Introduction

A country maintains and develops trade relations with other countries because it gains by doing so. Commodities are imported because either they cannot be produced in the country at all or can be produced at a very high cost. Import of such commodities by the country is, therefore, convenient and cheaper. In exchange for imports, the country has to export certain commodities which it can produce but which are not produced in some other countries, and for the production of which its resources are well suited. Thus foreign trade is a source of considerable gain for a country.

Bangladesh is not an exception to this. Because foreign trade is of vital importance to the economic development of Bangladesh. . In order to finance imports and also to reduce the country’s dependence on foreign aid grants, the government, since liberation, has been trying to enhance foreign exchange earnings through planned and increased exports. In the field of commerce the main task of the government is to make Bangladesh economy strong and dynamic enabling it to face the challenges of rapidly changing world trade system.

Nearly all sector contributed to the GDP growth, particularly significant were the growth of the export-oriented sectors, inflow of remittances and some service sectors like transport and communication. In that case foreign exchange operation of JBL plays an important role in the economic development of Bangladesh.

In Case of Import:

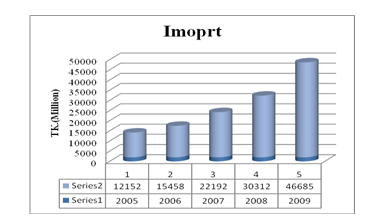

The total import business handled by the Bank in 2009 was Tk.46684.73 million compared to Tk.30311.71 million in the preceding year registering a rise of Tk.1673.02 million being 54.02 percent. A sizeable L/C’s were also opened by the Bank in the year under review. The import items included industrial raw materials, machinery, consumer goods, fabrics, accessories etc.

Particulars | Yearly Import Growth (Tk. In Millions) | ||||

2009 | 2008 | 2007 | 2006 | 2005 | |

Import | 46685 | 30312 | 22192 | 15458 | 12152 |

Table 5.1: Growth of JBL by conducting import

From the above table I see that there is up and down in the import position. Growth of JBL is hindered because of unsuitable economic condition in 2008 and in 2009 JBL recorded a significant growth of 16373. The expansion of import is responsible for the deterioration of the trade balance of JBL.

To have a clear idea, the growth of JBL is presented below graphically:

Figure : Growth of JBL by conducting import

Global recession fall in the price of commodities due to decrease in the production as a result importer imported less, in spite of that we can see a sudden increase in 2009 because of natural disaster such as devastating cyclone, price hike of oil and other commodities in the world market.

Jamuna Bank Limited has opted quality financing while facilitating import trade in2009. Import payment during FY09 amounted to US$21.60 billion (27.3%of GDP) compared to US$17.16 billion (25.1%of GDP) in FY08. This shows an upward trend in import cost.

Though higher import than export is not good but some cases this position helps to the country’s development. Like by increasing the import JBL facilitate port facility, creating employment facility , by importing machineries, raw materials it can increase country’s production ultimately increase the export and thus it develop BD’s economy.

In Case of Export:

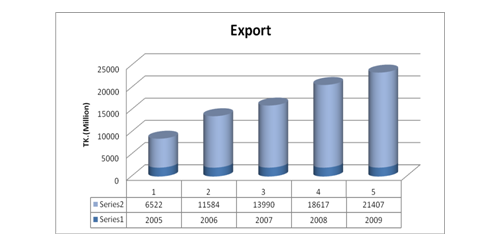

The Bank handled export business worth Tk. 21406.94 million in the year under report. In 2008 total export business handled by the Bank was Tk.18617.43 million. Thus there was an increase of Tk.2789.51 million in export business handled by the Bank, being 14.98 percent over the preceding year. The major export item was Readymade Garments. The export items are:

- Readymade garments

- Jute & jute goods

- Leather

- Tea

- Frozen foods

- Fish products etc.

Particulars | Yearly Import (BDT in million) | ||||

2009 | 2008 | 2007 | 2006 | 2005 | |

Import | 21407 | 18617 | 13990 | 11584 | 6522 |

Table 5.3: Growth of MBL by conducting export

JBL recorded 21407million growth at the end of 2009 as against that of 2790million at the end of 2008. From this I say that it gains by developing its export business.

For the clearance a graph is given below:

Figure : Growth of JBL by conducting export

Figure : Growth of JBL by conducting export

From The above Chart we are seeing that the Yearly Export growths are increasing. So JBL are developing their export position and earning foreign currency and that increase the financial position of the JBL.

As of the above graph I can say, in 2009 JBL brings a significant change to the overall economy of Bangladesh. Total Export of the bank increased to BDT 2790 million at the end of 2009 as against that of BDT 32670.10 million up to 2008 registering 24.950% growth.

Total export earnings during FY09 amounted to US$ 14.11 billion (17.8%of GDP) compared to US$ 12.18 billion (17.8%of GDP) in FY08. Among the exported items Readymade Garments (RMG) holds highest contribution (75% of total export earnings).

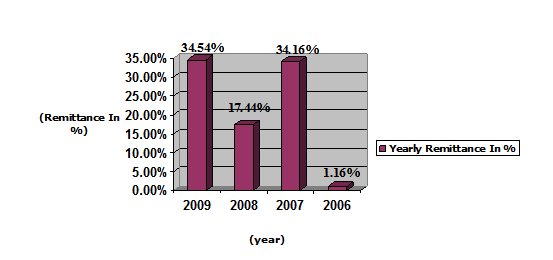

In Case of Remittance:

Remittance is the single largest sector in terms of achieving net foreign exchange. This has been used in financing the import of capital goods and raw materials for industrial development. Remittance also helps on the overall growth of JBL, which is shown in following table:

Particulars | Yearly Remittance (In Percentage) | |||

2006 | 2007 | 2008 | 2009 | |

Remittance | 1.16 % | 34.156 % | 17.44 % | 34.54 % |

Table 5.5: Growth of JBL by conducting remittance business

Despite the contraction of the overseas employment caused by the last few months of 2009, JBL achieved a significant growth in remittance business. From remittance business JBL achieved 34.54%growth in 2009 over 2008.

To have a clear idea, the growth of JBL is presented below graphically:

Figure : Growth of JBL by conducting remittance business

Another Contribution:

The bank has made provision of BDT 665.80 million for corporate tax in 2009 against BDT 658.34 million in 2008. The bank has also contributed to the economy by generating employment of 1115 full time officials. In the intermediation process, the bank mobilized resources of BDT 49538.36 million from the surplus economic unit and deployed BDT 41993.95 million in 2009. The bank has made top most significant contribution to Readymade Garments sector by handling export Letters of Credit.

Findings

SWOT Analysis of JBL:

SWOT analysis is an important tool for evaluating the company’s Strength, Weakness, opportunities, and Treats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition. Problem Identification

STRENGTHS | WEAKNESSES |

| ü Experienced top management. ü Satisfactory capital base. ü Low infection in loan exposure. ü Prospective IT infrastructure.

| ü Limited market share. ü Exposure to large loan‑ ü Excessive dependency on term deposits. ü Weak fund management. ü High cost of fund. ü Islamic Branch funds are not ring fenced. |

OPPORTUNITIES | THREATS |

| ü Regulatory environment favoring private sector Development. ü Credit card. ü Small and medium enterprises.

| ü Increased competition in the market for quality assets. ü Supply gap of foreign currency. ü Over all liquidity crises in money market. |

SWOT Analysis of JBL

Problem Identification:

During internship period in Jamuna Bank Limited Gazipur Chowrasta Branch tile following problems are observed.

- Human resource of any organization is considered as a valuable asset. But human resources, in the branch, are not equipped with adequate banking knowledge. Majority of the human resources have lack of basic knowledge regarding money, banking finance and accounting. Without proper knowledge in these subjects, efficiency cannot be optimized. Bank can arrange training program on these subjects.

- There is shortage of computer in general banking section. Sometimes the shortage of computer makes some unfortunate event on that section.

- Lack of internet connection. Our branch office use GP internet service that is not enough for Banks daily activities.

- Flora On-line banking software is used by JBL and this is quite difficult to use for the employee as the employees are not well trained.

- This bank does not have any plan to enter into the Credit Card Market. It is well versed that tomorrow’s payment will be consisted of only plastic money (Credit Card). A large part of business transaction will be done by credit card III near future. In western world, more than 50% of transactions are in credit card this bank does not prepare from now on, it cannot compete in the future market. So, the branch should give special attention to the introduction of Credit Card.

- Since a number of new banks are coming to existence with their extended customer service pattern in a completely competitive manner. Customer-services must be made dynamic and prompt.

Conclusion:

Bank is the most common type financial intermediary in todays globalizes world. Banks play important constructive role in the economy. Banking sector of Bangladesh quite positively contributing to its economy. In today’s globalizes world it’s impossible to stay without transacting among two countries i.e. foreign trade and banks are the only safe way transacting international transactions. The different nationalized and privatized banks are providing services among them foreign exchange services are important for globalized transactions. As a commercial bank of Bangladesh Jamuna Bank Limited is providing different services along with foreign exchange services. JBL is trying to establish is a stable position in competitive market and providing positive contribution to economy through different services as well as foreign exchange services. JBL foreign exchange department facilities not only induce export-import and private transactions but also help to encourage economic development of Bangladesh. The new mode of planned advance facilities that will be enforced in future by Jamuna Bank Limited for improving service quality. So I hope as Jamuna Bank Limited has great chance of being one of the leading banks of Bangladesh by enforcing its available opportunities and will highly contribute to the economic development of Bangladesh in future.

Bibliography:

1. Text Books:

- Ashraf Ali. Syed, 1986, Foreign Exchange & International Finance, Page: 35-42,78-84,129-143,152-160.

- Varshney R.L, 1992, International Financial Management, Page: 264-297, 330-336.

- Nurul Islam, 1976, Foreign Trade and Economic Controls in Development, Page: 65-79.

- Rodriguer R.M. and Carter, 1981, International Financial Management, Page: 23-36, 91-102.

- Kate L. Turabian, 1972, A Manual for Writers of Term Papers, Theses and Dissertations, page: 1-15, 125-143.

2. Journals and Articles:

- Kavaljit Singh, 2002, Global Foreign Exchange Trading: Status and Issues, Asia Pacific Research Network Journals, Vol-6, No-4.

- Ian H. Giddy and Gunter Dufey, The Management of Foreign Exchange Risk, Resources in Finance, New York University and University of Michigan.

- Harun-Ar-Rashid Khan, M. Farid Ahmed, Ehsan Latif, 1993, Foreign Banks in Bangladesh: Performance& Limitations, Dhaka University Journal Of Business Studies, Vol- 14, No-1, Page: 185-198.

- Begum Khaleda Khanam & md. Abdul Hakim, 2002, Performance Apprisal system in Private Banks, Dhaka University Journal Of Business Studies, Vol- 23, No-1, Page: 129-136

3. Instructional Publications:

- Bangladesh Bank, 1996, Guidelines for Foreign Exchange Transactions, Vol-1, Page: 4-29.

- Jamuna Bank Limited, 2009, Annual Report.

4. Web Sites:

- Foreign Exchange, 1998, Available at: www.investorwords.com

- Methods of Expanded Payments, 2006, Available at: www.fnb.com

- Cambridge Mercantile Corporation, 2004,Foreign Exchange Global Payments, Available at: www.cambridgefx.com

- Convertibility of Taka for Foreign Transactions, Available at: www.bbank.org

- Trade Port, Global Trade Tutorial, March 17, 2005 Available at: www.caltp.org

- SITPRO, February 23, 2007, Methods of International Payments, Available at: www.info@sitpro.org.uk

- WORLDLawDirect, What are letters of credit in international trade?, April 15, 2005, Available at: www.worldlawdirect.com

- Freightgate-International Trade Terms, February 5,2007, Available at: www.freightgate.com

- International Finance Corporation, 1999, The Basics of Foreign Trade and Exchange, Available at: www.ifc.org

- Foreign Currency Account, 2005, Available at: www.bankasia.com

- Foreign Exchange Risk, Available at: www.riskinfo.org

- Information about Mercantile Bank Limited, Available at: www.jamunabankbd.com

5. Newspaper:

- Financial Statements 2006 Of Jamuna Bank Limited, Doynik Jhonokonto, 3 March, 2007, Page: 13-16

- Foreign Exchange Management, New Nation, 1 March, 2006