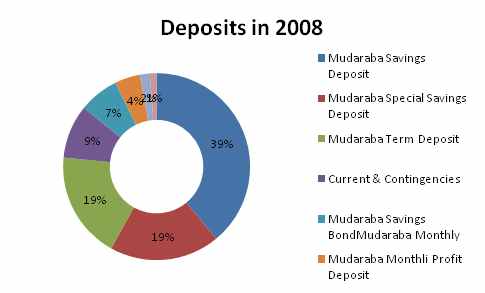

Facts Regarding Deposit

Islami Bank Bangladesh Limited collects a huge portion of money from the Mudaraba Savings Deposit in the period 2009. Mudaraba Special Savings Deposit, Mudaraba Term deposit, Current & Contingencies are prominent here. There are also other sectors here from where Islami Bank collects a huge amount of deposit.

From which sectors Islami Bank Bangladesh Limited collected a huge portion of deposit and those who were prominent in 2009 they were also same sorts of prominent at period 2008. So from both the period we find that the deposit collected by Islami Bank are getting bsame sort of priority.

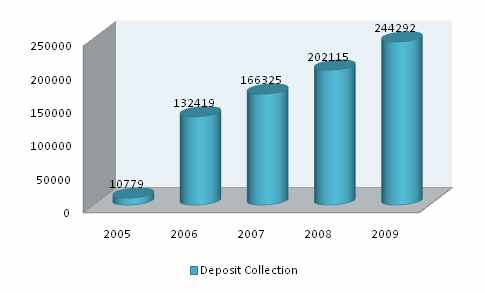

2009 was the successful year for collection of deposit. Bank’s total deposit of this year 2009 was 42177 million in comparison which at the previous period was 202115 million taka which indicates the growth of 20.87% increased. In the total banking sector of the country the growth rate was 18.31%. In 2008 this growth was rate was 21.52%.

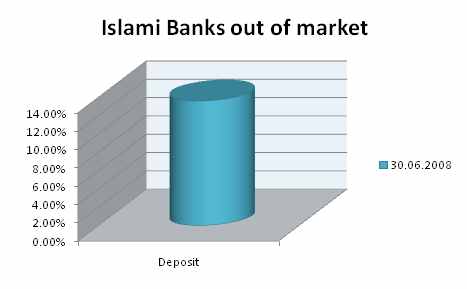

The contribution in collecting deposit by IBBL was 7.77% of the total banking sector of the country for the period 2009. 29.49% was only of the govt. commercial banks. The deposit collected by specialized bank was 5.46%, private commercialized banks contributed 42.49%, 15.27 was of Islami banks and 7.29% was of foreign commercial banks.

The number of depositor has been increased 5.26% from the previous period. In 2008 this number was 14.70%

Facts Regarding Investment

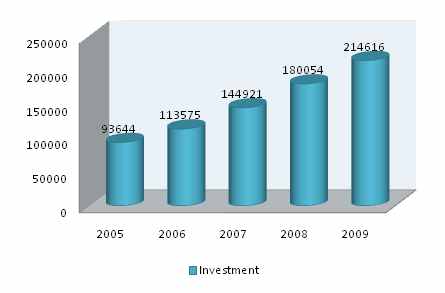

In 31st December, 2009 the total invested amount by the bank was 214616 million taka which was in previous period 180054 million taka. That indicate that total invested in 2009 has been increased by bank 34562 million taka. The growth of investment was 19.20%.

In compared to banking sector this growth was 18.57% for giving importance in the fruitful use of depositors money – this growth rate has been increased so much. In 2008 this growth rate was 24.24%.

The contribution in investment by banking was prominent but after of that the IBBL has invested 7.11% of the total baking sector.

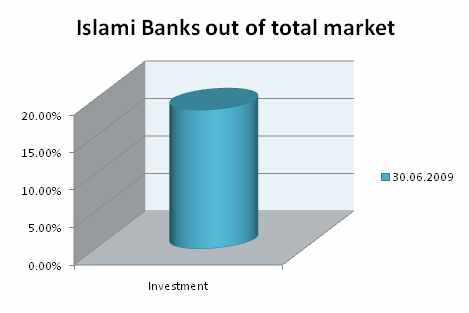

At the period 30th June 2009 the govt. commercial banks have contributed 22.76%, 7.33% was of specialized banks, 44.42% was of private commercial banks, 18.53% was of Islami banks and at last 6.96% was of foreign commercial banks.

In compared to market we find that in case of investment the Islami banks are clearly ahead in compared to govt. owned commercial banks and specialized commercial banks. The strong growth of Islami Banks has been notified here.

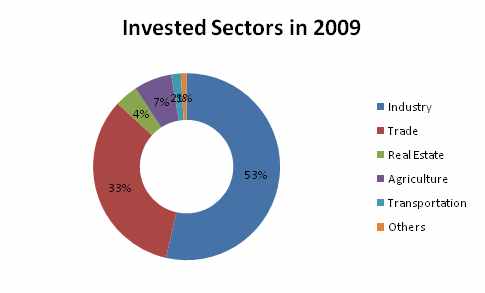

In our country the industry sector is still alive because of two banks in our country. One of them is IBBL. Even from the above chart we can easily notify the sectors for which IBBL pays special care. Among them Industry is the most prominent sector. After of that we find that Trade is the second, Real estate is the third and agriculture the fourth. So from the above graph it is also clear to us that IBBL wants to invest only those sectors from where they will be able to make our economy and on the way of following Shariah. So we also can say that IBBL also invest safety and healthy sector – no any tobacco sector which are profitable but against of Shariah.

In case of 20008 we also find about the same as like of 2009 without the change of percentage. So IBBL is walking its own way in case of investment to different sector and at the need7y sector and about the set up policy based. The ranking is also about as like the previous periods here we find- industry, trade, real-estate, agriculture, transportation and others. So we can say that IBBL gives importance to some specialized sectors.

In terms of investment methods following the Islami Shariah we find that they are here following the Islam. So from the perspective they are following mostly in profit sharing based sector Bui-Murabaha. Second investing is the highest following the hire purchase under Shirkatul Milk. Thirdly they are giving importance in Bui-Muajjal.

The same sort of scenario we also find at the period of 2008 in investing under Islamic methods.

As we find that Islami banks hive priority to the industry sector, if we look at the deep of the industrial sector then we find that Islami bank has given top priority to textile sector. Then it has given importance to steel and engineering sector. Agro based and garments industry is also notified here.

From 2010 to 2013 the bank has taken a specialized business plan for the period of four years- bank is now trying to implement this one. From the part of this plan in case of investment, whose target is the size of investment, sectors, geographical location, economic purpose and considering other things proving banking services to all sectors of the society.

- House holds Project: giving different sorts of facility to the fixed income people to develop their life standard through purchasing of their household needs. Up to the end of the year 2009 the have this facility to 18864 people where the invested amount was 686.49 million taka.

- Village Development project: combined village development and reducing poverty IBBL has started its project in 1995. Under this sector, Islami bank is working for the people those who live under the below of poverty line, helpless people, and to increase their income. There is no need of any security for taking the benefit of this project. 16 kilometers has been recorded to give the facility to away from their branch location.

- Special project: Islami is also concern to the all sector people of the society. Among them- village development project, doctors project, transportation project, car project, small industry project etc.