4.21.1 Account Related Service:

When customer want to know about their account balance, transaction details, and loan account details and stop or lose their ATM card & cheque book we provide guide line to the customers. For account Balance and loan account information Business Executive ask customer following things. Such as:

- Account name

- Date of birth

- Mobile number

- Communication address

If customer fail answer the question properly, they can not get the account related service.

4.21.2 Product Related Service:

Different types of Account:

Brac Bank Ltd. is now offering different dynamic products for mobilizing the saving of general people are as follows:

Savings Account:

Any Individual, self employed, proprietorship, club, charity, and private company can open this account. Its opening balance is TK: 15000 & ROI 5.5% p.a. (interest credit to account – half yearly). Its relationship fee: TK. 920, Card Fee: TK.598 yearly.

Current Account:

It is a non interest bearing current account. Any Individual, self employed, proprietorship, club, charity, and private company can open this account. Its opening balance is TK: 15000. Its relationship fee: TK. 920, Card Fee: TK.598 yearly.

Ezee Account:

Ezee Account is an interest bearing non cheque Account. Individual & corporate people can open this account. Its opening balance is TK: 10000 & ROI 4% p.a. (June 30th and 31st December) Card Fee: TK.598 yearly. Customer can get 12 page chequek books on request.

Bizness Account:

Small and medium sized business (only sole proprietorship business) can open this account. It’s an interest bearing current account. Its opening balance is TK: 10000 & ROI 4% p.a. (interest credit to account – half yearly). Bizness Account will be given opened in the name of the business & Card will be given in the name of the proprietor. Its fees & charges: TK. 1000 =15% vat =1150.00 per year.

TBSA Account:

TBSA means Triple Benefit Saving Account. In this account three benefits are offered to the customers. These benefits include unlimited transaction, maximum 8% interest & totally charge free account. To get this benefit customer should keep at lest TK. 50000 averagely in every month. The opening balance of this account is TK. 50000. If customer fail to keep monthly TK. 50000 in their account, he will punish and cutoff TK. 750 for half yearly.

Salary Account:

MNCs, LLCs, NGOs, Large Proprietorship, Partnership Firm & Minimum 10 permanent staff employed at any point of time. Minimum monthly total pay roll TK. 100k and an average salary per employ of TK. 10000 per month. Its interest rate is 4% p.a. interest credited twice a year and Card Fee: TK. 345 yearly.

Account Opening Requirements:

For Salaried

- 2 pp size photograph – Account Holder.

- 1 pp size photograph – Nominee.

- An Introducer from of BRAC Bank is needed.

- Any identification documents such as current valid passport, valid driving license or voter ID card.

- Proof of residence – copy of a utility bill (i.e. BTTI, DESCO, GAS).

Additional for Business:

- 6.Trade License

- Copy of Memorandum & articles of the association (For Ltd. company).

- Board of Resolution copy.

- Proof of ID.

- Proof of residence – copy of a utility bill (i.e. BTTI, DESCO, GAS).

Account Opening Requirements:

Bangladeshi Nationals:

- Account Opening Form (AOF) duly completed and signed.

- Passport Copy – 1st 6 pages or copy of the national ID card.

- Nominee Form.

- Risk assessment profile.

- 2 Copies of photograph dully attested by the introducer.

- 1 Copies of Nominee’s photograph dully attested by the Account Holder.

Non Resident Bangladeshi:

- Resident Permit / Work permit.

- Copy of the passport

- Passport size photograph – 2 Copies.

- Photograph of the Nominee

- Proof of Address

Deposit Products:

Type of FDR:

General FDR:

| Retail FDR | |||

| Tenor | 100K-<500K | 500K-<5M | 5M and Above |

| 1 months | 7.00% | 7.00% | 7.00% |

| 3 months | 7.50% | 8.50% | 9.00% |

| 6 months | 8.00% | 8.50% | 9.00% |

| 12 months | 9.00% | 9.50% | 9.50% |

| 24 months | 9.00% | 9.00% | 9.00% |

| 36 months | 9.00% | 9.00% | 9.00% |

Freedom Fixed Deposits:

| Freedom Fixed Deposit | |||

| Tenor (months) | 100K-<5M | 5M-< Above | |

| 6 | 8.50% | 9.00% | |

| 12 | 9.00% | 9.25% | |

| 24/36 | 9.00% | 9.25% | |

Interest First FDR:

| Interest First FDR | ||

| 3 months | 100K & Above | 8.50% |

| 6 months | 100K & Above | 8.50% |

| 12 months | 100K & Above | 8.50% |

ABIRAM:

| Principle Amount & Rare of Interest | ||||

| Tenor | 100K-999K | 1000K-4999K | 5000K-9999K | 10000K & + |

| 12 months | 8.50% | 9.00% | 9.00% | 9.00% |

| 24 months | 8.50% | 9.00% | 9.00% | 9.00% |

| 36 months | 8.50% | 9.00% | 9.00% | 9.00% |

DPS:

| Term | Rate of Interest |

| 4 years | 8.50% |

| 7 years | 9.00% |

| 11 years | 9.50% |

| 14 years | 9.75% |

Deposit Premium scheme’s monthly installment can not be as low as Tk.500 or any multiplies like Tk.1000, Tk.2500, Tk.5000 and so on. Customers are free to choose the maturity of his or her DPS and they also selected the period like 4 years, 7 years, 11 years and 14 years it’s depending on customer’s convenience.

Card Product:

DEBIT VISA CARD:

Visa debit card is a popular mode of withdrawal/payment option. Globally, more visa payment transactions are made using visa debit cards than visa credit cards. With a debit card the money for each transaction comes directly out of your linked bank account.

Card Number:

4 3 2 1 4 9

Advantages:

- From ATM BDT 50,000 per day but customer can use 5 times in a day.

- From Brac Bank’s Branch POS BDT 1, 00,000 per day withdrawal limit.

- There would be no fees if the transaction takes taka place in Brac Bank ATMs & POS. But there will be small charges (which is currently $ 1 per transaction) if any cash withdrawal takes place in other Bank’s VISA enable ATMs.

- There will also be no fee if you use the card in other Bank’s merchant POSs.

Annual Fees: BDT 520 + 15% vat = BDT 598.00

Card Design:

Aarong Card:

BRAC Bank Aarong co-branded ATM card is a new variant (product/brand extension) of our existing ATM card, which is designed to leverage the high brand value of Aarong – the most popular retail chain of gift/design house of Bangladesh. This card has similar functionality as our classic BRAC Bank ATM card with

extra advantage of having “Cash BRAC” facility. The holder of the card will get a 5% discount on every purchase at any Aarong outlet. This discount will be directly credited into the cardholder’s account for each purchase at Aarong.

Annual Fee for the Card: The fee is Taka. 575.00 (With 15% VAT)

Alico Card:

BRAC Bank ALICO co-branded ATM card is a new variant (product/brand extension) of our existing ATM card, which is designed to leverage the high brand value of American Life Insurance Company. This card has similar functionality as our classic BRAC Bank ATM card with extra advantage of having “Insurance Coverage”. The Bank on behalf of the customers will pay insurance premium.

Annual Fee for the Card: The fee is Taka. 575.00 (With 15% VAT)

Dia Gold Card:

BRAC Bank Dia Gold co-branded ATM card is a new variant (product/brand extension) of our existing ATM card, which is designed to leverage the brand value of Dia Gold. This card has similar functionality as our classic BRAC Bank ATM card with extra advantage of getting “Discount” for purchasing jewelry items from Dia Gold outlets.

Annual Fee for the Card: The fee is Taka. 575.00 (With 15% VAT)

Loan Products:

Salary Loan:

Keep an extra 15 month’s salary in your pocket. You can get BRAC Bank Salary loan, Loan against your salary. If you are a salaried individual working in Bangladesh, Please read on. Because Salary Loan from BRAC Bank has been designed with just you in our minds.

Who can apply?

- Employed as a regular salaried staff

- Have minimum age of 25 years, max -53 years (at the time of application)

- If you earn a gross monthly salary of Tk. 10000

Doctor’s Loan:

BRAC Bank introducing Doctor’s Loan, an exclusive loan facility for the Doctor’s fraternity. Now practicing Doctor’s can avail this loan very easily to meet their professional needs. So prescribe yourself a dream today. Anti-Headache solution for Doctor’s.

Who can apply?

- Having M.B.B.S. with 2 years of experience

- A salaried or a self employed Doctor’s

- Aged between 25 to 55 years

NoW Loan:

‘You choose while we pay’!! Life is good make it better when you can enjoy BRAC Bank NoW Loan. In case you need to purchase home appliances, furniture’s, computer or other consumer durables for personal use, we offer you the most appropriate solution with our NoW loan.

Who can apply?

- BRAC Bank account holder aged from 25 to 55

- A salaried employee with minimum monthly income of TK 15, 000

- Employed in your current organization for two years

Car Loan:

Why toy with your dreams when you can own one’, BRAC Bank Car Loan can stop your dreaming and Start driving Whether you want to purchase a brand new car or a reconditioned one, we have the most customer-friendly car loan scheme available for you.

Who can apply?

- Both salaried executives and business persons

- Age between 21 at the time of application to 60 at the time of maturity

- Minimum monthly income BDT 25,000

- Length of service/Age of business: Minimum 2 years

Study Loan:

Your gateway to the world’ BRAC Bank Study Loan gives your child deserves the best education and you have planned it ahead. But worried about financing? BRAC bank has the perfect solution for your child’s future.

Who can apply?

- Parent/ financial guarantor of the student pursuing higher education locally and abroad

- Earning TK 25,000 per month

- Aged between 30 to 60 years

Teachers’ Loan:

Honest profession, Honest Service’. BRAC Bank Teachers’ Loan provides a wedding or a dream holiday, financing a business or surviving an emergency, Teachers Loan can be yours just within three days of application!

Who can apply?

- A teacher of any reputed school or university

- Have a minimum length of service record of at least two years

- Have a minimum net salary of Tk.. 5000

- Have a minimum age of 23 years

Documents for Loan Product:

For Service Person:

- Latest Salary Slip

- Letter of Introduction

- Attested statement of account, bill etc. showing designation & Company’s name

- Bank Statement – last 3 months

- Visiting Card

- Personal Guarantor Required

- Proof of residence

- Proof of ID

For Business Man:

- Last 6 months bank statement

- TIN certificate

- Trade License

- Spouse Guarantee

- Proof of residence

- Business Card

- Personal Guarantor Required

Doctor’s Loan:

- Copy of Registration Certificate

- Employment Certificate

- Pay order of BDT 150 for BMDC certificate verification

4.21.3 Banking Related Service:

Evening Banking Service:

Customer can cash deposit and cash withdrawal in evening banking service. But customer can withdrawal maximum 1 lacks in evening banking. Its time duration is 3 p.m.-8p.m. No. customer service is given in this time duration. Some branches given these services such as:

- Gulshan Branch

- Banani Branch

- Nawabpur Branch

- Satmoszid Branch

- Rampura Branch

- Zindabazar Branch

- Agrabad Branch

- Mirpur Branch

- Uttara,

- Momin Road Branch

- Mirpur Branch

- Moghbazar Branch

Saturday Banking Services:

Cash withdrawal, deposit, pay orders & only welcome A/C is opened in Saturday banking. Some branches are give this services such as:

- Gulshan Branch

- Agrabad Branch

- Motijheel Branch

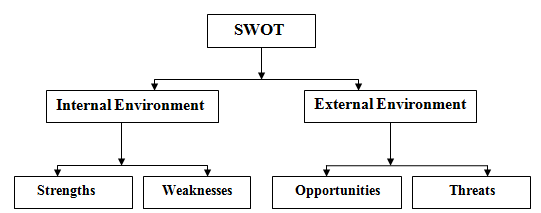

4.22 SWOT Analysis

SWOT means Strength, Weakness, Opportunity, and Threats. Basically Strength and weaknesses are form influenced and calculated by organizational internal factors. Opportunity and Threats are influenced and calculated as external environment factors.

S-Strengths:

- Wide range of service line.

- Excellent working environment.

- The banking service is easily accessible & feasible.

- Higher profitability.

- The bank lunched several deposit schemes, which have been appreciated by the customers resulting growth of deposit of bank.

- The bank has earned customers loyalty as well as organization loyalty. The bank has also committed to maintain quality services to client.

W-Weaknesses:

- Lack of proper motivation, training and job rotation for new employees.

- Insufficient space & equivalent of office.

- Lack of promotional objective & strategies.

- Lack of experienced employee in junior level management.

O-Opportunities:

- To increasing skilled customer bank can earned more profit

- The bank will go for immediate automation of all brunches through computer network.

- Deposit stiff competition among bank operating in Bangladesh, both foreign & local.

T-Threats:

- Increase competition in the market for quality service for other banks.

- Opening of the branches & ATM Booth of newly private banks & foreign banks the competition will be intensified.

- More policies of Bangladesh bank & lowering the bank rate by Bangladesh bank, BRAC Bank Ltd. reduce the lending rate.

5.1 Learning Point:

It’s very difficult for anyone to mention all of his learning about three months internship period in his internship report. But I tried my best to mention the following thing which I have learned during these three months:

- The overall retail products and services of the bank and the criteria which have to fulfill to achieve it.

- What are DBR (Debt Burden Ratio) and the calculating process of DBR.

- Activities & responsibilities of the employees of Telesales department in BRAC Bank Ltd.

- What are EMI (Earning Monthly Installment) and AMI (Area of Median Income) and how we have to calculate it?

- Meaning and the calculation of the equation of (DBR) = (EMI / AMI) (100)

- How and which ATM Booths customers can use to withdraw and deposit their money easily.

- What is POS and how much money can be withdraw by the customer within very short period of time.

- Enterprise selection criteria to provide Retail or consumer’s loan and the necessary papers to make their loan file.

- The work process and monitoring system of Telesales Department in BRAC Bank Ltd.

- Which step we follow to make customers done.

- Rate of interest and annul charge of various products and ATM cards.

- Evening Banking System, Bank’s products, Saturday Banking, Internet Banking, SMS banking and about the ATM Booth where we can deposit money easily.

5.2 Findings & Analysis:

On the basis of previous analysis and practical experience of 3 months internship program, the following findings are observed during the research period:

- Lac of BOPs (Box of Phones) and head phones are provided by the BBL to the Business Executives.

- Absence of proper guideline/ planning of respective job.

- Lack of motivation and training program for entry level employees and inadequate information provide to the customers.

- Calculation of DBR (Debt Burden Ratio) by using inadequate data and prepare loan file using this calculation.

- Sales volume of telesales department was reduced during the month of May than the month of April in 2009 because increasing the interest rate of loan and decreasing the interest rate of deposit.

- Highly reduce of the rate of interest on deposit and FDR and increase of the yearly charge of account and card create negative effect to the customers.

- On the other hand stable rate of interest on loan products become the cause of reduce customers.

- The POS machine of BRAC Bank is not easy to use than Standard Chartered’s POS and some time its will hazard to the customers.

- Inadequate work force also hamper to the customer to provide better service like HSBC.

- Increasing huge numbers of ATM Booth and POS Help customers to maintain transaction easily.

- Online Banking and phone banking systems of BRAC Bank can help customer reduce their time to get information without physical represent of them.

- The average number of calls in 2008 is less but the average feedbacks are high. On the other hand the average number of calls in 2009 is high but the average feedbacks are less.

6.1 Conclusion:

A satisfied customer’s statement is more than a thousand commercial advertisements that BRAC Bank Ltd. tries to achieve by providing effective and efficient services. It is a great pleasure to have a practical experience it couldn’t be possible for me to compare the theory with practices. There are number of commercial banks operating their activities in Bangladesh. BRAC Bank Ltd. is a promising one of them. For the future planning and successfully operation in achieving its prime goal in this current competitive environment, BRAC Bank Ltd. always provide potential and dynamic service trough business sector and operating sector. Telesales Department is one of the important department that sells the various products and services of BRAC Bank Ltd.

From the evolution and analysis of the facts and information collected during the period of my internee, it is clear the BRAC Bank Ltd. is promising satisfactory over the last years and growing rapidly preserving a unique position in the banking sector of the country. The bank is gaining improvement in almost all sectors over last years. The bank has all the possibility of becoming one of the leading banks of the country if it maintains this trained of improvement, and I think it will be able to do so.

6.2 Recommendation:

As per we know the BRAC Bank Ltd. is a faster growing bank in Bangladesh and it’s provide batter and standard service than most of the bank in our country. However, some steps should be taken to increase the performance and productivity of the bank in future which are given below:

- The employees should train enough to provide faster and better service to the customers.

- CSO of brunch should be more attentive about their customers, when they are providing their services.

- BBL should increase huge numbers of ATM Booth and Brunch to provide better and faster service to the customers.

- There is totally huge pressure on account opening department, a helping hand should be given for relieving his pressure accurate and proper working.

- To increase their customers they can more camping about their new products, named TBSA. Because customer can take this product without any charge and get maximum 8% interest.

- BBL can offer millennium and bilinear scheme like other bank to attract new customers.

- Telesales department should build proper coordination with IT department.

- Motivate the best performer by providing him/ her increment or reward.

- Training program should be taken more seriously and often. Business Executive should be sent for training for betterment of service.

- Business Executive should Calculate DBR (Debt Burden Ratio) by using adequate data and prepare loan file using this calculation.

- They should care enough about the interest rate for both Loan & deposit’s products, and the charges of the account and card. Because they provide loan with 19.5% interest rate, & they cutoff high charges for the account which is higher than SCB.

- To increase their feedback and sell more products via phone they should train up and provide Business Executive modern technology and handsome remuneration.

Some More Parts-

Report on Telesales Department Activities of Brac Bank Limited (Part-1)

Report on Telesales Department Activities of Brac Bank Limited (Part-2)

Report on Telesales Department Activities of Brac Bank Limited (Part-3)