Introduction:

Internship is an important & unavoidable part for completing the graduation in business studies. Internship can help the students to acquire practical knowledge about his or her particular learning. For the four years BBA program, internship is a major requirement for sharing knowledge & to gather knowledge. I need to do my internship in any business organization that is well reputed in its field. I have got a great opportunity to involve in a leading commercial bank namely ISLAMI BANK BANGLADESH LIMITED which is a recognized bank not only in our country but also all over the world.

From the very beginning the world human needs well financing. At that time it was very difficult to identify well banking system. But modern banking system makes sure welfare and profitable financing.

Financing is directly related with human life. Bankers always face social responsibilities and duties of providing safe and effective financing, demanding uncompromising efforts of all levels of activities.Islami bank Bangladesh is one of the nations leading banking specialties of uncompromising quality in several world class banking.The leading banking company of Bangladesh has been making every effort to ensure the effectiveness and safety of the financing which it makes sure.Islami bank provide the highest quality financing at comfortable facilities to fulfill the needs of the millions of people of the country. Regular introduction of innovative system in line with the needs of customers has been the key to the company’s success over the years.IBBL always follows some basic criteria to satisfy the quality management. Their mechanism assurance system establishes control or checkpoint to ensure the quality of the investment during a certain period.

Objectives of the study:

The broad objective of the study is to fulfill the requirement of my internship and achieving academic and practical knowledge about how organizatiom are managed in real life. This report also has some other specific objectives, these are

- Ø To know the historical background of the organization including its mission, vission, and objectives.

- Ø To give a clear cocept about different Modes of Investment of IBBL.

- Ø To identify IBBL ‘s strength & weakness of investment.

- Ø To measure Perfomance of Investment

- Ø To identify the problems relating to investment faced by IBBL.

- Ø To recommend action to redesign the investment of IBBL and to improve the performance of distribution and finance department of the organization.

Rational of the study:

Investments are crucial part of any commercial bank. Success of banking transaction depends on well management. When the writer practices at the working place of the organization, the writer was able to get practical knowledge’s, the organization to known their branches well actives on the basis report. The achievement can only be possible with proper planning and perform accordingly.As a business student the writter wants to know the various modes of investment of IBBL that’s why he selected the topic named “Analysing Performance of Investment of Islami Bank Bangladesh Limited -A Study on Kanchpur Branch” and the writter does think that this is the appropriate title of his study considering his aim.

Scope of the study:

Islami Bank Bangladesh Limited is a large Banking organization. It has several departments. It is not possible for an internee to cover all of the department of IBBL in his or her study within the short period of time of internship as well as they do not get access to all department. The writter was posted at INVESTMENT depertment OF IBBL. So here in this report only the investent mode would be explored and discussed. Methodology of the study:

Sources of data

The writter will use both primary and secondary sources of data to make the report more meaningful and presentable both the following sources of data and information will be used widely:

a) The Primary Sources:

- Ø Face-to-face discussion with the relevant officials.

- Ø Practical/ hands-on experience of working at the Investment department.

- Ø Study of relevant files provided by the officers concerned.

b) The Secondary sources:

- Ø Annual Reports.

- Ø Working Papers

- Ø Office Files

- Ø Selected Books.

- Ø World wide webs

Tools & Techniques:

The writter was use several tools and techniques to evaluate the performance of Investment of different modes and make the report more effective and informative to the readers of the report. some of those tools are

For data Presentation

Common size statement analysis

Treand Statement

For data Collection

Interviewing people

Reading background material

For data Processing

Microsoft Word.

Microsoft Excell&

Graphs

Investment:

Investment operation of a Bank is of vital importance as the greatest share of total revenue is generated from it, maximum risk is cantered in it and the very existence of a Bank mostly depends on prudent management of its Investment Port-folio.

As such, for efficient deployment of mobilized resources in profitable, safe and liquid investments, a sound, well-defined, well-planned and appropriate Investment Policy framework is necessary pre-requisite for achieving the goal of the Bank.

The special feature of the investment policy of the Bank is to invest on the basis of profit-loss sharing system in accordance with the tenets and principles of IslamiShari’ah, Earning of profit is not the only motive and objective of the Bank’s investment policy rather emphasis is given in attaining social good and in creating employment opportunities.

Pursuant to the Investment Policy adopted by the Bank, a 7-year Perspective Investment Plan’ has been drawn-up for the year 2003 to 2010 and put into implementation. Recently a further 5-year perspective investment plan has been drawn up for the year 2010 to 2015 and put into implementation.

The plan aims at diversification of the investment port-folio by size sector geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic groups of the society within the fold of Bank’s investment operations.The special feature of the Investment Policy of the Bank is to invest on the basis of profit-loss sharing system in accordance with the tenets and principles of Islamic Shari’ah. Earning of profit is not the only motive and objective of the Bank’s Investment Policy rather emphasis is given in attaining social goal and objective in creating employment opportunities.

Objectives and Principles:

The objectives and principles of investment operations of the Bank are:

- To invest fund strictly in accordance with the principles of Islami Shari, ah.

- To continue investment division activity based on Quran &Sunnah.

- To diversity its investment portfolio by size of investment, by sectors (public and private) by economic purpose, by securities and by geographical area including industrial, commercial & agricultural.

- To ensure mutual benefit both for the Bank and the investment client by professional appraisal of investment proposals, judicious sanction of investment close and constant supervision and monitoring thereof.

- To make investment keeping the socio economic requirement of the country in view.

- To increase the number of potential investors by making participatory and productive investment.

- To finance various development schemes for poverty alleviation, income and employment generation with a view to accelerate sustainable socio economic growth and for upliftment of the society.

- To invest in the form of goods and commodities rather than give out cash money to the investment clients.

- To encourage social upliftment enterprises.

- To avoid even highly profitable investment in fields forbidden under Islamic Shari, ah and are harmful for the society.

- The Bank extends investments under the principles of Bai-Murabaha, Bai-Muajjal, Hire Purchase under Shirkatul Mealk and Mudarabah. The bank is making sincere efforts to go for investment under Mudarabah principle in near future.

Collection of fund from different sources:

IBBL, Kanchpur branch collect fund from reserves, and fund rose through borrowing from deposit account. The main part of their operational part, fund is divided from different categories of deposits accepted on the Islamic principles of Al-wadiah (safe custodianship) Mudarabah (trust financing) and Provident fund of this branch.

Categories of Investment in IBBL:

IBBL Kanchpur branch has provided various types of investment modes for different types of customers’ according to their requirements The Investment provided by IBBLcan be divided into three types, Those types are sub-classified into various types which are given bellows:

Bai-Mechanism (Trading Mode)

- Bai-Murabaha

- Bai-Muajjal

- Bai-Salam

- Bai-Istishna’a

Ijara Mechanism (Leasing Mode)

- Hire Purchase (Ijarah)

- Hire purchase under Shirkatul Malk (HPSM)

Share Mechanism (Partnership Mode)

a. Mudarabah

b. Musharaka

But IBBL Kanchpur branch has Invest only two categories those are Bai-Muajjal & Bai- Murabaha

Bai- Mechanism (Trading Mode):

a. Bai-Murabaha: The term ‘Bai-Murabaha’ has been derived from Arabic words ﻊﻴﺒ and ﺢﺑﺭ (Bai’un and Ribhun). The word ﻊﻴﺒ means purchase and sale and the word ﺢﺑﺭ means an agreed upon profit. ﺍﻠﻤﺮﺍﺒﺢﻊﻴﺒ ‘Bai-Murabaha’ means sale on agreed upon profit.

Definition: Bai-Murabaha means sale on agreed upon profit. Bai-Murabaha may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shari’ah and the Law of the land), to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by instalments.

In Brief

- Profit is shared as per agreement.

- Loss beard by client.

- Amount can be paid on instalments basis.

- Usual duration 1-2 year(s).

- Rebate may be given on Early Adjustment.

Explanation:From the graph (Appendix-3-5) it is found that the investment of branch in Bai-Murabaha for the last three year (2010 to 2012) is increased gradually. In the year 2010, the investment way 17.8 million while in 2012 it increased to 57.6 million.

Types of Murabaha:

In respect of dealing parties Bai–Murabaha may be of two types

- Ordinary Bai-Murabaha, and

- Bai-Murabahaorder on and Promise.

- Ordinary Bai-Murabaha is a direct transaction between a buyer and a seller. Here, the seller is an ordinary trader who purchases goods from the market in the hope of selling these goods to another party for a profit.

- Bai-Murabaha order on and Promise involves three parties – the buyer, the seller and the bank. Under this arrangement, the bank acts as an intermediary trader between the buyer and the seller. In other words, upon receipt of an order and agreement to purchase a certain product from the buyer, the bank will purchase the product from the seller to fulfill the order.

Features

- It is permissible for the Client to offer an order to purchase by the Bank particular goods deciding its specification and committing him to buy the same from the Bank on Murabaha, i.e. cost plus agreed upon profit.

- It is permissible to make the promise binding upon the Client to purchase from the Bank, that is, he is to either satisfy the promise or to indemnify the damages caused by breaking the promise without excuse.

- It is permissible to take cash/collateral security to guarantee the implementation of the promise or to indemnify the damages.

It is permissible for the Bank to authorize any third party to buy and receive the goods on Bank’s behalf. The authorization must be in a separate contract.

B. Bai-Muajjal: Bai-Muajjal may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shari’ah and the Law of the Country), to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by instalments. The seller may also sell the goods purchased by him as per order and specification of the Buyer.

Explanation: From the graph (Appendix-3-5) it is found that the investment of branch in Bai-Muajjal for the last three year (2010 to 2012) is increased gradually. In the year 2010, the investment way 4.1 million while in 2012it increased to 9.6 million.

Important Features of Bai-Muajjal

- It is permissible and in most cases, the client will approach the bank with an offer to purchase a specific good through a Bai-Muajjal agreement.

- It is permissible to make the promise binding upon the client to purchase the goods from the bank. In other words, the client is required to either satisfy the promise or to indemnify the bank for damages caused by breaking the promise without excuse.

- It is permissible to take cash/collateral security to guarantee the implementation of the promise or to indemnify the bank for damages caused by non-payment.

- It is also permissible to document the debt resulting from Bai-Muajjal by a Guarantor, or a mortgage or both, like any other debt. Mortgage/Guarantee/Cash.

C. Bai-Salam: Under this mode Bank will executive purchase contract with the client and make payment against purchase of product, which is under process of production. Bai-Salam contract will be executed after making any investment showing price, quality, quantity, time, place and mode of delivery.This profit is to be negotiated. It this mode the payment as the price of the goods is made at the time of Agreement and the delivery of the goods is deferred.

Features:

- Bai-Salam is a mode of investment allowed by Islamic Shari’ah in which commodity (ies)/product(s) can be sold without having the said commodity (ies)/ product(s) either in existence or physical/constructive possession of the seller. If the commodity (ies)/product(s) are ready for sale, Bai-Salam is not allowed in Shari‘ah. Then the sale may be done either in Bai-Murabaha or Bai-Muajjal mode of investment.

- Generally, Industrial and Agricultural products are purchased/ sold in advance under Bai-Salam mode of Investment to infuse finance so that production is not hindered due to shortage of fund/cash.

- It is permissible to obtain collateral security from the seller client to secure the investment from any hazards viz. non-supply/partial supply of commodity (ies)/product(s), supply of low quality commodity (is)/Product(s) etc.

- It is also permissible to obtain Mortgage and/or Personal Guarantee from a third party as security before the signing of the Agreement or at the time of signing the Agreement.

- Bai-Salam on a particular commodity (ies)/product(s) or on a product of a particular field or farm cannot be affected. [For Agricultural Product(s) only].

The seller (manufacturer/producer) client may be made agent of the Bank to sell the goods delivered to the Bank by him provided a separate agency agreement is executed between the Bank and the Client (Agent).

D. Bai-Istishna’a: lsteshna’a is a contract between amanufacturer/ seller and a buyer under which the manufacturer/seller sells specific product(s) after having manufactured, permissible under Islamic Shari’ah and Law of the Country after haying manufactured at an agreed price payable in advance or by instalments within a fixed period or on/within a fixed future date on the basis of the order placed by the buyer.

The Purchaser is called ‘Mustasnia’ contractor and the seller is called ‘Sania’ maker or manufacturer and the thing is called ‘Masnooa‘, manufactured, built, made (ABIIB). Islamic banks can utilize Istishna’a in two ways.

- It is permissible for the bank to buy a commodity on Istishna’a contract then sell it after receipt for cash or deferred payment.

- It is also permissible for the bank to enter into aIstishna’a contract in the capacity of seller to those who demand a purchase of a particular commodity and then draw a parallel Istisna’a contract in the capacity of a buyer with another party to manufacture the commodity agreed upon in the first contract.

Features

- Istisna’a is an exceptional mode of investment allowed by Islamic Shari’ah in which product(s) can be sold without having the same in existence. If the product(s) are ready for sale, Istisna’a is not allowed in Shari’ah. Then the sale may be done either in Bai-Murabaha or Bai-Muajjal mode of investment. In this mode, deliveries of goods are deferred and payment of price may also be deferred.

- It facilitates the manufacturer sometimes to get the price of the goods in advance, which he may use as capital for producing the goods

- It gives the buyer opportunity to pay the price in some future dates or by installments

- It is a binding contract and no party is allowed to cancel the Istisna’a contract after the price is paid and received in full or in part or the manufacturer starts the work

Istisna’a is specially practiced in Manufacturing and Industrial sectors. However, it can be practiced in agricultural and constructions sectors also.

Ijara Mechanism (Leasing Mode):

- a. Hire Purchase (ljarah): The term Ijarah has been derived from the Arabic works Ajr and Ujrat which means consideration, return, wages, or rent. This is really the exchange value or consideration, return, wages, rent of service of an Asset. Ijarah has been defined as a contract between two parties, the Hiree and Hirer where the Hirer enjoys or reaps a specific service on benefit against a specified consideration or rent from the asset owned by the Hiree. It is a hire agreement under which a certain asset is hired out by the Hiree to a Hirer against fixed rent or rentals for a specified period.

- b. Hire purchase under Shirkatul Malk (HPSM): Hire purchase under Shirkatul Melk is a special type of contract which has been developed through practice. Actually, it is a synthesis of three contracts: Shirk at, Ijarah and sale. Shirk at means partnership. Sharikatul Melk means share an ownership. When two or more persons supply equity, purchase an asset, own the same jointly, and share the benefit as per agreement and bear the loss in proportion to their respective equity, the contract is called Shirkatul contract.

Explanation: From the graph (Appendix-3-5) it is found that the investment of branch in HPSM for the last three year (2010 to 2012) is increased gradually. In the year 2010, the investment way 43.1 million while in 2012 it increased to 137.7 millions.

Hire Purchase under Shirkatul Melk is a Special type of contract which has been developed through practice. Actually, it is a synthesis of three contracts:

- a. Shirkat b.Ijarah c. Sale

Shirkat

Shirkat means partnership. Shirkatul Melk means share in ownership. When two or more persons supply equity, purchase an asset, own the same jointly, and share the benefit as per agreement and bear the loss in proportion to their respective equity, the contract is called Shirkatul Melk contract.

Ijarah

The term Ijarah has been derived from the Arabic works (Air) and (Ujrat) which means consideration, return, wages or rent. This is really the exchange value or consideration, return, wages, rent of service of an asset. Ijarah has been defined as a contract between two parties, the Hire and Hirer where the Hirer enjoys or reaps a specific service or benefit against a specified consideration or rent from the asset owned by the Hire. It is a hire agreement under which a certain asset is hired out by the Hire to a Hirer against fixed rent or rentals for a specified period

Sale

This is a sale contract between a buyer and a seller under which the ownership of certain goods or asset is transferred by seller to the buyer against agreed upon price paid / to be paid by the buyer.

Important features

In case of Hire Purchase under Shirkatul Melk transaction the asset / property involved is jointly purchased by the Hire (Bank) and the Hirer (Client) with specified equity participation under a Shirkatul Melk Contract in which the amount of equity and share in ownership of the asset of each partner (Hire Bank & Hirer Client) are clearly mentioned. Under this agreement, the Hire and the Hirer becomes co-owner of the asset under transaction in proportion to their respective equity participation.

- As the ownership of hired portion of the asset lies with the Hire (Bank) and rent is paid by the Hirer (Client) against the specific benefit, the rent is not considered as price or part of price of the asset.

- The promise to transfer legal title by the Hire and undertakings given by the Hirer to purchase ownership of the hired asset upon payment part by part as per stipulations are effected only when it is actually done by a separate sale contract.

- As soon as any part of Hire’s (Bank’s) ownership of the asset is transferred to the Hirer (Client) that becomes the property of the Hirer and hire contract for that share / part and entitlement for rent thereof lapses.

- In Hire Purchase under Shirkatul Melk Agreement, the Shirkatul Melk contract is affected from the day the equity of both parties deposited and the asset is purchased and continues up to the day on which the full title of Hire (Bank) is transferred to the Hirer (Client).

Share Mechanism (Partnership Mode):

- a. Mudaraba: It is a form of partnership where one party provides the funds while the other provides the expertise and management. The first party is called the Sahib-Al MaaI and the latter is referred to as the Mudarib. Any profits accrued are shared between the two parties on a pre-agreed basis, while capital loss is exclusively borne by the partner providing the capital.

Partnership in Profit:

- Two parties: a. Sahib Al-maal b.Mudarib

Role of Sahib Al-maal

- To provide capital

- Not to participate in the business activity

- Not to dictate the Mudarib

Role of Mudarib:

- To conduct the business independently

- Has to compensate the loss if the business fails at his own fault

- However, he has to bear the loss of his time & labor if he business incurs loss naturally

Steps of Mudarabah

The bank provides the capital as a capital owner. The Mudarib provides the effort and expertise for the investment of capital in exchange for a share in profit that is agreed upon by both parties.

- The Results of Mudarabah: The two parties calculate the earnings and divide the profits at the end of Mudarabah. This can be done periodically in accordance with the terms of the agreement, subject to the legal rules that apply.

- Payment of Mudarabah Capital: The bank recovers the Mudaraba capital it contributed before dividing the profits between the two parties because the profit is considered collateral for the capital.

- Distribution of wealth resulting from Mudarabah: In the event a loss occurs, the capital owner (the bank) is responsible for the entire loss. In the event of profits, they are divided between the two parties in accordance with the agreement between them, subject to the capital being recovered first.

Rules of Mudarabah:

There are some legal rules that govern the business relationship Mudaraba which are as follows.

- It is a condition that capital must be in the form of currency in circulation. However, merchandise can be contributed, so long as both parties to the business arrangement agree upon its value.

- It is a condition that the capital cannot be subject to indebtedness.

- It is permissible for a Mudarib to mix his private capital with the capital of the Mudaraba, thus becoming a partner. In addition, it is also permissible for the Mudarib to dispose of capital on behalf of the Mudaraba.

- It is a condition that the capital of the Mudaraba is delivered to the Mudarib. Some of the jurists permit the capital.

Important Feature:

- Ø Bank supplies Capital as Sahib Al-Maal and the client the invest if in the business with the experience

- Ø Administration and Management is maintained by the client

- Ø Profit is divided as per agreement

- Ø Bank beats the actual loss alone

b. Musharaka: An Islamic financial technique that adopts “equity sharing” as a means of financing projects. Thus, it embraces different types of profit and losssharing partnership. The partners (entrepreneurs, bankers etc.) Share both capital and management of a project so that profits will be distributed among them as per rations, where loss is shared according to ratios of their equity participation.

Musharaka may take two forms:

i) Permanent Musharaka and

ii) Diminishing Musharaka.

Permanent Musharaka:

In this case, the bank participates in the equity of a company and receives an annual share of the profits on a pre-rate basis. The period of termination of the contract is not specified. This financing technique is also referred to as continued Musharaka.

The contributions of the partners under this mode may be equal or unequal percentages of capital for the purpose of establishing a new income-generating project or to participate in an existing one. In this arrangement, each participant owns a permanent share in the capital structure and receives his share of the profits accordingly.

Diminishing Musharaka:

Diminishing or Digressive Musharaka is a special form of Musharaka, which ultimately culminates in the ownership of the asset or the project by the client. It operates in the following manner.

The Bank participates as a financial partner, in full or in part, in a project with a given income forecast. An agreement is signed by the partner and the bank, which stipulates each party’s share of the profits. However, the agreement also provides payment of a portion of the net income of the project as repayment of the principal financed by the bank. The partner is entitled to keep the rest. In this way, the bank’s share of the equity is progressively reduced and the partner eventually becomes the full owner.

Welfare Oriented Special Investment Schemes:

In addition to the normal commercial and industrial investment operations, many special Investment Schemes like:

i) Rural Development Scheme, ii) House-hold Durables Scheme, iii) Investment Scheme for Doctors, iv) Transport Investment Scheme, v) Car Investment Scheme, vi) Small Business Investment Scheme, vii) Micro-Industries Investment Scheme viii)Agricultural Implements Investment Scheme, ix) Housing Investment Scheme, x) Real Estate Investment Program, xi) xiii) Small Transport Investment Scheme,xiv) Micro Industries Scheme, xv) Women Entrepreneurs’ Investment Scheme etc.,

Targeting different economic groups have been introduced by the Bank over the years. The schemes have been implemented and being expanded to meet the specific and welfare oriented needs of the different segments of people of the country.

The Bank, since its inception, has been working for the upliftment and emancipation of the under-privileged downtrodden and neglected sections of the population and has taken up various financing schemes for their well-being. The objectives of these schemes are to raise the standard of living of low-income group. 3(three) Schemes of Investment in Real Estate Sector operates by IBBL in a short are:

A. Housing Investment Scheme:

One of the basic human needs is to have a house to live in. Housing has now become an acute problem in the country, especially in the towns, cities and metropolis. With their limited income, it has become almost impossible on the part of the lower middle class, middle class and sometimes, even for upper middle class to solve their housing problem. To meet this basic human need, Islami Bank Bangladesh Limited is committed to contribute to this end to provide a peaceful and happy house in his own.

B. Real Estate Investment Program:

Professionals, Service-holders, Businessmen, Real Estate Developer and other categories of people who are not entitled for availing investment facilities under Housing Investment Scheme, shall be eligible under this program Investment is to be extended to build new houses and for extension, completion of the house already constructed, commercial building, shopping complex, flat apartment etc.

C. Palli Griha Nirman Biniyog Prakalpa

About 75% of our population lives in the villages and most of them resides in katcha structures. For the provision of safe, hygienic and better shelter of rural people, improve their standard of living, health condition and social position which, in turn, will enhance their energy, efficiency, capacity and quality of work and these surely will contribute to the GDP for the benefit of the nation as whole IBBL has introduced a program for providing housing facility to the rural people on easy terms and conditions in the name and style of “Palli Griha Nirman Beniyog Prakalpa”.

Branch Portfolio Investments

Sectors wise & Mode wise investment of Kanchpur branch are shown below:

a)Sector-Wise Investments

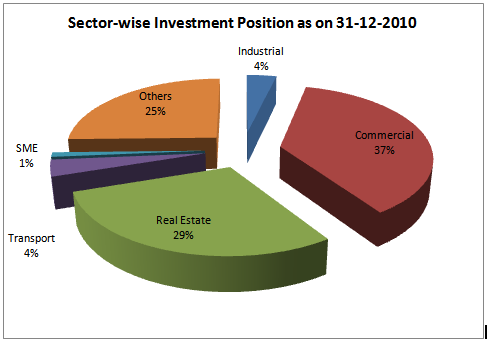

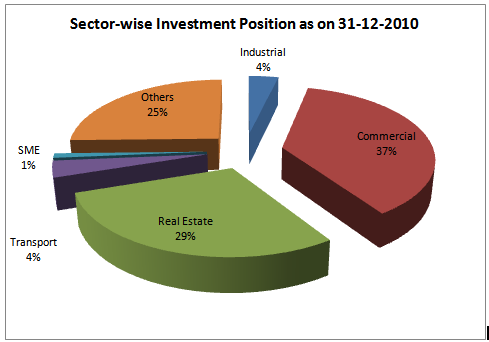

Sector-wise distribution of investment as on 31st December 2011 is the corresponding period of last year is given below:

Table-1: Sector wise investment Statement

SL. No. | Sector | 2011 | 2010 | ||

Amount | % to Total Investment | Amount | % to Total Investment | ||

| 1 | Industrial | 2768051 | 2.46% | 2103891.37 | 3.69% |

| 2 | Commercial | 51879175 | 46.01% | 21040173 | 36.94% |

| 3 | Real Estate | 33026045 | 29.29% | 16703787 | 29.32% |

| 5 | Transport | 21159398 | 18.77% | 2092937 | 3.68% |

| 6 | SME | 1140808 | 1.01% | 584750 | 1.02% |

| 7 | Others | 2770735 | 2.46% | 14438470 | 25.35% |

| Total | 112744212 | 100.00% | 56964008.37 | 100.00% | |

Source: Branch Data

Sector-wise compare between last two years: Table-1 depicts the sector-wise comparison between2010 and 2011.In industrial sector (In App 3-5) it is found that the majority of the investment inCommercial sector was 36.94% which rose to 46.01%. Whereasthelowest portion of investment was in SME sector amounting 1.02% in 2011which was 1.01% in 2010.

Analysing Performance of Investment of Islami Bank Bangladesh Limited

Explanation:

From the pie chart(in App 3-5) it is found that the majority of the investment went on in the commercial sector 46% whereas the minor investment was in SME sector 1% the next major investment in 2011amounting 29% in Real-Estate and 19% in Trransports.

Explanation:

From the pie chart (in App 3-5)it is found that the majority of the investment went on in the commercial sector 37%.Whereas, the minority of investment was in SME sector whcih was1%. The next major investment in 2010 was 29% in Real-Estate and 4% in Transports.

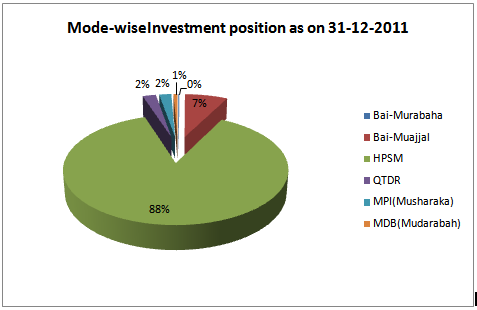

b) Mode- Wise Investment

Table 02: Mode- wise investment Statement

| Mode | 2011 | 2010 | ||

Amount | % to Total Investment | Amount | % to Total Investment | |

| Bai-Murabaha | 182438 | 0.18% | 17889283 | 26.02% |

| Bai-Muajjal | 7352564 | 7.31% | 4161300 | 6.05% |

| HPSM | 87967769 | 87.49% | 43189976 | 62.82% |

| QTDR | 2279400 | 2.27% | 1406250 | 2.04% |

| MPI(Mudaraba) | 2080151 | 2.06% | 773300 | 1.13% |

| MDB(Musharaka) | 687900 | 0.69% | 1330591.37 | 1.94% |

| Total | 100550222 | 100% | 68750700.37 | 100% |

Source: Branch Data

Mode-wise compare between last two years:

Table-2 depicts the mode-wise comparison between 2010 and 2011.Inmode-wisesector (In App 3-5) it is found that the majority of the investment inHPSM 62.82% which rose to 87.49% Whereas the lowest portion of investment was inMDB (Musharaka) 1.94% amounting 0.69% in 2011 which was 1.01% in 2010.

Figure no -: Two years Mode wise Investment

Explanation:

From the pie chart (in App 3-5) it is found that the majority of the investment went onMode-wise Investment are 100%. Among the 88% are invested in Hire purchase under Shirkatul Melk. whereas the minor investment 7% in Bai-Muajjal. The next major investment in 2011 was 2% in MPI (Musharaka).

Explanation:

From the pie chart (in App 3-5) it is found that the majority of the investment went onMode-wise Investment are 100%. Among the 63% are invested in Hire purchase under Shirkatul Melk. whereas the minor investment 26% in Bai-Murabaha. The next major investment in 2010 was 6% in Bai-Muajjal.

c) Welfare Oriented Investment (Special Scheme)

Outstanding amount of Investment as at the yearend under different welfare Schemes are as under:

Table-03: Welfare Oriented Investment

Sl. No. | Name of Scheme | 2012 | 2011 | 2010 |

i. | House-hold Durables Scheme (HDS) | 24107 | 238579 | 380874 |

ii. | Staff House hold-Durable Scheme (SHDS) | 372286 | 345945 | 44831 |

iii. | Small Business Investment Scheme (SBIS) | 1693661 | 1140808 | 584750 |

iv. | Real Estate Investment Scheme(REIS) | 70156967.32 | 33026045 | 16703787 |

v. | Transport Investment Scheme (TIS) | 26981424 | 21159398 | 2092937 |

vi. | Staff House Building Investment Scheme (SHBIS) | 27152718 | 24025101 | 20393252 |

vii. | Rural Development Scheme (RDS) | 37229345 | 27213931 | 20588570 |

| Micro Industries Scheme(MIS) Proposed | 363244 | – | – | |

ix. | Women Entrepreneurs’ Investment Scheme (WEIS) | 386319 | – | – |

| Sub-total(Investment under Schemes) | 164360071.32 | 107149807 | 60789001 | |

| Total Investment | 257385098.22 | 173481108 | 102371490.37 | |

| % to total Investment | 63.86.% | 61.76% | 59.38% | |

Source: Branch Document

Operation Procedure Investment of IBBL

SELECTION OF THE CLIENT |

Investment department of IBBL (Kanchpur Branch) generally follows the below mention procedure & steps for sectioning the investment as available with thebranch

APPLICATION OF THE STAGE |

APPRAISAL STAGE |

SANCTION STAGE |

MONITORING STAGE |

DOCUMENTATION STAGE |

DISBURSEMENT STAGE |

Sources: Official web site

Selection of the Client

Islami Bank Bangladesh Limited maintain their banking activity by receive money from depositor and invest it expected entrepreneur. If any client wants to take investment they must be selected by the bank. It is to be noted that the client/customer must agree with the bank’s rules & regulations before availing investment. Generally, bank analyses the following Six C’s of the client.

Character: Specific purpose for loan and serious intent to repay loan.

Capacity: Customer has legal authority to sign binding contract.

Cash: Does the borrower have the ability to generate enough cash to repay the loan.

Collateral: Does the borrower have adequate asset to support the loan.

Condition:Must look at the industry and changing economic conditions to assess repay the loan.

Control: Does loan meet written loan policy and how would change laws and regulation affect loan.

Application Stage

The Prospective client has to apply to Kanchpur Branch for investment by filling up ofF-176A application from. The bank will collect necessary information about the potential client. For this reason, bank informs the potential/clients to provide or fill properly relevantinformation which is vital for the opening of investment proposal. Generally, all the required documents for taking investment have to prepare by the client himself. Documents that are necessary for getting investment of IBBL are certain bellow:

- Application in letterhead pad with new proposition /inclusion of new item

- Application in bank’s certain from (F-176A)

- Stock Report(F-163)

- Trade license(Up-to-date)

- Photograph of proprietor /partner/directors(two copy each)

- Income Tax clearance/TIN certificate

- Declaration of liability position with other banks(Up-to-date)

- Particulars of assets of the proprietor/company

- Attested copy of memorandum of Association (MOA) & Article of Association (AOA) for the joint company.

- Attested copy of tax identification number(TIN) including final assessment

- Tenders of the proposed assets(in case of HPSM)

- Detailed summary of the sundry debtors & creditors (including both time & schedule)

- Summary of the personal movable & immovable assets and others.

Processing and appraisal

Afterreceiving the application from,(Kanchpur Branch) sends a letter to Bangladesh bank by the head office for obtaining a report. This report is called CIB (Credit information Bureau).The purpose of this report is to being informed that the borrower has taken loan from any bank or not if “yes” then these loans are classified or not.

Name of the Borrower

Father’s name

Permanent Address

City

Sector Code

Nature of Ownership

Sanctioning Stage

Banks maintains formality provide a proposal to the client for this client receive a letter. It‘s called sanction letter. IBBL sanction letter contains the following elements:

1.Investment Limit Million of IBBL head office mentions the 300 millions or 30 core

2. Mode and Amount of investment 27 core 48 laces invested the last year.

3. Purpose of InvestmentLong term investment andShort term investment

4. Period of Investment, (getter than one year, House building investment) and (less than one Year)

5. Rate of Return of IBBL 16% basis of Commercial sector.

6. Section amount 28 core

6. Securities:

- a. Primary- Stock of goods is the primary security

LC/Bills, related Documents

Murabaha post Investment(MPI)/Bai-Murabaha: Pledge of MPI/Bai-Murabaha goods

MPI/Bai-Murabaha-TR: Lien on goods to be released

b. Cash/Goods-

- Bai-Murabaha: 25% cash security on cost price to be subsequently converted to goods security.

- TR: (Trust Receipt) without cash security.

- Collateral: Immovable Properties

Condition of Cash goods Security

Bank | Client | Total |

75% | 25% | 100% |

Documentation Stage

At this stage, the bank analyses the clients document are in order. In the documentation stage IBBL, Checks the following documents of their clients:

Sanction Advice deal-wise duly accepted by the client.

Agreement.

Letter of Pledge.

Single party D.P. not if there s no guarantor.

Double party D.P. not if there s no guarantor(s) to be made by the client in favour of the guarantor and endorsed by the later to the bank.

D.P. Not delivery letter.

Letter of Hypothecation for the asset(s) and client’s stock in Trade work –in –process

Letter of disclaimer.

Insurance policy duly recorded in insurance requester.

Letter of guarantee.

Balance confirmation letter.

Letter of installments

Disbursement stage:

At this stage verifying all documents, the branch disburses the investment to the client, the client gets his/her desired fund or goods. At the end of the periods Branch are disbursement this branch section amount are 28 cores, Disbursement amount are 27 cores 48 laces last year this branch.

Monitoring and Recovery Stage:

At this final stage of investment processing of the IBBL, will contract with the client continually, for the bank can obtain monthly stock report from the client in case of micro investment. The bank will keep his eye on over the investment taker. If need the verifying by bank then they are physically inspect the client’s operation. Also bank feels that anything is going wrong then it tries to recover its investment fund from the client.

Classified Loan Amount:

Islami bank Bangladesh limited Kanchpur Branch is established in 2008.This Branch classified loan amount is zero because this branch are performing very well, and their clients are too much responsible. Those clients are paid their instalment in due time and branch are very conciseness of their clients, so this branch classified loan amount are zero.

Findings on Investment

Findings about investment are two types

- a. Specific findings and

- b. Others findings

A. Specific Findings:

a)From the graph Major findings this branch profit last two year 20120 to 2011 (Appendix 1-2) Page number – viii

b)From the graph Sector-wise investments are also well and comparatively between the last two years it’s also increaseof the branch. (Appendix 3-5) and Page number (23-24)

c)From the graphSector-wise investments are also well and comparatively between the last two years it’s also increase of the branch. (Appendix 3-5) and Page number (23- 25)

d)From the graph Mode-wise investments are very well and comparatively between the last two years and increase (Appendix 3-5) and Page number (26-27)

e)From the graph Mode-wise investments are very investing HPSM more than invest 62% in 2010 and 87% in 2011. (Appendix 3-5) and Page number (26-28)

f)This branch also finds out there is no classified loan.

g)Last year this branch sanctioning amount is 28 cores, whereas disbursement amount is 27.48 core in Kanchpur branch.

h)This branch also invested on Special schemes as HDS, RDS, SBIS, TIS, SHDS etc. and added this year two special schemes. (Appendix 3-5) and Page number (29-30)

i) There is no classified loan because their clients are too much responsible and they are also paid their instalments in due time and employer are concern to their clients. (Appendix 3-5)

j) This branch disburses the investment to the client, the client gets his/her desired fund or goods. At the end of the periods Branch are disbursement this branch section amount are 28 cores, Disbursement amount are 27 cores 48 laces last year this branch

B. Others Findings

- a. Lack of customer knowledge about Islamic banking System: The most difficult job for the most bank staffs/executives is to create faith on customer mind. They are not familiar with Islamic Banking system & procedures.

- b. Lack of customer knowledge regarding investment: This result in too much time needs for the marketer to make a better understanding regarding their perception about IBBL’s products

- c. Lacking of Govt. /Controlling Bodies Motoring: Lacking of proper policy for secured Bank’s investment, proper monitoring from controlling bodies, and unfairness of Departmental Officials etc.

- d. Miscellaneous: Disturbance of illegal corners, collectors of subscription, corruption from the government and non- government bodies is also major problem in this sector

SWOT Analysis

The SWOT analyses provide a useful strategic guidance. A SWOT analyses (Strength, weakness, Opportunity, Threats) allows in the constructing balance sheet of the Bank. In the analyses one can bring together all the internal factors, influencing organization’s strength and weakness. Based on these factors we can identify external factors which can help to define opportunities and threats that a company faces due to competitive forces and trends in the business environment. SWOT of IBBL on particular case of financing in Investment modes Sector may be of the followings:

Strengths Provide online services. Computer based official activity. Experienced Management. Foreign Trade operation use SWIFT Endow with ATM card services. Customer taka locker services. Specific women cash pay & withdraw counter. |

Opportunity This branch launch new product. Mobile banking (M Cash) in the market. Run the new investment scheme for the customer. The efficiency of sound exchange reserve level is providing a good opportunity for effective investment decisions. |

Threats Many banks are coming in the state with new services. Increased in competition others bank branch. Procedural delay in decision making Growing global technological advancements and adaptation of modern style of management in banking sectors |

Weakness Congested and tri- angle office place. Lack of Decoration facility. Limited number of employees. Long term process to provide investment. investment opportunity through research & marketing |

Recommendations:

Putting recommendation is very complex for me with my short experience & Knowledge but with my shallow knowledge. I want to mention the following points for IBBL (Kanchpur Branch)

This branch launches their new product mobile banking (M-cash) because it can easily handle to their client’s needs and assist in carrying money in an out of IBBL instead of via agent

This branch is also good, because their client’s must be paid their installments, and there is no classified loan.

IBBL (Kanchpur branch) need to finance the needy entrepreneurs who have no money at all and they are new comer in the business.

To complete with other competitor, bank should give most priority to welfare investment scheme

They are developing new product in the investment department and new account should be attracted in branch

IBBL (Kanchpur Branch) should expand to another spacious places so that they can accommodate all the function accordingly.

To keep up branch well decorated and sound environment to their clients.

IBBL investment process should become easier.

To continue daily activities, bank should increase qualify employee.

To satisfy the employee, bank should increase well salary

Conclusion:

In our country from 1983 IBBL as operating with great confident as a large Islamic commercial, it took various steps to create and socio economic development for the people through Islamic revolution. IBBL (Kanchpur branch) is a bank which tries to operate its modes of according to Quran and Sunnah. It does not create any illegal pressure on client. The special feature of the investment policy of IBBL (Kanchpur branch) is to invest on the basis of profit loss sharing system in according with principle Shari’ah.

Investment modes is recognized the world over as the main engine that runs the economy, creating work not only for masons and managers, accountants & architects, but also for makers and sellers of building materials. It means work for maintenances, security, cleaning and other services work for makers and sellers of appliances, furniture and vehicles; work for bankers and bureaucrats, lenders and lawyer. May suggest the following recommendations for sound and success investment in the by Islami Bank Bangladesh Limited.

Everyday IBBL (Kanchpur branch) do their banking work with other conventional bank. In Bangladesh there is no Islamic environment. It is one kind of problem to maintain Shari’ah base banking activity for IBBL (Kanchpur branch).Although it is facing some problem. It has bright future day by day. It is enhancing its financial modes of over the country. Many organizations are following the IBBL and they are starting their business based on IslamicShari’ah in our economy.

References

Book References:

A.A.M. Habibur (2001), 1st Edition), Islami Banking, Publiher- HelanaPervin

Mannan Mohammad Abdul (207), Islamic Bank Babostha, Central Shari’ah Board of Islamic Banks, Dhaka

RaquibAbdur (2007), Principles & Practice of Islamic Banking, 1st Edition, Dhaka, Panam Press Ltd., Page 104-167

Shamsul Huda Mohammad & Shamsuddoha Mohammad (2011) “Investments Modes of Islamic Banks principle of Shari’ah, IBTRA, IBBL.