Executive Summary

Islami Bank Bangladesh Limited (IBBL) is trying to establish the maximum welfare of the society by maintaining the principles of Islamic Shari’ah which is based on “Quran” and “Sunnah”. Since 1983, IBBL is the pioneer in welfare banking in this subcontinent and it is trying to do all its activities for the betterment of its depositors. For the greater interest of the depositors the investment policy of IBBL is to invest on the basis of profit and loss sharing in accordance with the tents and principles of Islamic Shari’ah.

To complete my report I have used both qualitative and quantitative data. In the first chapter I have tried to discuss about the objectives , methodology, scope and limitations of the study. The main objective of the report is to acquaint with the different modes of investment of Islami Bank Bangladesh Limited and to evaluate its effectiveness. In the second chapter I have tried to discuss about the industrial and theoretical background of banking sector in Bangladesh. In the third chapter I have tried to show about the concept of Islami banking and its background in Banking sector in Bangladesh. In the fourth chapter I have tried to discuss about Different Modes of Investment. In the fifth chapter I have tried to discuss about Investment Performance of IBBL. In the sixth chapter I have given findings, some recommendation and conclusion.

Introduction

Banking plays an important role in the economy of any country. In Bangladesh Muslim constituted more than 80% of its population. These people possess strong faith on Allah and they want to lead their lives as per the constructions given in the holy Quran and the way shown by the prophet Hazrat Muhammad (Sm). But no Islamic banking system was developed here up to 1983 The Traditional banking is fully based on interest it is commonly meant as commercial banks. But interest is absolutely prohibited by Islam. As a result the people of Bangladesh have been experiencing such a non-Islamic and prohibited banking system against their normal values and faith. Bank is a nothing but a financial intermediary. Bank works as a bridge between the depositor and the investment seeker or loan taker. The investment or loans that are sanctioned by the banks are the most managing issue for the management of bank. Proper selection of client, choosing appropriate investment option for alternative, bringing back the invested money to the bank with profit are the core investment related work. If this jobs are functioned properly a bank can earn sufficient profit to satisfy its depositors and also for the shareholders. The banks that are regulated according the Islamic Shari’ah they operate their investment operation on the basis of profit and loss sharing. While the conventional banking system sanction loan on the basis of interest. That is why there are always observation prevails whether the Islamic banking system is doing well or conventional banking system performing better jobs. Naturally there are some specific difference prevails between the investment operation of Islamic banks and conventional banking system. From the context of our country Islamic Banks are doing good job comparing with the conventional banking system. Islamic banks are searching for Shari’ah approved sectors and bringing out smart profit. Among all the banks Islami Bank Bangladesh Limited is doing the finest job in our country. Not only in competing with the Islamic Banks but it is absolutely ahead in performance in comparing with the conventional banks. That is why Islami Bank Bangladesh Limited is got special attention to examine its performance specially its investment.

Origin of the Study

As an obligatory requirement of MBA Internship program, I have prepared this report for the partial fulfillment of my MBA internship program. In my report entitled “Different Modes of Investment of Islami Bank Bangladesh Limited”, here I am supposed to analyze investment banking as a whole scenario of Islami Bank Bangladesh Limited (IBBL) particularly in terms of its precise definition, problems, factors, contributions, and inventions.

Background of the Study

Any academic course of the study has a great value when it has practical application in the real life. Only a lot of theoretical knowledge will be little important unless it is applicable in the practical life. So we need proper application of our knowledge to get some benefit from our theoretical knowledge to make it more fruitful when we engage ourselves in such field to make proper use of our theoretical knowledge in our practical life, only then we come to know about the benefit of the theoretical knowledge. Such an application is made possible through internship. When theoretical knowledge is obtained from a course of study it is only the half way of the subject matter. Internship implies the full application of the methods and procedures through rich acquired knowledge of subject matter can be fruitfully applied in our daily life. Such a procedure of practical application is known as internship. The case study is titled “Different Modes of Investment of Islami Bank Bangladesh Limited”. As a student of MBA this study will be more significant in my practical life. I have worked at New Market Branch of Islami Bank Bangladesh Limited to complete the internship program as an academic requirement.

Objective of the Study

The primary objective of this report is to observe the investment related activities for the Investment Department of Islami Bank Bangladesh Ltd.

The other objectives include:

To understand the different modes of investment of IBBL.

- With a view to familiarize with the various investment schemes.

- To assess the investment performance IBBL for 5 years.

- To analyze performance through the flow of time.

- To understand various forces those have impact on investment operation.

- To Analyze the Bank about its strength, weakness, opportunities and threat

- To understand the basic difference in relation to conventional bank.

Scope of the Study

In this report I have focused on all the qualitative which include profiles of IBBL, investment modes like Bai mode, Profit & loss sharing, bearing mode, Rent sharing mode,. This study covers the performance of the bank through the years using ratio analysis, SWOT analysis etc. This study is confined to only this bank other than conventional bank.

Methodology of the Study

a) Nature of the study: Exploratory

b) Sources of information: Both primary and secondary information sources were used to complete this report.

- Primary sources: Primary sources were officers and manager (VP) of the Islami Bank Bangladesh Ltd., New Market Branch. Following factors were considered to collect information:

- Face to Face conversation.

- Secondary sources: Secondary information was collected from various books, journals, manuals, and also from the web sites.

c) Analysis techniques: Self study was used to analyze the collected information.

d) Presentation of information: Collected information and findings of the analysis are

presented in both table and graphical form

e) Methods of data analysis: I analyze the data in both quantitative and subjective way. I

used some techniques for the purpose of analysis. These are:

- Theoretical analysis

- Graphical analysis

- Tabular analysis

- Ratio Analysis

- SWOT Analysis

Statement of the Problem

Regular return from investment can carry a bank into a healthy position. That is why every bank tends to make huge amount of investment and gaining maximum profit. So while investing there is a lot of tasks are interrelated. Making excessive investment not identifying the withdrawal behavior of depositor can put the bank in risky position and carry to bankruptcy situation. On the other hand bank cannot rest it money idly by not making investment fearing the withdrawal behavior of depositor. So there are needed to maintain a tradeoff between reserve money for depositor and money for investing.

It is also important for the bankers to assess the maximum return giving sectors to investment. Banks are committed to return the depositors money with some profit. So making sustainable profit is important for any bank. Profit Loss Sharing kind of business places the bank in a risky position. So it is interesting to see whether an Islami bank makes investment in profit loss sharing business.

In recent years there is economic slowdown occurred worldwide. The side effect of this economic slowdown put the investment situation of our country vulnerable. The RMG sector of our country is experiencing lots of trouble. Overall the economic environment of our country is not in most excellent mode. To overcome the crisis the banks are opted to invest in capital market to make quick profit which is not only making vulnerable situation of the capital market but also making the banks unable to meet the demand of the depositors.

Limitations of the Study

I have faced some problems during preparing my report:

i. Lack of time:

The time period of this study is very short. We had only 8 weeks in my hand to complete this report, which was not enough. So I could not go in depth of the study. Most of the times, the officials were busy and were not able to give me much time

ii. Insufficient data:

Some desired information could not be collected due to confidentiality of business

iii. Lack of monitory support

Few officers sometime were busy in their job. Sometime they didn’t want to supervise us out of their official work

iv. Other limitations:

As we are newcomers, there is a lack of previous experience in this concern. And many practical matters have been written from our own observation that may vary from person to person.

Detail of Banking Industry

The name bank derives from the Italian word banco “desk/bench”, used during the Renaissance by Florentines bankers, who used to make their transactions above a desk covered by a green tablecloth. However, there are traces of banking activity even in ancient times.

In fact, the word traces its origins back to the Ancient Roman Empire, where moneylenders would set up their stalls in the middle of enclosed courtyards called macella on a long bench called a bancu, from which the words banco and bank are derived. As a moneychanger, the merchant at the bancu did not so much invest money as merely convert the foreign currency into the only legal tender in Rome- that of the Imperial Mint.

The definition of a bank varies from country to country. Under English law; a bank is defined as a person who carries on the business of banking, which is specified as:

- Conducting current accounts for his customers

- Paying cheque drawn on a him, and

- Collecting cheque for his customers.

Banks have influenced economies and politics for centuries. Historically, the primary purpose of a bank was to provide loans to trading companies. Banks provided funds to allow businesses to purchase inventory, and collected those funds back with interest when the goods were sold. For centuries, the banking industry only dealt with businesses, not consumers. Commercial lending today is a very intense activity, with banks carefully analyzing the financial condition of their business clients to determine the level of risk in each loan transaction. Banking services have expanded to include services directed at individuals, and risk in these much smaller transactions is pooled.

In most English common law jurisdictions there is a Bills of Exchange Act that codifies the law in relation to negotiable instruments, including cheque, and this Act contains a statutory definition of the term banker: banker includes a body of persons, whether incorporated or not, who carry on the business of banking’ (Section 2, Interpretation). Although this definition seems circular, it is actually functional, because it ensures that the legal basis for bank transactions such as cheque do not depend on how the bank is organized or regulated.

The business of banking is in many English common law countries not defined by statute but by common law, the definition above. In other English common law jurisdictions there are statutory definitions of the business of banking or banking business. When looking at these definitions it is important to keep in minds that they are defining the business of banking for the purposes of the legislation, and not necessarily in general. In particular, most of the definitions are from legislation that has the purposes of entry regulating and supervising banks rather than regulating the actual business of banking. However, in many cases the statutory definition closely mirrors the common law one. Examples of statutory definitions:

“banking business” means the business of receiving money on current or deposit account, paying and collecting cheque drawn by or paid in by customers, the making of advances to customers, and includes such other business as the Authority may prescribe for the purposes of this Act; (Banking Act (Singapore), Section 2, Interpretation).

Development of Banking in Bangladesh

After liberation reformed the destroyed economy on 26th March 1972 the banking sector of Bangladesh was nationalized. After nationalization government of Bangladesh changed the entire bank to six banks which are Sonali Bank, Rupali Bank, Janata bank, Agrani Bank, Pubali Bank & Uttara bank. Their role in development of trade and commerce of Bangladesh as well as in the development Bank system was practiced in the Indian subcontinent from the ancient period. In Indian subcontinent merchants, goldsmith moneylenders were the primary bankers. During the Moghal period banking and credit business was enchanted rapidly. Then the agency house of jagth Seth was similar to the merchant house of Lombardy Street. In 1700 AD “Hindustan Bank” was established as the first joint stock bank. In 1784 “Bengal Bank” and in 1786 General bank of India was lunched. Then both the bank absolved respectively in 1793 and 1832.

During the early period of nineteenth century in 1806 “Bank of Bengal” in 1840 “Bank of Bombay” and in 1843 “Bank of Madras” was established. These Banks were called Presidency Bank. Then in 1920 these three banks merged to “Imperial Bank of India”. In 1947 after the separation bank business in our country faced a severe disaster as non Muslim Bankers left to India. Then “Reserve bank of India” acted as the “Central Bank of Pakistan” in 1948 to re-build the Bank Business “State Bank of Pakistan” was established as central bank of Pakistan.

In 1971 Bangladesh became independent. After liberation “Bangladesh Bank” was automated with the assets and liabilities of former “State Bank of Pakistan”. It is the central bank of Bangladesh. During Pakistan period in our country there were 1090 branches of 12 commercial banks. Three foreign banks were also active with 14 branch offices. Before liberation 80% of banking activities of our country was controlled by Pakistan. Consequently Bangladesh traders and industrialists didn’t get notable of economy.

Branch Based Islamic Banking

- AB Bank Ltd. (Branches: 1)

- Dhaka Bank Ltd. (Branches: 2)

- Jamuna Bank Ltd. (Branches: 2)

- Southeast Bank Ltd. (Branches: 5)

- The City Bank Ltd. (Branches: 1)

- Premier Bank Ltd. (Branches: 2)

- Standard Chartered Bank Ltd.( Sadiq) (Branches: 1)

- HSBC (Ama-nah) (Branches: 1)

Banking Rules

This Act may be called the Banking Companies Act, 1991. It shall be deemed to have come into force on 14th February 1991.

Application of Other Acts: The provision of this Act shall be in addition to, and not, save as hereinafter expressly provided, in derogation of, the Companies Act, 1913 (VII of 1913), and any other Act for the time being in force.

Limited application of this Act to co-operative banks and other financial institutions: Nothing in this Act shall apply to a co-p-operative bank or any other financial institutions registered under the Co-operative Societies Ordinance, 1985 (I of 1985) or any other Act for the time being in force relating to co-operative banks: Provided that the Bangladesh Bank may carry out inspection of and issue directions to co-operative banks as prescribed for banking companies under section 44 and 45 of this Act.

Power to suspend operation of this Act: The Government if, on a representation made by the Bangladesh Bank in this behalf it is satisfied that it is expedient so to do, may be notification in the official gazette suspend for at most 60 days the operation of all or any of the provisions of this Act in relation to any specified banking company. The Government may, by notification in the official Gazette, extend from time to time, the period of any suspension under sub-section for such period or periods, not exceeding 60 days at one time, as it thinks fit, so however that the total period does not exceed one year. Notifications issued under this section shall be submitted to the national parliament as follows:

A) If it is session, within 10 days of the issue of the notification, and

B) If it is not in session, within 10 days of the beginning of the session following the issue of the notification.

Explanation: Any company which is mainly engaged in the manufacture of goods or carries on any trade and which accepts deposits of money from the public merely for the purpose of financing its business such as manufacturer or trade shall not be deemed to transact the business of banking within the meaning of this clause. “banking” means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by check, draft order or otherwise; “temporary liability” means any liability other than demand liability; “gold” means gold in the form of coin, whether legal tender or not, or in the form of bullion or ingot, whether refined or not; “register” shall have the same meaning as in the Companies Act.

Act to override articles, memorandum, etc.: Same as otherwise expressly provided in this Act except new banks and special banks, the provisions of this Act shall have effect notwithstanding anything to the country contained in the memorandum or articles of a banking company, or in any agreement executed by it, or in any resolution passed by the banking company in general meeting or by its Board of Directors, whether the same be registered, executed or passed, as the case may be, before or after the commencement of this Act, and any provision contained in the memorandum, articles, agreement or resolution aforesaid shall, to the extent to which it is repugnant to the provision of this Act, be void.

Bangladesh Bank

Bangladesh Bank (BB) has been working as the central bank since the country’s independence. Its prime jobs include issuing of currency, maintaining foreign exchange reserve and providing transaction facilities of all public monetary matters. BB is also Bangladesh Bank (BB) has been working as the central bank since the country’s independence. Its prime jobs include issuing of currency, maintaining foreign exchange reserve and providing transaction facilities of all public monetary matters. BB is also responsible for planning the government’s monetary policy and implementing it thereby.

The BB has a governing body comprising of nine members with the Governor as its chief. Apart from the head office in Dhaka, it has nine more branches, of which two in Dhaka and one each in Chittagong, Rajshahi, Khulna, Bogra, Sylhet, Rangpur and Barisal.

Bank Licensing

Bank Company Act, 1991, empowers BB to issue licenses to carry out banking business in Bangladesh. Pursuant to section 31 of the Act, before granting a license, BB needs to be satisfied that the following conditions are fulfilled: “that the company is or will be in a position to pay its present or future depositors in full as their claims accrue; that the affairs of the company are not being or are not likely to be conducted in a manner detrimental to the interest of its present and future depositors; that, in the case of a company incorporated outside Bangladesh, the Government or law of the country in which it is incorporated Bangladesh as the Government or law of Bangladesh grants to banking companies incorporated outside Bangladesh and that the company complies with all applicable provisions of Bank Companies Act, 1991.”

Licenses may be cancelled if the bank fails to comply with above provisions or ceases to carry on banking business in Bangladesh.

Commercial Banks

The commercial banking system dominates the financial sector with limited role of Non-Bank Financial Institutions and the capital market. The Banking sector alone accounts for a substantial share of assets of the financial system. The banking system is dominated by the 4 State Owned Commercial Banks, which together controlled more than 30% of deposits and operates 3383 branches (50% of the total) as of June 30, 2008.

Financial Institutions (FIS)

Twenty-nine financial institutions are now operating in Bangladesh. Of these institutions, 1(one) is govt. owned, 15 (fifteen) are local (private) and the other 13(thirteen) are established under joint venture with foreign participation. The total amount of loan & lease of these institutions is Tk.99, 091.80 million as on 31 December, 2007. Bangladesh Bank has introduced a policy for loan & lease classification and provisioning for FIs from December 2000 on half-yearly basis. To enable the financial institutions to mobilize medium and long-term resources, Government of Bangladesh (GOB) signed a project loan with IDA, and a project known as “Financial Institutions Development Project (FIDP)“ has started its operation from February 2000. Bangladesh Bank is administering the project. The project has established “Credit, Bridge and Standby Facility (CBSF) “ to implement the financing program with a cost of US$ 57.00 million.

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Islami Bank Bangladesh Limited on March 13, 1983, is the true reflection of this inner urge of its people, which started functioning with effect from March 30, 1983. This Bank is the first of its kind in Southeast Asia. It is committed to conduct all banking and investment activities on the basis of interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent personalities of the Middle East and the Gulf countries, Islami Bank Bangladesh Limited has by now earned the unique position of a leading private commercial bank in Bangladesh.

Concept of Islami Banking

The concept of Islamic Banking represents a radical departure from traditional banking. Almighty, Omnipotent, Omniscient and Ubiquitous Allah have strictly forbidden investing or earning on the basis of interest (riba). Because, according to Islamic Shari’ah, interest (riba) is prohibited in Islam. So every sort of transaction must be free from riba.

An Islamic Bank is a financial institution that operates with the objective to implement and materialize the economic and financial principles of Islam in the banking arena. The Islamic banks organize their operation on the basis of profit/loss sharing and other modes which are permitted in Islam.

According to Organization of Islamic Conference (OIC), “Islamic bank is a financial institution whose statutes, rules and procedures expressly state its commitment to the principles of Islamic Shari’ah and to the banning of the receipt and payment of interest on any of its operations.”

According to Dr. Ziauddin Ahmed “Islamic Bank is essentially a normative concept and could be defined as conduct of banking in consonance with the ethos of the value system of Islam.”

IBBL as an Islami Bank

In August 1974, Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganize it economic and financial system as per Islamic Shari’ah.

In November 1980, a delegation of IDB visited Bangladesh and showed keen interest to participate in establishing a joint venture Islamic Bank in the private sector. Two professional bodies Islamic research Bureaus (IERB) and Bangladesh Islamic Banker’s Association (BIBA) made significant contribution towards introduction of Islamic Banking in the country.

At last, the long drawn struggle to establish and Islamic bank in Bangladesh became a reality and Islamic bank Bangladesh was established in March 1983, in which 23 Bangladeshi National, 4 Bangladeshi institutions and 1 banks, financial institutions and Governments bodies of the middle East and Europe including IDB and two eminent personalities of the kingdoms of Saudi Arabia joined hands to make the dream into a reality.

Business philosophy of IBBL

The philosophy of Islami Bank Bangladesh Limited is to the principles of Islamic Shari’ah. The organization of Islamic conference (OIC) defines an Islamic Bank as “a financial institution whose status, rules and procedures expressly state its commitment to the principles of Islamic Shari’ah and to the banking of the receipt and payment of interest on any of its operations. The sponsor, perception is that IBBL should be quite different from other privately owned and managed commercial bank operating in Bangladesh, IBBL to grow as a leader in the industry rather than a follower. The leadership will be in the area of service, constant effort being made to add new dimensions so that clients can get “Additional” in the matter of services commensurate with the needs and requirement of the country growing society and developing economy.

Mission of the Bank

To establish Islamic banking through the introduction of a welfare oriented banking system and also ensure equity and justice in the field of all economic activity balanced growth and equity development through diversified investment operations particularly in the priority sectors and less development areas of the country. To encourage socio-economic uplift and financial services to the low income community particularly in the rural areas.

Vision of the Bank

The vision of IBBL is to always strive to achieve superior financial performance, be considered a leading Islamic Bank by reputation and performance.

- To establish and maintain the modern banking technology

- To ensure the soundness and development of the financial system based on Islamic principles and become the strong and efficient organization with highly motivated professionals, working for the benefit of people, based upon accountability, transparency and integrity in order to ensure stability of financial system.

- Try to encourage savings in the form of direct investment

- Try to economic investment particularly in projects, which are move likely to lead to higher employment.

Special Features of IBBL

- All activities are conducted on interest-free system in accordance with Islamic Shari’ah Principles.

- Investment is made through different modes as per Islamic Shari’ah.

- Investment-income of the Bank is shared with the Mudaraba depositors according to an agreed upon ratio ensuring a reasonably fair rate of return on their deposits.

- Aims to introduce a welfare-oriented system and also to establish equity and justice in the field of economic operators.

- Extends socio-economic and financial services to individuals of all economic background with strong commitment in rural advancement uplift.

Distinguishing Features of Conventional and IBBL

Conventional banking is essentially based on the debtor-creditor relationship between the depositors and the bank on the one hand, and between the borrowers and the bank on the other. Interest is considered to be the price of credit, reflecting the opportunity cost of money.

Islam, on the other hand, considers a loan to be given or taken, free of charge, to meet any contingency. Thus in Islamic Banking, the creditor should not take advantage of the borrower. When money is lent out on the basis of interest, more often it happens that it leads to some kind of injustice.The first Islamic principle underlying such kinds of transactions is that “deal not unjustly, and ye shall not be dealt with unjustly”. Hence, commercial banking in an Islamic framework is not based on the debtor-creditor relationship.

The second principle regarding financial transactions in Islam is that there should not be any reward without taking a risk. This principle is applicable to both labor and capital. As no payment is allowed for labor, unless it is applied to work, there is no reward for capital unless it is exposed to business risk. Thus, financial intermediation in an Islamic framework has been developed on the basis of the above two principles. Consequently financial relationships in Islam have been participatory in nature. Several theorists suggest that commercial banking in an interest-free system should be organized on the principle of profit and loss sharing. The institution of interest is thus replaced by a principle of participation in profit and loss.That means a fixed rate of interest is replaced by a variable rate of return based on real economic activities. The distinct characteristics which provide Islamic banking with its main points of departure from the traditional interest-based commercial banking system are: (a) the Islamic banking system is essentially a profit and loss sharing system and not merely an interest (Riba) banking system; and (b) investment (loans and advances in the Conventional sense) under this system of banking must serve simultaneously both the benefit to the investor and the benefit of the local community as well. The financial relationship as pointed out above is referred to in Islamic jurisprudence as Mudaraba.

For the interest of the readers, the distinguishing features of the conventional banking and Islamic banking are shown in terms of a box diagram as shown below:

Table-2 (Difference Between Conventional and Islami Banking)

| Conventional Banks | Islamic Banks | |

| 1. The functions and operating modes of conventional banks are based on man made principles. | 1. The functions and operating modes of Islamic banks are based on the principles of Islamic Shariah. | |

| 2. The investor is assured of a predetermined rate of interest. | 2. In contrast, it promotes risk sharing between provider of capital (investor) and the user of funds (entrepreneur). | |

| 3. It aims at maximizing profit without any restriction. | 3. It also aims at maximizing profit but subject to Shariah restrictions. | |

| 4. It does not deal with Zakat. | 4. In the modern Islamic banking system, it has become one of the service-oriented functions of the Islamic banks to collect and distribute Zakat. | |

| 5. Leading money and getting it back with interest is the fundamental function of the conventional banks. | 5. Participation in partnership business is the fundamental function of the Islamic banks. | |

| 6. Its scope of activities is narrower when compared with an Islamic bank. | 6. Its scope of activities is wider when compared with a conventional bank. It is, in effect, a multi-purpose institution. | |

| 7. It can charge additional money (compound rate of interest) in case of defaulters. | 7. The Islamic banks have no provision to charge any extra money from the defaulters. | |

| 8. In it very often, bank’s own interest becomes prominent. It makes no effort to ensure growth with equity. | 8. It gives due importance to the public interest. Its ultimate aim is to ensure growth with equity. | |

| 9. For interest-based commercial banks, borrowing from the money market is relatively easier. | 9. For the Islamic banks, it is comparatively difficult to borrow money from the money market. | |

| 10. Since income from the advances is fixed, it gives little importance to developing expertise in project appraisal and evaluations. | 10. Since it shares profit and loss, the Islamic banks pay greater attention to developing project appraisal and evaluations. |

11. The conventional banks give greater emphasis on credit-worthiness of the clients.11. The Islamic banks, on the other hand, give greater emphasis on the viability of the projects.12. The status of a conventional bank, in relation to its clients, is that of creditor and debtors.12. The status of Islamic bank in relation to its clients is that of partners, investors and trader.13. A conventional bank has to guarantee all its deposits.13. Strictly speaking, and Islamic bank cannot do that.

Functions of IBBL

Islamic banks render almost similar services to their customers conventional banks do. However, differences exist in administering incentives for deposits and charging for capital investments, in so far as techniques of calculating the incentive or the cost of the capital are concerned. Like a conventional bank, the Islami bank also accepts deposits from customers and advances investment. The bank invests its funds for short as well as long term deposits. The Islami bank also acts as a custodian of its customers and performs all foreign transactions on behalf of them. The IBBL perform mainly three different types of functions Banking services, Investment, and Foreign exchange services banking services comprise three regular types of operations related to acceptance of deposits in the different customers accounts as mentioned earlier, as well as, different transactional services to the customers, safekeeping of personal valuables and securities, collection of bills, agency services, etc. The bank lends its funds for the rapid growth and development of industrial sectors and the promotion of trade and commerce in the country. The bank also invests its funds in various socio-economic schemes such as, Rural Investment Scheme, Small Traders Investment Scheme, Doctors Investment Scheme, Small Transport Scheme, Small and Cottage Industry Project, Hawker’s Investment Scheme, Household Durable Scheme and Low Cost Housing Scheme. The third important function of the bank is to render services to customers regarding foreign exchange transactions plus services to its customers for import and export of different industrial, commercial, agricultural and other items.

General Banking

It includes: –

- Mobilization of deposits

- Receipts and payment of cash.

- Handling transfer transaction.

- Operations of clearing house

- Maintenance of accounts with Bangladesh bank and other bank.

- Collection of cheques and bill.

- Issue and payment of Demand Draft, telegraphic transfer and payment Order.

- Executing customers standing instructions.

- Maintenance of safe deposit lockers.

- Maintenance of internal accounts of the bank.

While doing all the above noted work IBBL issue cheques-book, Deposit account operating form, SS card, Ledgers, Cash book, Deposit account ledgers, preparation statement of accounts, Pass book, Balance of different accounts and calculates profits.

Special Scheme of IBBL

Islami Bank Bangladesh Ltd. being welfare oriented institution has now designed and implemented investment schemes keeping in view the needs of different sectors and various sections of people for their socio-economic uplift and to improve their quality of life. The special scheme is as follows:

- Household Durable Scheme

- Housing Investment Scheme

- Real Estate Investment Program

- Transport Investment Program

- Car Investment Program

- Investment Scheme for Doctors

- Small Business Investment Scheme

- Agriculture Implements Investment Scheme

- Micro Industries Investment Scheme

- Mirpur Silk Weavers Investment Scheme

- Rural Development Scheme

ATM Service of IBBL

Automated Teller Machine (ATM), has unveiled the horizon of Electronic Banking of 21st Century. Through ATM, customers can avail non-stop online teller service without going to the specific branch of the member bank. They can withdraw or deposit cash or cheque as well as pay utility bills like BTTB, Grameen, AKTEL, City Cell Phone, DESA, WASA, TITAS etc. with the help of this modern computer controlled machine. The service is now offered by ETN and eleven member banks including Islami Bank Bangladesh Limited.

Facilities

- ATM Card holders can withdraw cash from ATM at any time.

- Customers can make transactions from any of the machines with logo ‘E-cash’ installed at different places in the city.

- In course of time utility bills like WASA, TITAS and DESA etc can be paid through ATM.

- Now BTTB, Grameen, AKTEL, City Cell Phone bill can be paid through ATM.

- Now IBBL E-cash cardholders can be paid their monthly installment of Mudaraba Hajj Savings, MSS (Pension), Mudaraba Muhor Savings and HDS schemes of IBBL through ATM.

- The machines are located in convenient places where customers usually deal with money matters. Therefore, they can easily avoid the risk of cash carrying by using ATM Card.

- Customers may know their present balance at any time from the machine.

- In course of time, POS (Point of Sale) can be used.

Achievements of IBBL

National and international ratings of IBBL

IBBL’s past performances have been evaluated by Bangladesh Bank, several credit rating agencies home & abroad and by the local press.

International Press

“In the midst of a difficult Banking system known to be plagued by high non-performing loans (NPLs), one could easily conclude that it would be difficult to find a bank that is different from norm. However, IBBL provides a refreshing change and is, thus, a pleasant surprise. Although it does not command the market share as the 4 public sector banks, IBBL, which claims to have little interference in lending from the government, has nonetheless, managed to find a niche market of its own-says the ‘BANK ATCH’ a New York based international Credit Rating Agency in its January 30, 1998 issue. “As a market leader offering banking services based on the Islamic rule of Shariah, IBBL’s profitability trend has been quite impressive. The Bank’s ability to keep its return on asset (ROA) well above the industry’s average reflected its resilience to possible shocks in the banking system. Concerns over massive NPLs and under provisioning are common amongst local banks. But this seems well resolved in IBBL. IBBL’s good performance and solid capital base have indeed provided refreshing change found within a banking system saddled and held back by huge NPLs” the above agency continued to comment in the same issue.

National Press

“It is one of a few local banks according to CAMEL (Capital, Assets, Management, Earnings & Liquidity) rating made by the Bangladesh Bank. It holds the highest amount of liquidity among all banks and its ability to keep return on assets at 1.07 percent is well above the banking sector’s average of 0.33 percent”- The Financial Express, Dhaka commented in its issue of May 28, 1998.

“The Holiday” in its 29th August, 1997 issue carried out a report under the heading “Setting a precedence of sound banking” and commented “While the country’s banking system is burdened with bad debt portfolios and also suffers from a liquidity shortage, the Islami Bank Bangladesh Ltd. (IBBL) has created a unique precedence by improving its reserve and deposit positions substantially, making handsome profits, and offering attractive dividends to its share holders and depositors.”

IBBL’s World rating

As per Bankers’ Almanac (January 2001 edition) published by the Reed Business Information, Windsor Court, England, IBBL’s world Rank is 1771 among 3000 banks selected by them. This position was 1902 among 4500 selected banks as on January 1999 edition.

IBBL’s country Rank is 5 among 39 banks as per ratings made by the above Almanac on the basis of IBBL’s Financial Statements of the year 2001.

Award and Prizes: International & National Perspective

IBBL was awarded for several times by international & national organisations. The Global Finance, a reputed London based quarterly magazine, awarded IBBL as the best bank of the country for the year 1999 and 2000.

IBBL has got the 2nd prize of National Export Fare for its pavilion of Service Organisation in 1985.

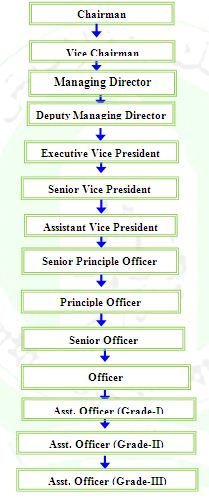

Organizational structure of IBBL

Theoretical Analysis

Investment is the action of deploying funds with the intention and expectation that they will earn a positive return for the owner. Funds may be invested in either real assets or financial assets. When resources are used for purchasing fixed and current assets in a production process or for a trading purpose, then it can be termed as real investment. Specific examples of financial investments are: deposits of money in a bank account, the purchase of Mudaraba Savings Bonds or stock in a company. Since Islam condemns hoarding savings and a 2.5 percent annual tax (Zakat) is imposed on savings, the owner of excess savings, if he is unable to invest in real assets, has no option but to invest his savings in financial assets.

Investment Modes of IBBL

When money is deposited in the IBBL, the bank, in turn, makes investments in different forms approved by the Islamic Shari’ah with the intention to earn a profit. Not only a bank, but also an individual or organization can use Islamic modes of investment to earn profits for wealth maximization. Some popular modes of IBBL’s Investment are discussed below.

- Bai-Mechanism

- Bai-Murabaha

- Bai-Muajjal

- Bai-Salam

- Bai-Istisna

- Mudaraba

- Musharaka

- Share Mechanism

- Ijara Mechanism

- Hire Purchase Under Shirkatul Melk

- Ijara Bil Bai

Steps of Bai-Murabaha

- First Step: The client submits a proposal regarding his requirements of the bank. The client sends a proposal with the specifications of the commodity to be acquired from the bank. The proposal also indicates details regarding the date, time and place of delivery as well as price and form of payment information. The bank responds by sending a counter proposal either accepting the buyer’s price or stipulating a different price.

- Second Step: The client promises to buy the commodity from the bank on a Bai-Murabaha basis, for the stipulated price. The bank accepts the order and establishes the terms and conditions of the transaction.

- Third Step: The bank informs the client (ultimate buyer) of its approval of the agreement to purchase. The bank may pay for the goods immediately or in accordance with the agreement. The seller expresses its approval to the sale and sends the invoice(s).

- Fourth Step: The two parties (the bank and the client) sign the Bai-Murabaha Sale contract according to the agreement to purchase.

- Fifth Step: The Bank authorizes the client or its nominee to receive the commodity. The seller sends the commodity to the place of delivery agreed upon. The client undertakes the receipt of the commodity in its capacity as legal representative and notifies the bank of the execution of the proxy.

Rules of Bai-Murabaha

- It is permissible for the client to offer to purchase a particular commodity, deciding its specifications and committing itself to buy it on Murabaha for the cost plus the agreed upon profit.

- It is permissible that the mutual agreement shall contain various conditions agreed upon by the two parties, especially with respect to the place of delivery, the payment of a cash security to guarantee the implementation of the operation and the method of payment.

- It is permissible to stipulate the binding nature of the promise to purchase. Thus, the agreement can only be satisfied by either fulfilling the promise to purchase or by indemnifying the bank for any losses incurred if the promise to purchase is not fulfilled.

- It is a condition that the bank purchases the requested commodity (first purchase contract) before selling it on Murabaha to the buyer. The contract in the first purchase must be settled, in principle, between the source seller and the bank.

It is permissible for the bank to authorize a second party including the buyer to receive the commodity on its behalf. This authorization must be in a separate contract, particularly if the buyer is going to receive the goods on behalf of the bank. This is necessary to avoid any conflicts with the ensuing Murabaha sale.

BAI-MUAJJAL (Deferred Sale)

Meaning of Bai-Muajjal

The Bai-Muajjal may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods, permissible under Shari’ah and law of the country, to the buyer at an agreed fixed price payable at a certain fixed future date in lump sum or in fixed installments.

Features of Bai-Muajjal

- It is permissible and in most cases, the client will approach the bank with an offer to purchase a specific good through a Bai-Muajjal agreement.

- It is permissible to make the promise binding upon the client to purchase the goods from the bank.

- It is permissible to take cash/collateral security to guarantee the implementation of the promise or to indemnify the bank for damages caused by non-payment.

- It is also permissible to document the debt resulting from Bai-Muajjal by a Guarantor, or a mortgage or both, like any other debt. Mortgage/Guarantee/Cash security may be obtained prior to the signing of the Agreement or at the time of signing the Agreement.

- All goods purchased on behalf of a Bai-Muajjal agreement are the responsibility of the bank until they are delivered to the client.

- The bank must deliver the goods to the client at the time and place specified in the contract.

- The bank may sell the goods at a higher price than the purchase price to earn profit.

- The price is fixed at the time of the agreement and cannot be altered.

- The bank is not required to disclose the profit made on the transaction.

Some Observations

The following points should receive attention before making any investment decision under Bai-Muajjal.

- Whether the goods that the client intends to purchase are marketable and have steady demand in the market.

- Whether the price of the goods is subject to frequent and violent changes.

- Whether the goods are perishable in short or in long-term duration.

- Whether the quality and other specifications of the goods as desired by the client can

- Be ensured.

- Whether the goods are available in the market and the bank will be in a position to purchase the Goods in time and at the negotiated price.

- Whether the sale price of the goods is payable by the client at the specified future

- Date in lump sum or in Installments as per the agreement.

MUDARABA (Investment made by the entrepreneur)

Definition of Mudaraba

The term Mudaraba refers to a contract between two parties in which one party supplies capital to the other party for the purpose of engaging in a business activity with the understanding that any profits will be shared in a mutually agreed upon. Losses, on the other hand, are the sole responsibility of the provider of the capital. Mudaraba is also known a Qirad and Muqaradah

Steps of Mudaraba

The bank provides the capital as a capital owner. The Mudarib provides the effort and expertise for the investment of capital in exchange for a share in profit that is agreed upon by both parties.

- The Results of Mudaraba: The two parties calculate the earnings and divide the profits at the end of Mudaraba. This can be done periodically in accordance with the terms of the agreement, subject to the legal rules that apply.

- Payment of Mudaraba Capital: The bank recovers the Mudaraba capital it contributed before dividing the profits between the two parties because the profit is considered collateral for the capital.

- Distribution of wealth resulting from Mudaraba: In the event a loss occurs, the capital owner (the bank) is responsible for the entire loss. In the event of profits, they are divided between the two parties in accordance with the agreement between them, subject to the capital being recovered first.

Rules of Mudaraba

- There are some legal rules that govern the business relationship Mudaraba which are as follows.

- It is a condition in Mudaraba that the capital be specific in nature. In other words, the amount of capital must be known at the inception of the contract. The purpose of this rule is to ensure that there is no uncertainty about the amount of capital and, thus, no uncertainty about the division of profits.

- It is a condition that capital must be in the form of currency in circulation. However, merchandise can be contributed, so long as both parties to the business arrangement agree upon its value.

- It is a condition that the capital cannot be subject to indebtedness.

- It is permissible for a Mudarib to mix his private capital with the capital of the Mudaraba, thus becoming a partner. In addition, it is also permissible for the Mudarib to dispose of capital on behalf of the Mudaraba.

- It is a condition that the capital of the Mudaraba is delivered to the Mudarib.

- It is permissible to impose restrictions on the Mudarib as long as the restriction is beneficial and does not hinder the agent’s ability to make a profit.

- It is permissible for the Mudarib to hire an assistant to perform difficult work that he is unable to perform on his own.

Features of Musharaka

- The capital in Musharaka comes from all the partners.

- In Musharaka, all partners can participate in the management of the business and can work for it.

- Profit is distributed as per pre-agreed ratio.

- Loss shared as per capital ratio.

- The liability of the partners in Musharaka is normally unlimited. Therefore, if the liabilities of the business exceed its assets and the business goes in liquidation, all the liabilities exceeding liabilities shall be borne pro rata by all the partners.

- In Musharaka, as soon as the partners mix up their capital in a joint pool, all the assets of the Musharaka become jointly owned by all of them according to the proportion of their respective capital, therefore each one of them can benefit from the appreciation in the value of the assets, even if profit has not accrued through sales.

IJARA

Definition of Ijarah

According to Islamic Shari’ah, Ijarah is a contract between two parties – the lessor and the lessee, where the lessees (Hirer or Mustajir) have the right to enjoy/reap a specific benefit against a specified consideration/rent/wages from the lessor – the owner (Muajjir).

Elements of Ijarah

- According the majority of Fuqaha, there are three general and six detailed elements of Ijarah:

1) The wording: This includes offer and acceptance.

2) Contracting parties: This includes a lessor, the owner of the property, and a lessee, the party that benefits from the use of the property.

3) Subject matter of the contract: This includes the rent and the benefit.

- The lessor (Mujjir) – The individual or organization who leases out/rents out the property or service is called the lessor.

- The lessee: (Mustajir) – The individual or organization who hires/takes the lease of the property or service against the consideration rent/wages/remuneration is called the lessee (Mustajir).

- The Benefit (Maajur) – The benefit that is leased/rented out is called the benefit (Maajur).

- The rent (Aj’r or Ujrat) – The consideration either in monetary terms or in quantity of goods fixed to be paid against the benefit of the goods or service is called the rent or Ujrat or Aj’r.

Rules for Ijarah

- It is condition that the subject (benefit/service) of the contract and the asset (object) should be known comprehensively.

- It is a condition that the assets to be leased must not be a fungible one (perishable or consumable) which cannot be used more than once, or in other words the asset(s) must be a non-fungible one which can be utilized more than once, or the use/benefit/service of which can be separated from the assets itself.

- It is a condition that the subject (benefit/service) or the contract must actually and legally be attainable/derivable. It is not permissible to lease something, the handing-over of the possession of which is impossible. If the asset is a jointly owned property, any partner, according to be majority of the jurists, may let his portion of the asset(s) to co-owner(s) or the person(s) other than the co-owners. However, it is also permissible for a partner to lease his share to the other partner(s),

- It is a condition that the lessee shall ensure that he will make use of the asset(s) as per provisions of the Agreement or as per customs/norms/practice, if there is no expressed provision.

- The lessor is under obligation to enable the lessee to the benefit from the assets by putting the possession of the asset(s) at his disposal in useable condition at the commencement of the lease period.

- In a lease contract, the period of lease and the rental to be paid in terms of time, place or distance should be clearly stated.

- It is a condition that the rental falls due from the date of handing over the asset to lessee and not from the date of contract or use of the assets.

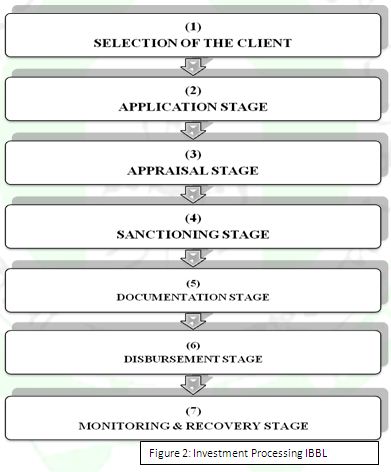

Investment Processing of IBBL

Generally a bank takes certain steps to deliver its proposed investment to the client. But the process takes deep analysis. Because banks invest depositors fund, not banks’ own fund. If the bank fails to meet depositors demand, then it must collapse. So, each bank should take strong concentration on investment proposal. However, Islami Bank Bangladesh Limited (IBBL) makes its investment decision through successfully passing the following crucial steps:

Here, investment taker (client) approaches to any of the branch of Islami Bank Bangladesh Limited (IBBL). Then, he talks with the manager or respective officer (Investment). Secondly, bank considers five C’s of the client. After successful completion of the discussion between the client and the bank, bank selects the client for its proposed investment. It is to be noted that the client/customer must agree with the bank’s rules & regulations before availing investment. Generally, bank analyses the following five C’s of the client:

- Character;

- Capacity;

- Capital;

- Collateral; and

- Condition.

Key achievements in 2010

- Operating profit crossed 11,000 million.

- 20 new branches added.

- 41,369 investment clients inducted iun the year.

- Around 5 lac deposit accounts opened.

- Islamic Bank Securities Limited (IBSL) started operation since April 2010.

- Received 05 AD license & 03 offshore Banking Unit (OBU) license.

- 157 ATM were opened including IBBL’s own ATM.

- Business discretion was enhanced/upgrade substantially.

- New pay scale made effective form June 2010.

- MC, ALCO, task force & others committees have been strengthened.

- Received award from Global Finance, ICICI Bank, Bankers Forum etc.

Investment in 2011: strategies and action plan

- To enhance capacity and capability of the employees of the bank to handle investment operations through imparting training.

- To arrange training and motivational programs for investment clients and their officials on Islamic banking including legal issues.

- To develop new entrepreneurs.

- To induct best of the best investment clients, check exodus of good investment clients.

- To launch dynamic camping to hunt good investment clients from the market.

- To improve each and every employee of the bank to induct new good business. Each and every employee will induct at last one good investment clients (excluding RDS & MEIS) in each month.

- To be aware of over-financing and under financing and to give prompt decision on investment proposal.

- To have a clear picture of investment diversification and opportunities in the market in terms of size, sector, geographical area, economic purpose, security-wise.

- To maintain asset quality particular in RMG and textile sector.

- To obtain proper primary and collateral securities and ensure proper supervision, monitoring and control of investment.

- To keep our investment cost minimum to offer competitive and lower rates and facilities to the clients.

- To give due consideration to high risk, high return and low risk, low return investment proposals.

- To encourage investment involving less risk weight.

- To adopt modern technology in the investment operations.

- To deploy mobilized fund, as far as possible, locally by the concerned Branch.

- To observe strictly the single party exposure rule.

- To prefer syndication for large investment.

- To give importance to increase Agriculture and SME investment, particularly investment in various development, employment generation & poverty alleviation schemes like Real Estate, Transport, Doctors, Women Entrepreneurs, RDS, Small Business, Agriculture Implements, Rural Housing, HDS etc.

- To take effective steps to recover non-performing investments, particularly Bad & Doubtful and written of investment.

- To give due consideration to maintain a balanced investment portfolio of all branches in terms of size, economic purpose, area, mode and security.

- To increase investment at environment friendly solar energy/Bio gas, Effluent Treatment Plant (ETP), Biological Processing Plant, Wastage Refinery Plant and discourage investment in environment polluting industry.

- To enlighten the manpower with uptodate legal knowledge.

- To ensure proper documentation with the help of law Department, if necessary.

- The year theme of the bank for 2011 “Year of Welfare and Green Banking.” Which is line with the objectives of Islamic Economics, Maqasid Shariah as well as ethical & sustainable Banking? This is no doubt, a challenging task. By the Grace of Almighty Allah, concerted efforts, constant monitoring, continuous supervision of all concerned and advice & guidance of the policy makers, they shall be able to address the challenges.

SWOT Analysis of IBBL

Every organization has some internal Strengths and Weaknesses as well as they have also some external opportunities and threats. To survive in world competitive market, every organization should emphasize on SWOT analysis that help to take proper decision and to achieve the ultimate goal of the organization. As an internee of IBBL New Market Branch, I have tried to find out what are their Strengths and Weakness as well as opportunities and threats are stated below:

Strength

S1. Adequate Finance

Islami Bank Bangladesh Ltd. has adequate finance. That is why; they need not to borrow money from Bangladesh Bank or any other financial sources.

S2. More funds for Investment

For adequate financial ability, they can provide more investment facility to their clients compared to other Banks.

S3. Honest and Reliable Employees

All of the employees of Islami Bank are honest and reliable. They are always devoted to their clients for better services.

S4. People’s Perception About Bank

Most of the people of Bangladesh are Muslim and they are trusted in superior performance of IBBL as a Shari’ah based-Islamic Banking.

Weakness

W1. Centralized Decision Making

The decision making of the bank is too much centralized. No decision is made without the authorization of the head office.

W2. Lack of up-to-date equipments

IBBL has lack of modern technologies and equipments. Most of the Branches are not well decorated. Number of ATM Booth is not sufficient compared to their vast banking operation.

W3. Deficiency of expertise

Many of the employees are unskilled and from them, superior performance is unexpected to survive in the national economy as well as in the world economy.

W4. Lack of Advertising

IBBL has lack of advertising like other banks. They don’t telecast any attractive advertisement in the media.

W5. Most of employees from other than business background

The employees who come from business background has much sense about investment opportunity, customer perception etc.

Opportunities

O1. Innovative and modern customer service

This bank can introduce more Innovative and modern customer services to its customers to survive better in the competition market

O2. Retaining vast customers

IBBL has a vast opportunity to hold most of the customers by extending its banking operation all over the country as most of the people of Bangladesh are religious minded.

O3. Special image

IBBL has a great opportunity to save the county’s poor people from being taking loan from different NGOs or few banks with higher interest rate.

O4. Poverty alleviation

IBBL has created special image to the people as a more reliable bank. People believe that if they keep their money in Islami bank it will be more secured than other banks.

O5. SME Financing

SME financing is opening new door IBBL to invest and to comply with its mission and vision.

06. Capital Market Operations

Islami Bank Securities Limited is going to be launch shortly which is a huge opportunity for IBBL to maximize its profit.

Threats

T1. Rules and regulations

Rules and regulations of Bangladesh Bank defers with Islamic Banking System. So they have to face various problems to operate their activities according to the Islamic Shari’ah.

T2. Islamic Banking operation introduced by conventional Banking

Conventional banks have started to open their Islamic Banking operation shortly.

T3. Absence of Shari’ah compliant Call Money Market

In the money market of Bangladesh, there is no call money market for Islamic banks. So in time of liquidity crisis they cannot borrow money from another bank.

T4. Lower salary structure

Now many of the Banks are hiring young talent and expertise employees with higher remuneration where IBBL could not hire skilled manpower because of lower salary structure compared to other banks.

Recommendations

Islamic banking system of Bangladesh, as a new paradigm of banking, has been able to establish its own presence with a continued expansion geared by increasing acceptance by the people. To continue this dynamic expansion, the first action that deserves immediate attention is the promotion of the image of Islamic banks as PLS banks. Strategies have to be carefully devised so that the image of Islamic character and solvency as a bank is simultaneously promoted. The following policy actions are suggested for immediate application:

- Islamic banks should clearly demonstrate by their actions that their banking practices are not guided merely by profitability criterion. They must also establish that their practices ensure efficient allocation of resources and provide true market signals through PLS modes.

- Pilot schemes in some selected areas should be started to test innovative ideas with profit-loss-sharing modes of financing as major component. This type of scheme may be experimented both in urban and rural areas. This endeavor will serve as a ready reference that Islamic banks are in the process of transforming themselves as PLS banks. Side by side, they will gain experience from real situation as to the problems that might come up while implementing profit-loss-sharing modes on trial and error basis.

- IBBL needs to recruit skilled human resources which can turn the bank ahead.

- As the Islamic banks have to promote their distributional efficiency from all dimensions together with profitability, Islamic banks, step by step, have to be converted into profit-loss-sharing banks by increasing their percentage share of investment financing though PLS modes. The Islamic banks, to do that, can be selective in choosing clients for financing under PLS modes. Islamic banks should immediately take measures to revert the trends of resource transfer from both low-income groups to high-income groups and from rural to urban areas. This is extremely important from the viewpoint of their banking philosophy as well as for their tacit commitment for distributional equity. The Islamic banks should also actively consider utilization of rural potentials from both efficiency and equity grounds in the context of the present day socio-economic conditions of Bangladesh.

- The Islamic banks can improve their allocate efficiency by satisfying social welfare conditions in the following manner. First, they should allocate a reasonable portion of their investible funds to social priority sectors such as agriculture (including poultry and fishery), MSME (micro, small and medium enterprises) sector, and export-led industries like garments, shrimp cultivation etc. Secondly, when the percentage shares of allocation of investible funds are determined among the sectors of investment financing, profitability of projects should be the criterion for allocating investment funds. The criterion would be best satisfied if more and more projects were financed under PLS modes.

- It is assumed that in the face of competition with interest-based institutions, a critical initial mass of the hybrid type is necessary not only for the survival but also ensuring efficiency of the PLS in a heterogeneous environment. The recent financial innovations may be tried to suit the need of the integrated global Islamic financial markets.

- Islamic ethics supports a poverty-alleviation strategy that is based on the principle of promoting economic growth with productive equity. Islamic banks should act as ‘Banks for Enriching the Poor’ (or as Rural Poor Bank and Urban Poor Bank), because the current collateral-based system for efficiently financing business/projects kicks the poor out of participation in economic activities. Banning interest should have the illuminating effect of allowing greater access by population to finance, and hence lead to a better income distribution, the ultimate objective of the glorious Shari’ah.

- Determination of profit and loss in profit-loss sharing arrangements and treatment of Costs and reserves in such accounting is a pertinent issue to be addressed with utmost importance and priority. It may be mentioned that if the Islamic financial system is to become truly liquid and efficient, it must develop more standardized and universally (or at least widely) tradable financial instruments. The development of a secondary financial market for Islamic financial products is crucial if the industry is to achieve true comparison with the conventional system. It must also work hard to develop more transparency in financial reporting and accounting. Development in the wholesale and especially inter-bank money markets will be the key to Islamic finance growing outside its current little sphere of influence, and becoming a truly robust and dynamic banking system alongside the traditional system.

Conclusion

Islam is a complete way of life and Allah’s guidance extents into all areas of our lives. Islam has given detail regulations for our economic life. Therefore, Islami Bank Bangladesh Limited (IBBL) is trying to establish the maximum welfare of the society by maintaining the principles of Islamic Shari’ah which is based on “Quran” and “Sunnah”. Since 1983, IBBL is the pioneer in welfare banking in this subcontinent and it is trying to do all its activities for the betterment of its depositors. For the greater interest of the depositors the investment policy of IBBL is to invest on the basis of profit and loss sharing in accordance with the tents and principles of Islamic Shari’ah. Profit earning is not the only motive and objective of the bank’s investment policy rather emphasis is given in attaining social good and in creation employment opportunities.

IBBL is not secular in its orientation. IBBL does not finance any project which conflicts with the moral value system of Islam. IBBL does not strictly consider the credit worthiness of the entrepreneur. IBBL receives a return only if the project succeeds and produces a profit. IBBL considers the soundness of the project and business acumen and managerial competency of the entrepreneur. Therefore, the rate of return of investment of IBBL is greater comparing to that of conventional banks.

Finally, Islami Bank Bangladesh Limited (IBBL) has been established with a view to conduct interest free banking to establish participatory banking instead of debtor-creditor relationship and finally to establish welfare oriented banking through its investment operations that would lead to a just society.