Capital Market Crash and Investor’s Behavior at City Brokerage Limited

(Period: 2010-2011)

There is a phrase, that your customer is always right. This single line helps to understand the value of customer and their satisfaction toward an organization. By inspiring with this, I have made an internship program in customer service department of City Brokerage Limited. As the organization is related to the capital market, I have selected my topic on capital market scenario and investors’ behaviors after the 2010-2011 market crash. In this report, I mainly concentrate on the understanding capital market trends and how and why a capital market is crashed and its impact on investors’ investment decisions. To give an ample outlook the report, is segmented into several chapters. It starts with the chapter one covering the company overview, vision, mission, SWOAT analysis and other information related to City Brokerage Ltd. as well as main functions of City Brokerage Limited where I pursue the internship period. Then the second chapter describes the Job site experiences performed by me as an intern at Head Office. Next part of the report contains the project part includes origin of the report, objective, scope and methodology and limitation. Third chapter of this report titled as “Theoretical Analysis” which includes some theoretical terms related to stock market. Moreover, chapter four and five contain stock market crash 2010-2011 and after the crash what are the market scenario and the impacts of the investors’ behaviors respectively. I also have done a survey of 12 people to get the insight of the true investors’ behaviors. In the sampling questionnaires, there was taken information of gender, age and occupation of customers.

Background:

City Brokerage Limited had been set up in 2010 as a wholly owned subsidiary of The City Bank Limited to provide the capital market business requirements to the institutional and individual clients. City Brokerage Limited come to the market with full- fledged international standard brokerage service for retail, institutional and foreign clients. And before being a wholly owned subsidiary City Brokerage Limited had obtained membership in both Dhaka Stock Exchange and Chittagong Stock Exchange bearing member Id No. 145 and 133 in consecutively in 2009. Moreover an important thing about City Brokerage Limited is, it is a full service depository participant of Central Depository Bangladesh Limited bearing depository participant Id. No.45000 and the company is able to open BO account as requirement of clients. City Brokerage Limited has a bunch of dedicated and highly skilled professional with maintaining strong ethical standard to provide the best service to local and foreign investor. And it has established reputation in serving customer with maintaining strong compliance practices.

OBJECTIVE OF THE REPORT:

Objective of the report can be divided into two parts. These are:

- General objective

- Specific objective

General objective

The general objective of the report is to gain insights and understanding of daily operations performed by the different officials of City Brokerage Limited at Head Office and find out the market scenario and investors’ behaviors on capital market.

Specific objective

The specific objective of this topic is to find out the scenario behind the market crash 2010-2011and after the historical crash, investors’ behavioral trend in capital market. In the whole report, I will thoroughly discuss about capital market trend after 2010 market crash and the rules and procedures of capital market. Besides, in the project part, I will discuss about the effective solutions of these problems.

SCOPE:

In my whole report, I will focus on the market trend after the market crash 2010-2011 and how investors are behaving after the market crash and why they are losing their money gradually, what capital market indicators show after the market crash. What are the reasons which make them satisfied and what are the barriers they find out. To complete a reflective and informative report, I studied different reports of market researchers on market crash 2010-2011 and investors’ behaviors. Moreover, I have taken 12 regular customers opinion through questioners. However, I have been experienced with practical job done by me at that Head Office. I also get know about their operating process by having several discussions with officials of City Brokerage Limited.

METHODOLOGY:

The task of data collection begins after the research problem has been defined and research design chalked out. While deciding the method of data collection to be used for the study, the researcher should keep in mind two types of data. They are given below:

- Primary data and

- Secondary data.

Primary: Survey

The number of customers of City Brokerage Ltd at Head Office is around 3800. Among them, I took 12 customer’s opinion as samples to conduct my survey. And my primary source of data is the customer’s opinion of city Brokerage Limited.

Secondary: Reports, Internet, Textbooks, Journals, Articles etc.

The relevant information was obtained from the reports, internet and the textbook. For the secondary data, I had to rely mainly on the different reports written by authorized writers, articles on share market scenarios, online journals and different websites. Unfortunately, there were not enough sources to obtain secondary information which was one of my limitations.

Main functions of City Brokerage Limited:

Since the establishment of the company as a wholly owned subsidiary of The City Bank Limited, City Brokerage Limited is engage in different functions to provide the promising services to its existing and potential clients and stakeholders. It has developed a disciplined approach toward providing capital market services, including beneficial owner accounts opening and maintaining, margin lone providing and with the research and publication. The main functions operated by City Brokerage Limited are as follows:

CDBL Services as full service Depository Participant:

- Bo (Beneficial Owner) accounts opening and maintenance

- Dematerialization and Re-materialization

- Transfers and multiple accounts movement

- Pledging, un-pledging and confiscation

- Lending and borrowing

- Corporate events announcement enquiry (Cash and non Cash).

Sales and Brokerage Services:

Brokerage services for Intuitional Clients :

- Foreign Fund Managers

- Insurance Companies

- Banks and Financial Institution

- Trust

- Corporation

- Brokerage Service for retail (Individual) Clients

- Provide Margin lone at competitive interest rate

- International and Domestic Placement of Securities

- Brokerage ServicesTrade Execution Dhaka and Chittagong Stock Exchange Limited

- Pre-IPO private placement opportunities through Merchant Banks

- Appointment of dedicated and skilled sales representative

- Opportunities for trading in different financial instruments

Custodial Services:

- City Brokerage Limited have an exclusive arrangement for clients to keep their shares in safe custody in our vault

- Safe Deepings of securities

Research and Publication:

- Daily price information Market Overview, Daily Fact Sheet

- Monthly report

- Industry/Corporate research report

- Industry/Corporate research report

- Free access to our company research reports through our web-site

- Half yearly political and economic update

Value Added Services:

- Daily portfolio services through email

- Daily trade confirmation through SMS service

- Web services for portfolio and report

Project Part (Theoretical Analysis)

What is Stock Market?

Fellowes (2008, p.29) described that stock market has same features like a normal market with buyers, sellers and agreed price. Moreover, there will be a middleman who guides investor to deal offers of buying and selling shares in the stock market. Simply it can be said that it is a place where shares are bought and sold, i.e. a stock exchange. However, in this market shares of publicly held companies are issued and traded either through exchanges or over-the-counter markets, also known as the equity market. At that market we usually get stock exchange, regulatory organizations, investors, listed companies with securities, broker houses, merchant banks, and other intermediary organizations in a stock market with collaboration of central bank and government of the country.

BANGLADESH STOCK MARKET

Here, the study explains history of the Bangladesh stock market and the history of the two exchanges, Dhaka and Chittagong stock exchanges, with their role and functions. Moreover, it also gives concise information about the capital market structure of the country, Security & Exchange commission as the market regulator and CDBL as an important organization of the market.

HISTORY OF BANGLADESH STOCK MARKET

The voyage of Bangladesh stock market started on April 28, 1954 as East Pakistan Stock Exchange Association Ltd. At that time Pakistan ruled Bangladesh and the name of the country was East Pakistan. Other than trading on this market started in 1956 with a total paid up capital of Taka 4 billion and 196 securities were listed on this market. Besides, the exchange was renamed as Dhaka Stock Exchange (DSE) Limited on June 23, 1962. On the other hand, trading on Dhaka Stock Exchange was suspended from 1971 to 1976 because of liberation war and its post-independence weak economy. In 1976, the trading was started again with 9 listed securities having a total paid up capital of Taka 137.52 million.

By 1987, the number of listed companies in DSE increased up to 92. But high development of the market is noticeable in the 1990s comparing with any other time since its establishment. (Economy watch, 2010)

Dhaka Stock Exchange (DSE)

Dhaka Stock Exchange is the first & biggest stock exchange of Bangladesh. The business of Dhaka Stock Exchange started on May 14, 1964 after renaming East Pakistan Stock Exchange Limited. Dhaka Stock Exchange (DSE) is registered as a Public Limited Company and its actions are regulated by its Articles of Association rules & regulations and bye-laws along with the Securities and Exchange Ordinance – 1969, Companies Act – 1994 & Securities & Exchange Commission Act – 1993.

In the beginning it was a physical stock exchange and used to buy and sell in the open out-cry system. After that automated trading system was introduced to secure smooth, timeliness & effective operation on the market.

Moreover, the system was installed on 10th August, 1998 and was advanced time to time. The latest upgrading was done on 21st December, 2008.

On the other hand, the members in Dhaka Stock Exchange are 250 and total 533 listed securities. The working days of DSE is 5 days in a week without Saturday, Sunday public holidays & other government holidays. The trading time is from 11:00 am to 15:00 pm (local time). Investment options for an investor in this market are ordinary share, Debenture, Bond & Mutual funds.

As mentioned by Fellowes (2008), “Every stock market has its indices to show movements in the market as a whole”. In the beginning DSE had only one index. However, now there are three different indices which are DSI (All share), DGEN (A, B, G & N) and DSE 20. DSE introduces two new indices, which are known as the DSE Broad Index (DSEX) and DSE 30 Index (DS30).

(Source: www.dsebd.org)

Functions of DSE

The major functions are:

- Listing of Companies (As per Listing Regulations).

- Providing the screen based automated trading of listed Securities.

- Settlement of trading (As per Settlement of Transaction Regulations).

- Gifting of share / granting approval to the transaction/transfer of share outside the trading system of the exchange (As per Listing Regulations 42).

- Market Administration & Control.

- Market Surveillance.

- Publication of Monthly Review.

- Monitoring the activities of listed companies (As per Listing Regulations).

- Investors’ grievance Cell (Disposal of complaint by laws 1997).

- Investors Protection Fund (As per investor protection fund Regulations 1999).

- Announcement of Price sensitive or other information about listed companies through online.

Chittagong Stock Exchange (CSE)

The Second stock exchange of Bangladesh is Chittagong Stock Exchange. As it introduces modern technology & sophisticated logistic support, it is said that CSE is the pioneer of the modern capital market of the country.

Besides, it was incorporated as a self regulated non-profit organization on 1st April, 1995 and formally opened on November 4, 1995. Though it started its trading through cry-out system but after that Chittagong Stock Exchange started first automated trading bourse of the country. CSE started its automated trading on 2nd June, 1998 and internet trading service on 30th May, 2004.

The trading time of CSE is between 11:00 am to 15:00 pm. The working days & holidays of CSE are same as like as DSE. CSE consists of 25 members of whom 12 are elected through election of CSE members, 12 members are elected from different major economic & social arena of Bangladesh and CEO is nominated and appointed by its own board but the approval of SEC mandatory.

There are 147 members and 273 of listed securities in Chittagong Stock Exchange. Moreover, there are four different markets in CSE same as DSE which are public, Spot, Block & Odd Lot market. In addition, trading is done through all these four markets. The Five categories of company listed in CSE are A, B, N, G and Z but in G category there is not any company.

Chittagong Stock Exchange has its own indices to calculate movements of its total market value. CSE maintained only one index that was All Share Price Index until 10th October, 1995. Now CSE has 3 indices in the stock exchange those are All Share Price Index (CASPI), CSE Selective Index (CSE30) and CSE Selective Categories’ Index (CSCX).

Structure of Bangladesh Stock Market

Primary Market:

A new share issuance of a company comes through primary market called Initial Public Offerings (IPOs).

Companies can issue new securities after getting permission from the market regulators. Moreover, a market that issues new securities on an exchange is called Primary Market. However, Primary Markets are facilitated by underwriting groups, which consist of financial institutions that will set a beginning price range for a given security and after that oversee its sale directly to investors.

Secondary Market:

Secondary market deals with existing securities or previously issued securities. “A market where investors purchase securities or assets from other investors, rather than from issuing companies themselves”. However, securities can be sold or bought from this market from the investors. In a stock exchange most of the trading figures comes from the secondary market. According to its different trading characteristics, market is divided differently.

Public Market:

Instruments are traded on this market in normal volume which is called lot share.

Spot Market:

“A commodities or securities market in which goods are sold for cash and delivered immediately. Contracts bought and sold on these markets are immediately effective.” Trading is done in normal volume under corporate actions and must be settled in 24 hours.

Block Market:

“An order or trade submitted for sale or purchase of a large quantity of securities. A block trade involves a significantly large number of shares or bonds being traded at an arranged price between parties, outside of the open markets, in order to lessen the impact of such a large trade hitting the tape”. Moreover, in this market bulk volume of instruments are trades through pick & fill basis.

Odd lot Market:

“An order amount for a security that is less than the normal unit of trading for that particular asset. Odd lots are considered to be anything less than the standard 100 shares for stocks.” Odd lot refers to a quantity of shares that is less than market lot. Odd lots of all instruments are traded through pick & fills in this market. Basically odd lots generated from bonus and rights issues.

Bull Market:

“A financial market of a group of securities in which prices are rising or are expected to rise. The term “bull market” is most often used to refer to the stock market, but can be applied to anything that is traded, such as bonds, currencies and commodities”. Moreover, when the economy is strong, the unemployment rate is low, and inflation is under control this market tend to develop.

Market Bubble:

“A bubble occurs when investors put so much demand on a stock and the stock price rises above its value in relation to some system of stock valuation.

Security & Exchange Commissions (SEC)

The reasons to form Security Exchange Commission are to protect investor`s interest, improvement of securities markets, appropriate issuance of securities and proper guiding of securities laws. Moreover, DSE, CSE, CDBL, stock brokers, merchant banks and asset management companies are under supervision of SEC.

On 8th June, 1993, the Government of Bangladesh founded Security and Exchange Commission (SEC) under the Securities and Exchange Commission Act, 1993. Besides, there is a chairman and four members in this commission. In addition, the Chairman & members of security exchange commission are selected by the government of Bangladesh. However, SEC is directly connected with the ministry of Finance and has rights to manage all of securities laws & regulations. According to Securities and Exchange Ordinance, 1969 SEC has been authorized to control even self regulatory institutions for instance Stock Exchanges.

The main functions of SEC are following:

- Registering and regulating the business operation of DSE, CSE, stock brokers, merchant banks, underwriters, share transfer agents, portfolio managers and other intermediaries.

- Developing investor`s education, providing training for intermediaries, executing market research and publishing those.

- Controlling every authorized self regulatory organizations too

- Inspecting and controlling fraudulent and unfair trading in security markets

- Auditing and investigating of any intermediaries or stock exchanges

- Collective investment scheme registering & controlling

(Source: www.secbd.org)

Central Depository Bangladesh Limited (CDBL)

CDBL has created a value to the stock market of Bangladesh and after the establishment of CDBL, it attracted more investors especially foreigners. Moreover, when the CDBL was not established, process of transferring and delivering ownership was too lengthy and risky. However, after implementing automated trading system in DSE & CSE and introducing central depository system, the stock market of Bangladesh became more effective and credible to the investors.

CDBL was included as a public limited company on 20th August, 2000. DSE, CSE, banks, Investment Corporation of Bangladesh and some other financial institution are the owners of CDBL. Besides, the participants of CDBL are called Depository Participant (DP). CDBL charges fees from its participants for different services provided by CDBL.

The functions of CDBL are given below:

- Operate and maintain the Central Depository System (CDS) of Electronic Book

- Recording and maintaining securities accounts and registering transfer of securities

- Changing the ownership without any physical movement or endorsement of certificates

- Supervision of Depository participant activities

- Providing different investor services including providing a platform for the secondary market trading of Treasury Bills and Government Bonds issued by the Bangladesh Bank.

(Source: www.cdbl.com)

STOCK MARKET CRASH 2010-2011

STOCK MARKET CRASH OF BANGLADESH IN 2010-11

History of the stock market crashes show that ‘Bull Run’ before a stock market crash is kind of normal phenomenon. There was no exception for the stock market crash of Bangladesh in 2010-11. Most important factors that guided to the Bull Run are described here.

Root of bubble

Due to political conflict of Bangladesh state of emergency was declared and military took power of the country in 2007. Moreover, during military-backed regime investment in real sectors as well as FDI decreased but the inflow of foreign remittance increased. At that time, investors were looking for alternative investment sector to invest their savings and found stock market as an attractive alternative.

According to Centre for Policy Dialogue (CPD) 2011, the total number of BO Account holders on 20th December, 2010 reached to 3.21 million though the number was 1.25 million in December 2009. Most of these new investors don’t have enough knowledge about the stock market but invest their most or all savings in the market. However, 238 brokerage houses opened 590 branches at 32 districts. As CPD (2011) found, there are some factors which attracts investors such as internet-based trading operation, opening branches of brokerage houses across the country, easy access to the market information, arranging a countrywide ‘share mela (fair)’.

Unfortunately, to chase huge capital of too many investors, there were not enough supplies of new securities through IPOs in the market. On the other hand, there was a lot of excess liquidity due to less business opportunities in the recession period of 2009-10 in banks and other financial institutions of Bangladesh. Theses financial institutions and its officials as well as other people captured the opportunity and took loan and invest in the share market to minimize the cost of bearing excess liquidity. This made a huge entry of liquidity in the share market. For that reason the daily transaction in the share market was on an average from Taka 20,000 to 30,000 million in 2010 and the figure was double comparing to 2009.

To produce Bangladesh`s economy by 7-8% per year Bangladesh Bank adopted accommodative monetary policy during the high inflation periods to support investment. Bangladesh Bank has locked Taka against dollar to support exports. As Taka has been undervalued it has made excess growth in money supply. Because of Bangladesh Bank’s ex-change rate policy last couple of years broad money made excess. However, a big portion of this excess liquidity had gone to the stock market but there were very few shares in the market. The policy that was adopted by Bangladesh Bank to grow economy by increased exports and investment ultimately misguided and ended up blowing the mother of all bubbles. Besides, the government again increased the bubble after permitting whitening of black money through tax breaks and schemes.

Furthermore Security & Exchange Commissions was not proficient to monitor the market conditions properly. Because of the poor monitoring & market surveillance share prices of Z Category Companies and small companies increased dramatically. Though some initiatives were taken by SEC but those were not effective and changed directives frequently such as; it changed directives of margin loan ratio 19 times.

Time of historical fall

Timeline of historical fall of the crash has been divided into two sections which are December 2010 and January 2011.

December 2010

It has been stated by Bhuiyan (2011) that 5th December, 2010 as the last glorious day of the year for the investors of Bangladesh stock market. On this day DSE General Index (DGEN) gained its all-time highest 8, 918.51 point & broke all old records of DSE turnover by Taka 32.50 billion.

Security & Exchange Commissions and Bangladesh Bank introduced a lot of directives to keep the market under control in 2010. Unfortunately, in December both BB and SEC changed many of their previous directives because of the failure and applied new more. On 6th December, 2010 SEC again introduced a directive saying that buy orders will be carried out after encashment of Investor`s cheque. In addition, on the following day another directive called “netting facilities” was applied. This instruction said that no investor will be able to purchase securities against the sale proceedings of any other securities during the settlement & clearance period.

After that both directives of 6th & 7th December were cancelled on 8th December. The reason of cancelling these directives was a significant fall of share prices on 8th December.

SEC changed directive of margin loan ratio by increasing it from 1:0.5 to 1:1 on 13th December and later it was again climbed to 1:1.5 & 1:2 because of free fall of share prices. Bangladesh Bank got objection that Banks are investing money in the stock market from their reserve. According to this complain on the 1st day of December BB sent 50 teams in different banks of Dhaka & Chittagong to investigate and found some banks in such irregularities.

Raisa (2011) discussed about the most important advices initiated by BB in December 2010 are withdrawal of illegally invested industrial loans, increasing SLR and CRR. Moreover, BB increased CRR and SLR by 0.5 percent and increased to 19 and 6 percent. As a lot of the reserved money was invested in capital market, banks took the opportunity and started selling shares and withdrawing that money from the market. By the time investors became anxious. BB extended its deadline for submitting and adjusting loans to handle the disastrous & assure the panicked investors. For the merchant banks the deadline was January 15, 2011 and for the commercial bank February 15, 2011.

Institutional investors including financial institutions started selling shares from the beginning of December showing high return on investment at their balance sheet. Since the Institutions & banks started selling their shares from the beginning of December, the turnover of DSE was the highest ever in its history on 5th December.

On the other hand, for Bangladesh stock market 19th December was a historical day of the financial year 2010- 11. On this day DSE observed its biggest one day fall in 55 years history until the date with losing 551.76 points or 6.71 percent. Moreover, the losing index was even higher than 284.78 points or 3.32 percent of 12th December. Prices started to drop in an hour after the trading started and about 200 points were clean off. In the middle of the trading session it recovered little bit and ended up the session at 7654 point.

On the other hand, to meet CRR & SLR requirements of BB by the deadline formed liquidity crisis in banking sector and call money rate made a new record of 180% by 20th December. In addition, investment Corporation of Bangladesh (ICB), State owned commercial banks (SCBs), regulators and government brought some kind of stability in the market after the big fall of 19th December and liquidity crisis. As a result, share prices increased from 20th to until 30th December and index stood at 8290 point at the end of the financial year 2010-11.

January 2011

Share prices again started to fall from 3rd January, 2011 as investor had the information of ongoing liquidity crisis of financial & non-financial institutions that preventive margin loan. The down slope of index is visible from January 2nd to 10th. As Chairman of probe committee Mr. Ibrahim Khaled (2011) mentioned, “Due to trigger sale of shares from 2nd to 5th January, market experienced its biggest decline in share prices and market crash from 6th to 10th January.”

On 9th January DSE General (DGEN) Index declined by 600 points and all indices declined nearly 7.75 percent. Furthermore, on 10th January Dhaka Stock Exchange General (DGEN) Index lost by 660 points or 9 percent and Chittagong Stock Exchange Selective (CSE) Index declined by 914 points or 6.8 percent within 50 minutes of trading. Besides, CSE All Share Price Index (CASPI) stood at 19212.34 losing by 1,396.21point, which is 6.77 percent. CSE Selective Categories Index (CSCX) lost 914 points or 6.87 percent and CSE -30

Index also lost 1490.83 or 8.28 percent. These falling indexes had broken all previous records. After that Security and Exchange Commission called for an emergency meeting with Bangladesh Bank and stop trading at both Dhaka & Chittagong Stock Exchanges. After that, investors came out in the street with processions and demonstrated against free fall of Share index in both bourses as well as suspension of trading. Investors from different parts of the country brought out processions and clashed with law enforces in some places as well.

Following two days consecutive historical fall of share prices the government, Central Bank and SEC took instant actions to steady the market and bring the confidence among million of small investors. The government created pressure on Bangladesh Bank and SEC to recover the market condition. As a result, recovery was initiated with Institutional buyer for instance merchant banks, state owned banks & non-financial institutions.

On 11th January market improved 15.6 percent of General index by the end of the session and made a record in Bangladesh stock market history of gain.

Moreover, Ahmed (2011) mentioned that institutional buyers were asked not to sell shares rather to buy.

Bangladesh Bank pushed money into the market as liquidity support and repo. On 18th January, Index started to decline again and market hits the lowest turnover in nine months which is taka 8.49 billion. Since of free fall of share prices, Investors came out in the street again and started protesting against free fall of share prices.

However, SEC asked DSE and CSE to stop trading for the 2nd time within 8 days. DSE General Index (DGEN) declined by 243 points or 3.29 percent and CSE Selective Category Index (CSCX) declined by 298 points after a trading of around 2.4 hours.

Although steps were taken and applied by the government, BB and regulators to improve the market conditions and bring the investors’ confidence, market index declined heavily on 20th January DGEN by falling 599.77 points or 8.68 percent. From 26th of January there was noticed an increasing of index. But finally Index stood at the lowest point which is 5579 from 7th to 14th February.

Market Scenario and Investors’ Behavior after Market Crash

Market Scenario:

Before and after the market crash 2010-2011, the scenario of stock market is different. If we look at the stock market trend from different views, we can predict the market conditions and the investors’ movement according to this changing market. Some stock market indicators are described below:

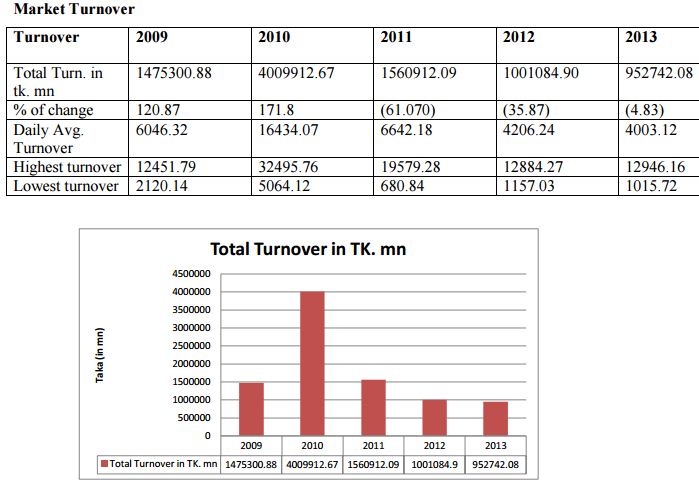

Here, we can see the huge turn over in 2010 by Tk. 4009912.67 million and the percentage change of that time is 171.8 which simply indicate that on that time huge liquidity was seen. Moreover, it indicates that trading is vigorous and stocks are highly liquid. It is simple to find buyers and sellers, although the pricing may be highly variable. And we all know that in 2010 the huge participation of investors made the market highly liquid.

Besides, a low share turnover reflects illiquidity, where shareholders have difficulty buying and selling stocks and could be in a trouble if they need to sell off their stock. On the other hand, in 2011 the market turnover in terms of Taka is decreasing which point out the market improvement a little bit from an abnormal scenario in 2010.

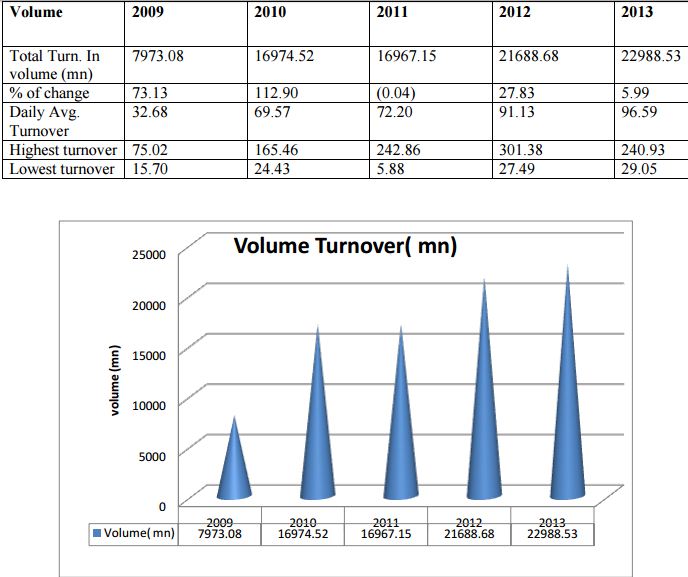

Market Volume:

Market volume measures the commitment behind stock price movement. Moreover, it helps you to know how many people are involved in that move. On the other hand, if a stock moves on low volume then it tells that relatively few people are participating in this movement and if a stock moves on high volume then many traders or investors are involved in that movement as a result it will be easier to find someone to buy from or sell to. In 2009 the stock volume was 7973.08 million which was hurriedly increased at 16974.52 million. It indicates that in 2010 there was surprisingly huge participation of the investors and as there were not enough new shares’ coming through IPO, there was created a bubble in the market. Besides, 2012 to 2013 the volume is increasing gradually.

Conclusion:

In the above study, we have observed the reasons and scenario behind the market crash 2010-2011 and also found out the investors’ behavior and how they are investing their money in the stock market. However, now we should find out some remedy so that in future investors can invest their money in capital market without any fearing or they can invest in this sector with honesty and make a good return of their investment. On the other hand, we can see that investors in general show irrational excitement in times of stock market bubble and undue doubt after the bust of the bubble. Both behavioral patterns cause stock prices to move away from their fundamental values. To avoid this kind of behavior, investors should assess long run profitability of companies.

If they observe a sudden jump in EPSs, investors must identify reasons of the jump and evaluate its long-run sustainability. The EPSs and NAVs are thus not always a good guide. Investors should therefore examine earnings persistency, not just the one period ahead forecast of EPSs. Besides, SEC can formulate laws so that investors can obtain financial analyst services and make informed investment decisions. Stock exchanges can also educate investors as to help them make sensible investment decisions. They can organize training programs on technical and fundamental analysis of securities. Press and electronic media can also play a great role to this end. Moreover, steps are needed to motivate institutional investors to be more active in the share market. To do so, it would essentially require that money market is stabilized and interest rate declines to a reasonable level.

That would also require that inflation declines to a reasonable level. Besides, City Brokerage Limited is a brokerage house under the city Bank. They have a well reputation for satisfying their customer through providing good services; since they have been starting their journey 2009. Along with other brokerage house, they use modern technology to give better services to their customers. Moreover, City Brokerage limited is dedicated to providing a high level of professional and personalized services to its domestic and international clients and that’s why its office is decorated in such way to give better services to their clients. In addition, we can see many of the Brokerage houses serve their clients in one big room but in City Brokerage LTD, there are several rooms for serving their clients. In addition, the company aims to offer high quality product and service at a competitive rate to all clients. After the 2010, capital market had been passing a tough time. During this tough period, City Brokerage Limited has tried best to give better services to their clients as possible. Also, they have ensured the customer satisfaction through their services. However, for sustainable growth, by implementing innovation they have to walk with the time. In this purpose, they must look on their strength and need to recover their weak sides. At the same time they must look after the opportunity and threats as well as.