Executive Summary

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in

Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited

company on May 20, 1999 under the Companies Act, 1994. Its operation started on July 1, 2001 with a vision to be the market leader through to providing all sorts’ support to people in terms of promoting corporate, small entrepreneurs and individuals all over the Bangladesh.

BRAC Bank will be a unique organization in Bangladesh. The bank consists of major

divisions named

1) Corporate banking,

2) Retail banking,

3) Treasury,

4) Small & Medium Enterprise (SME).

At present the Bank operating its business by 151 branches 250 ATMs, 421 SME Unit Offices and 8,306 (as on 30 april 2011) human resources, BRAC Bank’s operation now cuts across all segments and services in financial industry. With more than 1 Million Customers, the bank has already proved to be the largest SME financier in just 10 years of its operation in Bangladesh and continues to broaden its horizon into Retail, Corporate, SME, Probashi and other arenas of banking. BRAC Bank is

the first local commercial bank that provides online banking service to its customers from the very beginning from its journey.

BRAC Bank, for the first time among local commercial banks, starts providing loan

facilities to small and medium trading, manufacturing and service oriented enterprises all over the country. The bank has already established its network in different areas of the country with assistance of BRAC. As an intern I was assigned to scrutinize the SME loan facility.

BRAC Bank is trying to develop economic condition of the country. So the bank provides

loan facility BDT 2 to 50 lacs to small and medium enterprise which is not to easy to access other banks/financial institutes. The bank has established 150 Zones and 421 unit offices all over the country. There is 1576 Customer Relation Officers (CRO), 150 Zonal Managers (ZM), 20 Territory Managers (TM) for providing door- to door services to the clients.

Till December 2010, the bank provides loan facilities to 3,000,000 (three million clients which amount is Tk 13,000 crores. Average loan size is Tk 4.62 lacs. The success of SME will largely depend on the selection of a business and man behind the business.

1.1Introduction

Praise to God, the creator and sustainer who has given me the strength and opportunity to complete my Internship Report on the topic of “SME Financing” By BRAC Bank Limited as a part of my completing MBA degree which reveals not only read but also realize the subject deeply and knowledge has no value. So it is very necessary to achieve practical knowledge and clear concept about the subject. The practical experience also helps the learners to gather new ideas and techniques. From this view the Business Administration Department of Daffodil International University has introduced an internship program in order to obtain practical knowledge related with the different fields of Business.

What is SME?

According to some bankers:

“If a trader borrows Taka 100 million, it can be mentioned as medium enterprise loan because of the definition,” said an official with the SME credit department of a private bank.

He said many banks have shown their loans up to Taka 150 million as SME credit, which exaggerated the disbursed figure.

So the central bank redefined SMEs and loan limits last year, and directed the banks to give priority to small enterprises and women entrepreneurs. The loan limit for small entrepreneurs was set at Taka 50,000 to Taka 5 million

For the medium enterprises no limit has been mentioned. The banks decide the amount for such entrepreneurs on the basis of need.

Proposed definition of the GoB:

Small Enterprise has less than 50 employees and / or less than 15 million Tk in Fixed Capital Investment Medium Enterprise has 51-99 employees and / or Fixed Capital Investments between 1.5 and 100 m Tak

BB Regulations for Small Enterprises:

Private entity with less than 60 employees for the Manufacturing Sector 30 employees for the Service Sector 20 employees for the Trade Sector

1) Service Sector: Total Assets (excluding lands and buildings) between

50,000 and tk. 3 million.

As a part of the Internship Program of Masters of Business Administration (MBA) course requirement, I was assigned Origination Department for doing my internship in the BRAC Bank Limited (BBL) for the period of 4 months starting from January 01, 2011 to April 30, 2011 located at head office, Dhaka.

My organizational supervisor was Ms. Farzana Sultana, Sr. Pricipal Officer & Manager Wholesale Loan Origination. My project is “SME Financing by BRAC Bank Limited” which was assigned by organizational supervisor of the said bank.

To full these criteria, I had to work in BRAC Bank Limited at Head Office. In this study and observation about four months I have gathered knowledge on ‘SME Financing by BRAC Bank Limited’.

After all this Internship Report may satisfy my honorable supervisor and respected teacher Prof. M Shahjahan Mina, Advisor-Daffodil International University.

1.2 Objectives of the Report:

Broad Objective:

To know in details of SME financing of the BRAC Bank Ltd.

Specific Objectives:

- To know the SME loan activities at BRAC Bank.

- To find out basic appraisal of SME loan.

- To know the enterprise selection criteria to provide SME loan.

- To know the terms and conditions of SME loan.

- To analyze the SME sector in Bangladesh.

- To know the success factor of SME banking at BRAC Bank Limited.

- To know the disbursement and recovery procedures of SME loans.

- To make some recommendations and conclusion to further the development of SME loan products of BRAC Bank Ltd.

1.3 Scope of the Study

The study will provide the scopes of knowing the followings:

The entire concept of SME loan.

Characteristic of SME loan as a sophisticated area of finance.

Recent performance level of the BRAC Bank SME loan in the country.

Entry of commercial banks into SME banking industry in Bangladesh.

Small entrepreneurs of rural -urban spectrum are enjoying the BRAC Bank loan facility without coming in the bank.

1.4 Methodology

The study uses both primary and secondary data. The report is divided

into two parts. One is the Organizational Part and the other is the Project Part. The

parts are virtually separate from one another.

The information for the Organizational part of the report was collected from both

secondary sources like books, published reports and web site of the BRAC Bank

Limited (www.bracbank.com). For general concept development about the bank

short interviews and discussion session were taken as primary source.

The information for the Project” Analysis of SME loan in BRAC Bank Limited”

both were collected from primary and secondary sources. For gathering concept of

SME loan, the Product Program Guideline (PPG) was thoroughly analyzed. Beside

this observation, discussion with the employee of the SME department and loan

administration division of the said bank was also conducted. More over a market

survey was conducted with a specific questioner. To identify the implementation,

supervision, monitoring and repayment practices, interview with the employee and

extensive study of the existing file was and practical case observation was done.

1.5 Limitations of the Study

The study succeeded in the middle of some limitations which are mention below:

It is not possible to collect the data, which are confidential BBL maintains very strict rules about providing their information. So it is quite difficult to collect all necessary date that are required to complete the report.

In reality it is hard to understand all the concepts and gain sufficient knowledge about the particular field within three or four months.Sufficient records, publications facts and figures are not available to complete the report, these hampers the scopes of real analysis.

Overview of the Organization (BBL):

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994. BRAC Bank will be a unique organization in Bangladesh. The primary objective of the Bank is to provide all kinds of banking business. At the very beginning the Bank faced some legal obligation because the High Court of Bangladesh suspended activity of the Bank and it could fail to start its operations till 03 June 2001. Eventually, the judgment of the High Court was set aside and dismissed by the Appellate Division of the Supreme Court on 4th June 2001 and the Bank has started its operations from July 01, 2001

The importance of financial intermediaries in the development of the overall economy of country cannot be described in short. From the inception of the civilization the banking sector dominate the economic development of a country by mobilizing the saving from the general people and channeling those saving for investment and thus helping economic development and growth. The importance of commercial banks after the ravage of the liberation war to develop a better economy was severally needed and it is needed now and will be required in future also. In time-to-time, Government of Bangladesh. Agreed to permit the private commercial banking in the country.

BRAC bank will be a knowledge-based organization where the BRAC Bank professionals will learn continuously from their customers and colleague’s world wide to add value. It will work as a team, they innovate and break barriers to serve customers and create customers loyalty through a value chain of responsive and professional delivery. The bank promotes broad-based Participation in the Bangladesh economy through the provision of high quality banking services. BRAC Bank will do this by increasing access to economic opportunities for all individuals and business in Bangladesh with a special focus on currently under-served enterprises and households across the rural – urban spectrum. BRAC Bank believes that the pursuit of profit and developmental goals is mutually reinforcing. Increasing the ability of undeserved individuals and enterprises to build their asset base and access market opportunities will increase the economic well being for all Bangladeshis, at the same time, this will contribute significantly to the profitability of the Bank. BRAC Bank intends to set standards as the Market leader in Bangladesh. It will produce earnings and payout dividends that can support the activities of BRAC, the Bank’s major shareholder. Development and poverty alleviation on a countrywide basis needs mass production, mass consumption and mass financing. BRAC Bank goal is to provide mass financing to enable mass production and mass consumption, and thereby contribute to the development of Bangladesh. BRAC Bank intends to set standard as the market leader in Bangladesh by providing efficient, friendly and fully automated modern online service on a profitable basis.

Aiming at offering commercial banking service to the customers’ door around the country, BRAC Bank Limited. Established 69 branches up-to current year. This organization achieved customers’ confidence immediately after its establishment.

Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. The is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution. Thus within this short time it has been able to create an unique image for itself and earned significant solution in the banking sector of the country as a bank with a difference. The emergence of BRAC Bank Limited is an important event in the country’s financial sector at the inception of financial sector reform. The authorized capital of

BBL (Brac bank ltd.) is Tk. 480 Cr and paid up capital of the same bank is Tk. 267 Cr.

Share Holdings position:

(as on 31-Dec-2010)

| Shareholders | No. of Shares | Amount in Tk. | Percentage | |

| BRAC | 21,009,600.00 | 2,100,960,000.00 | 43.77% | |

| Int’ Finance Corp. | 2,572,800.00 | 257,280,000.00 | 5.36% | |

| Shore cap Int. Ltd. | 412,800.00 | 41,280,000.00 | 0.86% | |

| Non Resident Bangladeshi | 206,400.00 | 20,640,000.00 | 0.43% | |

| Mutual Funds | 1,545,600.00 | 154,560,000.00 | 3.22% | |

| Institutions & General Public | 22,252,800.00 | 2,225,280,000.00 | 46.36% | |

| Total | 48,000,000.00 | 4,800,000,000.00 | 100% | |

2.1 Organizational Vision:

BRAC Bank is a unique organization in Bangladesh. It is a knowledge-based organization where the BRAC Bank professionals learn continuously from their customers and colleagues worldwide to add value. They worked as a team, stretch themselves, innovate and break barriers to serve customers and create customer loyalty through a value chain of responsive and professional service delivery. Continuous improvement, problem solution, excellence in service, business prudence, efficiency and adding value will be the operative words of the organization. BRAC Bank serves its customers with respect and work very hard to install a strong customer service culture throughout the bank. It will treat its employees with dignity and will build a company of highly qualified professionals who have integrity and believe in the Bank’s vision and who are committed to its success. BRAC Bank is a socially responsible institution that will not lend to businesses that have a detrimental impact on the environment and people. BRAC Bank believes him as a financial partner not financier. That’s the reason of its rapid success. We are looking for Vision 2C11 (2011) .To become the 2nd largest bank in terms of fund under management (FUM) by 2011

2.2 Organizational Mission:

BRAC Bank will adhere to highly professional and ethical business principles and internationally acceptable banking and accounting standards. Every BRAC Bank professional will need first of all a commitment to excellence in all that he/she does, a keen desire for success, a determination to excel and a drive to be the best.

2.3 Organizational Goals:

BRAC Bank will be the absolute market leader in the number of loans given to small and medium sized enterprises throughout Bangladesh. It will be a world-class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the world.

2.4 Organizational Objectives:

The objectives of BRAC Bank Limited are specific and targeted to its vision and to position itself in the mindset of the people as a bank with difference. The objectives of BRAC Bank Limited are as follows:

- Building a strong customer focus and relationship based on integrity, superior service.

- To create an honest, open and enabling environment.

- To create value and respect people and make decisions based on merit.

- To strive for profit & sound growth.

- To create value of the fact that they are a member of the BRAC family – committed to the creation of employment opportunities across Bangladesh.

- To work as a team to serve the best interest of its owners.

- To relentless in the pursuit of business innovation and improvement.

- To base recognition and reward on performance.

- To make responsible, trustworthy and law-abiding in all that the bank does ..

- To mobilize the savings and channeling it out as loan or advance as the

- company approve.

- To establish, maintain, carry on, transact and undertake all kinds of

- investment and financial business including underwriting, managing and

- distributing the issue of stocks, debentures, and other securities.

- To finance the international trade both in import and export.

- To develop the standard of living of the limited income gr6up by providing Consumer Credit.

- To finance the industry, trade and commerce in both the conventional way

- and by offering customer friendly credit service.

- To encourage the new entrepreneurs for investment and thus to develop the country’s industry sector and contribute to the economic development

2.5 Management of BRAC Bank Limited:

Boards of directors are the sole authority to take decision about the affairs of the business. Now there are 5 directors in the management of the bank. All the directors have good academic background and have huge experience in business. Mr. A Rumee Ali is the chairman of the bank. The boards of directors of the bank are as follows.

2.6 Departments of BRAC Bank Limited:

particular department it would be very difficult to control the system effectively. If the department nation is not fitted for the particular works there would be haphazard situation and the performance of a particular department would be difficult to measure. BRAC Bank Limited does this work very well.

There are-

-Human Resources Department

-Financial Administration Department

-Origination Department

-Credit Division

-Banking Service Department

-SME Division

-Internal Control & Compliance Department

-Marketing & Product Development

-Remittance Operation Department

-Treasury Division

-General Administration division

-Information Technology Department

-Ops Risk

-Business Relationship

-Trade & Remittance

-Central Operation

Business Units:

There are five different business units generating business of BRAC Bank Limited:

i) Small & Medium Enterprise (SME)

ii) Corporate Banking

iii) Retail Banking

iv) Treasury

v) Remittance Services

All the units are being operated in a centralized manner to minimize costs and risks. Here I discuss only the SME division:

i) Small & Medium Enterprise (SME):

BRAC Bank Limited is the largest SME Bank in the country and 4th largest SME Bank in the world in terms of outstanding loan amount. SME Banking Division holds highest asset volume among the business divisions of the Bank (SME Banking, Retail Banking, Corporate Banking, and Probashi Banking). As the name signifies, it provides lending and deposit solutions as well as value adding services (payment reminder, payment notification, etc) to small and medium size businesses within the country.

As of March 2011

- The division has captured 5.37% market share within SME Banking arena of Bangladesh.

- It has served 320,000 entrepreneurs, with BDT 144,330 million of SME loan through 503 customer touch points (SME Unit Offices, SME Sales and Service Centers, Krishi Branches, and Branches).

- BDT 37,400 million SME asset was fueled by BDT 8,970 million SME deposits and deposit from other sources in 2010.

- PAR (Portfolio at Risk) has been brought down slightly in 2010.

Vision:

Remain the leader in SME banking, respected locally and globally while focusing on people, profit, and planet.

Strengths:

- Brand image

- Trained sales force

- Good quality staff and service

- Quality distribution network

- Strong credit & collection framework

- Superior technology and service

Target Market:

- Trading of grocery item

- Hardware

- Chemical products

- Sanitary ware

- Building materials (rod, cement, brick, paint, and others)

- Electrical and electronic items

- Imported foods (biscuits, cheese, juice, and such items)

- Light machinery

- Large tailoring business

- Weaving mills

- Bakery

- Printing house

- Feed mill

- Poultry

- Dairy farm

- Fisheries

- Manual/auto rice mill

- Boutiques and parlors

- Restaurant

- Distributor of FMCG products/others

- Fish wholesaler

- Food grain wholesaler

- Wood processing/saw mills

- Many more…

Presence:

Small Business department of the division works through 421 unit offices all throughout the country. The department is divided into three regions. Each region comprises of 6 to 7 territories. Territories are divided into zones and zones are further divided into unit offices. Currently there are 20 territories and 126 zones. The frontline employees of small business are called Customer Relations Officer (CRO). More than 1,700 CROs are working in the department as of April 2011.

The territories are:

| Dhaka Region | Chittagong Region | Rajshahi Region |

|

| Rangpur Bogra Rajshahi Kushtia Gopalganj Barisal |

Medium Business department is currently located in Dhaka and Chittagong city to look after the mid size borrowers of SME Banking arena.

SME Banking Products, Structure & Process:

Lending Products:

The division has designed 9 lending products based on customer need and lifecycle (small loan/large loan, secured loan/unsecured loan, repayment arrangement – term loan/single payment/overdraft, purpose – working capital/fixed asset purchase/import-export, assessment – bank statement based/no bank statement).

Funded facilities :

It tells that this type of facilities allows the customer to have money ‘on his hand’ for use i.e. he will get money as to meet his business demand.

Examples are-

- Working Capital Loan.

- Over Draft Facility.

- Term Loan.

- Lease Finance.

- Demand Loan.

Non-Funded Facilities:

Non-Funded facilities are those type of facilities where customers don’t get fund on their hand rather get Bank’s Guarantee service to do international trading- import and export. Letters of Credit, Bank guarantees etc. are the examples of the non-funded facilities.

The Lending products are explained below

| Product | Description |

| Anonno | Loan upto BDT 10 lac without any collateral/security for small size business in trading, manufacturing, and service sectors throughout the country. |

| Durjoy | Unsecured loan upto BDT 25 lac for comparatively larger urban business houses. Bank statement based analysis. |

| Prothoma | Loan upto BDT 10 lac without any collateral at 10% interest rate for women entrepreneurs. |

| Shamolima | Loan for agricultural and new sectors (biogas plant, solar panel, effluent treatment plant, etc.) with minimum 9.99% interest rate. |

| Apurbo | Secured loan upto BDT 50 lac (secured against land/building). |

| Shokti | Partially secured loan upto BDT 70 lac (covered against cash collateral). |

| Shomriddhi | Letter of credit/loan against trust receipt/bill discounting/revolving loan/overdraft facility for importers/exporters upto BDT 1 crore. |

| Shohoj | Fully cash secured facility. |

| Shompod | Secured loan upto BDT 3.5 crore (secured against residential apartment/commercial space). Also, purchase of commercial space is catered. |

Deposit Products:

There are currently 2 deposit products, namely Prapti and Prachurjo. The products are explained below:

| Product | Description |

| Prapti | Current account with interest upto 4% p.a. on daily balance. |

| Prachurjo | Fixed deposit with competitive interest rate. |

Structure:

The division is structured into following departments –

Small Business is organized into regions, territories, zones, and unit offices all throughout the country. Historically the department provided small loans to entrepreneurs. Now it is fully equipped to provide all kinds of products and services to small entrepreneurs. It is the biggest department of the division in terms of asset, deposit, and nationwide presence.

Medium Business works in Dhaka and Chittagong to cater medium size businesses. It is looked after by Senior Relationship Managers/Relationship Managers.

Product and Portfolio department looks after both lending and deposit product development, implementation, review, training, and communication aspect of the division. It also manages the product support function (internal staff queries, pricing, and product collateral management). The department also has separate product focused sales teams (Large loans/trade finance/commercial vehicle finance).

Deposit Mobilization looks after the overall deposit portfolio of SME Banking. It undertakes all activities (Product modification, communication, training, pricing, and others) to bolster deposit growth. The department also has product focused sales team for liability products.

Monitoring and MIS looks after the processes of the division, control aspect of unit offices, management reports, communication with stakeholders (IFC/Board), and special initiatives.

Compliance looks after the Human Resources compliance, regulatory reporting/communication, and proactive risk management.

Processes:

Customer Relations Officer (CRO) helps a customer choose the scheme which best meets his financial requirements and fits his business size and nature. The CRO then collects all the requisite documents from the customer, consolidates the information, and after ensuring that all the required documentation are in place, he prepares the Loan Application Proposal (LAP) and passes it on to his Zonal Manager. The Zonal Manager visits the business, gives the file a final check and forwards it to the Credit Risk Management department of our bank.

The Credit Analyst in the SME Credit wing visits the business location and analyzes the loan proposal by making an assessment of the customer’s ability to repay based on his business profile and matching customer’s proposal with his credit assessment to determine whether the customer can be financed. Our credit officers are always proactive in identifying and managing any risks/gaps in the credit file and communicating them to the respective CRO’s so they can correct the discrepancies and provide the required information. In areas where there is no centralized credit assessment department, the bank has audit team that visits the business location and assesses the file.

The Origination department verifies the documentation and opens the loan accounts of our customers. In addition, they help obtain the CIB of the customer, a mandatory requirement of Bangladesh Bank. The loan is then disbursed to the customer. SME Business and CRM jointly manage the collection responsibility across the country based on overdue aging. SME Repayment Unit performs the functions of loan repayment and the Closing Unit does the loan closure. The CRO obtains the deposit slip from the customers for the monthly installments; he sends a mobile text to Head Office for realization of the installment. The slips are collected at the repayment unit for reconciliation. As the loan matures, the closing and clearing units handle the necessary paperwork and forward the clearance certificate and redemption authority of mortgage property to the respective CRO/ZM, who then hand them over to our customer.

2.7 Capital Fund:

The authorized and paid up capital as on 31-12-2010 is TK. 480 crore and TK. 267 crore respectively. The paid up capital is one of the strongest in the banking industry.

Internal and External source of cash:

| Type of Fund | Year 2009 | Year 2010 |

| Ordinary share @ Tk 100 | 1,000,000,000 | 1,000,000,000 |

| Ordinary share (issued as bonus share) @ Tk 100 | 320,000,000 | 795,200,000 |

| Right share @ Tk 100 | 264,000,000 | 264,000,000 |

| Preference share @ Tk 100 | 500,000,000 | 500,000,000 |

| Statutory reserve | 404,690,166 | 428,717,788 |

| Surplus in profit | 973,450,830 | 1,303,588,940 |

| Total | 1,378,140,996 | 1,732,306,728 |

(Amount in BDT)

3.1 Selection of Potential SME Enterprise & Entrepreneur:

Enterprise Selection Criteria

The success of SME will largely depend on the selection of a business and man behind it. In terms of the business (Enterprise) the following attributes should be sought:

- The business must be in operation for at least one year

- The business should be environment friendly, no narcotics or tobacco

business - The business should be legally registered, i.e., valid trade license, income tax

or VAT registration, wherever applicable. - The business should be in legal trade, i.e.; smuggling will not be allowed or

socially unacceptable business will not be entertained. - The business must have a defined market with a clear potential growth

- The business must be located ideally close to the market and the source of its

raw materials/suppliers. It should have access to all the utilities, skilled

manpower’s that are required. - Any risk assessed by the management in turn will become a credit risk for the

bank. So effort should be made to understand the risk faced by the business.

Entrepreneur Selection Criteria:

In order to understand the capability of the management behind the business, the

following should be assessed:

The entrepreneur should be physically able and in good health, preferably between the age of 25-50. If he/she is an elderly person closer to 50, it should be seen what the succession process will be and whether it is clearly defined or not. The entrepreneur must have the necessary technical skill to run the business, i.e. academic background or vocational training, relevant work experience in another institution or years of experience in this line of business.

a) The entrepreneur must have an acceptable social standing in the community (People should speak highly of him), he should possess a high level of integrity (Does not cheat anyone, generally helps people), and morally sound (Participates in community building)

b) The entrepreneur must possess a high level of enthusiasm and should demonstrate that he is in control of his business (Confidently replies to all queries) and has the ability to take up new and fresh challenges to take the business forward.

c) Suppliers or creditors should corroborate that he pays on time and is general in nature

d) Clear-cut indication of source of income and reasonable ability to save.

3.2 Terms and Conditions of SME Loan:

The SME department of BRAC Bank will provide small loans to potential borrower

under the following terms and condition:

The potential borrowers and enterprises have to fulfill the selection criteria

The loan amount is between Tk. 3 lacks to 30 lacks.

Loan can be repaid in two ways:

a) In equal monthly loan installment with monthly interest payment, or

b) By one single payment at maturity, with interest repayable a quarter end residual on maturity

Loan may have various valid dates, such as, 3 months, 6 months, 9 months, 12 months, 15 months, 18 months, 24 months, 30 months and 36 months.

The borrower must open a bank account with BBL or correspondent Bank.

Loan that was approved will be disbursed to the client A/C through that account by Cash (BBL) or TT (Telephonic Transfer ) for correspondent Bank.

The loan will be realized by every monthly installment basis, starting from the very next months whatever the date of disbursement,

The borrower has to issue an account payable blank cheque in favor of

BRAC Bank Limited before any loan disbursement along with all other

security.

The borrower will install a signboard in a visible place of business of

manufacturing unit mentioned that financed by “BRAC Bank Limited”.

The borrower has to give necessary and adequate collateral and other securities as per bank’s requirement and procedures.

BRAC Bank may provide 100% of the Net Required Working Capital

but not exceeding 75% of the aggregate value of the Inventory and

Account Receivables. Such loan may be given for periods not exceeding

18 months. Loan could also be considered for shorter periods including

one time principal repayment facility, as stated in loan product sheet.

In case of fixed asset Financing 50% of the acquisition cost of the fixed

asset may be considered. While evaluating loans against fixed asset,

adequate grace period may be considered depending on the cash

generation after the installation of the fixed assets. Maximum period to be

considered including grace period may be for 36 months.

3.3 Basic Appraisal of Small & Medium Enterprise:

Business or project appraisal is a technique of evaluating and analyzing Business from various aspects, primarily the risks associated with that business enterprise. At the time of appraisal of any manufacturing, trading or service related organization, factory or industry; one has to perform a feasibility study on the different aspects. These are:

- Management and Personal Aspects

- Technical Aspects

- Marketing Aspects

- Financial Aspects

- Social Economic Aspects

- Security Aspect

a. Management and personal aspects:

During the appraisal prosecution the Customer Relation Officer (CRO) should endeavor to obtain details about the prospective borrowers, some of which are:

- Business related information

- Credit History

- Liquidity Information

- Management Background

In considering the above, one should look at the business is management process. The CRO should also consider clients previous credit history like facilities sought and availed, loan repayment, an overdue record, if any.

One should also check the client bank account and amount of balance maintained. Management’s qualification, experience, successor and maintenance of records should provide insight into the business.

Technical Aspects:

From a business perspective, this aspects deals with design of the system in place, the operation of the business, the different type of physical resources used, the technology used, the capacity to handle business and all other inputs (labor, raw materials, utilities etc.)

Among the technical factors to be investigated during an appraisal are:

- The size of project.

- The process, materials, equipment and reliability of technical systems to be used.

- Location of projects.

- Sustainability of the plans, layout and design used.

- Total quantity of the goods Service produced Traded monthly.

- Environment of the business and its surrounding areas.

- Availability to various factors of production, both physical and human.

- Raw materials availability, price level and its variation to be considered.

c. Marketing Aspects:

CRO should consider the following factors of a business before making any loan commitment with a customer:

Total demand and supply of the products in the market that the business operates in growth of sales and major marketing threats that the business may face.

d. Financial Aspects:

This aspect allows us to check the financial health of a business, through an analysis of the profit and loss account, balance sheet, cash flows, ratios and requirement of working capital. If the collection of the financial data can be done properly, then it may be able to make a somewhat realistic picture of the business financial position. However, all the data collected must be

cross-checked as much as possible with the physical features of business.

The following things are to be considered and determined at the time of verifying the

financial feasibility of the business:

- Current year’s profit/Loss of the business and probable profitability of

- business after taking the loan.

- Determination of assets, liabilities and net worth of the manufacturing/ trading

- service institution before and after taking loan.

- Present net cash flow of the business after disbursement of loan should be determined.

- To know the cash position of the institution.

- To know the source of income, production and other expenditure of the business probable financial risks of the business.

d. Socio Economic Aspects:

Here the analyst like will to observe the contribution

of the business to the country’s GDP, the employment generated, the sort of

adverse impact of the business on the environment, if there is any benefit to the

country.

e. Security Aspects:

Along with observation of different aspects .and views of the projects, the CRO should also see closely the aspects of the projects and ensure about the reliability to the mortgaged property/assets. Ensure proper surveyor verification of the security offered Ensure attachment of survey report.

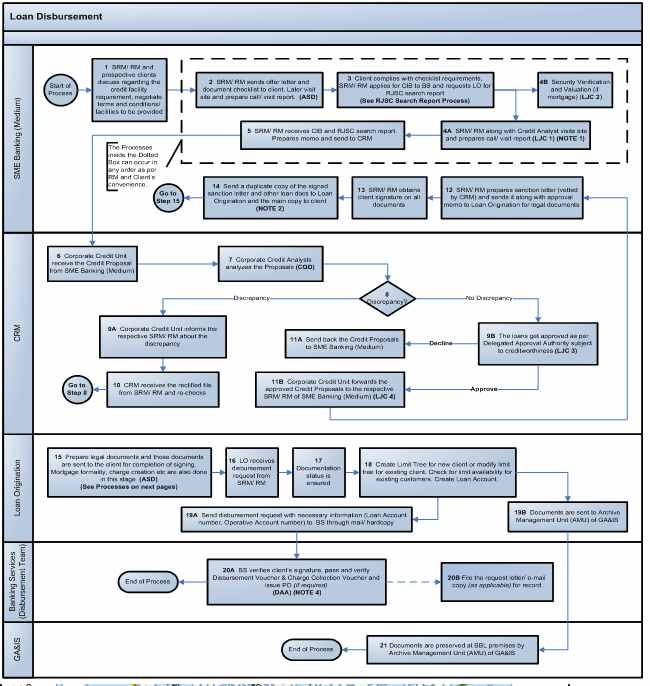

3.4 SME Loan Sanction process flow:

SME Credit team is a unit under Credit Risk Management Division, manages the credit risk of the Bank’s SME credit portfolio. A typical SME borrower merely maintains regular banking transaction and often found not having proper financial records. They often lack definite fund utilization plan. Low investment in the business is very common in such enterprises. As such assessing creditworthiness of these borrowers requires more than conventional credit risk management wisdom. Our bank being the pioneer in financing such borrowers in a large volume is experiencing this phenomenon and developing the expertise by the strategy may be named ‘Learning by doing’.

Credit Analysts assess the proposal with due emphasis on Client’s requirement and capacity. During assessment the analysts fulfill a Risk Evaluation Sheet (which covers most PPG criteria) to ensure compliance with Policy and PPG. Identifying key risks involved in the proposal is one of the most critical and tricky tasks for the credit analysts; it requires experience of handling such clients directly to understand the business modalities and more importantly behavioral issues viz. reputation, character etc.

Unlike Corporate, Retail and Cards (where all loan proposals require approval from Head office) SME credit deals with approval of loan proposals of certain area at present. However Centralization of SME loan approval is under process. At present 14 territories of SME businesses are covered by CRM. . They are:

- Dhaka Urban 1,2,3,4

- Dhaka 1,2,3 and

- Chittagong, Cox’s Bazar, Jessore, Khulna, Kushtia, Gopalganj, Sylhet

In other Territories Zonal Managers / Associate Relationship Managers are authorized to approve the loans from other territory (At present it is less than or equals to BDT 6 Lac). However Approval Authority shall be restricted to CRM only across the country on phase by phase. It has been decided that SME Credit shall run its operation from Nine CRM centers along with from Dhaka and Chittagong. They are: Rangpur, Bogura, DEPEZ, Mymenshing, Sylhet, Comilla, Jessore and Barisal.

Credit Analysis is abide by the policies, and it’s a must do for approving a SME proposals. Below are the policy documents SME Credit is required to follow –

- Prudential Regulation for Small Enterprise Financing

- Credit Policy for Small Enterprise Financing

- Product Program Guidelines (PPG)

- Environmental Policy of the Bank

- Other Bangladesh Banks Guidelines and Circulars issued from time to time

Generally, as a support division, SME Credit Team supports the SME Business Unit by ensuring the quality of the Credit. Credit Analysts are the key working force for pulling down the above-mentioned task and their responsibility is to

i). Assess Creditworthiness of a potential borrower

ii). Analyze requirement and capacity of the customer

iii). Ensure compliance with all internal & external (regulatory) Policy/PPG/Circulars related to sanctioning of a credit facility,

iv). Identify Credit Risk & Mitigates associated with a loan proposal and

v). Recommend for Approval/ Rejection with appropriate terms and condition after through Credit assessment.

After recommendation by the credit analysts the loan files are presented before appropriate authority for approval. The approval authority is delegated to Officers of the Bank according to their experience in related field. Managing Director delegates the approval authority to individual Officers in their name, not to any position.

If a simple algorithm of the whole process can be written down it would be as follows –

Step 1: CRO’s located in the unit offices across the country prepares a loan proposal

Step 2: Respective Supervisor (ZM / ARM) Recommends the loan proposal and sent to SME Credit

Step 3: Credit Analysts analyzes the loan proposal and place it before approver

Step 4: Credit Approver Approves / Declines the loan proposal based on the recommendation

Step 5: File sent to origination for disbursement process.

Loan proposal assessment being the principal function, SME Credit team also contributes to

- Providing Policy Input

- Offsite monitoring of SME Portfolio to some extent

- Staff development by training

- Creation of awareness among the related employees by issuing circular, etc.

About 50% of Bank’s portfolio is concentrated to SME sector. Performance of this portfolio has immense impact on Bank’s overall performance. With the increased responsibility of SME Credit team its role has become very critical to Bank’s future growth and long-term sustainability along with keeping the promises to its different stakeholders.

3. 5 Security Documentation against SME Loan:

A document is a written statement of facts and a proof or evidence of particular transaction between parties involved. While allowing any disbursements against credit facilities to borrowers, it should be ensured that prior to any disbursements; security documentation is fully and properly completed.

3.5-(a) Purpose of Documentation and its Importance

Documentation is necessary for the acknowledgment of a debt and its terms and conditions by the borrower and the creation of charge on the securities in favor of the bank by the borrower. Correct and proper documentation allows a bank to take legal measures against the borrowers in the non-payment of the debt. If filing a suit with the courts against a default borrower becomes necessary, the court will first review all documents. If any of the documents is found to be defect or incomplete, the very purpose of security documentation will be defeated and a court ruling in favor the bank cannot be expected. Proper care should, therefore, be taken while completing security documentation.

3.5 -(b ) Type of Securities

The following listed securities may be obtained from borrower against loan to enterprises, either individually or in a combination. It is really up to the bank what they would like to accept as security from the borrower although not all the securities stated below are suitable:

- Mortgage of loan and other immovable property with power of attorney to sell.

- Lien of Fixed Deposits receipts with banks and other non-banking financial

- institutions, lined, these have to be confirmed by the issuer (Now these are rarely accepted)

- Lien of Pratirakkha sanchay patra, Bangladesh sanchay patra, ICB unit certificates and wage earner development bond, all considered Quasi or Near cash items. All these instruments, as lien, have to be confirmed by the

- Lien of shares quoted in the stock exchange (This is rarely accepted)

- Pledge of goods (Banks are akin to stay away from such securities nowadays)

- Hypothecation of Goods, Book Debt & Receivables, Plant & Machineries

- Charge on fixed assets of a manufacturing enterprise

- Lien of cheque, Drafts and order

- Lien of work orders, payment to be routed through the bank and confirmed by the issuer.

- Shipping documents of imported goods

3.5 -(b-i) Land related securities documentation process:

Each SME unit office will consult with at least two local lawyers who will work on behalf of the bank. These always will be employed whenever a borrower and where the security will be landed and immovable property accept a loan sanction. Anyone of the lawyers will be provided with photocopies of all the relevant land related documents and while handing over show the original documents to

them. The lawyers will carry out checks of the originals and if satisfied returned to the borrower. The documents generally provided are:

- Title Deeds or Deed of conveyance otherwise known as ‘Jomeer Dalil’, which signifies ownership of a particular land.

- Baya Dalil or Chain of Documents, which signifies that the conveyance of titles has been proper and legal.

- Mutation Certificate if Khatian which signifies that the title of the land has been duly registered in the Government Sub-registrar’s records.

- Duplicate Carbon Receipt or OCR

- Latest Khajna or land rent receipt

- Purchase such as CS Khatian, SA Khatian, R. S Khatian and BS Khatian

- Mouja Map

- Municipal rent receipts if the land falls within a municipal area

The lawyer will then carry out a search at the Sub-registrar of land’s office to check if the proffered land is actually registered in the name of the proposed mortgagor and whether the said land is free from any encumbrances. The Sub- registrar’s office, which means that the land or immovable property can be mortgaged to the bank, then the lawyer, will provide his own opinion on the acceptability of the property, whether it is legally held and explain the chain of ownership.

If all is acceptable, the lawyer will draw up the Mortgage Deed that will be registered, the irrevocable power of attorney to sell the land and the Memorandum of Deposit of Title Deed.

The lawyer will have the borrower or the Mortgagor, if different or 3rd party, sign the documents in front of the Sub-registrar of land to register the mortgage, The CRO must ensure that the receipt for the original Mortgage deed must be signed off (Discharged) at the back of the receipt so that the bank may obtain the originals in the future. The borrower will bear all the Charges and will pay directly at the Sub- Registrar’s office including the cost of the stamp paper required.

The cost of the lawyer will also be realized from the borrower by an account payee cheque in favor of the lawyer and handed over to the lawyer straight away. The charges related to the creation of mortgage and other associated costs are incorporated in a separate sheet and are attached herewith.

The CRO will have all other security documents, as sent by SME HO, signed by the borrower and who will carryall the security documents including all the original land documents and deliver those to the credit administration officer who will check the list of documents and receive those through a check list in writing. The credit administration officer once satisfied will prepare the disbursement memo to disburse the loan.

3.5 (b-ii) There are two types of mortgages that are popular and usually accepted in Bangladesh:

i) Equitable Mortgage or Memorandum of Deposit of Title Deeds: It is created by a simple deposit of title deeds supported by a Memorandum of Deposit of Title Deeds along with all the relevant land documents. All the searches and verification of documents as stated above must be carried out to validate the correct ownership of the property. This deed also provides the bank power to register the property in favor of the bank for further security, if needed.

ii) Registered Mortgage:

It is created by an execution of a Mortgage Deed registered irrevocably in favor of the bank at the Sub-Registrar of land’s office. This virtually gives the bank the right to posses and shelf if accompanied with a registered irrevocable power of attorney to sell the property executed by the owner of the property, in case of default.

Sanction Letter:

Once a loan is approved, the borrower is advised by a ‘Sanction or offer letter’ which states the terms and condition s under which all credit facilities are offered and which forms an integral part of their security documentation. If the borrower accepts, then a contract between the bank and the borrower is formed and which both party are obligated to perform. Accordingly all other charge documents and

securities are drawn up which is given below:

- Demand Promissory Note

- Letter of Continuity

- Letter of Arrangement

- General Loan Agreement

- Letter of Disbursement

- General Loan Agreement

- Letter of Disbursement; Basically a letter requesting disbursement of the loan

- Letter of Installment, in case the facility is to be repaid in installment

- Letter of Undertaking

- Letter of Hypothecation of Goods & Stocks and Book Debt and Receivable

- Letter of Hypothecation of Plant & Machinery

- Letter of Lien and Right to Set Off

- Personal Guarantees

3.6 SME Loan Disbursement Process:

3.7 SME Loan Monitoring

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a CRO to know the borrowers activities after the loan disbursement. This also facilitates the build up of an information base for future reference.

Importance of Monitoring:

Through monitoring a CRO can see whether the enterprise invested the sanctioned amount in the pre-specified area of his business, how well the business is running, the attitude of the entrepreneur, cash credit sales and purchase, inventory position, work in process and finished goods etc, This information will help the CRO/BRAC Bank to recover the loan accruing to the schedule and to take the necessary decisions for repeat loans. Moreover, monitoring will also help to reduce delinquency. Constant visit over the client /borrower ensures fidelity between the bank and the borrower and tends to foster a report between them.

Area of Monitoring:

The purpose is to know the entire business condition and all aspects of the borrowers so that mishap can be avoided.

a. Business Condition:

The most important task of the CRO to monitor the business frequently, it will help him to understand whether the business is running well or not, and accordingly advice the borrower, whenever necessary. The frequency of monitoring should be at least once in a month if all things are in order.

b. Production:

The CRO will monitor the production activities of the business and if there is any problem in the production process, the CRO will try to help the entrepreneur to solve the problem. On the other hand the CRO can also stop the misuse of the loan other than for the purpose for which the loan was disbursed.

c. Sales:

Monitoring sales proceed is another important task of the CRO it will help him to forecast the monthly sales revenue, credit sales etc. which will ensure the recovery of the monthly loan repayments from the enterprise as ‘well as to take necessary steps for future loans.

d. Investment:

It is very important to ensure that the entire loan has been invested in the manner invented. If the money is utilized in other areas, then it may not be possible to recover the loan.

e. raw materials:

In case of a manufacturing enterprise, management of raw materials is another important area for monitoring. If more money is blocked in raw materials than necessary, then the enterprise may face a fund crisis. On the other hand the production will suffer if there is not enough raw materials.

4.1 SME Loan Recovery Procedures:

Receive SMS/Fax for installment deposits: When the borrower repays any installment

of the loan then he/she informs it to the unit office/CRO. Then the unit office/CRO

send a SMS through mobile phone or a Fax to the loan administration division

informing the repayment. Loan administration divisions collect these SMS /Fax and

take a paper print of these SMS. Entry the installment information to FINACLE:

Loan administration division entry the repayment installment information to the

banking software FINACLE.

4.1 (a) Print Vouchers:

Completing the entry, the loan administration division takes paper print of all

vouchers in a prescribed yellow paper.

Cross Check SMS/Fax and solve problems (If any): The loan administration is

responsible for all entry in FINACLE. If the there is any error found in future then the

respective officer who is entering these information in FINACLE will be liable for it.

User 10 will easily identify it. So they always aware to ensure the correct entry.

Completing the entry of information, they print a hard copy and crosscheck it with the

SMS/Fax. If there any error found then it is solved and ensure the correct

information entry.

4.1 (b) Posting in finacle:

If it is confirmed that all entering information is

correct and there are no errors, then the responsible officer of the loan administration

division post it to FINACLE (core banking sofware). If one time posted, it is not rectifiable without permission of the higher authority. So the loan administration is always aware regarding the recovery procedures of SME loan.

4.2 Closing procedures of SME loan in BRAC Bank:

4.2 (i) Pre-closing manual activities:

Receive SMS/Fax requesting for closing: The borrowers repay the loan as per

repayment schedule. When the repayment is being complete the borrower request

the unit office/CRO to close his loan account. The unit office/CRO sends an

SMS/Fax the loan administration division requesting to close the loan account of the

respective borrower.

Print the SMS/Fax: Receiving the request from the respective unit office/CRG, the

loan administration division takes a paper print and takes necessary steps to close

the account

Bring the loan file from archive: The loan account file of the respective borrower

brought from the archive. Cross checked the documents of file with FINACLE

record.

Obtained approval from the concern authority: it is require the permission of

concerned authority to close the loan. If concerned authority approved the closing of

the loan account then next initiatives are taken.

Checking in FINACLE: The loan administration division checks the loan status in

FINACLE. If there is any difference found with the SMS/Fax from unit office and

FINACLE then deposits sleeps are re-checked. Then the loan administration division

calculates the total balance of the loan account (Ledger balance + buffer interest

+Excise duty)

SMS sent to concerned CRO: Loan administration division sent an SMS to the

concerned CRO informing the current balance of the requested loan account.

Receive and print closing SMS/Fax checking & freezing: The concerned CRO send a

final SMS to loan administration division informing that the respective borrower cleared all his liabilities regarding the loan. The loan administration division takes

paper print of the SMS, check it and finally close the loan account.

4.2 (ii) FINACLE entries for loan closing:

Pre closing data entry: Completing the manual activities, the loan administration

division enters some information to FINACLE for future requirement and complete

following tasks:

- Interest/provision charging & print voucher

- Charges collection & print voucher

- Final repayment entry & print voucher

- Final repayment entry checking

- Repayment voucher posting

Activate account closing in FINACLE: Completing above mentioned tasks, the loan

administration division finally close the requested loan account in FINACLE.

Post closing manual activities:

Re-checking with deposit slip: Completing FINACLE activities, the loan

administration re-check all deposit sleeps of the loan account. If there is any error

found then immediately resolves it otherwise the file sends to the archive for future

requirements. The client may take repeat loan in future and then information from

this file will help to approve and disburse loan, which will minimize risk. If the client

asks to return security then the loan administration releases security completing

following tasks:

Documents photocopy before security release

Closing certificate issuing and security release

Daily MIS updating for loan closing: Finally the authorized officer of the loan

administration division update the banking software FINACLE (Millennium Banking)

5.1 Analysis of Findings:

After analyzing the comparative analysis of SME Financing of BRAC Bank Limited with other banks we have found some limitations are there:

According to the SME financing in the banking sector BBL position is highest than other banks and NBFI in Bangladesh.

BBL provides highest interest rate where other banks introduced lower interests

BBL taking Medium loan application fees tk. 200+ Vat whereas others banks loan application is quiet high.

BBL provides three types of loan like working capital, Quarterly interest Bullet payment system and long term financing

BBL Taking 2 personal guarantee and hypothecation up to 10 lacs for providing SME loan and taking collateral security above tk. 10 lacs loan. This is very much amazing.

Loan application fee is very lower compared with other bank.

In case of SME Financing some credit risk arises due to non collectivity of loan amount. To minimize credit risk BBL has introduced BASEL II accord from year 2009.

Besides the profitability position of BBL is in a sound position as its net income is increasing year to year.

After analyzing the leverage ratio, we have seen that the debt position is decreasing year to year.

BBL maintain good capital adequacy ratio.

6.1 Recommendations:

All the banks play an important role in the economic development in the country. Without the banks it is not possible to run business activities. As such BBL helps SME entrepreneur by providing SME loans to starts or renovate the business. Although the small & medium entrepreneur’s intention to doing the business but due to lowest capital are not able to do their business.

Moreover, after analyzing the SME financing of BBL we have some problems compared to other bank To remove the problem the bank should perform some activities. Such as

Despite the introduction of refinance facilities by the Bangladesh Bank, the supply of institutional finance still remains inadequate for the SME’s. Although several banks have opened special windows for catering to SME loan. Of them some banks have introduced collateral free loan. It is important to develop and adhere to common norms in bank SME relationship so that the SME can access in a timely and efficient manner.

Like in many East Asian countries where SME’s have played a key role in promoting rapid industrial and export growth. Bangladesh needs to adopt its own model of creating institutions and support mechanism for SME covering government, private 7 NGO’s sectors.

The scope of work dedicated SME windows for catering to SME loan could be broaded to provide comprehensive SME related one stop service including financial counseling and resource availability.

Besides the profitability position of BBL is in a sound position as its net income is increasing year to year.