The Origins of Money

The word money derives from the Latin ‘moneta’ – the first Roman coinage was minted at the temple of Juno Moneta in 344BC. Before coinage, various objects such as cattle, pig’s teeth and shells had been used as money.

For most of its history money has taken the form of coins made of precious metal. The money, therefore, had intrinsic value. Many of the units of modern money recall their origin in amounts of precious metal; for example, the pound sterling was originally the Roman pound (twelves ounces) of silver.

The Beginning of Banking in Britain

In Britain, the modern age of banking began in 1640 when King Charles I, needing cash to pay the (English) army that he was raising against Scotland (of which he was also king!), seized the gold bullion that many merchants and nobles had placed in the Tower of London for safe-keeping.

The 2nd Bishop’s War (founded on a difference of religious opinion) soon petered out and, with Parliament and its powers of taxation recalled, the bullion was returned to its owners.

in 1642, further warfare broke out with the English Civil War between the King and Parliament. London was the stronghold of Parliament and was the safest city in the Kingdom. So those who desired not to have their bullion seized by one side or the other placed their gold in the hands of goldsmiths in the city, who naturally had their own methods of safe-keeping.

Goldsmiths: The First Bankers

In exchange for this gold, the depositors received a receipt: ‘promissory notes’. These notes, the first bank notes, once their veracity was established, proved to be very popular with their recipients, as gold was heavy and cumbersome. Soon, these notes began to be used as currency, with everyone happy to accept that each was backed 100% by a deposit of gold.

Except that once the goldsmiths realised that few people actually wanted to redeem their notes, they began very secretly to issue more than they had gold to back them. This newly-created money was then lent out to people who wished to borrow it at a rate of interest. This was a practice of highly dubious legality, but its practice was never tested in court.

The Bank of England

Then in 1694, this practice of creating money out of thin air was effectively legitimised with the founding of the Bank of England. It was not the first bank to be founded (Coutts was founded in 1690), but the nature of its creation was central to the role that banks went on the play in the supply of money.

In 1694, England was still a predominantly rural country. Most people still grew their own food, built their own homes, collected their own firewood for fuel, drew their own water from wells and frequently made their own clothes. Money was not the necessity that it is today for most people, but it was still needed in large amounts when the nation went to war.

The then King (William III) needed money to fight his war against the French. Both the King’s capacity to tax and his authority was limited, so the quickest and easiest way to acquire his needs was to borrow.

A consortium of six London goldsmiths, lead by one William Paterson, were given royal authority to the create the first ‘joint-stock’ bank on the condition that they lent the King £1.2 million in gold at 8%. This was the start of the National Debt.

More importantly, however, they were given the authority to create £1.2 million in paper money for private lending. This paper money was theoretically backed by the gold, but as that had been lent to the King, it meant that the same sum of money was lent out twice over! The validity of this practice was never tested in a court of law, as it remained a matter that was hidden from the general public. Even today, the banks like to draw a veil over their activities.

Growth During the Industrial Revolution

The 18th and 19th century saw the growth and development of the British banking system, which soon spread around the world with the Empire. It also saw the decline in the use of precious metals (gold and silver) as currency and the increasing confidence in paper money and base (non-precious, eg copper) metal coins.

As new banks sprung up and grew, they each issued their own bank-notes. Unfortunately, problems sometimes occurred if a bank issued too much of its own paper money over its stock of gold and silver coins. The first inkling of problems would cause a mad panic (a rush on the bank) as people rushed to exchange their notes for ‘proper money’, thereby creating the very collapse that they had tried to avoid!

Because of the potential problems with these crises, the Bank of England, although itself a private bank, because of its special relationship with the government became the ‘lender of last resort’. Its notes were almost as good as gold, and it lent to those banks that created a ‘liquidity’ crisis for themselves by lending more money than they had gold to meet the demand.

Private Note Issue Ceases

Throughout the 19th century, the other banks were persuaded to stop creating their own currencies. The last English bank to do so ceased in 1921, although the privately owned banks in Scotland, Northern Ireland and the Isle of Man and the State’s owned banks of the Channel Islands do so to this day. Their currency, although commonly acceptable in England, is not legal tender. (‘Legal tender’ is defined as that money which cannot be refused for the settlement of a debt.)

Although deprived of the means of creating their own bank-notes, the private banks were not stopped the power to create money. Just as Bank of England notes were replacing gold as the ultimate form of redemption, so bank deposits replaced bank-notes as the means of money creation.

To enable people to spend the money that banks created as loans in their accounts, the banks created the cheque system. A cheque was effectively a single use note drawn against an individual’s account for any amount required.

In 1945 the Bank of England was nationalised. It became an agency of the government and so the notes that it created effectively amounted an income to the government that it could spend for the benefit of the nation without need of taxation or borrowing.

The Growth of Privately Created Money

Although the nature of money has changed over the past three centuries, making distinctions between different types of money, difficult to compare, it is useful and valid to draw a distinction between publicly created money and privately created money, and by this distinction the growth of privately created money within the economy can be clearly seen.

From its beginnings in 1694, privately created money grew slowly over the next 250 years as a proportion of the total money until in 1946, the year after of the nationalisation of the Bank of England, it amounted to some 54%. In the last 60 years, it has grown far more rapidly until it now exceeds 97%.

| The Story of Money |

A long time ago, before there was any money (coins or paper money), people got the things that they needed by trading or exchanging. Salt was one of the first items used as a valuable to exchange for other items. Later, some of the common things that were used for exchange were tea leaves, shells, feathers, animal teeth, tobacco, and blankets. Around 3000 B.C. (about 5,000 years ago), barley, a type of grain, was used for exchange. Here is a picture of barley:

The world’s first metal money was developed by the Sumerians who melted silver into small bars all weighing the same. This was around 1000 B.C. (about 3,000 years ago). About 700 B.C. (about 2,700 years ago), people started using coins as official money.

About sixty years later, around 640 B.C., people in the ancient kingdom of Lydia (which was in Turkey) created special coins called staters guaranteed to be of an exact weight and purity. They were made of gold and silver called electrum and stamped with a lion’s head. Here are two examples of staters:

Later, other empires such as Greece, Persia, and Rome adopted the concept of coins and started developing their own in many different shapes and of different metals.

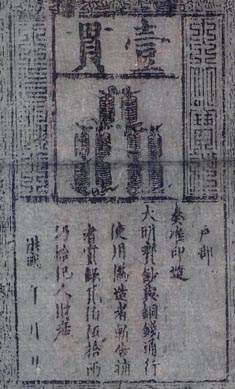

Around the year 1000 (1,000 years ago), the Chinese started using paper money. The Europeans discovered this thanks to Marco Polo1 who went to China in 1295. The Chinese had different values for the paper notes which were made and guaranteed by the Chinese government. Here is a picture of early Chinese paper money:

It took until 1661 (about 340 years ago) for Sweden to become the first European country to make money made of paper.

Until 1850, the Spanish dollar was the coin most widely used throughout the world.

Now we can tell the story of money in the United States. One of the first coins made in colonial America was the Pine Tree Shilling, made in Boston, Massachusetts in 1652. These pictures show the front and back of a Pine Tree Shilling:

After the American revolution in 1776, all of the colonies began to make their own money as coins and paper bills. In 1787, the Congress established a single official currency for all the colonies. A mint (a factory where money is made) was started in Philadelphia in 1792 to make gold, silver, and copper coins. Around this time, native Americans used beads made into wampum belts for money. This picture shows a beaded wampum belt:

Ancient Money

In order to better understand what money is and what role it plays in our lives, we should begin by defining what we mean by the word ‘money’. Simply put, money is nothing more than what is offered or received for the purchase or sale of goods and services. The earliest money came in many forms–cattle, salt, grain, tobacco, whiskey and stones, to name a few. In Southeast Asia, the use of cowry shells (bia) dates back to pre-history.

Traders realised that it was easier to assess the quality and weight of metals than other commodities. References to the use of gold and silver as money can be found in 3000 year old Hindu epics. During the Srivichai period from 850 to 1450 (1400 – 2000 BE) each region in what is today Thailand had its own distinct form of money. In the South, the ‘namo’, a coffee bean shaped silver piece stamped with a Sanskrit letter, was introduced via Indian traders. Silver bracelet money (‘gamlai meu’), droplet money (‘ngoen tork’) and Chinese money were all commonly used in the Lanna kingdom in the north; while, in the Northeast, merchants under the influence of the Lan Chang empire, used bar-shaped ingots made of various metals, known as ‘hang’, ‘tu’, ‘hoy’, and ‘lat’.

With the emergence of Siam as a modern state, the use of bullet money (‘ngoen paduang’), became more widespread. The bullet money, 89 to 95% silver and marked with the stamps of the King, the government and the smith, was known to villagers as ‘bent leg’ money (‘ngoen ka ngor’) or ‘coiled pupa’ money (‘ngoen kad duang’) due to its

appearance. Initially, bullet money was produced by both government and private silversmiths; while the bullet money of the government was supposed to be uniform, the bullet money of the silversmiths varied greatly in size, weight and composition. Various attempts were made to restrict the production of bullet money to government-sanctioned smiths.

After the Bowring Treaty in 1855 (2398 BE), foreign coins began to enter Siam along with the flow of trade. During this period, Mexican, Peruvian, Dutch, Chinese and Indian coins were commonly used. The Royal Minting Department produced the first Siamese coins, known as ‘pae’ in 1860 (2403 BE). Along with increased usage of coins came the discovery, as had been made in Europe, that by slightly altering the coins–lowering the precious metal content slightly or shaving a little bit off the edge of the coin–enormous profits could be had. Eventually, the Siamese government was forced to re-stamp all foreign coins coming into the country in order to assure Siamese citizens that they were genuine. The use of bullet money was finally outlawed in 1904 (2447 BE) by Rama IV–silver artisans could simply not produce enough bullet money to meet the increasing demands of foreign trade. This coincided with the introduction of both coin presses and foreign-made paper notes to the SiameseKingdom.

Money Through Revolution and War

It has been argued that the American, French, Russian and Chinese revolutions were fought on the back of paper money printed by their respective governments. The economic base and political will simply did not exist to raise the necessary funds from taxation. Moreover, no banker in their right mind would lend such enormous amounts when there was little or no intention to repay. In fact, the inflation which resulted from increases in government-issued money was far less damaging for the domestic political agenda than enormous interest payments to foreign creditors would have been. However, there is one very powerful group whose interests are negatively affected by such inflation–banks.

By the beginning of the nineteenth century, the world’s leaders had devised a system which, they believed, would stabilise currencies. Known as the ‘gold standard’, it meant that each country’s currency could be exchanged into gold, and then from gold into another currency at a fixed exchange rate. (Siam first passed the Gold Standard Act in 1908). This system facilitated international trade, but, more importantly for bankers, it assured that their loans would not be repaid in money of inferior purchasing power.

The experiment with the gold standard ended abruptly with the outbreak of World War One. Gold flowed out of Europe and into the United States for the purchase of American goods, eventually forcing European countries to suspend gold payments for fear that their gold reserves would be completely exhausted. US gold reserves rose from $203 million in 1914 to $2.9 billion in 1917. This fact, and the effects of the war, started two economic processes in motion:

On the one hand, the outflow of gold was symbolic of a more general lack of confidence in European economies. As governments printed more and more notes to try to repair the damage of five years of war, runaway inflation gripped many parts of Europe. In Germany, by the end of 1923, prices had reached 1 422 900 000 000 times their pre-war levels! A single US dollar could buy room and board for a week. This attracted an international army of bargain hunters; rumours were spread in Germany that they were Jews. The importance of money management is highlighted by the fact that all of the countries of Central Europe which suffered a collapse of their currencies following World War One were eventually to experience fascism, communism or both.

On the other hand, the massive inflow of investment in the US inflated stock prices and real estate values to unheard-of levels, fostering a nearly decade long economic boom. When it finally sank in that earnings expectations were far beyond actual performance, the bubble burst. In 1929, the Great Depression began. The newly created US Federal Reserve system (the American central bank) proved powerless to either slow the initial expansion or counteract the even more rapid contraction. In an expression used at the time, it was suggested that monetary policy, the manipulation of interest rates and the money supply to influence the economy, was like a string. You could pull it with incalculable results. But you couldn’t push it at all. That is, you can increase interest rates and shrink the money supply to slow the economy down, but once the economy has hit rock bottom, the reverse action does little or nothing at all to start the engine back up again–depression era efforts to stimulate the economy using monetary tools failed miserably.

Money politics played a key role in the Siamese People’s Committee Revolution of 1932, the event which marked Siam’s political transition from an absolute to a constitutional monarchy. During the uncertainty of the depression, investors sought to change their money into gold. This resulted in an outflow of gold from government reserves, eventually forcing the United Kingdom to (once again) abandon its promise to exchange pound notes for gold. Siam, however, did not leave the gold standard, making Siamese exports more expensive relative to those of Britain and its colonies. There was a general feeling that the Siamese government would eventually be forced to devalue the baht. This lead speculators to withdraw baht from banks to buy foreign currency, in the hopes that they would be able to buy back the baht at the devalued rate. (This should sound familiar to contemporary Thai readers!) The Siamese economy continued to deteriorate, eventually forcing the government to abolish several government agencies, lower pay and lay off civil servants. These disgruntled cadres would play pivotal roles in supporting the People’s Committee Revolution just a year later.

Post World War Two: The Bretton Woods Agreements

At the end of the Second World War, 730 policy makers from 44 countries attended the Bretton Woods conference in a small resort town of the same name in New Hampshire. While Thailand was not an original signatory to the Bretton Woods treaties, she did agree to join the gold standard in January, 1946, and eventually joined the IMF and World Bank in May, 1949. The primary objective of the Bretton Woods agreement was to

attempt to reinstate the gold standard–once again–in order to facilitate international trade and protect creditors from any potential currency devaluations.

However, in 1944, the world’s supplies of gold were even more unevenly distributed than they had been when the gold standard was abandoned thirty years earlier. The United States held nearly two-thirds of the world’s gold supply in its vaults. Many countries which had been buying too much and selling too little were left with no gold reserves at all. The only way to overcome such a deficiency, according to economists, was to make a country a more attractive place for others to buy and make imports less attractive for its own citizens. Unfortunately, this involved keeping government expenditures low, freezing wage rates and keeping interest rates high–in other words, sacrificing the domestic social agenda to the needs of international trade. In the meantime, the International Monetary Fund (or, ‘IMF’) would provide the funds needed to keep the trade flowing.

Under the Bretton Woods arrangement, countries agreed to keep the value of their currencies stable in relation to other currencies (called the ‘par value system’). If a country was buying more than it was selling and the value of its currency started to fall, the central bank was expected to step in and buy the currency to maintain its value. If the central bank did not have sufficient reserves to maintain the value of the currency, it could borrow funds from the IMF on a temporary basis. It would then be up to the government to correct the situation which had created the trade imbalance in the first place by raising taxes and interest rates and lowering government expenditure.

In contrast to the role of the IMF as banker to balance of payments troubles, the World Bank (initially called the International Bank for Reconstruction and Development, or ‘IBRD’) was to provide the funds necessary for the reconstruction and economic growth of post-war Europe. In fact, the World Bank played a relatively minor role in this respect; the great majority of such funds came from the US brokered Marshall plan, a transfer of nearly 13 billion $US to war-torn European countries in the ten year period following the end of the war. Towards the end of the 1950s, as the economies of Europe recovered, the IMF began to play its role bridging the gap between exports and imports. It was only in the 1970s that the World Bank began moving towards its current focus on rural poverty alleviation through the provision of (small credit schemes).

The Last Thirty Years

Like the three previous attempts at establishing a universal currency standard, the Bretton Woods agreements soon collapsed. While other nations, particularly Germany and Japan, had reinvested in more efficient industrial production after the Second World War, the US continued with obsolete manufacturing methods; this, combined with the drain of the Vietnam War meant that, as long as the US adhered to fixed exchange rates, international investors would buy in cheap markets overseas and sell in the relatively over-priced American market. By the late sixties, rumours abound that the US dollar was over-valued. Piles of US dollars sitting in European banks, accumulated from the sales of European corporations in the US, were turned into gold. For over twenty years, US dollars had been a safe bet–now it was better to put your money in gold, Deutschemarks or Swiss Francs.

By 1971, the once massive inflow of gold to the US had become an equally alarming outflow, causing President Richard Nixon to rescind his promise to pay the international holders of US dollars in gold. In an attempt to put a brave face on the unilateral violation of an international agreement, the US came up with the term ‘floating exchange rate’ to describe the ensuing devaluation of the US dollar under the Smithsonian Agreements. A similar play on words was given by Thai Prime Minister, Chavalit Yongchaiyudh, to explain his backpedalling on a promise not to devalue the baht in 1997.

The devaluation of the dollar forced Thailand to change the value of the baht in terms of gold in order to maintain the previous dollar exchange rate. During the 25 year period after the Second World War, Thailand held reserves predominantly in US dollars. This was done for a number of reasons: The sheer size of the US economy and the backing of nearly two-thirds of the world’s gold supply meant that the greenback was easily the most accepted currency in international trade; moreover, the US dollar and American prices had proven relatively stable since the War. But now, with the value of the US dollar plunging, Thailand was handcuffed–if she did not devalue in line with the US, the value of US dollar reserves in baht terms would have plummeted.

Despite the fact that the essential reason for the existence of the IMF and the World Bank had been lost with the US abandonment of the gold standard, these two bodies forged for themselves a new role on the global stage. Under the leadership of former US Secretary of State, Robert MacNamara, the World Bank undertook an ambitious program of loans to so-called ‘third world’ countries to encourage them to industrialise. In order to meet the interest payments on these loans the IMF was brought in to enforce what were called ‘structural adjustment programmes’, or ‘SAPs’; essentially, the SAPs involved cutting government expenditure on social programmes and organising industry for export promotion in order to earn the international currency required to repay the interest on the World Bank loans.

This plan might have worked if there had only been one or two ‘under-developed’ nations trying it out. Unfortunately, the experts at both the World Bank and the IMF failed to predict that when scores of nations all began to compete for limited markets, the price of commodities fell. This left the countries of Asia, Africa and Latin America in a no-win situation; the price of foreign inputs, necessitated by the switch to export-oriented growth, rose, while the world price of commodities plummeted, all the while interest on debts continued to mount. This resulted in a situation where, by 1990, there was an annual transfer of wealth from the world’s poorest countries to its wealthiest of approximately 200 billion US$ per year.

The late 80s and early 90s marked the beginning of massive deregulation of the Thai economy. The Bank of Thailand liberalised the deposit and lending rates of commercial banks, broadened the scope of operations of financial institutions, and allowed for the creation of Bangkok International Banking Facilities (BIBF). The BIBFs were nothing more than licenses for major commercial banks to accept deposits and make loans in foreign currencies to the elite of the Thai business sector. The banks enjoyed the easy, seemingly risk-free, profits to be made from borrowing low-interest foreign funds and then loaning them out at a premium (while remaining competitive with much higher rates on Thai money); Thai businesses enjoyed lower interest rates while foreign creditors stumbled over one another to get rates of return higher than that which they could receive at home.

From 1994 to 1996, more than 50 billion US$ had been issued by the BIBFs. Foreign debt had risen 60% to $US 89 billion during this same period. No one seemed to notice, or care, that most of the money was going into unproductive investment–uneeded condominiums, golf courses and financial speculation. Real estate values and stock prices were artificially inflated. The trade deficit soared as a result of the use of loans for the purchase of foreign luxury goods rather than domestic production.

We are almost to the end of our story. In 1997, the bubble burst. Foreign currency speculators estimated that, after years of running trade deficits, the Bank of Thailand’s foreign reserves must be running dangerously low. They bet enormous amounts of money that the Thai government would be forced to devalue the baht–and won. Once the dam had broken, Thai investors rushed to withdraw their savings, sell their stockholdings and convert them to greenbacks. The value of the baht crashed to 55 baht to the US dollar by January, 1998.

With the long overdue realisation that the value of land and stocks had little or no connection to either actual or potential earnings, foreign investment raced out of the country as fast as it had come in. In 1996, net capital inflows to Indonesia, South Korea, Malaysia, the Philippines and Thailand totalled $US 95 billion; by 1998, net outflows may reach $US 40 billion. The financial system, which as we have discussed, is predicated on the assumption of an ever-increasing pyramid of debt, collapsed. As loans turn bad and banks curtail new lending activities, the money-creating mechanism with which outstanding loans can be repaid is destroyed. This, in turn, causes more debtors to default on their loans. As the value of the baht fell lower and lower, Thai companies with outstanding foreign debt (most of which had been chanelled through the BIBFs) were forced into bankruptcy. The social costs have, and will continue to be, heavy. Nearly one quarter of the population is expected to be plunged into poverty by the year 2000.