BSRS History

We have chosen BSRS to portray the financier point of view in the process of entrepreneurial development.

Bangladesh Shilpa Rin Sangstha (BSRS) was established on October 31, 1972 under the Bangladesh Shilpa Rin Sangstha Order, 1972 (President’s order No. 128 of 1972) to provide credit facilities and other assistance to industrial concerns and encourage and broaden the base of investment in Bangladesh.

BSRS extends medium and long term credit facilities to industrial projects mainly in private sectors. Besides, it provides, underwriting advance /bridge finance/debenture loans to public and private limited companies. BSRS also guarantees under certain conditions, deferred payments of machinery imported under supplier’s credit and provides guarantee and counter guarantee for loans for loans , debts, credits, performance of contract and financing arrangements with foreign leading agencies as well as local banks and financial institutions. BSRS is an active member of Dhaka Stock Exchange (DSE), engages in trading securities in both the primary and secondary securities market. It also acts as a manager and banker to the public issues of the securities. BSRS started commercial banking operations from 4th may, 1997.

Organizational setup:

BSRS has 18 operational departments under 4 divisions at its head office in Dhaka. It has one commercial banking branch at Motijheel and a corporate branch in Karwan Bazar, Dhaka. BSRS has four branch offices outside Dhaka, one each at Chittagong, Rajshahi, Khulna and Sylhet.

Capital and Resources:

Currently the resources of BSRS consist of local currency funds only. Since 1985, BSRS has not received any foreign currency fund. Prior to 1985, the foreign currency funds were the lines of credit channeled by the government from various international and regional leading agencies. The foreign currency reserves were also augmented by contracting direct credit lines from different foreign countries and by borrowing foreign currency from the Government or from any bank or financial institution in Bangladesh or from any foreign countries, governments, or foreign banks or financial institutions. The local currency fund of BSRS consists of paid up capital, reserves, deposits and borrowing from the Government.

The authorized and paid up capital of BSRS are Tk. 2,000 Million and 700 million respectively. BSRS equity as on june 30, 2001 stood at Tk. 1,573,707 million ( Including reserves and surplus )

The resource position of BSRS as on June 30, 2001 is shown below.

Table -1: RESOURCES

Million Taka)

| Source | 30th June | |

| 2001 | 2000 | |

| Paid up Capital | 700.000 | 700.000 |

| Reserves | 873.707 | 755.654 |

| Borrowing / Term loans | 500.667 | 584.000 |

| Deposits | 135.445 | 89.447 |

| Total | 2,209.819 | 2,129.101 |

Major sectors of BSRS loan disbursement:

BSRS’s major sector wise loans and advances are presented here. Please note in point that ICT loan is not indexed separately as it constitutes a very little part of the organization’s total disbursement. It has been included in the miscellaneous section

BSRS

Sector wise loan and advances

(Figure in Million)

| Industry Sector | Long term loan | Debentures & underwriting loan | Total |

| Food & Allied | 3,004.699 | 47.045 | 3051.744 |

| Jute & Allied | 5,596.139 | 61.660 | 5657.799 |

| Textile & Allied | 3303.556 | 41.444 | 3345.000 |

| Paper & Printing | 71.348 | 60.218 | 131.566 |

| Chemicals, Pharmaceuticals | 2379.390 | 37.957 | 2417.347 |

| Tannery, Leather & rubber | 159.014 | 3.472 | 162.486 |

| Transport | 1196.791 | 2.155 | 1198.946 |

| Services | 698.147 | 39.003 | 737.150 |

| Engineering | 556.756 | 20.656 | 577.412 |

| Misc. | 92.334 | – | 92.334 |

| 17371.784 | |||

| Others | |||

| Commercial Loans | 2.228 | ||

| Loan Under investors’ scheme | 2.445 | ||

| Staff loan | 88.658 | ||

| Total Taka | 17058.174 | 313.610 | 17465.115 |

Project Implementations and Recovery:

Close monitoring & supervision of projects are undertaken to ensure that the projects are implemented on schedule. During the year, 2 projects went into commercial operations and 1 project went into partial operation. At the end of FY 2000-2001, 11 projects were under different stages of implementation.

Table -2: Stages of Implementation of Projects

(No. of Projects)

| Sl. No. | Status of Projects | 1999-2000 | 2000-2001 |

| 1 | Commercial operation | 02 | 02 |

| 2 | Total Operation | 02 | 01 |

| 3 | Under construction | 03 | 03 |

| 4 | Documentation not completed | 04 | 05 |

| Total: | 11 | 11 |

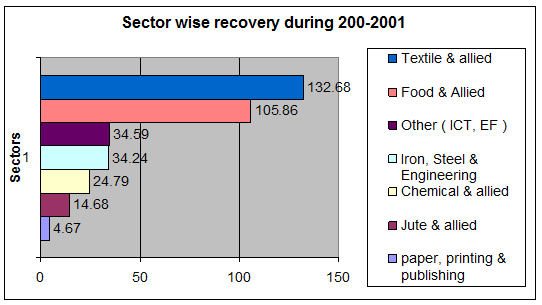

Chart 1: Sector wise recovery during 2000-2001

Recovery trends and status:

In order to ensure credit discipline, BSRS strictly observed the credit guidelines of the Bangladesh bank. as on 30 June 2001, 91.10% of industrial term loans was classified. The amount of provisions (including interest suspense) kept in books of accounts was 91.05% of the loan portfolio.

Recovery of due / overdue loans received utmost priority during FY 2000-2001 as in the previous years. BSRS provided a number of incentives, rebates and concessions to the borrowers for repaying the dues on or before scheduled dates. (This trend continues throughout the better part of 2004 as increasing pressure from government forced BSRS to close many of its overdue accounts as bad debts and reconcile many others. Relevant data and trend graphs are presented afterwards. )

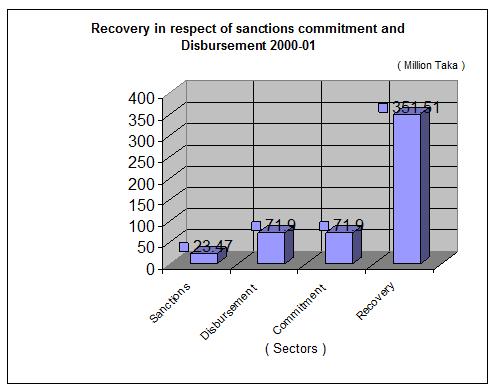

During FY 2000-2001, BSRS recovered a total amount of Tk. 351.506 million. It comprised of recovery of 334.709 million in respect of term loans in foreign and local currency and Tk. 16.797 million on account of other operations such as dividends on shares and interest on debentures.

Chart2: Recovery in respect of sanctions commitment and Disbursement 2000-01

Outstanding and overdue loans of BSRS during the 1997 to 200

| Outstanding | Overdue | Overdue as % of outstanding | |||||

| Year | Private | Public | Total | Private | Public | Total | |

| 1997 | 15,249.02 | 391.58 | 15,640.60 | 12,987.76 | 203.55 | 13,191.31 | 84.34 |

| 1998 | 16,513.44 | 369.60 | 16,883.04 | 14,271.06 | 219.63 | 14,490.69 | 85.90 |

| 1999 | 17,865.91 | 353.98 | 18,219.89 | 15,141.05 | 230.87 | 15,371.92 | 86.58 |

| 2000 | 17,578.73 | 274.86 | 17,853.59 | 15,517.55 | 207.00 | 15,724.55 | 88.07 |

| 2001 | 17244.02 | 221.10 | 17,465.12 | 15232.47 | 207.00 | 15,439.47 | 88.40 |

Highlights of BSRS’s Activities in the last six years

| Particulars | Years | Cumulative (Since Inception) | |||||

|

Years >> | 2002-2001 | 2001 – 2000 | 2000 – 1999 | 1999 – 1998 | 1998 – 1997 | 1997 – 1996 | |

| Net Approvals: | |||||||

| Term loans | 23.47 | 83.70 | 97.17 | 241.55 | 226.61 | 5183.58 | |

| Underwriting Advance & Debenture loans | 6.38 | 34.67 | 20.00 | 48.20 | 132.31 | ||

| Equity Investment | 27.42 | 35.13 | 8.84 | 42.42 | 31.46 | 259.34 | |

| Debentures Investment | 63.43 | ||||||

| Disbursement: | |||||||

| Term Loans | 65.52 | 121.98 | 199.90 | 212.41 | 114.18 | 4899.49 | |

| Underwriting advance & debenture loans | 6.38 | 29.09 | 40.38 | 18.20 | 115.65 | ||

| Equity investment | 27.42 | 35.13 | 8.84 | 42.42 | 31.46 | 259.34 | |

| Debenture Investment | 64.43 | ||||||

| Recovery: Economic Highlights | 351.51 | 278.13 | 261.52 | 302.85 | 291.03 | 7905.45 | |

| Gross Investment | 41.82 | 659.70 | 508.32 | 970.43 | 607.00 | 10246.74 | |

| Job Creation (nos) | 80 | 628 | 658 | 1135 | 213 | 3117 | |

| Financial Highlights: | |||||||

| Paid up capital | 700.00 | 700.00 | 700.00 | 700.00 | 700.00 | 700.00 | |

| Reserves | 873.71 | 755.65 | 690.61 | 620.07 | 547.32 | 873.71 | |

| Borrowings/term debts | 500.67 | 584.00 | 584.00 | 584.34 | 501.00 | 500.67 | |

| Total Assets | 18608.43 | 18834.46 | 19212.21 | 2429.56 | 2366.14 | 18608.43 | |

| Total Income | 247.35 | 196.14 | 161.63 | 174.19 | 260.90 | 7205.06 | |

| Total Expenses | 139.24 | 129.30 | 121.96 | 119.02 | 215.56 | 5507.54 | |

| Total expenses to total Income (%) | 56.29 | 65.92 | 75.65 | 68.33 | 82.50 | 56.29 | |

| Total Income to total Assets (%) | 1.33 | 1.04 | 6.17 | 7.17 | 11.65 | 1.33 | |

| Total expenses to total Assets (%) | 0.75 | 0.69 | 4.60 | 4.90 | 9.62 | 0.75 | |

| Net Income before tax | 108.11 | 66.82 | 39.25 | 55.17 | 44.54 | 1908.78 | |

| Net income after tax | 69.11 | 44.42 | 39.25 | 55.17 | 32.92 | 832.03 | |

| Tax paid | 22.45 | 7.29 | 6.52 | 19.64 | 47.77 | 1649.28 | |

| DSL payment to GOB | 135.68 | 115.00 | 32.99 | 44.00 | 1790.00 | 5541.94 | |

| DSL payment to Donors | 0.69 | 0.69 | 350.07 | ||||

| Contribution to national Exchequer | 8.75 | 8.75 | 7.00 | 7.00 | 7.00 | 168.18 | |

| Debt-equity ratio | 0.32:1 | 0.40:1 | 0.41:1 | 0.44:1 | 0.40:1 | 0.32:1 | |

| Debt service coverage | 2.58 | 5.28 | 4.53 | 3.23 | 0.25 | 2.58 | |

Notes:

a. Color codes:

| Approximate position as on June, 2001 | Percentage | Ratio | Numbers |

b. These data have been provided by BSRS’s MIS department and DSE Library and subject to changing in approximate values.

Investment process for BSRS:

To apply for financial assistance from BSRS and inclusion in ICT Incubator a potential SMEs has to go through a set schedule of processes. They have been described below.

Formal Application to BSRS for loan or financial support:

The applicant company has to acquire formal application from BSRS office paying

Tk 100 as pay order to BSRS chief disbursement officer.

While receiving the form these documents have to be shown.

The memorandum of association. ( For Limited Companies )

- Listing certificate from Registrar of Joint Stock companies. or

- Listing from city corporation as registered partnership or proprietorship

Business.

- The VAT certification Number or

- TIN number ( Tax Identification Number )

- List of Directors and their consent letter.

The Application submission :

The formal application consists of primarily information about the applicant and the intended business pattern he or she likes to chose. Please refer to appendix 1.02 for a demo of the formal application form/

The application Processing:

The BSRS authority takes a disclosed time (Usually 2 to 3 weeks) to process the submitted application. This time is spent evaluating the given data in the application and a preliminary assessment of the applicant for loan purposes. The data collection usually revolves around:

The assessment of truth in

Business Address

Business Capital

Business Partners

Business Registration

Government taxes payment trends.

Eligibility findings.

This process is dedicated in assessing whether the applicant passes the

Eligibility qualifications, as in education, financial solvency, nationality,

Affiliation with government service, etc.

4. Preliminary interview & submission of project proposal:

If the application passes through the preliminary application processing, he/she is notified of the eligibility and is asked to appear before an assessment officer with a copy of the financial proposal paper for the financing asked from BSRS. The project paper or proposal is an integral part of the processing as the actual loan disbursement decision largely depends on the soundness of the report. The report paper should contain

The proposed financial structure of the organization after the receiving of the financial assistance from BSRS.

- The allocation of funds from the financing opportunity.

- The forecasted company / organization accounts.

- Future payment method preference.

- Possibility survey and product line feasibility study.

- Market structure for the organization’s products.

- The administrative structure and future capabilities.

- Past and future forecasted growth rate of the profitability.

- Market share status and achievement report.

- Total overview of the company / organization operations.

- Current accounting methods.

- If previously any finance acquired, the name of the FI and the payment history.

In the interview the applicant is asked on these and other relevant issues focusing on the above noted issues. Then the applicant is asked to come back when the project proposal passes the investment board of BSRS’s

- Final approval for BSRS financing:

If the board of BSRS finds the project proposal lucrative and feasible, it passes through the investment board. The applicant is asked to appear before the board for the final time and submit the final proposal regarding the financing interest rate and payment method. Here some distinct points are settled. They are –

The interest rate set by the BSRS.

- The Payment method and period

- Whether BSRS holds steak in the new organization.

- If so, the applicant is asked to increase its capital by the financing and issue new shares on behalf of BSRS. BSRS follows a rule where the new organization is financed up to 49% of its working capital and 33% if the company or organization already has other institutionalized financing options received.

Upon the settlement of these factors, BSRS instructs the applicant to open a new account in any nationalized commercial bank and transfers the money ( Amount financed ) to the account. The account is jointly held by the applicant and BSRS.

6. ICT incubator Space allocation process:

In this segment if the company chooses to take part in ICT Incubator, the applicant has to apply formally to BSRS for allotment of space and take part in the ICT Incubator program. Upon application BSRS instructs the applicant to collect a separate application form from BASIS under BCC (Bangladesh Computer Council) for space allocation in ICT The form is given in the appendix

7. Receiving of the allotted space:

The ICT incubator form from BASIS should be taken from BSRS Bhaban, BASIS office in ICT Incubator. The paperwork that includes in this form are

The trade license

- Registrar certificate

- Form of organization

- Required space, (Minimum 500 sft.)

- Vat/ TIN number.

After submitting the filled out form with all the paperwork, BCC evaluates the request and if accepted instructs BASIS to allocate space and necessary infrastructure to the applicant organization.

8. The final allotment:

After the space allotment the applicant organization has the choice to join BASIS, which enables the organization to receive added infrastructural and market support from BASIS. The applicant occupies the ICT Incubator space and informs BSRS about the allotment. The allottee should first pay BCC/BSRS 3 months rent in advance as required by the space taken.

Thus concludes the entrepreneurial financing process of BSRS/BCC/Basis ICT Incubator.

The flowchart of the financing process:

Critical Analysis of BSRS Investment process:

Though in truest sense, BSRS is one of the most prominent among the handful of financing options available for ICT companies, the financing process is not without its critics. A long process of finalizing the disbursement and sanctions makes BSRS ICT loans one of the costliest in the country. Also, BSRS deeply divides its ICT Incubator financing with its normal industry financing. The terms and conditions for ICT institutions on or off Incubator are distinctly different. The case stands, a company cannot achieve easy financing without participating ICT Incubator. On the other hand ICT Incubator loan consists of 3 organizations. BASIS for space allocation, BCC for Incubator participation and BSRS for Financing. The continuous and often unduly strenuous paperwork reduces the competitive edge of the participating companies.

On another somber note, even the normal financing rate and the Incubator financing rate also are different. Where a firm outside Incubator can be subjected to loan interest according to the Government’s industry policy, the Incubator participants have the opportunity to have reduced interest rates.

Reduced interest rate is not also without its demerits. It is often seen that the firms needing most ( Startups, Small Entrepreneurs ) are deprived while big names in ICT industry get the often reduced loan interest rate from BSRS. The time frame of the total allocation and financing process is too long to be comfortable for any enterprise. As the space allocation is overseen by BASIS and financing is overseen by BSRS any lagging in either part causes further time delay.