Executive summary

Banks are most active financial intermediary in today’s world. As a financial institution bank mainly operate to communicate among persons and effectively works as safeguard among them in this age globalization. In recent economy banks plays a vital role to entrust international trade, it’s quite impossible to commit international without help of banks and it also properly works to hedge away risk international traders. Banks operates most effectively to settle any transactions within different countries either trade purposes or personal purposes. This report tries to identify banks role foreign exchange management through evaluating foreign exchange operations of MBL, Satmosjid Road branch. I examine different aspects foreign exchanges innovation, development, regulations and related work papers to identify its impact, position and usefulness as banking procedures. The report provides a general view on Mercantile Bank Limited, theoretical aspects related to international trade and foreign exchange transactions as well as gives idea about foreign exchange regulations used in Bangladesh to control related financial institutions. This study also tries to clarify the operating procedures of foreign exchange department of MBL as a commercial bank and also tries to identify some aspects of further improvement in operations. It may help us to provide a scenario of foreign exchange control system in Bangladesh and foreign exchange transitions procedures applied in Bangladeshi commercial banks.Mercantile Bank Limited is unique in its objectives. It is a blend of development and commercial banks. I include various points inside the report to highlight the foreign exchange performance of Mercantile Bank Limited. I have started with the history of the banking sector in Bangladesh and development of this sector, economic background of Bangladesh and the overview of banking industry. Then I have wanted to discuss about the Mercantile Bank’s overview, its company chronicle, its mission, vision, goal, objectives as well as its organ gram, time line of MBL-at a glance, its organizational structure and structural of management, also the products and services launched by this bank. I have shown the credit rating of this bank and the BASEL-II requirement of the bank. And then I have come to the main point of my report that is foreign trade operation. In this sector, I want to highlight the foreign exchange functions of this bank, how they operate their foreign exchange activities that means the services the bank is provided to its clients by the help of import and export sections that is the overall activities of L/C transactions, the payment procedure of both the export and import, types of money transfer through the bank, the remittances they earn, the facilities they provide to their exporters and importers, the effect of exchange rates fluctuation and finally the business position of foreign exchange operation of the bank. After this section, I go to the financial analysis of this bank and it includes the quantitative analysis of export import of foreign exchange, ratio analysis and value added statement. Finally, I have found some problems in order to operate their business and include SWOT analysis in these findings and also recommended how to remove these problems to operate its business smoothly in the upcoming years.

1.1 Background of the study

Mercantile Bank Limited is a specialized financial institution that performs most of the standard banking services and investment activities on the basis not only profit sharing but also social partnership. This study attempts to analyze the nature of modern banking activities and performance of Mercantile Bank Limited. All through the internship program, close observation was made on different banking activities of Mercantile Bank Limited. Its performance was reviewed and analyzed through the annual reports, and internal records of the bank. I have tried my best to use this opportunity to enrich my knowledge on banking system. After observing thoroughly, I have prepared this report on the basis of my findings and observation relating to the topic.

1.2 Objective of study

The objective of the study is to obtain an understanding of the practical banking activities and relate them with theoretical knowledge that I gained through the theoretical training in the university and from various documents of the bank. Beside this, the followings are the specific objectives which I will try to cover in my report:

- To apply theoretical knowledge in the practical field.

- To be familiar with rules, regulations theories and practices for banking.

- To understand procedures of foreign trade operation of commercial banks in Bangladesh.

- To gather knowledge about banking companies operations in practical field.

- To observe the working environment in commercial banks.

- To have coverage the functions of foreign exchange section.

- To get an overview of the private Banking in our country.

1.3 Scope of the study

I was sent to Mercantile Bank Limited, Satmasjid Road Branch, the scope of the study is only limited to this branch. I worked in the Mercantile Bank, Satmasjid Road Branch; I got the opportunity to learn different part of banking system. The supervisor divided the whole banking system in three parts; as a result I got the opportunity to work in all the three divisions (General Banking Division, Credit Division and Foreign Exchange Division). My main concern was to identify the foreign exchange operation of Mercantile Bank Limited. From the practical experience I had the opportunity to gather information about the relevant topic.

1.4 Methodology

In this report theoretical method and case study are basically used. For this purpose, I have been collected the information from following sources:

1.4.1 Data collection:

Source of data of this report can be divided into two categories:

- Primary Sources:

- Three months practical participation in internee ship

- Direct observations

- Secondary Sources:

- Annual Report of Mercantile Bank Limited

- Relevant books, Research papers, Newspapers and Journals

- Internet and various study selected reports

- Various publications on Bank

- Websites

- Files & Folders

Primary data are collected by using noted technique. The reports are an exploratory research and for qualitative survey open ended question were ask to the Bank official. After collecting the secondary data, those data are need to Classified, analyzed, interpreted and presented in the report. Some arithmetic and graphical tools are used in this report for analyzing the collected data and to classifying those to interpret them clearly. The collected data were scrutinized very well and were pointed out and shown as findings. Few recommendations are also made for improvement of the current situation. On the basis of the suggestions of our honorable faculty advisor some corrections were made to present the paper in this form.

1.5 Limitations of the study

The report is presented on the basis of face to face conversation with the officer and the practical experience in the bank. Mercantile Bank Limited organizational environment was very helpful,

but I felt some limitations such as:

- Too much paper work was practiced.

- Vast areas of tasks operated by the bank.

- Due to some risky monetary transaction.

- The secondary data that have been observe was in a form, which was not helpful for this study.

- Due to the safety and security reasons, access to all the confidential data was not obtained.

- The information that is provided is the synopsis of the real volume of information, so the complete pictures of the concerned aspects are not evident.

- Lack of self-knowledge concerning report preparation, was also a limiting factor in preparing a better report.

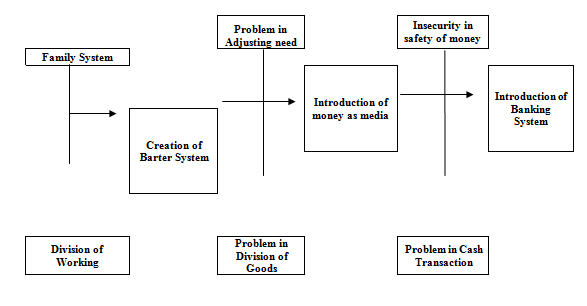

2.1 Historical Overview of Banking Sector

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word ‘Bank‘ was probably derived from the word ‘bench’ as during ancient time Jews used to do money – lending business sitting on long benches. First modern banking was introduced in 1668 in Stockholm as ‘Savings Pies Bank’ which opened up a new era of banking activities throughout the European Mainland. In the South Asian region, early banking system was introduced by the Afghan traders popularly known as Kabuliwallas. Muslim businessmen from Kabul, Afghanistan came to India and started money lending business in exchange of interest sometime in 1312 A.D. They were known as ‘Kabuliwallas’.

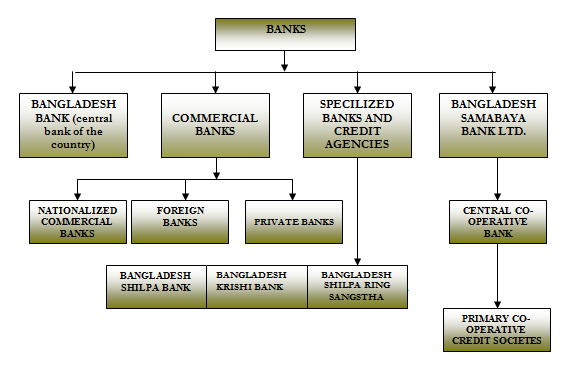

The previous discussion can be presented in the following diagram:

Figure: Diagram of evolution of banking business

After some time, businessmen started to charge some charges on those who took loan from them. It was the goldsmiths who introduced the ‘deposit slips’ in the history. Day by day, volume and complexity of transactions kept increasing, so as the concept of bank. The banking systems of ancient age and the banking systems of modern age are two distinctively separate entities.

2.2 Bangladesh Economy

Bangladesh is less developed country, whose economy is agro based. The agricultural system is primitive and frequently affected by natural disaster. Poverty is the main problems of this country. About 36% of its population is living below the poverty line whoever as about 18% of the population is living blows the hard-core poverty line (with less than 1800 calories per head per day).

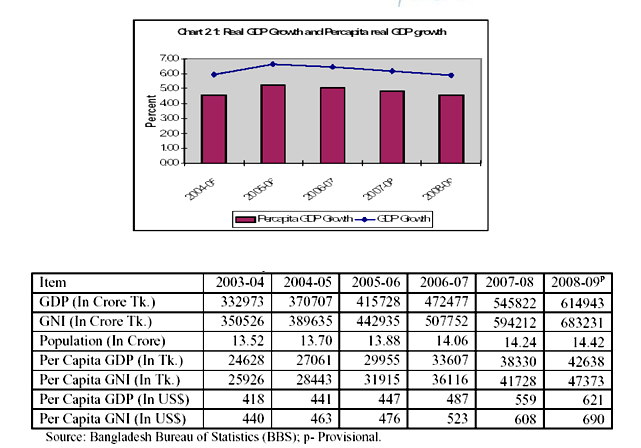

The economy has grown 5-6% per year since 1996 despite political instability, poor infrastructure, corruption, insufficient power supplies, and slow implementation of economic reforms. Bangladesh remains a poor, overpopulated, and inefficiently-governed nation. Although more than half of GDP is generated through the service sector, nearly two-thirds of Bangladeshis are employed in the agriculture sector, with rice as the single-most-important product. Bangladesh’s growth was resilient during the 2008-09 global financial crisis and recession. Garment exports, totaling $12.3 billion in FY09 and remittances from overseas Bangladeshis totaling $9.7 billion in FY09 accounted for almost 25% of GDP.

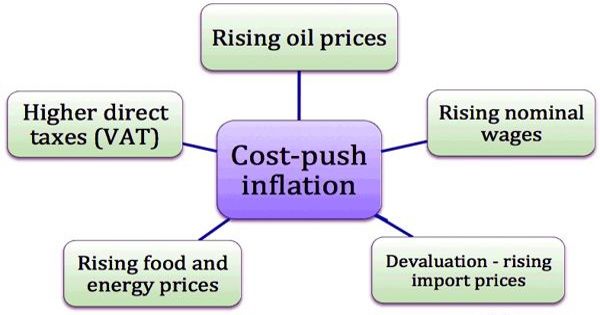

Bangladesh Bureau of Statistics has provisionally estimated the GDP growth rate to 5.88 percent in FY 2008-09. The GDP growth rate is assumed slightly lower compared to the previous fiscal year due to the adverse effects of global recession and the decline of growth in manufacturing and wholesale and retail trade sectors. It may be noted here that, according to the final estimate, the GDP growth rate was 6.19 percent in FY 2007-08. The Medium Term Macroeconomic Framework (MTMF) envisages the real growth of GDP for the fiscal year 2009-10, 2010-11 and 2011-12 are 5.5 percent, 6.0 percent and 6.5 percent respectively. The growth rate of agriculture sector is estimated an increase of 2 percentage points in FY 2008-09. Growth rate of industry sector, in particular, manufacturing sector is assumed to decline slightly. In spite of growth in some sectors, overall growth in services sector estimated to decline. The GDP growth rate and per capita GDP growth at constant prices for FY 2003-04 to FY 2008-09 are shown in graph From table it is observed that the per capita GDP and national income is increasing over the years and in FY2008-09 per capita GDP exceeded the US$600 mark for the first time. In FY 2008-09, the per capita national income and GDP are US$ 690 and US$ 621 respectively. At current prices, the per capita GNI for FY 2008-09 is estimated at Tk. 47,373 which is 13.53 percent higher compared to the previous fiscal year. Per capita GDP was Tk. 38,330 in FY 2007-08 which increased to Tk. 42,638 in FY 2008-09. In FY 2008-09, the growth rate of per capita GDP is 11.24 percent which was 14.05 percent in the preceding fiscal year.

From table it is observed that the per capita GDP and national income is increasing over the years and in FY2008-09 per capita GDP exceeded the US$600 mark for the first time. In FY 2008-09, the per capita national income and GDP are US$ 690 and US$ 621 respectively. At current prices, the per capita GNI for FY 2008-09 is estimated at Tk. 47,373 which is 13.53 percent higher compared to the previous fiscal year. Per capita GDP was Tk. 38,330 in FY 2007-08 which increased to Tk. 42,638 in FY 2008-09. In FY 2008-09, the growth rate of per capita GDP is 11.24 percent which was 14.05 percent in the preceding fiscal year.

2.2.1 Macro-economic trend:

Year | Gross Domestic Product | US Dollar Exchange | Inflation Index | Per Capita Income |

| 1990 | 1,054,234 | 35.79 Taka | 58 | 1.16 |

| 1995 | 1,594,210 | 40.27 Taka | 78 | 1.12 |

| 2000 | 2,453,160 | 52.14 Taka | 100 | 0.97 |

| 2005 | 3,913,334 | 63.92 Taka | 126 | 0.95 |

| 2008 | 5,003,438 | 68.65 Taka | 147 | – |

| 2009 | US$224.889 billion. | 69.27 Taka |

Table: Macro-economic trend

This is a chart of trend of gross domestic product of Bangladesh at market prices estimated by the International Monetary Fund with figures in millions of Bangladeshi Taka. However, this reflects only the formal sector of the economy.For purchasing power parity comparisons, the US Dollar is exchanged at 12.86 Taka only. Average wages in 2008 hover around $2-3 per day.

2.3 Banking Industry-Overview

The Banking Industry is Bangladesh is one characterized by strict regulations and monitoring from the central governing body, the Bangladesh Bank. The chief concern is that currently there are far too many banks for the market to sustain. As a result, the market will only accommodate only those banks that can transpire as the most competitive and profitable ones in the future.

Currently, the major financial institutions under the banking system include:

- Bangladesh Bank

- Commercial Banks

- Islamic Banks

- Leasing Companies

- Finance Companies

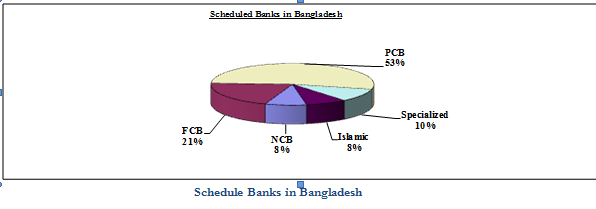

Of these, there are four nationalized commercial banks (NCB), 5 specialized banks, 11 foreign banks, 26 domestic private banks and 4 Islamic Banks currently operating in Bangladesh. All local banks must maintain a 4% Cash Reserve Requirement (CRR), which is non-interest bearing and a 16% Secondary Liquidity Requirement (SLR). With the liberalization of markets, competition among the banking products and financial services seems to be growing more intense each day.

2.4 Categories of Banks

The prosperity of a country depends upon its economic activities like any other sphere of modern socio-economic activities; banking is a powerful medium of bringing about socio-economic changes of a developing country. Agriculture, commerce and industry provide the bulk of a country’s wealth. Without adequate banking facility these three cannot flourish. For a rapid economic growth a fully developed banking system is highly essential. A suitably developed banking system can provide the necessary boost for the economic uplift of the country. The whole economy of a country is linked up with its banking system.

Banks in Bangladesh can be classified into the following categories.

Figure: Classification of Banks in Bangladesh

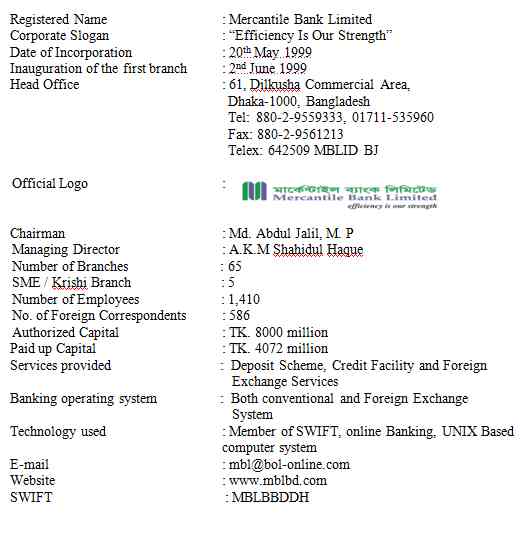

3.1 About Mercantile Bank Limited

Mercantile Bank Limited was incorporated in Bangladesh as a Public Limited Company with limited liability under the Bank Companies Act, 1991 on 20 May 1999 and commenced commercial operation on 02 June 1999. The Bank went for public issue of shares on in 2003 and its shares are listed with Dhaka Stock Exchange and Chittagong Stock Exchange. Mercantile Bank Limited emerged as a new commercial bank to provide efficient banking services and to contribute socio-economic development of the country.

Mercantile Bank Limited has gained firm confidence in the minds of its clients within a short period of its operation. The success is primarily attributed to prompt and bold decision-making, efficient and cordial services, economic use of resources and introduction of new financial products and technologies. The continued endeavors of the Management Staff of the Bank under prudent guidance and timely support of the Board of Directors have substantially contributed to success of the Bank. The Board of Directors takes this opportunity of expressing its heart-full appreciation and gratitude to the Government of the People’s Republic of Bangladesh, Bangladesh Bank, Securities and Exchange Commission (SEC), Dhaka Stock Exchange (DSE), Chittagong Stock Exchange (CSE), and Registrar of Joint Stock Companies and Firms for their help and assistance, valuable guidance and advice extended to the Bank from time to time.

The Board of Directors also expresses deep appreciation to the management and all members of staff for their meritorious and sincere services and also to the clients, the sponsors, the shareholders/stakeholders, patrons and well-wishers, whose continued support and patronage have made the results possible.

3.2 Company Chronicle

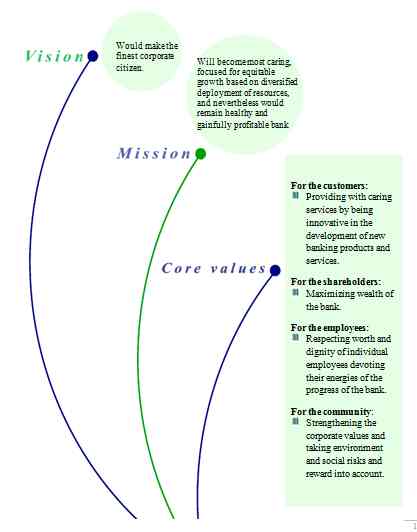

3.3 Vision Mission And Core Values

3.4 Objectives of MBL

3.4.1 Strategic objectives:

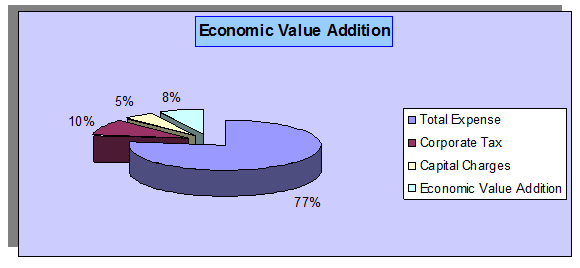

- To achieve positive Economic Value Added (EVA) each year.

- To be market leader in product innovation.

- To be one of the top three Financial Institutions in Bangladesh in terms of cost efficiency.

- To be one of the top five Financial Institutions in Bangladesh in terms of market share in all significant market segments we serve.

3.4.2 Financial objectives:

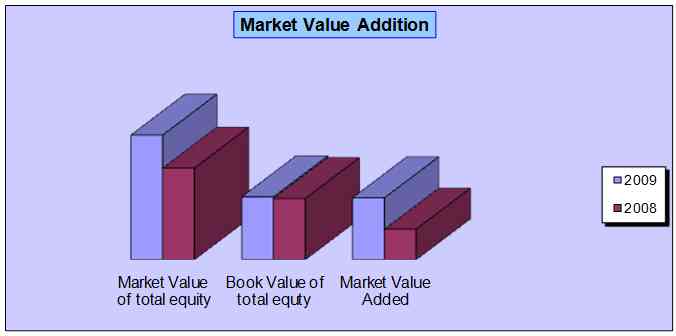

- To achieve 20% return on shareholders’ equity or more, on average.

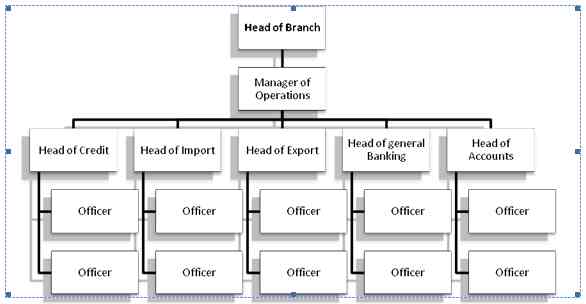

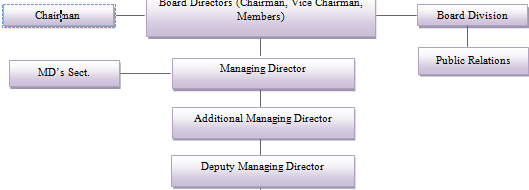

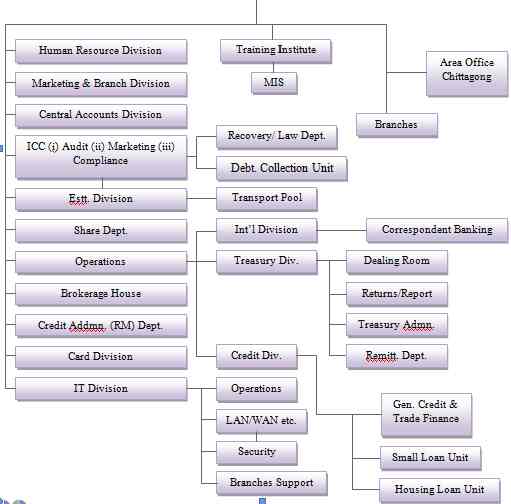

3.5 Organ Gram Of MBL

3.6 Time Line Of MBL- At A Glance

| Particulars | 2005 | 2006 | 2007 | 2008 | 2009 |

| Authorized Capital | 1200.00 | 3000.00 | 3000.00 | 3000.00 | 8000.00 |

| Paid-up Capital | 999.27 | 1199.12 | 1498.90 | 1798.68 | 2158.42 |

| Assets | 28890.48 | 37159.65 | 44940.54 | 55928.72 | 66166.52 |

| Investments | 3517.68 | 5407.90 | 7099.97 | 6264.71 | 9664.72 |

| Deposits | 25727.43 | 33317.64 | 39348.00 | 49538.35 | 58033.47 |

| Advances | 21857.05 | 26842.14 | 31877.86 | 43419.36 | 48295.55 |

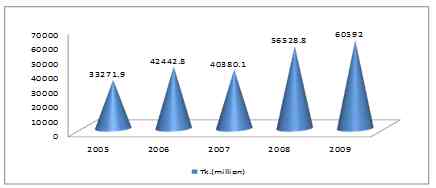

| Import | 33271.90 | 42442.80 | 40380.10 | 56528.80 | 60592.50 |

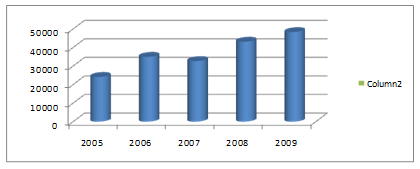

| Export | 24108.57 | 34592.10 | 32670.10 | 43108.50 | 46298.60 |

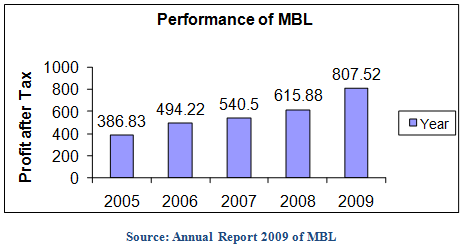

| Profit after tax | 386.83 | 494.22 | 540.50 | 615.88 | 807.52 |

| Earnings Per Share | 32.26 | 32.97 | 30.05 | 28.53 | 37.41 |

| Price earnings ratio | 9 times | 10 times | 17 times | 9 times | 10 times |

| No. of Branches | 28 | 35 | 41 | 42 | 53 |

| No. of Employees | 663 | 879 | 945 | 1115 | 1303 |

| No. of foreign Correspondence | 266 | 271 | 584 | 586 | 590 |

3.7 Branch Location Of MBL

3.7 Branch Location Of MBL

Mercantile Bank has total 57 existing branches currently among these 52 branches and 5 SME/Krishi Branches with one head office, one zonal office, and one training institute. The objective of MBL is not only to earn profit but also keep the social commitment and to ensure its co-operation to the persons of all levels, to the businessmen, industrialists-specially who are engaged in establishing large scale industries by consortium and the agro-based export oriented medium and small scale industries by self inspiration. MBL as the largest private bank is committed to continue its endeavor by rapidly increasing the investment of honorable shareholders into asset.

3.7 Organizational Structure of MBL

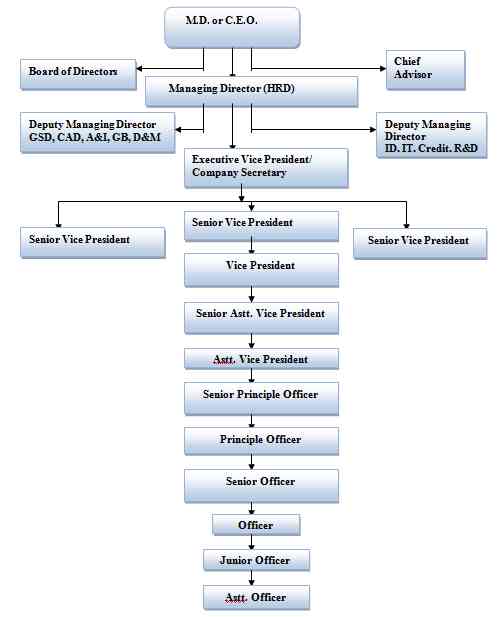

3.9 Structural of Management

3.10 Products And Services of MBL

3.10.1 Services offer by MBL:

The Bank launched several financial products and services since its inception. Among them are:

Deposit Schemes:

- Family Maintenance Deposit (FMD).

- Monthly saving scheme (MMS).

- Pension and Family Support Deposit (PFSD).

- Monthly Benefit Scheme.

- Quarterly Benefit Deposit Scheme.

- 1.5 times Benefit Deposit Scheme.

- Double Benefit Deposit Scheme (DBDS).

- Special Saving Scheme (SSS).

Credit Schemes:

- Consumer Credit Scheme (CCS).

- Car Loan Scheme.

- Doctors Credit Scheme.

- Rural Development Scheme.

- Lease Financing.

- Personal Loan.

- Small Loan Scheme.

3.10.2 Products Scheme:

The Bank has launched a number of financial products and services since its inception. Among these, Monthly Savings Scheme, Family Maintenance Scheme, Double Benefit Deposit Scheme, Quarterly Benefit Deposit Scheme, 1.5 Times Benefit Deposit Scheme, Advance Benefit Deposit Scheme, Consumer Credit Scheme, Small Loan Scheme, Lease Finance Scheme, Overseas Employment Loan Scheme, Car Loan Scheme, Home Loan Scheme and SME Loan have received wide acceptance among the people.

Deposit Products:

- Monthly Saving Scheme

- Family Maintenance Deposit

- Double Benefit Deposit Scheme

- Quarterly Benefit Deposit Scheme

- Times Benefit Deposit Scheme

- Advance Benefit Deposit Scheme

Loan Products:

- Consumer Credit Scheme

- Small Loan Scheme

- Lease Finance

- Doctors’ Credit Scheme

- SME Loan Scheme

- Personal Loan Scheme

- Car Loan Scheme

- Home Loan Scheme

- Overseas Employment Loan Scheme

4.1 Credit rating

4.1.1 Stable Credit Rating of MBL:

Year | Long Term Rating | Short Term Rating |

2009 | AA- | ST-2 |

2008 | A | ST-2 |

Credit Rating Information and Services Limited (CRISL) has upgraded the rating of Mercantile Bank Limited with “AA-” (pronounced as double A minus) in Long Term and reaffirms “ST-2” rating in Short Term based on financials upto December 31, 2009 and other qualitative and quantitative information.

MBL’s Long Term Rating has been upgraded to “AA-” which testifies its good fundamentals such as good profitability, increase in NIM, increase in non-funded business, diversified investment portfolio, increase in loans and advances, augmentation of Asset base etc. This level of rating indicates a banking entity with high quality, offer higher safety and have high credit quality.

The Short Term rating “ST-2” indicates high certainty of timely repayment. Liquidity factors are strong and supported by good fundamental protection factors. Risk factors are very small.

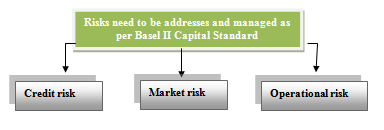

4.2 Basel – II requirement

Bangladesh Bank, the prime supervisory authority of the banking industry has been implemented the new capital accord (Basel – II) from first January, 2009 parallel to Basel – I. MBL has formed Basel – II implementation unit to ensure smooth and timely adoption of Basel II accord.

Basel II may be implemented with the following specific approaches as initial steps:

i. Standardized Approach for calculating Risk Weighted Amount (RWA) against Credit Risk supported by External Credit Assessment Institutions (ECAIs)

ii. Standardized Rule Based Approach against Market Risk and

iii. Basic Indicator Approach for Operational Risk.

4.2.1 Credit Risk management:

- MBL manages its credit risk by the following manner:

- Creating credit risk awareness culture

- Approved credit policy by the board of directors

- Separation of credit risk management division from credit administration division .

- Formation of law and recovery team

- Large loan limit and credit facility on business consideration

- Credit quality and portfolio diversification

- Early warning system

- Provision and suspension of interest

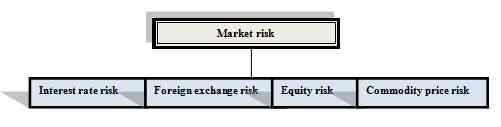

4.2.2 Market Risk management:

Market risk is defined as the risk of potential losses in earnings arising from movements in the market prices and their respective correlation and volatilities.

Market risk management has given more importance under Basel II capital standard. MBL encourages stress testing to foresee potential risks that may arise from extreme market events. Commodity risk does not exist in MBL as the bank is not involved. Managing the effects of adverse market movement on the banks earnings and capital effectively is the main objective of market risk management. Asset liability Committee (ALCO), in fact has the main responsibility to manage the market risk.

A policy has been set out for managing market risk by the board of directors of the bank where clear instructions have been given on:

- Loan deposit ratio

- Whole sale borrowing guidelines

- Medium term funding

- Liquidity contingency plan

- Local regulatory compliance

- Action plan

4.2.3 Operational Risk management:

Operational risks are the risks of loss resulting from inadequate or failed internal process, systems or from external events which are managed competently to protect and upload the bank’s reputation. Within the bank, operational risk may arise from:

- negligence and dishonesty of the employees

- lack of management supervision

- inadequate operational control

- lack of automation

- non compliance of regulatory requirements

- Internal and external fraud etc.

It is monitored and controlled within the bank through an operational risk management framework designed to provide a sound and well controlled operational environment.

5.1 Foreign Exchange Department

Foreign exchange refers to the process or mechanism by which the currency of one country is converted into the currency of another country. Foreign exchange is the means and methods by which rights to wealth in a country’s currency are converted into rights to wealth in another country’s currency. In banks when we talk of foreign exchange, we refer to the general mechanism by which a bank converts currency of one country into that of another. Foreign Trade gives rise to foreign exchange. Modern banks facilitate trade and commerce by rendering valuable services to the business community. Apart from providing appropriate mechanism for making payments arising out of trade transactions, the banks gear the machinery of commerce, especially in case of international commerce, by acting as a useful link between the buyer and the seller, who are often too far away from and too unfamiliar with each other.

According to Foreign Exchange Regulation Act (FERA) 1947, “Anything that conveys the right to wealth in another country is foreign exchange. Foreign exchange means and includes all deposits, credits and balances payable in foreign currency as well as foreign currency instruments such as drafts, TCs. Bill of Exchange, promissory Notes and Letters of Credit payable in any foreign currency. “

This definition implies that all business activities relating to Import, Export, Outward & Inward Remittances, buying & selling of foreign commissions, etc. come under the purview of foreign exchange business. Foreign exchange department of banks plays significant roles through providing different services for the customers.

5.2 International Trade

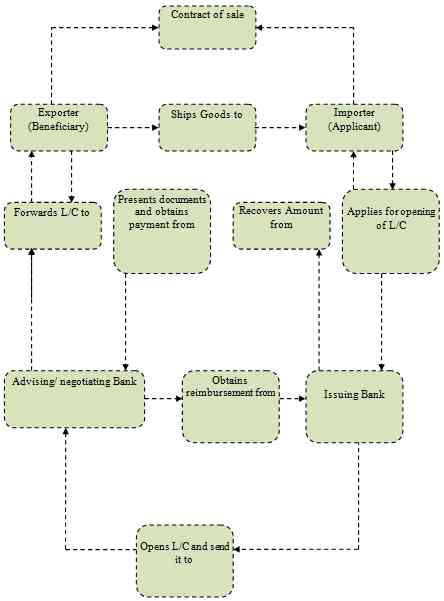

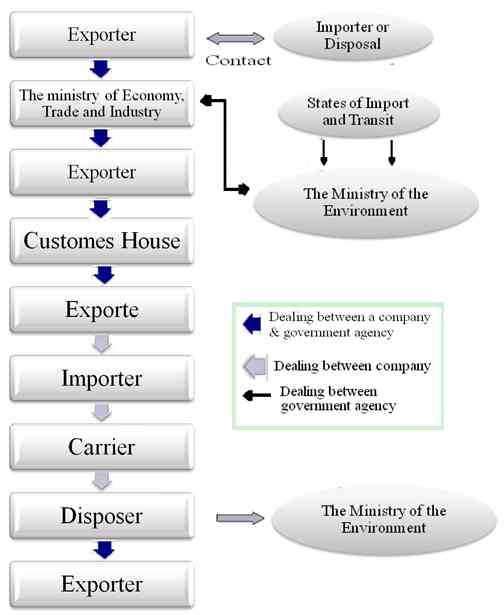

The international trade can be illustrated by the following diagram:

5.2.1 Foreign Exchange Market Participants:

There are four types of market participants—banks, brokers, customers, and central banks.

1 Banks and other financial institutions are the biggest participants. They earn profits by buying and selling currencies from and to each other. Roughly two-thirds of all FX transactions involve banks dealing directly with each other.

2 Brokers act as intermediaries between banks. Dealers call them to find out where they can get the best price for currencies. Such arrangements are beneficial since they afford anonymity to the buyer/seller. Brokers earn profit by charging a commission on the transactions they arrange.

3 Customer’s mainly large companies, require foreign currency in the course of doing business or making investments. Some even have their own trading desks if their requirements are large. Other types of customers are individuals who buy foreign exchange to travel abroad or make purchases in foreign countries.

4 Central banks, which act on behalf of their governments, sometimes participate in the FX market to influence the value of their currencies.

5.3 Foreign Exchange Transactions

Conversion of currencies or exchanges is known as foreign exchange transactions. The conversion may arise from a transaction between a bank and another bank at home or abroad. The transactions involve at least two currencies. For a bank in Bangladesh, the process of conversion frequently involves conversion of Bangladesh Taka into foreign currency and vice versa.

5.3.1 Types of FX Transactions:

There are different types of FX transactions:

- Spot transactions: Spot market – deals with currency for immediate delivery (within one or two business days). Two parties agree on an exchange rate and trade currencies at that rate. This expresses only a potential interest in a deal, without the caller saying whether he wants to buy or sell. Although spot transactions are popular, they leave the currency buyer exposed to some potentially dangerous financial risks.

- Forward transaction: One way to deal with the FX risk is to engage in a forward transaction. In this transaction, money does not actually change hands until some agreed upon future date. A buyer and seller agree on an exchange rate for any date in the future and the transaction occurs on that date, regardless of what the market rates are then.

a) Futures: Foreign currency futures are forward transactions with standard contract sizes and maturity dates — for example, 500,000 British pounds for next November at an agreed rate.

b) Swap: The most common type of forward transaction is the currency swap. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date.

5.4 Payment Mode of Foreign Trade

An export contract can be deemed to be successfully completed when the exporter gets paid for the goods shipped by him, how he has to negotiations between which is to be decided during earlier negotiations between the exporter and the importer. There are five methods of payment which involve varying degrees of risk for the exporters are as follows:

- Payment in advance

- Open account

- Documentary collections

- Shipment on consignment basis

- Documentary credit under letter of credit

1. Payment in advance:

In this method of payment buyer pays seller before goods are shipped. Its generally used in case of new relationships and for smaller Transactions where buyer is unable to obtain an L/C. there is no advantage for buyer – Pays prior to receipt of goods and documents. Its adventurous for seller as eliminates risk of non-payment

2. Open account:

In open account method Buyer pays seller subsequent to receipt of an invoice, normally after goods are shipped. It’s used when there is a high trusts relationship between buyer and seller and in inter-company transactions. It allows buyer to delay payment until goods have been examined, and/or goods have been sold. It doesn’t give any Advantage to seller – Risks non-payment.

3. Documentary Collections:

Documents (representing title to the goods) are exchanged through a bank for payment or acceptance (promise to pay). It is used for ongoing business relationships and transactions not requiring the protection and expense of L/C’s. It’s adventurous for buyer as delays payment until receipt of documents and buyer can be financed directly by seller through use of time drafts. Its benefit able for seller as they can retains title to goods until payment or acceptance.

4. Shipment on Consignment Basis:

In this method the exporter makes shipment to the overseas consignee/ agent, but the title to the goods, as also the risk attendant thereto, even through the overseas consignee will have the physical possession of the goods. The payment is only made when the overseas consignee ultimately sells the goods to other parties; this producer is rather costly and risky to the exporter.

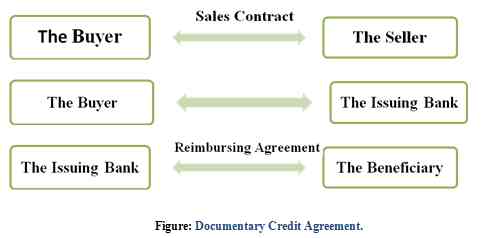

5. Documentary credit under Letter of Credit:

The most popular from in recent times, as the credit and payment risks of the exporter can be eliminated under appropriate forms of documentary credit. Documentary credit is any agreement, however named or described whereby a bank (the issuing bank) acting at the request and in accordance with the instructions of the customer (the applicant for the credit) (i) is to make payment to or to the order of a third party (the beneficiary) or is to pay, accept or negotiate bills of exchange (drafts) drawn by the beneficiary or (ii) authorizes such payment to be made or such drafts to be paid, accepted or negotiated by another bank against stipulated documents, provided that the terms and conditions of the credit are compiled with.

5.5 Letter of Credit

A letter of credit is basically a document issued by a bank guaranteeing a client’s ability to pay for goods or services. A bank or finance company issues a letter of credit on behalf of an importer or buyer, authorizing the exporter or seller to obtain payment within a specified timeframe once the terms and conditions outlined in the letter of credit are met. LC is a conditional commitment to pay certain amount after a certain period and some contains are fulfilled. It is useful when the importer or buyer is not well known and when exchange restrictions exist or are possible. Proper letters of credit have the following basic components:

1) Applicant: The party applying for the letter of credit, usually the importer in a grain transaction.

2) The Issuing Bank: The bank that issues the letter of credit and assumes the obligation to make payment to the beneficiary, usually the exporter.

3) Beneficiary: The party in whose favor the letter of credit is issued, usually the exporter in a grain transaction.

4) Amount: The sum of money, usually expressed as a maximum amount, of the credit defined in a specific currency.

5) Terms: The requirements, including documents that must be met for the collection of the credit.

6) Expiry: The final date for the beneficiary to present against the credit.

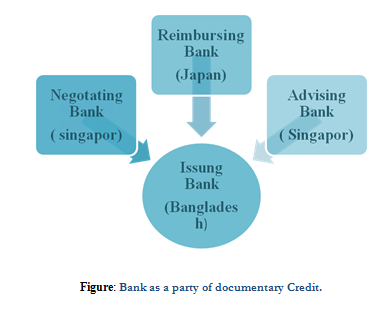

5.6 Letters of Credit Parties Involved

- Applicant: The party who applies to the opening (issuing) bank for the issuance of a letter of credit.

- Issuing Bank (Opening Bank): The bank, which issues the letter of credit on behalf of the applicant.

- Advising Bank: Denotes the bank giving notification of the terms and conditions of a letter of credit to the beneficiary (seller). The advising bank also takes reasonable care to check the apparent authenticity of the letter of credit, which it advises.

- Beneficiary: The party in whose favor the letter of credit has been established. The beneficiary is the party who demands payment under the letter of credit.

- Confirming Bank: A bank that at the request of the issuing bank, assures that drawings under the credit will be honored (provided the terms and conditions of the credit have been met).

- Negotiating Bank: Bank, other than the issuing bank, which elects to “negotiate” (advance funds or give value to the beneficiary) against presentation of complying documents.

- Paying Bank: The bank authorized in the letter of credit by the issuing bank to honor sight or deferred payments under the terms specified in the credit. (If this bank is the advising bank, it has no obligation to honor documents; however, if this is a confirming bank, it is obligated to pay against complying documents.)

- Reimbursing Bank: The bank authorized by the issuing bank to reimburse the drawee bank or other banks submitting claims under the terms of the credit.

5.7 Operations of Documentary Letters of Credit

The following five major steps are involved in the operation of a documentary letter of credit:

- Opening.

- Advising.

- Amendment.

- Presentation.

- Settlement.

a) Opening of Letter of Credit:

Opening of letter of credit means, at the request of the applicant (importer) issuance of a L/C in favour of the beneficiary (exporter) by a Bank. The Bank, which open or issue L/C opening Bank or issuing Bank.

b) L/C Advising:

Advising through a Bank is a proof of evident authenticity of the credit to the seller. The process of advising a credit consists of forwarding the original credit to the beneficiary to whom it is addressed. Before forwarding the advising Bank verify the signature (s) of the officer (s) of the issuing Bank & ensure that the terms & condition are not in violation of existing exchange control regulation & the other regulation relating to export. If credit is transmitted via telex, advising Bank will match the test used in the telex.

c) Amendment of Credit:

Parties involved in a L/C, particularly the seller and the buyer cannot always satisfy the terms and conditions in full as expected due to some obvious and genuine reasons. In such a situation, the credit should be amended.

d) Presentation of Document:

The seller being satisfied with the terms and conditions of the credit proceeds to dispatch the required goods the buyer and after that, has to present the documents evidencing dispatching of goods to the negotiating bank on or before the stipulated expiry date of the credit. After receiving the entire document, the negotiating bank then checks the documents against the credit. If the documents are found in order, the bank will pay, accept or negotiate to the issuing bank. The issuing bank also checks the documents and if they are found as per credit requirements, either effects payment, or reimburse in the pre-agreed manner.

e) Settlement:

Settlement means fulfilling the commitment of issuing Bank in regard to effecting payment subject to satisfying the credit terms fully. This settlement may be done three separate arrangements as stipulated in the credit.

5.8 Main Types of Money Transfers Through Banks

- SWIFT Inter-Bank Transfer: Now firmly established as standard practice in the major trading nations. The buyer will instruct their bank to make payment to any bank account specified by the exporter. It is good practice, therefore, for the exporter to include their account details on their invoice heads.

- Buyer’s Cheque: An unsatisfactory method of settlement for the exporter as it carries the risk of dishonor upon presentation as well as the added inconvenience of being slow to clear. There is also the very real danger of the cheque being lost in transit as well. A cheque is also unsatisfactory if it is in the currency of the buyer, as this will take longer to clear and will involve additional bank charges. Exporters should only use this method if they have an established trading history with their customer or in cases where the profit margin has been increased to offset cash flow problems anticipated by the delay in receiving payment.

- Banker’s Draft: The buyer who asks their bank to raise a draft on its corresponding bank in the exporter’s country arranges this. Provides additional security to a buyer’s cheque, but they can be costly to arrange and they do run the risk of getting lost in transit.

- International Money Orders: These are similar in nature to postal orders. They are pre-printed therefore cheaper to obtain than a Banker’s Draft, although again there is the risk of loss in transit.

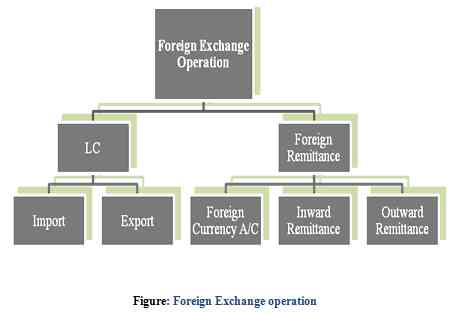

5.9 Part of Foreign Exchange Operation of MBL

There are mainly three types of transactions which lead to foreign exchange. These are:

1. Import

2. Export

3. Foreign Remittance

5.10 Import Section of MBL

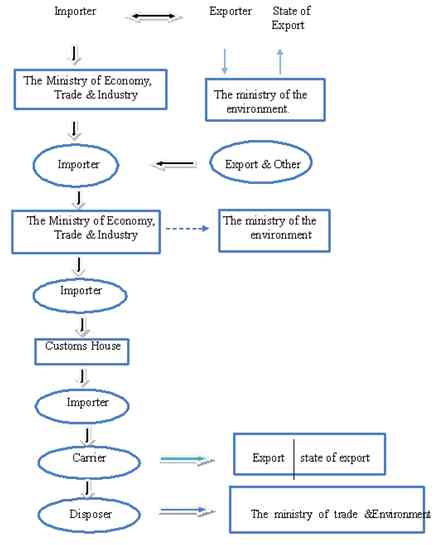

As a authorized dealer the major import items financed by MBL, Satmosjid Road branch are capital machinery, Hot Roll Steel, electronic equipment, rice, wheat, seeds, polyolefin, cement clinkers, dyes, chemicals, raw cotton, garments accessories, fabrics, cotton etc. To import, a person should be competent to be an ‘importer’. According to Import and Export (Control) Act, 1950, the officer of Chief Controller of Import and Export provides the registration (IRC) to the importer. After obtaining this, the person has to secure a letter of credit authorization (LCA) from Bangladesh Bank. And then a person becomes a qualified importer. He requests or instructs the opening bank to open an L/C.

5.10.1 Import procedures:

1. Registration with CCI&E:

For engaging in international trade, every trader must be first registered with the Chief Controller or Import and Export.

2. Purchase Contract between importers and exporter:

Now the importer has to contact with the seller outside the country to obtain the Performa invoice/indent, which describes goods or Indent is got through indenters a local agent of the sellers.

3. Collection of LCA form:

Then the importer collects and Letter of Credit Authorization (LCA) from MBL Satmosjid Road Branch.

4. Opening a Letter of Credit (L/C) :

Bank provides guarantee to importer and exporter through Letter of Credit. Thus the contract between importer and exporter is given a legal shape by the banker by its ‘Letter of Credit’. The process of opening L/C regarding to import through MBL, Satmosjid Road branch are as following:

5.10.2Flow Chart of Import Procedure:

A. Interview of probable L/C opener:

At first in case of import L/C opening opener must give an oral interview to the responsible officers of MBL. If the officers are satisfied with opener’s motive of import, type of import goods, quality of imported goods and marketability of goods than they will give approval to opener to further steps.

B. Application for L/C limit:

Before opening L/C, importer applies for L/C limit. To have an import L/C limit, an importer submits an application to the Department of MBL furnishing the following information-

- Nature of business.

- Required amount of limit.

- Payment terms and conditions.

- Goods to be imported.

- Offered security.

- Repayment schedule.

- Full particulars of bank account maintained with MBL Satmosjid Branch.

C. The L/C Application:

After getting the importer applies to the bank to open a letter of credit on behalf of him with required papers. Documentary Credit Application Form:

- Tax Identification Number Certificate.

- VAT Registration Certificate.

- Membership Certificate of recognized Trade Association as per IPO.

- Proforma Invoice: It states description of the goods including quantity, unit price etc.

- L/C Form: MBL provides a printed form for opening of L/C (MF-fx 13) to the importer. This form is known as Credit Application form. A special adhesive stamp is affixed on the form. While opening, the stamp is cancelled. Usually the importer expresses his desire to open the L/C quoting the amount of margin in percentage.

- L/C authorization form (LCAF) duly signed by the importer.

- The insurance cover note: The name of issuing company and the insurance number are to be mentioned on it.

- IMP form duly signed by the importer.

- Forwarding for Pre-Shipment Inspection (PSI): Importer sends forwarding letter to exporter for Pre-Shipment Inspection. But all types of goods do not require PSI.

D. Time limit for opening L/C

E. Terms of L/C

F. Shipment Validity & Expiry

G. Amendments

H. Transmission of L/C to Beneficiary through Advising Bank

I. Presentation of the Documents:

- The seller being satisfied with the terms and the conditions of the credit makes shipment o the goods as per L/C terms.

- After making the shipment of the goods in favor of the importer the exporter submits the documents to the negotiating bank.

- After receiving all the documents, the negotiating bank then checks the documents against the credit. If the documents are found in order, the bank will pay, accept or negotiate to MBL.

- MBL, Satmosjid Road Branch & bank received seal to be affixed on the forwarding schedule.

- MBL, Satmosjid Road Branch crossed the bill of exchange & transport documents immediately to protects loss or fraudulent.

J. Lodgment of Documents

K. Retirement of Documents

L. Endorsement of Non-Negotiable Copy Documents:

For clearance of cargo:

In the event of non-receipt of import documents relating to goods, which have already reached the port, the customer may ask the bank to provide a Shipping Guarantee/NOC to enable them to clear the goods, form the customers. The Shipping Guarantee may be given on the basis of a written undertaking from the clients by MBL. The S/G should state, inter alias, that he will in due course accept the original documents in spite of discrepancies, if any and bear the exchange loss on account of fluctuation of exchange rates between the dates of guarantee to actual date of lodgment of original documents, when received.

- MBL, Satmosjid Road Branch will check the non-negotiable copy documents with the L/C terms and make entries of particulars of copy documents in the Shipping Guarantee Issue Register (MB fx-06)

- MBL, Satmosjid Road Branch will recover Taka equivalent of F.C value of N/N copy documents and charges from the customer.

- MBL, Satmosjid Road Branch will ensure return back of the shipping indemnity/guarantee from the shipping company by delivering original shipping documents to the importer after receipt of original documents from the payee bank.

- MBL, Satmosjid Road Branch will mark cancellation on the shipping indemnity/guarantee returned by the shipping company through the importer and file it in the respective L/C file.

5.10.3 Import Financing by MBL:

1. Payment against Document (PAD):

The MBL, Satmosjid Road branch starts PAD procedure after getting all documents from the exporter of importer as evidence of exporting goods. Documents required for PAD is mentioned below:

- Original (Non-negotiable) bill of Leading.

- Commercial Invoice.

- Certificate of Insurance.

- Certificate of Origin.

- Bill of exchange.

- Pre-shipment Inspection Certificate.

- Packing List.

- Clean Report of Findings (CRF).

2. Examination of PAD Documents:

Scrutinizing documents is very important for the MBL, Satmosjid Road branch. As after examining all the documents the MBL will make payment to the negotiating bank. So any mistake in the examination process may cost MBL, Satmosjid Road branch.

3. Loan against Trust Receipt (LTR):

Under this LTR, Loan is allowed by MBL only to first class importers. Here only on the basis of trust without paying MBL anything or a partial amount, the importer takes the documents. Then importer is allowed 60-90 days time to make payment.

5.10.4 Accounting Treatment for Opening Import L/C:

When the officer thinks fit the application to open a L/C, giving the following entries- creates the following charges-Table-Showing accounting treatment at the time of L/C opening:

Particulars | Debit/ Credit | Charges in Taka |

| Customer’s A/C | Debit | |

| L/C Margin A/C | Credit | Commonly 10-20% |

| Commission A/C on L/C | Credit | 0.09% |

| VAT | Credit | 15% on commission |

| SWIFT Charge | Credit | 3500/= |

| Service Charge | Credit | 1000/= |

| Stamp | Credit | 150/= |

| Miscellaneous | Credit | 600/= |

The following accountings treatments are given by MBL in different stages of import L/C are as following:

When import L/C is opened:

Date | Particulars | Ref.No | Debit(TK) | Credit(TK) |

| Customers Liability . . . . . . . Dr.Bankers Liability . . . . . . . . . Cr. |

When L/C against import is opened then bank as gives guarantee on behalf of customers so customer’s liability is transferred to bankers liability.

When charges are taken by MBL:

Date | Particulars | RefNo | Debit(TK) | Credit(TK) |

| Party A/C . . . . . . . . . . . . . . Dr.Margin on L/C . . . . . . . . Cr. |

Commission on L/C . . . . Cr.

Vat on L/C . . . . . . . . . . Cr.

Swift charges . . . . . . . . Cr.

Bank service charges . . . Cr.

Stamps . . . . . . . . . . . . Cr.

Miscellaneous . . . . . . . . . Cr.

When different charges and margin is charged by bank for import L/C then party a/c or current deposit account of L/C opening party is charged against different charges and margin on L/C.

When documents are received:

Date | Particulars | RefNo | Debit(TK) | Credit(TK) |

| PAD A/C……………………….…………. Dr.ETCA Head Office………..…….Cr. |

IncomeA/C Telex……………..…Cr.

Income A/C Interest on PAD A/C….…………….…………….Cr.

Income A/c Exchange on Earnings .………………………….………Cr. Bankers Liability……………………..Dr.Customers liability…………………Cr.

When documents is received than the amount provided to importer is debited under PAD account and head office and other charges as income is credited and at the same time as documents is received so MBL liability against that documentary credit is decreased and importers liability is increased.

5.11 Export Section of MBL

The other type of L/C facility offered by PBL’s is Export L/C. Bangladesh exports a large quantity of goods and services to other countries. Readymade Garments (both knitted and woven), jute, jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exports export to foreign countries. Garments sector is the largest sector that exports the utmost share of the country’s export. Bangladesh exports most of its RMG products to USA and European Community (EC) countries. Bangladesh exports about 40 % of its RMG products to USA. Most of the exporters who export through PBL are RMG exporters.

The Bank handled total 17926 export bills worth BDT 46298.60 million in 2009 as against that of 17581 export bills and BDT 43108.50million during 2008. The focal point of the bank in export financing was garments industry, the lone driving force of the economy of Bangladesh in single biggest source of foreign exchange and employment provider of the country. Other notable items were jute and jute goods, leather, handicrafts, tea, frozen food and fish.

5.11.1 Export Procedures:

MBL is running exciting as well lively export to deliver the surplus products to other countries and thereby earns huge amount of foreign currency. Payment for goods exported from Bangladesh should be received through an Authorized dealer in freely convertible foreign currency or in Bangladeshi Taka from a Non- Resident A/C.

In the export section, two types of L/C are handled-

- Back-to-Back L/C

- Export L/C

Export financing can be done in two ways. These are:

- Pre-shipment financing.

- Post-shipment financing.

5.11.2Flow-chart of Export Procedure:

The followings process must be passed by an exporter to open a documentary credit in MBL, Satmosjid Road branch:

(a) Registration of Exporters: For obtaining ERC, intending Bangladeshi exporters are required to apply to the controller/ Joint Controller/ Deputy Controller/ Assistant Controller of Imports and Exports, Dhaka/ Chittagong/ Rajshahi/ Mymensingh/ Sylhet/ Comilla/ Barishal/ Bogra/ Rangpur/ Dinajpur in the prescribed form along with the following documents:

1) Nationality and Assets Certificate;

2) Memorandum and Article of Association and Certificate of Incorporation in case of Limited Company;

3) Bank Certificate;

4) Income Tax Certificate;

5) Trade License etc.

(b) Securing the Order: After getting ERC Certificate the exporter may proceed to secure the export order. He can do this by contacting the buyers directly or through agent. In this purpose the exporter may get help from:

- License Officer;

- Buyer’s Local Agent;

- Export Promoting Organization;

- Bangladesh Mission Abroad;

- Chamber of Commerce (local & foreign)

- Trade Fair etc.

(c) Signing the Contract: After communicating buyer, exporter has to get contracted (writing or oral) for exporting exportable items from Bangladesh detailing commodity, quantity, price, shipment, insurance and marks, inspection and arbitration etc.

(d) Receiving Letter of Credit: After getting contract for sale, exporter should ask the buyer for Letter of Credit (L/C) clearly stating terms and conditions of export and payment.

(e) Procuring the materials: After making the deal and on having the L/C opened in his favor, the next step for the exporter is to set about the task of procuring or manufacturing the contracted merchandise.

(f) Shipment of goods: Then the exporter should take the preparation for export arrangement for delivery of goods as per L/C and incomer’s, prepare and submit shipping documents for Payment/ Acceptance/ Negotiation in due time.

Documents for shipment:

- EXP form,

- ERC (valid),

- L/C copy,

- Customer Duty Certificate,

- Shipping Instruction,

- Transport Documents,

- Insurance Documents,

- Invoice,

- Other Documents,

- Bills of Exchange (if required)

- Certificate of Origin,

- Inspection Certificate,

- Quality Control Certificate,

- G.S.P. Certificate,

g) Documents submission: In this step exporter who confined with MBL will prepare export related documents and submit those documents to MBL, Satmosjid Road branch for negotiation. According to those documents MBL collects proceeds from the former issuing banks.

5.11.3 Export Financing by MBL:

Financing exports constitutes an important part of a bank’s activities. Exporters require financial services at four different stages of their export operation. During each of these phases exporters need MBL provides different types of financial assistance depending on the nature of the export contract are as follows:

1) Pre-shipment credit

2) Post-shipment credit

1. Pre-shipment credit:

Pre-shipment credit, as the name suggests, is given to finance the activities of an exporter prior to the actual shipment of the goods for export. MBL provides different type of Pre-shipment credit to its worthy customers for the following purposes:

- Cost of production or purchase

- Packing including any special packing for export

- Cost of special inspection or tests required by the exporter

- Internal transport cost

- Port, customs and shipping agent’s costs

- Freight and insurance charges if the contract is either C&F contract or a CIF contract

- Export duty or tax etc.

For Pre-shipment finance MBL, Satmosjid Road branch must consider the following factors related to exporters such as:

1) Honesty, integrity and capital of the borrower

2) Exporter experience in the line

3) Security offered

4) The margin and the rate of interest

5) The banks previous experience about the exporter

6) The standing of the foreign buyer

MBL provides facilities to extend Pre-shipment credit for contracts made on the basis of cables/fax/telex provided the following minimum information is available:

Details regarding customers

Particulars of the items

Quantity and unit price

Terms of sales and payment and

Date of shipment

An exporter can obtain credit facilities against lien on the irrevocable, confirmed and unrestricted export letter of credit in form of the followings from MBL, but PC and BTB L/C is most common form of pre shipment of credit provided by MBL:

- Export cash credit (Hypothecation)

- Export cash credit (Pledge)

- Export cash credit against trust receipt.

- Packing credit.

- Back to back letter of credit.

(a) Export cash credit (Hypothecation):

Here MBL only gets charge documents and lien on exports L/C or contract, bank normally insists on the exporter in furnishing collateral security. The letter of hypothecation creates a charge against merchandise in favor of MBL but neither the ownership nor the possession is passed to it.

(b) Export cash Credit (Pledge):

MBL provides such credit facility to exporter by pledge of exportable goods or raw materials. Here pledged goods are kept in MBL’s control and failure of the exporter to honor his commitment, MBL can sell the pledged merchandise for recovery the advance.

(c) Export Cash Credit against Trust Receipt:

In this case, MBL provides credit limit is sanctioned against trust receipt (TR). It’s also unlike MBL’s pledge facility, only difference is that the exportable goods remain in the custody of the exporter. This facility is allowed by MBL only to the first class party and collateral security is generally obtained in this case.

(d) Packing Credit:

Packing Credit is essentially a short-term advance granted by MBL to an exporter for assisting him to buy, process, manufacture, and pack and ships the goods. The highest limit of providing PC to a first class exporter by MBL is 10% of total export value.

Charge Documents for P.C.

Responsible officer of MBL should obtain the following charge documents duly stamped prior to disbursement:

I. Demand Promissory Note

II. Letter of Arrangement

III. Letter of Lien of Packing Credit (On special adhesive stamp)

IV. Letter of Disbursement

V. Packing Credit Letter

Additional Documents for P.C:

- Letter of Partnership along with Registered Partnership Deed in case of Partnership Accounts.

- Resolution of the Board of Directors along with Memorandum & Articles of association in case of Accounts of Limited Companies. In case of Corporation, Resolution of the Board Meeting along with Charter is needed.

- Personal Guarantee of all the Partners in case of Partnership Accounts and all the Directors in case of Limited Companies.

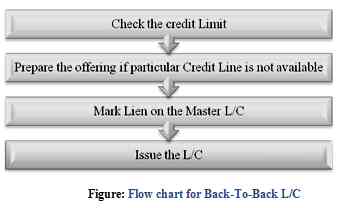

(e) Back to Back Letter of Credit (BTB):

When exporter falls short of raw materials in that case, exporter gives lien of export L/C to bank as security and opens an L/C against it for importing raw materials. This L/C is called Back To Back L/C. In back to back L/C, MBL gives facility to open BTB L/C up to highest 80% of lined export L/C.

5.11.4 Documents Required for Opening a Back-to-back L/C:

In MBL, Satmosjid Road Branch, following papers/ documents is required for opening a back-to-back L/C-

- Master L/C

- Valid Import Registration Certificate (IRC) and Export Registration Certificate (ERC)

- L/C Application and LCAF duly filled in and signed

- Proforma Invoice or Indent

- Insurance Cover Note with money receipt

- IMP Form duly signed

- In addition to the above documents, the followings are also required to export oriented garment industries while requesting for opening a back-to-back L/C –

- Textile Permission

- Valid Bonded Warehouse License

- Quota Allocation Letter issued by the Export Promotion Bureau (EPB) in favor of the applicant for quota items

- In case the factory premises is a rented one, Letter of Disclaimer duly executed by the owner of the house/premises to be submitted.

A checklist to open back-to-back L/C is as follows –

- Applicant is registered with CCI&E and has bonded warehouse license;

- The master L/C has adequate validity period and has no defective clause;

- L/C value shall not exceed the admissible percentage of net FOB value of relative Master L/C;

- Usage Period will be up to 180 days.

1) Payment of Back-to-Back L/C:

Client gives the payment of the BTB L/C after receiving the payment from the importers. But in some cases, client sells the bills to the MBL. But if there is discrepancy, the MBL sends it for collection. In case of BTB L/C, MBL gives the payment to the beneficiary after receiving the payment from the L/C of the finished product (i.e. exporter). Bank gives the payment from DFCA (Deposit Foreign Currency Account) where Dollar is deposited in national rate.

In MBL for BTB L/C, opener has to pay interest at LIBOR rate (London Inter Bank Offering Rate), which is 4% to 7%. A schedule named PI (Payment Instruction); Forwarding Schedule is prepared while making the payment to MBL’s foreign corresponding banks. PI is prepared when the payment of L/C is made and it contains the followings:

i) Reference number of the beneficiary’s bank and date.

ii) Beneficiary’s name.

iii) Bill value.

iv) Payment order number and date.

2) Reporting to Bangladesh Bank:

At the end of every month, the reporting to Bangladesh Bank regarding the following information is mandatory-

- Filling of E-2/P-2 schedule of S-1 category that covers the entire month’s amount of import, category of goods, currency, country etc.

- Filling of E-2/P-3 Schedule of all charges, commission with T/M Form.

- Disposal of IMP Form

3) Export L/C:

The other type of L/C facility offered by PBL’s is Export L/C. Bangladesh exports a large quantity of goods and services to other countries. Readymade Garments (both knitted and woven), jute, jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exports export to foreign countries. Garments sector is the largest sector that exports the utmost share of the country’s export. Bangladesh exports most of its RMG products to USA and European Community (EC) countries. Bangladesh exports about 40 % of its RMG products to USA. Most of the exporters who export through PBL are RMG exporters.

Check Points Noted in Master L/C:

Following sensitive points of the Master L/C are carefully checked by the officials of MBL. This are-

- Issuing Bank is not reputed

- Advising credit by the advising Bank without authentication

- Port of destination absent

- Inspection clause

- Nomination of specific shipping/Air line or nomination of specified vessel by subsequent amendment

- Bill of lading endorses blank, endorses to 3rd Bank, endorses to buyer or 3rd party

- No specific reimbursing clause

- UCP clause not mentioned

- Shipment/ presentation period is not sufficient

- Original documents to be sent to buyer or nominated agent

- FCR or HAWB consigned to applicant or buyer

- “Shipper’s load and count is not acceptable” clause

- L/C shall expire in the country of the issuing Bank

- Negotiation is restricted

3.Post Shipment Credit:

This type of credit refers to the credit facilities extended to the exporters by the banks after shipment of the goods against export documents. Before extending such credit, it is necessary for MBL to look into carefully the financial soundness of exporters and buyers as well as other relevant documents connected with the export in accordance with the rules and regulations in force. MBL provides following post shipment credit to the exporters through:

- Foreign Documentary Bill Purchase (FDBP)

- Advances against Export Bills surrendered for collection

(a) Foreign Documentary Bill Purchase (FDBP):

Most of the client submits the bill of export to bank for collection and payment of the BTB L/C. In that case, MBL purchases the bill and collects the money from the exporter. MBL subtracts the amount of bill for PC and BTB payment and gives the rest amount to the client in cash or by crediting his account or by the pay order.

For this purpose, MBL maintains a separate register named FDBP Register. This register contains the following information:

- Date

- Reference number (FDBP)

- Name of the drawee

- Name of the collecting bank

- Conversion rate

- Bill amount both in figure & in Taka.

- Export form number

- Export L/C number

(b) Advances against Export Bills surrendered for collection:

MBL also accept bills for collection of proceeds when they are not drawn under an L/C or when the documents, even though drawn against an L/C contain some discrepancies. MBL generally negotiates bills drawn under L/C, without any discrepancy in the documents, and the exporter gets the money from the bank immediately. However, if the bill is not eligible for negotiation, the exporter may obtain advance from MBL against the security of export bill. In addition to the export bill MBL generally ask for collateral security like a guarantee by a third party and equitable/registered mortgage of property.

5.11.5 Appraisal of Documentary Credit in MBL:

The sequence that are provided in open an export L/C up to its proceeds realization the following steps are generally passed in MBL, Satmosjid Road branch which are recorded in performance register are shown below:

When customer open export L/C in MBL, Satmosjid Road branch then it provides export finance through packing credit (PC), the limit of PC is highest 10% of export L/C value is provided to customers by MBL. Generally export L/C holder have advantage of opening back-to-Back (BTB) L/C under its export L/C, in MBL customers can open BTB L/C up to 80% of their export L/C value.

When BTB L/C documents is realized than MBL acknowledged the date and amount of payment for BTB Bills to its export L/C holder. The period of payment of BTB Bills is always kept longer than period of export value realization which helps to reduce risk of MBL.

When export proceeds than documents is presented in MBL than foreign documents bills is presented for purchase (FDBP) as 10% is given as PC and 80% is for BTB L/C so the remaining percentage of L/C value is purchased by MBL. When proceeds is realized than 10% is taken for PC and 80% is used for BTB payment and remaining is deposited to foreign currency (FC) Held account. If customers only present foreign documents bills for collection than remaining portion of export value other than PC and BTB payment will be deposited to parties CD account.

5.11.6 Accounting treatment for exports L/C:

In different stages of export L/C the different accounting treatment is taken by MBL, Satmosjid Road branch, which are recorded in different register i.e. L/C Register, PAD, Due Date Register, BTB L/C Register, BTB Bills Register, Performance Register etc. The followings recording process is generally maintained by MBL, Satmosjid Road branch in case of export L/C:

When export L/C is opened than no voucher is passed but when PC is taken than following voucher is passed:

Date | Particulars | Ref. No | Debit(TK) | Credit(TK) |

| PC A/C.………………………………………..Dr.CD A/C…………………………………Cr. |

As packing credit is provided to the customers so MBL will deposit the packing credit amount to the parties’ current account.

When BTB L/C is opened than following vouchers is passed:

Date | Particulars | Ref. No | Debit(TK) | Credit(TK) |

| Customers liability against BTB L/C.……….Dr.Bankers liability against BTB L/C………Cr. | ||||

| CD A/C…………………………………………..Dr.I/A on Commission……………………..Cr. |

I/A on service Charges………………….Cr.

I/A on SWIFT…………………………..Cr.

I/A on Stamps……………………….….Cr.

I/A on Miscellaneous………………..…..Cr.

When BTB L/C is opened than party’s liability is transferred to MBL so bankers liability against BTB L/C is credited and different charges is taken from party so amount of different charges is transferred from party account to income account.

When documents under BTB L/C are received lodgment is made and due date is realized than vouchers are passed as follows:

Date | Particulars | Ref. No | Debit(TK) | Credit(TK) |

| Banker’s liability against BTB L/C…………Dr.Customers liability against BTB L/C……..…………………………….Cr. | ||||

| Customers liability against BTB Bills.…….Dr.Bankers liability against BTB Bills…Cr. | ||||

| CD A/C………………………………………….Dr. Income A/C………………………………….Cr. |

When documents against BTB L/C are received than bankers liability on BTB L/C is reduced and banker’s liability for BTB Bills is increased and income is also increased for lodgment process.

When due date arises:

Date | Particulars | Ref. No | Debit(TK) | Credit(TK) |

| Bankers liability against BTB Bills…..…….Dr.Customer liability against BTB Bills………………………………………..Cr. |

When due date appears bankers liability against BTB Bills is decreased by MBL and customers liability against BTB Bills is increased by passing above vouchers.

For BTB payment following treatment will be given:

Date | Particulars | Ref. No | Debit(TK) | Credit(TK) |

| FC Held ……………………………………..Dr.Head Office…….………………………Cr. | ||||

| Head Office………………………………………….Dr.I/a on Exchange Gain…………….……Cr. |

I/A on Commission…………………….Cr.

I/AonVAT…………….……………….Cr.

I/Aon P.O……………………………..Cr.

I/A on postage………………………….Cr.

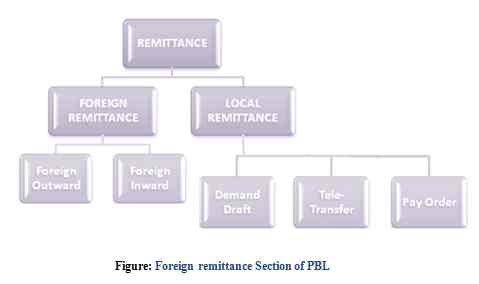

5.12 Foreign Remittance Section of MBL

Foreign exchange department of MBL, Satmosjid Road branch are responsible to deal with outward and inward remittance other export and import only when remittance are in foreign currency. MBL has already made foreign remittance arrangement with UniCredito Italiano, Italy and ICICI bank Canada to expedite inward foreign remittances. MBL also has established Drawing Arrangement with United commercial Bank and Arab Bangladesh Bank for prompt delivery services of remittances to the beneficiaries located any corner of Bangladesh.

Workings of this department:

- Overall supervision of Foreign Remit. Dept.

- Foreign TT payments & Purchase of F. Drafts, preparations of F.B.P. (Foreign Bill Purchased).

- Issuance of outward TT & FDD.

- Issuance of proceed responding certificate (PRC).

- Foreign Collection, Bangladesh Bank Clearing Check Collection, which comes from all branch of MBL.

- Withdrawal from F.C. A/C.

- Encashment of T.C. & Cash Dollar and Sterling Pound.

- Deduction of Tax and VAT. On behalf of Bangladesh Bank.

- Preparation of related statements including convertible Taka Accounts.

- Preparation of IBCA & IBDA and Balancing of Collection and other special assignment as desired by Department in charge.

- Balancing of Account Statements.

- Compliance of audit & inspection.

- Statement of all related works submitted to Bangladesh Bank.

All foreign remittance transactions are grouped into two broad categories of remittance i.e. Outward remittance & Inward remittance. As an AD MBL foreign exchange department focuses on these two sources of remittance.

5.12.1 Outward Remittance of MBL:

The term “Outward remittances” include not only remittance i.e. sale of foreign currency by TT. MT, Drafts, Traveler’s cheque but also includes payment against imports into Bangladesh & Local currency credited to Non-resident Taka Accounts of Foreign Banks or Convertible Taka Account. The main three type of outward remittance find MBL are as follows:

1. Private Remittance:

- Family remittance facility

- Remittance of Membership fees/registration fees etc

- Education

- Remittance of Consular Fees

- Remittance of evaluation fee

- Travel

- Health & Medical

- Seminars & workshops9. Foreign Nationals

- Remittance for Hajji

2. Fiscal & Business Travel:

- Official Visit

- Business Travel Quota for New Exporters

- Business Travel Quota for Importers and Non-exporting producers:

- Exporters’ Retention Quota

4. Commercial Remittances:

- Opening of branches or subsidiary companies abroad

- Remittance by shipping companies’ airlines & courier service

- Remittance of Royalty and technical

- Remittance on account of training & consultancy

- Remittance of profits of foreign firms/branches

- Remittance of Dividend

- Subscriptions to foreign media services

- Costs/ for Reuter monitors

- Advertisement of Bangladeshi Products in mass media abroad

- Bank Charges

5.12.2 Inward remittance of MBL:

The term” Inward Remittance” includes not only purchase of Foreign Currency by TT, MT, Drafts etc. but also purchases of bills, purchases of Traveler’s cheques. The main two sources of inward remittance are proceeds realized from export process and also a strong source Bangladeshi workers remittance from abroad.

Purchase of Currency Notes, Travelers cheques, Drafts etc:

Following General observations are required in addition to common judgment/intelligent /vigilance of the dealing officers: –

- Currency notes to be checked very carefully so as to avoid risk of purchasing counter fiet Notes.

- While purchasing Travelers cheque signature of the holder to be obtained on the TC/s in front of MBL officials and should be verified with the signature of the holder already given at the time of issuance of T.Cs,

- Drafts should not be purchased under any circumstances unless the holder is a regular/valued customer of MBL. Indemnity Bond to be obtained for revering the amount paid in advance to the holder in case of dishonor of the instrument.

- Private cheque should not be purchased under any circumstance without prior approval of MBL Head Office.

5.13 Foreign Exchange Business Position of MBL

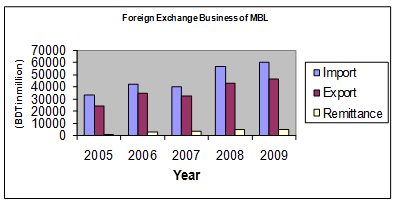

The main three streams of foreign exchange business of MBL is export, import and remittance section. The performances of three section of MBL from year 2001-2005 are presented below:

(BDT in millions)

Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Import | 33271.90 | 42442.80 | 40380.10 | 56528.80 | 60592.50 |

| Export | 24108.57 | 34592.10 | 32670.10 | 43108.50 | 46298.60 |

| Remittance | 679.10 | 2989.10 | 3510.40 | 4722.90 | 5061.30 |

The above information provides quite impressive results of performance of these three sections of MBL, as they all are in positive increasing trends. The MBL position of import business is quite better tat of export position but its noticeable that increase in export in 2005 in nearly double of increase in import in 2005. Though remittance is positive increasing but slow moving So MBL should take further steps to increase in this trend. The comparative position of these three sections from 2001-2005 in BDT is shown in the following graph:

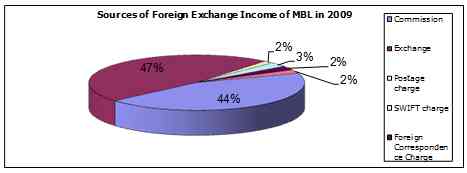

4.14.1 Income sources of foreign exchange department:

The different income sources of foreign exchange department of MBL, Satmosjid Road branch are as follows:

- Income on commission of L/C.

- Income on data transmission/ SWIFT charges

- Income on postage

- Income on Courier Charge

- Income on discrepancies

- Income for amendment charges

- Income from IMP and EXP fill up Charges

- Income from exchange gain

- Income on miscellaneous charges

The income of foreign exchange department of from different sources from year 2007-2009 is presented below:

| Year | 2007 | 2008 | 2009 |

| Commission | 217.15 | 300.61 | 387.82 |

| Exchange | 268.21 | 259.20 | 414.93 |

| Postage charge | 8.85 | 9.10 | 12.24 |

| SWIFT charge | 8.00 | 13.73 | 23.32 |

| Foreign Correspondence Charge | 6.38 | 12.53 | 20.75 |

| Others | 7.71 | 28.28 | 18.41 |

Source: Annual Report 2009 of MBL The distribution of major income

Sources of foreign department of MBL in 2006 are shown in pie chart below:

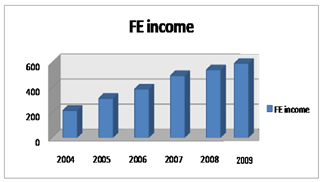

Foreign exchange income of Mercantile Bank Limited:

Foreign exchange income is very important source of revenue for the bank.

The different sources of income for foreign exchange business are revealed and the income is showing a continuous increasing trend from 2004 to 2009. The most dominant variable in foreign exchange income is exchange gain. This is achieved from import, export and remittance business. The graph is showing that foreign exchange income is increasing. In year 2009 as achieved highest income from foreign exchange.

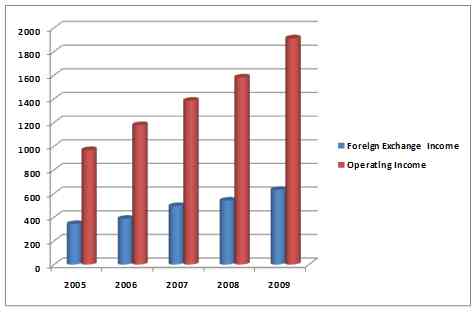

Foreign Exchange Income and Operating income:

It is shown that along with the increasing trend in foreign exchange income the operating income is also increasing. So, foreign exchange income has a positive effect on operating income as well as profit.

6.1 Quantitative Analysis of Foreign Exchange business

6.1.1 Import Trade:

The Diagram represents a significant growth in import trading within the last five year. In 2007 the import trade was little bit slower because of political condition of the country. In 2008 we can see a significant growth.

The principal items were capital machineries, garments and accessories, ships breaking.

6.1.2 Export Trade:

The graph shows the export operation progress of Mercantile Bank Limited. Diagram represents a significant growth in export trading within the last five year. In 2007 the export trade was little bit slower as like as import and the reason was political condition of the country. In 2008 we can see a significant growth in export operation.

The main export items of the bank were readymade garments, leather, products etc.

6.2 Ratio Analysis

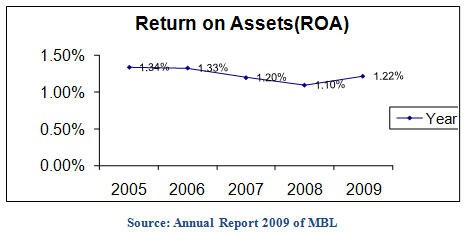

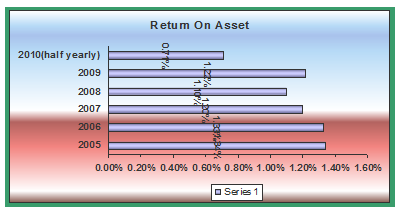

6.2.1 Return on Asset:

2005 | 2006 | 2007 | 2008 | 2009 | 2010(half yearly) |

1.34% | 1.33% | 1.20% | 1.10% | 1.22% | 0.71% |

Interpretation: Return on asset measure the return of the bank to the total asset available which was higher at the year 2005 and 2006 comparing to other years

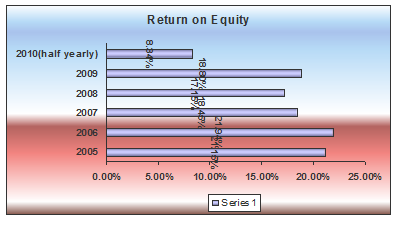

6.2.2 Return on Equity:

2005 | 2006 | 2007 | 2008 | 2009 | 2010(half yearly) |

21.15% | 21.94% | 18.45% | 17.15% | 18.80% | 8.34% |

Interpretation: Return on equity measures the return of the bank to the total equity available to shareholder to meet which was higher at the year 2005 and 2006 comparing to other years.

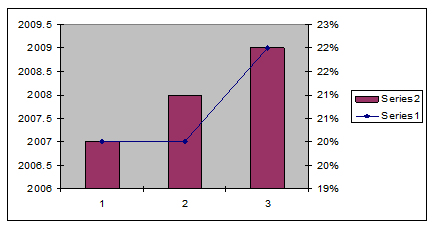

6.2.3 Dividend Rate:

2007 | 2008 | 2009 |

20 % | 20% | 22% |

Interpretation: The Board of directors recommended 22 % stock dividend for the year 2009. The bank paid out 20% stock dividend to the shareholders for last two years of 2008 and 2007.

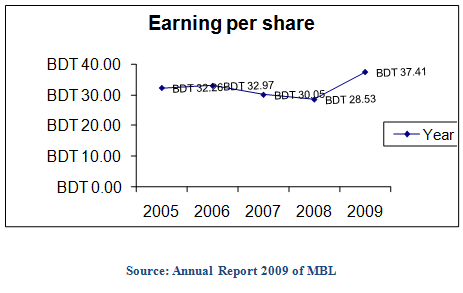

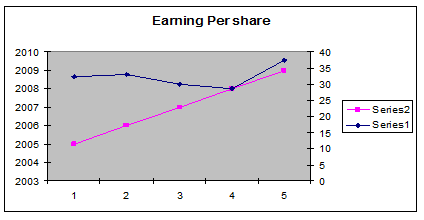

6.2.4 Earnings per share:

2005 | 2006 | 2007 | 2008 | 2009 |

32.26 | 32.97 | 30.05 | 28.53 | 37.41 |

Interpretation: Since the inception and enlistment in stock exchange the bank has been making positive EPS. The bank’s scenario for the last five years is given there.

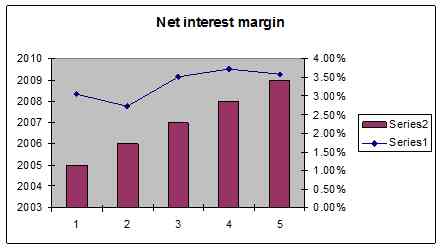

6.2.5 Net interest margin:

2005 | 2006 | 2007 | 2008 | 2009 |

3.05% | 2.73% | 3.52% | 3.72% | 3.58% |

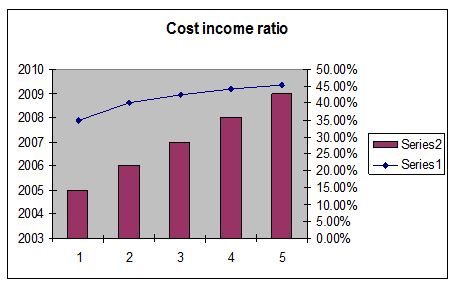

6.2.6 Cost income ratio:

| 2005 | 2006 | 2007 | 2008 | 2009 |

34.88% | 40.13% | 42.33% | 44.15% | 45.25% |

Interpretation: The cost to income ratio measure the degree to meet up the cost associated in the bank from the income earned in a particular year.

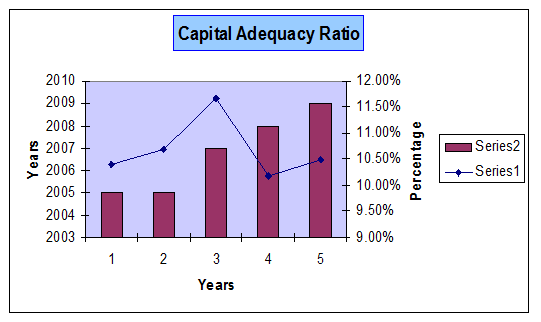

6.2.7 Capital adequacy ratio:

| 2005 | 2006 | 2007 | 2008 | 2009 |

10.3% | 10.68% | 11.6% | 10.1% | 10.48% |

Interpretation: It measure from the tier 1 that is the core capital and from tier II that is the supplementary capital needed for a bank. Here the risk weight is to be adjusted to find out the ratio.

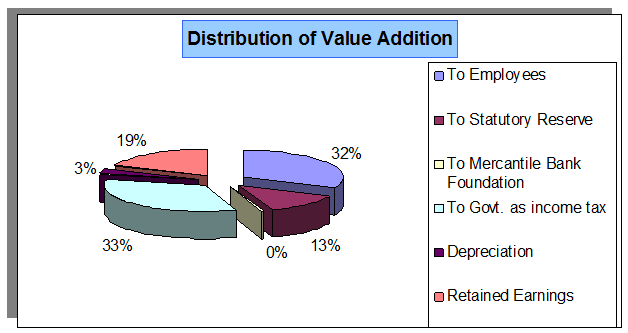

6.3 Value Added Statements

| Particulars | (BDT in millions) 2009 2008 |