A comparison between credit Schema of Prime Finance & Others

4.1 INTRODUCTION:

Consumer Credit Scheme is very much popular in Bangladesh. Most of the Private Commercial Banks are offering CCS program. Among them Prime Bank Limited, Dhaka Bank Limited, HSBC, South East Bank Limited, AB Bank Limited, East Bank Limited Standard Chartered Bank Limited, Mercantile Bank Limited and Premiere Bank Limited are the prime contributors of such consumer loan. The comparison is made based on products of Prime Bank and the similar products offered by other banks. Household loan, Car loan, Education loan, Travel loan and Wedding loan are taken into consideration to compare the total CCS program of Prime Bank. Among them Household loan and Car loan are the common products offered by the Banks.

4.2 HOUSEHOLD LOAN

The aim to provide Household loan is to increase the living standard of people by supporting financially. In our busy life it is necessary to purchase various household items to make our life easy, comfortable and enjoyable. The various Banks of Bangladesh come forward to assist their valued clients by providing the loan for household items. Almost all the Private Commercial Banks are providing household loan. Among them Dhaka Bank Limited, HSBC and South East Bank are to be considered the competitors of Prime Bank Limited for their attractive offering.

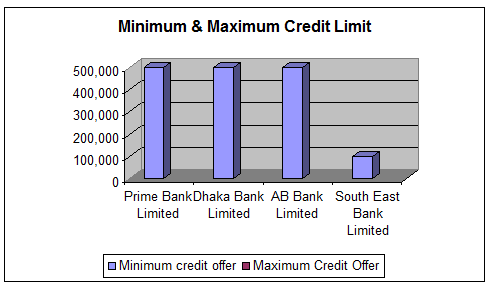

4.2.1 Amount of Credit Offer:

| Amount of Loan(In BDT) | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Minimum Credit offer | 10,000 | 25,000 | 25,000 | 15,000 |

| Maximum Credit offer | 500,000 | 500,000 | 500,000 | 120,000 |

Table 2: Maximum and Minimum loan offered by different banks in Household loan

Figure 2: A comparison on Loan limit of Household loan of different banks

A client can apply for a maximum household loan of BDT 500,000 from the three banks, i.e. Prime Bank, Dhaka Bank and AB Bank. South East Bank follows a very conservative policy by offering a least amount of loan of BDT 120,000. Prime Bank’s minimum offering of loan is BDT 10,000 with compare to Dhaka Bank (BDT 25000), AB Bank (BDT 25000) and south east Bank (BDT 15000).

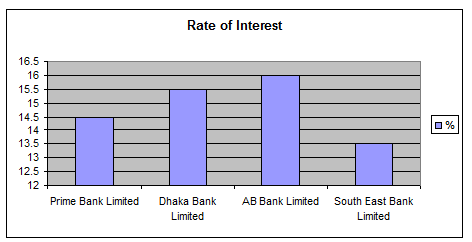

4.2.2 Rate of Interest:

| Amount of Loan(In BDT) | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Rate of Interest | 15 | 16 | 16.5 | 14 |

Table 3: The rate of interest of different banks on Household loan

Figure 3: A comparison of rte of interest on Household loan

In household loan, South east Bank offer a very low interest rate of 14% and this rate is very competitive with compare to other Banks. Prime Bank’s interest rate is moderate (15%) where as Dhaka Bank’s interest rate is 16% and AB Bank’s interest rate is 16.5% respectively.

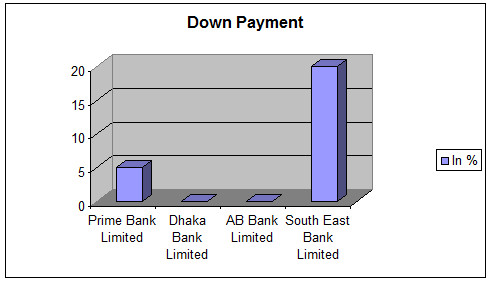

4.2.3 Down Payment: (Table 4: Down payment)

| Amount of Loan(In BDT) | Name of the Bank

| |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Down Payment (In %) | 10 | 0 | 0 | 25 |

Figure 4: A comparison of Down payment of different banks on Household loan

For the household loan of Dhaka Bank and AB Bank, a client does not need to pay any advance. But prime Bank charges a down payment of 10% on the loan applied. A customer needs to deposit a down payment of 25% in case of obtaining a Household loan from South East Bank.

4.2.4 Maximum time to repay:

| Amount of Loan(In BDT) | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Maximum Tenure (In year) | 3 | 5 | 3 | 3 |

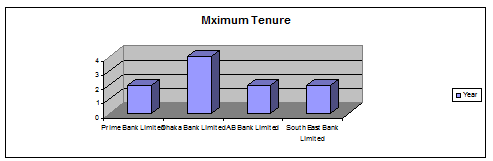

Table 5: Maximum time required to repay Household Loan

Figure5: A comparison on time limit offered by various banks on Household loan

A customer can take a maximum period of five years to repay his loan if he obtains a Household loan from Dhaka Bank. On the other hand, all other Banks offer a maximum period of three years to repay their loan.

4.2.5 Application fee:

| Amount of Loan(In BDT) | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Application | 10 | 500 | 0 | 200 |

Table 6: Application fee on Household loan.

AB Bank does not demand any application fee to obtain their loan of household. On the other hand, Dhaka Bank charges a highest fee of BDT 500 to apply for their loan. South east charges a moderate fee of BDT 200 and prime Bank Charges a very low fee of BDT 10 respectively.

4.2.6 Services and other Charges: (Percent of the Loan)

| Services and otherCharges | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Service charges | 1% | 1% | 1% | 1% |

| Risk fund | 1% | 1% | 0 | 1% |

| Stamp Charge | 470 BDT | 470 BDT | 350 BDT | 720 BDT |

| Penalty Charge | 0 | 200 | 0 | 0 |

| CIB | 50 BDT | 50 BDT | 50 BDT | 50 BDT |

Table7: Service and other charges of Household Loan.

Service charge is only 1 percent of loan offered for all Banks. AB Bank does not charges any risk fund and the remaining other Banks demands 1 percent of loan offered for risk fund. Stamp charges vary from Bank to Bank due to the numbers of guarantors required for household loan. CIB charges are same for all Banks. Dhaka Bank charges a penalty of BDT 200 for late payment of installment.

4.2.7 Refinancing

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Refinancing | Repayment of 75% of previous loan | Repayment of 70% of the previous loan | Repayment of 100% of the previous loan | Repayment of 100% of he previous loan |

Table 8: Refinancing.

Prime Bank refinances the same client in case he pays the 75% of the loan previously owned, whereas it is 70% for Dhaka Bank. AB Bank and South East Bank refinance the same client only if the client able to pay his previous loan by 100%.

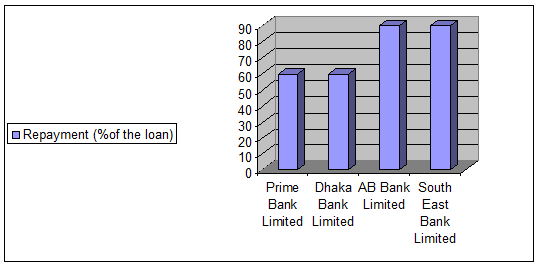

Figure 6: A comparison on refinancing facility

4.3 CAR LOAN:

A car is a more than symbol of solvency & prestige. Having a car means not depending on the kindness of others to go where we and our family need to go. A car gives us the convenience we seek while protecting our families from the heat & pollution that saturate our streets. Indeed nothing represents freedom of movement more than a car. So the owning of a car is something different. To meet such demand, various Banks comes forward to offer car loan. Among them AB Bank Limited, South East Bank Limited and Mercantile Bank Limited are taken into consideration for comparison with Prime Bank Limited.

4.3.1 Amount of Credit Offer:

| Amount of Loan (In BDT | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Minimum Credit offer | 50,000 | 50,000 | 20,000 | 50,000 |

| Maximum Credit offer | 4,000,000 | 1,000,000 | 1,000,000 | 400,000 |

Table 9: Maximum and Minimum loan offered by different banks in Car loan

Prime Bank offers a maximum amount of BDT 4,000,000 which is highest with compare to other three Banks. On the other hand AB Bank and South East Bank offer the same amount of BDT 1,000,000 as car loan. Mercantile Bank facilitate with only BDT 4000,000 which is lowest with compare to others. Prime Bank, AB Bank and Mercantile Bank offer a minimum amount of BDT 50,000 for car loan and South East’s offer is BDT 20,000.

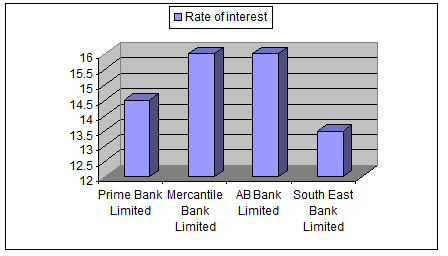

4.3.2. Rate of interest:

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Rate of Interest | 15 | 6.5 | 14 | 14 |

Table 10: The rate of interest of Car Loan offered by different bank.

Figure 7: A comparison of rate of interest on Car loan.

Mercantile Bank Limited and South East Bank Limited facilitate its customer with charging an interest rate of 14 percent and this is very competitive in Car loan market. AB Bank Limited offers a very high interest rate of 16.5 percent whereas Prime Bank’s offer is 15% for Car loan.

4.3.3 Down Payment. (Percent of the Loan)

| Condition of Cr | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Brand New | 10 | 30 | 30 | 30 |

| Recondition | 10 | 40 | 30 | 30 |

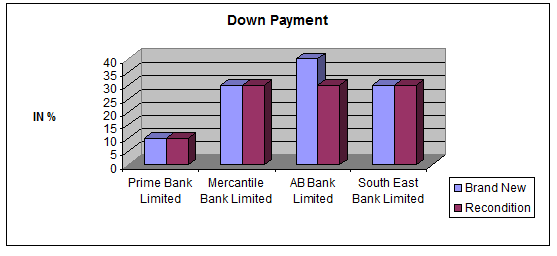

Table 11: Down payment of different banks on Car loan

Figure 8: A comparison of Down payment of different banks on Car loan.

The down payment for both Brand new car and reconditioned car is 10% of the provided loan in case of Prime Bank Limited. On the other hand it is 30% for both south ast Bank Limited and Mercantile Bank Limited. AB Bank charges 30% down payment for brand new car and 40% down payment for recondition car.

4.3.4 Maximum time to repay:

| Conditions of Car | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Brand New | 5 | 5 | 5 | 4 |

| Recondition | 4 | 3 | 5 | 4 |

Table 12: Maximum time required to repay Car Loan

South East Bank Offers a maximum period of five years for the payment of installments in case of both brand new car and recondition car. It is four years for Mercantile Bnak Limited. The maximum period facilitates by Prime Bank is five years for repayment in case of brand new car and whereas it is four years for recondition car.

4.3.5 Application fee:

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Application fee(In BDT) | 10 | 0 | 200 | 100 |

Table 13: Application fee required for Car loan.

The application fees required for Car loan of Prime Bank, South East Bank and Mercantile Bank are BDT 10, BDT 200 and BDT 100 respectively. On the other hand, AB Bank doesn’t charge any fee.

4.3.6 Services and other Charges:

| Services and other Charges (Percent of the Loan) | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Service charges | 1% | 1% | 1% | 0.25% |

| Risk fund | 0 | 1% | 1% | 1% |

| Stamp Charge | 470 BDT | 500 BDT | 720 BDT | 720 BDT |

| Penalty Charge | 0 | 0 | 0 | 0 |

| CIB | 50 BDT | 50 BDT | 50 DT | 50 BDT |

Table 14: Service and other charges of different banks regarding Car loan.

All the three Banks other than Mercantile Bank Limited charged 1 percent of the loan offered as a service charge whereas mercantile Bank demands a service charge of 0.25 percent of the loan disbursed. No Bank charges any penalty for late payment of installment. CIB form charge is same for all Banks.

4.4 EDUCATION LOAN:

Education never ends – it is not said without reason. We are educated all our lives and getting and education not only is a great achievement but something that gives us the tools to find our own way in the world. Education is indispensable; little do we realize how much more it can bring to us in terms of worldly amplifications. Anyone can have propensity and the natural endowment for education. But one might not have the resources to finance their education. In this regard many Banks come forward to facilitate the students to make their dream come true by providing education loan. Education loans can realize education plans or the education plans of children. One can strengthen one’s own future and the future of one’s son or daughter with education loans. Prime Bank Limited, HSBC, Eastern Bank Limited an South East Bank Limited provides an attractive Education loan for their customers.

4.4.1 Amount of Credit Offer:

| Amount of Loan(In BDT) | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Minimum Credit offer | 10,000 | 50,000 | 50,000 | 15,000 |

| Maximum Credit offer | 300,000 | 1,000,000 | 750,000 | 100,000 |

Table 15: Maximum and Minimum loan offered by different banks in Education loan.

Eastern Bank Limited served its customer with a maximum amount of BDT 1,000,000 and the offer is highest with compare to others. On the other hand, Prime Bank Limited, HSBC and South East Bank Limited offer a maximum amount BDT 300000, 750000 and 100000 respectively.

4.4.2 Rate of Interest:

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Rate of Interest | 15 | 16 | 18 | 14 |

Table 16: The rate of interest of Education Loan offered by different banks

Interest rate for education loan is highest in HSBC (18%) and lowest in South East Bank Limited (14%). Prime Bank Limited and Eastern Bank Limited offer an interest rate of 15% and 16% respectively for education Loan.

4.4.3 Down Payment:

| DownPayment | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | Southeast BankLimited | |

| 10 | 0 | 0 | 25 | |

Table 17: Down of different bank on education loan

There is no down payment required for obtaining Education loan from Eastern Bank Limited and HSBC. On the other hand Prime Bank Limited and South East Bank Limited demands a down payment of 10% and 25% of loan applied respectively.

4.4.4 Maximum time to repay:

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Maximum tenure | 5 | 5 | 5 | 4 |

Table 18: Maximum time required to repay Education loan.

The maximum period to repay the loan is five years for the three banks i.e. HSBC, Prime Bank Limited and Eastern Bank Limited. But it requires four years to repay the installments for full adjustment in case of South East Bank Limited.

4.4.5Application fee:

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Application fee | 10 | 0 | 200 | 100 |

Table 19: Application fee required for Education loan.

The application fee for obtaining Education loan is highest for HSBC. And it is BDT 200. Prime Bank and Eastern Bank Limited follows a very aggressive policy to disburse loan with offering an application fee of BDT 10 and BDT 0 respectively. South East Bank’s offering is BDT 100 for application fee.

4.4.6Services and other Charges:

| Services and otherCharges | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Service charges | 1% | 1% | 1000 BDT | 1% |

| Risk fund | 1% | 0 | 0 | 1% |

| Stamp Charge | 470 BDT | 470 BDT | 470 BDT | 720 BDT |

| Penalty Charge | 0 | 0 | 0 | 0 |

| CIB | 50 BDT | 50 BDT | 0 | 50 BDT |

Table: 20: Service and other charges of different banks regarding Education loan.

Service charges are 1 percent of the Loan applied for Prime Bank Limited, Eastern Bank Limited and South East Bank Limited. HSBC charges 1000 BDT as service charges. No risk fund is required for HSBC and Eastern Bank Limited. But Prime Bank and South East Bank incur a risk fund of 1% of the loan.

4.5WEDDING LOAN

The Wedding of oneself or family members is usually one that people want to celebrate with pride and joy. When it is the most important day they want to give the best memories of the day to cherish. Wedding loan is idle to make sure that all arrangements are made well in advance and every comfort meticulously provided for. Unsecured Wedding Financing Loan Program is designed by Banks to help make that special day even more memorable. Avery few Banks are offering such wedding loan. Among them Prime Bank Limited, Bank Asia Limited, Eastern Bank Limited and Standard Chartered Bank Limited are a head to offer such Loan.

4.5.1 Amount of Credit Offer:

Amount of Loan | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Maximum Credit offer | 200,000 | 300,000 | 1,00,000 | 5,000,000 |

Table 21: The Limit of Wedding loan for different banks

The loan offer for wedding Loan by Prime Bank, Bank Asia, Eastern Bank and Standard Chartered Bank are BDT 200000, 300000, 1000000 and 500000 respectively.

4.5.2 Rate of Interest:

( In Percent)

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Rate of Interest | 15 | 14 | 16 | 16.5 |

The interest rate of wedding loan is highest for Standard Chartered Bank Limited (16.5%) and it is lowest for Bank Asia Limited (14%). On the other hand interest rates of Prime Bank Limited and Eastern Bank Limited are 15% and 16% respectively.

4.5.3 Down Payment: (Percent of the loan)

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Down Payment | 10 | 25 | 0 | 25 |

Table 23: Down payment of different banks on Wedding loan.

Bank Asia Limited and Standard Bank Limited charge a Down payment of 25% of the Loan applied for wedding Loan. On the other hand Prime Bank Limited demands 10% Down payment and Eastern Bank Limited demands no Down payment.

4.5.4 Maximum time to repay: (In year)

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Maximum tenure | 3 | 3 | 5 | 5 |

Table 24: Maximum time required to repay loan of Wedding.

A client can avail the Wedding loan for a maximum of five years if he obtains loan from Eastern Bank Limited or Standard Chartered Bank Limited. Prime Bank Limited and Bank Asia Limited offer a maximum period of three years to repay loan.

4.5.5 Application fee:

Name of the Bank | ||||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Application fee | 10 | 0 | 0 | 0 |

Table 25: Application fee required for Wedding loan.(IN BDT)

No application fee is required for Wedding Loan in case of the loan disbursement from bank Asia Limited, Eastern Bank Limited and Standard Chartered Bank Limited. A client has to give BDT 10 to apply for Wedding Loan of Prime bank Limited.

4.5.5 Services and other Charges: (Percent of the loan)

| Services and other Charges | Name of the Bank | |||

| Prime BankLimited | Dhaka BankLimited | AB BankLimited | South East BankLimited | |

| Service charges | 1% | 1% | 1% | 2% |

| Risk fund | 1% | 0 | 0 | 1% |

| Stamp Charge | 470 | 350 | 470 BDT | 470 BDT |

| Penalty Charge | 0 | 0 | 0 | 0 |

Table 26: Service and other charges of different banks regarding Wedding loan.

Service charges are 1% of the loan applied for all banks other than Standard Chartered Bank with 2% of the loan applied. No risk fund is required by Bank Asia Limited and Eastern Bank Limited. But 1% of the loan is considered as a risk fund in Prime Bank Limited and Standard Chartered Bank Limited.

4.6Travel Loan:

Everyone needs a break at some point to relax, unwind and enjoy the good life. The travel loan program is designed to help any one to take trip now, rather than at some later date that usually never arrives. Prime Bank, HSBC, Eastern Bank and Dhaka Bank aim to facilitate such necessity by providing Travel loan.

More parts of this post-

An Overview of Prime Bank Banking System (Part-1)

An Overview of Prime Bank Banking System (Part-2)

An Overview of Prime Bank Banking System (Part-3)

An Overview of Prime Bank Banking System (Part-4)