Zero Balance Project of BRAC Bank Limited

BRAC Bank Limited, one of the latest generation of commercial banks started its journey on July 04, 2001 which is an affiliate of BRAC, the world’s largest non-governmental development organization founded by Sir Fazle Hasan Abed in 1972. Though is the pioneer of SME loan in Bangladesh but the Retail Banking Division of BRAC Bank enhanced it’s footprint day by day with a superior consciousness. The report is all about the analysis of Zero Balance Project of BRAC Bank Limited where it mentioned all the important aspects of why the Zero Balance project were initiated, it’s frequency, target customers, the gap of this project and how to mitigate those gaps. Basically, the goal of Zero Balance project is to increase the active number of accounts, to increase non-funded income, to decrease dormant account numbers. Besides, the report is containing a brief idea about the prospects of Zero Balance projects, where it mentions about the efficiency and effectiveness of this project.

Overview of the Banking Sector in Bangladesh

There is no denying the fact that the financial system plays a significant role in the economic development of a country. The importance of an efficient financial sector lays in the fact that, it ensures domestic resources mobilization, generation of savings, and investments in productive sectors. In fact, it is the system by which a country’s most profitable and efficient projects are systematically and continuously directed to the most productive sources of future growth.

Financial sector in Bangladesh, like most in developing countries, is dominated by banking institutions. With recent gains in financial fronts Bangladesh’s financial sector is now comparable with most of the countries in South and East Asia in terms of financial deepening.

Bangladesh, like other developing countries, still has an underdeveloped financial system and is facing serious problems with the operation of its financial system and poor financial intermediation presents significant disincentives to foster economic growth.

Nevertheless, the banking sector occupies an important place in Bangladesh because of its intermediary role; it ensures allocation and relocation of resources and keeps up the momentum of economic activities. It plays a pivotal role in the economic development of the country and forms the core at the money market.

Banks can be defined in various ways. In Bangladesh, any institution which accepts for the purpose of lending or investment, deposits of money from the public, repayable on demand or otherwise, and is transferable by checks, draft order or otherwise, can be termed as a bank. The purpose of banking is thus to ensure transfer of money from surplus unit to deficit units or in other words, to work as the repository of money.

History of BRAC Bank

BRAC Bank Limited, one of the latest generation of commercial banks started its journey on July 04, 2001. It is an affiliate of BRAC, the world’s largest non-governmental development organizations founded by Sir Fazle Hasan Abed in 1972. It has been the fastest growing Bank in 2004 and 2005. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shore Cap International, has been the fastest growing Bank in Bangladesh for the last three consecutive years. In the recent past the bank has gone public with price of shares reaching impressive heights, further showing promising future.

A fully operational Commercial Bank, BRAC Bank Ltd. focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last five years of operation, the Bank has disbursed over BDT 1,500 crore in loans to nearly over 50,000 SMEs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. Since inception in July 2001, the Bank’s footprint has grown to 157 branches, over 421 SME unit offices and 322 ATM sites across the country, and the client base has expanded to over 200,000 deposit and 45,000 advance accounts through 2006. The Bank is constantly coming up with new products. Recently BBL has introduced Visa Silver and Visa Gold both Local and International credit cards; and further more the Bank is in the process of introducing VISA Debit card. In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of SME unit offices, Retail Branches and ATMs across the country.

About BRAC Bank Limited

BRAC Bank Limited is a full service scheduled commercial bank. It has both local and International Institutional shareholder. The bank is primarily driven with a view of creating opportunities and pursuing market niches not traditionally meet by conventional banks. BRAC Bank has been motivated to provide “best-in-the-class” services to its diverse assortment of customers spread across the country under an on-line banking dais.

Today, BRAC Bank is one of the fastest growing banks in the country. In order to support the planned growth of its distribution, network and its various business segments, BRAC Bank is currently looking for impressive goal oriented, enthusiastic, individuals for various business operations.

The bank wants to build a profitable and socially responsible financial institution. It carefully listen to the market and business potentials, It is also assisting BRAC and stakeholders to build a progressive, healthy, democratic and poverty free Bangladesh. It helps make communities and economy of the country stronger and to help people achieve their financial goals. The bank maintains a high level of standards in everything for our customers, our shareholders, our acquaintances and our communities upon, which the future affluence of our company rests.

Corporate Mission

BRAC Bank Limited wants to be the absolute market leader in the number of loans given to small and medium sized enterprises, service holders, teachers, students, immigrants and people belong to all income and professional groups throughout Bangladesh. It tries to be a world-class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It wants to become the Bank of choice both for its employees and its customers, the model bank in this part of the world.

The missions that BBL follows are –

- Continuous endeavor to increase fee based income

- Sustained growth in ‘Small & Medium Enterprise’ sector

- Keep our Debt Charges at 2% to maintain a steady profitable growth

- Continuous low cost deposit growth with controlled growth in Retained Assets

- Corporate Assets to be funded through self-liability mobilization.

- Growth in Assets through Syndications and Investment in faster growing sector

- Achieve efficient synergies between the bank’s Branches, SME Unit Offices and BRAC field offices for delivery of Remittance and Bank’s other products and services

- Manage various lines of business in a fully controlled environment with no compromise on service quality

- Keep a diverse, far flung team fully motivated and driven towards materializing the bank’s vision into reality.

Corporate Vision

The vision of BBL is to build a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assisting BRAC and stakeholders build a just, enlightened, healthy, democratic and poverty free Bangladesh. They want to focus on 3ps (People, Planet and Profit).

Special Features of BRAC Bank Limited

BRAC Bank Limited possesses a number of special features. BRAC Bank will attach special emphasis to the target group strategy of development. The Bank emphasizes on the creation of self managed institutions for its clients. These institutions will be based at the clients‟ localities.

A special feature of BRAC Bank will be the provision of training for its clients. The aim of the training will be to increase the capability of the borrower to utilized loans effectively. The Bank will encourage the use of new and improved technologies in order to increase employment opportunities and productivity of the poor. The credit activities will be structured in such a way that the use of appropriate technology is ensured and the poor can benefit from improved technology.

BRAC Bank will provide credit without security. The poor who do not have resources to offer as collateral have, so far, been denied access to formal credit. However, BRAC Bank will not normally seek collateral for providing credit and will use peer pressure to ensure timely repayment which has already proved effective. BRAC Bank will provide service at the doorsteps of the customers. Unlike the traditional banking system, BRAC Bank worker go to the villages regularly to collect savings and loan repayments. BRAC Bank also intends to attach special attention to women in development.

Zero Balance Project –

Description of the project: This topic is very much crucial and has importance to prepare my report as I am working as an intern in the Customer Experience Department of Retail Banking division. That is why it is easy for me to provide all the information about the related topics. I have tried to provide all the information related to this topic. The main theme of the topic is on Zero Balance Account. This report provides the overall information & scenario of the zero balance account holders and its recovery process.

Objective:

The objective of the report can be viewed in two forms:

- General Objective

- Specific Objective

Methodology:

For collecting the information primary and secondary source both are used similarly. In primary source the information is collected by doing the job performance, consulting with supervisors and other employees and also the raw data which is used throughout my internship period. In secondary source different websites of BRAC Bank, journals and books are used for retrieving the information.

Liquidity Situation:

Managing liquidity for a bank involves having enough cash on hand and being able to borrow cash at reasonable cost in order to meet cash needs exactly when they arise. The two most common uses of the bank’s liquid funds are to cover deposit withdrawals and to meet requests for loans. Banks can meet those funds needs by selling assets (i.e., disposing of stored liquidity) or borrowing in the money market (i.e., using purchased liquidity).

If we consider the present liquidity condition then we can see that according to Bangladesh Bank data from January 1 to January 23, state owned Agrani Bank Limited borrowed from the call money market on an average over Tk. 300 crore every working day. It was the highest borrowing rate. Another state-owned bank, Sonali Bank Limited, is on second position as it borrowed about Tk. 250 crore daily. Within this period, the aggregated amounts of borrowing by these two banks are Tk. 5,054 crore (Agrani) and Tk. 4,217 crore (Sonali). However, two other state-owned banks- Janata Bank Ltd and Rupali Bank Ltd- have lent to call money market on a regular basis. Within this period, Janata Bank lent Tk. 15,334 crore while Tk. 1,698 crore. Among private bank, big lenders were:

- Basic Bank Ltd (lending amount Tk. 11,894 crore)

- United Commercial Bank Ltd (Tk. 8,769 crore),

- Pubali Bank Ltd (Tk. 6,825 crore),

- Dutch Bangla Bank Ltd (Tk. 5,434 crore), (Banglavision Research Journal Vol. 14, No. 1, 2014)

The Trust Bank Ltd, Bank Al-Falah, Premier Bank Ltd, One Bank Ltd and Bangladesh Development Bank are also the big borrower. Borrowing and lending are almost parallel for The City Bank Ltd (aggregated lending Tk. 2,391 crore and borrowing Tk. 2,955 crore) and Standard Bank Ltd (borrowing Tk. 1,060.50 crore and lending Tk. 1,133 crore). Two foreign banks that went for regular borrowing from the call money market are Bank Asia Limited and National Bank of Pakistan. Among foreign banks, Commercial Bank of Ceylon, Citibank NA, Habib Bank Limited, Honkong Shanghai Banking Corporation, Standard Chartered Bank, State Bank of India and Woori Bank have lent to the call money market. Meanwhile, International Leasing, Lanka Bangla, Peoples Leasing, Prime Finance, Union Capital, Reliance Finance Ltd, ICB Islamic Bank Ltd, are facing acute liquidity crisis. The Steps of Bangladesh Bank should be taken. The Bangladesh Bank (BB) should be more operational independence to exercise properly its regulatory powers over the country’s financial sector, specially its own operational building.

State-owned Sonali Bank Limited has, once again, highlighted the need on guaranteeing proper functional independence to the Bangladesh Bank (BB), without being overloaded by any unnecessary interfere.

Interest Rate

In Bangladesh, interest rates decisions are taken by the Bangladesh Bank. The Bangladesh Bank controls two policy interest rates: the repo rate (repurchase rate), which it uses to inject money into the banking system, and the reverse repo rate.

From the above mention criteria, we can say that at the beginning of this year the economic condition is not so good due to political unrest or some other staffs. For that reason investor lose their confidence to invest. In that time we see liquidity crisis in the market and government needs to borrow from the banking system as well. Although the condition improves a lot but still the liquidity crisis is exists in the market and for that reason most of the bank wants to increase the deposit amount.

If we consider the BRAC Bank scenario, we can say that Zero Balance Project is an internal initiative of BRAC Bank Limited to increase the deposit amount to hedge the risk of current economic condition.

What Is Zero Balance Account?

A Zero balance account is an account which balance is approximately less than hundred taka or zero. For example, the accountholder does not have any money in that account or have some money which is less than hundred taka.

Background of the Zero Balance Project:

Zero Balance Project is an internal project of BRAC Bank Limited which main aims are to keep the customer account active whose balance is zero. This project was initially started at two years before and the bank actually started this project for considering the dormant condition of the customer account and at the same time due to the huge charges made by the zero balance account. By initiating this project BRAC Bank keep their zero balance customer account active which would be otherwise dormant after 12 months and at the same time get fresher fund from those account. So this is a helpful project for both the perspective of the customer and the bank. The reason behind this is that if customer account will be dormant then they are not able to use their account. However their account will be exists and at the same time charges will be continuously dues for those accounts. It creates a bad record for the customer and at the same time they are not using the account but they have to pay charges if they want to re-active their account or continue their account. So from that perspective it is better for the customer to keep their account active and use the account. On the other hand, bank has some costs for the customer account. So from this project those zero balance customer account keeps active which help them to cover their charges amount and at the same time banks get the deposited amount.

Reason behind starting this project:

At the initial state the key personnel of the bank found that there are lot of zero balance accounts, which the customer do not know or know but do not want to deposit fund for service problem or some other issues. So from this thinking the journey starts and now a day it does not only inform the customer about their zero balance amounts but also give them proper support. Like sometimes customers told about their different problem and the person who call the customer give enough support to them. For that the customer who feels that the service of BRAC Bank is not good he/she get some positive message about the bank image and ultimately it turns them to deposit funds. So from this project customer get to know about their zero balance account which make them aware to keep their account active and at the same get some sorts of solution over the phone if they face some problem regarding their account.

Frequency of this Project:

Zero Balance Account is a continuous two years project. It was calculated or checked in every month to show the progress or to show that how much fund is deposited by the zero balance customer. So from that perspective we can easily say that the frequency of the Zero Balance Project is every month in a year.

Goal of the Zero Balance Account Project:

- To increase the active number of accounts.

- To increase non-funded income.

- To decrease dormant account numbers.

Target Customer:

As zero Balance Project deals with the customer whose account balance is zero, they are actually fall under the Easy Banking customer segment. They are the most profitable segment of the bank because although their deposit amount is not that much high but the number of customer is huge in this segment. In this segment, customers have to maintain annual average balance of less than BDT 50,000 Tk. So ultimately in this project they are the main target customer.

Statistics of Zero Balance Account:

Throughout my internship period I got 11,915 customers information in two different excel sheet. One is for Current Account and another one is for Savings Account. Here the statistics of from how much time the account is zero is given below:

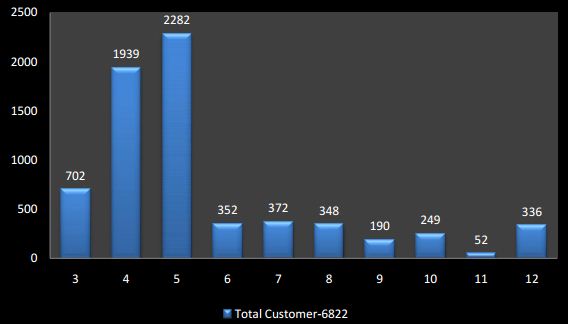

Figure: Statistics of how much time the customers Current Account is zero (from 3 to 12 months)

From the above mention table, we can see that around 6822 customers Current Account balance is zero. From them around 2282 customers account was zero from 5 months, which is the highest value. If we consider the lowest value we can see that around 52 customers account is zero from 11 months.

So from this table we can easily come to a conclusion that the number of Current Account which will be dormant very soon is not that much high compare to the account which is zero from 3 to 5 months. Here the mentioning reason can be that for service quality or high accounts maintenance costs, zero balance customer account is high from 5 months and now customer’s wants to discontinue the account. So the bank’s personnel need to take proper steps like inform the customer at the beginning where the zero balance customers‟ number started to be huge. If they will do so then ultimately the burden of zero balance account can be minimize and it cannot happen in a huge amount and banks also will not lose their charges amount from the customer.

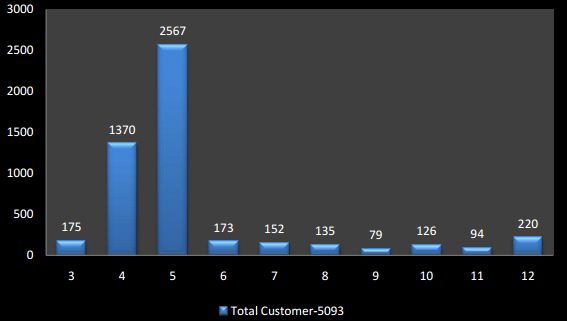

Figure: Statistics of how much time the customers Savings Account was zero (from 3 to 12 months)

From the above mention table, we can see that around 5093 customers Savings Account balance is zero. From them around 2567 customers account was zero from 5 months, which is the highest value. If we consider the lowest value we can see that around 79 customers account is zero from 9 months.

So from this table we can easily come to a conclusion that the number of Savings Account which will be dormant very soon is not that much high compare to the account which is zero from 3 to 5 months. The reason behind this scenario can be that with the help of Zero Balance Project, customer are informed about their zero balance condition and then they try to active their account and for that reason they deposited fund in their account. So for that, we cannot see here the larger amount of zero balance customers from 06 to 12 months, as may be they inform earlier. Here Zero Balance Account proves its success.

Prospect of Zero Balance Project

Fund Inflow: From the BRAC Bank perspective if we consider the zero balance projects we can see that they get huge success by initiating this project. In my internship period, only one month data is analyzed. The customer whom we (intern) called in the month of June, from them around one hundred ninety eight customer deposit funds in their account and the bank get BDT. 14.5 Million as a fresh fund inflow from the customer. At the same time the lien amount realization amount is BDT. 0.04 Million. This is actually possible for conducting the Zero-Balance Project. Otherwise bank may lose this valuable amount. So ultimately it increases the total fund of the bank.

Efficiency: Efficiency means getting more output with less input. Here in BRAC Bank if we consider this efficiency we can easily say that they also achieve this by conducting Zero-Balance Project. The main reason behind this is that for conducting Zero-Balance Project, they need to use less input but they get more output from this project. For example, we can say that informing the customer is the main moto of this project and for that the bank only need some sort of staffs. Which are given below:

- Some employee (2/3)

- XCRV system

- Local internet

- MS Excel

- Finacle software

- PABX phone

- Some intern

So from the above list it is clear about how much they need to spend for this project. On the other hand, the output from this project is huge as previously discussed that about BDT 14.5 Million fresh fund inflow from this project in the month of June. So if we consider this one month information for one year than we get the round figure of one year fresh fund inflow amount. This is much higher than the using staffs as used as input. Finally we can say that the bank get the efficiency by conducting this project.

Future Plan of Zero Balance Project:

As Zero Balance Project is a continuous project, so management of BRAC Bank wants to continue this project in future and several strategies is taken for it to improving the effectiveness of this project. Like previously the dormant customer is not informed but at present they are starting to call the dormant customer about to inform their dormant account condition. The other thing is that previously for this project only three interns were assigning but at present there are nine interns who are working for this project. This is the result of the improvement that they are continuously assign new strategy and we hope that it will be continuing in the future.

Recommendation

The number of ATM booth needs to increase:

Although BRAC Bank have 350 plus ATM booth to serve the existing customer but this number is not enough. When we call the customer most of the time they claim about this that they are not getting the services all over. So to improve the banking experience of the customer BRAC Bank should increase the number of ATM booth.

The number of CDM machine needs to increase:

CDM machine is a new feature of BRAC Bank Ltd and for a pilot basis they implement this to some specific branch in Dhaka. However from Zero Balance project we get to know that customer are more interested with this CDM machine and if it will implement to all over the country then customer will be more satisfied with their desired services. So BRAC Bank should increase this CDM machine number to give the customer prompt services.

Better solution needs to provide to the customer:

Sometimes customer complaints about that they are not getting the proper solution to their problems which they are facing at the bank. For example, a customer complained that he sends his check to the check box but he could not get back the check amount. Already he complaint to the bank about it but cannot get proper solution till now. Although, this is a rare case but BRAC Bank should careful about this type of problems and provide the better solution to the customer.

Set up some strategy to communicate:

By working this Zero Balance Project I get to know that customer wants to communicate to the bank’s authority for their complaints and lot of queries. Although Customer Experience Department are there to solve customer complaints and queries but direct or easy communication is not there. So bank personnel should set up some strategy so that the customers can easily communicate.

Open some new branches where needed:

Although BRAC Bank has huge branch network among the country but sometimes we get complaints that there are no branches in some specific places and for that reason customer is not able to get banking facility in those places and ultimately they start their banking with another bank which is close to them. It happens mainly in Rangpur, Khagrachori and some other places where the branch is located only in town and customer may live outside the town and they find this branch far long distance. So bank personnel should take some necessary steps to open some new branches where needed.

Conclusion

To conclude, it can be said that it was a lifetime experience for me to work in the “Zero Balance Project” and gather knowledge from it. BRAC Bank is an organization who tries to establish their services and they can improve their services through low price services with skilled services provider and Zero Balance Project is a successful initiative of it.

In this Zero Balance Project, although there are some limitations and gaps exist but they (the key personnel) carefully taken under consideration of those and ultimately the result of this Zero Balance Project is huge success. Most of the time which we see is that normally dormant account will be closed but here by this Zero Balance Project we see the difference that BRAC Bank utilizes this zero balance account and the result is obviously the huge fund they get from this.

Finally, it can be said that the ultimate success comes by dedication, commitment and dynamic leadership of the management committee and in this Zero Balance Project of BRAC Bank Ltd, all of those are present and for that reason the project gets the ultimate success.