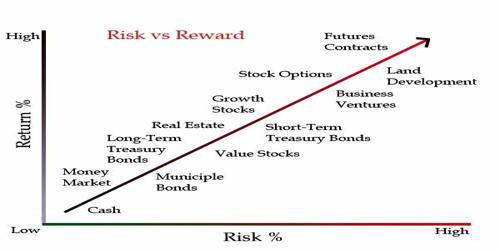

When you invest, you make choices about what to do with your financial assets. Risk is any uncertainty with respect to your investments that has the potential to negatively affect your financial welfare. Investors purchase financial assets such as shares of stock because they desire to increase their wealth, i.e., earn a positive rate of return on their investments. The future, however, is uncertain; investors do not know what rate of return their investments will realize.

Investment risk can be defined as the probability or likelihood of occurrence of losses relative to the expected return on any particular investment.

For example, your investment value might rise or fall because of market conditions (market risk). Corporate decisions, such as whether to expand into a new area of business or merge with another company, can affect the value of your investments (business risk). If you own an international investment, events within that country can affect your investment (political risk and currency risk, to name two).

In finance, we assume that individuals base their decisions on what they expect to happen and their assessment of how likely it is that what actually occurs will be close to what they expected to happen. When evaluating potential investments in financial assets, these two dimensions of the decision making process are called expected return and risk. Sometimes the investors take their decision based on previous data. They make decision by taking previous years Rate of Return into consideration. Here we will discuss how an investor invests on stock based on Rate of Return and Risk. For getting good Rate of Return in the future we need to analyze past data. That is previous risk and return.

Investment in stock is risky. Stock markets have been volatile in recent years. For minimizing risk from the investment an investor need to analyze the market. Here an analysis has been made on risk and return of Bank companies. Today, stock investment is the easiest way to earn higher profit within very short time. For this proper information and guideline are needed. The investor need to understand the market. They need to analyze the market before investment. Investor who has no knowledge about market will fail to earn higher profit. Many investor in our country, invest to the stock by seeing others. They don’t feel necessity to analyze the market. For this one time they lose their money. How an investor can best use of his/her money, it is shown here.

Description

Stating simply, it is a measure of the level of uncertainty of achieving the returns as per the expectations of the investor. It is the extent of unexpected results to be realized.

Risk is an important component in assessment of the prospects of an investment. Most investors while making an investment consider less risk as favorable. The lesser the investment risk, more lucrative is the investment. However, the thumb rule is the higher the risk, the better the return.

Risk and return are important criteria of making investment decision. Investors irrespective of individual and institutional should make a trade off between risk and return while making both short and long term investment decisions in any area of businesses. They are also required to make a compromise between these two in managing investment in different outlet in practice. Failure to manage between these two gives birth to either higher risk or low profitability. Investors or Portfolio managers are to expose to risk arising out of failure to make a trade off between risk and return. Risk taking is essential to an active market and legitimate risk taking should not be unnecessarily or unduly stifled. Regulators cannot be expected to prevent nor can it prevent absolutely failure of market intermediaries but the risk of failure can be and ought to be minimized. And, the Regulator should seek to mitigate the impact of any failure, if and when it occurs. For this purpose, what is required is effective. Risk Management system, continually monitored and up graded as warranted. The size and complexity of the market will dictate the imperative the kind and the level of sophistication of the system.

In security market, every one involved is subject to risk. It not only facilitates trading of shares and securities, but also enables parties in making trade off between risk and return in the process. Parties to the stock market are stock exchange, brokers, dealers, security and exchange commission, investors- individual and institutional-merchant bankers, central depositor system etc. Investors are required either to diversify risk or to hedge risk or to reduce risk through the application of risk management tools and techniques. On the other hand, Regulator-CSE and Stock exchanges-DSE and DSE have to play important role for creating a level playing field in the stock market environment for all categories of investors by imposing either direct administrative and regulatory measures or punitive (financial) measures. This is how; stock market can bring the confidence of investors back in the stock market. The present paper is an attempt to look into risk management in stock marker and implications for stock exchange and SEC.

Information Source: