The present business world is continuously expanding due to the course of globalization and international trade in a spontaneous way. Being a developing country Bangladesh has made its footsteps on this international business environment by the help of its Export Processing Zones (EPZ) which are the places provided by the government specialized in manufacturing export oriented products and services maintained by proper standards and guidelines.

HSBC, one of the leading and most prominent international banks operating in Bangladesh, has revolutionized the concept of corporate institutionalized banking to an outmost superiority. To achieve substantial growth over the competitors, HSBC is continuously rendering different kinds of services to its corporate clients.

This paper describes some potential opportunities for HSBC regarding the EPZ of the country where HSBC can invest their assets to generate a huge amount of revenue in the upcoming years. Though HSBC has always been the market leader in the EPZ segment, but it holds less than half of the market share which they can maximize by improving some service oriented challenges and providing exclusive services to this segment. This report observes the trend of the EPZ business, the customers we have in our portfolio regarding the investment flow and demand for services. It also covers the understanding of the visits to the existing and potential EPZ customers on different location. We have analyzed the service related gaps and proposed some solutions to increase the quality of the services as well as we have suggested some ways to increase the share of this segment for HSBC DAKs wallet.

INTRODUCTION

Money, being called ‘The Second God’, has always been the life fluid of running the business, doing transactions, acquiring the opportunity and taping the growth for organization as well as overall economic situation. From the dawn of the civilization, people are doing business to meet the demand of the living and over the ages this growth has crossed over the personal stage to the international playground through overcoming the national boundary.

Alongside with other business, the banks have also extended their services to the global market members for their smooth transaction providing with the security from different forms of international business risk. Since the independence in 1971, Bangladesh has been struggling to develop the social, cultural, economic, political infrastructure of the country so that the citizens can have a better living quality. In due course, for the development of the international trade, like many other countries, Bangladesh has established dedicated Export Processing Zones (EPZ) around the country which has become an attractive place for foreign direct investment (FDI). Many

researchers (Paul-Majumder and Begum 2000; Hossain, Jahan and Sobhan 1990; Muqtada, Singh and Rashid 2002; Islam. M. J. 2006) has showed the brilliant growth of EPZs in the terms of entrepreneurial skills, conditions and regulations, EPZ’s impact on the overall economy and its importance in globalization as well as importing the ‘Know-Hows’ to offer efficiency in the production. But in accordance to this it seems more important to evaluate the

role of the financial institutions, specifically the international banks, in regards to boost up the growth of this important sector. Many national and international banks are extending their support to the EPZs so that they can grab the major percentage of the market. In this service area, Hong Kong and Shanghai Banking Corporation (HSBC) has always been showing a prominent role over the years and promises to continue so in the near future too. Though HSBC is offering a range of services to its client base, but continuously they are trying to develop it more so that they can tap into the most numbers of clients in terms of highest customer satisfaction and retention rate. This paper is a qualitative approach to find out the opportunities and threats of the present operations and services provided by HSBC to its EPZ customers and recommending some profitable steps to develop it more.

OBJECTIVE

The paper focuses on the performance of HSBC Bank in terms of the diversified portfolio of the bank to attract the FDI as well as their services provided to the customers based on EPZ of the country. This will specifically cover four areas:

- Observing the trend of EPZ customers relating to the investment flow and demand for service.

- Identification and documentation of the service-related gaps.

- Propose solutions to the service-issues.

- Investigation and suggestion of the ways to increase the market share of HSBC DAK’s in EPZ.

METHODOLOGY

The study includes both primary and secondary data. We have visited some of the customers from HSBC client list accordingly some outside customer to solicit their views regarding the different aspects of the investment climate. We have also visited the EPZ authority office to investigate some technical information regarding the investment flow and regulations evaluations. The secondary data involves the information from the Board of Investment (BOI), Bangladesh Export Processing Zone Authority (BEPZA), Ministry of Commerce (MOC) and different researches and web reports etc.

EXPORT PROCESSING ZONE (EPZ)

Export processing Zones are specific kinds of free trade zone, set up by the government, especially in the developing countries to promote industrial and Commercial exports, also known as Commercial Development Zone (CDZ). In Bangladesh, the first EPZ was established in Halishahar, Chittagong, at 1983 followed by the second EPZ in Savar, Dhaka at 1993. Now we have eight (08) EPZ in different part of the country namely Dhaka, Uttara (Nilphamari), Adamjee, Chittagong, Comilla, Ishwardi, Karnaphuli and Mongla. In our country the EPZs accommodate various kinds of industries including textile, agro-based industries, chemicals, electrical equipment and components, garments and garments accessories, woven and knitted fabrics, leather products and foot-wear, pharmaceutical

products, jute products, laboratory ware, Do-it-yourself tools and equipment, musical instruments etc. These industries produce for different renowned brands like Nike, Reebok, H&M, GAP, J.C. Penny, Wal-Mart, Mother Care, Tommy Hilfiger, Adidas, American Eagle, Phillip-Maurice, Decathlon, Konica, Nikon, Fuji, Olympus, Sony, Nissan, Mitsubishi etc.in our EPZs the companies are divided into three distinct groups of Type-A (100% foreign

owned), Type-B(Joint venture between foreign and local companies) and lastly Type-C (100% locally owned) and depending on the types, the companies can have a lot of opportunities including tax exemption for 5-10 years, duty and quota free access to import and export, no ceiling for investment, customs clearance at factory site and lot more.

The reasons the foreign investors are attracted to our country to invest are:

- Infrastructure facilities

- Reduction of lead time

- Cost of doing business

- Friendly policy of government

- Incentives

- Signatory of MGA, ICSID, WIPO, OPIC

- Asia’s low cost production base

- Lower labor cost

- Nationwide transportation facilities as well as access to the sea ports etc.

HONGKONG AND SHANGHAI BANKING CORPORATION (HSBC)

Hong Kong and Shanghai Banking Corporation (HSBC), founded by Sir Thomas Sutherland on 1865, has maintained its image as world’s leading international trade bank by offering a range of services and credit facilities to the rapidly growing business globalization. In Bangladesh, the history of HSBC dates back to 1996 and since then it has been providing banking services to a large portfolio of customer with a fair presence in all the EPZs of the country. HSBC is providing basically four types of services to its customer in Bangladesh including:

- Retail Banking and Wealth Management

- Commercial Banking

- Corporate and Institutional Banking

- Global Markets

In this study, we are going to understand the value and services provided to the customers by HSBC, the evaluation of customer satisfaction level as well as their demand and suggestions alongside with the recommendation to get around the deviation from the ideal propositions. Retail Banking and Wealth Management HSBC is providing retail banking to more than 50 million customers across the world with a range of product including personal internet banking, mortgage, home and personal loans, saving and investments, insurance and retirement savings policies etc.

These services are increasing the freedom of the customers to buy their special requirements as well as fund them to increase the spending power with a push. Commercial Banking In the sector of commercial banking HSBC has revolutionized the banking concept with a proposition of better quality services providing commercial bank accounts, finance and borrowing, insurance and international banking facility, payment services and fund management advises. It is trying its best to establish itself as a one-stop-service for all types of commercial banking solutions to the up growing business by ensuring proper movement and allocation of funds.

Corporate and Institutional Banking

HSBC has always been prominent in providing services to the corporate clients differentiated into large, medium and international corporate clients occupying them with mid and long term credit facility, structured finance and transaction banking over the world in a convenient way. The relationship management team is dedicated globally to assist the corporate clients to a smoother transaction process.

Global Markets

Being one of the most dynamic research wings of the bank, global market by its expertise helps the investors to invest in the four major class assets- foreign exchange, rates, credit and equities. Investors can get professional advice in terms of investment in fixed and floating bonds, global support through internet banking and other banking services through the global relationship network etc.

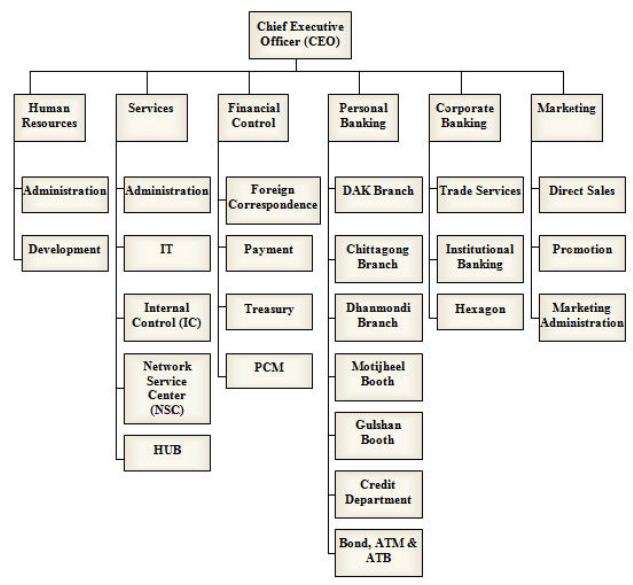

Organogram of HSBC Bangladesh

Job Description: Internship at Corporate Banking (International Corporate)

Specific Responsibilities

- Market risk analysis regarding assistant liability

- Analysis of credit risk.

- Implementation and feedback of strategic decision

- Follow-up and facilitate documentation in corporate customer relationship.

- Assists the treasury department.

- Collect information from different organizations and maintain liaison with them.

- To monitor the corporate accounts on daily basis.

- Maintains export and import formalities

- Ensure customer credit documents and necessary papers.

- Analyses the financial statements of the customers and analyses the data to identify possible risk.

Performance and achievements

- Reviewed maximum numbers of account and resolved various issues.

- Arranged Sino- Bangla Event 2014 to promote business relationship prospects with China and Bangladesh.

- Maintained and created new relationships with different organizations including MNCs and Embassies too.

- Arranged Staff Night 2014 involving CTG and DAK market segment.

- Arranged different cultural and sports programs for HSBC DAK.

ANALYSIS

THE SCOPE AND THE OPPORTUNITY

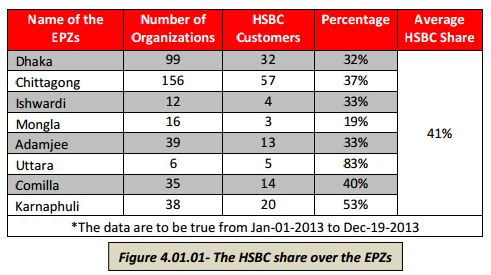

During to a survey conducted by some IC team member of HSBC, we have come across some important overview over the present market situation on the EPZs all over the country and this has showed constructive future prospects for achieving a huge amount of revenue from this segment. The list below shows the number of organizations running on different EPZs of the country and the number of customers we have on those EPZs:

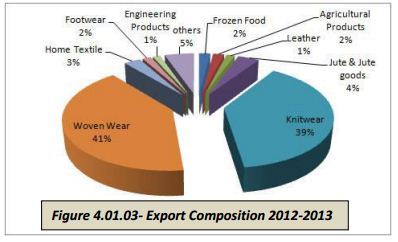

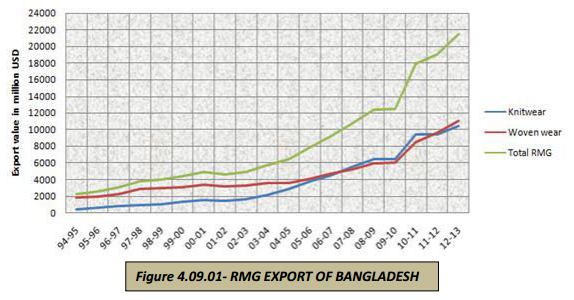

The average share of HSBC has been determined as approximately 41 percent all over the country. It’s good news for us that we are maintaining a large pocket in our portfolio but the data also showing a gargantuan place waiting for exploration. Again the export growth of the country is growing enormously day by day which is pushing the importance of international banks to play vital role in assistance of this globalization process. Bangladesh has achieved export growth of 11.18% in a total amount of 27.02bn USD in the fiscal year 2012-13 which promises to a

continuous growth for the next some years.

In this regard if HSBC can tap into the organizations especially in the RMG sector (generating 80% from the total earnings), that will give a chance to generate a huge amount of revenue form this segment and nevertheless growing market of jute and jute made products can be appealing to concentrate too. In spite of various setbacks, i.e. labor unrest, variability of raw material prices, our RMG industry has proved resilient as demand for the low to mid-priced apparel products stayed robust despite global economic slowdown. The overall economic condition is in favor of the banks to increase their wallet size by providing extensive priority in international banking services.

PRESENCE IN THE MARKET

The primary target of HSBC has always been the bigger players in the market. In this process they have been only in the major EPZs which have limited their access to the whole market over the country. As a matter of fact, HSBC has to maintain its customer group in Savar by the help of a Business Development Office and corresponding banks which can’t be a well alternative solution for the customer.

Even we don’t have strong position in Uttara, Ishwardi and Mongla EPZs as we haven’t set any branch their so far.

This could prove to be very crucial problem for an organization like HSBC not having sufficient amount of branches to provide support to its customer. This has been challenged by the other banks that have set up branches on this EPZ as we all know customer will pursue those who can guarantee them proper time to time delivered services. Some of the customers of HSBC have already complained about the absence of availability of the full banking services of the bank in the EPZ branches. In this fierce competition, if we can’t set up enough amounts of branches for the convenience of the customer, maybe we have to lose some major portion.

RISK ASSOCIATED WITH EPZ CUSTOMERS

The business risks associated with the customers are very low as the government has structured favorable business policies and management process which secures the investment and let the investment grow in the same time. The EPZs are governed through BEPZA, BGMEA, BKMEA, MOF and other regulatory bodies to give proper legal and operational support to continue business and production process smoothly. These companies get various kind of financial and non-financial opportunities form the government like:

- Duty free import of machinery, equipment, raw materials etc.

- Discounted tax base on the base of industry type

- Exemption on income tax on salaries of foreign investment

- Low cost labor and production facility along with hazard free working environment that includes insurance coverage too.

- Relief from double taxation for more than 28 countries.

- Sound labor law that is free from any trade union influence.

If we review the advantages the EPZ listed companies get from the government, we can assure ourselves about the continuous generation of revenues and without doubt a proper flow of payment of loans and investment. These merits are helping the organization to earn much more than the similar organizations outside the EPZs and make them less risky than the others in the industry. So flow of fund in this segment in terms of investment and long term

loans can be spontaneous as it’s been backed by government authorities. The another important risk issues is regarding the inflation rate of the country which can be proved to be a major threat over the longer period of time. As our country is a developing country, the economy is not so stable to control the inflation rate which can lead to earn

money that is not so attractive regarding the present value of the future investment return. Careful consideration of interest rate can easily shrink this risk in long term.

RESOURCE ALLOCATION

HSBC, no doubt being an international bank, have a huge amount of deposits over the year from different places around the world. As we have seen the market of export in Bangladesh is expanding rapidly, we can concentrate our investment and long term loans to this sector which is less risky to invest as well as the collateral and conditions are favorable for the bank as the manufacturers will be welcoming to the new financing source to boost up their

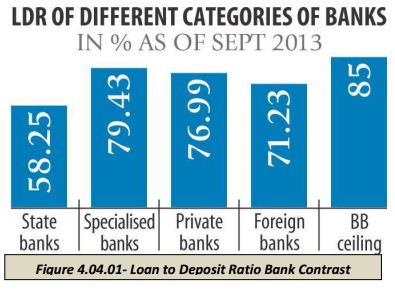

production level. Nevertheless, competition in the banking sector defines the availability for the resources which are needed to attract the borrowers into credit terms as it is the principal revenue generating source for the banks. From the chart below we can see the Loan To Deposit Ratio (LDR) of different types of bank in Bangladesh:

Foreign banks are maintaining an average LDR of 71.23% where they are eligible to use the remaining 14% to ensure more financing to the customer segment where EPZ could be an interesting area of choice. Moreover, as HSBC has always been prompt to help the Chinese companies to tap into the offshore debt capital markets and has launched a number of new initiatives to help the expansion of these companies abroad, they can motivate the flow of this huge amount of capital to this EPZs where they can create more opportunities for the country itself as well as the investors. Again, leveraging on its knowledge of the local market and its global network, it can continue providing advisory services to its major clients across the countries too. Though HSBC has to face huge liquidity due to the political unrest last year, it can easily overcome the situation in the present year by proper planning and careful ripple of funds across the portfolio of HSBC.

MARKETING EFFORT

It has been seen from the very beginning that the marketing effort taken by HSBC, Bangladesh has always been passive than its competitors. As the psychology of the customer segment is different form the other Western and Asian countries, the best way to achieve a handsome amount of customer in our country is aggressive marketing efforts. We can describe the EPZ segment for banking in a growth stage where HSBC has a huge opportunity to tap into the market by providing a lot of investments in marketing and they can imply priority in marketing research and development to find out new opportunities in the EPZ as well as may be with some new product ideas to capture some customers or retain some old customers too. In this regards we can suggest some new ways to finance the consumers of EPZ by providing them funds for:

- Building Effluent Treatment Plant (ETP)

- Day care service center for working mothers

- Individual medical service options

- Loans for employee transportation

- Insurances for health and hazards in the working place

- Financing for installing Management Information System (MIS)

- Financing to leverage Research and Development Sector etc.

It has been showed through study conducted by Financial Management Solutions Inc., the number of customers increased in the banks and financial institution to 40% from 1992 to 2012 due to the different kinds of marketing efforts provided by the organizations. For banks, it’s very important to let the customers and potential customers know the various types of opportunity and priority they are going to get by mantling a relationship with the bank.

This information let the customer choose the financial services they need to develop and grow the business substantially. HSBC can arrange different marketing effort like:

- Organize seminars to educate the customers taking loan for the first time regarding their purpose.

- Provide any additional support and security for huge amount of transaction.

- Easy access to the foreign exchange market through the customer’s account

- Introduction and popularization of Renminbi to the customers and its advantages.

RELATIONSHIP MANAGEMENT

The most important part that we need to consider in terms of better growth of bank customer portfolio is the relationship with our customers. It has been proven that a better relationship with the customers let the bank attract more customers by the help of words of mouth fame.

The IC team of HSBC, Bangladesh has a excellent combination of 17 people specialized in relationship management. This team work relentlessly for the development of the customer base leading to a smoother transaction process as well as other banking and financial activities. It has been seen that the team has more than 700 accounts with a composition from different types of industry including EPZs. Here is an important fact lies under the hood is that EPZs need special attention as the importance of timeliness is a prime concern for this industry where a small late in preparing L/C can lead to a huge loss for the organizations. So, it has been suggested by most of the EPZ customer from the portfolio that there should be more RM recruited for the support of the customers and it would be better if the team can manage a separate sub-team of RMs who will be dedicated to the EPZ customers designing and fulfilling their specific demands and resolving their service related issues.

CUSTOMER SATISFACTION

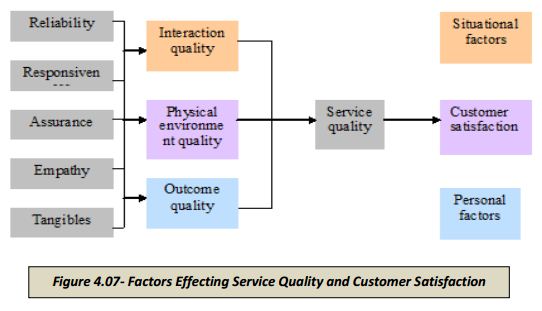

Customer satisfaction is a prime concern of any service related business as satisfied customer group will lead to grab more market share as well as better privileges over the competitors. For HSBC, it has always been on the peak of its competitors in terms of the quality maintained to provide attractive service propositions to its customers fulfilling their specific needs and wants. In terms of service quality, there have been some discrepancies noticed by some of our customers which I would like to elaborate with the 5 (Five) basic factors of customer satisfaction designed by the experts:

Reliability

It refers to perform the promised services accurately. In case of banking reliability is vey important because if the client pretends that the bank is not able to continue its service properly in the future they will not be interested to banking with HSBC. From our survey we have found out that most of the customers chose HSBC because they think of its reliability in terms of quality service compare to the other banks as it is providing unique features regarding the accounts. But there are some complains of negligence and irresponsibility regarding some L/C issues, timing to process the payment, issuance of credit facility etc. which can create negative impact on the customers and ccustomers may switch to other competitors soon.

Responsiveness

It is another vital factor that controls customers’ perception about the quality of the services. It refers to the willingness to help the customers to a smoother business development. According to the perception of customers, responsiveness is very important to increase the quality of the service. If employees do not response to the demand immediately, valuable time of the customers will be spent unnecessarily which may lead to frustration to the

customers and decreases retention rate.

Assurance

Assurance means the knowledge and ability of the employees to develop trust in the mind of the clients about the completion on the task properly and on time. Customers have a great perception about the performance of HSBC in this regard but sometimes it can be hampered if the new members of the team are not being well trained for the job of maintain relations properly with the customers. Again switching of RM from a customer with different RM may

create a slight change in the quality of the service comparing to the older RM of the client. We have to remember that if the customers have confidence on our professionalism we can achieve more reputation and as a result more EPZ customers in our portfolio.

EMPATHY

To ensure a better service it is very important for the employees to have empathy towards the customer group. Empathy refers to the action of the employees in terms of their ability to offer attention to the individual customer and providing proper care handling their demand and problems. There is no doubt that HSBC has a group of young and energetic employee group that interact with the customers nicely and they continuously ask about their satisfaction and dissatisfaction of every individual. But ‘To err is human’, considering the fact, sometimes issues comes up with complex circumstances that should be handle with experienced and careful hands.

TANGIBILITY

Tangibles are the major factors that direct the consumers mind about the quality of the service. It can be physical facilities, equipment etc. used in the context of service company. Interior decoration, sitting arrangements, temperature of the room, cleanliness everything controls the perception of customers about the quality of the service. HSBC has confirmed well interior decorations in all of their branches and special decorations for Select branches but in the same time maintaining the standard service providing procedures play an important role too.

DEVELOPMENT OF INFORMATION TECHNOLOGY

HSBC has been supported by a state of the art management information system which is being developed through a lot of complex software and hardware support to ensure security and safety for the consumers. But the most important challenge in this regard is that, if we cannot convey the true value of these services, then this huge investment can’t generate any fruitful effect in the wallet of HSBC. Moreover through the HUB technology, the bank has achieved a new height to avoid any type of fraud risk as well as human faults for every transaction which is controlled directly by the headquarter in Hong Kong. With this comes the personal banking facility with a unique security device to ensure proper security by altering the key of the account by a unique array of data. Again we can emphasis on the use of HSBCNet which let the customers know about the current situation and standing of their company alongside with some expert suggestions and forecasting about the industry which

will help the consumer to take proper attempts to grow and excel.

OPPORTUNITIES TO ATTRACT FDI IN RMG

As the analysis of different data suggest that the country earn more than 45% of its revenue through the trade of which 80% are generated from ready-made garments (RMG) industry of the country. Being the 3rd largest apparel producing country of the world, Bangladesh holds approximately an amount of 22bn of revenue form the 440bn worth of the total market and this industry has experience a growth of more than 300% from FY 2001 to FY 2012.

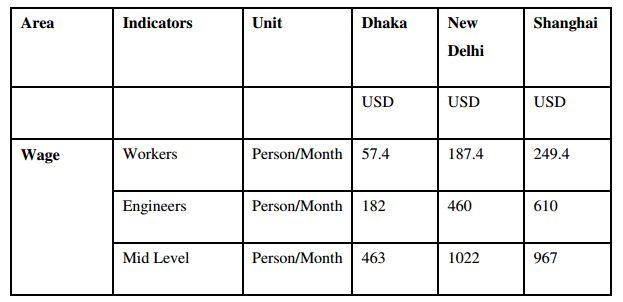

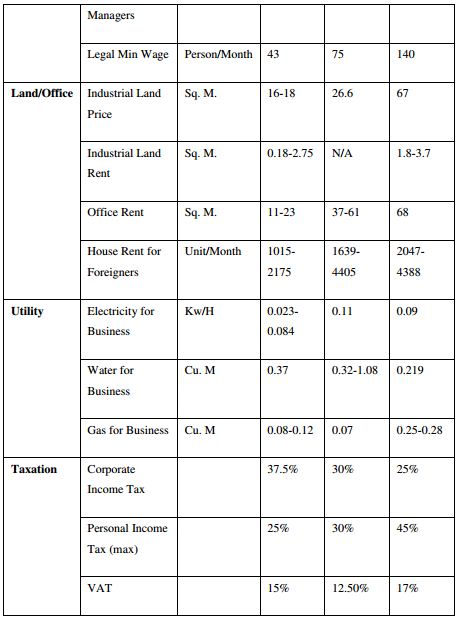

The cost of setting up a business in Bangladesh is very convenient comparing to the other countries of the world. It has been seen that it is even cheaper and less time consuming then that of China and India. The table below shows the competitive business setup cost in this three region:

RECOMMENDATIONS AND SUGGESTIONS

HSBC is continuing their business over a longer period of time in our country and they have gained more experience as an international bank on delivery of proper service to its customers. Now some suggestions are recommended which may help to increase the number of EPZ customers in the portfolio:

- Concentrate on Deposits: HSBC should attract more EPZ customer in the terms of deposits specially the long term as well as the provident funds. This will help the consumers to get access to the information about various services provided by us and make them interested to avail such services.

- Effective Branding: Men are the bundle of emotions and perceptions which we can influence through effective marketing of our product to the targeted customer here to the EPZ companies for the case. These marketing efforts should be eye catching, easy to remember and provocative too.

- Customer Awareness: The most important challenge faced by the banks is the information delivery about the product to its customers. If the customers are not aware of the products then the portfolio is never going to expand. So DAK should take necessary steps like arranging advertisements, door to door services, seminars and other effective methods to let the customer know about the value propositions of the bank to encourage more EPZ customers to engage in relationship with HSBC.

- Exact Time of Service Delivery: Customer service representatives must communicate a near precise time of a service delivery to the customer. Not just that, the CSRs have to act accordingly to deliver the service within the promised time. This will let the EPZ customers rely more on us as punctuality is a key business challenge in exporting business.

- Employee Behavior and Appearance: The management must ensure that HSBC employees, under all circumstances are making courteous behavior and professional appearance. From the survey, few exceptions were found, which effected the overall service quality. Management of HSBC must establish a strong customer feedback system to ensure that, customers are happy with every service dimension, including this segment. It is very easy to assume that if the customers feel exceptional and have priority they will pursue our service more and more.

- Use of Marketing Research: The management of HSBC should regularly administer marketing research activities in order to keep a regular track of quality of services. Regular research should also be conducted to find out customer expectations about various service aspects and their satisfaction in terms of these aspects. As customerexpectations vary greatly with time, static figures, regular research at sufficient intervals should be conducted. Moreover, research should be conducted to design and enhance the propositions according to the demand of the time and effectiveness of the EPZ customers so that they can have a tailored product range for themselves.

- Setting up Guidelines: HSBC should build up a proper and easily understandable guideline for its employee on different aspects regarding the service issues as well as any type of incidents occurred by the course of daily activities to decrease the confusion and misunderstanding among the customers and management.

- Decrease Communication Gap: It has been observed that there lies significant communication gap between the HSBC management and its EPZ customer group. This deviation should be decreased and more steps should be taken to enhance the interactions as it will help to find out the discrepancies of our services and the changing demand trend of the clients.

- Timeliness and Reduce Negligence: It has been a crucial thing that HSBC management has less control and co-ordination among the branches and management head office. This is leading to a lot of issues regarding negligence which cost a lot of time to open accounts, process L/Cs, completing transactions and payments. This creates negative impact on the EPZ customer group and influences them to switch to the other competitors. Measures should be taken to reduce these issues and ensure proper service timings. Nevertheless, due to the course of time, many new challenges should be emerging as well as new suggestions would be generated to deal with the specific situation.

CONCLUSION

Banking sector reforms have changed the traditional way of doing banking business. Mainly technology is the outcome of banking reforms. Customer is now the king and customer focus or satisfaction of customer is the main aim of the banks. With the introduction of new products and services competition has grown up among the banks. Only those banks will survive who face the competition with the effective ways of marketing. We have been

observing a tremendous growth in the economy of our country by the help of EPZs all over the country who are playing a vital role to the GDP. So it’s a very rewarding sector to concentrate our focus on this customer group which can help HSBC to take a huge leap towards growth of the bank over its competitors. As the growth strategy of Standard Chartered Bank and CITI Bank NA has been redefined to a slower pace, it is high time for HSBC to take effort to capture the opportunity to excel their market with a combination of specific products for the EPZ customers and better service assurance. Though there are some challenges that can’t be reduced soon enough but it is worth a try while the market is booming to its pace towards prosperity.