INTRODUCTION

1.1 Origin of the Report

After completion of 4 years in the BBA program, studies, three months organizational attachment is must. So the preparation and submission of this report is partial requirement for the completion of the Bachelor of Business Administration (BBA).This report is outcome of the three month long internship program conducted in Jamuna Bank Limited, one of the reputed private commercial banks of the country .While working in the bank the standard operating procedures carried out by the bank the standard operating procedures carried out by the bank were observed and understood.

1.2 Objectives of the Report.

The objectives of this report are:

- To have exposure to the oveall banking experience other function of Jamuna Bank Limited.

- To have a clear understanding of the business operation of Jamuna Bank Limited.

- To identify the major strength and weakness of Jamuna Bank Limited in respect to other banks.

- To discuss the products and services offered by Jamuna Bank Limitcd.

- To assess and evaluate the growth trends and its shareholders and participants of Jamuna Bank Limited.

- To evaluate the profitability of Jamuna Bank Limited.

- To recommend ways and means to solve problems regarding banking of Jamuna Bank Limited.

1.3 Methodology

This report is based mainly on observations that I experienced during the internship period. Data required for this report were collected from the annual report of Jamuna bank. Apart from these, helpful information was collected from online resources. To analyze the performance of Jamuna bank limited different statistical and financial tools such as ratio analysis, growth analysis were done.

1.3.1 Data/ Information Required

It is tried, in the study, to identify the policy scenario and recommendations Practice of JBL. Some existing reports, working papers, websites are also surveyed. In order to make the study meaningful and presentable, both primary and secondary sources of data have been used.

1.3.2 Sample Design

In order to make the study meaningful and presentable, both primary and secondary sources of data have been used.

- Primary Sources.

- Secondary Sources.

1.3.3 Sources Of Data:

The main methodology that has been followed in this report was:

- Oral interview to the different personnel throughout the organization.

- Compare the different performance indicators of the Malibagh branch of Jamuna Bank.

- To present the core consideration regarding the performance consideration of the banking practice.

- A sample is presented to show how much requirement a branch has to fulfill to provide a proposal to head office.

This report is an exploratory and descriptive one in nature and involved with both oral and written source of data in being used and has been administered by collecting both primary and secondary data. Personal interview through oral non-questionnaire technique is being used in this report.

1.3.3.1 Methods of Primary Sources:

For the preparation of this report both qualitative and quantitative data is being collected. The following technique is being followed for primary data collection:

- Face-to-face Conversation with the respective officers, executives & also with the staff of the Branch.

- Informal conversion with the clients.

- Practical work exposures form the different desks of the departments of the Branch covered.

- Relevant file study as provided by the officers concerned at each desk of the departments I have worked.

1.3.3.2 Methods of Secondary Sources:

For the purposes of this report three kinds of secondary data is being used:

- Annual Report of the “Jamuna Bank Ltd”

- The Published materials as such; various books, articles regarding “General Banking Functions, “Foreign Exchange Operations, & also “Credit Policies”.

- Different “Procedure Manual” Published by JBL.

- Different Circular Sent by the Head office of JBL & Bangladesh Bank.

1.4 Limitation

Although the officials were so busy, they gave me wholehearted cooperation in the time of internship also in preparing this report. It was such a nice experience I have gathered from JBL. But I have faced the following that may be terns as die limitations of the study.

No remuneration was provided

The first obstacle was that they would not provide any remuneration even TA/DA for doing internship in JBL.

Lack of records

Sufficient books, publications and figures were not available. If this limitation were not been there, the report would have been more useful.

1.5 Background Information of Jamuna Bank Limited

Jamuna Bank Limited is one of the leading private commercial banks in Bangladesh that has achieved tremendous popularity and credibility among the people for its products & services. It is a public limited company and its shares are traded in Dhaka and Chittagong stock exchange. The bank undertakes all types of banking transaction

To support the development of trade and commerce in the country JBLs service is also available for the entrepreneurs to set up new ventures and BMM-, of industrial units.

To provide clientele services in respect of international trade it has established wide, corresponded Banking relationship with local and foreign banks covering major trade and financial interest home and abroad.

1.7 Corporate Slogan of JBL

Your Partner For Growth

2.1 The term bank is derived from the French word Banco which means a Bench or Money exchange table. In olden days, European money lenders or money changers used to display (show) coins of different countries in big heaps (quantity) on benches or tables for the purpose of lending or exchanging.

Finance is the life blood of trade, commerce and industry. Now-a-days, banking sector acts as the backbone of modern business. Development of any country mainly depends upon the banking system.

2.2 Objectives of JBL

- To earn and maintain CAMEL Rating Strong.

- To establish relationship banking and improve service quality through

development of strategies marketing plans.

- To remain one of the best banks in Bangladesh in terms of Profitability and

assets quality .

To introduce fully automated system through integration of Information Technology.

- To ensure an adequate rate of return on investment

- To keep risk position at an acceptable range (including any of balance sheet risk)

- To maintain adequate liquidity to meet maturing obligation and commitments.

- To maintain a healthy growth of business with desired image

- To maintain adequate control systems and transparency in procedure

- To develop and retain a quality work force through an effective Human Resources Management System

- To ensure optimum utilization of all available resources

- To pursue an effectivesystem of management by ensuring compliance to clinical norms, transparency and accountability

2.3 Historical Background of JBL

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act 1994 with its Head Office at PrintersBuilding, 5 Rajuk avenue Dhaka-1000. The bank started its operation from 3rd June 2001. Jamuna Bank Limited (Jf31,) is a highly capitalized new generation Bank with an Authorized capital and paid-up capital of Taka 1600.00 million and Tk 390.00 million, Paid up capital of the Bank raised to Tk.429 million as of December, 2005 and the number of branches raised to 29.Thc bank gives special emphasis on export, import, trade finance SME finance Retail credit and finance to woman Entrepreneurs.

3.1 About JBL

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 with its Head Office at Chini Shilpa Bhaban, 3, Dilkusha C/A, Dhaka-1000. The Bank started its operation from 3rd June 2001.

The Bank undertakes all types of Banking transactions to support the development of trade and commerce of the country. JBL’s services are also available for the entrepreneurs to set up new ventures and BMRE of industrial units. Jamuna Bank Ltd., the only Bengali named new generation private commercial bank was established by a group of winning local entrepreneurs conceiving an idea of creating a model banking institution with different outlook to offer the valued customers, a comprehensive range of financial services and innovative products for sustainable mutual growth and prosperity. The sponsors are reputed personalities in the field of trade, commerce and industries.

The Bank is being managed and operated by a group of highly educated and professional team with diversified experience in finance and banking. The Management of the bank constantly focuses on understanding and anticipating customers’ needs. The scenario of banking business is changing day by day, so the bank’s responsibility is to device strategy and new products to cope with the changing environment. Jamuna Bank Ltd. has already achieved tremendous progress within only eight years. The bank has already ranked as one of top quality service providers & is known for its reputation.

At present the Bank has real-time centralized Online banking branches (Urban & Rural) throughout the Country having smart IT-Backbone. Besides these traditional delivery point, the bank has ATM of its own, sharing with other partner banks & Consortium throughout the Country.

The operation hour of the Bank is 10:00 A.M. To 6:00 P.M. from Sunday to Thursday with transaction hour from 10:00 A.M. to 4:00 P.M. The Bank remains closed on Friday including government holidays.

3.2 Vision of JBL

To become a leading banking institution and to play a pivotal role in the development of the country.

3.3 Mission of JBL

The Bank is committed to satisfying diverse needs of its customers through an array of products at a competitive price by using appropriate technology and providing timely service so that a sustainable growth, reasonable return and contribution to the development of the country can be ensured with a motivated and professional workforce.

3.4 Strategies of JBL

- To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund.

- To strive for customer satisfaction through quality control and delivery of timely services.

- To identify customers credit and other banking needs and monitor their perception towards our performance in meeting those requirement.

- To review and update policies, procedures and practices to enhance the ability to extend better services to customers.

- To train and develop all employees and provide adequate resources so that customer needs car, be responsibly addressed.

- To promote organizational effectiveness by openly communicating company plans, policies, practices and procedures to all employees in a timely fashion

- To cultivate a working environment that fosters positive motivation for or improved performance

- To diversify portfolio both in the retail and wholesale market

- To increase direct contract with customers in order to cultivate a closer relationship between the bank and its customers.

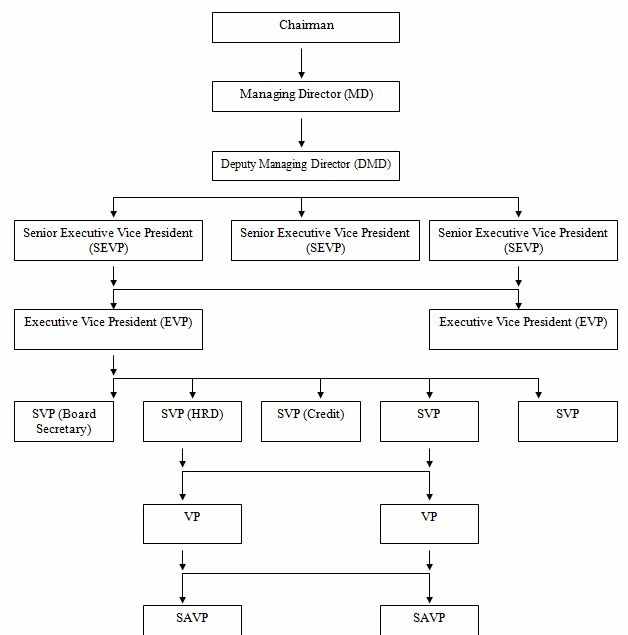

3.5 Organ gram of JBL

3.6 Corporate Governance

Board of Directors

The Board of Directors consists of 13 members elected from the sponsors. The Board of Dirc-7 supreme body of the Bank.

Executive Committee

All routine matters beyond the delegated powers of management are decided upon by or routed through the “Executive Committee, subject to ratification by the Board of Directors.

Audit Committee

In line with the guidelines of Bangladesh Bank, a three-member Audit Committee of the Board of Directors been formed to assists the Board in matters related to Audit and Internal Control System of the Bank.

Chairman

AI-Haj Nur Mohammed

Vice Chairman

Mr.Md. Sirajul Islam Varosha

Directors

Al-haj M. A. Khayer

Engr. A. K. M. Mosharraf Hussain Mr. Arifur Rahman

Mr. Golam Dastagir Gazi, Bir Protik Mr. Fazlur Rahman

Mr. Md.Tajul Islam

Mr.Md. Mahmuclul Hoque Mr.Md. Irshad Karim

Mr. Shaheen Mahmud

Mr. Mohammad Nurul Alam

Sponsor Directors Engr.

Md. Atiqur Rahman

Al-haj Md. Rezaul Karim Ansari Mr.

Md. Belal Hossain

Mr. Sakhawat Abu Khair

Mohammad Mr. M.N.H. Bulu

Mr. Farhad Ahmed Akand

Mr.Md. Ismail Hossain Siraji

Mr. Gazi Golam Murtoza

Mr. Kanutosh Majumder

Shariah Council

Professor Dr. Mustafizur Rahman Mawlana

Mufti Ruhul Amin Mawlana Abdur Razzak

Professor Mowlana

Md.Salahuddin Mr. M Azizul Huq

Managing Director

Mr. Mohammed Lakiotullah

Additional Managing Director

Mr.Md. Motior Rahman

Company Secretary

Mr.Md. Anwar Hossain

Auditors

M/s. G. Ki b ria & Co. Chartered Accountants

3.7 SWOT ANALYSIS OF JBL

| STRENGTHS | WEAKNESSES |

| • Experienced top management. | • Limited market share. |

| • Satisfactory capital base. | • Exposure to large loan‑ |

| • Low infection in loan | • Excessive dependency on term deposits. |

| exposure. | • Weak fund management. |

| • Prospective IT infrastructure. | • High cost of fund. |

| • Islamic Branch funds are not ring fenced. | |

| OPPORTUNITIES | THREATS |

| • Regulatory environment | • Increased competition in the market for |

| favoring private sector | quality assets. |

| Development. | • Supply gap of foreign currency. |

| • Credit card. | • Over all liquidity crises in money market. |

| • Small and medium enterprises. |

3.8 Products & Services

The products and services can be classifying in two ways & those arc.

- The deposit products & services

- The lending products & services

| Deposits products & services | Lending/Investment products & services |

| Corporate Banking | Hi-her Purchase |

| Personal Banking | Lease Finance |

| Online Banking | Personal loan for woman |

| Monthly Savings Scheme | Project Finance |

| I Monthly Benefit Scheme | i Loan Syndication |

| Double/Triple Benefit Scheme | Consumer Credit |

| Marriage Scheme | Import and Export. Handling Financing |

| Education Scheme | |

| Lakhpati Deposit Scheme | |

| Q-Cash ATM |

3.9 Corporate Banking

The motto of JBL’s Corporate Banking services is to provide personalized solutions to their customers. The Bank distinguishes and identifies corporate customers’ need and designs tailored solutions accordingly.

Jamuna Bank Ltd. Driers a complete range of advisory, financing and operational combining trade, treasury, investment and services to its corporate client groups coin transactional banking activities in one package. Whether it is a project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transition, there Corporate Banking Managers will offer you the accurate solution, their corporate Banking specialists will render high class service for speedy approvals and efficient processing to satisfy customer needs.

Corporate Banking business envelops a broad range of businesses and industries. Every one can leverage on our know-how in the following sectors mainly:

- Agro processing industry

- Industry (Import Substitute / Export oriented)

- Textile Spinning, Dyeing / Printing

- Export Oriented Garments, Sweater.

- Food & Allied

- Paper & Paper Products

- Engineering, Steel Mills

- Chemical and chemical products etc.

- Telecommunications.

- Information Technology

- Real Estate & Construction

- Wholesale trade

- Transport • Hotels, Restaurants

- Non Bank Financial Institutions

- Loan Syndication

- Protect Finance • Investment Banking

- Lease Finance • Hire Purchase • International Banking

- Export Finance.

- Import Finance

3.10 Personal Banking

Personal Banking of Jamuna Bank offers wide-ranging products and services matching the requirement of every customer. Transactional accounts, savings schemes or loan facilities from Jamuna Bank Ltd. make available to all a unique mixture of easy and consummate service quality.

They make every endeavor to ensure their clients’ satisfaction. Their cooperative & friendly professionals working in the branches will make your visit and enjoyable experience.

3.11 Online Banking

Jamuna Bank Limited has introduced real-time any branch banking onApril 05, 2005. Now, customers can withdraw and deposit money from any of its 30 branches located at Dhaka, Chittagong, Sylhet, Gazipur, Bogra, Naogaon, Narayanganj and Munshigonj. Their valued customers can also enjoy 24 hours banking service through ATM card from any of Q-cash ATMs located at Dhaka, Chittagong, Khulna, Sylhet and Bogra. All the existing customers of Jamuna Bank Limited will enjoythis service by default.

Marriage Deposit Scheme

Marriage of children, specially daughter is a matter of great concern to the parents. Marriage of children involves expense of considerable amount. Prudent parents make effort for gradual building of fund as per their capacity to meet the matrimonial expense of their children specially daughters. Parents get relief and can have peace of mind if they can arrange the necessary fund for marriage of their children, no matter whether they survive or not till the marriage occasion.

It can be a great help to the parents if there is any scope of deposit of a modest amount as per their financial capacity, which grows very fast at high rate of interest yielding a sizeable amount on maturity.

With this end in view JBL has introduced Marriage Deposit Scheme, which offers you an opportunity to build up your cherished fund by monthly deposit of small amount at your affordable capacity. Eligibility:

- Marriage Deposit account can be opened in the name of children below the age of 18-years along with legal guardian.

- For opening a marriage deposit account, maintenance a savings account with JBL is required.

Lakhpati Deposit Scheme

To become a lakhpati is a dream to most of the people of Bangladesh especially to the lower and lower middle class income group. We experience our expectations and wants are enormous in nature in our small span of life. To meet our deposit and wants we need right plan.

Keeping the above in mind JBL has introduced “Lakhopati Scheme” which has flexibility in report of maturity and monthly installment as per affordable capacity.

Millionaire Deposit Scheme

It is a dream for many small savers to become a Millionaire. The word ‘Millionaire’ is really exciting. This dream can be a reality if you have a calculated plan and strong determination. JBL has introduced ‘Millionaire Deposit Scheme’ which has flexibility in respect of period and monthly deposit as per your affordable capacity for giving a sum of Tk.1.00 (one) million i.e. Tk.10(ten) lac at a time.

Eligibility:

Millionaire Deposit account can be opened at any Branch of JBL

- For opening a millionaire deposit account, maintenance a savings account with JBL is required.

- Customer can deposit monthly installment through any of our online branches

- Understanding instruction system, Customer can deposit money automatically his accounts.

Kotipati Deposit Scheme

To become ‘Kotipati’ is simply a dream for the most of the populace of Bangladesh. It is realizable for high income group who have strong determination and savings habit. If you decide and plan to save money from your regular income, you can own Tk1.00 crore easily by making a planned savings. In this regard, JBL has introduced “Kotipati” Deposit Scheme” offering the savings plan fit to your income and to execute your dream to be a Kotipati by monthly deposit at your affordable capacity. You can take advantage of the “Kotipati Deposit Scheme” from JBL and plan for your golden future accordingly.

Eligibility

· Kotipati Deposit account can be opened at any Branch of JBL.

· For opening a Kotipati deposit account, maintenance a savings account with JBL is required.

Education Savings Scheme

Education is a basic need of every citizen. Every parent wants to impart proper education to their children. Education is the pre-requisite for socio-economic development of the country. As yet, there is no arrangement of free education to the citizens from the government level. As such, there should be pre-arrangement of fund to ensure higher education of the children. Otherwise higher education may be hindered due to change of economic condition, income of the parents at the future time when higher education shall be required. Today’s higher education is becoming expired day by day. Parents can get relief and can have peace of mind if they can arrange the necessary fund for higher education of their children. As such, JBL has introduced ‘Education Savings Scheme’ which offers you an opportunity to build up your cherished fund by monthly deposit of

small amount at your affordable capacity or initial lump sum deposit to yield handsome amount on a future date to meet the educational expenses. Under this Scheme you have the different attractive options to avail the future benefit i.e. withdrawal of the total amount accumulated in lump sum or withdrawing monthly benefit to meet educational expense keeping the principal amount intact or to withdraw both principal and accumulated profit monthly for a certain period.

Eligibility:

- Education Savings account can be opened in the name of children below the age of 18-years along with legal guardian.

- For opening a education savings account, maintenance a savings account with JBL is required.

3.12 Monthly Savings Scheme (MSS)

Savings is the best friend in bad days. Small savings can build up a prosperous future. Savings can meet up any emergences. JBL has introduced Monthly Savings Scheme (MSS) that allows saving on a monthly basis and getting a handsome return upon maturity. If anyone wants to build up a significant savings to carry out you’re cherished Dream, JBL MSS is the right solution.

3.13 Monthly Benefit Scheme (MBS)

Jamuna Bank Limited has introduced Monthly Benefit Scheme (MBS) for the prudent persons having ready cash and desiring to have fixed income on monthly basis out of it without taking risk of loss and without enchasing the principal amount. This scheme offers highest return with zero risk. Everyone can plan your monthly expenditure with the certain monthly income under the scheme.

3.14 Double/Triple Growth Deposit Scheme

For people who have cash flow at this moment and want to get it doubled/tripled quickly JBL has introduced Double/Triple Growth Deposit Scheme that offers to make double/triple money within 6(six) years and 9.5 (nine and a half) years respectively resulting a high rate of interest.

3.15 Q-Cash Round The Clock Banking

Jamuna Bank Q-Cash ATIM Card enables the costumers to withdraw- cash variety of banking transactions 24 hours a day. Q-Cash ATMs are conveniently located covering major shopping centers, business and residential areas in Dhaka and chittagong. ATMs in Sylhet, Khulria and other cities will soon start be introduced. The network will expand to cover the whole country within a short span of time.

With customers Jamuna Bank Q-Cash ATM card they can:

- Cash withdrawal Round The Clock from any Q-Cash logo marked ATM booths.

- POS transaction (shopping malls, restaurants, Jewell Aries etc)

- Enjoy overdraft facilities on the card (if approved)

- Utility Bill Payment facilities

- Cash transaction facilities for selective branches nationwide

- ATM service available in Dhaka and Chittagong Withdrawal allowed from ATM’s of Jamuna Bank Ltd., AB Bank, The City Bank, Janata Bank, IFIC Bank, Mercantile Bank, Pubali Bank, Eastern Bank Ltd. respectively

- And more to come Is Q-Cash

3.16 Hire Purchase

Hire purchase is a type of installment Credit wider which the Hire purchase agrees to take goods on hire at a stated rate which is inclusive of the repayment of principle as well as interest for adjustment of the loan within a specified period.

3.17 Lease Finance

Lease means a contractual relationship between the owner of the asset and its utter- fur a specified period against mutually agreed upon rent. The owner is called the Lessor and the user is called the Lessee.

Lease finance is one of the most convenient source of financing of assets viz machinery, equipment vehicle, etc. The user of the assets i.e. Lessee is benefited through tax advantages, conserving working capital and preserving debt capacity. Moreover, Lease is an off-balance sheet item 1.e lease amount is not shown in the balance sheet of the lessee and does not affect borrowing capacity.

Leasing enables the lessee to avail the services of a plant or equipment without making the investment or incurring debt obligation. The Lessee car, use the asset by paying a series of periodic amounts called “lease payment” or “lease rentals” to the owner of the asset at the predetermined rates and generally in advance. The payments may be made monthly or quarterly.

Jamuna Bark Ltd., the highly capitalized private Commercial 1 Bank in Bangladesh has introduced lease finance to facilitate funding requirement of valued customers & growth of their business houses.

3.18 Personal loan for women

Goal

To make financially sound and solvent surd self dependent the women.

Three categories of women are under this loan-

Self Employed Women

Working Women

House Wife

The salient features of the scheme are as follows:

| 1. | Name of the Scheme | Personal Loan for Women |

| 2. | Target Market | Working Women Self employed women Housewives with reasonable income of the spouses |

| 3. | Purpose(s) | A personal loan scheme to Women for purchasing: Household appliances for personal use Buying equipment/ accessories for Business use Hospitalization or other emergency medical needs, House renovation, Office equipment, Marriage in the family, Holiday expenses, Educational/professional training of the family members. Purchase of personal Computer.

|

| 4. | Age Group | Minimum 18 years Maximum 57 years |

| 5. | Minimum Service | 1 year |

| 6. | Minimum Income | Working Women – Tk. 8,000/= to Tk. 10,000/= per month Self employed Women – Tk. 20,000/= to Tk. 25,000/= per month Housewives – Tk. 15,000/= per month (Husband’s income/salary) |

| 7. | Minimum Loan Size | Tk. 25,000/= (Taka Twenty Five Thousand only) |

| 8. | Maximum Loan Size | Tk. 300,000/=(Taka Three Lac only) |

| 9. | Down payment | Nil |

| 10. | Loan Term | From 12 months to 36 months |

| 11. | Disbursement | · Payment shall be made directly by the Bank to the vendor or to the customer, as may be determined by the bank, depending upon the purpose of the loan . |

| 12. | Security | · Two Personal Guarantees with attested photograph acceptable to the Bank · In certain cases the Bank may take hypothecation of the purchased assets. · Demand Promissory Note & other Documents as per Scheme. · Four Cheques each covering three installment amount for twelve months loan period. Additional cheque covering the rest installment amount of the period.

|

| 13. | Debt- Burden Ratio | Monthly loan installment cannot exceed 40% of customer’s take home salary. |

| 14. | Proof of Income | By submitting the following: · Bank statement for last 6 months · Salary Statements duly certified by the employer · House rent agreement in case of direct income from other source |

Table-3: Salient features of the scheme

3.19 Project Finance

Project loan is considered as long term investment of the bank. If the period is helpful to improve the economy and has a wide market then the bank thinks about giving project loan. To give this kind of lona the bank observes the willingness of the customer, his capacity and his ability to run the project. Having obtained this kind of information the bank makes a credit report about the customers loan proposal. Interest rate on loan varies from project Ratio of investment of customer and bank varies from customer to customer and the customer’s relationship with the bank.

3.20 Loan syndication

Bank cannot invest more then 15% of its paid up capital on one individual. When the loan amount exceeds 15% of its paid up capital then the bank share the loan with other bank for giving one individual and this is call loan syndicate.

3.21 Consumer Credit

Consumer credit scheme is relatively new field of micro-credit activities. People with limited income can avail of this credit facility to buy any household effects including car, computer and other consumer durable. It is a special credit scheme and the customers allow the loan on soft terms against personal guarantee and deposit of specified percentage of equity. The loan is repayable by monthly installment within a fixed period.

3.21 Import and Export handling and financing

3.21.1 import Financing

Is the most important method of import -financing International trade take place between sellers and buyers located in different countries. The parties to a trade transaction are not always known to each other. Even if they are known to each other the seller may not have full confidence in the carried worthiness of the buyer or the buyer may not like to pay before he actually receives the goods. In letter of credit the bankers credit worthiness is substituted for the credit worthiness of the importer. Under a bank- cards letter of credit, the issuing bank gives a written undertaking on behalf of the buyer that the bank will honor the obligation of

payment or expectance as the case may be on presentation of stipulated documents. As the request of the importers bank issue the letter of credit at a merging by the govt. instruction. Bail: does not generally issue the letter of credit less then 50% margin. JBL follow the margin prescribed by the government strictly.

3.21.2 Export Financing

The Exporter needs finances at various stages, some at pre-shipment stage and the other at the post shipment stage.

Definition of Foreign Exchange

An ordinary citizen usually perceives “foreign exchange” as foreign money. The term foreign exchange is used in a broader sense. It can simply be defined as a ‘process of conversion of one currency into another’. The foreign exchange regulation act refers that foreign exchange means foreign currency and includes any instrument drawn accepted, made or issued under clause (13) of article 16 of the Bangladesh Bank order, 1972, all deposits, credits and balances payable in any foreign currency and any draft, travelers cheques, letter of credit and bill of exchange expressed or drawn in Bangladesh currency but payable in any foreign currency.

Export at a Glance:

L/C Open

Beneficiary place documents

Lien jBL

Back to back L/C

Raw material procuring

Production

Shipment

Negotiation

Documentation Forwarding

Claim re-imbursement

Disbursement of fund

Card Division

Card Division introduces to the customers with a variety of products. Our Card Division continuously meets the challenges of developing new products and services to match the specific requirements of customers.

Card Division issues both VISA Debit Cards and VISA Credit Cards. VISA is the renowned Card brand in the earth. Jamuna Bank Limited is a principal member of VISA Worldwide. Remittance Cell is another successful wing of the Card Division. Our product range includes:

VISA Debit Cards – You can now avail the convenience of VISA Debit Card. It is the easiest and the most secured way of utilizing your money for 24/7 retail purchases as well as cash withdrawal.

VISA Credit Cards – The JBL Credit Card gives you a fast, convenient and reliable way to pay, 24 hours a day, wherever you are in the world.

VISA Classic

VISA Gold

International Credit Cards – JBL International Credit Cards (VISA) allows you flexibility and convenience when you travel internationally. The VISA International card entitles you to exclusive discounts worldwide.

VISA Dual (Gold)

To offer our customers a greater banking convenience, we have introduced many modern banking facilities and some are under developments that include:

With our large ATM network including non-branch ATM across the country you have the privilege of round the clock withdrawal and other account services at your convenience. · Customer can enjoy higher ATM withdrawal limit each day.

No fees on retail purchase and can use our Credit Cards at thousands of retail outlets around the world. · There will be no commission charge on the endorsement of foreign currency for self and spouse.

Our customer service agents are available on 365 days to offer assistance for you. Just connects to our agents and satisfy your banking needs anytime of a day or any query that you might have.

Connect with us:

You’re most welcome to drop by any of our branches or simply call at (88) 01713 067771, (88 02) 956 4587, (88 02) 956 2773 or (88 02) 957 0912 to ask for it. Our Sales Executive is always available at your doorsteps.

Terms and conditions apply.

International Trade Finance

International Trade forms the major business activity undertaken by Jamuna Bank Ltd. The Bank with its worldwide correspondent network and close relationships with key financial institutions provides an extensive trade services network to handle your transactions efficiently. Our key branches throughout the country and Offshore Banking Unit (OBU) are staffed by personnel experienced in International Trade Finance. These offices are the focal point for processing import and Export transactions for both small and large corporate customers. We offer a complete range of Trade Finance services. Our professionals will work with you to develop solutions tailored to meet your requirements, through mobilizing our full range of trade services locally, and drawing on our global resources. We can offer you professional advice on all aspects of International Trade requirements, namely:

Issuing, advising and confirming of Documentary Credits.

Pre-shipment and post-shipment finance.

Negotiation and purchase of Export Bills.

Discounting of Bills of Exchange.

Collection of Bills.

Foreign Currency Dealing etc.

Offshore Banking Services

Jamuna Bank Limited offers the following range of Offshore Banking services :-

Foreign Currency Deposits (Non Resident entities and NRBs),

Loans in Foreign Currencies,

Credit Facilities including Trade Financing,

Negotiation / Purchase of Export Bills.,

Discounting of Export Bills.

Corporate Treasury Services etc.

List of Foreign Correspondents

To provide International Trade related services we have Correspondent Banking relationship with 728 locations of 207 world reputed Banks throughout the world having substantial credit line to facilitate trade finance activities. Our main Correspondent Banks are:

Commerzbank AG, Bank of China, BHF Bank, BNP Paribas, KBC Bank NV, Citibank N.A., Standard Chartered Bank, Bank of New York, Bank of Nova Scotia, Duetche Bank, Habib American Bank, Habib Bank AG Zurich, Bayerische Hypo Vareins Bank

HSBC, Woori Bank, Bank Of America, Mashreq Bank PSC, Nordea Bank AB, Royal Bank of Canada, UBS AG, Union De Banques Arabes ET, Francaises, Wachovia Bank NA, Forties Bank S.A/NV, Svenska Handlesbanken, Bank of Ceylon, Banca Toscana, ABN Amro Bank, Commonwealth Bank of Australia, Danske Bank A/S. Absa Bank Ltd., Agricultural Bank of Chaina, Banca Intesa SPA, Banca Italo Albanese, Banca Popolare Commercio E Industria SPA, UniCredit Group, Commonwealth Bank of Australia, Bank Madiri (Europe), Bank of Cyprus, Bank of Bahrain and Kuwait, Bank of Jordan Ltd, Blue Nile Bank, Commercial Bank of Kuwait, Commercial Bank of Qatar Ltd., Development Bank of the Philippines, Dexia Bank SA, EON Bank Berhad, First International Merchant Bank PLC., Foreign Trade Bank of North Korea, Foreign Trade Bank of Vietnam, Hiroshima bank, HVB, Hungary RT, ICICI Bank, Industrial and Commercial Bank of China, ING Bank NV, Islamic Bank of Yemen and for Finance & Investment, Korea Exchange Bank, National Commercial Bank, Shinhan Bank, State Bank of India (Canada) Bank of Tokyo Mitshubishi UFG, UBAE Italy, FIM Bank, United Bank of India, Bank of Bhutan, Allied Bank Philippines, National Australia Bank Ltd, Bank Of Shanghai, Bank of Communication, Mizuho Corporate Bank, Nordea Bank, UBI Banca, Intesa Sanapaoli SPA, Kookmin Bank, Korea Exchange Bank, Bank of Newyork, EON Bank Berhad, Development Bank of Philippines, Islamic Development Bank, Asian Development Bank, Abudhabi Commercial Bank, Dubai Islamic Bank etc.

NRB- Banking & Foreign Remittance

Jamuna Bank Ltd is one of the fast growing private commercial bank in the country having wide branch & associate network throughout the Country. All the branches are running with real-time Online and ATM facilities to settle their transaction from remote areas. We have dedicated NRB Banking Dept. to ensure personalized services to the valued customers at branch & Head Office Level.

We have an admirable Remittance Tie-up with a good number of world renowned Exchange Houses and Banks throughout the World to facilitate the Remittance services to the Beneficiaries. Besides our 67 branch network and 1,500 ATM outlets (own & shared) throughout the Country, we have also a strong Remittance Settlement/distribution Network with different associate Banks, NGOs, Post Office & BEFTN (Bangladesh Electronic Fund Transfer Network) covering more than 8000 remote locations throughout the Country for providing following services:

• Instant Cash/Spot Cash/ Over the Counter payment (OTC) at all Branch counters of Jamuna Bank Ltd.

• Direct Account Credit of Jamuna Bank Ltd within a minute.

• Account Credit to the Beneficiaries of 7,854 Branches of all the Banks on the same day under BEFTN throughout the Country.

• Home delivery of remittance proceeds.

Our main purpose is to cater to the needs of NRBs & their beneficiaries offering different products and services both deposit and investment like, FC A/C, NFCD A/C, FC Term Deposit, Wage earner’s development Bond, USD Premium Bond, USD Investment Bond, Govt. Treasury Bond, Investment in Capital Market through None Resident Investment Taka Account (NITA), Monthly Deposit Scheme, Monthly Income scheme, Double/ Triple growth deposit Scheme, Lakhopoti Deposit Scheme, Millionaire Deposit Scheme, Kotipoti Deposit Scheme, Education Savings Scheme, Marriage Deposit Scheme, Consumer Credit, etc.

Prioritizing the needs of NRBs, we are in process to offer different personalized products & services by establishing JBL own Exchange Houses in different Countries like UK, USA, Malaysia, Singapore, Italy, Spain, Australia, Japan, etc.

We have wide range of Correspondent Banking Network & Remittance drawing arrangement with different International reputed Banks & Money Transfer Companies/Exchange Houses throughout the world to facilitate Bangladesh bound Remittance Globally. We value our customers to provide prompt & efficient services offering best competitive price for their hard-earning Foreign Currencies.

List of our Major Money Transfer Companies & Exchange Houses with services:

| Sl No. | Name of the Exchange House | Location | Offered Services |

| 1 | Western Union Money Transfer | Global | Instant Cash |

| 2 | Money Gram Payment System | Global | Instant Cash |

| 3 | Xpress Money Services Ltd | Global | Instant Cash |

| 4 | Placid NK Corporation | Global | Instant Cash & Account Credit |

| 5 | Home Link Remit (UK) Ltd | UK | Instant Cash & Account Credit |

| 6 | Money Link U.K. Ltd | UK | Instant Cash & Account Credit |

| 7 | Raffles Exchange | UK | Instant Cash & Account Credit |

| 8 | Fast Remit | Malaysia | Instant Cash & Account Credit |

| 9 | Rumana Money Services | UK | Instant Cash & Account Credit |

| 10 | ZENJ Exchange Co. (Turbo Cash) | Bahrain | Instant Cash & Account Credit |

|

For any query and assistance please contact: NRB Banking Dept. International Division, Head Office, 3, Dilkusha C/A, Dhaka, Bangladesh. Tel: +88 02 9570912, +88 02 9555141, Ext: 115, 124. Cell: +88 01730430982, email: nrbbanking@jamunabank.com.bd |

Table-4: Major Money Transfer Companies

REAL ESTATE FINANCING

Home ownership is a basic need and a dream of every individual. Since housing industry plays a vital role in the national economy, our bank has come forward for Real Estate financing for Individual as well as Developers. The main objective of Real Estate Financing is to promote Real Estate Developers and Individuals.

Scope of Real Estate Loan:

• For Construction of Residential Building [CRB]

• For Construction of CommercialBuilding [CCB]

• For Flat Purchase [FP]

• For Building Purchase [BP]

• For Developers [DEV]

Purpose:

· Construction / Extension / Renovation of Residential / Commercial Building.

· Purchase of Building /Flat /Office Space /Chamber /Shops.

Eligibility:

· Salaried Individuals and Professionals

· Self -Employed professionals

· Businessman

· Wage Earners or other professional serving abroad

Maximum Age Limit: 70 [Seventy] years at the end of loan tenor.

Minimum Income :

· Net Income/Take home salary will be at least Tk.40,000/-[forty thousand] per month.

Maximum Loan Size :

· For Flat Purchase Tk.75.00 (seventy five) lac

· For Building Purchase/Construction of Residential Building Tk.100.00 (one hundred) lac

Maximum Loan Tenure : Up-to 15 (fifteen) years including 01(one) year grace period.

Maximum Loan Ratio:

· 50% of total Purchase Price for Flat / Building.

· 60% of total Construction cost for Residential/Commercial Building.

Requirement:

· Registered Mortgage and Original Title Deed.

· Registered Irrevocable Power of Attorney (RIPA) in favor of JBL.

· Documents stated in the sanction advice.

Credit Facilities

The main focus of Jamuna Bank Ltd. Credit Line/Program is financing business, trade and industrial activities through an effective delivery system.

- Jamuna Bank Ltd. offers credit to almost all sectors of commercial activities having productive purpose.

- The loan portfolio of the Bank encompasses a wide range of credit programs.

- Credit is also offered to major thrust sectors, as earmarked by the govt., at a reduced interest rate to develop frontier industries.

- Credit facilities are offered to individuals including housewives, businessmen, small and big business houses, traders, manufactures, corporate bodies, etc.

- Loan is provided to the rural people for agricultural production and other off-farm activities.

- Loan pricing system is customer friendly.

- Prime customers enjoy prime rate in lending and other services.

- Quick appreciation, appraisal, decision and disbursement are ensured.

- Credit facilities are extended as per guidelines of Bangladesh Bank (Central Bank of Bangladesh) and operational procedures of the Bank.

Shop Finance Scheme

Objectives:

01. To enable the small business community to run the business smoothly

02. Facilitating expansion of the existing businesses

03. To improve the banking habit of self employed persons

04. To diversify bank’s lending to Small & Medium Enterprises (SME) which

are considered as less risky and help community developments. It may be

noted down that the government is also encouraging investment in SME sector.

Categories of eli gible business:

i) Grocery/departmental/whole sale store

ii) Confectionary/bakery (owned by the bakers)

iii) Stationary shops

iv) Cloth materials & small local garment traders

v) Shoe makers/shops

vi) PVC & plastic product traders/small manufacturers

vii) Tiles/sanitary items retailers

viii) Computer/Photostat/Cyber Café.

ix) Electrical & electronic items retailers

x) Pharmacy

xi) Gift shop/cosmetics shops

xii) Restaurant/fast food joints

xiii) Hardwire shops

xiv) Glass/ceramic retail outlets

xv) Sports kit retailers

xvi) Photo studio

xvii) Rod, Cement & C.I. Sheet (Tin) Shop

xviii) Engineering Workshop

xix) Fertilizer & Pesticide shop

Maximum Loan Amount:

1) Up to a maximum of 10.00 lac in single case or 60% of possession value (distress value to be considered) whichever is lower. However, loan size will depend on creditworthiness of the borrower and the decision of the sanctioning authority.

2) Branch Manager must verify the amount of possession money actually paid before recommending such proposal.

Tenure of the loan limit:

Minimum 01 year – Maximum 03 years from the date of disbursement of the loan

Eligibility criteria:

The applicant must fulfill the following criteria to be eligible for loans and advances under the scheme:

i) Shop owner must run the establishment himself, having at least three years of successful business experience

ii) Valid lease deed for a minimum period of 03 years up to 05 years

iii) Satisfactory conducted deposit account with JBL for minimum 03 months.

iv) To deposit the daily sales proceeds in the account maintained with JBL

v) Agree to abide by credit rules & regulations of JBL

vi) Furnishing net-worth of the applicant/client .

vii) Clean CIB

viii) The bank reserves the right to accept or reject any application without assigning any reason whatsoever.

ix) The intending borrower /loanee shall apply through the letter head of the business firm or through a plain paper requesting the branch manager for sanction of loan under the Shop Finance Scheme

Security:

i) Simple deposit of valid lease deed of agreement of the shop.

ii) A tripartite agreement to be signed in between leaseholder/shop owner/Bank- to the effect that the leaseholder cannot rent out or transfer the leased property without the written consent of the Bank.

iii) The lease deed between the landlord and the borrower must be duly executed & the original lease deed should be kept in the Bank as part of document.

iv) Lease must contain provisions enabling the landlord to forfeit the lease and enable the bank to enforce a right to sell the possession of the shop to liquidate the default debt (if any).

v) Letter of disclaimer by the landlord to facilitate the bank to liquidate the default loan (if any)

vi) Equal numbers of post dated cheques covering amount of each loan installment

Insurance

All borrowing customers’ inventory i.e. Stock-in-trade will be insured against Fire, Rsd & other risks with the Bank’s mortgage clause cost of which will be borne by the shop owner/client/borrower.

Repayment Schedule:

Repayment schedule should be as under:

i) In case of 01 year, 10 monthly installments for the loan limit up to Tk. 3.00 lac with 02 month

grace period from the date of disbursement

ii) In case of 02 year, 22 monthly installments for the loan limit up to Tk.6.00 lac with 02 month

grace period from the date of disbursement

iii) In case of 03 year, 34 monthly installments for the loan limit above Tk.6.00 lac with 02 month grace period from the date of disbursement

Lease Finance

Lease means a contractual relationship between the owner of the asset and its user for a specified period against mutually agreed upon rent. The owner is called the Lessor and the user is called the Lessee.

Lease finance is one of the most convenient source of financing of assets viz machinery, equipment vehicle, etc. The user of the assets i.e. Lessee is benefited through tax advantages, conserving working capital and preserving debt capacity. Moreover, Lease is an off-balance sheet item i.e lease amount is not shown in the balance sheet of the lessee and does not affect borrowing capacity.

Leasing enables the lessee to avail the services of a plant or equipment without making the investment or incurring debt obligation. The Lessee can use the asset by paying a series of periodic amounts called “lease payment” or “lease rentals” to the owner of the asset at the predetermined rates and generally in advance. The payments may be made monthly or quarterly.

Jamuna Bank Ltd., the highly capitalized private Commercial Bank in Bangladesh has introduced lease finance to facilitate funding requirement of valued customers & growth of their business houses.

Lease Items

· Vehicles like luxury bus, Mini bus ,Taxi cabs cars, Pick-up, CNG three wheeler etc .

· Factory equipment.

· Medical equipment

· Machinery for Agro Based Industry

· Construction equipment

· Office equipment

· Generators, Lift & Elevators for commercial place.

SWIFT

Jamuna Bank Limited is the member of SWIFT (Society for Worldwide Inter-bank Financial Telecommunication). SWIFT is a member owned co-operative, which provides a fast and accurate communication network for financial transactions such as Letters of Credit, Fund transfer etc. By becoming a member of SWIFT, the bank has opened up possibilities for uninterrupted connectivity with over 5,700 user institutions in 150 countries around the world.

SWIFT No.: JAMUBDDH

Trading of Government Treasury Bond & Other Govt. Securities

Jamuna Bank Limited has been nominated as a Primary Dealer by the Bangladesh Bank for trading 5 years & 10 Years Treasury Bonds and other Government Securities.

1. Eligibility criteria:

(i) Individuals and institutions resident in Bangladesh, including provident funds, pension

funds, bank and corporate bodies shall be eligible to purchase the BGTBs.

(ii) Individuals and institutions not resident in Bangladesh shall also be eligible to purchase the BGTBs, with coupon payment and resale/redemption proceeds transferable abroad in foreign currency subject to fulfillment of conditions as mentioned in the Bangladesh Govt. Treasury Bond Rules-2003.

2. Loan facility:

JBL offers loan upto 95% of the present value of the bond/other securities against lien of the above instrument for their customers.

Online Banking

Jamuna Bank Limited has introduced real-time any branch banking on April 05, 2005. Now, customers can withdraw and deposit money from all branches located throughout the Country. Our valued customers can also enjoy 24 hours banking service through ATM card from any of Q-cash ATMs located at different location throughout the Country..

All the existing customers of Jamuna Bank Limited will enjoy this service by default.

Key features:

- Centralized Database

- Platform Independent

- Real time any branch banking

- Internet Banking Interface

- ATM Interface

- Corporate MIS facility

Delivery Channels:

- Branch Network

- ATM Network

- POS (Point of Sales) Network

- Internet Banking Network

Branches Network

Dhaka Zone

In Dhaka zone there is total 38 branches of Jamuna Bank Ltd

Chittagong Zone

In Chittagong zone there is total 12 branches of Jamuna Bank Ltd

Rajshahi Zone

In Rajshahi zone there is total 13 branches of Jamuna Bank Ltd

Sylhet Zone

In Sylhet zone there is total 04 branches of Jamuna Bank Ltd

Comilla Zone

In Comilla zone there is total 05 branches of Jamuna Bank Ltd

Barisal Zone

In Barishal zone there is total 06 branches of Jamuna Bank Ltd

Khulna Zone

In Khulna zone there is total 04 branches of Jamuna Bank Ltd

4.1 Loans and Advances

This section lends the fund what the bank mobilizes through its various deposit accounts This is the second function of banks two generic function -deposit mobilization and credit creation. The majorpart of banks income is derived from credit and since the banks credit is customer’s fund, bank takes extreme caution in lending.

4.2 Sanctioning Loans and Advance

To have a clear idea about the credit management of JBL the following points are essential.

a. Credit policy of the Bank

b. Credit Sanctioning Authority of JBL and

c. Processing and Screening of credit proposal

4.1.1 Credit Policy of the Bank

JBL Credit Policy contains of total macro-economic development of the country. as a whole by way of providing financial support to the trade, commerce and industry. Throughout its credit operation JBL goes to every possible corners of the society. They are financing large and medium scale business house and industry. At the same time they also take care entrepreneur through its operation of lease finance and some micro credit, small loan scheme etc. The bank has come up with a scheme where women will be 91-verL financial support for their self employment and development.

4.1.2 Credit Sanctioning Authority of JBL

Delegated powers are expected to be exercised by the authorized executives sensibly keeping the bank’s interest in mind. In exercising the power so delegated authorized

Executive’s shah also have credit restriction, tools and regulations .as governed by Banking Company Act, Bangladesh Bank, and other usual credit norms. However, the following guidelines are laid down before the executives of JBI. For exercising the delegated power

- The borrower must be a man of integrity and must enjoy good reputation in the

Market.

- The borrower must have the capacity and capability for utilizing credit. Properly and profitably.

- The enterprise of the borrower must be viable and profitable i.e. proposal of (lie borrower must be evaluated properly and carefully so as to ascertain its profitability. The enterprise must generate sufficient fund for debt and servicing.”

- A customer to whom credit is to be allowed should be faras possible within the command area. .

- No sanctioning officer can sanction any credit to any of his near relatives and to any company where his relatives have financial interest.

4.1.2.1 Tools for Appraisal Credit

The 10 C’s of Good and Bad Loan

In addition to the formal credit appraisal, the credit an official of JBL tries to judge the possible client based on some criteria. These criteria are called the C’s of good and bad loan. These are described below:

1. Character: Make sure that the individual or company they are lending has outstanding integrity.

2. Capacity: Make sure that the individual or company they are lending has the capability of repaying the loan.

3. Condition: Understanding the business and economic conditions that whether it will change after the loan is made.

4. Capital: Make sure that die individual or the company they are lending has in appropriate level of investment in the company.

5. Collateral: Make sure that there is a second way out of a credit but do not allow that to drive the credit decision.

6. Complacency: Official do not rely on past. They remain alert every time whether any mistake is taking place or not.

7. Carelessness: They believe that documentation, follow up and consistent monitoring are essential to high quality loan portfolio.

8. Communication: They share credit objectives and credit decision making both vertically and laterally within the bank.

9. Contingencies: Make sure that they understand the risk, particularly the downside possibilities and that they structure and price the loan consistently with the understanding.

10. Competition: They do not get swept away by what others are doing.

Lending Risk Analysis (LRA)

Lending Risk Analysis is a financial tool to analyze the risk associate in a loan proposal. According to Bangladesh Banks order every bank has to conduct LRA. For every loan amounting Tk. I Core and above. JBL is frequent user of this technique.

4.1.2.3 SWOT Analysis

It is a technique used by the credit officers to evaluate credit proposal submitted by the company especially by the production concern. Here,

S stands for Strength

W stand’s for Weakness

0 stands for Opportunity

T stands for Threat

Strength

It analyzes the inherent of the company, resilience, and brand loyalty, endowment etc. Weakness this analyzes the inherent weakness of a company, such as management, supply risk etc.

Opportunity

This analyzes the opportunity, which will be available to a company in a near future, such as tax incentives export credit facilities etc.

Threat

It analyzes the threats, which the company may face such as legal barriers withdrawals of tax exemption and international law, withdraw of most favorable nation (MFN) and GSP facilities etc.

4.1.2.5 Credit Monitoring and supervision Cell

JBL is a unique characteristic in its loan management to make sure that there will be no bad loan in its-loan portfolio; JBL established a loan monitoring and supervision cell headed by a First Assistant Vice President. He along with other official frequently visits customer premises or business whether loan amount, which is taken, is used properly or not. Sometimes customer need more fund or ether types of facilities to run business profitably, then the monitoring authority takes necessary steps to meet customer’s need.

4.1.2.6 COMPUTATION CREDIT RISK GRADING

The following step-wise activities outline the detail process for arriving at credit risk grading.

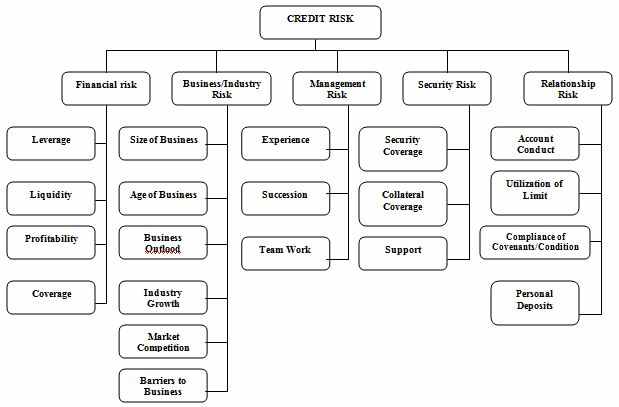

Step I : Identify all the Principal Risk Components

Credit risk for counterparty arises from an aggregation of the following: Financial Risk

- Business/Industry Risk

- Management Risk

- Security Risk

- Relationship Risk

Each of the above mentioned key risk areas require be evaluating and aggregating to arrive at an overall risk grading measure.

a) Evaluation of Financial Risk:

Risk that counter parties will fail to meet obligation due to financial distress. This typically entails analysis of financials i.e. analysis of leverage, liquidity, profitability & interest coverage ratios. To conclude, this capitalizes on the risk of high leverage, poor liquidity, low profitability & insufficient cash flow.

b) Evaluation of Business/Industry Risk:

Risk that adverse industry situation or unfavorable business condition will impact borrowers’ capacity to meet obligation. The evaluation; of this category of risk looks at parameters such as business outlook, size of business, industry growth, market competition & barriers to entry/exit. To conclude, this capitalizes on the risk of failure due to low market share & poor industry growth.

c) Evaluation of Management Risk:

Risk that counter parties may default as a result of poor managerial ability including experience of the management, its succession plans and teamwork.

d) Evaluation of Security Risk:

Risk that the bank might be exposed due ‘:o poor quality or strength of the security in case of default. This may entail strength of security & collateral, location of collateral and support.

e) Evaluation of Relationship Risk:

These risk areas cover evaluation of limits utilization, account performance, conditions/covenants compliance by the borrower and deposit relationship.

Step II Allocate weight ages to principal Risk Components

According to the importance of risk profile, the following weitght ages are proposed for corresponding principal risks.

Principal Risk Components Weight:

- Financial Risk 50%

- Business/Industry Risk 18%

- Management Risk 12%

- Security Risk 10%

- Relationship Risk

Step III Establish the key parameters

Principal Risk Components: Key Parameters:

- Financial Risk Leverage, Liquidity, Profitability & Coverage Ratio

- Business/Industry Risk Size of Business, Age of Business, Business

Outlook,

Industry Growth, Competition & Barriers to Business

- Management Risk Experience, Succession & Team Work.

- Security Risk Security Coverage, Collateral Coverage and Support.

- Relationship Risk Account Conduct, Utilization of limit, compliance

of Covenants/conditions & Personal Deposit.

Step III Establish the key parameters

Principal Risk components: Key parameters: Weight:

- Financial Risk 50%

–Leverage 15%

-Liquidity 15%

-Profitability 15%

-Coverage 15%

- Business Industry Risk – 18%

-Size of Business 5%

-Age of Business 3%

-Business Outlook 3%

-Industry growth 3%

– Market Competition 2%

– Entry/Exit Barriers 2%

- Management Risk 12%

-Experience 5%

-Succession 4%

-Team Work 3%

- Security Risk 10%

-Security coverage 4%

-Collateral coverage 4%

-Support 2%

- Relationship Risk 10%

-Account conduct 5%

-Utilization of limit 2%

-Compliance of covenants/condition 2%

-Personal deposit 1%

Step V Input data to arrive at the score on the key parameters.

After the risk identification & weight age assignment process (as mentioned above), the next steps will be to input actual parameter in the score sheet to arrive at the scores corresponding to the actual parameters.

This manual also provides a well-programmed MS Excel based credit risk scoring sheet to arrive at a total score on each borrower. The excel program requires inputting data accurately in particular cells for input and will automatically calculate the risk grade for a particular borrower based on the total score obtained. The following steps are to be followed while using the MS Excel program.

a) Open the MS XL file named, CRG_SCORE_SHEET

b) The entire XL sheet named, CRG is protected except the particular cells to input data.

c) Input data accurately in the cells which are BORDERED & are colored YELLOW.

d) Some input cells contain DROP DOWN LIST for some criteria corresponding to the Key Parameters. Click to the input cell and select the appropriate parameters from the DROP DOWN LIST as shown below.

| |||

| |||

e) All the cells provided for input must be filled in order to arrive at accurate risk grade,

f) We have also enclosed the MS Excel file named, CRG_Score_Sheet in CD ROM for use.

The following is the proposed Credit Risk Grade matrix based on the total score obtained by an obligor.

| Number | Risk Grading | Short Name | Score |

| 1 | Superior | SUP | 0 100% cash covered |

| n Government guarantee | |||

| n International Bank guarantees | |||

| 2 | Good | GD | 85+ |

| 3 | Acceptable | ACCPT | 75-84 |

| 4 | Marginal/Watch list | MG/WL | 65-74 |

| 5 | Special Mention | SM | 55-64 |

| 6 | Sub-standard | SS | 45-54 |

| 7 | Doubtful | DF | 35-44 |

| 8 | Bad & Loss | BL | <35 |

Table-6: Credit Risk Grade Matrix

5.1.3 Processing and screening of Credit Proposal

There are some common regulations governed by Banking Company Act, 1991 Bangladesh Bank and the law of the State, which has to be followed strictly at the time of screening a credit proposal. In addition. Credit proposals are appraised critically by JBL credit officials from various angles to judge the feasibility of proposal.

The customer at the branch of the bank place credit proposals. When a customer comes with accredit proposal, the credit department officials of the branch make an open discussion with the customer on different issues of the proposal to judge.

Worthiness of tile proposal and customer. If theproposal scenes worthwhile in all aspect then the proposal is placed before credit committee of the bank. After threadbare discussion, if the committee agrees in principle the proposal is sanctioned as per the delegated business power of the branch.

However, if the magnitude of the proposal is beyond the delegated business power of the branch they forward it to the Head Office with, sanction of approval.

On receiving rile proposal, the Credit Division of Head Office places the proposal in the Head Credit Committee. The committee further analyzes proposals critically and if agree in principle they sanction the same as per delegated business power. Again if the merit and magnitude of the proposal is beyond the delegated business power of the Head Office Credit Committee or Managing Director forward proposal to the Board of the Bank with recommendation for approval.

If the proposal is found unviable at the branch level they decline the same from their desk. In the same way, proposals are also declined from the Head Office Credit Committee and from Board if it is not feasible.

4A.3A Securities

It is essential that the proposals define clearly thepurpose of. The sources of repayment. The agreed repayment schedule. The value of security (land, machinery security papers, bond, sanchay patra etc.) and thecustomer relationships consideration implicit In, The credit division.

Where the security is to be accepted as collateral for the facility all documentation relating to the security shall be in the approved from.

All approval procedures and required documentation shall be completed and ail securities shall be place prior to the disbursement of the facility.

For creation of mortgage on the property-A3L requires die following documents:

- Original sale deed favoring owner of the land.

- Certified copy of the sale deed of the previous owner of the same property.

- Duplicate Carson Receipt (DCR)

- Up to date rent receipt and Municipal Tax Receipt

- Certified copy of C.S.S A. and R.S. Khatians

- Up to date Non-Encumbrance Certificate

- Valuation Certificate

- Clearance from RAJUK/WORKS MINISTRY

- RAJUK approved plan of the building with the approval letter

- Photograph of the property from three different angles and the over of the property

- Site Plan/ Mouza Map

- Board Resolution for mortgaging property if the same belongs to any limited company.

The borrower is requested to submit the above-mentioned papers inoriginal for Verification by the Bar-1n lawyer and creation on the property intended to mortgage against advance.

4.2 Documentation

A document is a written statement of facts of proof. or evidence arising out of particular transaction, which on placement may bind the parties there to answerable and liable to the law for satisfaction of the charge in question.

The execution of documents in proper from and according to the requirements of the law is known as documentation. The documentation does establish a legal relationship between the lending bank and the borrower. The terms and conditions of loans and advances, the securities charged and the repayment schedule are recorded in writing Proper documentation is necessary to safeguard the future interest of the bank.

Documents are necessary for the acknowledgement of the debt by the borrower and charging of securities to the bank by him. Proper and correct documentation is essential not only for the safety of advance but also necessary for taking legal action against the debtors in case of non-repayment of dues. Depending on the types of loans and advances different documents are required. Such as

4.2.1 Documentation of Loan

1 Demand of Promissory (DP) Note

2 Letter of partnership (in case of partnership concern) or resolution of the board of Directors (in case of Limited concern)

3 Letter of Agreement

4 Letter of Disbursement.

5 Letter of Pledge (in case of pledge of goods)

6 Letter of Hypothecation (in case of hypothecation of goods)

7 Trust Receipt (in case –of LTR facility)

8 Letter of Lien and Ownership (in case of advance against share)

9 Letter of lien for packing credits (in case of packing credits)

10 Letter of lien (in case of advance against FOR)

11 Letter of Lien and transfer authority (in case of advance against PSP, SSP etc.

12 Legal documents for mortgage of the property (as drafted by legal advisor)

4.2.2 Documentation of Overdraft

1 Demand of Promissory (DP) Note

2 Letter of partnership (in case of partnership concern) or resolution of the board of Directors (in case of Limited concern)

3 Letter of Agreement

4 Letter of Continuity

5 Letter of Lien and Ownership (in case of advance against share)

6 Letter of Lien (in case of advance against FOR)

7 Letter of Lien and transfer authority (in case of advance against PSP, SSP etc,

8 Legal documents for mortgage of the property (as drafted by legal advisor)

4.2.3 Documentation of Cash Credit

- Demand of Promissory (D.P) Note.

- Letter of partnership (incase of partnership concern) or resolution of the board of Directors (in case of Limited Concern.

- Letter of Agreement

- Letter of Continuity

- Letter of Pledge (in case of pledge of goods)

- Letter of Hypothecation (in case of hypothecation of goods)

- Letter of Lien and Ownership (in case of advance against share)

- Letter of Lien (in case of advance against (FDR)

- Letter of Lien and transfer authority (in case of advance against PSP, SSP etc,

- Legal documents for mortgage of the property (as drafted by legal advisor)

4.2.4. Documentation of Bills Purchased

- Demand of Promissory (D.P) Note.

- Letter of partnership ( in case of partnership concern) or resolution of the board of Directors (in case of Limited Concern)

- Letter of Agreement

- Letter of Hypothecation of Bill

All required Documents as mentioned before should be obtained before any loan is disbursed. Disbursed of any credit facility requires approval of the component authority that should ensure before exercising such delegated authority that all the required documentation have been completed.

4.3 Credit Facilities Extended by JBL

The man functions of a commercial bank are tow:1) to take deposit and 2) to make advance. Making advance is the most important function of a bank. These expend the profitability of the bank. Moreover, Bank make advance out of the deposits to the public which are payable at demand. A Commercial Bank makes advances to different sectors for different purpose i.e. financing of trade and commerce, Export and import, industries Agriculture, Transport, House-Building etc.

4.4.1 CC Hypo (Cash Credit Hypothecation)

Cash Credit allowed against hypothecation of an asset is known as Cash Credit

(Hypo) of goods on which charge of lending bank is created.

For Cash Credit (Hypo) Bankers takes following precaution:

- The banker carefully verifies the stocks of the hypothecated assets and their market price

- Obtains periodical statement of stock duly signed by the borrower

- Ensure dial docks are duly insured against fire, burglary with bank clause

- Obtains sufficient collateral securities.

- Identify that whether the goods are ready saleable and whether they have good demand in the market.

Ensure the borrowers trustworthiness.

4.4.2 CC Pledge (Cash Credit Pledge)

Cash credit allowed pledge Of goods is known as “Cash credit (Pledge). For Cash Credit (Pledge) the borrower pledges his goods to the bankers as a security against the credit facility. The ownership of pledge goods remains with the pledged. The bank remains the effective control of the pledged goods. Pledged goods can be stored in the custody of borrower but under lock and key of the bank. Banks appointed guards are taken care of those goods round the clock. The banks delivered the pledged gods to the party by turns against payment.

For Cash Credit Pledge following points arc taken into consideration before allowing.

- Whether the quality of goods is ascertained.

- Whether the goods are easily saleable and those goods must have good demand in the market.

- The quality of goods is ensured. The goods cannot be perishable and will not deteriorate in quality as a result for short and long duration.

4.4.1 CC Hypo (Cash Credit Hypothecation)

Cash Credit allowed against hypothecation of an asset is known as Cash Credit (Hypo) In cash of hypothecation die borrower retains the ownership possession of goods on which charge of lending bank is created.

- For Cash Credit (Hypo) Bankers takes following precautions:

- The banker carefully verifies the stocks of the hypothecated assets and their market price

- Obtains periodical statement of stock duly signed by the borrower

- Ensure Mai stocks are duly insured against fire, burglary with bank clause.

- Obtains sufficient collateral securities.

- Identify that whether the goods are ready saleable and whether they have good demand in the market

- Ensure the borrowers trustworthiness.

4.4.2 CC Pledge (Cash Credit Pledge)

Cash Credit allowed against pledge of goods is mown as Cash Credit (Pledge) For Cash Credit (Pledge) the borrower pledges his goods to the banker as a security against the credit facility. The ownership of pledge goods remains with thepledged. The bank remains the effective control of borrower but under lock and key of the bank. stored in the custody of borrower but under lock and key of the bank. Banks appointed guards are take care of those goods round the clock. The banks delivered the pledged gods to the party by turns against payment.

For Cash Credit Pledge following points are taken into consideration before allowing.

- Whether the quality of goods is ascertained.

- Whether the goods are easily saleable and those goods must have good demand in the market.

- The quality of goods is ensured. The goods cannot be perishable and will not deteriorate in quality as a result for short and long duration.

- The borrower has the absolute title of goods.

- The prices of the goods have to steady and are not subject to violent change.

- Goods should be stored in the presence of a responsible bank office.

- Ensure that stocks are duly insured against fire, burglary, with bank clause.

- Stocks must be invocated regularly byresponsible bank office.

- The locks of the store are scaled and keys are kept in the bank.

4.4.3 Overdraft

The overdraft is always allowed on a special A/C operated upon cheques. The customers may be allowed a certain limit up to which he can overdraw within a specific period of time. In an overdraft A/C withdrawal and deposit can be made any number of times within the limit and prescribed period. Interested is calculated and charged only on the actual debit balances on daily product basis.

Overdraft are three types

- Temporary overdraft (TOD)

- Clean overdraft (COD)

- Secured overdraft (SOD)

4.4.3.1 Temporary overdraft (TOD)

Temporary overdraft (TOD) is allowed to honor cheques which is future dated for the valued client. Without any prior arrangement. This kind of facilities is provided for short time.

4.4.3.2 Clean overdraft (COD)

Sometimes Overdrafts are allowed with no other security except personal security of borrowers.

4.4.3.3 SOD Secured overdraft (SOD)

When Overdrafts are allowed against security is known as secured overdraft (SOD)

Purposes

- To businessman for expansion of their business.

- To contractors and suppliers for carrying construction works and supply orders.

- Lien on fixed/term deposits.

- Shares/Debentures/Protiraksha Sanchay Patra

- Insurance Policy.

- Mortgage on real estates and properties.

Securities

Interest Rate: 15 % per annum

Payment against Document (PAD)

Eligibility

PAD is generally granted to importer for import of goods.

Interest Rate: 16 % per annum

4.5.2Internal Bills Purchased (IBP)

This kind of arrangements is allowed for purchase of internal bills. Some times Contractors need money to his liquidity problem. To avoid thus kind of situation they want to take loan against their future dated cheque.

Eligibility

Internal Bills Purchased is usually provided for future dated cheque against some service charge before 21 days of the maturity date.

4.5.3 Loan against Imported Merchandise (LIM)

This is as similar as CC Pledge. But these loans are provided to the selected customers with internal contract.

Eligibility

These loans only fur old and some special customers.

4.5.3Loan against Trust Received (LTR)

Under this arrangement, credit is allowed against trust receipt and the exportable goods remain in the custody of exporter but he is required to execute a stamped export trust receipt in favor of the bank. Where the declaration is made that he holds Purchased with financial assistance of the bank lit trust for the ‘bank.

Eligibility

LTR is generally granted to exporter for exportation of goods.

Interest Rate: 16 % per annum.

5.5.4 Local/Foreign Documentary Bills Purchased (LDBP/FDBP)

Under this arrangement, credit is allowed for exporter for or exportable goods. Banks provide all the agency commission. Its pay back period is 21 days.

Eligibility

LDBP/FDBP is generally granted to exporter for exportation of goods.

Interest Rate: 16 % per annum

4.5.5 Letter of Credit

Issuing letter of credit is one of the important services for JBL. A letter of credit is a document authorizing by the bank for a specific amount of money. Two types of L/C is provided by JBL.

Demand Loan ABP Mack T o Back L/C) Demand Loan ABP (Deferred Payment, L/C)

Eligibility

This facility is given to the exporter/manufacturer /producer

Terms and Conditions

- It should stipulate the name of the loan/credit/grant.

- It should bear the name of the designed bank.

- Item mentioned in the LCA form must contain with the permissible item.

4.6.1 Hire Purchase