With the clear mission of providing efficient banking services and to contribute socioeconomic development of the country, Mercantile Bank Ltd emerged as a new commercial bank and inaugurated its operation on 2 June, 1999. From the beginning of the formation in banking service, the bank has involvement with foreign exchange business regarding conversion of currency value, maintain exchange rates and trade with other countries. The department deals with all these related activities are named as itself Foreign Exchange Department including three sub-departments- Export, Import & Remittance.

The purpose of this study is to understand the foreign exchange operations of Mercantile Bank Limited and to evaluate this service which has been done by analyzing the financial information of the last five years. This paper highlights the foreign exchange functions, about the procedure of their service provided to clients by the help of import and export sections, overall activities of LC transactions, the payment procedure of both the export and import, types of currency transfer through the bank, remittances they earn, the facilities they provide to their exporters and importers, the effect of exchange rates fluctuation and finally the business position of foreign exchange operation of the bank.

Afterwards, various financial apparatus that used for the export-import business; consequently, documentary credit or LC is the most important of them. The requirements, procedures, maintenances and disbursements of letter of credits are pre-settled by the Import and Export (Control) Act, 1950 of Bangladesh. Also the bank has their own rules and regulations for clients addressing to the government policies. There are time limitation, shipment validity & expiry included with the export-import trade. Besides, the position of the bank for financing in international commerce as the negotiation and advisory on behalf of parties are opposing.

Objectives of the Report

The purpose of the study is to obtain the understanding of the general banking and foreign trade activities of the bank. This experience is to relate them with the theoretical knowledge gained through academic semesters of my BBA program. Beside this, the more specific objectives are as follows which I try to cover in my report:

- To apply academic knowledge in the practical field

- To understand procedures of foreign trade operation of commercial banks in Bangladesh

- To learn the features of foreign trade

- To gather information about banking companies operations in practical field

- To have coverage the functions of foreign exchange section

- To get an overview of the private Banking in our country

Methodology

In this report, both the theoretical method and case study are basically used. The academic documents, lectures as well as the on-work training of the banking hour were the source of collecting information. The charts and graphs are constructed on basis of the quantitative data which is gathered from the previous five years annual reports.

There is a project workings based on quantitative approach which is conducted by providing questionnaires to the corporate customer of the foreign exchange department. Firstly, the gathered data is used for measure the satisfaction level of customers who has trade contract with the foreign exchange department of MBL. Thus, this method would also consent to carry out statistical analysis on the data collected in order to develop an instrument for measuring the quality of foreign trade. Twenty different companies attend the survey. Lastly, some findings and recommendations are included for the betterment of the process.

Profile of the Bank

Mercantile Bank Limited is a banking and financial services company headquartered in the capital of Bangladesh, Dhaka. It was incorporated in banking sector as a Public Limited Company with limited liability under the Bank Companies Act, 1991 on 20 May 1999 and originated commercial operation on 02 June 1999. At the beginning there was tk. 800 million as the authorized capital which was divided into 8 million ordinary shares of tk. 100 each.

The Bank went for public issue of shares in Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) on February 16, 2004 and February 26, 2004 respectively. The Bank has acquired commendable reputation by providing high quality services through different financial products with profitable utilization of fund. Its various credit and deposit products have attracted the clients in both corporate and individual level and made it a progressive commercial bank in the private sector. By creating new opportunities for its clients, giving customized services and maintaining harmonious banker-client relationship, the bank has been conducting its operation for more than a decade. It has now set up a standard in financing of industrial trade and foreign exchange business and also earning income from its non-fund activities other than the interest earnings. Capital market operations for example underwriting, portfolio management, mutual fund management, investor‟s account and also commission based business like letter of guarantee, inland remittance, foreign remittance etc non-fund activities has expanded the Bank‟s services to the public.

The Mercantile Bank Limited is providing these broad ranges of financial services to its customers and corporate clients with a strong branch of network nationwide to effectively address the needs of its cross-segment customer base under the dynamic guidance of the Board of Directors, The Bank has 86 branches by the end of 2012 and planning to open more branches in the coming years to perform even better by adding new and better products and

services to its customers.

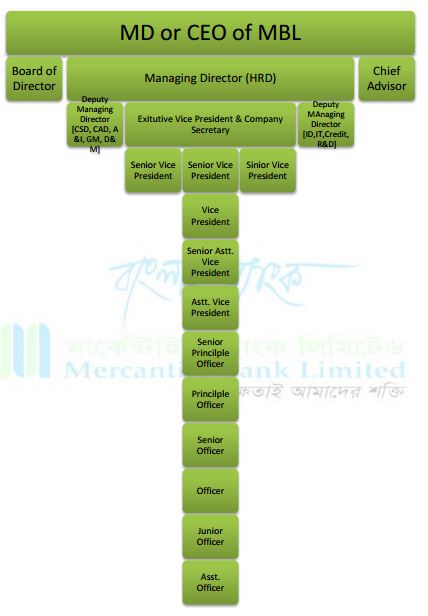

Organizational Structure

Mercantile Bank Limited appoints its own directors of board and chairman according to bank company act 1991. There are at present 14 directors in command including the managing director who is an ex-officio member of the board of directors. Executive Committee and Audit Committee are the two supporting squadrons of the board of the

bank. The members of the executive committee settles upon all routine and day to day operational aspects beyond delegated supremacy of the Management, subject to ratification of Board of Directors. On the other hand, the audit committee ensures the proper and reasonable reflection of banks performance with its episodic financial statements. It assists in ensuring the promised working system as per the frame work. The three members of the audit committee are formed with the vote of the directors form the board.

The operational and decision making process is headed by the Managing Director of the bank. Under his concern, there are additional, deputy managers as well as the departmental heads to complete the management level hierarchy. The head of branch is usually ether the senior vice president or the vice president rank holder. He has to report to the deputy managing director and, for functional purposes, to the Heads of Departments. Eventually there are several positions under one head of branch to complete the whole hierarchy of banking operation.

Management structure of MBL

Foreign Exchange Business

Mercantile Bank Limited has embarked on an extensive foreign exchange business with a view to facilitating international trade transactions of the country. The major three departments of foreign trade of the bank have achieved several milestones. In terms of import Mercantile Bank Limited trading, MBL handled a total of 25,357 Letters of Credit amounting to BDT 113,434.10 million during the year 2012. Compared to previous year, this is a growth of 19.39% in import business. The bank is now allied in opening the letter of credit with different manufacturing and industrial sectors of the country including machineries, garments & accessories, wheat, sugar, CDSO, vegetable oil, cement clinkers, hot roll steel, raw cotton, ships-breaking industries etc.

Secondly, Mercantile Bank Limited has attained a total export business of 25,712 export bills worth of BDT 81,477 million in 2012 as against 22,501 export bills and BDT 81,311.80 million in 2011. Growth rate of year 2012 is 0.20% based on previous year. This export financing is focusing basically on the readymade garments industry including the jute & jute products, leather, handicrafts, tea, frozen food & fish products.

The foreign remittance is the financial instrument of mobilizing the inward foreign currency from Non-Resident Bangladeshis (NRB) living or working abroad. During the year 2012, the bank handled total inward foreign remittance of BDT 15,792.80 million compared to BDT 7,150.00 million in 2011 registering a growth of 120.88%. Therefore the bank has established strategic alliance with foremost exchange companies and banks in USA, United Kingdom, UAE, Kuwait, Bahrain, Canada, Italy, and France etc. Furthermore, the global money transfer companies including Western Union, Money Gram, Xpress Money, Placid Express, Instant Cash Worldwide, Prabhu Money Transfer and Trans-Fast Remittance are the co-partner of Mercantile Bank Limited to make the process smooth and convenient. It also motivate both remitters and beneficiaries to use formal banking channel for money transfer from abroad

Correspondent Relationship

Mercantile Bank Limited has wide range of correspondent facilitated foreign banks across the world to smooth the international trades at the promised echelon to the customers. At present, the number of corresponding banks is 627across the 67 countries. Also MBL maintains their 29 nostro accounts in 6 major international currencies at the center of the world business. These accounts help to facilitate the settlements of foreign exchange and trade in various international currencies. Moreover, the process of increasing number of corresponding banks and the accounts is in MBL‟s higher priority to make the service zone extensive and convenient. Mercantile Bank Limited

Corporate Social Responsibility

Mercantile Bank Limited is committed to the society concerning the positive initiative in increasing wellbeing of the environment, customers, employees and communities that they are operate in. In order to make some good impact to the society and the country, the bank upheld their first CSR activity at the next year of its incorporation by forming the foundation titled itself „Mercantile Bank Foundation‟. All of the MBL CSR activities are overseen by the

Mercantile Bank Foundation. The main motive of the foundation in the initial years was a fixed amount of 40 lacks or one percent of the operating profit, which one is higher, to allocate as their CSR actions for the foundation to undertake projects in order to lend a hand to under privileged. In the year 2012, this has reached at BDT 85.90 million as the donation for their CSR activities. The allocation of resource for these developments is increasing every year. Right now, MBL is trying to assist the deprived sectors such as community outreach, health and medical research, education and natural disaster management of Bangladesh through funding in innovative and advance projects.

- Mercantile Bank Award- This program was commenced to honor the countries intellectual personalities for their outstanding contributions in education, health care, culture, economy, journalism and so other activities in their respective fields. This program is arranged each year on the founding ceremony of the bank. This award is not person limited but as much as excellence. The honor includes a gold medal, a crest and one time financial endowment worth BDT 1.00 lakh. In 2012 MBL provided awards to fourteen scholars from different fields of Bangladesh.

- Education scholarship & sponsorship program – To the development of youth through education, Mercantile Bank Foundation launched a scholarship & sponsorship program in the name and style, „Mercantile Bank Abdul Jalil Education Scholarship‟ for the meritorious and poor scholars across the nation under the category of J.S.C, S.S.C and H.S.C education scholarship program. This approach establishes MBL‟s motive towards building the nation through extending hands of assistance to the future generation of the country. In the year 2012, there was open application from eligible candidates among which 750 awardees got selected by a

committee. - Helping hand for disaster response- Also the bank is entirely enthusiastic to provide prospects for economically destitute communities by fostering economic development and supporting local communities. Not only financial help but also funding in rehabilitation and rescue programs is taken by MBL in several times when needed. In terms of widened its arms toward poor people; there is distribution of winter cloths program held in every year during the winter season in different cold affected areas of the country. At the highest crisis of the nation, MBL always tried to spread its hand to upraise the humanity. In 2009, just after the heartrending incident of BDR mutiny, the bank has take initiative to share the sufferings of the revolt affected families. In continuation of previous years, in 2012, MBL donated BDT 0.96 million to two mutiny-affected families and also will continue this support for next six years. Furthermore, Mercantile Bank Limited has made the contribution of BDT 0.50 million to BAB for the financial and other supportive aids to the fire effected garment

workers of “Tazreen Fashion”. MBL also raise funds worth BDT 0.20 million for rehabilitation purpose of 65 bundle tin sheets to fire victims of Boubazar and BDT 0.44 million to Chittagong Baddarhat tragedy. - Health & Medical- This is Mercantile Bank‟s one of the CSR activity to provide not only monetary aid to different medical and health intuitions, but also financial assistance to individuals for their treatments and operations. There was an amount of BDT 26.80 million financial aids provides by MBL to individuals and hospitals in the year 2012. Mercantile Bank Limited Foreign Exchange Proc

FOREIGN EXCHANGE DEPARTMENT

International Trade

Foreign exchange refers to the instrument or procedure from each of the participants‟ part by which the currency of one country is converted into the currency of another country in order to achieve business. Foreign exchange is the means and arrangement by which rights to wealth in a currency are converted into rights to wealth in another currency.

In banks when we concern of foreign exchange business, we refer to the general mechanism by which a bank converts currency value, maintain exchange rates and trade with another country. Regarding the increasing demand and supply of products and service of consumers needs, modern banks facilitate trade and commerce by rendering valuable services to the business community from home to abroad. The bank equipments the payments system arising out from the transactions of trade, especially in case of international trade, by performing as a useful association between the buyer and the seller, who are often too far away from and too unknown with each other.

This implies the bank as an adapter of foreign business activities relating to every export & import deals, outward & inward remittances, buying & selling of foreign commissions under the authority of the agent of the parties at overseas. Foreign exchange department of a bank provides the facility to the importer to issue the letter of credit documents in order to import the products and the exporter will be assured to obtain payments following the completion of transaction process.

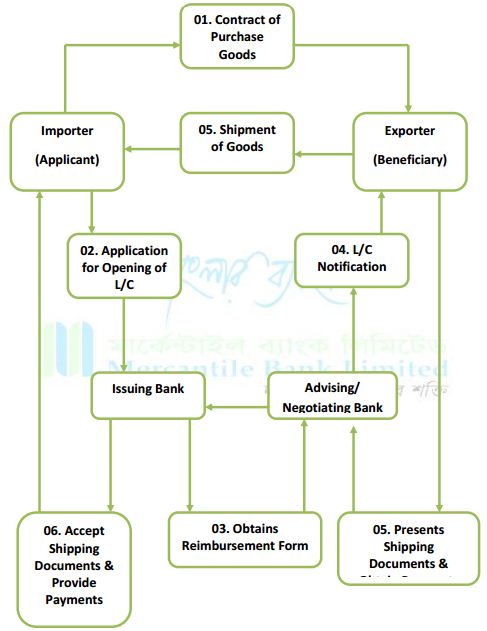

Banks participation in international trade can be illustrate by following diagram,

Market Participants of Foreign Trade

There are four significant market participants involved in every foreign trade businessbankers, brokers, commercial companies and central bank.

- Banks perform their activities along with the financial institutions such as insurance companies and commercials. The difference involving buying and selling currencies from and to each other is considered as the revenue of banks. There is no stick currency amount to trade with but the United Sates Dollar is the most traded value all over the world with an 87% of the whole.

- Brokers operate as intermediary in between the banks and the export-import traders. Their dealers ask them to search out the best worth of any specific currencies. However brokers earn return by imputing a commission on the transactions they arrange.

- Commercial Companies are required to comprise foreign currency in the course of doing business or making investments in different countries. For the execution of export and import trading, the companies are depended on the value of different currencies which is fixed by the central bank of every country.

- Central bank is the representative of government to ensure currency reserves, stabilize the exchange rate and to fix misalignments. In order to do those, central bank sometimes participates in the FX market to pressure the value of the currency in their market.

Foreign Exchange Operation of MBL

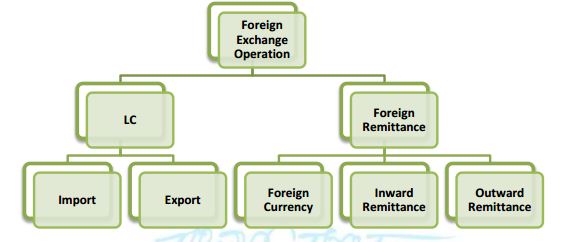

In Mercantile Bank limited there are three basic business sections construct up their foreign exchange department- Import, Export & Remittance. As long as the paper is constructed considering the source of the fiscal records available on latest materials published form the bank authority, the foreign exchange trade is BDT. 210,704.00 million as a whole. Where the import contribution is BDT 113,434.10 million, export is 81,477.10 million and last but not least BDT 15,792.80 million for remittance.

Basically export and import business actions are spotlighted to letter of credit authorizations, documentations and completion process. On the other hand the foreign remittance is an amalgamation of foreign currency exchange-rate and inward & outward remittance. So, from this point of view, we also can say the operations of this department can be classified into two major subdivisions- LC & Foreign Remittance.

Import Section of MBL

Mercantile Bank Limited, Motijheel branch, import division operates their activities with the authorized importers who are mostly in contract with capital machinery, hot roll steel, electronic equipment, rice, wheat, seeds, polyolefin, cement clinkers, dyes, chemicals, raw cotton, garments accessories, fabrics, cotton etc. Firstly the importer is given the Import Registration Certificate (IRC) from the officer of Chief Controller of Import and Export under the Import and Export (Control) Act, 1950 of Bangladesh. After getting the certificates, the importer needs to collect the letter of credit authorization (LCA) from Bangladesh Bank for a permissible business deal through opening an LC at Mercantile Bank Limited.

Some of the steps are indifferent to other commercial banks of this country and some are MBL originality. The whole process that the bank follows for an import purchase is illustrated here as per sequence.

1. Registration with CCI&E

At first the trader required to be registered with Chief Controller of Import and Export (CCI&E) in order to obtain Import Registration Certificate (IRC) to be eligible for performing international trade. There he submits the trade license, membership certificate of trade association, TIN, banks certificate and memorandum & articles of association. Then he may proceed to next step.

2. Purchase Contract between importers and exporter

At this phase the importer make the contact with the seller outside the country to obtain the Performa Invoice or Indent, which contains the complete description of imported goods. The indent is got through indenters a local agent of the sellers.

3. Collection of LCA form

Then the importer collects the Letter of Credit Authorization (LCA) from Mercantile Bank

Limited, Motijheel branch. This form is the application of authorization for opening a LC from the branch of the bank.

4. Opening a Letter of Credit

After getting the LCAF form the importer, the bank provides the facility of guarantee for the import of goods and the payments to both the importer and the exporter through issuing the Letter of Credit (LC). To avail this service, Mercantile Bank Limited, Motijheel branch, encloses some requirement of documents and actions regarding the import.

i. Meeting with probable LC opener

At first in case of import L/C opening, the opener fixes a formal meeting to the responsible officers from the foreign exchange department of MBL. This meeting is basically an oral presentation which includes the opener‟s motive of import, type of import goods, quality of imported goods and marketability of goods. If the officers are satisfied with information provided by importer, they will give approval to opener to further steps.

ii. Application for LC limit

The importer then applies to fix the LC limit by submitting necessary documents. This is a formal request generally formed in United States dollar value and proposes to the department of MBL furnishing the following information;

- Temperament of business

- Required amount of limit.

- Payment terms and conditions.

- Detail description of goods to be imported

- Offered security

- Repayment schedule

- Full particulars of bank account maintained with Mercantile Bank Limited

iii. The LC Application

After receiving the request from the importer, the bank takes essential approaches toward opening a letter of credit on behalf of importer. At this time, MBL asks for some mandatory documents with the form;

- Copy of valid Import Registration Certificate (commercial/industrial)

- Copy of Tax Identification Number Certificate (TIN)

- Copy of VAT Registration Certificate.

Forwarding for Pre-Shipment Inspection (PSI)

The IRC, TIN certificate, VAT registration certificate and membership certificate should be approved and be acknowledged by the respective authority for the importer to attend international trade. Besides these the importer required to confirm his proforma invoice which is the initial contract document sent from the exporter mentioning the absolute information about the goods to-be imported. The LC application form, which is also known as credit application form, is needed to have a special adhesive stamp worth of BDT 150.00 affixed on it. The insurance cover note comprises the name of issuing company and the insurance number. At the last of this phase, importer sends forwarding letter to exporter for Pre-Shipment Inspection. But not all types of goods require PSI.

Time limit for opening LC

The time duration of the LC is pre-fixed and mentioned is the LC opening form. This LC expiry period can be different from one practice to another according to the terms and policies stetted by the foreign exchange authority of Mercantile Bank, Motijheel branch. It also refers the information given in contract between the importer and exporter.

Shipment Validity & Expiry

The date of shipment validity and expiry of goods means the consignment has to be shipped out from exporter‟s point on or before last date of shipment of letter of credit. So the bill of lading should be on or before the date of shipment mentioned in MBL‟s LC as „Shipment Date‟. But there is another criterion of the bank saying „On Board‟ shipment date mentioned in the LCs, which means the date of on board bill of lading should be on or before the date of on board date. Like the time limit for opening LC, this shipment validity period can also vary for different LCs.

Amendments

The amendments are attached with the LC terms and conditions. There are some changeable factors reserved for the future validity of the documents. A change or addition to a legal document in which the LC terms and conditions can be relaxed but at MBL the tolerance of any financial value would be 05% or less which is applicable every party involved in any particular LC process.

Transmission of LC to Beneficiary through Advising Bank

When the importer gets the agreement of letter of credit with Mercantile Bank Limited, he is to send the LC documents along with the other entails to the exporter. This transmission must to involve advising or negotiating bank.

Presentation of the Documents

The exporter gets all the documents and after being satisfied with the terms and conditions of the credit, makes shipment of the goods as per LC offered. Completing the shipment of the goods in favor of the importer, the exporter submits the documents to the negotiating bank to checks the documents against the credit. After having the documents as its order, the bank will consider to pay, accept or negotiate to MBL, Motijheel branch. Then the Bank itself and also Motijheel Branch received seal to be affixed on the forwarding schedule. Lastly the branch crosses the bill of exchange & transport documents immediately to protects loss or fraudulent.

Endorsement of Non-Negotiable Copy Documents

Importer can receive goods only after showing customs clearing documents provided from the bank. Exporters send all the relevant documents to Mercantile Bank Limited after the shipment. They also send the duplicate copy of the documents to the importers. But sometimes bank does not receive the documents in due time. In that case, the importers present the duplicate copy to the bank and disburse the payable bills. MBL approves the duplicate documents and through the permitted duplicates importers clear the goods from the customs. These duplicate copies are called the Non-negotiable copy.

Import Financing By MBL

1. Payment against Document (PAD) Mercantile Bank Limited, Motijheel branch initiates payment against document (PAD) procedure after getting all documents from both the parties as evidence of import goods. This is a very general system of disbursement of LC process. Documents required for PAD is mentioned below:

- Original (Non-negotiable) bill of Leading

- Commercial Invoice

- Certificate of Insurance

- Certificate of Origin

- Bill of exchange

- Pre-shipment Inspection Certificate

- Packing List

- Clean Report of Findings (CRF)

2. Loan against Trust Receipt (LTR)

Unlike the PAD procedure, MBL performs the later mechanize as a foreign exchange instrument under providing advance against the Trust Receipt from the customers. The Trust Receipt is a document that creates the Banker‟s lien on the goods and practically amounts to hypothecation of the proceeds of sale in discharge of the lien. This is only facilitate to first class tested parties when the documents covering an import shipment or other goods pledged to the Bank as security are given without payment. For this concern the branch asks for prior

authorization from the head office.

3. Loan against Imported Merchandise (LIM)

MBL offers advance (Loan) against the security of merchandise imported through the Bank may be allowed either on pledge or hypothecation of goods. In that case the bank has provisional possession earthier on the imported goods or the account balance or any of the assets of the importer. Bank shall also obtain a letter of undertaking and protection from the parties involved in the trade, before the clearance of the goods from the port through LIM account.

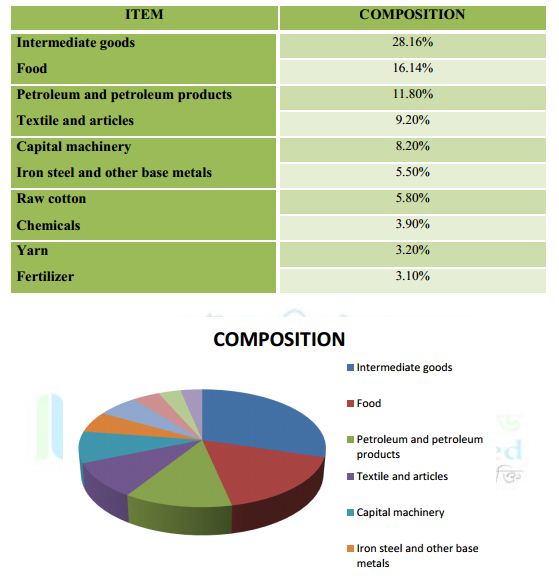

The Import Payment & Its Composition

Import payments during fiscal year 2011-12 reached to USD 35.52 billion as balanced to USD 33.66 billion in fiscal year 2010-11 indicating 5.52% growth over the preceding fiscal. However, import growth marked negative growth of 8.11% during first half of fiscal year 2012-13.

The composition of this achievement is given bellow;

Export Section of MBL

Mercantile Bank Limited provides the export LC facility to the Bangladeshi exporters form the very beginning of the foundation of the bank. After the establishment of the Motijheel branch, there is large number of individual and conglomerate exporters have taken the service not only because of MBL management structure but also the most convenient location which is actually at the center of capital. The exporters most of the readymade garments (both knitted and woven), jute, jute-made products, frozen shrimps, tea are the main product that exporters have to export form Bangladesh to outer country. Among these, the garments sector along have the contribution of 4.5 United States dollar value of our whole GDP. Mostly the RMG exporters come to obtain Mercantile Bank‟s LC services are focused on USA and European Community (EC) markets. About 40% of the total export-LC is made by the ready

mage garments exporter from Mercantile Bank Limited, Motijheel branch.

a) Export LC types

1. Export LC

The letter of credit uses for any export of goods from Bangladesh to abroad for the individual and commercial exporter, is entitled as the export LCs. The exporters have to gain some requirements to attend the international trade and then he asks for the registration for export. The exporter first collects the orders from foreign buyers and prepares the prearranged materials in to ordered products. The bank, MBL, plays the role of advising or the negotiating bank here. As a result, all contracts of payments are discussed by MBL with the issuing bank on behave of both parties.

2. Back-to-Back LC

In the field of international trade, it is somehow impossible to produce all along under some factory-roof. Moreover the developing countries like Bangladesh, it is harder as most of the time we are facing toward foreign countries for the raw materials of the production. After receiving order from the importer, very frequently exporters face troubles of scarcity of raw material because some raw materials are not available in the country. In that case, exporter offers a lien of export LC to bank as security and opens a LC against it for importing raw materials. This specific LC is called Back To Back LC.

b) Export Procedures

MBL has export operations including exciting as well as lively exports to deliver the fully export oriented and also surplus products to other countries and thereby earns foreign currency. Payment for goods exported from Bangladesh must to receive through an authorized dealer in freely convertible foreign currency or in Bangladeshi Taka from a NonResident AC. Besides there are a number of other formalities for exporting goods form this

country. These formalities or procedures are enumerated as follows;

1. Export Registration Certificate (ERC)

According to Import and Export (Control) Act, 1950; no exporter is permitted to atten export oriented business of any commodity permissible for export from Bangladesh unless he is registered with Chief Controller of Imports and Exports (CCI & E) and holds valid Export Registration Certificate (ERC). To be recorded into CCI&E, the exporter required to submit following documents;

- Nationality and Assets Certificate inspected by authority Memorandum and Article of Association and

- Certificate of Incorporation in case of Limited Company

- Bank Certificate

- Income Tax Certificate

- Company‟s Trade License

2. Obtaining EXP Form

The second step is to get an EXP form of MBL with the submission of valid ERC, trade license and other necessary certificates from concerned government authority. In that case, the bank verifies the documents and then issues an EXP form against the exporter.

3. Securing the Order

After getting ERC clearance, the exporter may proceed to secure the export order. He can do this by contracting the buyers directly through correspondence or can take help from license officer, local agents, export promoting organizations, chamber of commerce and many more national and international sources.

4. Signing the Contract

Then the exporter needs to get the written documents of the contract with importer for sending overseas items from Bangladesh detailing commodity, quantity, price, shipment, insurance and marks, inspection and arbitration etc.

5. Receiving Letter of Credit

The letter of credit is the documents of exporting terms & conditions and payments of products for the exporter. So after signing the contract of trade, the exporter asks for the letter of credit for the settlement the expression and position of the products and payments.

6. Procuring the Materials

Now, it is necessary to obtain the required materials to be collected. As early as possible the materials are charged into the machines, there is a better chance to accomplish production target and manufacture the contracted merchandise.

7. Approval and Disposal of EXP Form

The EXP form is required to endorse by the bank authority before the customs or portal officers make any steps. Without the bank‟s authentication, the exporter cannot proceed toward the shipment of exportable goods. Besides, exporter must announce all exports goods on the EXP issued by the authorized dealers. The export form is compulsory to prepare four in number of copies. They have different names and also need to submit to different authority.

Original copy: At first exporter reports the first copy of EXP to Bangladesh Bank after shipment of the goods.

Duplicate copy: Negotiating bank reports the Duplicate to Bangladesh Bank in or after negotiation date but not later than 14 days from the date of shipment.

Triplicate copy: On realization of export proceeds the same bank to the same authority reports Triplicate.

Quadruplicate copy: Finally, the negotiating bank as their office copy retains Quadruplicate.

8. Shipment of goods

Once the product is ready and the documents are submitted in right order, the exporter can make the shipment of the importable goods by preplanned vehicles and according to the LC contract terms and conditions.

9. Documents submission

Last but not the least, the business person needs to prepare and submit the following documents to Mercantile Bank Limited, Motijheel branch for negotiation and obtain payments;

- Bill of Exchange or Draft

- ERC form

- Bill of Lading

- Invoice (Proforma & Commercial)

- Insurance Policy Certificate

- Certificate of origin

- Inspection Certificate

- Consular Invoice

- Packing List

- Quality Control Certificate

- G.S.P. certificate

- Photo-sanitary Certificate

c) Export Financing by MBL

In order to get full economic support from the bank, there is some export funding criteria arranged for the exporters. Mainly those financing services are needed in four specific phases in an export function. The phases are described in this section. Considering the shipment schedule, here MBL divide the export financing into two categories;

1. Pre-shipment credit

As the name suggests, pre-shipment credit is the financing services provides for all the export related activities to the exporter prior to make the actual shipment of the exportable products. The reason of this service is to make the raw materials and other production allied assets into working capital for the right time delivery of the goods. This funding is very constructive for the exporters to manage monetary gain of procuring and processing of raw materials,

packaging and transport, insurance fees and also fright charges. Before allocating the credit to the exporters, the foreign exchange division of Mercantile Bank Limited takes into consideration about the exporter‟s credit worthiness, previous export performance, together with all other necessary information required for sanctioning the credit in accordance with the existing rules and regulations. Verifying all the needed information the bank offers diverse credit scheme against lien on the irrevocable, confirmed and unrestricted export letter of credit in form of the followings

a. Export cash credit (Hypothecation)

This is the financing procedure in which credit is legitimate against hypothecation of the raw materials or finished goods intended for export. As this funding service is limited only for the first class exporters, the bank does not get security asset against the credit except the charge documents and lien on exporters LC contract. In that case bank depends on the exporter in furnishing collateral security. Against the hypothecation documents, the bank charges a fee but does not have the ownership or passion of the assets of the exporters.

b. Export cash Credit (Pledge)

Under this agreement, the exporter can borrow cash amount from bank as pledge of goods that is to congregate in the warehouse under the MBL‟s control by signing the letter of pledge and other necessary documents. It creates the bank‟s full authority of the surrendered goods and similarly bank holds the right of physical possession of the assets. If the party fails to make the payments of the dues, Mercantile Bank Limited reserves the authority to sell the pledged merchandise for recovery of the advance.

c. Export Cash Credit against Trust Receipt

When the credit service is offered against a document titled Trust Receipt, is called export cash credit against trust receipt. Unlike the previous export financing, this service offers the full authority and control over the goods to the exporter himself. Only he requires preparing and signing a special stamped export trust confession in favor of the bank declaring that the goods purchased for the purpose to manufacture of the exportable goods are financed by the

bank against the trust receipt. After that he could get the credit for completing the export process such as goods processing, packaging and so on. The difference between export cash credit and this service is the bank does not seize the goods in its custody but provide the credit amount. Mercantile Bank obtain collateralized assets for the security of this investment. To get this facility, the exporter needs to gain the first class position in MBL exporter‟s record.

d. Packing Credit

Packing Credit is a short-term advance granted by MBL to an exporter for assisting him to buy, process, manufacture, and pack and ships the goods. This type of credit is sanctioned for the transitional period starting from dispatch of goods till the negotiation of the export documents. The maximum edge of providing this pre-shipment credit is 10% of total export value which required to be adjusted fully once within a period of 3 to 6 months only for a

first class exporter of MBL.

e. Back to Back Letter of Credit (BTB)

Back-to-back letter of credit is a specialized and most common foreign trade instrument at the field of export business in Bangladesh. This LC facilitated the exporter to commit a lien of export LC as a security and open a new LC against it for the purpose to import raw materials. The core point behind this LC document is to reduce the difficulty of shortage of raw materials in time of production of overseas goods. Sometimes necessary production equipments and unprocessed input ingredients are not available in our country and so we are completely dependable on others. Consequently the exporter frequently experiences the shortage of financing those components when he needs to import those. The bank gives the opportunity to lien the export LC as a defense and opens a new LC against the master LC for importing the raw materials. That new LC is named as Back-to-back LC and MBL keeps no margin for this. However sometimes there is provision from the government and the authority to import any specific item or a certain portion of the whole export LC amount. In that case MBL opens the certified amount as a new LC.

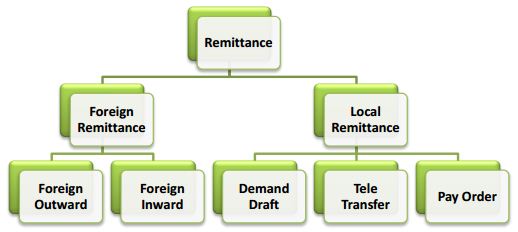

Foreign Remittance Section of MBL

This section of the bank can be illustrated into two branches; the remittance of foreign currency and the local remittance. The foreign currency again is divided into two parts which are foreign inward and foreign outward. Similarly the local remittance includes demand draft, tele-transfer and pay-order.

a) Outward Remittance of MBL

The outward remittance earnings of the bank mainly generated from selling the foreign currency through TT, MT, various drafts and traveler‟s cheques. It also reveals the payments against imports into Bangladesh and local currency created to non-resident currency accounts of foreign banks.

There are two types of forms are used for outward remittance management in the bank‟s Motijheel branch. To record all the outward remittance, there is IMP forms against each account of importers. The second one, TM form is for all other outward remittance prepared by MBL.

According to the remittance practice purpose, the currency transaction from taka to nonresident currency can be categorized into three divisions- private remittance, fiscal & business travel and commercial remittance. The private remittance is generally used for paying foreign education fees, membership & registration fees, family vacation tour,

individual & group travel, health & medical purpose, attending private seminars & workshops, personal of foreign nationals, remittance for Hajji and so many other personal concerns.

Official & business travel remittance is limited within the export-import party oriented abroad tours attuned by the businessmen. Someone who needs to attend official visit to abroad, fresh export-import businessperson with business travel quota and exporters‟ retention quota are classified in official & business travel remittance. Commercial remittance is for extending branches or subsidiary companies out of the country, remittance from transport companies‟ airlines & courier service, remittance of royalty and technical, on account of training & consultancy, from profits of foreign branches, remittance of dividend, subscriptions to foreign media services, costs of Reuter monitors, advertisement of Bangladeshi products in mass media abroad and for the payment of various bank Charges.

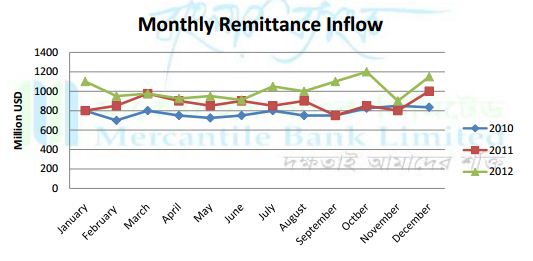

b) Inward remittance of MBL

Basically inward remittance indentifies the purchases of foreign currency through TT, MT drafts etc. Beside this, MBL also earn inward remittance by purchasing foreign bills and travelers‟ cheques as well. The major two sources of inward remittance are proceeds realized from export process from Bangladesh to foreign countries and also a very strong source of Bangladeshi personnel sending remittance from abroad. The remittance from the personnel

working in different countries increases every year which is marked a substantial growth of 22% during the first half of fiscal year 2012-2013.

Like the outward remittance, here inward remittance section also uses two specific forms as prescribed by Bangladesh Bank to acquire foreign currency into local cash- EXP form & Form C. The remittance received from the business of export products from Bangladesh done by MBL is processed through EXP forms. Other than that, the remittances equivalent to USD 2000.00 or above are recorded and executed by using form C. In terms of inflow of remittance, MBL has good records for the past few years. In fiscal year 2012, the bank handled total inward foreign remittance of BDT 15,792.80 million compared to BDT 7,150.00 million in 2011 registering a growth of 120.88%. Also the monthly remittance earnings are also higher than the previous years.

Reporting to Bangladesh Bank

The whole process of foreign exchange department is to be informed and updated on regular basis to the service of Bangladesh Bank. This updates can be daily or under the operation based. Bangladesh Bank creates a separate entity for each and every banking corporation in order to report to the central bank and so the bank management authority can check and monitor the whole foreign trade situation of the country from the center. The foreign trade department of Motijheel Branch has to confirm each and every step of the process of exchange goods as well as transaction of currency with abroad. For the purpose, there is an online service under the name of Online Foreign Exchange Transaction Monitoring System in their official webpage. There are four segments inside this- Foreign

Exchange Transaction Monitoring Dashboard, Online Inward Remittance Monitoring System, Online Export Monitoring System, Online TM Form Monitoring System, Online Import Monitoring System and last but not the least Online Foreign Exchange Market Monitoring System.

The commercial banks dealing with foreign trade has a user name and password to get inter into each section. The sections that has described in this report, all needed to be inform through this web channel under respective section.

Foreign Exchange Business Position of MBL

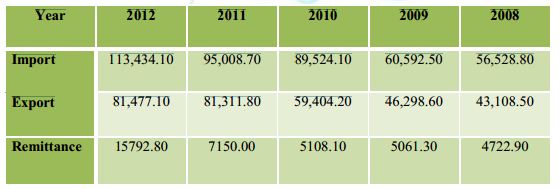

Foreign exchange income is considered as a vast source of revenue for Mercantile Bank Limited. This revenue is generated from its three segments of foreign exchange department into two forms- commission and exchange gain. The financial performances of these sections from fiscal year 2012 to 2008 are presented below;

The monetary information explain an impressive result of performance for the last five years of foreign exchange division of MBL, as they all represents the positive increasing trends. Also the import business situation is much healthier than the export; but it‟s still noticeable that the export is never lessening than the previous year in this five year. The remittance movement is always positive and most eye-catching in 2012 that the trend had a tremendous

amplify of a double than the fiscal year 2011.

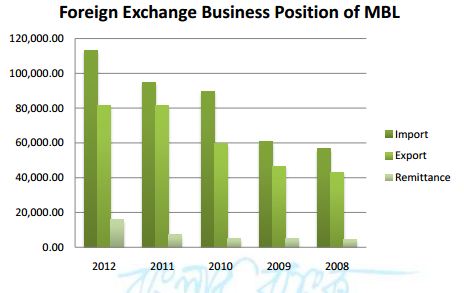

From observing this continuous improvement, it is clear that the MBL authority is very much concern about managing and implementing the foreign exchange policies for the betterment ation in upcoming as well. The comparative situation of these three sections from 2012-2008 in BDT is shown in the following graph:

Foreign Exchange Income

The earnings of foreign exchange division of the bank is always in an escalating movement. The performance movement of MBL from fiscal year 2008 to 2012 is here;

This graph is showing the upward movement of the revenue portion of MBL, foreign exchange department. From 2008 to 2009, it was slight arise of profit, and then every year it was at least a 30% enhance in the revenue columns. In the year 2012, the income was around contribution of this improvement is the remittance portion as it turns into double although all the three division has upturn.

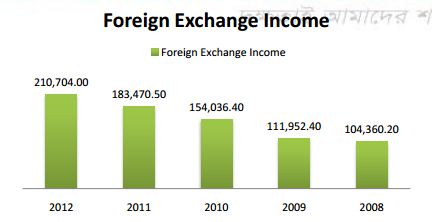

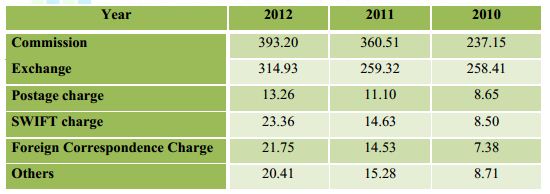

Income Composition of Foreign Exchange Business

The MBL has different sources of income from overseas business. Generally in the Motijheel branch, the main fonts of For Ex revenue are as follows:

- Income on commission of LC.

- Income on data transmission and SWIFT charges

- Income on postage

- Income on courier charge

- Income on discrepancies

- Income for amendment charges

- Income from IMP and EXP fill up Charges

- Income from exchange gain

- Income on miscellaneous charges

Referring the sources of foreign trade profit of MBL, the comparative evaluation from 2010 to 2012 is presented below:

The basic revenue generating portion of the foreign exchange business is commission and exchange gain which are making profit of 50% and 40% respectively. Other than these, there are postage charge, SWIFT charge foreign corresponding charge and the other revenue earning ingredients included.

Service Assessment

Service quality measurement attributes:

The service quality is being measured by using the questionnaire based on the aspects of the SERVQUAL service quality model. From all the factors of the model, the most relevant and supportive factors are considered for this project. As a result there were three main visions to understand the service worth and effectiveness. In core aspects; efficiency, reliability, fulfillment and security are being used. The recovery service factors include responsiveness,

contact and compensation. The last one is self aesthetics as named itself to know that how well the branch is furnished and designed to attract the customer and give the feeling of good service.

Sample Selection:

The quantitative study was conducted through the information collected by stratified sampling method from the customer receive the foreign exchange service from the bank. First the entire customer group is divided into three forms of export, import and remittance subgroup. Then from the subgroup there was a random sampling used to give equal chance to each of the population to be selected. Afterwards, I collected the record of the customer and

the companies from the database of MBL. Then from the list I asked the customer whether they would kindly put in some of their valuable time to filling out the questionnaire for a survey, disregarding all the factors that might cause him not to approach for the purpose. Data collection:

The survey is being successful by using a questionnaire containing 18 questions including 15 of Likert scale and the rest 3 are for knowing the customers profile of foreign exchange. After that there was using of face to face interaction, email service and telephone facility to collect the information. The commercials, representatives of the companies, wear participated in this survey inside the bank concerning my presents. However some of the individuals were not present, so I took help of emailing the questionnaire. Besides, there were telephone conversations regarding the survey. Since I was involve when the questionnaire was filled, any clarification about the questions were properly been instructed before the respondent once started to fill it out.

The questionnaire & dimension:

There are 18 questions inside the questionnaire. Three of them are for knowing the position and business level with the bank. It includes the information about the years of customer‟s foreign trade existence, his foreign business association with MBL and the frequency of using foreign exchange service form the bank.

The later part of 15 questions are asked to measure the level of satisfactions regarding the service provides by MBL. All the questions fall under the dimensions of SERVQUAL service quality model. Only the first question is for identifying the current level of satisfaction toward the department. The first two questions will answer the dimension of efficiency, where as the next two is for reliability of the service. Question no. 6 & 7 and continuation of next two, denote fulfillment and security dimension respectively. The banks service receptiveness, contact and compensations are measured by question no. 8; 11, 12 & 13 and 14. Lastly the site aesthetic is covered through question no 15. One suggestion segment is also added with the questionnaire.

In this survey, the seven point Likert scale is being used in the questionnaire. Here 1 represents strongly disagree; 2 is disagree; 3 is slightly disagree; 4 is not agree; 5 is slightly agree; 6 is agree; and 7 is strongly agree.

Findings of the study:

A. Project Findings:

Descriptive results:

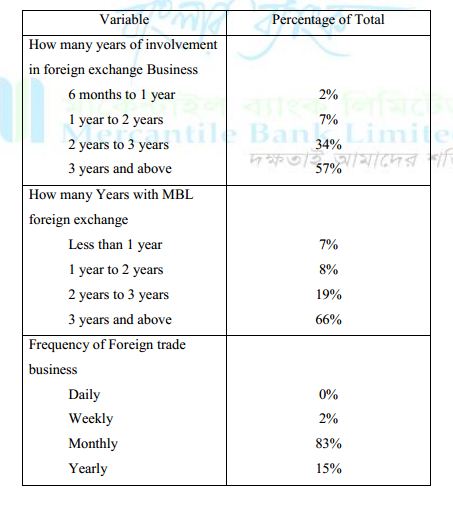

The survey was conducted by 20 questionnaires filled out by the customers from different segments who meet the criteria to take part in. the result is in the chart bellow here;

The table shows the result that the majority 57% of customers of MBL are involve in foreign trade for three years and above. The second portion of two years to three years of exportimport trading is 34%. In between one to two years and bellow one year, the groups hold 7% and 2% respectively. This result is indicating that the customer of MBL foreign exchange business is well experienced and knowledgeable about international trade.

Then the next section answered 66% is taking MBL foreign exchange service for two to three years, while rest of the 7% has been using it less than one year. In middle there is 19% of the respondent said they are connected with the bank in between two years to three years and rest 8% is for one year to two years duration. This result represents that the customers with MBL are loyal to it and majority is still continuing business for more than three years. This diagram also represents the service frequency of 83% respondents use monthly, while only 2% is using it on weekly basis. The rest of 15% has experienced it for yearly basis. There is no business in daily orientation. So the bank has export-import business mostly on monthly basis.

This analysis shows the customers mainly active with MBL foreign exchange business are mostly doing business for a long time in this field. So they are well known of the terms and condition as well as the situation of the current market. MBL is successful to grab long time relationships with the customers. Still there is a big opportunity to hold the rest 44% for future growth. Also, since the majority customers are monthly dealers, the bank should concern on different products and services degrading the customer‟s needs.

SWOT Analysis

SWOT matrix is helpful to understand the internal and external problems and prospects of any specific projects or the entire department. I took some records from the MBL documents as well as my personal observation to construct the analysis.

Strength:

- Better financial standing

- Efficient management

- Better location of the branch.

- Attractive consumer schemes.

- Quick delivery of foreign exchange.

- Healthy capital adequacy

- Diversified product line

- Experienced top management

Weakness:

- Manual registers are used in some cases

- Limited delegation of power

- Online facility is not available

- MIS at primary stage

- Inadequate work force

- Conservative loan facility

- Interest rate is less than others

Opportunities:

- Market leadership of MBL

- Growth of the banking sector

- Sophisticated consumer service scheme of the MBL

- Make the goodwill

- Perform services more quickly

Threat:

- Political instability

- Intense competition

- Market pressure for Dollar crisis

- Market segmentation

- Government rules and regulation

- Economical variation

- Policy of competitive banks

Recommendations

As started toward the beginning of the recommendations, there is need for advance research for an enhanced understanding of the quality dimensions of foreign exchange division and the influential factors of its customer satisfaction. This report is only showing the factors on which the customer has satisfied and which needs to be improved upon. Thus, the managers and concerned parties can take this study for a guideline of improvement of the quality of export-import business service. The bank should make the process easier for the customer so that they got encouraged to experience and also obtained it with minimum effort. Beside, the bank should ensure the availability of their service from both the personnel and automated system based. Similarly not only the accessibility but also the quick responsive and solving the problem is vital to encompass customer‟s fulfillment. Specific actions could make this improvement as the more efficient the service is the more satisfied the customer will be.

To comprise the improvement, the coordination among different departments should be more effective and is to ensure for maintaining proper synchronization of the operation of the branch. Therefore the high administration control should be exercised to Motijheel branch and proper delegation of authority should be established for every officers of every department to confine their own responsibility and duty, which will bring fluency in operation. Next, the course that MBL tagged to open documentary credit and settlement of endorsement should be liberalized as much as possible. It requires customer need based researches to obtain the facility to provide best services. Development of the process according to regulations will also attract more clientele.

Then MBL, Motijheel branch is to be concerned on operation-required equipments. The branch is not properly equipped with logistics and other modern communication facilities compared to the alternate commercial bank‟s branch situated in same location. As a result, it requires more time and resources to get the conclusion of any complicated errands and to respond with other areas of the organization.

Also, the business recording and documents securing procedure of the department must be improved through sequential effort system. It happened frequently that the huge volume of files that kept in various locker is not all time possible for officers to keep in proper format and to search-out those in time of necessity. Therefore they should use a systematic computerized procedure to get this improvement for all sort of recoding essential. It may require once a great investment but will save valuable resource and get more trade.

Finally, it should be mentioned that today‟s banking industry is much focused at on-line orientated business. Counting with MBL‟s webpage and online business facility are not in progress of customer satisfaction. The webpage required to be updated on regular basis. And for the improvement of online service facility, MBL should have customer focused research to know the demands and needs of customer about the service. Moreover the bank should take concern on aggressive advertising and promotional activities so that the new and innovative banking services can get broad geographic coverage inside the country and beyond. However the MBL authority should try to get positive word of mouth, as the service receiver companies do consider on other companies remarks rather than advertisement on media.

CONCLUSION

Working in an organization with complete role in every aspects of banking sector like Mercantile Bank Limited is a great opportunity to enrich practical learning. The bank has their activities of general level to the executive performances to provide banking service to customers. This course of on-job learning experience assists me to know bank and its activities from inside. During my limited period, I have collect, synchronize and analyze data to understand the process and this is how I include this finding section.

In order to make the investment worth it, retain the customers and keep their foreign exchange service better than all the rest being offered, a high quality of service has to be maintained. That is why it is essential to measure the amount of satisfaction the customers have using the service. This will allow the bank to understand whether or not the quality of the international banking service they are providing is good enough, or whether it has to be improved. Based on the SERVQUAL model developed by Parasuraman, Zeithaml and Malhotra for measuring quality of this specific service efficiency, fulfillment, reliability, security, contact, physical aesthetics, compensation and responsiveness dimensions. Furthermore, eighteen items are used to describe these eight dimensions in the questionnaire, against which the customers rated those items on using a 7 point likert scale. In order to evaluate how the customers of the bank perceive the quality of the different aspects of the foreign exchange department‟s services they use, descriptive statistics obtained from analyzing the data collected were used.