Abstract

My dissertation is about Credit is an important input in the production processes of a country as well as the income generation activities of an individual. But the demand for credit in a developing economy like Bangladesh is much higher than its supply. Since credit is a scare resource, its use has to be planned carefully so as to obtain optimum benefits.

The Premier Bank Ltd. is one of the leading third generation bank in Bangladesh. State and federal authorities to make loans to their customer characterize the principal reason of this bank. Bank is expected to support their local communities with an adequate supply or credit for all legitimate business and consumer activities and to price that credit reasonably in line with competitively determined interest rates. The Premier Bank Ltd. is providing different types of loan facilities (which will be discussed later on) to the customer, which is sometimes attractive to the customer, but the duty is not done after completing disbursement of loan. The bank follows strict rules and regulations in terms of selections of borrower, evaluation the borrower’s background, transaction performance, financial statements and other relative information that defines a borrower’s characteristics. For maintaining the standard evaluation process, Imamgong branch has a good recovery ratio so far compare to other branches. Most of the branches have been maintaining their standard level in terms of credit evaluation process. But Imamgonj branch is showing their outstanding performance in terms of loan and advance policy. After a successful completion of last fiscal year, Imamgonj branch has only 0.45% classified loan and 99.55% unclassified loan out of 100% of total loan and advance section. On the other hand this particular branch has only 2.5% overdue of loan, which will be collected by the subsequent period. This figure indicates the greater strength of this particular branch in terms of loan and advance section, which has a positive impact that will help them to achieve a greater size of 100% loan and advance recovery ratio. As this is the most critical part to explain, I have tried to observe each and every credit evaluation process very carefully to get the overall view of loan and advance section.

Introduction:

Modern banking system plays a vital role for a nation’s economic development. Over the last few years the banking world has been undergoing a lot of changes due to deregulation, technological innovations, globalization etc. These changes in the banking system also brought revolutionary changes in a country’s economy. Present world is changing rapidly to face the challenge of competitive free market economy. It is well recognized that there is an urgent need for better, qualified management and better-trained staff in the dynamic global financial market. Bangladesh is no exceptions of this trend. Banking Sector in Bangladesh is facing challenges from different angles though its prospect is bright in the future.

Origin of the report:

This report titled “The Premier Bank Ltd. Critical Analysis of Credit Approval Process in The Premier Bank Ltd.” is an termpaper report, which is the integral part of B.B.A program.

Scope of the Study

In this report, I am trying to portray the overall scenario or performance of Credit of The Premier Bank Ltd. As I have been working in The Premier Bank Ltd., Imamgonj Branch as a result this Branch has been an essential basis of this report. More over, I will be focusing on the critical analysis of credit approval process in The Premier Bank Ltd.

Objectives of the study

The objective of the study is to combine the theoretical exposure gathered from the BBA program with the practical knowledge on banking system and operation. This is a great opportunity to co-ordinate with the theoretical knowledge and the practical experience. The following are of objective for term paper in bank:

- To apply theoretical knowledge in the practical field.

- To analyze the service procedure of Premier Bank Ltd.

- To portray the banking operation.

- To reveal the area of General Credit.

- To describe the process of loan disbursement.

- To analyze the process of loan recovery.

- To describe the documents of credit.

Research Methodology:

Some fundamental steps of research methodology have been adopted through my specialization field of study of B.B.A program and also from the fields of other areas. In my study I had to go for personal interaction with staffs of The Premier Bank Ltd, Imamgonj Branch and Head office to conduct the research work.

Sources of information:

Both primary and secondary sources of information were being pursued with regards to the presentations of this study. The following procedure and sources I accessed:

- The web page of The Premier Bank Ltd.

- Prior researches report on this topic.

- Face to face interaction with all employees of the branch

- Significant amount of information was gathered from secondary sources, such as bank’s brochures, relevant different printed formats, different printed manuals and policies of The Premier Bank Ltd.

Limitations of the Report:

I have tried my best to provide with all necessary information about The Premier Bank Ltd. But due to exhaustive nature of this study most secret & strategic ethics could not be brought in this report. As having the status of the empirical study, this report is subject to following limitations.

The Premier Bank is fully a centralized bank and all information is available in head office. Branch gets information when special request is made. Branch employees only can know the information that’s available in EBBS (Electronic Base banking System).

Some of the data are self-generated by ratio analysis, so it was difficult to draw inference.

A worthwhile study requires the analysis of as much data as possible covering various aspects of the study. But I did not have access to the various types of information about Loans & advances.

To protect the organizational loss in regard of maintaining confidentiality some parts of the report are not in depth.

I carried out such a study for the first time. So, in-experience is one of the main factors that constituted the limitation of the study.

Backdrop of The Premier Bank Limited

The Premier Bank Limited is incorporated in Bangladesh as banking company on June 10, 1999 under Companies Act.1994. Bangladesh Bank, the central bank of Bangladesh, issued banking license on June 17, 1999 under Banking Companies Act.1991. The Head Office of The Premier Bank Limited is located at Banani, one of the fast growing commercial and business areas of Dhaka city. The Bank has a

Authorized Capital of BDT 2000.00 Million and the Paid up Capital is BDT 845.00 Million.

Vision

The Bank has clear vision towards its ultimate destiny – to be the best amongst the top financial institutions.

Missions

To be the most caring and customer friendly provider of financial services, creating opportunities for more people in more places.

To ensure stability and sound growth whilst enhancing the value of shareholders investments.

To aggressively adopt technology at all levels of operations to improve efficiency and reduce cost per transaction.

To ensure a high level of transparency and ethical standards in all business transacted by the Bank.

To provide congenial atmosphere which will attract competent work force that will be proud and eager to work for the Bank.

To be socially responsible and strive to uplift the quality of life by making effective contribution to national development.

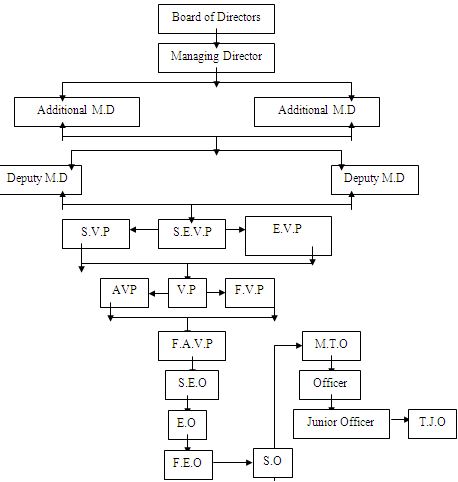

Organizational Organ gram:

SWOT Analysis:

The Premier Bank Ltd. is one of the dynamic banks in Bangladesh. Within a short period of time, the bank has achieved an emerging success and this bank has lot of potentiality to become a leading bank in the banking sector. For me it is very difficult to explain bank’s solidity as I am doing my term paper for only three months. But From my practical observation, I have tried to define The Premier Bank ltd by analyzing a SWOT Analysis:

Strength:

It has well reputation in the market

Not engaged in unfair business practice.

Concentrated market.

Officers are highly educated.

Executives are highly qualified and experienced.

Bank has many attractive deposit schemes.

Efficient management practices in the Bank.

Well diversified Credit Portfolio.

Deposit mix is very sound.

Weakness:

High Cost Deposit is more than low cost deposit.

Short time experiences of the Bank.

Officer has limited experience and not enough trained.

Long-term credit is not sufficient.

Small market shares in Banking-business.

Opportunities:

Can increase the credit scheme.

Can increase the advertising of the Bank.

Private Banks becomes more reliable to local public.

Govt. has banned some ‘Jatiya Sanchaya patra’.

Threat:

There are many competitors in the market.

Competitors have more deposit.

Govt. imposes tax and VAT on profile.

Govt. pressures to reduce interest rate.

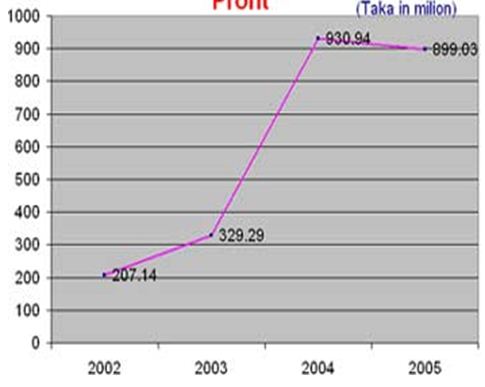

Financial performance of The Premier Bank Ltd:

The financial performance of The Premier Bank Ltd. shows the greater steadiness that the bank has perceived since the last few years. Here I have shown the some positive financial indicators of The Premier Bank Ltd. that I have collected from the Annual report of The Premier Bank Ltd. to address the emerging success that the bank is perusing over the years.

| (Tk. in million) | ||||||

Particulars | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| Authorized Capital | 1000 | 1000 | 1000 | 2000 | 2000 | 2000 |

| Paid-up Capital | 222.00 | 239.76 | 408.91 | 557.55 | 681.45 | 845.00 |

| Reserve Fund | 25.30 | 98.24 | 130.00 | 301.08 | 403.85 | 543.76 |

| Deposits | 2206.39 | 5373.75 | 10030.52 | 18005.20 | 20290.47 | 2419.90 |

| Advances | 2057.96 | 4280.73 | 8095.57 | 15383.93 | 18032.50 | 20677.61 |

| Investments | 270.13 | 680.09 | 1330.20 | 2750.00 | 2242.78 | 2392.00 |

| Foreign Trade Business | 6158.43 | 11782.80 | 20934.30 | 33937.38 | 33571.00 | 38797.18 |

| Foreign Remittance | 57.51 | 54.80 | 364.50 | 1408.00 | 1427.40 | 940.10 |

| Income | 415.41 | 576.78 | 1251.76 | 2395.45 | 2863.86 | 3622.50 |

| Expenditure | 291.27 | 380.54 | 851.03 | 1464.52 | 1964.83 | 2679.98 |

| Operating Profit | 124.14 | 196.24 | 400.73 | 930.93 | 899.03 | 942.07 |

| Fixed Assets | 47.59 | 73.29 | 107.90 | 149.57 | 165.48 | 163.93 |

| Total Assets | 3448.94 | 6036.92 | 11096.30 | 20100.25 | 22767.84 | 27170.45 |

| Book Value per share (Taka) | 121.68 | 140.97 | 168.12 | 207.69 | 203.31 | 192.44 |

| Earning per share | 26.09 | 28.30 | 67.02 | 84.40 | 32.45 | 43.63 |

| Dividend | 13.50% | 13.70% | 36.35% | 36.84% | 24.00% | 10.00% |

| Loan as % of total Deposits | 93.27% | 79.66% | 80.71% | 85.44% | 88.87% | 85.45% |

| Non-Performing Loan as percentage of total Loan | 0.64% | 1.16% | 0.36% | 0.43% | 3.86% | 4.91% |

| Capital Adequacy Ratio | 12.47% | 9.27% | 11.76% | 10.69% | 9.02% | 10.66 |

| Number of Branches | 7 | 12 | 17 | 21 | 21 | 26 |

| No of Foreign Correspondents | 131 | 156 | 238 | 297 | 297 | 350 |

| Number of Employees | 164 | 281 | 435 | 554 | 605 | 677 |

(For the year ended 31st December, 2008)

Capital

The authorized capital of the Bank is Tk.2,000 million and Paid up Capital of is Tk.845.00 million as on 31 December 2006. The Bank is processing to issue share to public within this year to raise capital of the Bank by about 24% from the present level. Capital Adequacy Ratio was 10.66% on risk weighted assets as on 31 December 2006 which is above the stipulated requirement for all Banks in Bangladesh. (9.00%).

Product and Services offered by The Premier Bank Ltd.:

Deposit Related Products

Deposit is often called the lifeblood of commercial banks. As blood is essential and vital for life is deposit for commercial banks. No commercial bank can be thought of without deposit. In fact modern commercial banking starts with deposits from the public followed by lending or financial trade, commerce and industry. The most of the deposit of a bank come from the various type of bank account that is provided by a bank. Those bank accounts are described below:

- Types of bank account

1. Savings Account

The Premier Bank Ltd. have added a special feature to their Savings Deposit Accounts. They pay interest (6.5% p.a.) on daily balances on Savings Accounts. Most of the Banks in Bangladesh pay interest on monthly minimum balance. So, if we are maintaining say Tk. 10.00 Lac in our Savings Account with our present Banker for 29 days and our deposit balance drops below Tk. 1000 even for a single day, we are not getting any interest on that amount. There are also several restrictions on withdrawal from the Account to qualify for interest.

In Premier Bank, however, we will get interest on any amount that we keep in the account. There is no restriction for withdrawal from the account and they are paying interest @ 6.5 % p.a. on daily balance. They hope that we will take full advantage of this offer and place our deposits with their Bank to earn more.

2. Current Account

The current account is probably the most useful bank account. This is a non-interest bearing deposit account

3. Foreign currency (FC) account

It is an account in foreign currency that can be opened in any of authorized dealer branches. Bangladesh nationals residing abroad, foreign nationals residing abroad or in Bangladesh and also foreign firms registered abroad and operating in Bangladesh or abroad may open and maintain this account. This account may also be opened in the names of resident Bangladesh nationals working with the foreign/ international organizations, operating in Bangladesh provided their salary be paid in the foreign currency. This bank offered a number of foreign currency accounts such as RFCD and NFCD. Other account includes Convertible taka Account, which is an account in taka, and the account holder has the option to convert taka into foreign currency and vice versa.

4. Corporate Account

The Premier Bank Ltd. is also paying interest @ 6.5% p.a. on daily balance for Corporate customers. It is a savings account that operates like a virtual current account. There are no restrictions on withdrawal.

Now we can have all the features of current account with the interest of savings account.

5. Short Term Deposit (STD) Account

The Premier Bank Ltd. pay interest @7.00% p.a. for minimum 1 Crore and @6.00% p.a for bellow 1 Crore on the daily closing balance of Short Term Deposit (STD) Account. Interest is payable on daily closing balance. Any individuals and corporate bodies can open STD account.

6. Fixed Deposit

The Premier Bank Ltd. offers very competitive rate of interest on Fixed Deposit (FDR). Indicative rate for one-year deposits at present is 12.75% p.a. The customer could also deposit for 1/2/3/6/12/24/36 months term – The choice depend on the customer.

| Term | Interest (%) | Taka 10 Crore & above Interest (%) | Taka. 40 Crore & above Interest (%) |

| 1 Month | 9.50 | 9.50 | 9.50 |

| 3 Month | 11.75 | 11.75 | 12.00 |

| 6 Month | 12.00 | 12.00 | 12.25 |

| 1 Year & above | 12.25 | 12.50 | 12.50 |

7. Double Benefit Scheme :Under this scheme, any deposit becomes almost double after only 6 years! The accepts deposits in multiple of Tk.10,000.00.

Specially designed instrument shall be issued for the deposit under the scheme in the same manner as issued in case of FDR. The instrument is not transferable and renewable. In case of premature encashment after 3 months, benefits may be allowed on the deposit amount at ruling savings rate.

Loan facility may be allowed up to 80% of deposit against lien/pledge on such instrument at bank’s prescribed rates and rules. Here the DBS rate is 12.54%..

| Terms | Initial Deposit | Payable at Maturity |

| 6 – Years | Tk.1,00,000/- | Tk.2,00,000/- |

| 6 – Years | Tk.2,00,000/- | Tk.4,00,000/- |

| Deposit Amount: Minimum Tk. 1,00,000/- or its multiple(s). | ||

8. Dui Bochore Digoon

The Prime objective of the scheme is to offer attractive investment opportunity. The individual/institutions have opportunity to invest for meeting any large expenditure in short future for various purposes. Different organizations, schools, colleges, universities may also invest their provident funds, security funds, trust funds of reserve funds for higher rate of return under the scheme. Under this scheme, the initial investment will be double after two years subject to the additional 24 equal monthly deposits. This scheme will build an attractive deposit base in a convenient way to meet the customer future business requirement. The duration of the scheme is two (2) years.

| Initial Deposit | Monthly Deposit for 24 Months | Payable at Maturity |

| Tk. 1,00,000 | Tk.3,400 | Tk.2,00,000 |

| Tk. 2,00,000 | Tk.6,650 | Tk.4,00,000 |

| Tk. 5,00,000 | Tk.16,350 | Tk.10,00,000 |

| Tk. 10,00,000 | Tk.31,450 | Tk.20,00,000 |

9. Monthly Income Scheme

Customer’s saving is precious. The Premier Bank Ltd. helps their customer’s investment to generate a regular monthly income for their wish through this scheme. The account holder shall get benefit of Tk. 1000.00 every month against deposit of Tk. 1,00,000.00 for 5 years and Tk. 980.00 every month for 3 years.

| Terms | Initial Deposit | Monthly benefit |

| 3 – Years | Tk. 100,000/- | Tk. 980/- |

| 5 – Years | Tk. 100,000/- | Tk. 1000/- |

| 3 – Years | Tk. 50,000/- | Tk. 490/- |

| 5 – Years | Tk.1, 15,000/- | Tk. 500/- |

| Deposit of Tk. 50,000 ( Minimum) or its multiple is acceptable. | ||

10. Monthly Savings Scheme

A regular savings pay off when the customer really needs it. Save small amount in the customer account each month and let customer savings grow with time through this Monthly Savings Scheme.

| Terms | Monthly deposit | On maturity |

| 3 – Years | Tk. 500/- | Tk.21,600/- |

| 3 – Years | Tk. 1,000/- | Tk.43,200/- |

| 5 – Years | Tk.500/- | Tk.41,000/- |

| 5 – Years | Tk.1,000/- | Tk.82,000/- |

| Monthly deposit of Tk. 500 or its multiple is acceptable | ||

11. Education Savings Scheme

The scheme has been designed to make future educational expenses of The customer children easier. Against an initial deposit, the bank provides a monthly amount after maturity or payment at a time as the depositor desires. A deposit of Tk. 50,000.00 will be Tk. 88,000.00 after 5 years. The customer may draw the amount at a time or the customer may choose to draw by monthly installment of Tk. 1,800.00 for a period of 5 years. Deposit of Tk. 25,000.00 or its multiple is acceptable.

| Terms | Deposit | Monthly Benefit for 5 Years | Lump sum payment |

| 5 years | Tk.25,000/- | Tk.900/= | Tk.44,000.00 |

| 5 years | Tk.50,000/- | Tk.1800/= | Tk.88,000.00 |

Customer Services:

1. Locker Service: For safekeeping of customers’ valuables like important documents and goods like jewelries and gold ornaments, Premier Locker Service is available in most of the Branches in urban areas.

| Nature of Service | Nature of Charges | Rate of Charges |

| Custody of Locker / Safe | Rent | a) Yearly TK.1,000/= for small size locker b) Yearly TK.1,200/= for medium size locker c) Yearly TK.2,000/= for big size locker |

2. Evening Banking Services

“Evening Banking”, a unique service of The Premier Bank, only for receiving Cash and Documents beyond transaction hours till 8 o’clock in the evening, is available at Premier Bank. The service is attractive for those, like shopkeepers, who accumulate cash as sales proceeds in the afternoon when counters of Bank branches usually remain closed.

3. Online Branch Banking Service: Online Branch Banking Service is designed to serve its valued clients. Under this system, the customer will be able to do the following type of transactions:

- Cash withdrawal from the account at any branch of the Bank.

- Deposit in the customer account at any Branch of the Bank.

- Transfer of money from customer’s account to any other account with any Branch of the Bank.

Premier Bank holds IPO Lottery

IPO share lottery of Premier Bank Ltd was held on April 23, 2007 at Bangladesh China Friendship Conference Centre in Dhaka. Under the auspices of Securities & Exchange Commission the lottery was conducted by Department of Science & Technology, BUET in presence of the representatives from CDBL, DSE, CSE, ICB, Issue Manager and a considerable number of applicants cum investors. Bank’s Chairman of Board Audit Committee Miss Nowrin Iqbal, Director Nurul Amin, Managing Director Abu Haniff Khan, Addl. Managing Director Nurul Alam Chowdhury & Board Secretary Syed Ahsan Habib was also present on the occasion.

Future Plan:

The Premier Bank Ltd. has some future plan that they want to implement in the near future. In most cases they wants to extend their existing facilities that they are providing to their customer but they are now trying grab more potential customer by implementing some lucrative features and these are:

- They have planned to extend their branch from the existing branch numbers.

- They have planned to recruit more skilled human resource for the development of the bank.

- They have a plan to open some foreign subsidiary in different countries.

- They have a plan to implement an international banking system, which is known as “BASEL II” which is going to be approved by Bangladesh Bank to all local banks in Bangladesh.

- They have planned to extend their ATM facilities.

- They are going to launch Debit Card in this month

General Banking Department:

This is very important department which help to attract, motivate the customers when the customer keep his steps in the bank. From this department a customer can get a sweet impression about a particular bank. If this department is unable to create a good impression in the mind of the customer, then a bank can loose their potential and valued customer, which will carry negative impression about the bank.

Deposit Accounts

Deposit Accounts of The Premier Bank are detailed step by step with the method of working and should be strictly adhered to, and will not deviate without the authority of an approver who has been authorized to do so.

Deposit Accounts basically are of three types:

- Demand Deposit

- Current Deposit Account

- Savings Deposit Accounts

- Short Term Deposit Accounts

- Term Deposit Account

- Fixed Deposit Receipt (FDR)

- Monthly Savings Scheme (MSS)

- Monthly Income Scheme (MIS)

- Double Benefit Scheme (DBS).

- Education Savings Scheme (ESS)

Current Deposit may be opened by an:

- Individual

- Personal and Joint Account

- Sole Proprietorship Account

- Partnership Account

- Limited liability Company Account

- Account for Association, Clubs, Committees, and Societies etc.

Similarly Savings Bank Account / Term Deposit Accounts are opened in The Premier Bank Ltd.

RESTRICTION ON DISCLOSURE OF INFORMATION

The banker is under obligation to maintain secrecy about the accounts of his customers unless it is specifically enjoined by law or practices and usage customary among bankers, necessary or appropriate for them to divulge such information.

When the customer is approaching for information regarding his accounts by his personal presence or through phone the under noted procedure should be followed:

- Balance of the account if requested by the Customer by his personal presence may be passed in a manner so that other do not hear provided the passing Officer is absolutely sure of the identification of the person requested for the balance.

- If the customer approaches the request through an authorized agent, the information should be in closed cover duly sealed by the Bank round rubber stamp and the envelope marked “STRICTLY PRIVATE & CONFIDENTIAL” and acknowledgement obtained from the bank.

- Balance information or any other information regarding the account should not be conveyed over phone without being sure of the customer’s voice.

INDIVIDUAL / PERSONAL ACCOUNT:

This is an account for an individual/person who wishes to open a Current/Savings/Term Deposit Account(s) in his own name has the unquestionable authority to open the account with full control over his account.

The Bank while accepting advice under mandate must obtain: –

- Photograph of the agent duly attested by the Account holder and verified by the authorized Bank Officer under bank’s rubber stamp.

- Specimen Signature Card of the agent completed and attested by the Account holder and verified by the authorized Bank Officer under bank’s rubber stamp.

If the AOF (Account Opening Form) has been correctly completed and all formalities/requirements met to bank’s satisfaction the bank official i.e. the approver will approve the acceptance of the opening of the account giving his signature with bank’s rubber stamp affixed and dated.

CLOSING OF ACCOUNTS:

Submit application for closing Accounts

- To close an account, parties may be requested to send an application along with the un‑used leaves of the Cheque Books if any, issued to them.

- On receipt of the application, the following to be taken:

The signature of the account‑holder shall be verified and

The number of unused Cheque Leaves shall be noted thereon.

The application shall then be sent to the Ledger Keeper, who shall write thereon the balance of the account and initial it.

Approval of application

- Before the account is closed the Manager shall approve the application after ascertaining the liability, if any, and closing charges to be debited to the account.

BANKER’S DRAFTS:

A bankers’ draft, is an order to pay a specified amount to the named payee, or to his order issued from the bank’s emanating branch to another branch and / or bank’s one branch to other named bank’s branch with whom we have Agency arrangements.

A Demand Draft is a bill of exchange as such becomes a negotiable instrument.

The purchaser of the Draft can cancel the draft before passing it to the payee, But once the draft has been delivered to the payee or his agent the purchaser is not entitled to stop payment of the draft to the payee and the bank cannot refuse to pay the amount thereof unless there is reasonable ground for disputing the title of the person presenting the draft.

PAY ORDER / TELEGRAPHIC TRANSFER:

The Bank also provides pay order / Telegraphic transfer on behalf of their customer from originating branch to other locations in the country where we have branch office(s).

SAVINGS ACCOUNT RULES

Account may be opened in the following names

In the name of an individual

Jointly in the names of two or more persons, to be payable to either or both or all of them, or to the survivor or survivors

May be opened in the names of Associations, committees, Societies, Clubs, School, College and of similar nature.

Term Deposit

Some specific requirements are followed and these are:

Follow instructions under New Account Opening Documentation.

Ensure that amount/interest rate/Terms/Maturity are clearly stated.

Customer should be advised that interest payment is subject to the deductions of tax, Levy etc. imposed by Government.

The depositor will select a nominee(s) whose passport size photograph(s) is/are attached with the nominee form, duly completed and signed by the Account .

SPECIMEN SIGNATURE CARD

The Bank’s Specimen Signature Book is kept with the Deposits In charge.

SPECIMEN SIGNATURE OF OTHER BANKS

The Specimen Signature of the other local banks are obtained on Form and kept in a bounded form with the Deposits In charge.

CLEARING OF CHEQUES

Clearing of customers’ cheque in Dhaka and other cities in Bangladesh are held through Bangladesh Bank that means the central Bank where all scheduled Bank accounts are maintained.

On all working days in the morning the members of each bank attend the clearing house at Bangladesh Bank and exchange their Cheques/negotiable instruments through Debit/Credit of their accounts maintained with Bangladesh Bank.

In the afternoon they meet again to know the fate of Cheques/negotiable instruments, and if any return of cheque/negotiable instruments is made the settlement of the Debit/Credit is made through account with Bangladesh Bank.

Where Bangladesh Bank does not have a Branch the clearing system is conducted by SONALI BANK and/or other Bank nominated by the Bangladesh Bank.

DISHONORED CHEQUES

When the bank decides not to honor a cheque, it is returned to the presenter, stating the reason in a slip. The remarks on the slip are brief. The remarks are as follows:

Discharge required that means, Payee’s endorsement required

Exceeds arrangement

Drawer deceased

No arrangement

Alterations / cuttings require drawer’s authentication by his full signature.

Drawer’s signature differs

Crossed Cheque to be presented through a Bank

Account closed

Crossed “account payee only”

Cheque is post dated / stale / out of date

Cheque is mutilated

Amount in figures and words differ, etc.

PAY ORDER / TELEGRAPHIC TRANSFER

The Premier Bank Ltd. Is also provides pay order / Telegraphic transfer on behalf of our customer from originating branch to other locations in the country where we have branch office(s)

Financial Administrative Department (FAD):

FAD is also a very important and crucial department for any bank because this department represents a total scenario of a particular branch performance. Basically this department is mainly responsible for preparing all types of book keeping related jobs like monthly, weekly, quarterly and yearly statements that will be recorded for further use. Preparing all types of bills payment, salary statement of a branch, implementing the instructions of Head Office, performing all sort of General Service Department (GSD) related jobs like marinating furniture, fittings, equipment, machineries, depreciation statement, creating all sort of debit and credit vouchers, sorting the vouchers, preparing daily Statement of Affairs through using PCBANK 2000, online transaction to transfer fund from one bank to another. This department is also responsible for enlisting a customer’s information that has been making transaction above their transaction limit with our bank. The Premier Bank Ltd. is using software, which is named Financial Inspection unit (FIU) that was provided by Bangladesh Bank to enlist the customer information in that software and that will be verified by Bangladesh Bank to make necessary actions. Overall this department is also known as central point of a particular branch.

Credit Department:

Bank is a financial intermediary whose prime function is to move scarce resources in the form of credit from savers to those who borrow for consumption and investment. The fundamental nature of credit is that an element of trust exists between buyer and seller-whether of goods or money. In a modern industrial society Banks are uniquely important because of their ability to create money. Lending comprises a very large portion of a Bank’s total assets and forms the backbone of the Bank and interest on lending constitutes the highest proportion of income of a Bank. As such credit quality remains the prime indicator of its commercial success. Unsound credit reduces the ability of a Bank to provide credit towards profitable borrowers and undermine liquidity and solvency. Therefore lending is very important for the profitability and success of a Bank.

The Premier Bank Ltd. follows strict guidelines in terms of making disbursement of loans to the customer. They have a strong evaluation process through which the entire lending procedure is performed. As my internship report is based on credit department, I have tried to come up with the basic understanding of the entire credit department. Credit department is multitasking department because when we make any loan disburse, our responsibly is not done. We have to take different initiatives to recover the loan from the customer. And this is a very difficult job to do. In The Premier Bank Ltd. the total loan and advance structure is centralized and it is performed in a systematic and efficient way. In this part I am going to describe the job responsibilities and nature of the job in a concise way. Because the total credit evaluation process will be described more elaborately in the next chapter.

Nature of the job:

To plan, organize, direct, control and review the operational and administrative functions of credit administration department to ensure efficient and effective support to the related banking departments in line with regulatory and Bank requirements while exercising appropriate control and independent judgment.

Primary job Responsibilities:

To ensure loan documentation and securities are duly completed and in place prior to disbursement of loans.

To ensure accurate and timely submissions of returns of both the Central Bank and the Bank’s head office.

Act on exception reports and ensure timely receipt of loan installments.

Ensure that adequate insurance is in place on all pledged assets, all approval conditions have been met, and any exceptions are appropriately approved prior to disbursement of loans.

Ensure that department operations, including the preparation of loan documentation, recording of charges, and reporting of exceptions is done in a timely and efficient manner.

Ensure compliance with internal policies and procedures and external regulatory requirements, and that all internal and external audit recommendations are implemented.

Summary

The Premier Bank Ltd. is one of the leading third generation bank in Bangladesh. State and federal authorities to make loans to their customer characterize the principal reason of this bank. Bank is expected to support their local communities with an adequate supply or credit for all legitimate business and consumer activities and to price that credit reasonably in line with competitively determined interest rates. The Premier Bank Ltd. is providing different types of loan facilities (which will be discussed later on) to the customer, which is sometimes attractive to the customer, but the duty is not done after completing disbursement of loan. The bank follows strict rules and regulations in terms of selections of borrower, evaluation the borrower’s background, transaction performance, financial statements and other relative information that defines a borrower’s characteristics. For maintaining the standard evaluation process, Imamgong branch has a good recovery ratio so far compare to other branches. Most of the branches have been maintaining their standard level in terms of credit evaluation process. But Imamgonj branch is showing their outstanding performance in terms of loan and advance policy. After a successful completion of last fiscal year, Imamgonj branch has only 0.45% classified loan and 99.55% unclassified loan out of 100% of total loan and advance section. On the other hand this particular branch has only 2.5% overdue of loan, which will be collected by the subsequent period. This figure indicates the greater strength of this particular branch in terms of loan and advance section, which has a positive impact that will help them to achieve a greater size of 100% loan and advance recovery ratio. As this is the most critical part to explain, I have tried to observe each and every credit evaluation process very carefully to get the overall view of loan and advance section.

Introduction

Lending is the principal function or the “Bread and Butter” of a banking company. It applies most of its resources to loans and advances in favor of a broad spectrum of clientele ranging from housewives to mammoth size conglomerates. The business of lending, nevertheless, is not without inherent risks. Since the banks deal with borrowed funds they cannot afford to put at stake these resources on risky ventures. While lending his funds, a banker, therefore, follows a very cautious policy and conducts his business by using sound lending principles.

Bank is a financial intermediary whose prime function is to move scarce resources in the form of credit from savers to those who borrow for consumption and investment. The word “credit” is derived from the Latin word “credere”, which means to trust. The fundamental nature of credit is that an element of trust exists between buyer and seller-whether of goods or money. In a modern industrial society Banks are uniquely important because of their ability to create money. Lending comprises a very large portion of a Bank’s total assets and forms the backbone of the Bank and interest on lending constitutes the highest proportion of income of a Bank. As such credit quality remains the prime indicator of its commercial success. Unsound credit reduces the ability of a Bank to provide credit towards profitable borrowers and undermine liquidity and solvency. Therefore lending is very important for the profitability and success of a Bank.

When a bank advances a loan, it does not pay the amount in cash. But it opens an account in his name and allows him to withdraw the required amount by cheque. Banks provide credit facilities to businessmen by way of loans and advances, overdraft and cash credit. When a loan is granted or overdraft is sanctioned, the amount of loan or overdraft is entered in the account of the customer and he is allowed to draw a cheques up to the amount agreed upon. Thus the bank creates a deposit in the name of the borrower. Basically credit is the function by which people can perform their job by depositing and lending money from the bank with an implied interest rate and bank performs here as a middleman. Banks create money and credit. It happens in two ways. First, when a customer is granted loan, he has to sign a promissory note and receive in turn, a bank’s demand deposit, or cash. The promissory note does not act as money but it receives money and can readily spend almost everywhere. Thus it creates credit. Second, the entire systems of banks also create money as the deposits generated by lending flow from bank to bank. By law, each bank must set aside a fractional reserve behind each deposit it receives and the remaining excess can be loaned out. No single bank can lend out more than its excess reserves, the entire banking system can create a multiple volume of deposit money through credit creation.

Importance of Bank Credit – Macro and Micro Aspects:

At Macro level, credit influences, and is influenced by, quantity of money, level of economic activity (GNP), imports and net foreign assets.

At Micro level, credit influences behavior of economic sector (industry, agriculture) and behavior of economic agents (business, financial institutions, households).

Credit Budgeting:

Credit is an important input in the production processes of a country as well as the income generation activities of an individual. But the demand for credit in a developing economy like Bangladesh is much higher than its supply. Since credit is a scare resource, its use has to be planned carefully so as to obtain optimum benefits. There are Macro and Micro aspects of credit planning. Bangladesh Bank being the central bank of Bangladesh is responsible for formulating monetary and credit program of the country.

Credit Division structure in The Premier Bank Ltd.:

Bank is a financial intermediary who take deposit from customers which is payable on demand or at maturity and also arrange lending of loanable fund among the potential borrowers to earn some income in the form of interest. But in lending there are always risks of non-payment or not repayment in time. Credit risk management has to be a robust process that enables banks to proactively manage loan portfolios in order to minimize loss and earn an acceptable level of return for shareholders.

Credit Division structure in The Premier Bank Ltd.:

Bank is a financial intermediary who take deposit from customers which is payable on demand or at maturity and also arrange lending of loanable fund among the potential borrowers to earn some income in the form of interest. But in lending there are always risks of non-payment or not repayment in time. Credit risk management has to be a robust process that enables banks to proactively manage loan portfolios in order to minimize loss and earn an acceptable level of return for shareholders.

In The premier bank Ltd. there are three core departments are operating the entire credit division and the segmentation of duties is being defined on the following lending functions:

- Credit Approval / risk Management.

- Relationship management / Marketing.

- Credit Management.

These three departments have different job responsibilities and tasks to improve the knowledge levels and expertise in a departmental level; to impose control over the disbursement of authorized loan facilities and obtain an objective and independent judgement of credit proposals. The credit approval section is to be centralized within the CRM function at Head office by the delegated Head office Executive (credit) / Head of Credit and Risk Management (CRM) / Credit Approval Committee / MD / CEO / EC / Board.

The following represents the Management structure, which may be revised from time to time.

The Key responsibilities:

In part of head of CRM, the Credit Approval Committee (CAC) will discharge the following responsibilities:

CRM: The head of CRM, executes the under stated functions through the branch managers who is henceforth act a Relationship Manager is assisted by the branch credit administration officer.

- Managing bank’s credit policies.

- Managing bank’s asset quality.

- Managing classified loan to maximize recovery ensures appropriate and timely provisioning for loans.

- Approve / recommend credit proposal recommended by RM.

- Providing advice on all credit matters to line management / RM’s.

Credit Administration:

The responsibility of Head office, credit Administration is on the following lines, which are monitored through the branch credit administration department, and the deputy manager and branch credit administration officer supervise it.

- Ensuring that all security documentation complies with the terms of approval and is enforceable.

- Monitoring insurance coverage is in place over pledged assets and are properly assigned to bank.

- Controlling loan disbursements only after all terms and conditions of approval are met and all security documentations are in place.

- To maintain control over security documentation.

- Monitoring borrower’s compliances with agreed terms and conditions and general monitoring of account performance.

Relationship Management / Marketing (RM):

- Act as the branch’s contact with borrowers.

- Have thorough knowledge of borrower’s business and industry through regular contact, factory / warehouse inspection etc. Proactive monitoring of the financial performance and account conduct of borrowers.

- Officer is responsible for the timely and accurate submission of credit application for few proposals and annual reviews taking into account the credit assessment requirements are as per norms.

- Highlighting any deterioration in borrower’s financial standing and amend the borrower’s risk grade in a timely manner where change in risk grades should be advised to and approved by CRM / Credit Approval Committee.

- Seeking assistance / advice at the earliest form CRM / CAC regarding the restructuring of facilities.

Responsibilities at Branch Level:

The functionalities of the respective Officer / Executive relating to Credit Marketing, Processing and Administration at Branch level is:

- Manager acts as Relationship Manager to maintain liaison with credit clients and act as prosper to their credit requirement.

- Credit officer acts as Relationship Officer and he / she will support Relationship Manager.

- Deputy Manager and Credit Administration Officer acts as Head of Branch CRM by disbursing authority with the support of the credit administration officer responsible for issuance of compliance certificate.

In absence of Manager, the Deputy Manager / Designated Branch in charge acts as the relationship manager. Under this situation the in-charge FCD of the branch acts as the disbursement authority supported by the credit administration officer.

Appeal process:

Any declined credit may be represented to the next higher authority for reassessment / approval. However, there should be no appeal process beyond the Managing Director.

Credit Administration:

In Head Office Credit Administration monitors its functionalities on the basis of the compliances certificate provided by the branch. The Credit Administration function is critical in ensuring that proper documentation and approvals are in place prior to the disbursement of loan facilities. For this reason, it is essential that the functions of Credit Administration is strictly segregated from Relationship Management / Marketing in order to avoid the possibility of controls that are compromised or issues not to highlight at the appropriate level.

Disbursement:

All securities, documents are prepared in accordance with approval terms and are legally enforceable. Standard loan facility documentation that has been reviewed by legal counsel should be used in all cases. Exceptions should be referred to legal counsel for advice based on authorization from an appropriate executive in CRM. Disbursements under loan facilities which are both funded or non-funded, are only made when all security documentation are in place. CIB report should reflect / include the name of all the lenders with family, limit and outstanding. All formalities regarding large loans and loans to Directors is guided by Bangladesh Bank circulars and related section of Banking Companies Act complemented by fulfillment of approved and terms and conditions.

Custodial Duties:

Loan disbursements and the preparation and storage of security documents is centralized at the branch. The loan disbursement / limit loading checklist and authorization certificate is initiated by the branch credit administrative officer. The branch Deputy Manager only upon completion / meeting of approved and accepted terms and conditions detailed in the sanction advice approves disbursement of the credit facility. They also issue a compliance certificate to that effect directly send the compliance certificate to Head office, Credit Administration Department. The compliance certificate which certifies the mitigation of the term and condition as approved and agreed upon by the parties concerned prior to disbursement is the responsibility of the Deputy Manager and the Credit Administration officer who is accountable and liable for any deviation of the approved term / conditions of the credit facilities.

Lending Guidelines

The Lending Guidelines shall be updated annually reflecting changes in the economic outlook and the evolution of the bank’s loan portfolio. Any departure or deviation from the Lending Guidelines shall be explicitly identified in credit applications and a justification for approval provided. Approval of loans shall not be allowed that do not comply with Lending Guidelines.

General Policy:

The Lending Guidelines always updated annually reflecting changes in the economic outlook and the evolution of the bank’s loan portfolio.

Any departure or deviation from the Lending Guidelines is explicitly identified in credit applications and a justification for approval provided. Approval of loans will not be allowed that do not comply with Lending Guidelines. In general the bank follows some general policy and rules to conduct a successful loan disbursement to the customer which are given below:

- In the normal course of conducting its business, the bank will prefer trade financing in the form of short term (up to 12 months) self-liquidating cash-flow supported well collateralized trade transaction.

- The bank will consider lending short-term working capital finance to well established entities engaged in manufacturing, assembling, processing of goods and commodities for domestic consumption or export market.

- The bank will selectively, on a case-by-case basis, carefully approve term loans (loans with original tenor exceeding one year) with proper credit risk assessment by satisfactory cash flow statement.

- The bank will, on a case-by-case basis, approve disclosed participation in syndication.

- The bank will consider financing construction contractors. However, all such transactions should be properly analyzed in line with the status of contract proceeds and proper cash flow justification.

- The bank will at all times maintain at the minimum a pari-passu status to other banks in all lending relationships. Second mortgages or lower, or second charge or lower, are not to be accepted as primary security/collateral.

Industry and Business Segment Focus:

At the beginning of the year Credit Division prepares a business/industry wise growth target of the bank’s loan portfolio, which is approved by the EC/Board in Head office.

Agricultural Credit:

Credit facilities to the agricultural sector falls under this category. It is subdivided into two major heads:

a) Loans to primary producers: This sector of agricultural financial refers to the credit facilities allowed to production units engaged in farming, fishing, forestry or livestock but does not include traders of agricultural producers.

b) Loans to input dealers / distributors: It refers to the financing allowed to input dealers and distributors in the agricultural sectors. Until the bank mobilizes enough funds and extends its outreach to rural areas, there would not be much scope for disbursement of loans to primary products.

Term loan for large and medium scale industry:

This category of advances accommodate the medium and long term financing for capital machinery and equipment of new industries who are engaged in manufacturing goods and services. Term financing to teagardens is also be included in this category depending on the nature and size of investment requires.

Term loan for small and cottage industries:

These are the medium and long term loans allowed to small and cottage manufacturing industries. Small industry is presently defined as those establishments whose total investment in fixed capital such as land, building, machinery and equipment (excluding taxes and duties) does not exceed 30 million taka. Cottage industries also fall in this category.

Working Capital:

Loans allowed to the manufacturing units to meet their working capital requirements, irrespective of their size, big, medium or small, fall under this category. These are usually credits and as such fall under the category. These usually take the character of continuing credits.

Export Credit:

Credit facilities allowed to finance exports against letter of credit / an/ or confirmed export orders fall under this category. It is accommodated under the heads “Export Cash Credit (ECC)”, Packing Credit (PC), Foreign Documentary Bills Purchased (FDBP), and Local Export Bills Purchased (LEBP).

Nature of Loan Facilities:

The Premier Bank Ltd. provides different types of loan in terms of both corporate loan and personal loan to the customer. Depending on the various nature of financing, all the lending activities have been brought under the following major heads:

Loan (General):

All types of Short term, Medium term & long term loans allowed to individual/firm/industries for a specific purpose but for a definite period and generally repayable by installments fall under this head. These types of lending are mainly allowed accommodating financing under the categories (I) Large & Medium Scale Industry and (II) Small & Cottage Industry. Very often term financing for (i) Agriculture & (ii) Other lending are also included here.

Overdraft, Demand Loans and Cash Credit:

Overdrafts and demand loans are granted mostly to private individuals and firms. So far as the operation of accounts is concerned, there is little difference between a cash credit and overdraft as in both these cases banks place at the disposal of the borrowers a certain limit for certain period and interest is charged quarterly on the outstanding daily balance. The borrower enjoys the convenience of drawing as and when necessary and repaying the amounts thus overdrawn as and when he is in funds. In the case of demand loan, however, the drawing is only made at the time advance is sanctioned / disbursed and thereafter no further drawings are allowed, but debits are raised only in respect of interest and other charges till the entire loan is liquidated by partial or on lump sum repayment. On demand loans interest is charged on daily balance periodically usually on quarterly basis.

House Building Loan (General):

Loans allowed to individual /enterprises for construction of house (residential or commercial) fall under this type of advance. The amount is repayable by monthly installment within a specified period. Such advances are known as House Building Loan (General).

Cash Credit (Hypo.):

Advances allowed to individual /firm for trading as well as wholesale purpose or to industries to meet up the working capital requirements against hypothecation of goods as primary security fall under this type of lending. It is a continuous credit. It is allowed under the categories (i) “Commercial Lending” when the customer is other than an industry and (ii) “Working Capital” when the customer is an industry.

Hire –Purchase:

Hire –Purchase is a type of installment credit under the borrower agrees to take the goods on hire at a stated rental, which is inclusive of the repayment of Principal as well as interest for adjustment of the loan within a specified period.

Lease Financing:

Lease Financing is one of the most convenient sources of acquiring capital machinery and equipment whereby a client is given the opportunity to have an exclusive right to use an asset usually for an agreed period of time against payment of rent. It is a term financing repayable by installment.

Consumers Credit Scheme:

It is a special credit scheme of the Bank to finance purchase of consumers’ durable to the fixed income group to raise their standard of living. The customers allow the loans on soft terms against personal guarantee and deposit of specified percentage of equity. The loan is repayable by monthly installment within a fixed period.

SOD (General):

These are advances allowed to individual /firms against financial obligation (i.e. lien on FDR/PSP/BSP/Insurance Policy/Share etc.). This may or may not be a continuous credit.

SOD (Others):

Advances allowed against assignment of work order for execution of contractual works falls under this head. This advance is generally allowed for a definite period and specific purpose. That means it is not a continuous credit. It falls under the category SOD “Others”.

SOD (Export):

Advance allowed for purchasing foreign currency for payment against LCs where the export does not materialize before the date of import payment. This is also an advance for temporary period, which is known as export finance and falls under the category “Commercial Lending”.

PAD:

Payment made by the Bank against lodgment of shipping documents of goods imported through LCs falls under this head. It is an interim advance connected with import and is generally liquidated against payments usually made by the party for retirement of the documents for release of imported goods from the customs authority. It falls under the category “Commercial Lending”.

LTR:

Advance allowed for retirement of shipping documents and release of goods imported through L/C falls under this head. The goods are handed over to the importer under Trust Receipt with the arrangement that sale proceeds should be deposited with Bank to liquidate the advances within a given period. This is also a temporary advance connected with import and known as post-import finance and falls under the category “Commercial Lending”.

IBP:

Payment made through purchase of inland bills/cheques to meet urgent requirements of the customer falls under this type of credit facility. This temporary advance is adjustable from the proceeds of bills/cheques purchased for collection. It falls under the category “Commercial Lending”.

Export Cash Credit (ECC):

Financial Accommodation allowed to a customer for exports of goods falls under this head and is categorized as “Export Credit”. The advances must be liquidated out of export proceeds within a given period.

Packing Credit (P.C):

Advance allowed to a customer against specific LC/firm contract for processing/packing/transportation of goods to be exported falls under this head and is categorized as “Packing Credit”. The advances must be adjusted from proceeds of the relevant exports within a given period. It falls under the category “Export Credit”.

FDBP:

Payment made to a customer through purchase/negotiation of a Foreign Documentary Bills falls under this heads. This temporary advance is adjustable from the proceeds of the shipping/export documents within 21 days, failing which interest shall be charged at normal rate. This advance falls under the category “Export Credit”.

FDBP (Local):

Payment made against documents representing sale of goods to Local export oriented industries which are deemed as exports and which are denominated in Foreign Currency falls under this head. This temporary advance is adjustable from the proceeds of the Bill within 21 days, failing which interest shall be charged at normal rate.

F B P:

Payment made to a customer through Purchase of Foreign Currency Cheques/Drafts falls under this head. This temporary advance is adjustable from the proceeds of the cheque/draft.

I D B P:

Payment made to a customer through purchase of inland documentary bills. This temporary liability is adjustable from the proceeds of the bill.

Special Credit Program’s:

Bank may evolve special credit schemes catering to the requirements of the clients of various categories/professions.

House Building Loan (Staff):

Loans allowed to our Bank employees for purchase/construction of house/flat shall be known as House Building Loan (Staff).

Personal Loan:

Any purpose loan for salaried person including PBL staffs. It could be anything from buying household appliance to emergency medical needs. Some of these could be –

- House renovation

- Hospitalization or other emergency medical needs

- Marriage in the family

- Travel or holiday expenses

- Advance rent payments

- Educational/ professional training

- Payment of taxes.

Other Loan to Staff:

Loans allowed to employees other than for HouseBuilding shall be grouped under head, Staff Loan (Gen).

Single Borrower/Group Limits/Syndication:

The bank’s Single Borrower/Group limits shall not exceed the limit permitted by Bangladesh Bank.

Application for Loan Advance:

An Application for a loan should be made by the intending borrower in writing normally in the prescribed form stating interlaid the purpose of the loan, the quantum of the loan needed, the repayment program and securities offered. Before processing of the advance proposal the dealing officer/ manager should ascertain the detailed information of applicant’s occupation / business and his assets and liabilities, collect market report about him and assess his overall credit worthiness in order to be reasonably sure that the borrower will conduct the loan account satisfactorily.

Credit Assessment:

A thorough credit and risk assessment should be conducted prior to the granting of loans, and at least annually thereafter for all facilities. The results of this assessment should be presented in the Credit Application that originates from the Branch Manager (“BM”) or Relationship Manager (“RM”), and is approved by Credit Risk Management (CRM). The BM/RM should be the owner of the customer relationship, and must be held responsible to ensure the accuracy of the entire credit application submitted for approval. BMs/RM s must be familiar with the bank’s Lending Guidelines and should conduct due diligence on new borrowers, principals, and guarantors.

It is essential that BMs/RMs know their customers and conduct due diligence on new borrowers, principals, and guarantors to ensure such parties are in fact who they represent themselves to be and shall follow the bank’s “Know Your Customer” (KYC) and Money Laundering guidelines.

Know Your Customer (KYC):

The success of a bank and the consistency of it’s profits depend on the efficiency and safety with which it makes use of it’s resources- Capital and deposits by lending those resources to various types of borrowers. Selection of customer is important; therefore the first criterion should be “Know Your Customer”.

The major factor in successful lending is ability to judge the Character and Credit-worthiness of the borrower.

Borrower Analysis:

The majority shareholders, management team and group or affiliate companies should be assessed. Any issues regarding lack of management depth, complicated ownership structures or inter-group transactions should be addressed, and risks mitigated.

Industry Analysis:

The key risk factors of the borrower’s industry should be assessed. Any issues regarding the borrower’s position in the industry, overall industry concerns or competitive forces should be addressed and the strengths and weaknesses of the borrower relative to its competition should be identified.

The purpose of the loan:

While lending a customer fund, The Bank does enquiries from the borrower the purpose for which a customer seeks the loan. The bank does not grant the loans for each and every purpose. They ensure the safety and liquidity of their funds by granting loans for productive purpose only. For meeting working capital needs of a business enterprise. Loans are not advanced for speculative and unproductive purposes.

Capacity:

The success of an enterprise largely depends on the ability, competence and experience of the entrepreneur. If the borrower possesses necessary technical skills, managerial skills and experience to run a particular industry or trade he or she is likely to succeeds in his or her chosen field of activities and will rank high on the scale of credit worthiness.

Capital:

The importance attached by the banker to the adequacy of capital of the borrower is not without significance. The bank is the repositories of the public money and lends the money mostly borrowed from the public through deposit or otherwise. The bank therefore, does not lend the money to an entrepreneur who does not have adequate funds for his or her own. In case of failure of the business enterprise the bank will be able to realize his or her money if the borrower’s own capital is sufficient.

Supplier/Buyer Analysis:

Any customer or supplier concentration should be addressed, as these could have a significant impact on the future viability of the borrower. The bank tries to find out the creditworthiness of the party by making enquiries from the brokers, traders and businessmen in the same trade or industry. Their individual opinions may differ but a balanced opinion may be formed about the borrower on the basis of the feelings expressed by a number of such people.

Past Financial Analysis:

An analysis of a minimum of 3 years historical financial statements of the borrower should be presented. Where reliance is placed on a corporate guarantor, guarantor financial statements should also be analyzed. The analysis should address the quality and sustainability of earnings, cash flow and the strength of the borrower’s balance sheet. Specifically, cash flow, leverage and profitability must be analyzed.

Projected Financial Performance:

Where term facilities (tenor > 1 year) are being proposed, a projection of the borrower’s future financial performance should be provided, indicating an analysis of the sufficiency of cash flow to service debt repayments. Loans should not be granted if projected cash flow is insufficient to repay debts.

Account Conduct:

For existing borrowers, the historic performance in meeting repayment obligations (trade payments, cheques, interest and principal payments, etc) should be assessed.

Adherence to Lending Guidelines:

Credit Applications should clearly state whether or not the proposed application is in compliance with the bank’s Lending Guidelines. The Bank’s Head of Credit or Managing Director/CEO should approve Credit Applications that do not adhere to the bank’s Lending Guidelines.

Mitigating Factors:

Mitigating factors for risks identified in the credit assessment should be identified. Possible risks include, but are not limited to: margin sustainability and/or volatility, high debt load (leverage/gearing), overstocking or debtor issues; rapid growth, acquisition or expansion; new business line/product expansion; management changes or succession issues; customer or supplier concentrations; and lack of transparency or industry issues.

Loan Structure:

The amounts and tenors of financing proposed should be justified based on the projected repayment ability and loan purpose. Excessive tenor or amount relative to business needs increases the risk of fund diversion and may adversely impact the borrower’s repayment ability.

Security:

A current valuation of collateral should be obtained and the quality and priority of security being proposed should be assessed. Loans should not be granted based solely on security. Adequacy and the extent of the insurance coverage should be assessed.

Name Lending:

Credit proposals should not be unduly influenced by an over reliance on the sponsoring principal’s reputation, reported independent means, or their perceived willingness to inject funds into various business enterprises in case of need. These situations should be discouraged and treated with great caution. Rather, credit proposals and the granting of loans should be based on sound fundamentals, supported by a thorough financial and risk analysis.

Collection of credit information:

For the purpose of assessing the creditworthiness of a borrower, the bank collects the above-mentioned information from a number of sources. In foreign countries specialized agencies collect all information relating to the status and financial standing of businessmen and supply the same to the banks. Bangladesh Bank has developed a system to collect information regarding the financial position of the borrowers through its Credit Information Bureau (CIB).

Credit Information Bureau:

The bureau collects credit information from the bank under section 42 of the Bangladesh Bank Order, 1972. The bank is required to provide to Bangladesh Bank the data on credit facilities provided to the clients. Bangladesh Bank maintains a database in its Credit Information Bureau. The Bank enjoy access to these data in respect of their prospective borrowers. Thus, the bank can find out if any of their customers are having excessive borrowings from the banking system at any particular moment and how meticulous they are to meet their repayment obligations. The information is of limited assistance to the bank.

Exchange of credit information amongst banks:

It is the practice and customary usage amongst banks to exchange credit information relating to the constituents in their mutual interest. Bangladesh Bank has asked the banks to supply information in respect of defaulting borrowers.

Credit Risk Analysis:

Credit risk is the primary financial risk in the banking system. Identifying and assessing credit risk is essentially a first step in managing it effectively. In 1993, Bangladesh Bank as suggested by Financial Sector Reform Project (FSRP) first introduced and directed to use Credit Risk Grading system in the Banking Sector of Bangladesh under the caption “Lending Risk Analysis (LRA)”. The Banking sector since then has changed a lot as credit culture has been shifting towards a more professional and standardized Credit Risk Management approach.

Credit Risk Grading system is a dynamic process and various models are followed in different countries & different organizations for measuring credit risk. The risk grading system changes in line with business complexities. A more effective credit risk grading process needs to be introduced in the Banking Sector of Bangladesh to make the credit risk grading mechanism easier to implement.

Keeping the above objective in mind, the Lending Risk Analysis Manual (under FSRP) of Bangladesh Bank has been amended, developed and re-produced in the name of “Credit Risk Grading Manual”.

The Credit Risk Grading Manual has taken into consideration the necessary changes required in order to correctly assess the credit risk environment in the Banking industry. This manual has also been able to address the limitations prevailed in the Lending Risk Analysis Manual.

All Banks already adopted a credit risk grading system outlined in this manual. Risk grading is a key measurement of a Bank’s asset quality, and as such, it is essential that grading is a robust process. The Premier Bank Ltd also follows this system to analyze the borrower’s loan performance.

Credit risk grading is an important tool for credit risk management as it helps the Banks & financial institutions to understand various dimensions of risk involved in different credit transactions. The aggregation of such grading across the borrowers, activities and the lines of business can provide better assessment of the quality of credit portfolio of a bank or a branch. The credit risk grading system is vital to take decisions both at the pre-sanction stage as well as post-sanction stage.

At the pre-sanction stage, credit grading helps the sanctioning authority to decide whether to lend or not to lend, what should be the loan price, what should be the extent of exposure, what should be the appropriate credit facility, what are the various facilities, what are the various risk mitigation tools to put a cap on the risk level.

At the post-sanction stage, the bank can decide about the depth of the review or renewal, frequency of review, periodicity of the grading, and other precautions to be taken.

Having considered the significance of credit risk grading, it becomes imperative for the banking system to carefully develop a credit risk-grading model, which meets the objective outlined above.

FUNCTIONS OF CREDIT RISK GRADING:

Well-managed credit risk grading systems promote the bank safety and soundness by facilitating informed decision-making. Grading systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. This allows bank management and examiners to monitor changes and trends in risk levels. The process also allows bank management to manage risk to optimize returns.

The proposed CRG scale consists of 8 categories with names and Numbers are provided as follows:

| Risk Rating | Grade | Definition |

| Superior – Low Risk | 1 | Facilities are fully secured by cash deposits, government bonds or a counter guarantee from a top tier international bank. All security documentation should be in place. |

| Good – Satisfactory Risk | 2 | The repayment capacity of the borrower is strong. The borrower should have excellent liquidity and low leverage. The company should demonstrate consistently strong earnings and cash flow and have an unblemished track record. All security documentation should be in place. Aggregate Score of 95 or greater based on the Risk Grade Scorecard. |

| Acceptable – Fair Risk | 3 | Adequate financial condition though may not be able to sustain any major or continued setbacks. These borrowers are not as strong as Grade 2 borrowers, but should still demonstrate consistent earnings, cash flow and have a good track record. A borrower should not be graded better than 3 if realistic audited financial statements are not received. These assets would normally be secured by acceptable collateral (1st charge over stocks / debtors / equipment / property). Borrowers should have adequate liquidity, cash flow and earnings. An Aggregate Score of 75-94 based on the Risk Grade Scorecard. |

| Marginal – Watch list | 4 | Grade 4 assets warrant greater attention due to conditions affecting the borrower, the industry or the economic environment. These borrowers have an above average risk due to strained liquidity, higher than normal leverage, thin cash flow and/or inconsistent earnings. Facilities should be downgraded to 4 if the borrower incurs a loss, loan payments routinely fall past due, account conduct is poor, or other untoward factors are present. An Aggregate Score of 65-74 based on the Risk Grade Scorecard. |

| Special Mention | 5 | Grade 5 assets have potential weaknesses that deserve management’s close attention. If left uncorrected, these weaknesses may result in a deterioration of the repayment prospects of the borrower. Facilities should be downgraded to 5 if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive leverage), if loan payments remain past due for 30-60 days, or if a significant petition or claim is lodged against the borrower. Full repayment of facilities is still expected and interest can still be taken into profits. An Aggregate Score of 55-64 based on the Risk Grade Scorecard. |

| Substandard | 6 | Financial condition is weak and capacity or inclination to repay is in doubt. These weaknesses jeopardize the full settlement of loans. Loans should be downgraded to 6 if loan payments remain past due for 60-90 days, if the customer intends to create a lender group for debt restructuring purposes, the operation has ceased trading or any indication suggesting the winding up or closure of the borrower is discovered. Not yet considered non-performing as the correction of the deficiencies may result in an improved condition, and interest can still be taken into profits. An Aggregate Score of 45-54 based on the Risk Grade Scorecard.

|

| Doubtful and Bad (non-performing) | 7 | Full repayment of principal and interest is unlikely and the possibility of loss is extremely high. However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as Loss. Assets should be downgraded to 7 if loan payments remain past due in excess of 90 days, and interest income should be taken into suspense (non-accrual). Loan loss provisions must be raised against the estimated unrealizable amount of all facilities. The adequacy of provisions must be reviewed at least quarterly on all non-performing loans, and the bank should pursue legal options to enforce security to obtain repayment or negotiate an appropriate loan rescheduling. In all cases, the requirements of Bangladesh Bank in CIB reporting, loan rescheduling and provisioning must be followed. An Aggregate Score of 35-44 based on the Risk Grade Scorecard |

| Loss (non-performing) | 8 | Assets graded 8 are long outstanding with no progress in obtaining repayment (in excess of 180 days past due) or in the late stages of wind up/liquidation. The prospect of recovery is poor and legal options have been pursued. The proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been provided for. This classification reflects that it is not practical or desirable to defer writing off this basically worthless asset even though partial recovery may be affected in the future. Bangladesh Bank guidelines for timely write off of bad loans must be adhered to. An Aggregate Score of 35 or less based on the Risk Grade Scorecard |

Qualitative Judgment:

In Premier Bank Ltd. if any uncertainty or doubt arises in respect of recovery of any Continuous Loan, Demand Loan or Fixed Term Loan, the same will have to be classified on the basis of qualitative judgment be it classifiable or not on the basis of objective criteria.

If any situational changes occur in the stipulations in terms of which the loan was extended or if the capital of the borrower is impaired due to adverse conditions or if the value of the securities decreases or if the recovery of the loan becomes uncertain due to any other unfavorable situation, the loan will have to be classified on the basis of qualitative judgment.

Besides, if any loan is illogically or repeatedly re-scheduled or the norms of re-scheduling are violated or instances of (propensity to) frequently exceeding the loan-limit are noticed or legal action is lodged for recovery of the loan or the loan is extended without the approval of the proper authority, it will have to be classified on the basis of qualitative judgment. Despite the probability of any loan’s being affected due to the reasons stated above or for any other reasons, if there exists any hope for change of the existing condition by resorting to proper steps, the loan, on the basis of qualitative judgment, will be classified as ‘Sub-standard’. But even if after resorting to proper steps, there exists no certainty of total recovery of the loan, it will be classified as ‘Doubtful’ and even after exerting the all-out effort, there exists no chance of recovery, it will be classified as ‘ Bad & Loss’ on the basis of qualitative judgment. The concerned bank will classify on the basis of qualitative judgment and can declassify the loans if qualitative improvement does occur.