millions) |

| 2005 | 21478 |

| 2006 | 28147 |

| 2007 | 34902 |

| 2008 | 46905 |

| 2009 | 53900 |

Comments:

Deposit of the bank at the end of the year 2007 was Tk. 34901.77 million, which was more than deposit of 2006. From 1999 to 2002 the bank had a rising position but in 2003 it decreased. It happened due to increase competition in banking sector where the customers are going to the other banks. But in 2006 bank’s deposits increased than previous year. This happened because of increasing confidence of customer in NCCBL. This inspired people to make more and more deposit with NCCBL.

Special Deposit Scheme

NCC Bank is now offering various depository products for mobilizing the savings of the general people to get the deposit from the little saver portion of the country, NCC Bank has started few schemes which by this time gained high popularity among the depositors. To ensure risk free and profitable investment of limited income of majority of people and thereby provide maximum benefits, NCC Bank has launched following savings schemes:

- Special Saving Scheme (SSS)

- Special Fixed Deposit Scheme (SFDS)

Special Saving Scheme (SSS)

Two types of Account can be opened under this scheme. One for term of 5 years and another for a term of 10 years. Rules for both the accounts shall be the same.

Monthly installments of deposit will be Tk.500/- and its multiple up to Tk.10,000/- only as mentioned below to be deposited every month during the entire period of the scheme as fixed at the time of opening the Account. Account may be opened for any installments but later on the same is not changeable.

The depositor(s) will be paid a fixed amount after expiry of the term as follows:

| SL | Monthly Installment (Taka) | Amount to be paid after the maturity @ 12.10% | |

| 5 years | 10 years | ||

| 01 | 500/- | 40,500/- | 1,10,750/- |

| 02 | 1000/- | 81,000/- | 2,21,500/- |

| 03 | 1500/- | 1,21,500/- | 3,32,250/- |

| 04 | 2000/- | 1,62,000/- | 4,43,000/- |

| 05 | 2500/- | 2,02,500/- | 5,53,750/- |

| 06 | 3000/- | 2,43,000/- | 6,64,500/- |

| 07 | 3500/- | 2,83,500/- | 7,75,250/- |

| 08 | 4000/- | 3,24,000/- | 8,86,000/- |

| 09 | 4500/- | 3,64,500/- | 9,96,750/- |

| 10 | 5000/- | 4,05,000/- | 11,07,500/- |

| 11 | 10000/- | 8,10,000/- | 22,15,000/- |

Source: Special Saving Scheme (SSS) department, NCC Bank ltd.

Special Fixed Deposit Scheme (SFDS)

- Minimum Tk. 50,000/- or multiple amount is acceptable under this scheme.

- The duration of the scheme shall be 5 years after which depositors can take back the principal amount, if not renewed.

- The duration of time between deposit and payment of first profit must minimum one month.

Monthly interest will be given to the depositors against the deposited amount according to the following schedule:

| Amount of Deposit (TK) | Monthly Profit (TK) |

| 50,000/- | 500 |

| 1,00,000/- | 1,000 |

| 2,00,000/- | 2,000 |

| 3,00,000/- | 3,000 |

| 4,00,000/- | 4,000 |

| 5,00,000/- | 5,000 |

| 6,00,000/- | 6,000 |

| 7,00,000/- | 7,000 |

| 8,00,000/- | 8,000 |

| 9,00,00/- | 9,000 |

| 10,00,000/- | 10,000 |

Source: Special Fixed Deposit Scheme (SFDS) department, NCC Bank ltd.

Loans and Advances

National Credit and Commerce Bank Limited is a scheduled commercial bank. Through financial intermediation the bank seeks avenues for employment of its funds where: (a) there is a profit, (b) risk is minimal; and (c) the cost of administrating is low. While “profit motivation” remains the prime consideration for viable operation and growth of the bank, the bank would also respond adequately to the socio-economic objectives formulated by the Government from time to time for accelerating the pace of economic development of the country.

National Credit and Commerce Bank Limited is a new generation bank. It is committed to provide high quality financial services products to contribute to the growth of G.D.P of the country through stimulation trade and commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and over all sustainable socio-economic development of the country.

Like every other business activity banks are profit oriented and profit is the central point on which the entire business activity rotates. A bank invests its fund in many ways to earn income. The bulk of its income is derived from investment. Since major part of banks income is derived from credit and since the money credited by bank is customer’s fund, banks should follow a cautious policy and should landing principles in the matter of lending.

The bank will put reliance on market forces via increased inducement to savers to mobilize saving and via profitability potential to allowance funds to the users of such sectors of trade, commerce, and industries as are consistence with the socio-economic objectives of the nation. The free market economy policy of the Government of Bangladesh will indeed facilitate healthier and efficient lending activities of the bank.

VARIOUS PRODUCT OF CREDIT:

- House Building

- Transport Loan.

- Project Loan.

- Loan under Consumer Finance scheme.

- Loan under Lease Finance Scheme.

- Secured Overdraft.

- Cash Credit (Pledge).

- Cash Credit (Hypothecation).

- Export Cash Credit.

- Bank Guarantee.

- Letter of Credit.

- Payment against Document.

- Loan against Imported Merchandise.

- Loan against Trust Receipt.

- Bank to Bank Letter of Credit.

- Accepted Bill for payment.

- Inland Bill Purchased.

- Local Documentary Bill Purchased.

- Foreign Documentary Bill for Collection.

- Forced Loan.

- Packing Credit.

- Foreign bank Guarantee.

- Foreign Bank Guarantee.

- Small Business Loan

- House Renovation Loan.

- Personal Loan.

- Festival Small Business Loan Scheme.

I) Loan Documentation Checklist

Documents/Papers

- Acceptance of the terms and conditions by the borrower

- BLA’s opinion

- Photographs

- NOC from prior charge holder on fixed and floating assets of the company

- NOC to create 2nd charge mortgage on the prior mortgaged property

- Personal Guarantee of acceptable person as per sanction letter

- letter of Hypothecation of stock, raw materials, Work in process and finished goods

- Letter of Authority on Tk.150 non judicial stamp paper to take insurance policy and renewal thereof to the debit of Loan Account/any other account of the client

- Confirmation letter from prior mortgagor that they will hold documents of property to be charged on 2nd mortgage with our bank, on our behalf even if liability of the client with them is fully adjusted and deliver the documents on redemption of charge thereon, to us only

- Registered Irrevocable General Power of Attorney duly confirmed by work entrusting authority to the effect that all checques/bills against the work orders/supply orders to be issued in the joint name of the bank account the client

- Income tax clearance certificate with latest income tax return submitted

- Copy of allotment letter and lease deed for lease hold property issued by the lessor

- Equitable mortgage deed/deed of agreement.

II) Types of loan

Some of these important loans are described in below:

Making advances is the primary function of a bank. A major portion of its funds is used for this purpose and this is also the major sources of bank’s income.

Loans are the right to receive payment or an obligation to make payment on demand or at some future time on account of the immediate transfer of goods (securities).

Loans are the largest asset item, which generally account for half to almost three-quarters of the total value of all banks assets. A bank’s account typically is broken down into several groups of similar type loans. The loan and advances made by the NCCBL can broadly be classified by following categories:-

- Continuous loan

- Demand loan

- Term loan

- Other Special Schemes

Continuous loan

These are those advances, which do not have any set schedule for drawing or disbursement but usually have a terminal date of full adjustment or repayment. Example: Cash Credit (CC), Over Draft (OD).

1) Cash Credit (CC)

Cash credit arrangements are usually made against the security of commodities hypothecated or pledged with the bank.

Cash Credit (Hypothecation):

This type of credit is allowed to the traders and industrial borrowers for promoting trade and commerce and industries. In case of Hypothecation the possession of goods is not given to the bank. The goods remain at the disposal and in the godowns of the borrower. The borrower furnishes periodical return of stock with the bank.

Cash Credit (Pledge):

Allowed for promoting trade, commerce and industries of the country against pledge of stock in trade under Bank’s control. In case of the pledge, the goods are placed in custody of the bank with its name on the godown where they are stored. The borrower has no right to deal with them.

2) Overdraft (OD)

Overdraft is an arrangement between a banker and its customer by which the letter is allowed to withdraw over his /her credit balance in the current account up to an agreed limit. This is only a temporary accommodation usually granted against securities. The borrower is permitted to draw and repay any number to times, provided the total amount drawn and not for the whole amount sanctioned.

A cash credit is differs from an overdraft in one respect. A cash credit is used for long term by businessmen in doing regular business whereas overdraft is made occasionally and for short duration.

There are two kinds of overdraft:-

- Secured overdraft

- Unsecured overdraft

- Secured overdraft

- Secured overdraft is loans which have collateral attached to them in the form of a lien. A lien is a monetary claim against a property to be fulfilled before repeat ownership can take place.

Secured overdraft dividend is into 2 forms. Those are:-

- Secured overdraft financial obligation (SOD-FO): Allowed against financial obligation (Like-FDR, SSS etc) for promotion of economic and business activities.

- Secured overdraft general (SOD General): Generally allowed to the traders for business promotion and economic activities. In case of SOD (General), bank keeps the land as collateral.

Unsecured overdraft

Banks sometimes, grant unsecured overdraft for small amount to customers having current account with them. Such customers may be government employees with fixed income or traders. Unsecured overdrafts are permitted only where reliable source of funds are available to a borrower for repayment.

Demand loan

The loan which becomes payable after serving demand notice by the bank concerned are termed as Demand loan.

Example: LIM, LTR, PAD, Loan against Packing Credit, Loan against Investment etc.

- LOAN AGAINST IMPORTED MERCHANDISE (LIM)

- LOAN AGAINST TRUST RECEIPT (LTR)

- PAYMENTS AGAINST DOCUMENT (PAD)

- LOAN AGAINST PACKING CREDIT

- LOAN AGAINST INVESTMENT

In order to contribute to the development of the capital market of the country NCC bank extends credit facilities against pledge of shares, debentures, price bonds, treasury bills etc. to the individuals as well as to the member of DSE and CSE.

Term loan

Term loan has specific term for repayment as specified in the loan agreement. Term Loans may be of various types which is discussed in the below:

- LOAN GENERAL:

In case of loan general, a lump sum amount for a certain period is given as an agreed interest rate. The entire amount is paid within the validity by deposited installment each period as stated in the loan agreement. The interest rate is charged for the outstanding amount.

- HOUSING LOAN:

NCC Bank Ltd. Sanction two types of House Building Loan.

1) Residential.

2) Commercial.

Maximum size of loan:

Loan for amount exceeding Tk. 5.00 lac to the maximum of Tk.50.00 lac is considered under the Housing Loan Scheme. The repayment will be 5 year to 15 years including grace period.

INTEREST AND OTHER CHARGES:

- Interest @ 13.50% P.A. subject to change with market situation.

- No processing fee will be charged.

- Documentation charge: 1% of loan amount to be realized on acceptance of loan.

- Interest will be charged on monthly reducing balances after realization of monthly installments.

- 5% rebate will be allowed on total amount of interest charged at the time of final adjustment of an account wherein no break of chain in repayment of installments will occur.

PROJECT LOAN:

NCC Bank has project loan scheme. Before investment in the project loan bank always assessed who is the person behind the project, security of the loan, repayment status etc. Borrower has completed a feasibility report on the proposed project showing the objective of the project, target customer, details cost of the project etc. Branch has not any authority to sanction the project loan. They send the proposal to Head Office along with all necessary papers after assessing the feasibility of the project. Head Office then evaluates the proposal, if feasible then Head Office gives a sanction letter to the branch indication all terms and conditions of the loan. The branch then gives another sanction letter to the client.

TRANSPORT LOAN:

Process of transport loan is more or less same as project loan. Borrower has to apply for the loan in the bank prescribed application form. In the application form borrower must mention which vehicle he wants to buy and what’s the quantity. Borrower also has to provide detail price list of the vehicle, insurance paper for each vehicle, possible repayment schedule of the loan, list of collateral, list of hypothecated securities and necessary other papers depend on clients and number of vehicles. After getting all necessary papers and field inspection branch makes a proposal for the loan and sends it to the Head Office. Head Office then again checks the necessary papers and does the field inspection. After inspection if Head Office thinks that for sanction of the loan they need more securities and papers, borrower has to provide these papers. Branch usually does not have any authority to sanction any amount of loan. Branch only recommends for sanctioning the loan. After getting sanction from Head Office, branch disburses the loan and monitors regularly whether the vehicle is purchased, is the quotation matches with the real one, vehicle is in the route and more importantly borrower repaying the installment regularly

PERSONAL LOAN SCHEME:

Fixed income employee’s of various firm or company need urgently financial assistance for the following purpose:

- Marriage purpose

- Education purpose

- Advance against salary

- Education Loan

- Travel Loan

Especially meet up this financing by own income source is very difficult for middle class people. To solving this problem NCCBL introduce Personal Loan Scheme for salaried Person.

HOUSE REPAIRING/RENOVATION LOAN SCHEME:

The ownership of a House/Building/Flat comes from purchasing or by heir. Huge amounts of fund are needed at one time for repairing them to make suitable for live or for modernization or renovation. The owner’s faces difficult problems to invest their fund in these sectors. NCCBL trying to solve this difficult problem by introducing “House repairing/ Renovation Loan Scheme”

FESTIVAL SMALL BUSINESS LOAN SCHEME (FSBLS):

This is one of the innovative products of NCCBL. The main2 factor of this loan is this loan fully applicable for festival purpose and only for small businessman. The requirement of loan is not very high but which have beneficial effects for the small businessman who requires extra finance to stock the goods to cope with market demand especially during the festival time (Eid-ul-fitr, Eid-ul-Azha, and Durga Puza) to run their business smoothly. The disbursement/transaction procedure for festival small business loan shall be is re-cycling order and disbursement shall be stopped 15 days before the festival day and the disbursement shall start before 1 month of festival.

Necessary Documents for FSBLS:

- P. Note

- Letter of Arrangement

- Letter of Disbursement

- Letter of Guarantee

- Letter of authority to debit the account for loan installment, incidental and other bank charges

- Letter of hypothecation

- Up to date trade license

FESTIVAL PERSONAL LOAN SCHEME FOR SALARIED PERSON (FPLS):

In our country or in the sub-continent culture religious festival is one of the biggest occasions for the whole year. No matter what the financial situation everyone just wants to involve in those occasion. So this is a big occasion for businessmen for their business purpose and also individual for the festival. Salaried person of our country cannot fulfill demand from their fixed income at the time of festival. During the festival they require to met up their expenses. In order to cater to such emergent needs of the service holders, NCCBL has introduced this new scheme.

Interest and other charges for this type of loan:

- Interest @ 15% P.A at quarterly rest, subject to change.

- Application Fees- Tk.100/-

Other Special Schemes

Consumer scheme:

The Scheme aims at improving the standard of living of the fixed income group. Under the scheme the clients may secure loan facilities at easy installment to procure household amenities.

Lease Finance:

An entrepreneur, under this scheme, may avail of the lease facilities to procure industrial machinery with easy repayment schedule. The clients also get special rebate in their income tax payment under the scheme.

Lease financing is one of the most convenient long term sources of acquiring capital machinery and equipment. It is a very popular scheme whereby a client is given the opportunity to have an exclusive right to use an asset, usually for an agreed period of time, against payment of rent. Of late, the lease finance has become very popular in almost all the countries of the world. An obvious advantage of the lease is to use an asset without having to buy it.

Micro Credit Financing:

To fulfill its commitment to pay a vital role in socio economic development of the country NCCBL has introduce a small and medium credit scheme for its customers. The objective of the scheme is:

- To encourage and develop medium and small entrepreneurs

- To provide credit with minimum complexity and

- To generate employment.

Under the scheme NCCBL is providing Loan:

- To meet working capital

- To purchase capital machinery and for expansion of business and

- For purchasing household durables

Credit and Debit Card Division

NCC Bank has launched Credit Card of VISA brand in August 2005, with access in local market. Credit card for international market is issued in later 2007. Procedure for obtaining credit card is given below:

Prescribed Application Form is available at:

a) Card Division of NCC Bank Head Office

b) All branches of NCC Bank.

Required Documents With Application Form:

The required documents very for service holder and for businessman. Such as:

a) Recent passport size Photograph (one copy).

b) Attested original salary certificate/pay slip.

c) Personal bank statement for the last 6 months.

d) TIN certificate.

e) Photocopy of valid passport (if any) first 6 pages/ Voter ID/ Driving license/ Office

f) Photocopy of any utility bill.

g) Other Credit card statement (if any)

Age Limit:

Principal card applicant must be over 21 years of age and 18 years for supplementary card applicant and the applicant should not be over 60 years. So, the age limit for principal cardholder is 21 to 60 years and for supplementary cardholder is 18 to 60 years.

Minimum Income:

Minimum monthly income to apply is Tk.10, 000 for Classic card, Tk. 20,000 for Silver card and Tk. 30,000 for Gold card.

Clearing Section

In clearing section, Cheque, dividend warrant and other forms of financial instruments, which are easy for encashment, are received. The clearing departments send these instruments to the clearing House of the Bangladesh Bank for collection. As soon as cash is received the amount is deposited in the clients account. Collection of Cheque, drafts etc. on behalf of its customers is one of the basic functions of commercial bank. Clearing sends for mutual settlement of claims made in between member’s bank at an agreed time and placed in respect of instruments drawn on each other. Negotiable instrument law provides protection to a banker who collects a Cheque or a draft if the banker fulfills the following conditions:

- He collects the instrument for customer

- The instrument be crossed

- The acts in good faith and without any negligence

Types of clearing:

- Outward clearing:

Outward clearing means when a particular branch receives instruments drawn on other bank within the clearing zone and those instruments for collection through the clearing arrangement is considered as outward clearing for that particular branch.

- Inward clearing:

The bank provides the instruments to other bank through clearing house, which have been collected from different clients. It performs this kind of service for its clients without any charge or the remittance.

- OBC (outward bill collection):

If a party gives a Checque to a branch of NCCBL to collect money from a branch of other bank, which is not situated in the clearing house then NCCBL collects money through OBC. In case of OBC two ways exist to collect money from another bank.

Remittance Department

Remittance is significant part of the general banking. The bank receives and transfers various types of bills through the remittance within the country. Obviously the bank charges commission on the basis of bills amount. NCCBL remittances are safe, swift, inexpensive and simple.

There are two types of remittances:

- Local remittance

- Foreign remittance

Local remittance:

Using DD, TT, MT and PO can send local remittance. Bank receives commission by providing these services.

Types of Local Remittance:

- Pay Order (PO)

- Demand Draft (DD)

- Telegraphic Transfer (TT)

- Mail Transfer (MT)

- Shanchay Patra (SP)

Pay Order (PO):

Pay order is an instrument that contains an order for payment to the payee only in case of local payment whether on behalf of the bank or its constitution. Unlike checque there is possibility of dishonoring Pay Order. NCCBL charge different amount of commission on the basis of Pay Order amount.

Demand Draft (DD):

By DD any person can send money from one branch to another branch of NCCBL. To send the money he/she must fill up the NCCBL’s prescribed form of DD and paid charge/ commission and receives DD block. The following information is included in the DD block:

- Name of the sender branch.

- Name and account of the party who receives the money.

- For security purpose a confidential test number are included in the DD block.

- Amount of money to be transferred.

- Name of receiver branch.

The sender sends this block to the receiver branch of DD. When this DD block is received by the receiver branch, the authorized officer of the receiver branch tests the DD confidential number and if the test number is proofed then he/she gives the money to the payee.

Telegraphic Transfer (TT):

- To send money urgently NCCBL may be requested for TT on payment of a nominal charge and telegram charge.

- Any person urgently sends money from one branch to another branch within NCCBL through TT.

- When a message of TT sends through phone from one branch to another branch in that time the message received by the authorized officer who has a right of power of attorney. After that, he/she fills up the TT form. Following things are included in the TT form:

- TT number

- TT test number

- Name and account number of the payee

- Power of attorney number of the sender and receiver of TT

- The amount to be transferred

- After fill up the TT form, he tests the number of TT. If he ensures through testing the test number then he credits the account of the payee. On the other hand, if the test number is not proved then he calls back to the sending branch of TT and request to send a new TT.

Mail Transfer (MT):

Money can be sent through mail transfer to anybody who has an account in any other branch of the same bank for this purpose the sender shall have to furnish the details like:

- The name of the beneficiary and his account number

- The amount to be transferred

- The name of the branch where the account is maintained

Foreign remittance:

NCC Bank is the member of Money Gram and SWIFT networks. Using the services of this global network, non-resident Bangladesh nationals can send money from abroad to their home country within a few minutes without any risk. NCC Bank has also arrangement with foreign exchange companies like UAE Exchange Co., Redha –Al-Ansari Co.etc.

Foreign remittance:

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Taka in Million | 2492.30 | 3856 | 7443.50 | 12098 | 13392 |

Source: Foreign Remittance department, NCC Bank ltd(2005-2009).

Money Gram:

Money gram is represented in over 115countries and is available at more than 25,000 locations worldwide. In the USA alone Money Gram is available at more than 15,000 locations. Besides, in the UK Money Gram is available through 1700 Postal Branches and 500 Thomas Cook travel shops making is the UK’s largest money transfer network. Finally using the Money Gram service could not be simpler. All one has to do is to visit a conveniently situated Money Gram agent anywhere in the world and to hand over the money they want to send their relatives or friends along with the one-off transaction fee:

- Sender completes a “send” form and gets a receipt. Money Gram Agent gives a Ref. No. This has to be passed to the receiver.

- NCC Bank makes an enquiry on the Money Gram computer network to obtain authorization to pay recipient and recipient receives the fund.

Money Gram is one of the fastest ways to transfer money. Customers using Money Gram can send or receive money usually within 10 minutes from anywhere in the world.

Beside this customer can also get remittance from:

- X-press money

- AFX (AL-FARDEN Fast Reemit)

- Habib Qatar

- Placid Express

Another three kinds of money transfer process NCC Bank has:

- Telemoney (Arab National Bank)

- Dhaka Janata Express (Italy)

- First Solution (UK)

Financial analysis

Introduction

Financial analysis is so much essential for each and every business institution as well as for the Banking institutions to assess their past financial performance and to identify the sources, where the necessary improvement is needed to perform better in the future and to meet the future challenges by taking effective business strategy. Financial analysis typically is associated with ratio analysis. Ratio analysis involves the methods of calculating and interpreting the financial ratios to analyze the firm’s relative financial performance. The main purpose of this analysis is to analyze and monitor the firm’s financial performance, so, that the interested parties (both the external and internal) can realize the firm’s actual performance easily and conveniently, which is so much essential for the parties. There are several ratios that help a particular analyst to analyze the past performance of a particular firm and to diagnose the various relevant variables, which are important for improving the future operation of that firm. The financial ratios, that are useful for analyzing the past financial performance of a financial institution, such as – Bank, can be divided into five broad categories for convenience and they are enumerated below ——–

- Liquidity Ratio.

- Operating Efficiency Ratio.

- Profitability ratio.

- Capital Ratio.

- Market Ratio

These five groups of financial ratios are used to analyze a particular firm’s past financial performance and to identify the sectors where the necessary improvement is needed to make the future performance of the firm far better than the past. It is also mentionable that there are three types of ratio comparison and they are

- Cross-Sectional Analysis: involves comparison of different firms’ ratios at the same point of time.

- Time Series Analysis: involves evaluates performance over time by observing the trend of a particular ratio.

- Combined Analysis: combines both the Cross-Sectional and Combined Analysis.

And in this section of the report I am going to evaluate the financial performance of the National Credit and Commerce Bank Ltd. over time by calculating and interpreting some common ratios. All the important ratios to analyze and evaluate the financial performance of the National Credit and Commerce Bank Ltd. are calculated and interpreted in the following pages:

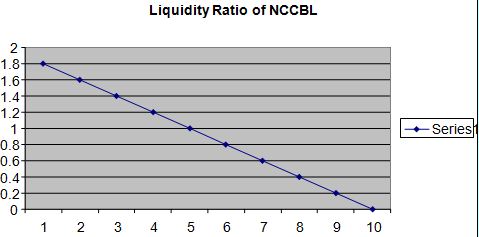

Liquidity Ratio

It measures a firm’s ability to meet up or satisfy its short term obligations, as they become due. The commonly used liquidity ratios are —-

- Current Ratio

A measure of liquidity, calculated by dividing the current assets by current liabilities. It shows the level of current assets that a particular firm has against per Taka of current liabilities of that firm. So the equation becomes—

“Current ratio = Current Assets / Current Liabilities”

| years | 2005 | 2006 | 2007 | 2008 | 2009 |

| Current Ratio | 1.21 | 1.29 | 1.38 | 1.49 | 1.62 |

Source: Annual reports NCCBL.

Comments: The graph of Liquidity ratio of NCCBL is showing that NCC Bank is performing well. So we can say that NCC Bank is properly utilizing there currents assets by currents liabilities.

Operating Efficiency Ratio

The ratio measures a particular Bank’s operating efficiency, which is the Bank’s ability to serve its customers in the most effective way by using least amount of resources (such as time, cost etc.). The following ratios are widely used to measure a particular Bank’s operating efficiency:

- Operating Cost to Income Ratio

It measures a particular Bank’s operating efficiency by measuring the percent of the total operating income that the Bank spends to operate its daily activities. It is calculated as follows:

“Operating Cost to Income Ratio = Total Operating Cost/Total Operating Income”

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Operating Cost (In Million) | 1914 | 2646 | 3489 | 5054 | 6195 |

| Total operating Income (In Million) | 2932 | 3913 | 5269 | 3317 | 4372 |

| Operating Cost to Income Ratio | 65.27% | 67.62% | 66.22% | 152.37% | 141.70% |

Source: Annual Reports NCC Bank Ltd.

Interpretation

We know that this ratio measures the operating efficiency of a particular Bank my measuring the portion of the total operating costs relative to the total operating income of that Bank and the higher the ratio, the lower the operating efficiency and vice-versa. So, after observing the figure drawn above, It can be said that the efficiency of the Bank has not been able to minimize its operating costs during the time period between years of 2005 to 2009.It was fluctuating which is not a very good sign for the bank.

- Total Asset Turnover

Total Asset Turnover indicates the efficiency with which the firm uses its assets to produce operating income. It is calculated by using the following formula –

“Total Asset Turnover = Total Operating Income /Total Asset”

- Investment to Deposit Ratio

It shows the operating efficiency of a particular Bank in promoting its investment product by measuring the percentage of the total deposit disbursed by the Bank as loan & advance or as investment. The ratio is calculated as follows:

“Investment to Deposit Ratio = Total General Investment/Total Deposit”

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Total Investment | 3010 | 3552 | 6267 | 6527 | 9672 |

| Total Deposit | 21478 | 28147 | 34902 | 46905 | 53900 |

| Investment to Deposit Ratio | 14.01% | 12.62% | 17.96% | 13.92% | 17.94% |

Source: Investment Department NCC Bank Ltd.

Interpretation

From the figure drawn above, I am able to say that, the Bank’s investment to deposit ratio is fluctuating year to year and in the year 2006 the Bank has disbursed the highest amount of loan & advances and the year 2005-2009 the Bank has disbursed on one-third of above of the total deposit collected by the Bank in each year, which is not good for the Bank.

Profitability Ratios

These ratios help us to evaluate the firm’s profits with respect to operating income, assets, or equity. Ratios are —-

- Net Profit Margin

It measures the percentage total operating income, that remains after all the costs and expenses have been paid. It is calculated as follows —

“Net Profit Margin = Net Profit after Tax/Total operating Income”

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Net Profit after Tax | 352 | 479 | 677 | 882 | 1720 |

| Total operating Income | 2932 | 3913 | 5239 | 4372 | 3317 |

| Net Profit Margin | 12.00% | 12.24% | 12.92% | 20.17% | 51.85%Source: Annual Report NCC Bank Ltd(2005-2009) |

Interpretation

We know that this ratio shows us the portion of total operating income that remains after deducting all the costs and expenditure for particular period of time. From the above graph, it can be said that the company’s net profit margin is fluctuating year to year or over the time and the Bank has generated maximum amount of net profit margin in the year 2007, which is 12.85% and lowest amount of margin in 2005 which is 3.49%.

- Return on Total Assets (ROA)

It is also called Return on Investment (ROI) and it measures the overall effectiveness of management in generating profit with its available assets. It is calculated as follows —-

“ROA = Net Profit after Tax / Total Asset”

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Net Profit | 352 | 479 | 677 | 882 | 1720 |

| Total Asset | 26114 | 32615 | 42523 | 65937 | 57365 |

| ROA | 1.35% | 1.47% | 1.59% | 1.33% | 2.10% |

Source: Annual Report NCC Bank Ltd.

- Return on Equity (ROE)

It measures the return earned by the funds invested by the common stockholders. It is calculated as follows —–

“ROE = Net Profit after Tax/Shareholder’s Equity”

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Net Profit | 352 | 479 | 677 | 882 | 1720 |

| Equity Capital | 1567 | 2135 | 2959 | 4055 | 6034 |

| ROE | 22.46% | 22.44% | 22.88% | 21.75% | 28.50% |

Source: Annual Report NCC Bank Ltd.

Comments: The graph of Retern on Total Assets of NCC Bank Ltd. Is showing that NCC Bank is performing well because yearly increase in the graph.

Capital Ratio

This type of ratio analyze a particular Bank’s capital structure and help us to determine the level of assets financed by the Bank’s creditors and the level of assets financed by the firm’s shareholder’s funds. The common types of ratios are as follows:

- Debt Ratios

The ratio analyzes a firm’s debt position, which indicates the amount of other people’ money being used in the firm to generate profits by measuring the portion of total asset financed by the firm’s creditor. This ratio is calculated as follows —

“Debt Ratio = Total Liabilities/Total Asset”

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Total Liabilities | 24254 | 30197 | 39175 | 53310 | 59903 |

| Total Asset | 26114 | 32615 | 42523 | 57365 | 65937 |

| Debt Ratio | 92.88% | 92.59% | 92.13% | 92.93% | 90.85% |

Source: Annual Report NCC Bank Ltd.

Comments: The graph of debt ratio of NCC Bank Ltd. Is showing that NCC Bank is not performing well because yearly decrease in the graph.

- Equity Capital Ratio

The ratio shows the position of the Bank’s owners’ equity by measuring the portion of total assets financed by the share holders’ invested funds and it is calculated as follows:

“Equity Capital Ratio = Total Shareholders’ Equity/Total Asset”

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Equity Capital | 1567 | 2135 | 2959 | 4055 | 6034 |

| Total Asset | 26114 | 32615 | 42523 | 57365 | 65937 |

| Equity Capital ratio | 6.00% | 6.54% | 6.96% | 7.07% | 9.15% |

Source: Annual Report NCC Bank Ltd.

Comments: Here the figure shows that’s NCC Bank Ltd is performing well because year to year increase the equity capital ratio.

Market Ratio

- Du Pont Equation:

Return on Investment (ROI):

Year – 2008

ROI = Net profit Margin * Total Asset Turnover

= (Net profit after Tax / Sales)* (Sales / Total Assets)

= (479219807 / 1866047408) * (1866047408 / 32615007792)

= 0.2568 * 0.5721

= .01469

= 1.47%

Year -2009

ROI = Net profit Margin * Total Asset Turnover

= (Net profit after Tax / Sales) * (Sales / Total Assets)

= (677176546 / 2530576172) * (2530576172 / 42522853993)

= 0.26759 * 0.05951

= 0.0159

= 1.59%

Interpretation

ROI= (1.47%) in 2006 indicates that NCC Bank Ltd. generates .0147 unit of net profit after tax by using 1 unit of total asset and ROI =(1.59%) in 2007 indicates that Bank generates .0159 unit of net profit after tax by using 1 unit of total asset. ROI of 2006 is less than 2007 year. It means their performance is improved day by day.

Performance of Loans and Advances

The performance of the bank in terms of loans and advances are as under:

Total loans and advances for 2003 was Tk.12850.85 million. It increased to Tk. 15211.15 million in 2004, Tk. 20533.13 million in 2005 and Tk. 24678.36 million in 2006. So we can see that the performances of loan and advances are increasing year by year in a chronological way. The total loans and advances are shown in the following graph:

| 2005 | 2006 | 2007 | 2008 | 2009 | |

| Loans and Advances | 20533.13 million | 24678.36 million | 32688 million | 46333 million | 50388 million |

Source: Annual Report NCC Bank Ltd.

Performance of Loan and Advance (2005-2009)

(Figure In Million)

Comments: Here the figure explains the increasing figure of loan and advance year to year is going successfully by giving customers services.

SECTOR WISE SEGREGATION OF LOANS AND ADVANCES:

The bank sanctions loan in different sectors to minimize the portfolio risk. The sector wise loans and advances of NCC Bank are as under:

Figure in Million (TK)

| SL | Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

| 01 | Agriculture | 62.40 | 133.26 | 420.243 | 202.103 | 291.930 |

| 02 | Industry | 3615.28 | 5459.20 | 8285.250 | 8935.153 | 11650.336 |

| 03 | Construction | 225.42 | 140.29 | 1119.639 | 2185.413 | 3235.757 |

| 04 | Water works | – | 9.87 | 2.548 | – | – |

| 05 | Transport and communication | 355.30 | 339.41 | 342.292 | 831.059 | 737.265 |

| 06 | Storage | 68.31 | 4.56 | 4.554 | .7 | – |

| 07 | Business | 657.27 | 6728.60 | 7987.439 | 8529.257 | 11592.541 |

| 08 | Others | 1866.84 | 2395.92 | 2371.164 | 3995.364 | 5179.924 |

| Total | 12850.85 | 15211.15 | 20533.13 | 24678.36 | 32687.75 |

Source: Annual Report NCC Bank Ltd.

Loans and advances on the basis of geographical location:

Division wise loans and advances are as under:

Figure in Million (TK)

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

| Dhaka division | 8305.98 | 9934.04 | 13253.009 | 16852.103 | 21561.865 |

| Rajshahi division | 177.62 | 243.45 | 364.349 | 481.603 | 695.327 |

| Chittagong division | 3826.39 | 4355.21 | 6097.568 | 6476.015 | 9383.120 |

| Sylhet division | 90.02 | 162.53 | 201.795 | 207.996 | 324.076 |

| Khulna division | 450.82 | 515.90 | 616.406 | 660.637 | 723.363 |

| Total | 12850.85 | 15211.15 | 20533.13 | 24678.36 | 32687.75 |

Source: Annual Report NCC Bank Ltd.

From the table it can be seen that Dhaka division is in the 1st position in all the years. Sylhet Division is in the last positioning. The figures are shown in the following graph as percentage form:

Nonperforming loan:

Loans are designated as non-performing when they are placed on accrual status or when the terms are substantially altered in a restructuring. Nonaccrual means that banks deduct all interest on the loans that was recorded but not actually collected. Banks have traditionally stopped acquiring interest when debt payments were more than 90 days past due.

Volume of non-performing loans of NCCBL from 2002 to 2006 is as under:

Figure in Million (TK)

| 2005 | 2006 | 2007 | 2008 | 2009 |

| 1234.14 | 1253.35 | 1188.40 | 981.54 | 1212.26 |

Source: Annual Report NCC Bank Ltd.

The non- performing loan of the bank has decreased in the year 2004 & 2005, which is another indicator of better performance of the bank. The figures are shown in the following chart:

Nonperforming Loan (2005-2009)

(Figure In Million)

Comments: This graph is says that the non performing of the bank has decrease in the year 2007 & 2008. Which is another indicator of better performance of the bank.

NCCBL generally gives facility to open the following accounts:

- Current Deposit (CD)

- Saving Deposit (SB)

- Short term Deposit (STD)

- Fixed Deposit (FDR)

- Bearer Certificate of Deposit (BCD)

- Sundry Deposit

Current Deposit Account

NCCBL opens current accounts for its clients to facilitate their day-to-day operations. The amount deposited in the current account can be withdrawn at any time. No interest is given on the current. In certain cases, however, interest is available at an agreed rate where withdrawals are subject to a written notice for a specified period. The minimum balance requirement for this account in Tk. 5000/- and Tk. 250/- is deducted from the account in case of closing the current account.

- Savings Account

The bank provides savings account services for the ease of its clients. It offers both personal and corporate savings account to its clients in every branch. The current rate on the deposit amount is 7% and minimum balance requirement is Tk.1000/-.

- Short Term Deposit (STD)

According to characteristics, short-term deposit is similar to current deposit except interest. Though it is C/D account but bearing some interest. Currently this interest rate is 6.00%.

STD account holders enjoy interest in the following cases:

| Account Holder Type | Amount (Daily) | Interest Rate |

| Collection account of DESCO, BTTB | Above Tk.10.00 lac | 6.00% |

| Other type of customers | Above Tk. 1.00 lac | 6.00% |

- Fixed Deposit

Fixed deposit is very much important for its contribution to the bank’s deposit creation process, because the highest amount of bank’s fund from its direct customers comes from fixed deposit. For increasing the deposit base every commercial bank offers its customers various rates according to the amount of deposit. NCCBL also offers its valuable customers some significant rates for different amounts as under:

| Duration | Interest Rate |

| For 3 month For 6 month For 12 months For 2 years | 8.00% 8.25% 8.50% 9.00% |

- Bearer Certificate of Deposit

It’s an instrument of deposit, where depositors name and address is not mentioned; only a receipt number is there. Just 2 or 3 years ago government of Bangladesh ruled on this type of deposit. They are discouraging bearer certificate of deposit; as a result this deposit in every bank is declined. Some amount of bearer certificate of deposit is being kept by the banks, which are not yet matured.

- Sundry Deposit

It is non-interest-bearing deposit. Any sort of non-interest bearing deposit is good for the banks. Though it is a liability, but banks do not pay any interest against this deposit. So, the sundry deposit of any bank will be a good part for the concern bank.

SWOT Analysis of NCCBL

A particular SWOT analysis discloses the following issues for an organization that an organization achieved over the time of its operation by analyzing it’s both internal and external environment:

- “S”- Strengths

- “W”-Weaknesses

- “O”-Opportunities

- “T”-Threats

The SWOT analysis of National Credit and Commerce Bank Ltd. is shown below:

Strengths

- Provides of good quality services: Having the reputation of being the provider of good quality services among its potential customers.

- Good investment portfolio: NCCBL never invest all types of business area, for that case their portfolio is very good.

- Low Balance Requirement: Relatively low minimum balance/deposit requirement to maintain an account with the Bank.

- Experienced Top management: Management of NCCBL is very efficient and they always take correct decision for give better service to the customer.

- Strong correspondent relationship: NCCBL maintains strong relationships with other commercial banks & a member of SWIFT service.

- Strong Capital: NCCBL has strong capital base and maintain all the statutory requirements to be a good Bank.

- Comfortable liquidity position: National Credit and Commerce Bank Limited always maintains a comfortable liquidity position in the market.

- Achieve goodwill from the clients: NCCBL has already achieved a strong goodwill among the clients.

- Strong concentration on Investment: Investment Division is the heart of NCCBL and main business area of the bank. Bank gives loans to the client by judging their business and concern how the clients repay the loan.

- Strong monitoring Process: Investment terms and conditions are monitored, financial statements are received on a regular basis, and any covenant exceptions are referred to the branch manager for timely follow up.

Weaknesses

- Complexity in account opening: Various complex requirements demanded by the Bank to open a new account.

- Limited delegation of power: For the sanction of a loan, the branch has no power. All power in handed in the Head office.

- Lengthy Process for sanction the loan: All power in the head office for that case for sanctioning loans it takes more time.

- No bank guarantee power: No branch has any bank guarantee power.

- Conservative mind setting in working: NCCBL working structure is very much conservative and for that case its growth is slow than other bank.

- Lack of strong and attractive promotional activities: It is a Commercial perspective bank, so it spends less money for promotional activities.

Opportunities

- Perception of NCC bank: The Bank should establish a Strong appetite for financial services among the people of Bangladesh.

- Give higher interest rate: Possibility to generate very high rate of return as compared to fixed rate of interest from other bank.

- Merge with Same & Different nature bank: Expansion of existing Banking networks through merge with same & different Banks that will facilitate the bank to enjoy the competitive advantage.

- Be Prepare in competitive advantage: A large number of private Banks coming into the market in the recent time. In this competitive environment National Credit and Commerce Bank must expand its product line to enhance its sustainable competitive advantage.

- Wide Banking networks: The bank should establish a wide range of banking network in the country and outside the country with online facility.

Threats

- Lack of awareness: Lack of awareness regarding the Credit Banking system among the people of Bangladesh.

- Increase financial institutions merging: The worldwide trend of mergers and acquisition in financial institutions causing problem.

- Money rate devaluation: Frequent taka devaluation and other rate fluctuation is causing problem for the bank.

- Guideline: Lack of adequate guideline by the Central Bank on the basis of Credit system.

- Competition increase: Increased competition from fellow Islamic Banks and Other Commercial Private Banks (PCBs).

- Government rules and regulations: Unfavorable Government rules and regulation created regarding Banking business that hampers their business procedure.

- Economic and political situation: Unfavorable economic and political climate, such as high inflation rate, political unrest & continuous devaluation of money.

Findings

Despite tremendous popular support spectacular success in terms of deposit and distribution of interest in Bangladesh yet to achieve the desired level of success due to the absence of appropriate legal framework for carrying out the operations in the country. All the government- approved securities in Bangladesh are interest bearing. As a result the banks, which are committed to give more interest, they are not able to pay more interest to their customers, because of the low interest rate of Government.

The following sections highlight the major findings of the problem that are associated with the financial transactions performance analysis of NCCBL.

Positive Finding:

- The Bank’s operating cost to income ratio is fluctuating the year 2005-2009 and it doesn’t maintain a standard level of low operating cost. That is not a good sign for the bank.

- The Bank’s total asset turnover is in bad position in the year 2004 but from the year 2005 it has started to rise.

- The Banks net profit margin is started to rise, and still now it turn into a profitable way, which is a good sign for the Bank.

- The Bank has financed on an average of above 5% of its total assets by using the shareholders’ invested capital and the Bank has maximum level of equity capital ratio in the year 2009, which is 13.55%.

- National Credit and Commerce Bank investment monitoring is done by investment in charge under supervision of Branch managers.

- The Bank has strong correspondent relationship with other commercial banks & the Bank is a member of SWIFT service community.

Negative Finding:

- NCCBL is newly 3rd generation bank of our country. The liquidity level of the Bank is fluctuating year to year and always below the standard limit. But recently the Bank’s liquidity level has started to rise, which is a good sign for the Bank.

- This bank started on-line service all over the country. As a result customers are getting the full service by the on-line service. But sometimes they have to face problem with on-line account.

- In case of clearing, postings are made through computer database program and currently the Bank (NCCBL) uses Flora database program, which is encountered by several problems and limitations.

Recommendations

It is not unexpected to have problems in any organization. There must be problems to operate an organization. But there should be remedies and the remedies should be followed by the organization. I can suggest the following recommendations to solve the above mentioned problems:

- The bank should try to increase the level of short term investment and to reduce the level of long term investment in its existing general investment portfolio.

- The bank should put emphasize to reduce its existing debt positioning the capital structure, which is always above 93% and to do so, the bank can exchange debt for equity, which means converting the creditors into owners of the bank by offering them shares of ownership rather repaying their funds.

- NCCBL needs to increase the job satisfaction level of its employees by providing several awards based on their performance.

- The bank should its training institution which arrange useful and distinctive training program time to time for the employees.

- NCCBL should be focus its scope of investment among the Bank officers, employer and the Clients by strong training, workshops and Clients get – together.

- Investment facilities should be provided to the new entrepreneurs.

- To avoid bad debts, NCCBL should give more emphasis on Invest. Risk Analysis (LRA) and try to conduct sensitivity analysis.

- More ATM Booth should be established.

Conclusion

Banking has changed enormously in the last decade. Management of bank is becoming complex because of fast growing needs of the economy in the context of changing business scenario in the increasing competitive environment of today in which the banks are functioning. There are a number of private Commercial banks, Nationalized Commercial Banks and Foreign banks operating in Bangladesh.

I really enjoyed my internship at NCC Bank from the first day. Internship program that is mandatory for my BBA program enabled me to have an insight into the practical working of a bank.

Banks always contribute towards the economic development of a country. Compared with other banks NCC Banks is contributing more by investing most of its fund in fruitful projects increase production of the country. It is obvious that right channel of banking establishes a successful network over the country and increase resources. The bank will be able to play considerable role in the development of the country.

NCC Bank is playing its leading role in socio economic development of the country. Since inception NCC Bank has been rendering its banking service to cope with the demands of people in the country. By doing many other works for state & society, NCC Bank has emerged as the pioneer bank in our country. NCC Bank should prosper in the coming days and the management should boldly navigate the organization in this turbulent ocean of competition as the bank embarks in to a new millennium.

The bank is committed to run all of its activities as per Central Bank. NCCBL, having its steady progress and continuous success, has earned the reputation of being one of the leading private sector Banks of the country. The Bank has shown continuous progress in this important sector. Main items of import like machinery, garments, fabrics and accessories, ships for scrapping, rice, pharmaceuticals raw materials etc. and main items of exports like jute-goods, readymade garments, leather, frozen fish, fertilizer etc. are operating through the help of NCCBL. NCCBL’s capital adequacy, deposits, reserves, earning per share, export, import and remittances are increasing day by day. So, undoubtedly NCCBL is going toward the top-most commercial Bank in Bangladesh. May Allah (SWT) give us the ability to grow further. Amin.

![Report on L/C Tracking System of HSBC [part-3]](https://assignmentpoint.com/wp-content/uploads/2013/03/hsbc1-110x55.jpg)