4.1Comparisons between Conventional and Islamic Banking

“Allah has permitted trade and forbidden usury” Sura-Al-baqarah- 275

Interest which has been the basis of conventional banking is prohibited by Islam in unqualified term. Reminding this thing in mind and to harmonize banking practices with the requirements of Islamic ideals of social and economic life, Islami banking has been emerged. Islami banks operate on Islamic principles of profit and loss sharing and strictly avoiding interest which is the root of all exploitation and responsible for large scale inflation and unemployment.

So one of the basic difference between Conventional/ Interest based banking and Shari’ah based banking is:

The former (Conventional Banking) provides the depositors with a return of a predetermined rate known as interest rate on the amount deposit irrespective of the utility of the concerned deposit/ fund. Thus conventional bank offers its depositors a fixed return (rate/ percentage) of the deposit (say 10% on deposit). Such a return is called Interest.

The latter (Islamic Banking) provides the depositors with a share of income/ revenue the bank earns by deploying those funds. Islamic banking, among other prohibitions, permits neither to pay nor to receive interest. It offers its depositors an agreed share/ proportion of income it earns through investment of their fund (say 40% of earned income unlike a conventional rate variable such as 10% on deposit). In other words under Islamic Banking profit to depositors is essentially a consequence of Return on Investment (ROI)/ Return on Asset (ROA). In terms of cause and effect such profit is the effect. It is neither the cause nor is it the independent. The share of (gross) income/ revenue (fetched by the bank) thus paid to the depositors is called/ known as profit.

However the Islami banking is completely separate and distinctive from conventional in regard to its principles, objectives, goals, procedures and methodologies.

Though my internship was going on general banking operation of Islami banking branch of AB Bank Ltd, I have also studied including investment the other sides of banking for seeking the differences between the Conventional and Islami banking. Because the difference is very little in banking operation and deposit collection. Rather the differences are mainly on the mechanism, principles, objectives, goals, procedures, investment, return etc. I have also showed some graphical presentation of performance for practicing Islamic banking in my branch over Conventional banking.

However the overall differences from different perspective are shown by my best efforts-

4.2 Comparisons on the basis of Definition

DEFINING A conventional Bank

- “A bank is dealer in debt – his own and of other people” – Crowther

- “ We can define a bank as an institution whose debts are widely accepted in settlement of other peoples’ debt to each other” – Sayers

- “A commercial bank is dealer in capital or more properly a dealer in money. He is intermediate party between the borrower and the lender. He borrows from one party and lends to another and the difference between the terms at which he borrows and those at which he lends form the source of his profit.” —-Prof. Gilbert

DEFINING an Islamic Bank

“Islamic Bank is a financial institution whose statutes, rules and procedures expressly state its commitment to the principles of Islamic Shari’ah and to the banning of the receipt and payment of interest on any of its operations.” – OIC.

In the April of 1978 this definition was approved in the conference of foreign ministers of Muslim countries held at Dakar the capital of Senegal.

Islamic banking is essentially a normative concept and could be defined as conduct of banking in consonance with the ethics of the value system of Islam

4.3 Comparisons on the basis of Objectives

| Conventional Banking | Islamic Banking |

| The main objective of conventional banking is to help the maximization of profit motive of the business, commerce and industry. | The main objective of Islamic banking is to help in building development and helping welfare of the human being by ending exploitation and Zulm from the society through the directives of the Almighty Allah. |

| Earning of profit | Establishment of an Interest-free financial system |

| Creating medium of exchange | Ensuring justice to both suppliers of fund (depositor) and user of fund (Investment |

| Development of industry and commerce | Encouraging and patronizing entrepreneurship |

| Development of a healthy money market | Alleviating poverty through Zakat and profit sharing micro-finance. |

4.4 Comparisons on the basis of Features

| Conventional Banking | Islamic Banking |

| In conventional bank, the relation between customer and banker is nothing but debtor and creditor. The bank does not have the responsibility of profit/loss of the customer. | An Islamic banking is not only banker but also a partner in business. It is a participatory banking in capital and profit/ loss. |

| The conventional banks give greater emphasis on credit-worthiness of the clients. | The Islamic banks, on the other hand, give greater emphasis on the viability of the projects. |

| Very often it results in the bank’s own interest becoming prominent. It makes no effort to ensure growth with equity. | It gives due importance to the public interest. Its ultimate aim is to ensure growth with equity. |

| For interest-based banks, borrowing from the money market is relatively easier. | For the Islamic banks, it must be based on a Shari’ah approved underlying transaction. |

4.5 Comparisons on the basis of Principles

| Conventional Banking | Islamic Banking |

| The activities of conventional banking are done by the procedures and laws evolved through human research, studies and innovation. | All the activities of Islamic banking are done according to Islamic Laws (Shari’ah ) i.e. as per guidelaine and directives of the Holy Qur’an and the Sunnah. |

| Conventional banking follows the man made practice and rules. | Islamic banks are to follow Quran, Sunnah, Ijma and Kias i.e. Shari’ah, in all the buswiness transactions including Accounting entires. |

| The basis of conventional banking is is interest and as such its all activities are operated with interest. | In Islamic banking interest (Riba) is strictly prohibited and consequently all its activities are operated without involvement of interest. |

| It aims at maximizing profit without any restriction | It also aims at maximizing profit but subject to Shari’ah restrictions |

4.6 Comparisons on the basis of Functions

| Conventional Banking | Islamic Banking | |

| Leading money and getting it back with interest is the fundamental function of the conventional banks. | Participation in partnership business is the fundamental function of the Islamic banks. | |

| Collection of deposit on the basis of interest | Collection of deposit on the basis of profit sharing | |

| Extending credit on the basis of interest. | Investment following Buy mode/investment mode/ lease mode | |

| Creating medium of exchange and credit | Acting against Creation of medium of exchange and credit | |

| Investment in shares and securities having coupon rate of interest | Investment in shares and Mudarabah bond | |

| Discounting of bill | No discounting of bill | |

4.7 Comparisons on the basis of Social Responsibility

| Conventional Banking | Islamic Banking |

| Conventional banks do not think about as much economic and social responsibility as the Islami banks do. | To ensure equitable distribution of wealth and to establish socio-economic justice is the main concern of Islamic Banking. |

| There is no commitment and undertaking in conventional banking system to make coordination with social development and economic development. | Islami banks make coordination with social development and economic development. It has clear social commitment. |

| They do not consider social factors or aspects rather it gives more importance on earning profit. | Islamic banks encourage investment in production of essential as well as in social welfare sector. |

| There is no justification or consideration whether the business id good or bad in conventional banking system. Earning interest is the main motive of this system | Islamic banks do not do the business on items harmful for societies though there are possibilities to earn more there against. |

4.8 Comparisons on the basis of Deposit

The Mudaraba deposit accounts of Islamic banks I different from the Savings Bank account of a conventional bank. Mudaraba is a form of business contract where one party supplies money and the other manages the business by investing labour, skill and time. The Financier is called Shahib-al-Maal and the person who undertakes the venture is Mudarib.

Mudaraba principles implies that the bank receive deposits from the depositor with the authority that the bank will have exclusive right to manage the fund and the profit resulting from such deposit will be shared between the bank and the depositor at a pre-agreed ratio and the loss, not the resulting from the negligence of the bank or any of its representative, will be borne by the depositors. Profit-loss sharing i.e. Mudaraba saving Account and various term deposits of Islamic banks are conducted on this principle. Through this account the depositors do not acquire any management (voting right) on the bank or on the deposits

| Conventional Banking | Islamic Banking |

| Collection of deposit on the basis of interest | Collection of deposit on the basis of profit&loss sharing |

| A conventional bank has to guarantee all its deposits. | Islamic bank can only guarantee deposits for deposit account, which is based on the principle of al-wadiah, thus the depositors are guaranteed repayment of their funds, however if the account is based on the mudarabah concept, client have to share in a loss position. |

| Their depositors do not share any profit or bear any loss. | Mudaraba depositors are to share the loss if any, incurred out of investment made from mudaraba Deposits. |

Rate of Profit Distribution on Deposit

Income derived from the use of Mudaraba deposits i.e. any benefit outy of investment activities of the bank using Mudaraba funds are shared by the bank and by the all types of Mudaraba depositors as per agreed ratio. These activities of

the bank are done under the principles of Islamic shari’ah. The depositors are not entitled to share any income of the bank derived from miscellaneous services other investment. Also the depositors will not share any income derived from investing bank’s equity and other cost-free income.

However the Mudaraba Term Deposit Account Holders along with other Mudarabah depositors shall get minimum 65% of the income derived from the deployment of Mudarabah fund in the investment according to their proportion in

the total investment during an accounting year applying the following weightage-

| Mudaraba Term Deposit | Weightage Rate |

| 36 months and above | 1.00 |

| 24 months | 0.98 |

| 12 months | 0.96 |

| 6 months | 0.92 |

| 3 months | 0.88 |

Benefits of full weightage of yearly cumulation of profit shall become payable if withdrawn on maturity.

But in case of Conventional Banking the deposit rate is fixed even if the bank can not employ the deposits of the depositors. It is not the matter of depositors’ headache whether the bank can make profit or not.

The rates of different amount of fixed deposit for different time period are in the following page-

| Interest Rate of Fixed Deposit under conventional Banking | |

| Fixed Deposit (Time Deposits) | |

| 15 (fifteen) Days | |

| 1,00,00,000 & above | 10.00% |

| 1 (one) Month | |

| 50,00,000 & above | 12.00% |

| 3 (three) Months | |

| 1 to 10,00,000 | 11.75% |

| 10,00,001 & above | 12.25% |

| 6 (six) Months | |

| 1 to 10,00,000 | 12.00% |

| 10,00,001 & above | 12.50% |

| 1 (one) Year | |

| 1 to 10,00,000 | 12.50% |

| 10,00,001 & above | 13.00% |

| 2 (two) Years | 12.75% |

4.9 Comparisons on the basis of Investment

| Conventional Banking | Islamic Banking |

| The mode of investment is basically lending. | The basic mode is investment through Bai+lease+direct Investment |

| Since income from the advances is fixed, it gives little importance to developing expertise in project appraisal and evaluations. | Since it shares profit and loss, the Islamic banks pay greater attention to developing project appraisal and evaluations. |

| Purpose of the loan is considered with less importance. | It is the most important to consider the purpose of the loan. |

| National interest is the secondary consideration. | National interest is the primary consideration. |

| Diversification of profit is the most important consideration | Diversification is not a prime consideration. |

| Close and constant supervision and monitoring is must be a routine work | Close and constant supervision and monitoring is not a routine work |

| In conventional Banking there is no practice of Musharaka, Mudaraba, Bai-Salam modes of Investment and most of their income can be recognized on accrual basis. | In Musharaka, Mudaraba, Bai-Salam modes of Investment, income cannot be accounted for on accrual basis. |

| No bai-Muraba and bai-muazzal investment in conventional banks. They charge interest/ penalty interest for delay in payment/ repayment. | For delay of payment of investment by the clients, in case of Bai-Mudaraba and Bai-Muazzal etc. investment further amount of profit cannot be charged |

| They do not pay a certain amount to the depositor from their investment income, rather pay fixed rate of interest irrespective of investment income. | Islamic Bank is to pay zakat 2.50% or 2.58% on its reserves. |

4.10 Comparisons on the basis of Accounting

The basic accounting Principle (Golden Rule) in determining Debit or Credit for Accounting Entries is universally accepted. In banking transactions the Golden Rule is also accepted. In Islamic Banking the Golden Rule is also accepted.

The golden Rule is as under-

Assets : An increase -Debit

A decrease -Credit

Liabilities : An increase – Credit

A decrease – Debit

Capital : An increase – Credit

A decrease – Debit

Income : An increase – Credit

A decrease – Debit

Expenditure : An increase -Debit

A decrease -Credit

In Islamic Banking accounting the main difference with conventional Banking is that Islamic Banking can not deal with interest transaction and also cannot deal with Haram business.

The differences are shown in the following page-

| Conventional Banking | Islamic Banking |

| They only follow International Financial Reporting Standards (IFRS), Bangladesh Bank guidelines, The rules of the Income tax, The rules of the companies Act, The rules of the Sec. | Islamic Banks are to follow Accounting and Shari’ah standards developed by Accounting and Auditing Organization for Islamic Financial Institution (AAOIFI) in addition to International Financial Reporting Standards(IFRS) developed by International Federation of Accountants, Bangladesh Bank guidelines, The rules of Income Tax, The rules of Companies Act , The rules of the SEC. . |

| They conduct their transactions on interest basis. | They cannot engage in any interest transactions. |

| Interest is their main income | If any interest is included/ entered in the operation of the banks, that should be excluded from the regular income of the Bank |

| They do not follow the Shari’ah rules and regulations. | If any income is earned violating Shari’ah Principles that cannot be included in the distributable income of the bank. |

4.11 Comparisons on the basis of Performance

Differences on the basis of performance depend on the various performance level of banking performance in the Islami Banking Branch that varies from the performance level of AB bank Limited. For conducting business in accordance with Islamic Shari’ah the differences on performance level are significant.

Here I have tried to give a distinguished picture of the performance level of ABBL from the perspective of practicing IslamicBanking and Conventional Banking-

These differences are shown below-

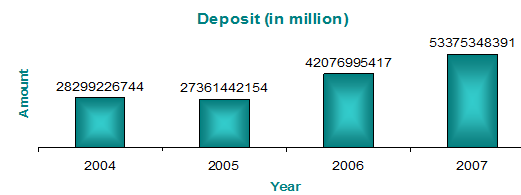

4.11.1 Deposit

Deposit of ABBL

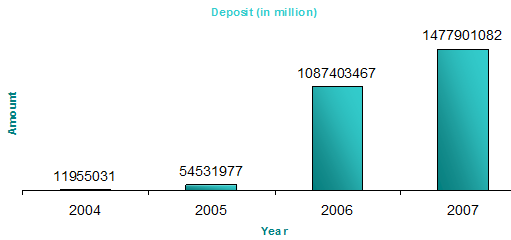

Deposit of IBB

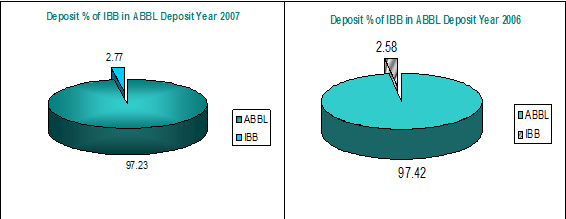

Deposit % of IBB in ABBL Deposit (Year 2006& 2007)

We can see from the above graphs that the Deposits are rising in a higher level in the Islamic banking in compared to conventional banking of AB Bank Limited. Also the deposit percentage of Islami Banking branch is higher than the other branches of ABBL that practice conventional banking system.

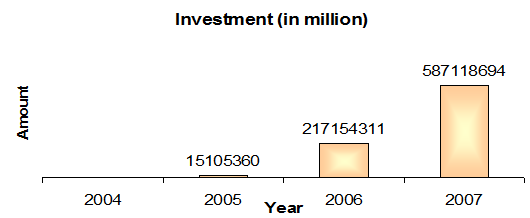

4.11.2 Loans and Investment

Loans and advances of ABBL

Investment of IBB

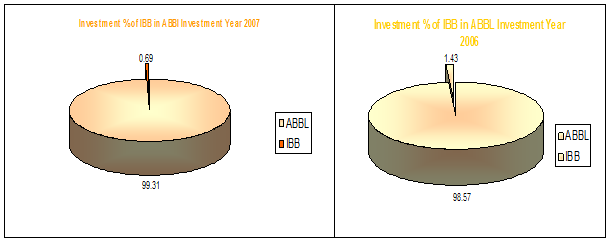

Investment % of IBB in ABBL Loans and Investment(Year 2006& 2007)

Like deposit the investment is also increasing in the Islami Banking as well as the conventional banking in aAB Bank Limited. But the percentage of investment is not as much higher as deposit in the Islami Banking of AB bank Limited.

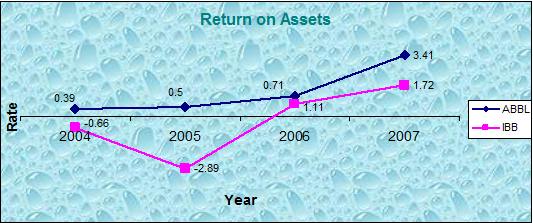

4.11.3 Return on Asset (ROA)

Return on asset is one of the important indicators of measuring performance through which we can understand the rate of net profit after tax returned to the utilization of branch assets. As the branch does not separately give tax, I assume and calculate 45% tax given by the branch itself for the sake of my study. If we see the graphical presentation of return on Asset (ROA) of ABBL IBB, we can understand that the ROA of Islami Banking branch of AB Bank Ltd is increasing at about same rate with Overall performance of AB Bank Ltd after meeting up its primary loss of initializing the system. After 2006 the ROA is increasing here at a satisfactory rate in Islami banking branch for practicing even Shari’ah-based banking.

5.1 Findings

Though the entry of Islamic Banking into the field of local financial market of Bangladesh and international financial markets has been well received, it has yet to cross many hurdles before it can claim to be an institution capable of handling the needs of world financial markets. I have identified those positive and negative findings during my study of differentiating Conventional banking from Islamic Banking. However those findings are tried to depict below-

- The Islamic Banks in Bangladesh have good prospects in our country. As the Islamic Banks meet both banking & ethical expectation, the people of the country have reposed a great deal of trust & confidence on them.

- Islamic banks operate on Islamic principles of profit and loss sharing, strictly avoiding interest, which is the root of all exploitation and is responsible for large-scale inflation and unemployment.

- An Islamic bank is committed to do away with disparity and establish justice in the economy, trade, commerce and industry; build socio-economic infrastructure and create employment opportunity.

- But like their counterparts around the world, the Islamic Banks in Bangladesh as well as in Islami Banking branch of ABBL are also facing some legal and practical constraints.

- Absence of Islamic money market, shortage of skilled manpower, lack of regulatory supervisory framework & shortage of link institutions are some of example of constraints for practicing Islamic banking operation

- Sometimes people become discouraged to deposit their money to the Shari’ah practiced bank as are to share the loss if any, incurred out of investment made from Mudaraba Deposits

- The Islamic Banks need a distinct organization & management structure to suit their purposes, but the branch is established on traditional organization & management structure.

- The Islamic Banks (full fledged) and Islamic Banking Branches are facing serious problems of lack of manpower having proper Islamic Banking knowledge due to non existence of appropriate and institutional supply line of Islamic Bankers.

- Sometimes some investment clients even being Muslims have no Shariah knowledge especially in respect of Riba, Permissible, and Prohibition etc. in financial transaction. It is a fact that without the basic knowledge of Shariah and adherence of the clients to the concepts of Halal and Haram Islamic Banking has become a difficult task.

- Most of the Islamic Banks operate on Bai- Murabaha, Bai Muazzal, Bai- Salam, Istisna, Hire Purchase/ Leasing mode of Investment i.e. Islamic Banks prefer to run on markup/ guaranteed profit basis. For this reasons, some times, the conventional Economists and general people fail to understand the real difference between the Islamic Banking and conventional Banking.

- Due to the application of limited modes of investments v.z. Bai-Murabaha Bai-Muajjal ,clear distinction could not yet be made to the general people

between Islamic Banks & Conventional Banks.

6.1 Conclusion

The concept of Islamic Banking is a very recent innovation to the Banking world. At the beginning the world was not familiar with Islamic Banking. In the very recent stage banking system was only understood a Capitalist system based on interest. Islamic Banking system emerged with its unique feature of interest free system. The focal point around which Islamic banking system revolved is the straight departure from interest. Based on the Shari’ah law all dealing, transaction, business approach, product feature, investment focus, responsibility of Islamic Banking lead to the significant difference in many part of the operations with as of the conventional. The growth of Islamic banking in Bangladesh is progressing day by day. The remarkable shifting or conversion of the conventional banks and their branches into the Islamic lines, signals high acceptance of the interest-free banking by the public in general. Moreover like their counterparts around the world, the Islamic Banks in Bangladesh as well as in Islami Banking branch of ABBL are also facing some legal and practical constraints. But with only minor changes in their practices, Islamic banking can get rid of all their cumbersome, burdensome and sometimes doubtful forms of financing and offer a clean and efficient interest-free banking. All the necessary ingredients are already there. The modified system will make use of only two forms of financing — loans with a service charge and Mudaraba participatory financing — both of which are fully accepted by all the Muslims. Thus such a system will offer an effective banking system where Islamic banking is obligatory and a powerful alternative to conventional banking where both co-exist. Additionally, such a system will have no problem in obtaining authorization to operate in non-Muslim countries.

6.2 Recommendations

To sustain and develop the Islamic banking system with its ethical and intrinsic values system, Islamic banking practiced banks and branch of the country have to strive to solve the problems mentioned in the findings, which stand in the way of their growth and survival. However, the recommendations may be the following-

- It requires complete examination on the Islamic Banks whether they are run by Shari’ah Council and competent professionals who are really practicing Muslims.

- The initiative, drive, farsightedness and relentless efforts of the people who are associated with the Islamic banking system may give it a great boost & momentum.

- The personnel should be equipped enough with proper Islamic Banking knowledge to meet the growing demands of Islamic Banking

- All of the people working in Islamic Banks should be well conversant with Islamic Banking modes and its operations

- The inspection and supervision of Bangladesh Bank and its massive training program on Islamic banking both at home and abroad should be equally familiar with different operational methodologies of the Islamic banking system.

- People should be made convinced and understood about the justification of real meaning and practice of Islamic Banking. They should really understand the basic difference between Conventional and Islamic banking.

- Lack of Regulatory and Supervisory Framework for Islamic Banking, Shortage of Supportive and Link Institutions are to be met up to meet the growing demand and sustain the growth of Islamic Banking.

Some more parts of this post-

Comparative Study Between Conventional And Islamic Banking (Part-1)

Comparative Study Between Conventional And Islamic Banking (Part-2)

Comparative Study Between Conventional And Islamic Banking (Part-3)