TRANSACTION COST

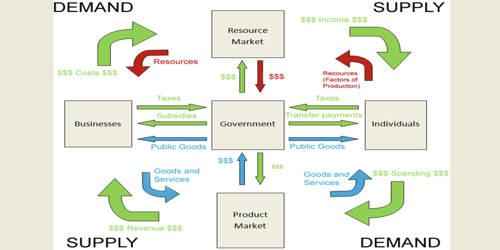

Transaction costs are the costs of arranging contracts or transaction agreements between demanders and suppliers, and it also includes shipping and handling costs. Middlemen and retailers bring goods near to buyers, so that they do not have to travel to producers of goods, and thus reduce transaction cost. If there were no grocery stores, imagine how difficult it would be for each buyer to identify farmers willing to sell grocery. Transaction costs use up real resources which may have alternative uses. They are expenses incurred when buying or selling a good or service.

Explanation

Transaction costs cover a wide range: communication charges, legal fees, informational cost of finding the price, quality, and durability, etc., and may also include transportation costs. Transaction costs are a critical factor in deciding whether to make a product or buy it. This includes commissions, markups, markdowns, fees, and any direct taxes. Transaction costs, which are of special significance to investors who frequently trade securities, can vary substantially depending upon the firm with which the investor conducts business.

A well functioning market provides necessary information to both buyers and sellers to facilitate transactions. When complete information is not available, transaction cost goes up. Consider sales of used books. When students sell their used books to book stores, they get paid only about 25 percent of the original price of the book. On the other hand, when students buy used books from book stores, they are charged about 75 percent of the original price. The difficulty of identifying those students who are willing to sell used books and those students who are willing to buy used books and then the difficulty to bring the potential buyer and seller together raises transaction costs of buying/selling used books. Book stores take advantage of this difficulty or high transaction cost while pricing used books they sell and used books they buy.

Use of money for transaction lowers transaction cost. In olden days when there was no money and goods were bartered, a double coincidence of wants only would allow a transaction to happen. Imagine a condition when the only way I could buy corn for my home was to barter it with a lecture in economics (because that is what I do for living). The transaction could take place only when my want of corn could be matched with a corn seller’s want of lecture in economics. Because of high transaction cost, the volume of trade in those days was small. By lowering transaction cost, volume of trade can be increased. That is what money does. Use of money as a medium of exchange abolishes the need of double coincidence of wants. I collect money in exchange of lecture in economics, whosoever buys the lecture, and then use this money to buy corn, whosoever sells the corn.

Conclusion

Thus, you see the importance of transaction cost. It can make or break a transaction or reduce the volume of transaction. For simplification, we shall assume negligible transaction costs in the rest of the discussions and focus on demand and supply, the other two aspects for a market transaction to happen.

Information Source: