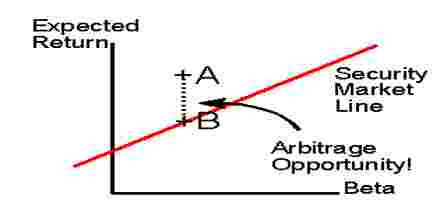

Principle purpose of this lecture is to present on Capital Market Theory. Here briefly focus on Capital asset pricing model. Capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset’s non-diversifiable risk. Capital market instruments used for market trade include stocks and bonds, treasury bills, foreign exchange, fixed deposits, debentures, etc.