An empirical study on SME Banking System

and Procedure of BRAC Bank limited

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on May 20, 1999 under the Companies Act, 1994. Its operation started on July 4, 2001 with a vision to be the market leader through to providing all sorts‟ support to people in term of promoting corporate, small entrepreneurs and individuals all over the Bangladesh.

BRAC Bank will be a unique organization in Bangladesh. The bank consist of major divisions named 1) Corporate banking, 2) Retail banking, 3) Operations 4) Small & Medium Enterprise (SME). At present the Bank operating its business by 165 branches and 624 SME offices. BRAC Bank is the first local commercial banks that proving online banking service to its customers from the very beginning of its starts. BRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country. The bank has already established its network in different area of the country with assistance of BRAC.

BRAC Bank is trying to develop economic condition of the country. So the bank provides loan facility 3 to 30 lacs taka to that small and medium enterprise that has no easy access to banks/financial institutes. The bank already established 41 Zones and 624 SME offices all over the country. There is 2104 Officers providing service to clients. Till 2014, the bank Disbursed 471618 loans which amount is Tk 291871 milion. The success of SME will largely depends on the selection of a business and man behind the business. BRAC Bank provides this facility to those whose business operation is minimum one year and environment friendly business. It provides no loan facility to tobacco business. The business should be legally registered and must have valid trade license. The entrepreneur should be physically able, preferably between the ages 21 to 50. She/he must have the necessary technical skills to run the business and acceptable social standing in the community i.e. people should speak highly of him/her. BRAC Bank gives equally important to the guarantor to getting the SME facility. The guarantor must have the ability to repay the entire loan and is economically solvent. The guarantor should know the entrepreneur reasonable well and should preferable live in the same community. SME loan can be repaid in two ways, 1) in equal monthly loan installment with monthly interest payment. 2) By one single payment at maturity, with interest repayable a quarter ends residual on maturity.

Customer relation officers search new potential customer by providing door-to-door service. They talk with clients and monitor their manners, activities of their business and provide the loan to the potential customers. SME, BRAC Bank may provide 100% of net required working capital but not exceeding 75% of the aggregate value of the inventory and account receivable.

Normally, organizations meet their working capital from over draft loan but BRAC Bank designed the loan to meet working capital but as term loan which is repaid in installment. The customer relation officers also monitor the borrowers‟ activities after the loan disbursement. Monitoring also facilitates the buildup of an information base for future reference.

Asset Operation Department acts as the last line defense of the bank. This division is responsible for the complete disbursement, recovery and closing procedures. The procedures start from the sanction of the SME loan. The respective select potential enterprise, collect confidential information about the enterprise, open clients account is the respective bank where BRAC Bank has its own account, filled up CIB form and send it to the Asset Operation Department. Then the Asset Operation Department starts its activities. The Asset Operation Department sends the CIB form to the Bangladesh Bank to know the CIB status of the applicant. If the report found clean then it send back to the unit office for send proposal for the loan. Then the unit office sanction loan and send it again in Asset Operation Department for disbursement. The Asset Operation Department then prepare a loan file and checks all necessary documents, prepare a list and disburse it. Then the Asset Operation Department starts enter all information regarding the loan in the banking software “Millennium Banking System (MBS)” which includes initial ID generation, loan account opening, risk fund collection, activation of the loan. Post disbursement manual activities includes repayment schedule send to unit office, documents stamp cancellation, send the loan file to archive. Recovering activities include receive SMS/Fax for installment deposit, entry the installment information to MBS, print vouchers, cross check SMS/Fax and solve problems, repayment voucher check and posting. Closing activities includes receive SMS/Fax requesting for closing, bring the loan file from archive, obtained approve to closing from the concern authority, checking in MBS, SMS sent to concern customer relation officer (CRO), receiving and print closing SMS/Fax. The core competence of the BRAC Bank is to provide the fastest loans to the clients in this country. To retain this competitive advantage BRAC Bank would provide computer and palmtop facilities whether they can give fastest services to clients than other banks. Also to convey the customer focus, BRAC Bank is trying to reduce collateral securities than other banks. It provides more collateral free secured loans to capture the market. Regarding the services by the CRO, almost all clients are satisfied by get these quick facilities from them.

SME Products:

Currently BRAC BANK is offering 13 SME packaging. These are listed and briefly explained below:

Anonno Rin- “AnonnoRin” is a business loan designed to finance small scale trading, manufacturing and service ventures, especially to help small and medium entrepgaps.

Apurbo Rin- Apurbo is a loan facility for Small and Medium business. Apurbo loan has been designed and tar

Pathshala Rin- “PathshalaRin” is a loan designed to meet the needs of small and medium sized private educational institutions, such as kindergartens, schools and colleges etc. Now it is not running.

Aroggo Rin- “Aroggo” is a loan allowed to various Health service Provider like private clinics, diagnostics centers and doctors’ chambers. The product offers fixed assets purchase financing under equated Monthly Installments. Now it is not running.

Digoon Rin- This is a double loan on clients‟ deposits. With this, clients do not need to encash their savings rather they can take double amount of loan on their deposit for their business expansion. Now it is not running.

Supplier Finance – SUPPLIER FINANCE is a loan facility for the enlisted Suppliers of various large retailers, marketing companies, distributors, exporters etc. This product‟s main objective is to help various Suppliers to meet their shortterm cash flow shortages or bridge the fund-flow gaps. Amount is minimum BDT 3 lac up to maximum BDT 30 lac. Now it is not running.

Prothoma Rin- “PROTHOMA RIN” is a loan facility for small and medium sized business, which is operated by women entrepreneur. The product offers terminating loan facilities for the purpose of working capital finance and/or fixed assets purchase. Loan limit is from minimum BDT 3 lac up to maximum of BDT 9.5 lac.

Cash Secured Loan – “Cash Secured Loan” is a loan facility for small and medium sized business. There are two types of loan facility in the product i.e. Secured Loan and Secured Overdraft. These facilities are fully secured by fixed deposit of BRAC Bank. Amount is minimum BDT 3 lac up to maximum BDT 30 lac. Now it is not running.

Super Supply Loan – Super Supply Loan is a loan facility for Suppliers of various large retailers, marketing companies, manufacturing companies and various corporate houses. This product‟s main objective is to help various Suppliers to meet their financial requirements. Now it is not running.

Retail Banking:

There are retail banking products of three categories. One is Loan Products, second is Deposit Products and the other is Cards. In Loan Products category there are eleven services/products facilitating clients‟ demands. These are:

Salary Loan, Now Loan, Car Loan, Teacher‟s Loan, Study Loan, Travel Loan, Credit Card Loan, Top Up Loan, HighFlyer Loan, Secured Loan/ OD and Doctor‟s Loan.

Under Deposit Products category currently there are ten services/products in total. These are: Fixed Deposit, Interest First, Abiram Account, DPS, EZee Account, Savings Account, Short Term Deposit, Current Account, Salary Account and Step Up Fixed Deposit.

The Co-Branded Cards are from Aarong, ALICO and DIA Gold. The BRAC Bank Aarong ATM Card gives users 5% cash back facility from shopping in any Aarong outlets. The holder of BRAC Bank ALICO ATM Card can enjoy a special life insurance facility with insurance coverage of upto BDT 200,000.00. And BRAC Bank DIA Gold

ATM card holder will enjoy a special cash back and cash discount feature. This feature is 10% discount from any diamond product bought and 8% discount on making charge of any gold products bought from DIA Gold.

Corporate Banking:

Corporate Banking section has three types of coverage currently. These are:

- Corporate Loan Products

- Trade Financing

- Corporate Cash Management

Corporate Loan Products:

Overdraft – This is an on-demand credit facility designed to meet day-to-day operational activities of the business, including purchase of raw materials and expenses.

Term Loan – Short Term Loan/Revolving Loan: This scheme is to meet different shortterm fund requirements of the client. Payment of duty, Tax, VAT and other expenses related to the release of goods from customs through pay orders in the name of customs authority or Bangladesh Bank cheque is payable through this scheme.

Lease Finance – One of the more convenient long-term sources of acquiring capital machinery and equipment. The client is given an opportunity to have exclusive rights to use an asset, for an agreed period of time, against payment of rent.

Loan Against Trust Receipt (LATR) – This is advancement against a Trust Receipt provided to the client when the documents covering an import shipment are given without payment. Under this system, the client will hold the goods of their sale proceeds in trust for the bank, until the loan allowed against the Trust Receipt is fully paid.

Probashi Banking:

Our nation‟s workforce who are away from their families, relatives, friend and above all, from breathing the air of our country, working abroad for the prosperity of their lives and the nation in the long run while sacrificing a lot. BRAC Bank, through Probashi Banking services, is facilitating the banking needs of remitters. Currently BRAC Bank is providing six services for remitters under Probashi Banking. These products/services are described below:

Probashi Current Account – It is ideal for Probashi Bangladeshis who do not wish to earn interest due to religious reasons. This account also comes with cheque book and ATM card and is ideal for regular transaction.

Probashi Savings Account – This account provides interest which is paid in June and December of each year. This account comes with a cheque book and ATM Card and is ideal for Probashi Bangladeshis who want to save. Accounts are maintained in Taka.

Probashi DPS – Is a savings scheme specially designed for the Probashi clients. This service requires monthly installment of minimum Tk. 500.00 and any multiples. Provides a savings account with a personalized cheque book, earnings remitted to savings account will be automatically transferred on the due dates and loans are provided against 90% of deposited amount.

Probashi Fixed Deposit – A fixed deposit account allows remitters to deposit their money for a set-period of time, thereby earning them a higher rate of interest in return. Fixed Deposits can be made from 3 months to 3 years. Interest is paid on the maturity at a very attractive rate. Accounts are maintained in Taka.

Description of the project:

Objective of the project: Broad Objectives:

- To analyze the repayment behavior of SME loan borrowers

- To know SME loan and its process of recovery

Specific Objectives

- To find out basic appraisal of SME loan

- To know the enterprise selection criteria to provide SME loan

- To know the terms and conditions of SME loans

- To know the disbursement and recovery procedures of SME loans

- To make some policy implications and conclusion to further the development of SME loan products of BBL.

- To know the work process and monitoring system of Asset operation Department

- To access the key performance indicator of the department

- To know how the SME loan borrowers would behave in repaying their loan.

- To know whether SME loan borrowers are dully paying their installments or not.

Methodology:

The study uses both primary data and secondary data. The report is divided into two parts. One is the Organization part and the other is the project part. The parts are virtually separate from one another. The information for the organization part of the report was collected from secondary sources like books, published reports and web site of the BRAC Bank Limited (www.bracbank.com). For general concept development about the bank short interviews and discussion session were taken as primary sources.

The information for the project “Analysis of SME loan in BRAC Bank Limited “both were collected from primary and secondary sources. For gathering concept of SME loan, the product program Guideline (PPG) thoroughly analyzed. Beside this observation, discussion with the employee of the SME department and loan administration division they said bank was also conducted. More over a market survey was conducted with a specific questioner. To identify the implementation, supervision, monitoring, and repayment practice –interview with the employee and extensive study of the existing file was and practical case observation was done.

Theoretical aspects of SME Banking

Define SME:

An SME is defined as, ―A firm managed in a personalized way by its owners or partners, which has only a small share of its market and is not sufficiently large to have access to the stock exchange for raising capital. SMEs ordinarily have few accesses to formal channels of finance and depend primarily upon savings of their owners, their families & friends. Consequently, most SMEs are sole proprietorships & partnerships.

SMEs have been defined against various criteria. The three parameters that are generally applied by the Governments to define SMEs are: Capital investment in plant and machinery, Number of workers employed, Volume of production or turnover of business.

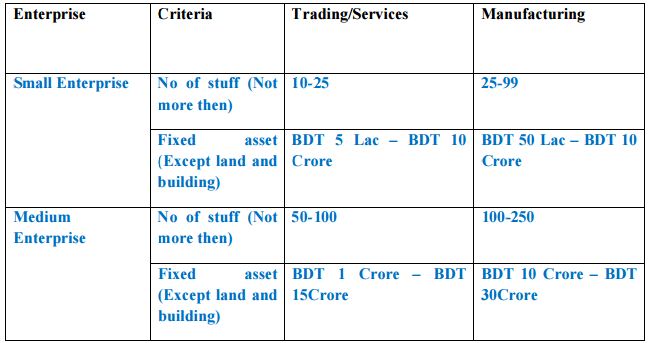

Definition of SME as per Bangladesh Bank:

Bangladesh Bank provides some rules and criteria that should maintain the entire bank. Organizations not a public limited company meet the following criteria:

SME financing in Bangladesh:

Most of the Commercial Banks and Financial Institutions have incorporated SME banking. The incorporation is done by only re-designing and scaling down their current financial products for the SME customer. This does not create expected value addition to SME financing, since it is regular financing under a Different name. SMEs provide low cost employment Opportunities and render flexibility to the economy. Many of the SMEs are engaged in export activities suggesting that they are internationally competitive.

Considering the importance of SME sector in the economy of Bangladesh and understanding the constraints under which such enterprises operate, it is evident that policies to support the development and growth of SMEs are necessary.

Reasons of SME Banking:

The main focus of BRAC Bank is to develop human and economic position of the country. Its function is not limited only to providing and recovering of loan. But also try to develop economy of a country. So reasons for this program from the viewpoint of BRAC Bank Ltd. are:

Support Small and Medium Enterprise:

To support small and medium enterprise, which requires not more than BDT 30 lacs but in the market, small and medium entrepreneurs do not have easy access to get loans from the commercial banks/ financial institutions. But BRAC Bank Ltd. Provides loans ranges between BDT 3 to 8 lacs without any kind of mortgage.

Economic Development:

Economic development of a country largely depends on the small and medium sized enterprises. Such as, if we analyze the development history of Japan, the development of small & medium size enterprises expedite the development of that country.

Employment Generation:

To create employment opportunities in the market. The bank gearing employment opportunities by two ways: Firstly, by providing loan to the small enterprises. Expanding, these businesses require more workers.

Secondly, small and medium enterprise (SME) program requires educated and energetic people to provide support to Entrepreneurs.

Profit Making:

SME program is a new dimensional banking system in the banking World. Most of the CROs are providing door-to-door services to the entrepreneurs. Entrepreneurs are satisfied by the service of the bank and making profit with guidance of the bank.

Encourage Manufacturing

The focus of BRAC Bank Ltd. is to encourage manufacturing by the entrepreneurs who produce by purchasing various types of materials. CRO„s try to educate them to produce material if possible because if they can produce in line of purchase profits will be high.

Spread the Experience

Another reason of BRAC Bank Ltd. is to spread the knowledge on the importance of SME banking regarding various businesses. The customer service officer shares their knowledge from various businesses and tries to help the entrepreneurs who have shortage of the gathered knowledge.

SME Banking: BRAC Bank

BRAC Bank is now 12 years old and pioneered the small and medium enterprise (SME) Banking. If we think of the financial pyramid, there are corporate institutions (local and Multinational) at the top of the pyramid and there are low income individuals at the bottom. Those at the top are served by banks and other financial institutions while those at the bottom are served by Micro Finance Institutions (MFIs), e.g. NGOs. But SME sector in the middle were missing access to necessary banking services and that„s where BRAC Bank has filled the gap. So, BRAC bank Launched SME loan for lower and middle classes business from the Concept of missing middle.

Selection Criteria for SME loan:

Enterprise Selection Criteria

The success of SME will largely depend on the selection of a business and man behind it.

In terms of the business (Enterprise), the following attributes should be sought:

- The business must be in operation for at least one year

- The business should be environment friendly, no narcotics or tobacco business

- The business should be legally registered, i.e., valid trade license, income tax or VAT registration, wherever applicable.

- The business should be in legal trade, i.e.; smuggling will not be allowed or socially unacceptable business will not be entertained.

- The business must have a defined market with a clear potential growth

- The business must be located ideally close to the market and the source of its raw materials/suppliers. It should have access to all the utilities, skilled manpower‟s that are required.

- Any risk assessed by the management in turn will become a credit risk for the bank. So effort should make to understand the risk faced by the business.

Entrepreneur Selection Criteria

In order to understand the capability of the management behind the business, the following should be assessed:

- The entrepreneur should be physically able and in good health, preferably between the age of 25-50. If he/she is an elderly person closer to 50, it should be seen what the succession process will be and whether it is clearly defined or not.

- The entrepreneur must have the necessary technical skill to run the business, i.e academic background or vocational training, relevant work experience in another institution or years of experience in this line of business.

- The entrepreneur must have and acceptable social standing in the community (People should speak highly of him), he should possess a high level of integrity (Does not cheat anyone, generally helps people), and morally sound (Participates in community building)

- The entrepreneur must possess a high level of enthusiasm and should demonstrate that he is in control of his business (Confidently replies to all queries) and has the ability to take up new and fresh challenges to take the business forward.

- Suppliers or creditors should corroborate that he pays on time and is general in nature

- Clear-cut indication of source of income and reasonable ability to save.

Guarantor Selection Criteria

Equally important is the selection of a guarantor. The same attribute applicable for an entrepreneur is applicable to a guarantor. In addition he should possess the followings:

- The guarantor must have the ability to repay the entire loan and is economically solvent ( Check his net worth)

- The guarantor should be aware about all the aspect of SEDF loan and his responsibility

- Govt. and semi-govt. officials can be selected as a Guarantor such as schoolteacher, college teacher, doctor etc.

- Police, BDR and Army persons, political leaders and workers, and Imam of mosque cannot be selected as a guarantor.

The guarantor should know the entrepreneur reasonable well and should preferably live in the same community

SME Banking System:

Every SME unit office will have a current account with a designate bank in the area of a unit office. This bank account will be opened and operated by SME head office.

- To meet petty expense such as stationary, entertainment and other incidental expense, all unit office will be allowed patty cash of Tk 2000/=

- The cheque of this patty cash will be issued from SME head office in the beginning of the month. All vouchers relating to such expenses should be send to the accounts from SME head office

- All the clients must open their account with the same bank account on the same day after receiving those from the borrowers, who should given a received as prescribed.

- Cheque‟s should be deposited to the SME unit office bank account on the same day after receiving those from the borrowers, who should given a receipt as prescribed.

- Any loan installment credit should be transferred to the SME head office account in Gulshan, Dhaka on the same day as per agreement with bank.

- Every CRO should have an individual account in the same bank branch for their personal use and to receive their salaries and other benefits.

- Payment of lease rentals, utility bills and cheque drawn on the SME unit office bank account and issued by SME head office should pay other expenses (Large amount). If these bills are small amount, they should be paid from the patty cash and replenished later.

All the financial accounting entries will be passed at the SME head office and will maintain separately on the basis of the unit office.

Loan can be repaid in two ways:

- In equal monthly loan installment with monthly interest payment

- By one single payment at maturity, with interest repayable a quarter ends residual On maturity:

- Loan may have various validates, such as, 3 months, 4 months, 6 months, 9 months, 12 months, 15 months, 18 months, 24 months, 30 months and 36 months.

- The borrower must open a bank account with the same bank and branch where the SME has its account.

- Loan that approved will be disbursed to the client through that account by account payee cheque in the following manner: Borrower name, Account name, Banks name and Branch„s name.

- The loan will be realized by 1st every months, starting from the very next months whatever the date of disbursement, through account payee cheque in favor of BRAC Bank Limited A/C. With Bank„s named and branches name

- The borrower has to issue an account payable blank cheque in favor of BRAC Bank

- The borrower will install a signboard in a visible place of business of manufacturing unit mentioned that financed by ―BRAC Bank Limited‖

- The borrower has to give necessary and adequate collateral and other securities as per bank‟s requirement and procedures

- SME, BRAC Bank may provide 100% of the Net Required Working Capital but not exceeding 75% of the aggregate value of the Inventory and Account Receivables. Such loan may be given for periods not exceeding 18 months. Loan could also be considered for shorter periods including one time principal repayment facility, as stated in loan product sheet

- In case of fixed asset Financing 50% of the acquisition cost of the fixed asset may be considered. While evaluating loans against fixed asset, adequate grace period may be considered depending on the cash generation after the installation of the fixed assets. Maximum period to be considered including grace period may be for 36 months.

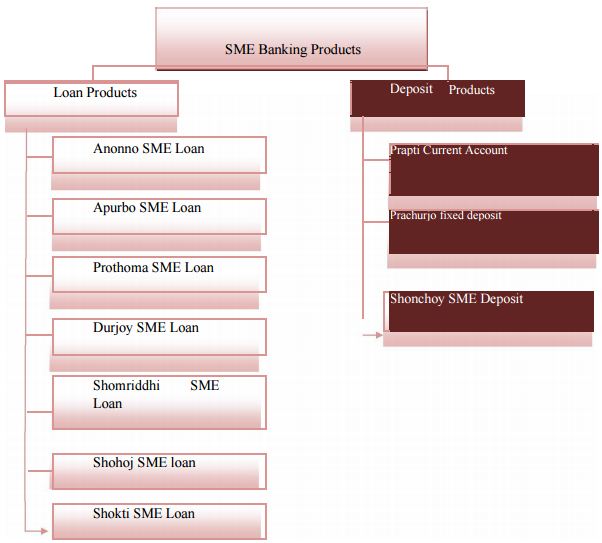

Products of SME Banking:

BRAC Bank is offering the following SME loan product and deposit products to the client for financing different purpose that fulfill the requirements of the bank and have good return to the investment as well as satisfy the client. The products of SME banking are:

SME deposits Products:

BRAC bank has several deposit products with different features and procedures. These are below:

Prapti Current Account

Prapti Current Account has been designed to encourage small and medium entrepreneurs to enter into the wide range of modern banking facilities of BRAC Bank Limited.

Prapticurrent account is an interest bearing current account for SMEs. This account ensures the profitable and easy transaction facilities for business concerns.

Eligibility:

Any kind of organization (such as sole proprietorship, partnership, private limited company,Educational institution, NGO/Project, Co-operative society and so forth) Specialty of PRAPTI Current account

- Prapti has been designed to fulfill business transactional requirements

- It is a current account in which interest is paid on daily balance

- Opening balance for Prapti Account is BDT 2000 for welcome package with

- 0% interest rate

- No outstation cheque fees

- Prapti account has designed for unlimited transaction, no restriction

Prachurjo fixed deposit:

“Prachurjo” is a lucrative fixed deposit for small and medium businesses. With a minimum 50,000 TK, any business enterprise having valid trade license can open this account.

Specialties

- Tenure: Minimum 1 month and maximum 36 months

- No fees except govt. excise / duty on interest earned

- Interest is applicable on maturity

- No pre-encashment fees

Eligibility

- Everyone involving in sole proprietorship, partnership and private limited companies

- Small and medium typed businesses (Educational institution, NGO and Cooperative society and others).

Shonchoy SME Deposit:

BRAC Bank introduces ―Shonchoy – Monthly Deposit Scheme‖ for all its SME clients. Shonchoy is a monthly deposit plan for entrepreneur in the case of emergency and business contingencies. Shonchoy is basically a monthly installment based loan and a habit to pay Monthly to the bank. Banks are reducing installment size by reducing interest rate, increasing tenor, and/or by removing uncompetitive features. It„s allow organization to save on a monthly basis as per your organization„s requirement and get a handsome return at maturity. Contribution options for both monthly installment size and maturity, starting from as low as BDT 500 to any multiple of it as per your organization„s need i.e. BDT 1,000, BDT 2,500, BDT 5,000 and so on.

Specialties

- Minimum monthly installment of BDT 500

- Tenor from 1 year to 10 years

- 95% Secured Over Draft facility on the deposited amount

- No account maintenance fee

Eligibility

- All sole proprietorship businesses

- Partnership businesses & limited companies

- Educational institutions

- Local NGOs/projects

- Local co-operative society

- Market/shop owner association

- Other organizations not mentioned above

BRAC Bank: SME loan product and procedure

Total Loans and Advances:

Loans and advances increased by BDT 20,216 million or 62% to BDT 52,677 million at 31st December 2014.This is a result of continued growth in lending business and solid growth in banking industry reflecting a continued focus on customers and profitable growth.

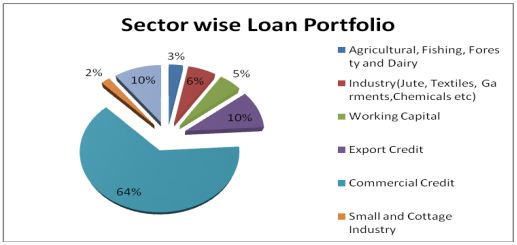

SME sector, the main concentrated area for the bank financing since its inception, comprises of 63% of the total loans and advances. Major portfolio of BRAC Bank belongs to commercial sector. Sector-wise credit portfolio is shown in the figure below:

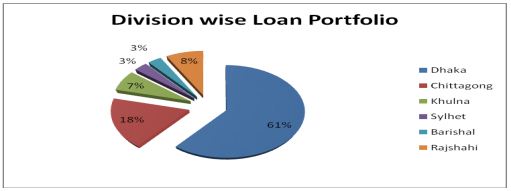

Credit concentration is shown in the above pie-chart to elaborate the area of concentration of loans and advances. About 39% of total loan portfolio concentrated outside Dhaka.

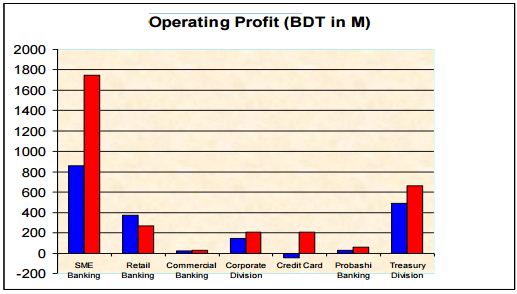

Operating Profit from SME:

BRAC Bank‟s operating profit increases in every year at a double digit growth. In 2013 it was near 800 million but in 2014 it increases 63%, near to 1800 million. Operating Profile is bellow

SME loan product:

BRAC Bank providing different type SLE loan products for the people those have really need the money to extend the business. The bank starts SME loan on different sectors. These are given below:

Anonno:

Anonno is a loan facility for small enterprises involved in trading, manufacturing, service, agriculture, non-firm rural activities, agro-based industries and many other acceptable sectors spread all over Bangladesh marketed through BRAC Bank„s SME unit offices or branches/SME branches/ Krishi branches across the country.

Eligibility:

- Entrepreneurs aged between 21 to 60 years

- Entrepreneurs with minimum 2 years‟ experience in the same line of business

- A business which must be a going-concern with more than 2 year in operation

Minimum amount:

From minimum BDT 2lac up to maximum of BDT 10lac for 12, 18, 24, 30 & 36months and minimum BDT 6lac up to maximum of BDT 10lac for 48 months

Features:

- Loan without mortgage

- For excellent borrowers who have paid or paying in due times, we offer discounted rates

- Quick, quality banking throughout the country

- Potential women entrepreneurs will also get the facilities of this loan

Interest Rate: 23.50% for New Loan; 23.50% for 1st time repeat (if applicable); 23.50% for 2nd time repeat& so on (if applicable).

Processing fees: 1.5% on loan amount + VAT

Apurbo

In order to help our SME borrowers for financing working capital or to purchase fixed assets, BRAC Bank Limited offers APURBO. It caters to the need of entrepreneurs who are operating in trading, manufacturing, service, agriculture, non-farm activities, agrobased industries and other sectors of our economy.

Eligibility:

- Entrepreneurs having a minimum of 2 years of some business activities

- A business which must be a going concern for 2 years

- Age minimum 21 years and maximum up to 60 years

Minimum amount: Starting from BDT 10lac to maximum of BDT 100lac

Features:

- Simple loan processing for expanding your business

- Quick disbursement

- Disbursement in one or two installment

- Flexible monthly repayment loan

Interest Rate: OD 18%; Term Loan: 18%; Takeover Loan (will be processed as per existing practice).

Processing fees: 1% of loan amount + VAT

Durjoy

An unsecured loan facility for small and medium sized trading, manufacturing, service, agriculture, non-firm rural activities, agro-based industries.

Eligibility:

- Entrepreneurs having a minimum of 2 years of some business activities

- A business which must be a going concern for 2 years

- Age minimum 21 years and maximum up to 60 years

Minimum amount: Starting from BDT 3lac to maximum of BDT 25lac

Features:

- The loan facilities will be term loan for regular businesses that are not subject to significant volatility in sales due to seasonality

- Loan tenor is 12 months to 60 months with an interval at 6 months

- Equal monthly installment facility and overdraft facility

Interest rate: 18%

Processing fees: 2% on loan amount + VAT

Shohoj

A term loan and overdraft facility for all types of business against FDR of BRAC Bank Ltd.

Eligibility:

- Entrepreneurs don„t need to have any previous business experiences in the same lineof business.

- A totally new established business can get the loan facilities.

- The proprietor/ partner must be Bangladeshi by nationality.

Minimum amount: Minimum amount is 2lac but there is no limit for maximum amount

Features:

- Meet the emergency cash needs of business

- Tenor for overdraft facility renewal after 12 months

- No processing fee for BRAC Bank Limited

- No rescheduling fee

Interest rate: FDR rate +3%

Processing fees: 1% on loan limits + VAT

Procedure of SME loan:

BRAC Bank maintains easy procedure for loan sanctioning and in the period of disbursement.

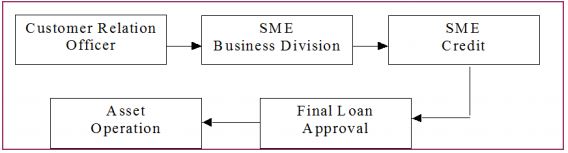

SME Loan Process Flow

When a customer comes to the unit office for a loan request, first he/she meets with the customer relationship officer to discuss about the loan, which loan product is suitable for him/her.

After then the following process takes place:

Loan Sanction activities

Select potential enterprise: For SME loan, in this step the CRO conduct a survey and identify potential enterprise. Then they communicate with entrepreneurs and discuss the SME program.

Loan Presentation: The function of CRO is to prepare loan presentation based on the information collected and provided by the entrepreneur about their business, land property (Where mortgage is necessary) Collect confidential information: Another important function of a CRO is to collect confidential information about the client from various sources. The sources of information are suppliers regarding the client‟s payment, customers regarding the delivery of goods of services according to order, various banks where the client has account, which shows the banks transactions nature of the client.

Open clients accounts in the respective bank: When the CRO decided to provide loan to the client then he/she help the client to open an bank account where BRAC bank has a STD a/c. BRAC bank will disburse the loan through this account. On the other hand the client will repay by this account. Although there is some exception occur by the special permission of the authority to repay by a different bank account.

Fill up CIB form: CRO give a CIB (Credit Information Burue) form to the client and the client fill and sign in it. In some case if the client is illiterate then the CRO fill the form on behalf of the client. Then CRO send the filled and signed form to the SME, head office.

Sending CIB to Bangladesh Bank: The SME, head office collects all information and sends the CIB form to Bangladesh Bank for clearance. Bangladesh Bank return this CIB form within 10-12 days with reference no.

CIB report from Bangladesh Bank: In the CIB report Bangladesh Bank use any of the following reference no:

NIL: if the client has no loan facility in any bank or any financial institution then BB (Bangladesh Bank) use „NIL‟ in the report UC (Unclassified): if the client has any loan facility in any bank or financial institution and if the installment due 0 to 5.99 then BB use UC in the report

SS (Substandard): if the client has any loan facility in any bank or financial institution and if the installment due 6 to 11.99 then BB use SS in the report

DF (Doubtful): if the client has any loan facility in any bank or financial institution and if the installment due 12 to 17.99 then BB use DF in the report

BL (Bad lose): if the client has any loan facility in any bank or financial institution and if the installment due 18 or above then BB uses BL in the report. This report indicates that the client is defaulter and the bank should not provide loan the client.

Loan decision considering CIB report: Considering CIB report, BRAC bank decide whether it will provide loan the client or not. If the bank decides to provide loan then the SME of head office keep all information and send all papers to the respective unit office to apply with all necessary charge documents.

SME Loan Sanction

The respective unit office sanctions loan to the client if it is 2 to 5 lacs, and then sends the sanction letter including all necessary charge documents to the loan administration division for disbursing the loan. If the amount is higher than 5 lacs then the respective unit office sends the proposal to SME, head office for sanction. The head of SME sanctions the loan and sends the sanction letter including all documents to the loan administration division for disbursement and inform the respective unit office regarding sanction of the loan.

Disbursement of SME loan

For SME loan operation, BRAC Bank Limited Ltd has in total 400 unit offices all throughout the country. The department is divided into three regions. Each region comprises of 6 to 7 territories. Territories are divided into zones and zones are further divided into unit offices. Currently there are 20 territories and 142 zones. The frontline employees of small business are called Customer Relationship Officer (CRO). More than 1,500 CRO„s are working in the department. These CROs work for the Bank to converge clients for getting the SME loan.

Pre Disbursement Manual Activities

Prepare loan file: Receiving all documents, Loan Administration Division prepare a loan file with all documents received from the unit office.

Charge documents checking: The loan administration division checks all charge documents. Following charge documents are checked:

- Money receipt (Risk fund).

- Sanction letter.

- Demand promising note (With stamp of Tk 20/=)

- Letter of arrangement (With stamp of Tk 150/=)

- General loan agreement (With stamp of Tk 150/=)

- Letter of undertaken (With stamp of Tk 150/=)

- Letter of stocks and goods (With stamp of Tk 150/=)

- Letter of hypothecation book debt and receivable (With stamp of Tk 150/=)

- Letter of disbursement

- Photocopy of trade license (attested by CRO)

- Insurance (Original copy)

- Blank claque with signature (one cheque for full amount and others same as no of installment on Favor of BRAC bank, no date, no amount)

- Two guarantors (one must be Spouse/parents)

If the loan provide for purchase of fixed assets or machineries and if the loan amount is over Tk 50,000/= then the stamp of a certain amount is require)

Documents deficiency and problem resolving: If there is any error found then it informed to the respective CRO. If the application form is not filled properly then the file send to the CRO to fill the application properly. If any document error found then the loan administration division asked the CRO to send the require documents and the file stored to the loan administration division.

Prepare disbursement list: The loan administration division lists all new sanctioned clients‟ details and send a request to the treasury through internal mail.

Disbursement of the amount: Sending the list to the treasury of BRAC bank for disburse the amount, the treasury disburse the amount to the client through the mother account of the clients bank. BRAC bank disburse amount through any of the following banks corporate branch nearer the BRAC bank head office and the corporate branch of the respective bank send the amount to the client account in the respective branch. These banks are:

- BRAC Bank Limited

- The City Bank Limited

- Janata Bank

- Bangladesh Krishi Bank

- Pubali Bank

- Agrani Bank

Message sent to the unit office: Completing the disbursement, loan administration division sent a SMS to the respective CRO informing the disbursement of the sectioned loan.

MBS entries for loan disbursement

Initial ID generation: After sending the list to the treasury, the loan administration division generates an initial ID against the borrower. Entering required information, the banking software MBS automatically provide a ID no for the borrower.

Loan account opening: According to the ID, the loan administration division opens a loan account in MBS against the borrower. Entering all required information, the MBS automatically give an account no. For the borrower.

Cost center assign: The loan administration division enter the following information in MBS:

- Security details set-up

- Guarantor details set-up

- Loan other details set-up

Risk fund collection: The loan administration division opens a different account risk fund of the client. This is known as loan processing fees. Receiving the risk fund, the loan administration division prints voucher and posting the voucher in the MBS. The amount of risk fund is not refundable.

Activision of the loan: Loan administration divisions do the following tasks to activate the loan

- Loan sanction details set-up

- Repayment schedule set-up and printing

- Loan activation

- Disbursement and CC wise voucher print

- Disbursement voucher posting

Post Disbursement Manual Activities

Repayment schedule sent to unit office: Completing the disbursement of the sanctioned amount the loan administration division prepare a repayment schedule in MBS and send it to the unit office. CRO from the unit office collect it and reached to the respective client. The client repays the loan according to this schedule.

Loan details MBS entry: The loan administration division enters details information regarding the loan in MBS. Each officer has an ID no in MBS and if there is any error found then the respective officer would be responsible for it. So everybody remain alert at the time of MBS entry.

Document stamp cancellation: The loan administration division cancels all document stamps. In future if any client found defaulter and the bank file sued against him then stamps of these document help to get the judgment favor of the bank. But if these stamps are not canceled then the judgment may not on favor the bank.

Send the loan file to archive: completing all activities, loan administration division sends the loan file to the archive for future requirement. In future if any document of the loan account requires then the bank can collect the file from archive and get the necessary document. If the clients take repeat loan then it is not require applying all documents because his all documents stored to the bank.

SME Loan Recovery Procedures:

The repayment process starts immediately after one month of the loan taken. Suppose if a loan is taken in July 7, 2007 then the repayment process will be started from August 7, 2007 and the borrower will pay his/her first installment in that date. Before that date, the borrowers will be informed about the number of installments and amount of each installment. He can deposit the installment by himself or by the Customer relationship officer (CRO). Again they can deposit the installments either in any branch of BRAC Bank or in any correspondence bank (where BRAC Bank has no branch). If the borrower cannot pay the installment in the stipulated date, interest will be charged for each day before they pay that installment. Again interest will be reduced if the borrower pays the installment before the date of repayment. Interest will be charged and added to the principal amount for every month or every 3 three months depending on the policy for each loan disbursement.

However, after the borrower repays the loan installments there are number of steps done in the repayment procedure of SME loan. These steps are:

Receive SMS/Fax for installment deposits

When the borrower repays any installment of the loan then he/she informs it to the unit office/CRO. Then the unit office/CRO sends an SMS through mobile phone or a Fax to the loan administration division informing the repayment. A loan administration division collects these SMS /Fax and takes a paper print of these SMS.

Entry the installment information to MBS

Loan administration division entries the repayment installment information to the banking software MBS.

Print Vouchers

Completing the entry, the loan administration division takes paper print of all vouchers in a prescribed yellow paper.

Check SMS/Fax and solve problems (If any)

The loan administration is responsible for all entry in MBS. If there is any error found in future then the respective officer who is entering this information in MBS will be liable for it. User ID will easily identify it. So they are always aware of to ensure the correct entry. Completing the entry of information, they print a hard copy and check it with the SMS/Fax. If there is any error found then it is solved and ensures the correct information entry.

Repayment voucher check and posting

If it confirmed that all entering information is correct and there is no error, then the responsible officer of the loan administration division posts it to MBS. If one time posted, it is not rectifiable without permission of the higher authority. So the loan administration is always aware of regarding the recovery procedures of SME loan.

Monitoring:

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a CRO to know the borrowers activities after the loan disbursement. This also facilitates the buildup of an information base for future reference. The purpose is to know the entire business condition and all aspects of the borrowers so that misfortune can be avoided.

Importance of Monitoring

Through monitoring a CRO can see whether the enterprise invested the sanctioned amount in the pre-specified area of his business, how well the business is running, the attitude of the entrepreneur, cash credit sales and purchase, inventory position, work in process and finished goods etc. This information will help the Bank to recover the loan accruing to the schedule and to take the necessary decisions for repeat loans. Moreover, monitoring will also help to reduce delinquency. Constant visit over the client /borrower ensures fidelity between the bank and the borrower and tends to foster a report between them.

Closing procedures of SME loan:

Pre-closing manual activities

Receive SMS/Fax requesting for closing: The borrowers repay the loan as per repayment schedule. When the repayment is being complete the borrower request the unit office/CRO to close his loan account. The unit office/CRO sends a SMS/Fax the loan administration division requesting to close the loan account of the respective borrower.

Print the SMS/Fax: Receiving the request from the respective unit office/CRO, the loan administration division takes a paper print and takes necessary steps to close the account.

Bring the loan file from archive: The loan account file of the respective borrower is brought from the archive. And the documents of file are checked with MBS record.

Obtained approval from the concern authority: it is require the permission of concerned authority to close the loan. If concerned authority approved the closing of the loan account then next initiatives are taken.

Checking in MBS: The loan administration division checks the loan status in MBS. If there is any difference found with the SMS/Fax from unit office and MBS then deposits sleeps are re-checked. Then the loan administration division calculates the total balance of the loan account (Ledger balance + buffer interest +Excise duty)

SMS sent to concerned CRO: Loan administration division sent an SMS to the concerned CRO informing the current balance of the requested loan account.

Receive and print closing SMS/Fax checking & freezing: The concerned CRO send a final SMS to loan administration division informing that the respective borrower cleared all his liabilities regarding the loan. The loan administration division takes paper print of the SMS, check it and finally close the loan account.

Checking MBS entries for loan closing

Pre closing data entry: Completing the manual activities, the loan administration division enters some information to MBS for future requirement and complete following tasks:

- Interest/provision charging & print voucher

- Charges collection & print voucher

- Final repayment entry & print voucher

- Final repayment entry checking

- Repayment voucher posting

Activate account closing in MBS: Completing above mentioned tasks, the loan administration division finally close the requested loan account in MBS.

Post closing manual activities:

Re-checking with deposit slip: Completing MBS activities, the loan administration rechecks all deposit sleeps of the loan account. If there is any error found then it is immediately resolved, otherwise the file sends to the archive for future requirements. The client may take repeat loan in future and then information from this file will help to approve and disburse loan, which will minimize risk. If the client asks to return security then the loan administration releases security completing following tasks:

- Documents photocopy before security release

- Closing certificate issuing and security release

Daily MIS updating for loan closing: Finally the authorized officer of the loan administration division update the banking software MBS (Millennium Banking System) by closing the respective loan account.

SWOT Analysis:

SWOT analysis is an important tool for evaluating the company‟s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition.

Strengths

Company reputation: BRAC bank has already established a favorable reputation in the banking industry of the country particularly among the new comers. Within a period of 6 years, BBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have leaded them to earn a reputation in the banking field Sponsors:

BBL has been founded by a group of eminent entrepreneurs of the country having adequate financial strength. The sponsor directors belong to prominent resources persons of the country. The Board of Directors headed by its Chairman Mr. F H Abed.

Therefore, BBL has a strong financial strength and it built upon a strong foundation.

Top Management: The top management of the bank is also major strength for the BBL has contributed heavily towards the growth and development of the bank. The top management officials have all worked in reputed banks and their years of banking experience, skills, expertise will continue to contribute towards further expansion of the bank. At BBL, the top management is the driving force and the think tank of the organization where policies are crafted and often cascaded down.

Facilities and equipment: BBL has adequate physical facilities and equipment‟s to provide better services to the customers. The bank has computerized and online banking operations under the software called Finacle banking operations. Counting machines in the teller counters have been installed for speedy service and the cash counters.

Computerized statements for the customers as well as for the internal use of the banks are also available.

Impressive branches: This creates a positive image in the minds of the potential customers and many people get attracted to the bank. This is also an indirect marketing campaign for the bank for attracting customers. 76 Branches of the bank are impressive and are compatible to foreign banks.

Interactive corporate culture: BBL has an interactive corporate culture. Unlike other local organization, BBL‟s work environment is very friendly, interactive and informal.

There are no hidden barriers or boundaries while interacting between he superior or the subordinate.

The environment is also lively and since the nature of the banking job itself is monotonous and routine, BBL‟s likely work environment boosts up the spirit and motivation of the employees.

Teamwork at mid-level and lower level: At BBL‟s mid-level and lower level management, there are often team works. Many jobs are performed in groups of two or three in order to reduce the burden of the workload and enhance the process of completion of the job. People are eager to help each other and people in general are devoted to work.

Weaknesses

Advertising and promotion of SME loan: This is a major setback for BBL and one of its weakest areas. BBL‟s adverting and promotional activities are satisfactory but it SME loan is not advertised well. It does not expose its SME product to general public and are not in lime light. BBL does not have neon sign or any advertisement for SME loan in the city. As a result people are not aware of the existence of this bank.

NGO name (BRAC): BRAC is one of the largest NGO of the world and it is operating its activities in Bangladesh. BRAC bank is not a NGO bank but many people of them country consider it as a NGO bank like Grameen Bank which is not correct.

Low remuneration package: The remuneration package for the entry and the mid-level management is considerably low. The compensation package for BBL entry-level positions is even lower than the contemporary banks. Under the existing low payment structure, it will be very difficult to attract and retain higher educated employees in BBL.

Specially CRO‟s are not satisfied with compensation package provided to them.

Opportunities

Diversification: BBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking or diversify in to leasing and insurance. By expanding their business portfolio, BBL can reduce their business risk.

Product line proliferation: In this competitive environment BBL must expand its product line to enhance its sustainable competitive advantage. As a part of its product line proliferation, BBL can introduce the following products.

ATM: This is the fastest growing modern banking concept. BBL should grab this opportunity and take preparation for launching ATM. Since BBL is a local bank, they can form an alliance with other contemporary banks in launching the ATM.

Threats

Multinational banks: The emergence of multinational banks and their rapid expansion poses a potential threat to the new growing private banks. Due to the booming energy sector, more foreign banks are expected to arrive in Bangladesh. Moreover, the already existing foreign bank such as Standard Chartered is now pursuing an aggressive branch expansion strategy. This bank is establishing more branches countrywide and already launched is SME operation. Since the foreign banks have tremendous financial strength, it will pose a threat to local banks.

Upcoming banks: The upcoming private local banks can also pose a threat to the existing private commercial banks like BBL. It is expected that in the next few years more local private banks may emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against an on slaughter of foreign banks.

Contemporary banks: The contemporary banks of BBL such as Dhaka bank, prime bank, and Dutch Bangla are its major rivals. Prime bank and other banks are carrying out aggressive campaign to attract lucrative clients as well as big time depositors.

Result and Discussion:

BRAC bank, as we know, is one of the fastest growing banks in Bangladesh. SME banking which has made the performance of this bank so enlightened is its core product to offer to the small and mediocre business entrepreneurs. In fact no businessman could think ever before that they could take loan so easily, without any collateral and without going to bank. But BRAC Bank has made this improbable process so successfully through SME banking. However from the analysis of SME loan repayment behavior I can make the following findings:

Age have a significant impact on the recovery of SME loan. Young entrepreneurs have a lower rate of recovery. On the other hand as middle aged and experienced entrepreneurs are very loyal with their loan repayment they can make proper and timely repayment of their loans. And that‟s why most of the SME loan borrowers age rages from 30 to 40.

Education does not have any direct relationship with the recovery rate. In fact, Most of the entrepreneurs of retail and whole business (small or medium in size) are not highly educated. Most of them studied up to class 9 or 10. Sometimes there are some entrepreneurs who have only alphabetic knowledge or who can give their signature only.

But still they are running their business so well for many years. In this case experience makes them successful in their business. So, education does have much impact on these small and medium enterprises and also on the recovery rate of SME loans.

Experience is the most significant variable, which has a great impact on any kind of business and recovery rate as well. Experienced entrepreneurs run their business so tactfully, identify the exact time what is their pick time of sales and when they need fund.

They take the loan in the pick season when they have excess demand but short of capital.

Then they ensures the best use of the loan and finally they reach to success and make the dully installments. So their recovery rate is good and that‟s why BRAC bank looks always for experienced entrepreneurs.

Number of installments (term of loan) and amount of loan taken do affect recovery rate slightly. But trends show that BRAC bank prefers to disburse loan of an amount of 300000 and at a term of 18 to 24 months.

Another variable affecting recovery rate very much is the income of the borrowers. The higher the existing income of the borrowers, the lower the rate of default. Higher income groups make the best use of the loan they have taken and get success. On the other hand lower income group may misuse the loan and ultimately may default in paying installments.

Personal or family asset might have some impact while sanctioning the loan as well as when recovering the loan installments. Suppose if a borrower fails to pay one of his installments, bank can find his personal assets as back up for the recovery of the installments.

Retail business and wholesale business both types of businesses get loans from BRAC Bank but whole sellers have a higher recovery rate as their business transactions occur at lot size and their collection is much quick.

Recommendations

The following suggestions are put forward for present and future sustainability of the SME of BRAC Bank Limited:

- Age, experience, income, past loan history of the entrepreneurs should be given more priority and analyzed properly before lending. Because this variables have major effects on loan recovery.

- BBL should initiate some promotional activates and advertise heavily to inform the general public about their SME products and also inform the people that BBL is a bank like other bank, it is not an NGO.

- Features of SME products should be designed more attractively compared to the competitors to lower the level of risk and attract more potential customer. To make this happens BBL should research competitor‟s products periodically.

- Bottlenecks or barriers should be removed by taking advanced step in mode of disbursement, charge documents and approval process.

- Loan facility parameter should be expanded so that all the people can get loan according to their needs.

- Business Power for sanctioning loans and advances can be increased at branch level.

- CRO‟s are the major media between bank and customers. They have given certain no of customer targets in a month. To fulfill their target they don‟t analyze borrowers‟ history, as a result no of defaulter increasing day by day. Also CRO‟s are not satisfied with compensation package provided to them. So bank should take some corrective actions about these matters.

- More SME service center need to be added to fully take the advantage of the huge potential customer segments.

Conclusion

BRAC Bank limited is a strong and effective player in the financial system. It is a solid forward-looking, modern local bank with a record of sound performance. It is a new generation bank. It is committed to provide high quality financial services/ products to contribute to the growth of GDP of the industrialization, boosting up export, creating employment opportunity for the educated youth, rising standard of living of limited income group and overall sustainable socio-economic development of the country. The bank has the vision to the best private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management etc. The bank must make a positive attempt to be more outward looking in their goals and aware of what is happening. They must also emphasize on the domestic scenario more closely and analyze any certain trends and strategies of their competitors. The bank must accept any failures and think of them as an objective to pursue future goals instead of blaming such failures on other factors and in this way the Bank will be able to keep on playing its important roles in our economy.