1.0. Introduction

Banks play an important role in the business sector and industrialization of a country. Basically bank take deposit from the customers against interest and lend it to the borrower’s interest for a certain period. Under this sphere, the bank offers different interest notes and other options to there customers to remit and deposit there money. Most of the common between the banks, only the customer service and other facilities vary.

It has become essential for every person to have some idea on the bank and banking procedure. By an internship program in bank, students can obtain practical knowledge, which helps to know real life situations, helping them to launch a career with some practical experience.

1.1. Background:

I work as an Intern in the EXIM Bank, Mirpur Branch, for studying only 3 months. After study I have to make a Report. The report covers the Bank’s Foreign Exchange Operation. So, the report covers “Foreign Exchange Operation of EXIM Bank Limited”.

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs conceived an idea of floating a commercial bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, Export Import Bank of Bangladesh Limited started commercial banking operations effective from August 03, 1999.The sponsors are reputed personalities in the field of trade and commerce.

This report gives a narrative overview of the Export Import Bank of Bangladesh Limited and its Foreign Exchange Business. This report does explain the nature and objective of the Foreign Exchange; this will fulfill the needs of the report. In the report I compared the Foreign Exchange of EXIM Bank with the Foreign Exchange of Islami Bank Bangladesh Limited, which helps me to analyze the Foreign Exchange of both bank.

As a fully licensed commercial bank, Export Import Bank of Bangladesh Limited is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition.

However, since the financial information is classified and sensitive in nature, so that I tried to construct this report with the help of available information.

1.2. Significance:

Knowledge and learning become perfect when it is associated with theory and practice. Theoretical knowledge gets its perfection with practical application. As our educational system predominantly text based, inclusion of practical orientation program, as an academic component is as exception to the norm. This Internship Report is an important partial requirement of four year BBA graduation program. As the parties; educational institution and the organization substantially benefit from such a program, it seems a “win-win situation”. That’s why practical orientation is a positive development in professional area. Recognizing the importance of practical experience, Department of Finance Studies of BUBT has introduced a three months practical exposure as a part of the curriculum of Bachelor of Business Administration (BBA) program. In such state of affairs the present aiming at analyzing the experience of practical orientation related to an appraisal of EXIM Bank Bangladesh LTD.

1.3. Scope of the Report:

During these three months internship program in EXIM Bank Limited, Mirpur Brach, almost all the desks have been observed. For that purpose I needed to get information from EXIM Bank Head Office. But I was appointed into EXIM Bank, Mirpur branch. There I had to work in Foreign Exchange, Loan & advances department desks as a routine work. It was difficult to collect the information relevant my report, because the people of this Bank was so busy with their duty that they cannot be able to give me much time. Here I try to cover the activities and rules and regulation related to investment.

1.4. Objectives:

Internship Report prepared as a requirement for the completion of the BBA program of the BangladeshUniversity of Business & Technology. The primary objective of internship is to provide an on the job exposure to the student and an opportunity for translation of theoretical conceptions in real life situation. Students are placed in enterprises, organizations, financial institutions, research institutions as well as development projects. The program covers a period of 12 weeks of organizational attachment.

General Objectives:

- The broad objective of the study is to prepare report on “Foreign Exchange Operation of EXIM Bank Limited”.

- The general objective of this report is to fulfill the requirement of internship report to acquire practical experience in different banking services of EXIM Bank Ltd.

Specific objectives:

- To gather knowledge about the transaction of different department of the branch especially foreign exchange department.

- To know about the conventional banking and their operation.

- To know about the Islamic banking and their operation.

- The problem prospects of Islamic bank.

- To know how to deliver their service to the customer.

- To know Its Different types of product for customer.

1.5. Methodology:

The study requires a systematic procedure from selection of the topic to preparation of the final report. To perform the study, the data sources were to be identified and collected, to be classified, analyzed, interpreted and presented in a systematic manner and key points were to be found out. The over all process of methodology has been given as below.

1.5.1 Research Design

This is an “Exploratory Research”, which briefly reveals the overall activity of EXIM Bank and also analyzes the “Foreign Exchange Operations of EXIM Bank Ltd”. Data have been collected from both primary and secondary sources.

1.5.2 Sources of Data, Data collection procedure

This study is mainly based on secondary data available from the various divisions and departments of EXIM BANK, in addition to these other necessary information have been collected from the daily news papers, relevant journals, annual reports of EXIM BANK, Bangladesh bank, Ministry of Finance and Planning and publications of other relevant institutions have also been taken into consideration.

Primary sources of data:

Face to face conversation with the bank officers & staffs.

Conversation with the clients.

Different’ manuals of EXIM Bank Limited.

Different circulars of EXIM Bank Limited.

Secondary sources of data:

Procedure manual published by the EXIM Bank Ltd.

Files and documents of the branch.

Annual report of EXIM Bank Limited, 2000.

Different papers of EXIM Bank.

Different text books.

1.5.3 Tools used for analysis

Both the qualitative and quantitative (such as SWOT, Ratio & Trend analysis) tools are used to analyze the gathered data.

1.5.4. Sample Size

15 to20 bank professionals of EXIM Bank Mirpur Branch

1.5.5. Duration of observation

12 weeks within the period of three months internship program.

1.6 Limitations of the study:

The present study was not out of limitations. But as an intern it was a great opportunity for me to know the banking activities of Bangladesh specially EXIM Bank. Some restraints are disclosed bellow:

- The main constraint of the study is insufficiency of information, which was required for the study. There are various information the bank employee can’t provide due to security and other corporate obligations.

- Due to time limitations many of the aspects could not be discussed in the present report.

- Since the bank personals were very busy, they could provide me very little time.

- I can’t present the recent data relating to Foreign Exchange Business. Because the annual report and the financial statement are published at the month of August every year.

- I carried out such a study for the first time, so in experience is one of the main constraints of the study.

2.0. An over view of EXIM Bank Ltd.

The EXIM Bank of Bangladesh Limited is an “Islamic Shariah based commercial Bank”, which is committed to provide high quality financial services to contribute to the growth of G.D.P. (Gross Domestic Product) of the country through stimulating trade & commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, Poverty alleviation, raising standard of living of the limited income group and over all socio-economic development of the country.

The Bank offers full range of Personal, Corporate, International Trade, Foreign Exchange, Lease Finance and Capital Market Services. EXIM Bank Limited is the preferred choice in banking for its friendly and personalized services, cutting edge technology, tailored solutions for business needs, global reach in trade and commerce and high yield on investments, assuring Excellence in Banking Services.

| EXIM BANK AT A GLANCE | |

Name of the Institution | Export Import Bank of Bangladesh Limited |

Date of incorporation | June 02,1999 |

Commencement of operation | August 03.1999 |

Authorized Capital | Tk. 1000.00 million (initial)Tk. 350..00 million (as on 31 December, 2007) |

Paid up Capital | Tk. 225 million (initial)Tk. 214.22 million (as on 31 December, 2007) |

Converted to Islamic bank | July 01,2004 |

Legal form | “A Sbariah based Islamic Bank” |

Slogan | “Together Towards Tomorrow” |

Industry | Banking industry of Bangladesh |

Nature of business | Shariah based Islamic banking with different financial services/products |

Target customers | Individuals and Corporate customers |

Deposits, accumulated (2007) | Tk 4154.66 crore |

General Investments (2007) | Tk 4019.52 crore |

Investments (shares & bonds) | Tk 245.77 crore |

Foreign Exchange Business (2007) | Tk11790.01crore |

Operating profit (2007) | Tk 190.82 crore |

Net proHt (2007) | Tk 930,843,607 crore |

Number of branch (2007) | 39 |

Total manpower | 1104 |

Chairman | Md. Nazrul Islam Mazumder |

Managing director | Mohammad Lakiotullah |

Web address | www.eximbankbd.com |

2.1. Historical Background:

The Export Import Bank of Bangladesh Limited (popularly known as EXIM Bank) is a private commercial bank that operates banking operation by maintaining the Islamic Shariah and principles regarding the business transactions. The Bank was incorporated on 2 June 1999 as a private sector banking company under the COMPANIES ACT 1994 with a target to play the vital role on the socio-economic development of the country. It started operations on 3 August 1999 with an authorized capital of Tk. 1 billion (1000 million) divided into 10 million ordinary shares of Tk. 100 each. The initial paid up capital of the bank was Tk. 225 million, fully subscribed by 28 sponsors. Initially the Bank started its operation as a private commercial Bank, but later on, the Bank has taken up the challenge to start Islamic

Banking Operations and migrated all of its conventional banking operation into Shariah based Islamic banking operations after obtaining approval from Bangladesh Bank on July 01, 2004. The Bank went for public issue of shares in the year 2004 and its shares are listed with Dhaka Stock Exchange (September 26, 2004) and Chittagong Stock Exchange (September 04, 2004).

Management of the bank is vested in a 22-member board of directors headed by the chairman. The managing director is the chief executive and the bank has a total of 130 employees including 19 executive officers. The bank finances export and import businesses and also conducts traditional commercial banking activities. All three urban branches of the bank (Rajuk Avenue, Dhaka) are conducted through a computer network.

Initially the bank was known as the BEXIM Bank Limited, which stands for “Bangladesh Export Import Bank limited”. But for some legal constraints the bank has to change the name and according to the proposed name of the Governor of Central Bank at that time it was named as the “Export Import Bank of Bangladesh Limited” or in short EXIM Bank Limited.

The bank finances export and import businesses and also conducts traditional commercial banking activities by maintaining the Islamic Shariah regarding the business. The commercial Banking activities of the Bank consist of services including mobilizing deposits, providing investment facilities, discounting bills, conducting money transfer, foreign exchange transactions and providing services i.e. issuing guarantees, safe keeping, acceptances and letters of credit etc.

With the pragmatic decision and management directives in the operational activities, the bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management. This organization has achieved customers’ confidence immediately after its establishment. Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. This is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution.

2.2. Corporate Culture:

This bank is one of the most disciplined Banks with a distinctive corporate culture. Here we believe in shared meaning, shared understanding and shared sense making. Our people can see and understand events, activities, objects and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to us. The people in the Bank see themselves as a tight knit team/family that believes in working together for growth. The corporate culture we belong has not been imposed; it has rather been achieved through our corporate conduct.

2.3. Key Function of EXIM Bank:

Like other commercial banks like EXIM bank performs all traditional banking business including introduction of a wide range of caving and credit products, retail banking and ancillary service with the support of modern technology and professional management, but the Exim Bank Bangladesh Limited emphasizes its function in export and import trade handing and financing of export oriented industries will enhance wealth, quotes more employment opportunities helps formation of capital and reduces in balance in the balance of payment in the country.

2.4. Social Commitment:

The purpose of the banking business is, obviously, to earn profit, but the promoters and the equity holders of EXIM bank are aware of their commitment to the society to which they belong. A chunk of the profit is kept aside and/or spent for socio-economic development through trustee and in patronization of art; culture and sports of the country and the bank want to make a substantive contribution to the society where we operate, to the extent of our separable resources.

2.5. Product and Services of Export Import bank of Bangladesh limited:

The bank serves all types of modern, progressive and dynamic business as well as banking services to the customers of all strata of the society. During the short span of time, the bank has been highly recognized and praised by the business community, from small entrepreneurs to large traders and industrial conglomerates and emerged as the fastest growing among the third generation banks in respect of business and profitability.

Export Import Bank of Bangladesh Limited successfully marketed its products designed to fulfill the needs of various socio-economic strata. Attractive features of the products have given a distinctive image among the private banks. The bank has been making continuous endeavor to offer new products and services. As a commercial bank, they provide all traditional banking services:

- General Banking Department

- Investment Department &

- Foreign Exchange Department

This three department provided services are:

Deposit products:

- Al-Wadiah Current Deposit Account

- Mudaraba Savings Deposit Account (MSB, MSTD, RFCD, NFCD)

- Mudaraba Term Deposit Receipt

- Mudaraba Monthly Savings Scheme

- Mudaraba Monthly Income Scheme

- Mudaraba Super Savings Scheme (Double Scheme)

- Mudaraba Multiplus Savings Scheme (Triple Scheme)

- Mudaraba Hajj Scheme

Investment Products:

- Corporate Finance

- Commercial Finance

- Industrial Finance

- Project Finance

- Lease Finance

- Syndicate Finance

- Hire Purchase Finance

- Real Estate Finance

2.5.1. Mudaraba Deposit Account (RFCD, NFCD):

The main objective of this account is to provide convenience to the customers to their savings. This account allows the customer to deposit his/her surplus money as and when available and receive lucrative profit on the same. The customer can deposit any sum desired at any time of the operational hour of this account.

2.5.2. Mudaraba Monthly saving Scheme (Money Grower):

The first and foremost objective of this scheme is to encourage people to build up a habit of saving. Under this scheme, one can deposit monthly a fixed amount of money regularly and will receive a substantial amount with handsome benefit after maturity of reasonable period/tenure.

2.5.3. Mudaraba Monthly Income Scheme (Steady Money):

It is an alluring and commonly accepted scheme of Export Import Bank of Bangladesh Limited as an investment of steady monthly returns. Under this scheme, the depositor is allowed to deposit at least Tk.1,00,000/- or its multiple amount for three years and in return he/she will receive profit on monthly basis at an attractive rate. This scheme mainly has been drawn up as well as introduced for the benefit of middle-income group, particularly retired person.

2.5.4. Mudaraba Super Savings Scheme:

Mudaraba super saving scheme is offered for all classes of people, specially for the middle class, where the depositor is allowed to deposit at least taka 5,000/- or its multiple amount for 6 (six) years and at the maturity of the account, deposited amount will be stood as more than double.

2.5.5. Mudaraba Multiplus Savings Scheme:

Under this scheme, the depositor is allowed to deposit at least taka. 5,000/- or its multiple amount for 10 (ten) years and at the maturity of the account, it will be arrived at more than triple of his/her deposited amount.

Moreover, the depositors may avail themselves of investment facility under above-mentioned schemes, by meeting easy terms and conditions in regard to scheme(s), as the case may be.

2.5.6. Mudaraba Education Savings- For Higher Education:

With a view to assisting the customer for higher education, Export Import Bank of Bangladesh Limited has introduced this scheme with convenient terms and conditions.

2.5.7. Mudaraba Hajj Prokalpa:

In view of smooth arrangement for performing Hajj, Export Import Bank of Bangladesh Limited has introduced his scheme under the tenure of 5, 8, 10, 15 & 20 years with nominal amount of deposit per month.

2.5.8. Mudaraba Credit Cards:

This service is introduced for the utmost convenience of the customers in paying for their purchase of commodities. The customer is allowed to avail credit purchase through this card and enjoy compensation free payment within a certain period as long as 50 days.

2.5.9. Foreign Currency Deposit Account:

This account provides the customer with safe and lucrative way of saving their foreign currency. All non-resident Bangladeshi are most welcome to save and remit their wages and earnings from abroad through this account.

2.6. Vision:

The gist of EXIM bank vision is ‘Together Towards Tomorrow’. Export Import Bank of Bangladesh Limbed believes in togetherness with its customers, in its march or the road to growth and progress with services. To achieve the desired goal, there will be pursuit of excellence at all stages with a climate of continuous improvement, because, in EXIM Bank, they believe, the line of excellence is never ending. Bank’s strategic plans and networking will strengthen its competitive edge over others in rapidly changing competitive environments. Their personalized qualities services to the customers with the trend of constant improvement will be cornerstone achieve their operational success.

2.7. Mission:

The bank has checked out the following corporate objectives in order to ensure smooth achievement of its goals-

- To be the most caring and customer friendly and service oriented bank.

- To create a technology base most efficient banking environment for its customers

- To ensure ethics and transparency in ail levels

- To ensure sustainable growth and establish full value of the honorable shareholders and

- Above all, to add effective contribution to the national economy

Eventually the bank also emphasize on:

- Provide high quality financial services in export and import trade

- Providing efficient customer service

- Maintaining corporate and business ethics

- Being trusted repository of customers’ money and their financial adviser

- Making its products superior and rewarding to the customers

- Display team spirit and professionalism

- Sound Capital Base

- Enhancement of shareholders wealth

- Fulfilling its social commitments by expanding its charitable and humanitarian activities

2.8. Goal:

This bank is one of the most disciplined Banks with a distinctive corporate culture. Here we believe in shared meaning, shared understanding and shared sense making. Our people can see and understand events, activities, objects and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to us. The people in the Bank see themselves as a tight knit team/family that believes in working together for growth. The corporate culture we belong has not been imposed; it has rather been achieved through our corporate conduct.

The word “EXIM BANK” implies the meaning of its “Operation”. To achieve the desired goals, it has the intention to pursuit of excellence at all stages with a climate of continuous improvement. Eventually the bank emphasizes on the following goals:

- Achieving excellence in customer – service next to none and superior to all competitors.

- Be the most caring and customer friendly and service oriented bank.

- Creating a technology based most efficient banking environment.

- Providing high quality financial services in export and import trade.

- Maintaining consistency in improving the service quality and customers’ perception regarding the bank.

- Maintaining a constant growth in sales and profit time to time

- Maximizing share holders wealth, by increasing the share price

- Making an effective contribution to the overall socio-economic growth of Bangladesh.

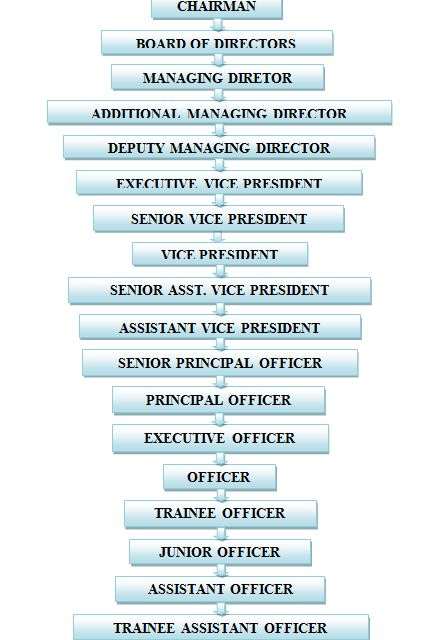

2.9. Organogram:

2.10. Branch Information:

During 2007 Bank has opened 05 (Five) new branches at different commercially important location of the country and thus the total number of branches raised to 39 (Thirty Nine). Out of total 39 branches, 25 are located at the prime business centre of urban areas and remaining 10 branches are at rural areas of the country. And the registered office (Head Office) of EXIM Bank Limited is situated at Printers building (15th floor), 5, Rajuk Avenue, Motijheel, Dhaka-1000. The following branches were opened during the calendar year 2007.

| SI. No. | Name of the Branch | Opening Date |

| 01. | Comilla Branch, Comilla | 10.05.2007 |

| 02. | Ran.qpur Branch, Ranqpur | 20.05.2007 |

| 03. | Moulvi Bazar Branch, Moulvibazar | 02.09.2007 |

| 04. | Savar Bazar Branch, Savar | 29.11.2007 |

| 05. | Karwan Bazar Branch, Dhaka | 03.12.2007 |

However, the Bank has a plan to expand its area of operation by opening new branches to cover rest of the important urban and rural areas of the country. Keeping this in view, Bank will open 09 (Nine) new branches in 2008 as follows:

SI No. | Name of the Branch (Proposed) | District

| Urban/Rural |

| 01. | Head Office Corporate Branch Gulshan-1 | Dhaka | Urban |

| 02. | Pahartali | Chittagong | Urban |

| 03. | Rajshahi | Rajshahi | Urban |

| 04. | Khulna | Khulna | Urban |

| 05. | Kushtia | Kushtia | Urban |

| 06. | Golapsonj | Sylhet | Rural |

| 07. | Mudaforgonj | Comilla | Rural |

| 08. | Chhasalnaiya | Feni | Rural |

| 09. | Noria | Shariatpur | Rural |

2.11. The Mirpur Branch:

Mirpur Branch of EXIM Bank Limited was established in 16 June, 2003 and the branch has achieved the confidence of the customers immediately after its establishment by providing superior quality service with sincerity. The branch is located at the central point of Mirpur-10 of Dhaka city. The total number of employees in Mirpur Branch is twenty four (24)

2.12. Financial Highlights of the EXIM Bank Ltd:

| Sl. No | Particulars | 2005 | 2006 | 2007 |

| 1 | Authorized Capital | 100.00 | 350.00 | 350.00 |

| 2 | Paid-up Capital | 87.90 | 171.38 | 214.22 |

| 3 | Reserve Fund | 57.00 | 81.09 | 113.46 |

| 4 | Deposits | 2831.90 | 3503.20 | 4154.66 |

| 5 | Investment (General) | 2604.60 | 3264.13 | 4019.52 |

| 6 | Investment ( Shares on Bonds) | 163.30 | 223.33 | 245.77 |

| 7 | Foreign Exchange Business | 7294.00 | 9617.51 | 11790.01 |

| a) Import Business | 4143.20 | 4959.67 | 6139.94 | |

| b) Export Business | 3128.50 | 4623.46 | 5579.04 | |

| c) Remittance | 22.30 | 34.38 | 71.03 | |

| 8 | Operating Profit | 117.58 | 137.87 | 190.82 |

| 9 | Loan as a % of total Deposit | 91.97% | 93.18% | 96.75% |

| 10 | No. of Foreign Correspondent | 222 | 246 | 246 |

| 11 | Number of Employees | 934 | 1020 | 1104 |

| 12 | Number of Branches | 28 | 30 | 39 |

| 13 | Return on Assets | 1.65% | 1.73% | 2.00% |

3.0 Overview of Foreign Exchange

In the modern world no country is self-sufficient, one country is to depend on other countries and from this point of view there arises the question of foreign trade and foreign currency transactions. That is, the international trade involves foreign exchange transactions particularly for receipt and payment against export and import of goods and services from one country to another. As without foreign exchange transactions we can not think of foreign trade. Of course, various rules and regulations are to be followed in connection with the foreign trade and foreign exchange transactions. It is well known fact that the money is a medium of exchange for all transactions that take place inside the country as well as outside the country. In Bangladesh, we have the Taka for financing the internal trade and other obligation. So, the home currency has to be converted into currencies of other currencies, to meet the obligation that arises out import of goods and services from other countries. That part of the economic science that deals with the conversion of Home Currency into Foreign Currency for the purpose of setting international obligations is called Foreign Exchange.

3.1. Foreign Exchange Regulation Act, 1994:

This Act regulates the exchange of foreign currencies, remittances and opening of foreign currency account under various classifications. According to this law, FC Accounts can be opened without initial deposits, and bears no interest and both the account holder and the nominee can operate the account. The entire remittance from adored is free from income tax. It also states the documents required for the opening of such account.

3.2. Definition of Foreign Exchange:

- Foreign exchange means foreign currency and includes all deposits, credits and balance of payable in foreign currency as well as Draft, Traveler’s cheques, Letter of credit, Bills of Exchange drawn in local currency but payable in foreign currency.

— Foreign Exchange Regulation Act, 47, Sec 2 (a)

- Foreign exchange means foreign currency and includes any instrument drawn, accepted, made or issued under clause 13 of section 16 of the Bangladesh bank Order, 1972 all deposits and credits and balances, Travelers cheques, Letter of credit and bills of exchange, expressed or drawn in Bangladesh currency but payable in any foreign currency. — Bangladesh bank order 1972.

3.3. Foreign Exchange Department:

Foreign exchange department deals with foreign currency and the transaction of it. The major jobs of this department are listed below:

1. Letter of Credit (for Export and Import)

2. Dollar/Traveler’s Cheque (TC) Endorsement

3. Foreign Remittance

4. Foreign Currency Account

3.4. Types of Letter of Credit:

REVOCABLE CREDIT: A revocable credit is a credit which can be amended or canceled by the issuing bank at any time without prior notice to the seller.

IRREVOCABLE CREDIT: An irrevocable credit constitutes a definite undertaking of the issuing bank (since it can not be canceled without the agreement of all parties thereto). Provided that the stipulated documents are presented and the terms and conditions are satisfied by the seller. An irrevocable credit can be either confirmed or unconfirmed depending on the desire of the desire of the seller. This sort of credit is always preferred to revocable letter or credit.

REVOLVING CREDIT: The revolving credit is one, which provides for resorting the credit to the original amount after it has been utilized. How much time it will be taking place must be specifically mentioned in the credit. The revolving credit may be either cumulative or non-cumulative.

TRANSFERABLE CREDIT: A transferable credit is one that can be transferred by the original beneficiary in full or in part to one or more subsequent beneficiaries. Such credit can be transferred once only. Fractions of a transferable credit can be transferred separately, provided partial shipments are not prohibited.

BACK TO BACK CREDIT: The back to back credit is a new credit opened on the basis of an original credit in favor or another beneficiary. Under back to back concept, the seller as the beneficiary of the first credit offers it as security to the advising bank for the issuance of the second credit. The beneficiary of the back to back to back credit may be located inside or the out side the original beneficiary’s country.

ANTICIPATORY CREDIT: The anticipatory credits make provision for pre-shipment payment to the beneficiary in anticipation of his effecting the shipment as per L/C conditions.

RED CLAUSE: When the clause of the credit authorizing the negotiating bank to provide pre-shipment advance to the beneficiary is printed typed in red, the credit is called “Red Clause letter of credit”

3.5. Parties to the Letter of Credit:

| The Applicant | Importer (Applies for L/C |

Issued BankIt is the Bank which opens issues a L/C on behalf of the importerConfirming BankIt is the Bank, which adds its confirmation to the credit and it, is done at the request of issuing Bank. Confirming Bank may or may not be advising bankAdvising or Notifying Bank

It is the bank through which the L/C is advice to the Notifying Bank exporter. This Bank is actually situated in exporter country. It may also assume the role of confirming and /or negotiating bank depending upon the condition of the L/CNegotiation Bank

It is the Bank which negotiated the bill and pays the amount to the beneficiary. The advising Bank and the negotiating bank may or may not be the sameAccepting bank

Sometimes it can also be confirming Bank accepting Bank lit is the Bank on which the bill will be drawn ( as per condition of the credit) usually it is the issuing BankReimbursing Bank

It is the bank ,which would reimburse the negotiating Bank after getting payment

4.0. Foreign Exchange Department of EXIM Bank

Foreign exchange is an important department of EXIM Bank Limited, which deals with import, export and foreign remittances. Foreign Exchange is an International Department of the Bank. It facilitates international trade through its various modes of services. It bridges between importers and exporters. This department mainly deals in foreign currency, that’s why it is called foreign exchange department.

This department is playing an important role in enhancing export earning, which aids economic growth and in turn it helps for the economic development. On the other hand, it also helps to meet those goods and service, which are most demandable and not adequate in our country.

4.1. Functions of Foreign Exchange Department:

The bank, which is authorized by Bangladesh bank for dealing foreign exchange business on transaction under the FER Act, 1947 is called Authorized Dealership. NCCBL, Kawran Brazar Branch is one of the Authorized Dealership Branch of NCCBL.

In EXIM Bank limited foreign exchange is divided in to three parts according to the major activities:

- Import oriented foreign exchange activities.

- Export oriented foreign exchange activities.

- Foreign Remittance Operation.

4.2. Import Section:

The function of this section is mainly to deal with various components such as:

- Letter of Credit (L/C)

- Payment against Document (PAD)

- Payment against Trust Receipt (PATR)

- Loan against Imported Merchandise (LIM)

There are a number of formalities, which on Importer has to fulfill before import goods. These formalities are explained bellow —

4.2.1. Import Registration Certificate (IRC):

The first thing one need to carry on a business of import is called Import Registration Certificate. But registration is not required for import goods, which do not involved remittance of foreign exchange like medicine; reading materials etc. can be imported without registration by the users within monetary limit. Documents to be required for Import Registration Certificate are as follows:

- Income Registration Certificate

- Nationality Certificate

- Certificate from Chambers of Commerce and Industry Registered Trade

- Association

- Bank Solvency Certificate

- Copy of Trade License

- Requisite fee

On receiving application, the respective CCI&E officer will scrutinize the documents and conduct physical verification and issue demand note to the prospective importers to furnish the following papers through their nominated Bank-

| Original copy of treasury deposited as IRC fees Assets Certificate |

Rent receipt

Affidavit from 1st class Magistrate

Two passport size photograph Partnership deed in case of partnership firms

Certificate of Registration, Memorandum and Articles of Association in case of Limited Company.

After scrutinizing and verifying, the nominated Bank will forward the same to the respective CCI&E office with forwarding schedule in duplicate through Banks representative. CCI&E then issue Import Registration Certificate to the Applicant.

4.2.2 Function of Import Section:

4.2.2.1. IMF-Form:

The form IMP contains the followings—

- Name and address of the Authorized dealers.

- Amount of remittance to be permitted (I .e. /C amount)

- LCA form no. Date and value in Taka.

- Description of goods.

- Invoice value in foreign currency, (I .e. /C amount)

- Country of origin.

- Port of shipment.

- Name of steamer / Airline

- Port of importation.

- Indenter’s name and address.

- Indenter’s registration number with CCI & E and Bangladesh Bank.

- Full name and address of the applicant.

- Registration number of the applicant with CCI & E.

- Type of LCAF

4.2.2.2 Import procedures:

The procedures, which follows at the time of Import are as, follow —

- The buyer and the seller conclude a sale contract provided for payment by documentary credit.

- The buyer instructs his Bank (the issuing Bank) to issue a credit in favor of the seller / Exporter / Beneficiary.

- The Issuing Bank then send message to another Bank (Advising Bank/Confirming Bank) usually situated in the country of seller, advice or confirms the Credit Issue.

- The Advising / confirming Bank then informs the seller through his Bank that the Credit has been issued.

- As soon as the seller receives the credit, if the credits satisfy him the he can reply that, he can meet its terms and conditions, he is in position to load the goods and dispatch them.

- The seller then sends the documents evidencing the shipment to the „! Bank where the Credit is available (nominated Bank). This can be the A issuing Bank or Confirming Bank; Bank named in the Credit as the paying, accepting and Negotiating Bank.

- The Bank then checks the documents against the credit. If the documents meet the requirements of the credit, the Bank then pay, accept or negotiate according to the terms of credit. In the case of credit available by negotiation, Issuing Bank will negotiate with recourse. The Bank, if other then the issuing bank, sends the documents to the issuing Bank.

- The issuing Bank checks the document and if they found that the document has meet the credit requirements, they realize to the buyer upon payment of the amount due or other terms agreed between him and the issuing Bank.

- The buyer sends transport documents to the carrier who will then proceed to deliver the goods.

An importer is required to have the followings to import through the bank:

- A bank account in the bank.

- Import Registration certificate.

- Tax paying identification number. S Performa invoice indent

- Membership certificate

- LCA (Letter of credit application) form duly attested.

- One set of IMP form.

4.2.2.3. Import Mechanisms:

To import, a person should be competent to be an importer. According to import and export control act, 1950, the officer of the chief controller of import and export provides the registration (IRC) to the importer. After obtaining this, this person has to secure a letter of credit authorization (LCA) from Bangladesh Bank and then a person becomes a qualified importer. He is the person who requests or instructs the opening bank to open an L/C. he is also called opener or applicant of the credit.

Step-1: Proposal for Opening of L/C:

In case of an L/C of a small amount only the prescribed application form i.e. the LCA (Letter of credit application) form is enough to open an L/C. but when the L/C amount is reasonably high, and then the importer is asked to submit a proposal to the bank authority to have a limit of L/C amount. This proposal should be approved in the meeting of the executive committee of the bank. The sufficient features of a proposal are —

- Full particulars of bank account.

- Nature of business.

- Required amount of limit.

- Payment terms and conditions.

- Goods to be imported.

- Offered security.

- Repayment schedule.

A credit officer scrutinizes this application and accordingly prepares a proposal (CLP) and forwards it to the Head office Credit Committee (HOCC). The committee, if satisfied, sanctions the limits and returns back to the branch. Thus the importer is entitled for the limit.

Step-2: L/C Application:

BDI provides a printed form for opening of L/C to the importer. This form is known as credit application form. A special adhesive stamp is affixed on the form. While opening, the stamp is cancelled. Usually the importer expresses his desire to open the L/C quoting the amount of margin percentage.

Letter of Credit Authorized (LCA) Form:

The LCA form contains the followings —

- Name and the address of the importer.

- IRC No. and year of renewal.

- Amount of L/C applied for.

- Description of items/to is imported.

- ITC number (s)/HS code.

- Stamp and signature of the importer with seal.

Step-3: Securitization of L/C Application:

The bank officials scrutinizes the application in the following manners-

- The terms and condition of the L/C must be complied with UCPDC 500 and Exchange control & import trade regulation.

- Eligibility of goods to be imported.

- The L/C must not be opened in favoring of the importer.

- Radioactivity report in case of food item.

- Survey reports or certificate in case of machinery.

- Carrying vessel is not of Israel or Serbia- Montenegro.

- Certificate declaring that the item is in operation not more than 5 years in case of car.

On scrutiny, if the application is found fit then the L/C is opened and particulars of the same are recorded in the L/C register. Then the transmission of L/C is done through tested Telex or Fax to advise the L/C to beneficiary. If the amount exceeds US$ 10,000 the bank takes the credit report of the beneficiary (CIB report) to ensure the worthiness of the supplying goods.

Amendment of L/C:

Parties involved in L/C, particularly the seller and the buyer cannot always satisfy the terms and conditions in full as expected due to some obvious and genuine reasons. In such a situation, the Credit should be amended. The bank transmits the amendment by tested telex to the advising bank. In case of revocable credit, it can be amended or cancelled by the issuing bank at any moment and without prior notice to the beneficiary. But incase of irrevocable letter of credit, it neither be amended nor cancelled without the agreement of issuing bank, the confirming bank (if any) and the beneficiary. If the L/C is amended, service charge and telex charge are debited from the party account accordingly.

Step-4: Presentation of the Documents:

The seller being satisfied with the terms and conditions of the credit proceeds to dispatch the required goods to the buyer and after that he has to present the documents evidencing dispatching of goods to the negotiating bank on or before stipulated expiry date of the credit. After receiving all documents, the negotiating bank, then checks the documents against the credit. If the documents are found in order, the bank will pay, accept or negotiate to bank. The usual documents are —

| Invoice |

Bill of lading

Shipping advice

Packing list

Certificate of origin Non negotiable copy of bill of Lading

Bill of exchange

Pre-shipment inspection report.

Shipment certificate

Step-5: Examination Documents:

Export Import Bank of Bangladesh Limited (EXIM) officials check weather these documents has any discrepancy or not. Here discrepancy means the dissimilarity of any documents with the terms and conditions of L/C.

Check lists of find our discrepancy:

Whether the presentation date is latter than the date of L/C expire date

- Commercial invoice-How many

- Packing list-How many

- Delivery Challan date is greater than the last shipment date

- Export L/C is written in all the document

- Amount is correct

- Whether the shipment is partial check in the L/C

- Bill of Exchange is dully presented

- In delivery Challan there is counter signature by the proprietor of Importer

- If the L/C is for cotton Yarn, than check whether they have submitted mushok-11 BTMA certificate of production and country of origin etc.

Step-6: Retirement of Shipping Documents:

On security if it is found that, the documents drawn are in order EXIM, lodges the documents in PAD and few vouchers are passed.

Retirement or Import Bills:

- Importer will deposit the claim amount

- Banker will prepare and pass Retirement Vouchers

- Certifying Invoices

- Passing of Vouchers

- Entry in the Register

- Endorsement in the B/E and transport document i.e. B/L AWB, TR etc.

At the end of the total procedure, taking the retirement of Import Bills/Clearing Certificate from the Bank, the Importer will clear the goods from the port through the Clearing Agent and Forwarding Agent.

On the other hand, completing the above all steps in the issuing Bank will prepare “Foreign Exchange Transaction Schedule” and send one copy to international division of Head Office and another one copy to recommendation.

4.2.2.4. Payment Procedure of the Import Documents:

This is the most sensitive task of the import department. The officials have to be very much careful while making payment. The task constitute the followings-

- Date of payment- Usually payment is made within seven days after the documents have been received. If the payment is become differed, the negotiating bank may claim interest for making delay.

- Preparing sale memo- a sale memo is made at B.C rate to the customer. As the TT & O.D rate is paid to the ID, the difference between these two rates is exchange trading. Finally an inter branch exchange trading credit advice is sent to ID.

- Requisition for foreign currency- for arranging necessary fund for payment a requisition is sent to the ID.

- Transmission of telex- a telex is transmitted to the correspondent bank ensuring the payment is being made.

4.2.2.5. Loan against Imported Merchandise (LIM):

If the importer does not come to negotiate the shipping documents from the issuing bank then it creates LIM through the bank clears the goods from the port and holds the goods in its warehouse beside the above as soon as the imported goods come to the port the party may fall into financial crisis and request the bank to clear the goods from the port making payment to the exporter, in this case the party later may take the goods partly or fully from the banks by making required payment (if he/she takes the goods time to time payment will be adjusted simultaneously).

4.3. Export Section:

By the term Export, we mean that carrying of anything from one country to another. On the other hand Banker’s define Export as sending of visible things outside the country for dale. Export Trade plays a vital role in the development process of an Economy. With the Export earning, we meet our Import Bills.

The export trade of the country is regulated by the Import and Export (Control) Act, 1950. There are some formalities, which an exporter has to fulfill before and after shipment of goods. No exporter is allowed to export any commodity from Bangladesh unless he/she is registered with Chief Controller of Export & Import (CCI&E) and holds valid Export Registration Certificate (ERC). The ERC is required to be renewed every year and this task is generally done by the bank. As per instruction by Bangladesh Bank, the bank has to report respective department of Bangladesh bank by mentioning latest payment.

4.3.1 Export Registration Certificate (ERC):

Similar to any other business, exporters are required to obtain ERC from the offices of the Chief Controller of Import and Export (CCI&E). No person is allowed to export any goods from Bangladesh without obtaining such ERC. For Registration, prospective Exporters required to submit the following documents —

|

|

On receipt of the above documents to the office of CCI&E, the applicant is required to deposit required registration fee to the treasury office and receipted Challan should be sent to CCI&E office for enabling there to issue ERC. Every year registered exporters are to make payment of prescribed fee towards renewal of ERC.

4.3.2. Function of Export Section:

4.3.2.1 The Export (EXP) Form:

Foreign Exchange Regulation (HER) Act- 1947 prohibit export of any goods directly or indirectly to any place outside Bangladesh unless the exporter furnish a declaration to the effect that the export value of goods has been or will be repatriated into the country within a period time specified by the Bangladesh Bank. So, repatriation of exportproceeds is mandatory for all exported good or services. Accordingly, before shipment of goods an exporter must declare on Export form (Exp) prescribed by Bangladesh Bank and issued by the Authorized Dealer (Exporters Bunk). The EXP forms are numbered serially and issued in quadruplicate. For delay in repatriation of export proceeds or non-realization of export proceeds, the exporters render themselves for action under Foreign Exchange Regulation Act 1947. Authorized Dealers (AD) and their officials who certify the export forms also render themselves of such action by the Central bank.

Disposal of Export Form:

| Original |

From Custom Authority to Bangladesh Bank after shipment goods.

Duplicate

From Negotiating Bank to Bangladesh Bank after Negotiation.Triplicate

From Negotiating Bank to Bangladesh Bank after realization of the proceeds of the ExportQuadruplicate

Retained by the Negotiating Bank as Office Copy.

4.3.2.2. Followings are Need to be examined:

L/C Terms:

Each and every clause in the L/C must be complied with meticulously and ensure the

Following –

- Documents are not stale

- Documents are negotiated within the L/C validity. If credit expires on a recognized bank holiday its life is automatically valid onto the next working day. This is to be stipulated on the documentary schedule.

- Documents value does not exceed the L/C value.

Draft:

Draft is to be examined as under

- Draft must be dated

- It must be made out in the name of the beneficiary bank to be endorsed to the order of the bank

- Bank must verify the signature of the drawer 4- Amount must be tallied with the invoice amount

- It must be marked as drawn under L/C No, date, issued by, bank.

Invoice:

It is to be scrutinized to ensure the followings —

- Invoice is addressed to the importer

- Full description of merchandise as per L/C

- Price, quantity, quality must be as per L/C terms

- Must be language in the language of L/C

- No other charges are permissible in the invoice beyond the stipulation on the L/C

- The amount of draft and invoice must be same and within the L/C value

- Required number of invoice must be submitted

- Shipping mark and number of packing list must be identical

- Invoice value must not be less than the value of declared in EXP form.

- Must be correct on the basis of price, quantity as appear L/C

4.3.2.3. Export Procedure:

A person eager to export should make application to obtain ERC from CCI&E office. Then the person should take step for export purpose into the bank for obtaining EXP form. He must submit following documents:

- Trade license

- Export Registration Certificate (ERC)

- Certificate from concerned Government Organization

After satisfaction on the documents the banker will issue EXP form to the exporter. Now exporter will be getting shipping and other documents from the shipment procedure. Exporter should submit all these documents along with letter of indemnity to his bank for negotiation.

4.3.2.4. Discrepancy and Industry:

After the shipment of goods, the exporter submits export documents to authorized dealer for negotiation of the same. Here authorized dealer is exporter’s bank. The banker is to ascertain that documents are strictly as per the terms of L/C before negotiation of the export bill; the banker should scrutinize and examine each and every document with great care & must be go through the original L/C in the time of scrutiny. Any kind of lacking can be classified as major or minor. There may be some discrepancies which are removable. If the discrepancies are minor, the export bill against submission of indemnity. Documents with discrepancy should be negotiated. With the permission of the exporter, such documents are to be sent on collection.

4.3.2.5. Negotiation:

At the time of negotiation the checklist or required documents are as follows –

- Commercial Invoice 8 copies (4 original)

- Custom Invoice of Importer’s Country

- Packing List 8 copies (4 original)

- Original Certificate of Origin

- Inspection Certificate by the Agent of Importer

- Acknowledgement Letter

- Frightful Letter etc.

All the documents are found strictly as per terms and conditions of L/C i.e. if the documents are free from discrepancies or if the discrepancies are covered by Indemnity of the party, bank has to negotiate the Export Bill for negotiation of cash export bills, the O.D buying rate prevailing on the date of negotiation is applied conversion of the foreign currency into Bangladesh currency. All transactions are reported through F.E.T sent daily to the international division Head Office, Dhaka. On receipt of the F.E.T the head office credits the FBNA Account by debit the balance with foreign Banks abroad Account after the process of the bill is realized. After negotiation of the export bills, the documents are to be sent abroad (normally to the L/C Issuing Bank) as per the instructions of L/C & claim reimbursement of the proceeds from the bank as mentioned in the L/C.

4.3.2.6. Risk in Negotiation:

If the Bank failed to indemnify any discrepancy in documents prepared by the Exporter and if bank paid the demanded amount, bank will face huge loss. At that time, the Negotiating Bank personally try to contact with party and if they agree to deliver the required documents then the bank may get rid out from huge loss otherwise not. So, Banker-Customer relationship is very important in this regard. Bank need to be very careful at the time of negotiation.

4.3.2.7. Banks Profit through Negotiation:

A question can arise that if the risks involved there, why banks will go for negotiation. Because –

- At first, through negotiation bank will earn a certain commission from the party without involving any fund.

- Bank will earn US$ from reimbursing bank from the foreign and bank is also earning commission from that.

- If the payment make overdue, on that time branch of the concerned bank will earn interest from that amount.

4.3.2.8. Back To Back L/C (BTB L/C):

- Back To Back L/C Opens:

It is a secondary letter of credit opened by the advising bank in favor of a domestic/foreign supplier on behalf of the beneficiary original foreign L/C. As the original letter of credit of bank by import letter, it is called Back-to-Back L/C. The second L/C is opened on the strength of the original L/C for a smaller amount.

- Back To Back L/C (Foreign):

When the B-To-B L/C is opened in a foreign country supplier it is called B-To-B L/C (Foreign). It is generally payable within 120 days at site.

- Back L/C (Local);

When the Back-to-Back L/C is opened for local purchase of materials, it is called Back-to-Back L/C (Local). It is generally payable within 90 days at site.

- Back To Back L/C Export Development Fund (EOF):

EOF provided by the ADB to Bangladesh Bank for export promotion of Third-World-Country like Bangladesh. When the bank is not in a position to support the amount of B-to-B L/C then they apply for loans to the Bangladesh Bank for B-To-B (EOF).

4.3.2.9. Procedures for Back To Back L/C:

- Exporter should make application for Back to Back LAC

- Export L/C or Master L/C under is lien

- Opening of Back to Back L/C

- Terms and conditions for Back to Back L/C

- That the customer has credit line facility

- That L/C is issued as per UCPDC 500

- That on the Export L/C a negotiating clause is present

- That there is no provision for blank endorsement of B/L

- That payment clause is thereon the L/C issuing bank ensuring payment

Consideration for Back To Back L/C:

- Whether client can manufacture within time period

- The unit price of the finished pro-forma invoice should be considering while allowing margin

- Consider the expiry date and shipment date

- Onside inspection whether manufacturing is carried out

Payment under Back To Back L/C:

Deferred payment is made in case of BTB L/C as 60, 90,120, 180 date of maturity period. Payments will be given after realizing export proceeds from the L/C issuing bank from the abroad.

4.3.2.10. Reporting of Bangladesh Bank:

At the end of the every month reporting of Bangladesh Bank is mandatory regarding the whole month export operation, the procedures in this respect is as follows —

- To fill-up the E-2/P-2 schedule of S-l category. The whole month import amount, quantity, goods category, country, currency, etc. all are mentioned. Respective IMP forms are attached with the schedule to fill E-3/P-3 for all invisible payment.

- Original IMP is forwarded to Bangladesh Bank with mentioning invoice value

- Duplicate IMP is skipped with the bank along with the bill of entry.

4.3.2.11. Documentation for Export Purpose:

Following major documents are required for export purpose —

|

|

4.3.2.12. Procedure for collection of Export Bill:

There are two types of procedures regarding collection of Export Bill —

- Foreign Documentary Bill for Collection (FDBC)

- Foreign Documentary Bill for Purchase (FDBP)

Foreign Documentary Bill for Collection (FPBC):

Exporter can collect the bill through negotiating bank on the basis of collection. Exporter in this case, will submit all the documents to the negotiating bank for collection of bill from importer. The exporter will get money only when the issuing bank gives payment. In this connection bank will scrutinize all the documents as per terms and conditions mentioned in L/C.

Foreign Documentary Bill for Purchase (FDBP):

When exporter sale all the export documents to the negotiating bank is known as Foreign Documentary Bill Purchase (FDBP). In this case, the exporter will submit all the documents to the bank. The bank gives 60-80% amount to the exporter against total L/C value.

4.3.2.13. Local Document Bill for Purchase (LDBP):

Incoming of L/C customer come with the L/C to negotiate

- Documents given with L/C.

- Scrutinizing documents as per L/C terms and conditions.

- Forward the documents to L/C opening bank.

- L/C issuing bank give acceptance and forward acceptance letter.

- Payment given to the party by collection basis or by purchasing documents.

4.3.2.14 Secure Over-Draft (SOD) Export:

Secured Overdraft is one kind of credit facility enjoying by the exporter from the export section. It is generally given to meet the back-to-back L/C claim. Sometimes it is given to the exporter by force for meet the back-to-back L/C claim due to delay of Master L/C payment.

4.3.2.15 Packing Credit (PC):

It is one kind of credit sanctioned by the export department to meet the exported goods shipment timely. Packing credit is granted to pay salary, wage& other related factory expenses of processing the imported products. The bank will give the facility after deduction of back-to-back.

4.4. Foreign Remittance

Fund transfer from one country to another country goes through a process which is known as remitting process. Suppose a local bank has 200 domestic branches and has the corresponding relationship with a foreign bank say-“X”, maintaining “Nostro Account” in US$ with the bank. Bangladeshi expatriates are sending foreign remittance to their local beneficiary, through that account. Now, when the Bangladeshi expatriates through other banks of different countries remit the fund to their teNostro Account” with “X”, then the local bank’s Head office international division will receive telex message and the remittance section will record the advice and generate the advice letter to the respective branch of the bank. The branch will first decode the test, verify signature and check the account number and name of the beneficiary. After full satisfaction, the branch transfers the amount to the account of the beneficiary and intimates the beneficiary accordingly. But sometimes complexity arises, if the respective local bank has no branch where the beneficiary maintains his account. Then the local bank has to take help of a third bank who has branch there.

Export Import Bank of Bangladesh Limited (EXIM) Bank is the Authorized Dealer (AD) to deal in foreign exchange business, as an authorized dealer, bank must provide some services to the clients regarding foreign exchange and this department provides the service of remitting foreign currencies from one country to another country. In the process of providing this remittance service it sells and buys foreign currency, the conversation of one currency into another takes place at an agreed rate of exchange , which than Banker quote one for buying and another for selling.

4.4.1. Foreign Currency Remitting Procedures:

There are two types of remittance:

4.4.1.1. Inward Remittance:

Inward remittance covers purchase of foreign currency in the form of foreign Telegraphic Transfer (T.T), Demand Draft (DD) and Bills & Travelers Cheque, Export Bill etc. sent from abroad favoring a beneficiary in Bangladesh, purchase of foreign exchange is to be reported to Exchange Control Department of Bangladesh Bank on from – letter of Credit (L/C). Basically, these are the formal channels of receiving inward remittance. A local bank also receives indenting commission of local firm also comes under purview of inward remittance.

4.4.1.2. Outward Remittance:

Outward remittance covers sales of foreign Currency by Authorized Dealer (AD) or Formal Channel through issuing foreign Telegraphic Transfer (T.T), Demand Drafts (D.D), Traveler’s Cheque etc. as well as sell of foreign exchange under L/C and against Import Bills retired. The Authorized Dealers have to demonstrate utmost caution to ensure that foreign currencies remitted or released by them are used only for the purposes for which they are released. Most outward remittance is approved by the authorized dealer on behalf of Bangladesh Bank.

Outward Remittance may be made for following purposes-

- Travel

- Medical Treatment

- Educational purpose

- Attending Seminar

- Balance Amount of Foreign Currency Account

- Profit of Foreign Companied

- Technical Assistance

- Letter of Credit (L/C) payment

- Fair, Exhibition for export promotion.

Foreign Remittance can be transferred in two ways:

4.4.2.1. Formal Channel:

Fund transfer from one country to another country through official channels, i.e. banking channel, post office and other private service channels, such as – Western Union Money Transfer, Neno Money Order, Money Exchanger etc.

The Legitimate purposes of moving money abroad through formal channel are –

- To invest

- To Lend

- To meet Trading/Personal Obligations

- To safeguard assets against theft or seizure by repressive regimes

4.4.2.2. Informal Channel:

Fund transfer from one country to another country through hand by hand or over telephone in an unofficial channel like – “Hundi”. Experts state that remittance collected by informal “Hundi” rings are used to finance illegal trade and transaction. Terrorist financing is also made by this sort of channel

Criminals use informal channel for moving money abroad because of-

- Dealing in arms & ammunitions

- Drug trafficking

- Financing terrorists’ activities

- Evasion of exchange regulations/control

- Evasion of taxation

- Disguise or remove proceeds of threat/fraud/bribe

- Making blackmail payments

- Paying random for Kidnappers

4.4.3. Income of the Bank in Foreign Exchange Sector:

- Commission on opening a BTB L/C which is determined on the basis of “Bills for Collection” selling rate.

- 0.45% commission on the deferred L/C for 120 days & .30% commission on the deferred L/C for 90 days if the applicant bank accepts the bill for payment (ABP) in respect of its applicant.

- Tk.500 for shipping guarantee to the customs department of the port if the applicant wants to discharge the imported products before receiving the documents related to export. The bank acts as a guarantor taking all responsibilities related to payments.

- 7-10% interest rate on packing credit.

5.0. Analysis of the particular Topic:

In my internship report my selected topic is Foreign Exchange Operation of EXIM bank and I am trying to analyze this part both qualitative and quantitative.

5.1. Qualitative Analysis:

SWOT Analysis:

SWOT Analysis is the detailed study of an organization’s exposure and potential in perspective of its strength, weakness, opportunity and threat. This facilitates the organization to make their existing line of performance and also foresee the future to improve their performance in comparison to their competitors. As though this tool, an organization can also study its current position, it can also be considered as an important tool for making changes in the strategic management of the Foreign Exchange activities.

Strengths:

- In Foreign Exchange Business EXIM Bank provides their services successfully and have achieved goodwill among the shariah based banks.

- In this sector the Bank is working with its efficiency and integrity.

- EXIM bank introduced first specialist banking service in Export Import sector.

- EXIM bank foreign exchange department communicate with foreign banks frequently and quickly.

- EXIM bank has a very competent and experienced top Management. The bank has already shown a tremendous growth in the profits and deposits sector.

- As an expertise and shariah based bank public reliable for their service.

- EXIM Bank has low Cost Fund

Weaknesses:

- In foreign Exchange Operations sector, EXIM bank investment is so much poor.

- EXIM bank Remittance investment so poor then other investment.

- Export Import Bank of Bangladesh Limited has not introduced online banking system which has an increasing public demand now a day.

- There is no separate customer care department, which can work solely with customer care and for continuous improvement of services.

- Shortage of manpower in every division. So during the working hour the employees can’t provide proper attention to the customer that enhances customer dissatisfaction.

Opportunities:

- Export Import Bank of Bangladesh Limited has a lot of growth opportunities in the consumer banking, money market operations & also export-based industries due to global economic recovery.

- EXIM has a chance to increase invest in remittance business.

- It does not foresee exciting any of its business lines since it maintains balanced portfolio & it is well-positioned to increase out-thrust into diversified interests.

- They have a big opportunity if they provide online Banking system.

- They do not look forward to increase their product or service basket.

Threats:

- The major challenge of Export Import Bank of Bangladesh Limited is there are already many financial institutions sharing the same size of the pie. As a result there is intense competition for generating business. Furthermore, due to the dual effect of competition & reduced rates (to the benefit of the borrower) they will find it challenging to bring their cost of fund to an acceptable level & yet maintain our high level of quality assets in our books & ensure our NPA(Non Performing Assets) is at an acceptable level.

- The emergence of several private & foreign banks within the post few years offering similar or more services with less or free charge for the facilities can be a major threat for the bank.

Overburden with regulations & frequent changes of policies create problems in adapting clients & complying with rules, which adversely affect the business.

5.2. Quantitative Data Analysis:

Analyzing the financial performance (also called financial analysis) is so much essential for each and every business institution as well as for the Banking institutions to assess their past financial performance and to identify the sources, where the necessary improvement is needed to perform better in the future and to meet the future challenges by taking effective business strategy.

5.2.1. Trend Analysis:

(Amount in crore)

| Particulars | Y2005 | Y2006 | Y2007 |

| Import Business | 4143.20 | 4949.67 | 6139.94 |

| Export Business | 3128.50 | 4623.46 | 5579.04 |

| Remittance | 117.58 | 137.87 | 190.82 |

| Total Foreign Exchange Business | 7294.00 | 9617.51 | 11790.01 |

5.2.2. Ratio analysis:

Ratio analysis involves the methods of calculating and interpreting the financial ratios to analyze the firm’s relative financial performance. The main purpose of this analysis is to analyze and monitor the firm’s financial performance, so, that the interested parties (both the external and internal) can realize the firm’s actual performance easily and conveniently, which is so much essential for the parties.

Ratio calculated as: Import ratio = Import / total foreign exchange

(Amount in %)

| Particulars | Y2005 | Y2006 | Y2007 |

| Import Ratio | 0.568029 | 0.514652 | 0.520775 |

| Export Ratio | 0.428914 | 0.480734 | 0.473201 |

| Remittance Ratio | 0.01612 | 0.014335 | 0.016185 |

6.0. Comparative Analysis:

Performance Evaluation in 2007 of Export Import Bank of Bangladesh Limited with the Islami Bank Bangladesh Limited.

6.1. Islami Bank Bangladesh Limited:

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Islami Bank Bangladesh Limited on March 13, 1983, is the true reflection of this inner urge of its people, which started functioning with effect from March 30, 1983. This Bank is the first of its kind in Southeast Asia. It is committed to conduct all banking and investment activities on the basis of interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent personalities of the Middle East and the Gulf countries, Islami Bank Bangladesh Limited has by now earned the unique position of a leading private commercial bank in Bangladesh.

6.2. Qualitative Analysis of Islami Bank compare to EXIM Bank:

SWOT Analysis:

Strengths:

- The foremost Strength of the bank is that they follow Muslim method.

- Good investment portfolio. Comfortable Liquidity position

- IBBL Foreign Exchange Business is so much strong.

- Wide branch network

- They have skillful and good combination of young and experience workforce.

- Now a days their promotional activities is rich than other private bank.

- Their rules and regulation is very tight.

- High market share .If the company is able to keep the growth rate that is a great strength for them. The overall performance of the company was satisfactory in the year under review and maintained healthy growth rate.

Weakness:

- They haven’t any strong advertisement.

- Customer service is not so much good.

- Lack of proper supervision.

- Lack of skilled manpower.

- Unfavorable business environment.

- Limited modern customer service facilities

- Moderate recovery of rescheduled investments

- High large investment exposures

- Initial stage of system based internal control procedures

Opportunities:

- Real time online banking

- Credit card in dual currency

- Creation of Islamic Money market product

- Introduce above 5 years Islamic bond

- Day by day their investment income is increasing.

- A highly profitable market.

- Increasing deposits.

Threats:

- New entrant: Any newly established bank is a threat for IBBL. Newly established bank can capture the market share of IBBL. Such as Al Arafah Bank, Shahjalal Islami Bank, Exim Bank.

- Market pressure for increasing the SLR

- Overall liquidity crisis in money market

- Government pressure to reduce investment rate

- Increase the capital adequacy position

- Threat from the competitor: Business firms are always threatened by the competitors. So IBBL can also face threat from their competitors. Such as Al Arafah Bank, Shahjala Islami Bank, Exim Bank.

- Another threat is the technology, the bank must be adjusted with new technologies and information

- A slump in the economy that could have a negative effect on people’s spending of discretionary income.

6.3. Comparative Quantitative Data Analysis of EXIM bank with Islami bank:

6.3.1. Trend Analysis:

(Amount in Crore)

Figure: 10, Source: Annual report 2006-07

| Particulars | Y2005 | Y2006 | Y2007 | |

| Islami Bank | Import Business | 7452.5 | 9687 | 13708.6 |

| Export Business | 3616.9 | 5113.3 | 6669 | |

| Remittance | 3694.8 | 5381.9 | 8414.3 | |

| Total Foreign Exchange Business | 14764.2 | 20182.2 | 28791.9 | |

| EXIM Bank | Import Business | 4143.20 | 4949.67 | 6139.94 |

| Export Business | 3128.50 | 4623.46 | 5579.04 | |

| Remittance | 117.58 | 137.87 | 190.82 | |

| Total Foreign Exchange Business | 7294.00 | 9617.51 | 11790.01 |

Import Business:

Import sector, as we see the above trend we can say that the IBBLs Import business is much higher than the EXIM Bank Import business. Though the both banks Import business is upward trend, we hope that the EXIM Bank can increase their total Import business in near future.

Export Business:

In export, as we see the above trend we can say that the IBBLs Export business is much higher than the EXIM Bank Export business. Though the both banks Export is upward trend, we hope that the EXIM Bank can increase their Export business in near future.

Foreign Remittance :

In foreign remittance, as we see the above trend we can say that the IBBLs is much higher than the EXIM Bank. We hope that the EXIM Bank can increase their Remittance business in near future.

Overall Foreign Exchange Business:

Overall foreign exchange business sector, As we see the above trend we can say that the IBBLs total Foreign Exchange business is much higher than the EXIM Bank. Though the both banks is upward trend, we hope that the EXIM Bank can increase their total foreign exchange business in near future.

6.3.2 Ratio Analysis:

Ratio calculated as: Import ratio = Import / total foreign exchange

(Figure in %)

Particulars | Y2005 | Y2006 | Y2007 | |

| Islami Bank | Import Ratio | 0.504768 | 0.479977 | 0.476127 |

Export Ratio | 0.244978 | 0.253357 | 0.231628 | |

Remittance Ratio | 0.250254 | 0.266666 | 0.292245 | |

| EXIM Bank | Import Ratio | 0.568029 | 0.514652 | 0.520775 |

Export Ratio | 0.428914 | 0.480734 | 0.473201 | |

Remittance Ratio | 0.01612 | 0.014335 | 0.016185 |

Figure: 11, source: calculate from annual report 2006-07

Import Ratio:

As we see the above chart we can say that the IBBLs import ratio is much higher than the EXIM Bank. Though the both banks show fluctuating trend, we hope that the EXIM Bank can improve their import ratio in near future.

Export Ratio:

As we see the above chart we can say that the EXIM export ratio is much higher than the IBBL. Though the both banks Foreign Exchange Business is upward trend, we hope that the EXIM Bank maintain their export ratio in near future.

Remittance Ratio:

As we see the above chart we can say that the IBBLs total Foreign Exchange Business is much higher than the EXIM Bank total Foreign Exchange Business. Though the both banks Foreign Exchange Business is upward trend, we hope that the EXIM Bank can increase their total Foreign Exchange Business in near future.

7.0. Findings

This study is focused on the Foreign Exchange Business of EXIM Bank. Now I will discuss in brief, what I have found after this research under the strength, weakness and success status of Foreign Exchange Business.

7.1. Findings of EXIM Bank:

- EXIM bank foreign exchange department communicate with foreign banks frequently and quickly.

- Modern technical equipment such as computer is not sufficient in foreign exchange department. As a result the exchange process makes delay and it is also complicated.

- EXIM Bank is the largest of the state-owned commercial banks that come into being in the year of 1999 through the merger of branches of some banks EXIM Bank has total of 15 branches as of 31st December 2002.

- EXIM bank remittance business so poor.

- EXIM Bank’s management information system and financial information system have been restructured over the recent years to keep pace with the process of development.

- The projects must be productive so as to maintain the streams of the yield that would ascertain the effectiveness and the velocity of the credit.

- Peoples are interested to doing business with this bank.

7.2. Findings of Islami Bank Bangladesh Limited:

- IBBL’s mainly focused on Islamic banking not in foreign exchange business.

- IBBL’s is not so expert in foreign exchange business.

- IBBL’s conduct interest-free banking.

- IBBL’s establish participatory banking instead of banking on debtor-creditor relationship.

- IBBL’s establish a welfare-oriented banking system.

- IBBL’s contribute towards balanced growth and development of the country through investment operations particularly in the less developed areas.

- IBBL’s conduct social welfare activities through Islami Bank Foundation.

7.3. Comparative Findings on EXIM bank & Islami Bank:

There are some products and services which are differs EXIM bank from Islami bank. And those are differences are mention bellow