Executive Summary

Working capital is referred to as the lifeblood of a firm. As human body cannot work properly without blood, the firm cannot operate the business without working capital. The firm needs current assets to effectively go on its production. That’s why working capital is necessary for the business.

Working capital is the bundle of short-term assets and liabilities of a firm. Generally, working capital has two components- short-term assets, and short-term liabilities. Short-term assets are- cash, accounts receivables, inventories, and short-term marketable securities. Short-term liabilities are- accounts payable, bills payable, notes payable, accrued expenses and other payables.

Emergencies may arise for which the firm needs immediate cash. The firm must hedge against the possibility of these unexpected needs. Several types of hedges are possible. For example, the firm can arrange to be able to borrow from its bank on short notice should finds suddenly be needed. Another approach is to hold extra cash and near-cash assets beyond what would be needed for transitions purposes.

Cash involves both cash and cash equivalents. Management of cash is important because it’s also considers the above mentioned two costs- carrying costs and shortage costs. The term cash management refers to all those activities relating to planning and execution of decisions involving collection of cash from different sources; disbursement cash in different uses; and holding or investing cash while within the firm. Thus management of cash inflows and outflows are important activities for the firm.

INTRODUCTION

Managing liquidity efficiently is a key concern of every company. Liquidity of a firm is the ability of a firm to convert its liquid assets into cash where aggregate liquidity position means the relationship between a firm’s potentially available cash and its potential cash needs. Aggregate liquidity focuses on the overall relationship between current assets and current liabilities of a firm.

Working capital could be defined as the portion of assets used in current operations. The movements of the funds from capital to income and profits and back to working capital are one of the most important characteristics of the business. This cyclical operation is concerned with utilization of the funds with the hope that will return with an additional amount called income. If the operations of the company are to run smoothly, a proper relationship between fixed capital and current capital has to maintain.

Generally, working capital has two components-

1) Short-term assets, and

2) Short-term liabilities.

Short-term assets are- cash, accounts receivables, inventories, and short-term marketable securities. Short-term liabilities are- accounts payable, bills payable, notes payable, accrued expenses and other payables. Working capital is referred to as the lifeblood of a firm. As human body cannot work properly without blood, the firm cannot operate the business without working capital. The firm needs current assets to effectively go on its production. That’s why working capital is necessary for the business.

Cash involves both cash and cash equivalents. Management of cash is important because it’s also considers the above mentioned two costs- carrying costs and shortage costs. The term cash management refers to all those activities relating to planning and execution of decisions involving collection of cash from different sources; disbursement cash in different uses; and holding or investing cash while within the firm. Thus management of cash inflows and outflows are important activities for the firm.

Company Profile

| 1) S. Alam Cold Rolled Steels Limited |

S. Alam Cold Steels Limited is a sister concern of S. Alam Group. It ensures the backward linkage of the Steel Industries of Galvanizing, Corrugated, Automobile etc. This C.R. Coil producing maintained a high quality standard to meet the local demands considering price to save foreign currency.

|

2) BSRM STEELS LTD:

The Company’s aspire to maintain leadership position in the steel industry by producing the best quality steel products, continuously enhancing customer satisfaction and becoming a reliable partner of customers and suppliers.

|

Reasons for Holding Cash

Cash and short term interest bearing investments (marketable securities) are the firm’s least productive assets. They are not required in producing goods or services, unlike the firm’s fixed assets. They are not part of the process of selling as are inventory and accounts receivable. Despite the seemingly low returns, there are several good reasons why firms hold cash and marketable securities .It is useful to think of the firm’s portfolio of cash and marketable securities as comprised of three parts with each part addressing a particular reason for holding these assets.

Cash for Transaction:

One very important reason for holding cash in the form of non interest-bearing currency and checking deposits is transactions demand. Since debt s are settled via the exchange of cash , the firm must hold some cash in the bank to pay suppliers and some currency to make change if it makes sales for cash.

Cash and near-cash assets as hedges:

Emergencies may arise for which the firm needs immediate cash. The firm must hedge against the possibility of these unexpected needs. Several types of hedges are possible. For example, the firm can arrange to be able to borrow from its bank on short notice should finds suddenly be needed .Another approach is to hold extra cash and near-cash assets beyond what would be needed for transitions purposes, By‘‘near-cash assets,” we mean interest –earning marketable assets that have very short maturities (a few days or less) .and thus can be liquidated to provide funds on short notice with very little risk of loss.

Clearly, the more of this total hedging reserve held in near-cash assets and the less held in cash, the greater the interest earned. However, there is a trade-off between this interest revenue and the transactions costs involved in purchasing and selling such near-cash assets. These transactions costs have a fixed cost component; the firm bears these fixed costs when it buys or sells these assets regardless of the size of investment. Thus whether it is economical to invest part or all of the hedging reserve in near-cash assets depends on the dollar amount of the reserve .

Temporary investments:

Many firms experience some seasonally in sales. Often, there will be times during the year when such firms have excess cash that will be needed later in the year. Firms in this situation have several choices. One alternative is to pay out the excess cash to its security holders when this cash is available , and then issue new securities later in the year when funding is needed. However, the costs of issuing new securities usually made this a disadvantageous strategy .More commonly, firms will temporarily invest the cash in interest-earning marketable securities from the time the cash is available until the time it is needed. Proper planning and investment selection for this strategy can yield a reasonable return on such temporary investments.

All of these are valid reasons for holding cash and marketable securities in response t o the needs and uncertainties faced by the firm. In fact firms generally hold a surprisingly large portion of their assets in these forms, despite the disadvantage of low returns

SOME CRUCIAL ISSUES ON HOLDING

CASH BALANCE

The finance manager of any firm is required to maintain cash balance items for hedging purpose, there must also be some issues that need special attention of the Finance Manager. These issues are-

- Liquidity

- Safety and

- Profitability

Liquidity:

The term liquidity here means the potentiality of the marketable securities to be converted in cash (or sold in the market) immediately without eroding significant value of the investment. The treasury bills and high graded commercial papers (not available in Bangladesh) pretty often fulfill the liquidity requirements of the government bonds and Certificates of Deposits (CDs) of top order banks do also meet liquidity criteria pretty confidently.

Safety:

The safety of funds invested by a company is best provided by the government securities (T bills). Because these are default free instruments, so there is no safety concern for the firm. Although some expert opine that, government of some developing or least developed countries specially those with high ‘deficit finance’ and other internal troubles can default at times. Any how, securities other than those of the government, like stocks and commercial papers of the ‘blue chips’ companies and more or less considered as default free securities for the long run.

Profitability:

In addition to safety and liquidity, profitability from the investment is also a matter of concern for the Finance manager. Therefore, profitability or return or yield from the marketable security over the costs of investment and liquidation must be considered before making any short term investment decision. The return in general depends on the nature of the security and the yield curve.

Traditional Ratios:

We calculated different working ratios for ascertaining the liquidity management’s efficiency of S. Alam Cold Rolled Steels Ltd. and BSRM Steels Ltd. These ratios measure the operating efficiency of the company. The ratios include:

- Current Ratio

- Quick Ratio

- Cash Ratio

- Inventory Turnover:

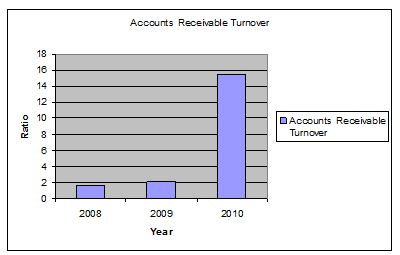

- Account Receivable Turnover:

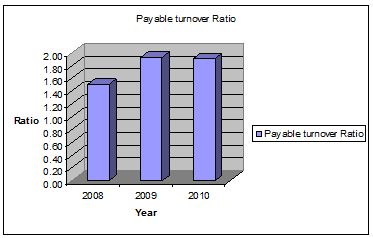

- Payable Turnover Ratio:

- Cash Conversion Cycle

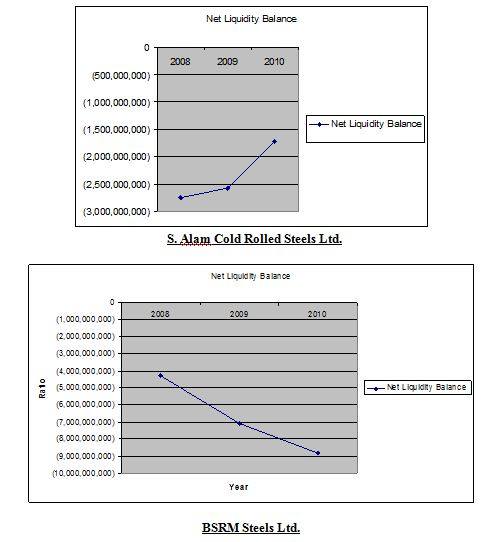

- Net Liquidity Balance

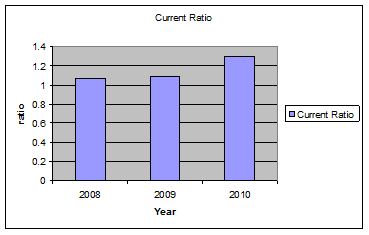

Current Ratio: The short term internal liquidity of a company is measured by current ratio. Liquidity refers to how quickly current assets can be converted into cash to meet the short term obligations. From the calculation we see that the current ratio has an increasing trend for S. Alam Cold Rolled Steels Ltd. and BSRM Steels Ltd. The management has earned a good result through the year 2009-2010. So liquidity management of both S. Alam Cold Rolled Steels Ltd. and BSRM Steels Ltd. is satisfactory.

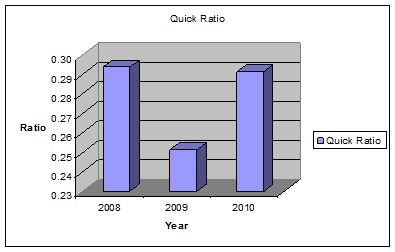

Quick Ratio: The quick ratio basically used for minimizing the inventory lag effect, very short notice assets. These include cash, marketable securities and account receivables as current assets and attempt to measure a firm’s liquidity position in terms of overall current liabilities. In 2009, the quick ratio for S. Alam Cold Rolled Steels Ltd goes down but recovered in 2010. In 2010, the quick ratio of BSRM goes a little down because of increase in due to affiliated companies and long term loan.

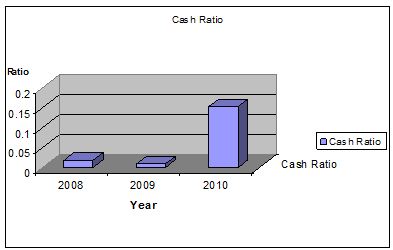

Cash Ratio: Cash ratio is found by dividing the cash and marketable securities by current liabilities. In case of S. Alam Cold Steels Ltd. 2009 to 2010 the cash ratio has increased at a higher rate because of increase in cash and bank balance. In case of BSRM, the ratio is decreased in the year of 2009 and remains almost same for the year of 2010.

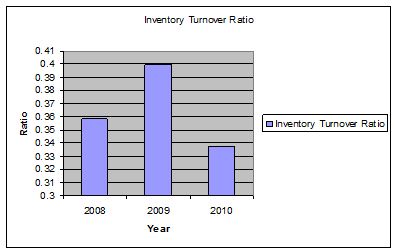

Inventory Turnover: Inventory turnover is computed as cost of goods sold divided by the average size of the inventory of the firm. Inventory turnover indicates how quick the inventory held converted into cash. The ratio increases for S. Alam Cold Steels Ltd. in the year 2009, it decreases to 0.34 in the year 2010, but it does not mean the disaster position. Since its sales remained increasing and inventory level was small, it generated more sales by increasing efficiency in inventory. In case of BSRM the ratio is almost same in the year 2009 and 2010.

Account Receivable Turnover: The ratio indicates how frequently a firm can convert its sales into cash flow. Another related measure is the average collection period (ACP) or account receivable period. The 1st graph indicates that in the year 2010, it substantially increased its A/R turnover in case of S. Alam Cold Steels Ltd. It’s possible cause may be controlling the credit policy efficiently. Account receivable period is the multiplicative result of the inverse of A/R turnover and 365 days. In case of BSRM the graph also indicates increasing pattern in ratio.

Payable Turnover Ratio: Account payable turnover can be found by dividing cost of goods sold by average account payable throughout the year. The lower the ratio is the better the situation. S. Alam Cold Steels Ltd. got a substantial improvement in the year 2009. It stretched the disbursement to the suppliers. This is a good result from effective payment management. But the management should consider the existing relationships prevailed between the company and its suppliers. In case of BSRM the ration decreased in the year of 2009 but managed to increase in 2010

BSRM Steels Ltd.

MODERN RATIOS

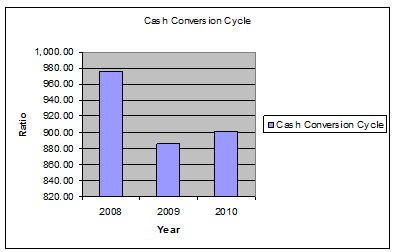

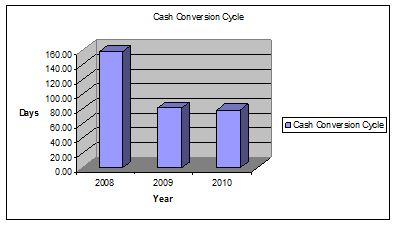

Cash Conversion Cycle: Firm’s Cash Conversion Cycle (CCC) is the length of time between the firm’s payment for its raw materials and the collection of payment from the customer is known as the firm’s Cash Conversion Cycle (CCC). Therefore the formula for cash conversion cycle is as follows-

Cash Conversion Cycle= Inventory period + Account Receivable Period – Account Payable Period

The longer the production process, the more cash must keep tied up in inventory. Similarly, longer account receivable period also add greater values in cash conversion cycle. On the other hand, account payable reduces net working capital.

The following graph shows the cash conversion cycle of S. Alam Cold Steels Ltd through the year 2008-2010. It indicates that CCC turned 880 days in 2009. Then in course of time it increased to 900 days.

S. Alam Cold Rolled Steels Ltd.

The following graph shows the cash conversion cycle of BSRM Steels Ltd through the year 2008-2010. It indicates that CCC turned 80 days in 2009.

BSRM Steels Ltd.

Net Liquidity Balance: NLB considers accounts receivables and inventory as additional assets to be financed. The accounts payable and other accruals that are part of current liabilities are treated not as maturing obligations but as a part of the firm’s permanent financial package. Only notes payable are treated as maturing obligation. S. Alam Cold Steels Ltd is in a liquid position because it has no available notes payable.

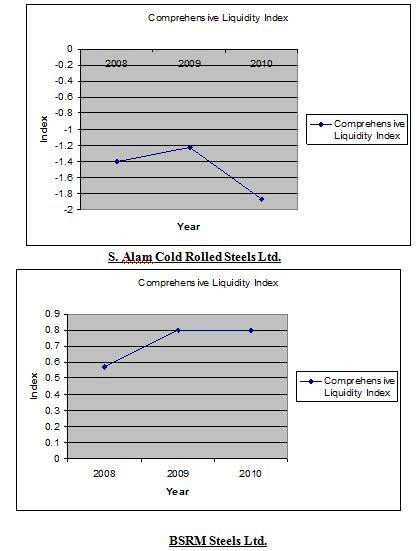

Comprehensive liquidity index: Comprehensive liquidity index overcomes the problems of current ratios by weighting each current assets and liability based on its nearness to cash. In computing the Comprehensive liquidity index, the dollar amount of each current asset or current liabilities is multiplied by one minus the inverse of the ratios is deducted. The results are summed over all current assets and current liabilities. The summed total is liquidity adjusted measures of total current assets and liabilities.

Observation & Findings

- In case of S. Alam Cold Steels Ltd, though Results of Inventory Turn over ratio is decreasing but results of current ratio, quick ratio, Net liquid balance and comprehensive balance have an increasing trend in the last three years.

So it indicates that liquidity position of S. Alam Cold Rolled Steels Ltd. is satisfactory.

- Inventory period and A/R period are decreasing and A/P period is increasing S. Alam Cold Rolled Steels Ltd in the last 3 years which is also satisfactory. But the inventory period is too high.

- In case of BSRM Steels Ltd, though Results of Inventory Turn over ratio is decreasing but current ratio, quick ratio is increasing but Net liquid balance and comprehensive balance have a decreasing trend in the last three years.

- Inventory period and A/R period are increasing and A/P period is fluctuating in case of BSRM Steels Ltd in the last 3 years which is not satisfactory.

CONCLUSION

S. Alam Cold Rolled Steels Ltd. and BSRM Steels Ltd. are two renowned steel manufacturing organizations in our country. The management is always strict about the liquidity management of the company.

Although Cash and short term interest bearing investments (marketable securities) are the firm’s least productive assets and they are not required in producing goods or services, unlike the firm’s fixed assets even they are not part of the process of selling as are inventory and accounts receivable, the company retains cash and marketable securities to meet it emergency needs

Considering the overall situation, we can conclude that the liquidity position of S. Alam Cold Rolled Steels Ltd. is satisfactory and the same of BSRM Steels Ltd. is not fully satisfactory.