Perfect Market competition

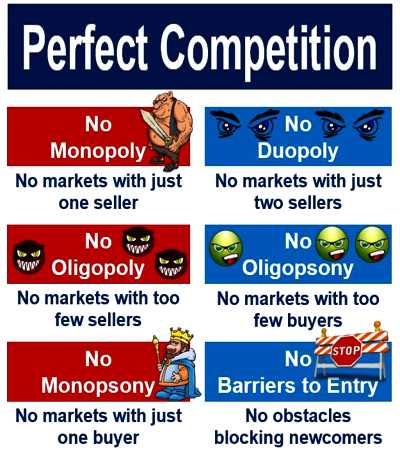

In economic theory, perfect/pure competition describes markets such that no participants are large enough to have the market power to set the quantity of a homogeneous product. Because the conditions for perfect competition are strict, there are few if any perfectly competitive markets. Still, buyers and sellers in some auction-type markets say for commodities or some financial assets may approximate the concept. Perfect competition serves as a benchmark against which to measure real-life and imperfectly competitive markets.

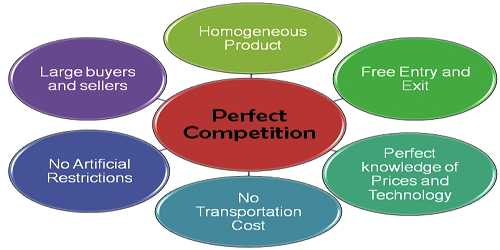

Characteristics:

Generally, a perfectly competitive market exists when every participant is a “price taker”, and no participant influences the price of the product it buys or sells. Specific characteristics may include:

- Infinite buyers and sellers – Infinite consumers with the willingness and ability to buy the product at a certain quantity, and infinite producers with the willingness and ability to supply the product at a certain quantity.

- Very few entry and exit barriers – It is relatively easy for a business to enter or exit in a perfectly competitive market.

- Perfect factor mobility – In the long run factors of production are perfectly mobile allowing free long term adjustments to changing market conditions.

- Perfect information – Prices and quality of products are assumed to be different from all producers.

- Zero transaction costs – Buyers and sellers incur no costs in making an exchange (perfect mobility).

- Profit maximization – Firms aim to sell where marginal costs meet Total revenue, where they generate the most profit.

- Homogeneous products – The characteristics of any given market good or service do not vary across suppliers.

- Non-increasing returns to scale – Non-increasing returns to scale ensure that there are sufficient firms in the industry.

In the short term, perfectly-competitive markets are not productively efficient as output will not occur where marginal cost is equal to average cost, but allocatively efficient, as output will always occur where marginal cost is equal to marginal revenue, and therefore where marginal cost equals average revenue. In the long term, such markets are both allocatively and productively efficient.

Under perfect competition, any profit-maximizing producer faces a market price equal to its marginal cost. This implies that a factor’s price equals the factor’s marginal revenue product. This allows for derivation of the supply curve on which the neoclassical approach is based. (This is also the reason why “a monopoly does not have a supply curve.”) The abandonment of price taking creates considerable difficulties to the demonstration of existence of a general equilibrium except under other, very specific conditions such as that of monopolistic competition.

Examples

Perhaps the closest thing to a perfectly competitive market would be a large auction of identical goods with all potential buyers and sellers present. By design, a stock exchange resembles this, not as a complete description (for no markets may satisfy all requirements of the model) but as an approximation. The flaw in considering the stock exchange as an example of Perfect Competition is the fact that large institutional investors (e.g. investment banks) may solely influence the market price. This, of course, violates the condition that “no one seller can influence market price”.

Free software works along lines that approximate perfect competition. Anyone is free to enter and leave the market at no cost. All code is freely accessible and modifiable, and individuals are free to behave independently. Free software may be bought or sold at whatever price that the market may allow.

Some believe. that one of the prime examples of a perfectly competitive market anywhere in the world is street food in developing countries. This is so since relatively few barriers to entry/exit exist for street vendors. Furthermore, there are often numerous buyers and sellers of a given street food, in addition to consumers/sellers possessing perfect information of the product in question. It is often the case that street vendors may serve a homogenous product; in which little to no variations in the product’s nature exist.

- There are large number of buyers and sellers.

- There are no entry or exit barriers.

- There is perfect mobility of the factors, i.e. buyers can easily switch from one seller to the other.

- The products are homogenous.

Information Source: