Limitations of Simple Interest

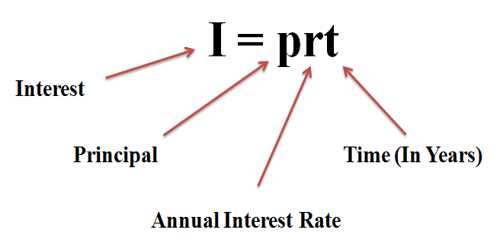

An interest rate is the amount charged, expressed as a percentage of principal, by a lender to a borrower for the use of assets. When money is borrowed, interest is charged for the use of that money for a certain period of time. When the money is paid back, the principal (amount of money that was borrowed) and the interest is paid back. The amount of interest depends on the interest rate, the amount of money borrowed (principal) and the length of time that the money is borrowed.

Simple interest is a basic way of looking at interest. In the real world, your interest—whether you’re paying it or earning it—is usually calculated using different methods. However, simple interest is a good start (and an important building block), and it can give you a general idea of what a loan will cost or what an investment will return.

If you want to get the most return on the money you save or invest, you want compound interest. Simple interest is paid only on the money you save or invest the principle, while compound interest is paid on your principal plus on the interest, you have already earned. Some limitations are,

- It’s ignoring the compound and when the interest on interest doesn’t have to be paid for.

- The simple interest is that you don’t really get anything from it, it’s usually used for small loans that can be paid back quickly.

- If you have a credit card and you owe money on it, you will pay less interest if the credit card company uses simple interest.

- Simple interest is money that is added to a principal amount that you have to pay over a period of time.

- Simple interest is that you only can make small payments & use it for small loans.

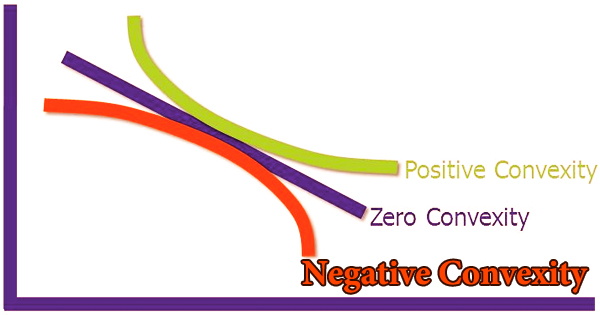

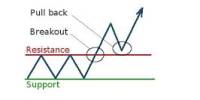

As the time period involved grows longer (if you’re dealing with a 30-year mortgage instead of a 1-year bank deposit, for example), simple interest calculations become less reliable than using the original method — using compounding, for example. The similarly is true of “compounding frequency.” For example, when you borrow with a credit card, you might estimate how much interest you pay using simple interest.

However, most credit cards quote a yearly percentage rate (APR), but interest is charged daily. As a result, you’ll owe a lot more than you imagine if you use a simple interest calculation. For a more accurate explanation of credit card calculations, see how your payments and interest charges affect your card balance.

The main thing to keep in mind is that simple interest does not take compounding into account. Compounding is the repetitive process of earning (or paying) interest, adding that interest to your principal balance, and earning, even more, interest in the next round due to that increased balance.

Information Source: