Investment Scenario of IBBL:

Islami Bank Bangladesh Ltd. through its steady progress and continued success has earned reputation and by the grace of the Almighty Allah has become leading private sectors bank of the country. The network of the branches widened and the size of investment portfolio of the Bank has been increasing substantially day by day.

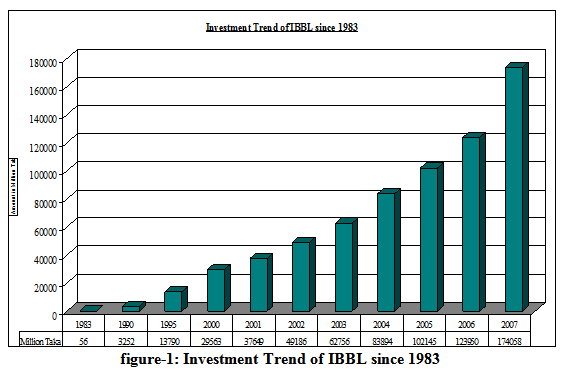

As in the past, over the years the Management concentrated its efforts on popularizing the Islamic Banking concept and side by side expanding its operational activities. Now IBBL is one of the Largest Private Commercial Banks in the country with the Investment of 174,058 million and Deposit 166,000 million. The growth rate of IBBL investment is tremendous as reflected in the following chart.

Sector Wise Investment of IBBL:

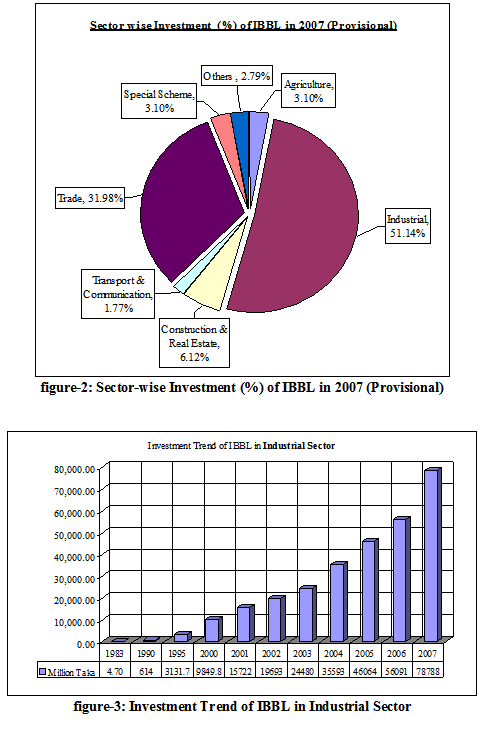

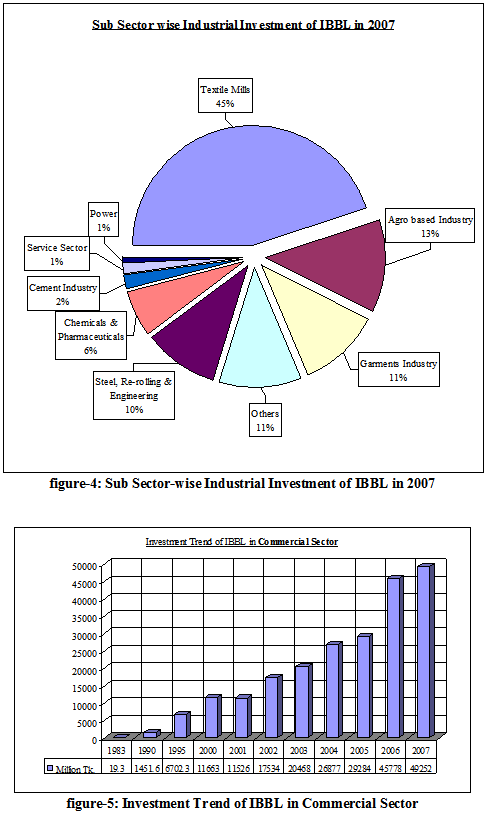

Industrial sector is contributing the highest to IBBL investment. In 2007, investment in industrial sector was Tk. 78,761 million which is 51.14% of total investment. It signifies the commitment of the Bank towards rapid growth of the economy and to increase the per capita income of the people by creating employment opportunities and greater contribution to the national economy. Sector wise investment of IBBL in 2007 is –

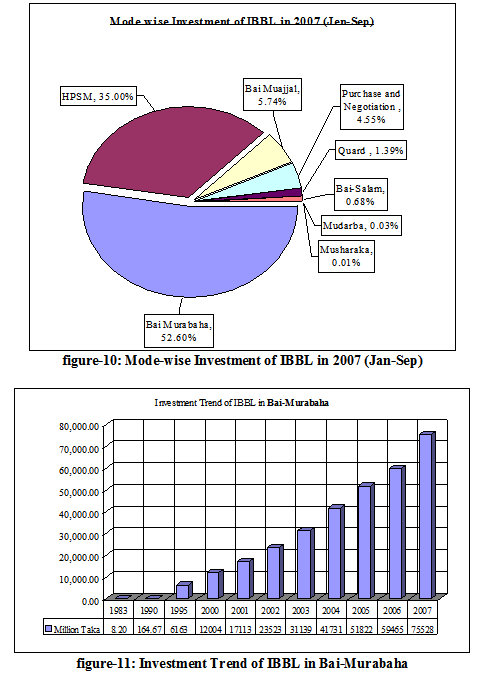

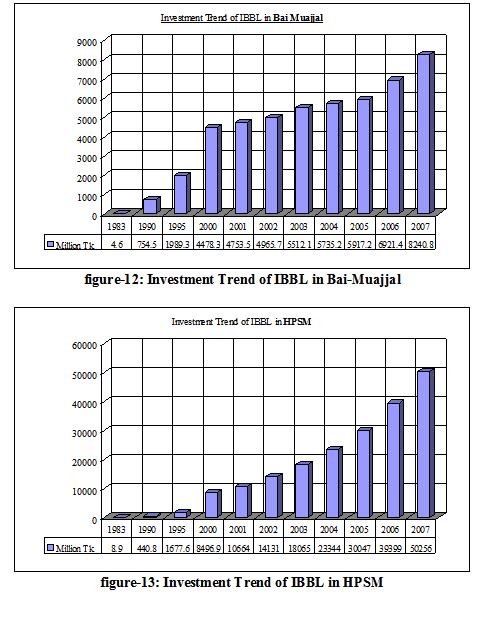

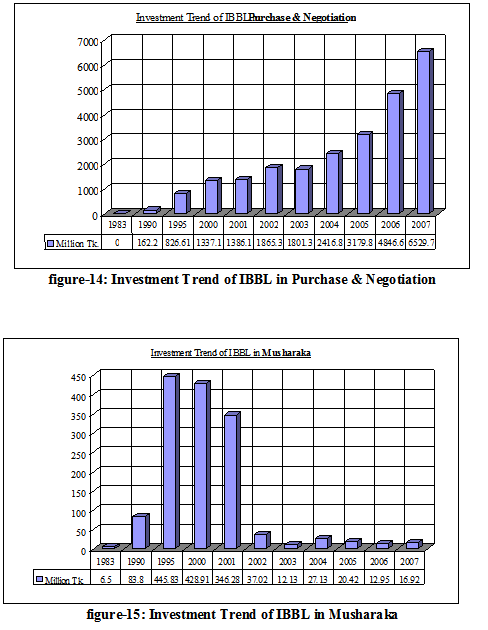

Mode Wise Investment of IBBL:

Investment of Islami Bank Bangladesh Limited is mainly concentrated in Bai Mode & HPSM. Share of Bai-mode is 59% in IBBL’s total investment. On the other hand, HPSM which is related shirkat contributes 35% in IBBL investment. Share of Mudaraba and Musharaka is not significant in the investment of IBBL.

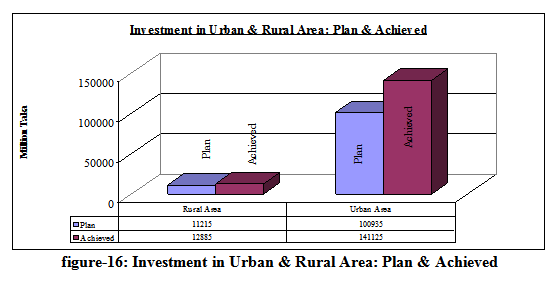

Area wise Investment of IBBL:

Islami Bank Bangladesh Limited diversifies its investment in urban and rural areas. 91.63% of IBBL’s total investment is in urban areas while in rural areas it is 8.37%.

Investment of IBBL in National Perspective:

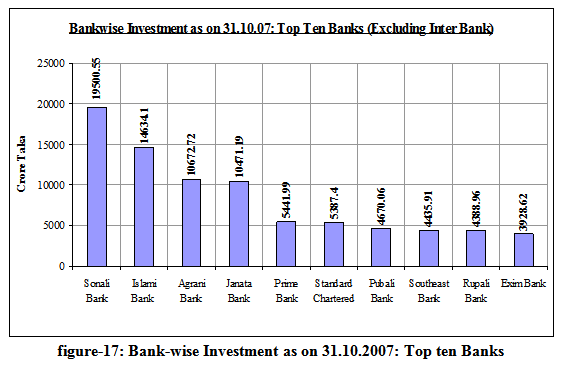

IBBL is the second largest Bank in investment among the Banks of Bangladesh with 9% share which was 7.67% in 2006 and 6.67 in 2005. Nationalized Sonali Bank is in the leading position with 12% share.

Investment Plan for 2008-2012:

Currently a “5 year perspective Investment Plan” has been porposed for the year 2008-2012 in continuation of 7 years Plan from 1996-2002 and 5 Years Plan from 2003-2007. The plan has been formulated keeping in view of the national economic priorities and aiming at diversification of the investment portfolio by size, sector, geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic activities and different economic strata of the society within the fold of Bank’s investment operations.

There are some special schemes under investment:

i. Household durable scheme:

Islami Bank Bangladesh Limited has introduced Household Durables Investment Scheme which has already created great enthusiasm among the people and received tremendous response from them. Objectives are to assist the service holders with limited income in purchasing household articles such as Furniture, electronic and electronic equipments like television, refrigerator, gas cooker etc.

ii. Investment scheme for doctors:

A good number or newly graduated doctors from Medical Colleges are unemployed. Many of the medical graduates are waiting for job because the opportunity for Government service is limited. If these young doctors could be self-employed by extending investment facilities, they could make modern facilities available at the door-steps of rural people.

In view of the above facts, Islami Bank Bangladesh Limited has taken the initiative an introduced the ” Doctors Investment Scheme” to ensure modern treatment and medical facilities available to the people through extension of Bank’s investment facilities for self-employment of newly graduated doctors and at the same time extending investment facilities to the established medical practitioners to procure modern and sophisticated medical equipment.

iii. Small business investment scheme:

Bangladesh a third-wood developing country is rich in natural and human resources. Inspite of vast possibilities, the majority people of the country livein hardship-below poverty tapped, explored and exploited. Physical labour is their only means of earning. A large segment of this populace is active youth force. Many of them are efficient, intelligent and energetic with initiative & drive and have courage to tale risks. But they can not uplift their socio-economic condition due to poverty, lack of financial support and other required facilities.

iv. Housing investment scheme:

One of the basic human needs is to have a house to live in. A house is in an abode of peace and happiness. Housing has now become an acute problem in the country, especially in the towns, cities and metropolis. With their limited income, it has become almost impossible on the part of the lower middle class, middle class and sometimes, even for upper middle class to solve their housing problem. To meet this basic human need, Islami Bank Bangladesh Limited is committed to contribute to this end to provide a peaceful and happy.

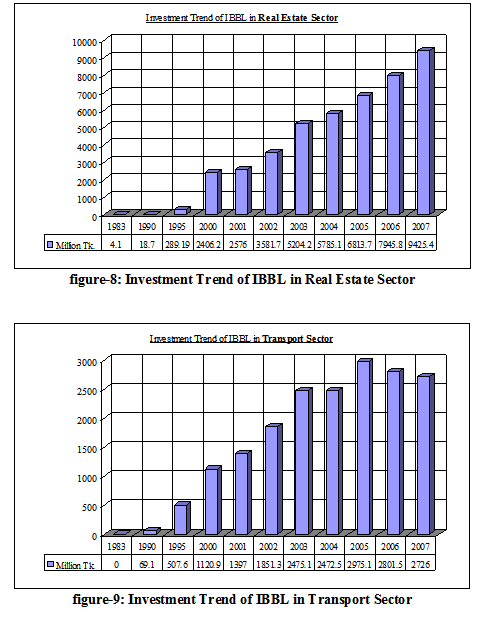

Real estate investment program:

Professionals, Service-holders, Businessmen, Real Estate Developer and other categories of people who are not entitled for availing investment facilities under Housing Investment Scheme, shall be eligible under this programme Investment is to be extended to build new houses and for extension/ completion of the house already constructed, commercial building, shopping complex, flat apartment etc.

Transport investment program:

Under this scheme, investment in being allowed to the existing successful businessmen and potential entrepreneurs in this sector for all types of road and water transport with simple and easy terms and conditions. The bank is also extending investment facilities to multinational companies, established, business houses and well to do officials and professionals for acquisition of private cars, microbus and jeeps.

Car investment scheme:

Car is considered as on essential mode of transport in the modern society, particularly by a section of the officials, business houses and business executives and established professionals for movement in discharging their duties and responsibilities punctually and efficiently. Many of these categories of people can not purchase a car on payment of entire purchase value at a time out of their own sources. To meet this need Islami Bank has introduced the ‘Car Investment Scheme’ for the mid and high ranking officials of government and semi-government organizations, corporations; executives and directors of big business houses and companies arid also for persons of different professional groups on easy payment terms and conditions.

Rural development scheme of ibbl:

Islami Bank Bangladesh limited (IBBL) envisages an economic system based on equity and justice. Taking into consideration that majority of the population below poverty line lives in rual Bangladesh, the Bank has devised a Rural Development Scheme (RDS) with a view to creating employment opportunity for them and alleviates their poverty through income generation activities.

Agricultural implements investment scheme:

Bangladesh is predominantly an agricultural country with vast majority of people living in rural areas. Most of our people for their living are dependent on agriculture. Agriculture still contributes the lion share of the gross domestic product. But we could not as yet become self-sufficient in food production. We still import a bulk quantity of food grains from abroad to meet the deficit. We must modernise our agriculture and establish more and more industries in order to minimise imports.

The Bank has introduced “Agriculture Implements Investment Scheme” to provide power tillers, power pumps, shallow tubewells, thrasher machine etc. On easy terms unemployed youths for self-employment and to the farmers help augment production in agricultural sector.

Micro industries investment scheme:

Islami Bank Bangladesh Ltd. has been appreciably participating in this direction by financing industrial sector. With a view to creating wider base for industries, the Bank has decided to iaunch “Micro Industries Investment Scheme” through its Branches.

Objectives and Principles:

• To invest fund strictly in accordance with the principles of Islami Shariah.

• To diversity its investment portfolio by size of investment, by sectors (public and private) by economic purpose, by securities and by geographical area including industrial, commercial & agricultural.

• To ensure mutual benefit both for the Bank and the investment client by professional appraisal of investment proposals, judicious sanction of investment close and constant supervision and monitoring thereof.

• To make investment keeping the socio economic requirement of the country in view,

• To increase the number of potential investors by making participatory and productive investment.

• To finance various development schemes for poverty alleviation, income and employment generation with a view to accelerate sustainable socio-economic growth and for enlistment of the society.

• To invest in the form of goods and commodities rather than give out cash money to the investment clients.

• To encourage social enlistment enterprises.

• To shun even highly profitable investment in fields forbidden under Islamic Shariah and are harmful for the society.

• The Bank extends investments under the principles of Bai-Murabaha, Bai-Muazzal, Hire Purchase under Shirkatul Melk and Mudaraba. The Bank is making sincere efforts to go for investment under Mudaraba principle in near future.

Importance of Assessing of Investment Needs:

Assessment of Investment needs is necessary for the following reasons.

1. To detect actual Investment limit of Bank.

2. To detect actual Investment against obsolete /out dated/non trading items.

3. To assess the quality, quantity, price and marketability of the commodities

4. To ensure proper follow-up supervision and monitoring of the Investment.

5. To ensure capacity of the client in handling Investment activities.

6. To over come the situation of Division of found by the clients

7. To ensure trading instead of lending of money.

8. To ensure payment against delivery of goods.

9. To ensure actual buying and selling of goods.