Introduction:

It was great opportunity for me to doing my internship program such leading commercial bank “Arab Bangladesh Bank Ltd.” This internship study was assigned as a part of the course requirement in order to complete my Bachelor degree program. To support my internship report I worked as an intern (at least ninety days) (Head Office) in Arab Bangladesh Bank Limited and my topic is Credit Management in Arab Bangladesh Bank Limited as part of the fulfillment of internship requirement. One of most significant challenges for a bank is to be strongly manages its credits. Since the largest slice of income generated by a bank and a major percentage of assets is subject to this credit, it is obvious that prudent management of this credit is fundamental to the sustainability of a bank.

Objective of the study:

The broad objective of preparing this study is to get an overall idea about the credit management system in banking sector by working in the practical world.

And the specific objectives of this study are as follows:

- To gather experience on field work.

- To find out whether the real life situation is matched with the theories or not.

- To learn the application of banking credit activities.

- To be capable of doing both quantitative as well as qualitative analysis.

- To get an idea about the credit management system of banking in Bangladesh

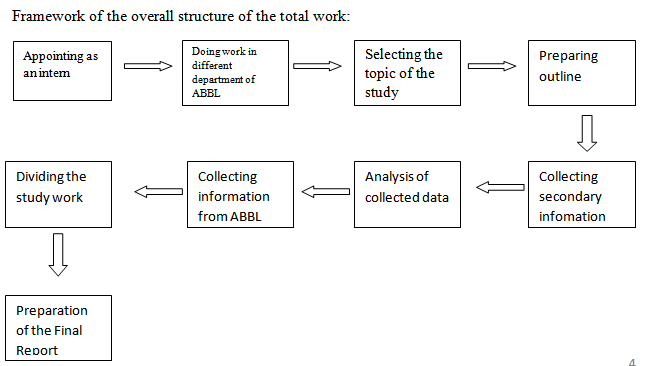

Methodology of the study :

I use both primary and secondary data for collecting information.

How I went through the process is mentioned here.

Primary Data:

Data has been collected primarily through correspondence with the personnel working in different department of ABBL. Personnel of the Head Office. (Credit division).

Secondary Data:

Sources of secondary data are showing below by the following table for easy and quick understanding.

Table sources of Secondary information

| Sources | Validity | Reliability | Practicality |

| Annual report of 2008 | Moderate | High | High |

| Internet | High | High | High |

| Text book | High | High | High |

Limitations of the study:

In preparation the study, I have experienced some keen problems that have, to some extent, affected the arrangement of the study. The problems were-

- · Time frame for the research was very limited.

- · Large –scale research was not possible due to constraints.

- · In many cases, up to date information is not published.

- · The information regarding the competitors is difficult to get.

- · Time was one of the concerns for not having the exact scenario.

- · And it is my first work and inexperience was a problem

- · Entrance to every nock and corner of the bank was not possible.

An overview of Arab Bangladesh Bank Ltd.

History of Arab Bangladesh Bank Limited:

AB Bank Limited, the first private sector bank under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh on 31st December 1981 and started its operation with effect from April 12, 1982.

Dubai Bank Limited (name subsequently changed to Union Bank of the Middleast Limited) decided to off-load their investment in AB Bank Limited with a view to concentrate their activities in the UAE in early part of 1987 and in terms of Articles 23A and 23B of the Articles of Association of the Company and with the necessary approval of the relevant authorities, the shares held by them in the Bank were sold and transferred to Group “A” Shareholders, i.e. Bangladeshi Sponsor Shareholders.

As of December 31, 2007; the Authorized Capital and the Equity (Paid up Capital and Reserve) of the Bank are BDT 2000 million and BDT 4511.59 million respectively. Authorized Capital of the Bank has been increased to BDT 3000 million in the Extra Ordinary General Meeting held on July 16, 2008.

Since beginning, the bank acquired confidence and trust of the public and business houses by rendering high quality services in different areas of banking operations, professional competence and employment of the state of art technology.

During the last 28 years, AB Bank Limited has opened 77 Branches in different Business Centers of the country, one foreign Branch in Mumbai, India and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with over 220 international banks of repute across 58 countries of the World.

AB Bank Limited, the premier sector bank of the country is making headway with a mark of sustainable growth. The overall performance indicates mark of improvement with Deposit reaching BDT 53375.35 million, which is precisely 26.85% higher than the preceding year. On the Advance side, the Bank has been able to achieve 30.76% increase, thereby raising a total portfolio to BDT 40915.35 million, which places the Bank in the top tier of private sector commercial banks of the country.

On account of Foreign Trade, the Bank made a significant headway in respect of import, export and inflow of foreign exchange remittances from abroad.

Since beginning, the bank acquired confidence and trust of the public and business houses by rendering high quality services in different areas of banking operations, professional competence and employment of the state of the art technology. AB bank Ltd celebrates their 28th anniversary during this year on April 12, 2010.

The root ABBL shown below at a short look:

| Position in banking sector | First Private Bank |

| Parent Bank | Dubai Bank Ltd. |

| Date of starting operation | April 12th 1982 |

| First Chairman | Mr.M. Matiul Islam |

| First Managing Director | Mr. Hafizul Islam |

VISION STATEMENT

“To be the trendsetter for innovative banking with excellence & perfection”

MISSION STATEMENT

“To be the best performing bank in the country”

Organization and Management Structure of AB Bank Ltd.

AB Bank Limited, the first private sector bank under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh on 31st December 1981 and started its operation with effect from April 12, 1982.

Dubai Bank Limited (name subsequently changed to Union Bank of the Middleast Limited) decided to off-load their investment in AB Bank Limited with a view to concentrate their activities in the UAE in early part of 1987 and in terms of Articles 23A and 23B of the Articles of Association of the Company and with the necessary approval of the relevant authorities, the shares held by them in the Bank were sold and transferred to Group “A” Shareholders, i.e. Bangladeshi Sponsor Shareholders.

Management Structure:

Major departments of Arab Bangladesh Bank Limited:

General Banking Department:

General Banking Department usually performs a lot of important banking activities. General banking department is that department which is mostly exposed to the maximum number of bank customer. It is the introductory department of the bank to its customer.

Local Remittance Department:

ABBL has its branches spared throughout the country and therefore, it server as best mediums for remittance of funds from one place to another. This service is available to both customer and non-customer of the bank. The department, which provides the facility, is known as local remittance department.

Remittance of fund:

1) Local Draft(L.D)

2) Pay order(P/O)

Financial Control Department:

Maintaining Authority in Services

Financial control department is called as the center of the bank. In banking business transaction are done every day is their transaction are to be recorded properly and systematically as the banks deal with the depositors money. Any deviation in proper recording many hamper public confidence and bank has to suffer a lot otherwise. Improper recording of transaction will lead to the mismatch in the debit side and the credit side. To avoid these mishaps, the bank provides a separate department, whose function is to check the mistake in passing voucher in wrong entries or fraud or forgery. This department is called Financial Control Department (FCD)

Foreign Exchange Department:

Providing international trade & communication with the world commercial banks deal with both internally and externally foreign correspondence. These correspondences are conducted through foreign currency and the department deals with this business are called “Foreign Exchange Department”. Arab Bangladesh Bank Ltd. Form the very beginning of its operation had a view towards globalization. It has 28 authorized dealer braches all over the country from where their international and foreign exchange related business are transacted.

|

The organizing structure of the Foreign Exchange Department of ABBL is shown through a flow chart in the below:

Credit and loan department of AB Bank Ltd:

The Credit and Loan department of AB Bank Ltd divided into two Sections

- Credit service department

- Loan Administration department

Loan and Advances of AB Bank Ltd.:

Credit activities during the year 2009, was vibrant registering significant growth. Total loans and advances at the end of the year increased by. Tk. 1482 core or 17% over the preceding period. This due to an increase in commercial and trade financing, term lending and working capital support.

AB Bank continued to support long-term loan under syndicate financing to augment the industrialization process. This include cement Manufacturing, modern poultry and hatchery, agro-processing and setting up of intermediary industries.

The consumer credit scheme also gained momentum this year, besides other credit schemes like, PC loan scheme and Educational loan Scheme.

AB Performance in Loan and Advance

Financial and others performance of ABBL:

(Figure in million Taka)

| particulars | 2008 | Changes % | 2007 | 2006 | 2005 |

| Operating Profit Net Operation Profit Profit after Tax | 4292.39 3600.62 2300.62 | 29.26 27.77 20.86 | 3325.29 2817.99 1903.49 | 710.69 532.19 532.19 | 755.03 407.45 162.45 |

| Authorized Capital Paid up Capital Statuary & other Reserves Shareholder’s Equity | 3000.00 2229.79 2702.95 6722.51 | 50.00 200 30.42 49.01 | 2000.00 743.26 2072.54 4511.59 | 2000.00 571.74 1456.47 2582.76 | 800.00 519.76 826.33 1526.88 |

| Deposits Loan and advances Investment Fixed assets Total assets | 68560.47 56708.77 11408.54 2444.65 84053.61 | 28.45 38.60 28.41 2.67 32.26 | 53375 40915.35 8884.60 2381.00 63549.86 | 42077.00 31289.25 6281.37 1148.46 47989.34 | 27361.44 21384.63 4060.95 370.06 33065.40 |

| No. of Branches | 72 | 1.41 | 71 | 68 | 67 |

Note: 2009 years in not available.

Credit Risk management of ABBL:

Credit risk Management:

Risk in inherent in all aspects of a commercial operation, however for banks and financial institutions, credit risk is an essential factor that needs to be managed. Credit risk is the possibility that a borrower or counter party will fail to meet its obligations in accordance with agreed terms. Credit risk, therefore, arises from the bank’s dealings with or lending to corporate, individuals, and other banks or financial institution.

Credit risk management needs to be a strong process that enables banks to proactively manage loan portfolios in order to minimize losses and earn an acceptable level of return for shareholders. Central to this is a comprehensive IT system, which should have the ability to capture all key customer data, risk management and transaction information including trade. Given the fast changing, dynamic global economy and the increasing pressure of globalization, consolidation and disintermediation, it is essential that we have a robust credit risk management policies and procedures that are sensitive and responsive to these changes. It is pertinent to mention here that we are already in the process of implementing state of the art IT system for integrated performance.

|

The Preferred Functions of Credit Administration Department:

Guide lines of Credit Policy:

The guidelines contain outline general principles that are designed to govern the implementation of more detail procedures and risk grading system within individual banks.

Lending Guidelines:

All Banks have an established “Credit Policies” that clearly outline the business development priorities and the terms and conditions that should be adhered to in order for loans to be approved. AB Bank Ltd has such type of guideline through which it manages the credit operation. This lending guideline is updated regularly in response to Bangladesh bank’s guidelines to reflect changes in the economic outlook and the evolution of the bank’s loan portfolio, and distributed to all lending/marketing officers. The lending Guidelines are approved by the Managing Director/CEO and Board of Directors of the bank based on the endorsement of the bank’s Head of Credit Risk Management and the Head of Corporate/ commercial banking.

Any Departure of deviation from the Lending Guidelines is explicitly identified in credit applications and justification for approval provided.

The lending guidelines provided the key functions for relationship managers to formulate their recommendation for approval incorporating the following:

- Industry and Business Segment Focus

The lending Guidelines clearly identify the business/ industry sectors that constitute the majority of the bank’s loan portfolio. For each sector, a clear indication of the bank’s appetite for growth is indication (as an example, Textiles: Grow, Cement: Maintain, Construction: Shrink). This will provide necessary direction to the bank’s marketing staff.

- Types of Loan Facilities

Indication of the type of loan that are permitted, such as working capital, Trade Finance , term loan, etc.

- Single Borrower / Group Limits/ Syndication

Details of the bank’s Single Borrower/Group limits are include as per Bangladesh Bank guidelines. ABBL establish more conservative criteria in this regard.

- Lending Caps

The bank establishes a specific industry sector exposure cap to avoid over concentration in any one-industry sector.

- Discourage Business Types

ABBL outline industries or lending activities that are discouraged. As a minimum, the following is discouraged:

-Military Equipment / Weapons Finance

-Highly Leveraged Transactions

-Finance of Speculative Investments

-Logging, Mineral Extraction/Mining, or other activity that is ethically or environmentally sensitive

-Lending to companies listed on CIB black list or Known defaulters

-Counter parties in countries subject to UN Sanctions

-Share Lending

-Talking an Equity Stake in Borrowers

– Lending to Holding Companies

-Bridge Loans relying on equity/ debt issuance as a source of repayment

- Loan Facility Parameters

Facility parameters (e.g. maximum tenor, and covenant and security requirements) clearly stated. As a minimum, the following parameters are adopted:

-Bank does not grant facilities where the Bank’s security position is inferior to that of any other financial institution.

-Assets pledged, as security is properly insured.

-Valuations of property taken, as security performed prior to loans being granted. A recognized third party professional valuation firm appointed to conduct valuations.

- Cross Border Risk

Risk associated with cross border lending, Borrowers of a particular country may be unable or unwilling to fulfill principle and interest obligations. Distinguished from ordinary credit risk because the difficulty arises from a political event, such as suspension of external payments

-Synonymous with cross political and sovereign risk.

-Third world debt crisis

For example, export documents negotiated for countries like Nigeria

Credit Assessment and Risk Grading:

Credit Assessment

A through credit and risk a:ssessment conducted prior to the granting of loans, and at least annually thereafter for all facilities. The results of this assessment are presented in a Credit application that originates from the relationship manager/account officer (RM) and is approved by Credit Risk Management (CRM). The RM is the owner of the customer relationship, and responsible to ensure the accuracy of the entire credit application submitted for approval. RMs must be familiar with the bank’s Lending Guideline sand conduct due diligence on new borrowers, principals and guarantors.

It is essential that RMs know their ckustome5rs and conduct due diligence on new borrowers, principals, and guarantors to ensure such parties are in fact who they represent themselves to be.

Credit Application summaries the result of the RMs assessment and includes, as a minimum, the following details:

-Amount and type of loans proposed.

-Purpose of loans.

-Loan Structure (Tenor, Covenants, Repayment Schedule, Interest)

-Security Arrangement.

In addition, the following risk areas are being addressed by the bank:

- Borrower Analysis: The Majority shareholders, management team and group or affiliate companies are assessed. Any issues regarding lack of management depth, complicated k ownership structures or inter-group transactions are being addressed, and risks mitigated.

- Industry Analysis: The key risk factors of the borrower’s industry need to be assessed. Any issues regarding the borrowers position in the industry, overall industry concerns or competitive forces is being addressed and the strengths and weakness of the borrower relative to its competition are identified.

- Supplier / Buyer Analysis: Any customer or supplier concentration is being addressed, as these have significant impact on the future viability of the borrower.

- Historical Financial Analysis: An analysis of a minimum of 3 years historical financial statement of the borrower is presented. Where reliance is placed on a corporate guarantor, analysis of guarantor financial. The analysis addresses the quality and sustainability of earnings, cash flow and the strength of the borrower’s balance sheet. Specially, cash flow, leverage and profitability are being analyzed.

- Projected financial performance: Where term facilities (tenor>1year) are proposed, a projection of the borrower’s future financial performance need to be provided, indicating an analysis of the sufficiency of cash flow to service debt repayments. Loan do not granted if projected cash flow is insufficient to repay debts.

- Account Conduct: for existing borrowers, the historic performance in meeting repayment obligation (trade payments, cheques, interest and principal payments, etc) is being assessed.

- Adherence to lending Guidelines: Credit Application clearly state whether or not the proposed application is in compliance with the bank’s Lending Guidelines. The bank’s Head of Credit or Managing Director/CEO approved credit Applications that do not adhere to the bank’s Lending Guidelines.

- Mitigating Factors: Mitigating factors for risks identified in the credit assessment are being identified. Possible risks include, but are not limited to margin sustainability and/ or debtor issues; rapid growth, acquisition or expansion; issues; customer or supplier concentrations; and lack of transparency or industry issues.

- Loan Structure: the amounts and tenors of proposed financing are being justified based on he projected repayment ability and loan purpose. Excessive tenor or amount relative to business needs increases the risk of fund diversion and may adversely impact the borrower’s repayment ability.

- Security: Obtaining a current valuation of collateral and the quality and priority being proposed need to be. Loans do not grant based solely on security. Adequacy and the extent of the insurance coverage are also assessed.

- Name Lending: Credit Proposals do not be unduly influenced by an over reliance on the sponsoring, principal’s reputation, reported independent means, or their perceived willingness to inject funds into various business enterprises in case of need. These situations are discouraged and treated with great caution. Rather, credit proposals and the granting of loans are based on sound fundamentals, supported by a through financial and risk analysis.

Risk Grading:

All Banks should adopt a risk grading system. ABBL adopt a system that define the risk profile of borrower’s to ensure account management, structure and pricing are commensurate with the risk involved. Risk grading is a key measurement of a bank’s asset quality, and as such, it is essential that grading is a robust process. All facilities should be assigned a risk grade. Where deterioration in risk is noted, the Risk Grade assigned to borrower and its facilities should be immediately changed. Borrower Risk Grades should be clearly stated on Credit Applications.

The following Risk Grade Matrix is provided as an example. If there is a difference between the personal judgment and the Risk grade Scorecard results, ABBL applied the more conservative risk grade (higher) however, monitoring standards and account management must be appropriate given the assigned Risk Grade:

| Risk Rating | Grade | Definition |

| Superior –Low Risk | 1 | Facilities are fully secured by cash deposits, government bonds or a counter guarantee from a top tier international bank. All security documentation should be in place. |

| Good- Satisfactory Risk | 2 | The repayment capacity of the borrower is strong. The borrower should have excellent liquidity and low leverage. The company should demonstrate consistently strong earning and cash flow and has an unblemished track record. All security documentation should be in place. Aggregate score of 95 or greater based on the Risk Grade Scorecard. |

| Acceptable-Fair | 3 | Adequate financial condition though may not be able to sustain any major or continued setbacks. These borrowers are not as strong as grade 23 borrowers, but should still demonstrate consistent earnings, cash flow and have a good tack record. A borrower should not be grades better than 3 if realistic audited financial statements are not received. These assets would normally be secured by acceptable collateral (1st charge over stocks/debtors/equipment/properly). Borrowers should have adequate liquidity, cash flow and earnings. An Aggregate score of 75-94 based on the Risk Grade Scorecard |

| Marginal – Watch List | 4 | Grade 4 assets warrant greater attention due to conditions affecting the borrower, the industry o9r the economic environment. These borrowers have and above average risk due to strained liquidity, higher than normal leverage, thin cash flow and inconsistent earnings. Facilities should be downgraded to 4 if the borrower incurs a loss, loan payments routinely fall past due, account conduct is poor, or other untoward factors are present. An aggregate Score of 65-74 based on the Risk Grade Scorecard. |

| Special mention | 5 | Grade 5 assets have potential weaknesses that deserver management’s. These weaknesses may result in a deterioration of the repayment prospects of the borrower. Facilities should be downgraded to 5 if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive leverage), if loan payments remain past due for 30-60 day’s, or if a significant. Petition or claim is lodged against the borrower. Full repayment of facilities is still expected and interest can still be taken into profits. An Aggregate Score of 55-64 based on the Risk Grade Scorecard |

| Substandard | 6 | Financial condition is weak and capacity or inclination to repay is in doubt. These weaknesses jeopardize the full settlement of loans. Loans should be downgraded to 6 if loan payments remain past due for 60-90 day, if the customer intends to create a lending group for debt restructuring purpose, the operation has ceased trading or any indication suggesting the winding up or closure of the borrower is discovered. Not yet considered non-performing as the correction of the deficiencies may result in an improved condition, and interest can still be taken into profits. An Aggregate Score of 45-54 based on the Risk Grade Scorecard. |

| Doubtful and Bad (non-performing) | 7 | Full repayment of principal and interest is unlikely and the possibility of loss is extremely high. However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as loss. Assets should be downgraded to 7 if loan payments remain past due in excess of 90 days, and interest income should be taken into suspense (non-accrual). Loan loss provisions must be reviewed at least quarterly on all non –performing loans and the bank should purse legal options to enforce security to obtain repayment or negotiate an appropriate loan rescheduling. In all cases, the requirements of Bangladesh Bank in CIB reporting, loans rescheduling and provisioning must be followed. An Aggregate Scorecard. |

| Loss(non-performing) | 8 | Assets graded 8 are long outstanding with no progress in obtaining repayment ( in excess of 180 days past due) or in the late stages of wind up/liquidation. The prospect of recovery is poor and legal options have been pursued. The proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been providing for. This classification reflects that it is not practical or desirable to defer writing off this basically worthless asset even though partial recovery may be affected in the future. Bangladesh Bank guidelines for timely write off of bad loans must be adhered to. An Aggregate Grade Scorecard. |

The Early Alert Report completed by the bank in a timely manner by the RM and forward to CRM for approval to affect any downgrade. After approval the report forward to Credit Administration, Who is responsible to ensure the correct facility / borrower Risk Grades are updated on the system. The downgrading of an account done immediately when adverse information in noted, and do not postpone until the annual review process.

3.3 Approval of Authority

The authority to sanction/approve loans clearly delegated to senior credit executives by the managing Director/CEO and board based on the executive’s knowledge and experience. Approval authority delegated to individual executives and not the committee to ensure accountability in the approval process. The following guidelines are normally applied in the approval/ sanctioning of loans:

- Credit approval authority delegated in writing from the MD/ CEO and board (as appropriate), acknowledged by receipts, and records of all delegation retained in CRM.

- Delegated approval authorities reviewed annually by MD/CEO /Board.

- The credit approval function separated from the marketing / relationship management (RM) function.

- The role of credit committee may be restricted to only review of proposals recommendations or review of banks loan portfolios.

- Approvals must be evidence in writing, or by electronic signature. Approval records must be kept on file with the Credit Applications.

- All credit risks must be authorized by executives within the authority limit delegated to them by the MD/CEO. The ‘pooling’ or combining of combining of authority limits should not be permitted.

- Credit Approval should be centralized within the CRM function. Regional credit centers may be established, however, all large loans must be approved by the Head of Credit and Risk Management or managing Director/CEO/Board or Delegated Head Office Credit executives.

- The aggregate exposure to any borrower or borrowing group must be used to determine the approval authority required.

- Any credit proposal that does not comply with Lending Guidelines, regardless of amount, should be referred to Head Office for Approval.

- Head of Credit Risk Management approve and monitor any cross-border exposure risk.

- It is essential that executives charged with approving loans have relevant training and experience to carry out their responsibilities effectives. As a minimum, approving executives should have:

-At least 5 years experience working in corporate/ commercial banking as a relationship manager or account executives.

-Training and experience in financial statement, cash flow and risk analysis.

-A thorough working knowledge of accounting.

-A good understanding of the local industry / market dynamics.

-Successfully completed and assessment test demonstrating adequate knowledge of the following areas:

- Introduction of accrual accounting.

- Industry / Business Risk Analysis.

- Borrowing Causes.

- Financial reporting and full disclosure.

- Financial statement Analysis

- The asses conversion/Trade Cycle

- Projection

- Loan Structure and Documentation

- Loan Management

A monthly summary of all new facilities approved, renewed, enhanced, and a list of proposals declined stating reasons thereof reported by CRM to the CEO/MD

3.4 Segregation of Duties

Banks aim to segregate the following lending functions:

- Credit approval / Risk Management

- Relationship Management / Marketing

- Credit Administration

The purpose of the segregation is to improve the knowledge levels expertise in each department, to impose controls over the disbursement levels and expertise in teach department, to impose controls over the disbursement of authorized loan facilities and obtain an objective and independent judgment of credit proposals.

Organizational structure is (credit Division):

The appropriate organizational structure is in place to support the segregation of the Marketing / Relationship Management function from Approval/ Risk Management/ Administration functions.

Credit approval centralized within the CRM function. Regional credit centers are established, however, all application are approved by the Head of Credit and Risk Management or Managing Director/CEO/Board or delegated Head Office credit executive:

Key Responsibilities:

Key responsibilities of the function are as follows:

Credit Risk Management (CRM)

- Over of the bank’s credit policies, procedures and controls relating to all credit risks arising from corporate/ commercial / institutional banking, personal banking and treasury operations.

- Oversight of the bank’s asset quality.

- Directly manager all substandard, doubtful and Bad and loss accounts to maximize recovery and ensure that appropriate and timely loan loss provision have been made.

- To approve (or decline), within delegate authority, credit Applications recommended by RM. Where aggregate borrower exposure is in excess of approval limits, to provide recommendation to MD/CEO for approval.

- To provide advice / assistance regarding all credit matters to line management /RM.

- To ensure that lending executives have adequate experience and / or training in order to carry out duties effectively.

Credit Administration:

- To ensure that all security documents comply with the terms of approval and it is enforceable.

- To monitor insurance coverage to ensure appropriate coverage is in place over assets pledged as collateral, and is properly assigned to the bank.

- To control loan disbursements only after all terms and conditions of approval have been met and all security documents.

- To maintain control over all security documents.

- Monitoring the borrower’s compliance with covenants and agreed terms and conditions, and general monitoring of account conduct or performance.

Relationship management:

- To act as the primary bank contacts with borrowers.

- To maintain thorough knowledge of borrowers business and industry through regular contact, factory / warehouse inspections etc. RM should proactively monitor the financial performance and account conduct of borrowers.

- To be responsible for the timely and accurate submission of Credit Applications for new proposal and annual reviews, taking into account the credit assessment requirements.

- To highlight any deterioration in borrower’s financial standing and amend the borrower’s risk Grade in a timely manner. Changes in risk Grades should be advised to and approved by CRM.

- To seek assistance / advice at the earliest from CRM regarding the structuring of facilities, potential deterioration in accounts or for any credit related issues.

Procedural Guidelines:

The main procedures that are followed by ABBL to ensure compliance with the credit policies narrated as under heads”

Approval Process

The approval process reinforces the segregation of relationship Management / Marketing from the approving authority. The responsibility for preparing the credit application rest with the RM within the corporate / commercial banking department. Credit Application recommended for approval by the RM team and forward to the approval team within CRM and approved by individual executives. Banks may wish to establish various threshold, above which, the recommendation of the Head of Corporate/Commercial banking is required prior to onward recommendation to CRM for approval team to handle routine approvals. Executives in head office CRM approve all large loans.

The recommending or approving executives take responsibility for and are held accountable for their recommendations or approval. Delegation of approval limits are such that all proposals where the facilities are up to 15% of the bank’s capital approved at the CRM level, facilities up to 25% of capital approved by CEO/MD, with proposals in excess of 25% of capital to be approved by the EC/Board only after recommendation of CRM, Corporate banking an MD/CEO.

The following diagram illustrates approval process:

- Application forwarded to Zonal Office for approved/ decline

- Advise the decision as per delegated authority (approved decline) to recommending branches. A monthly summary of ZCO approvals sent to HOC and HOCB to report the previous month approvals sanctioned at the Zonal offices. The HOC reviews 10% of ZOC approvals to ensure adherence to Lending Guidelines and Bank policies.

- ZCO supports and forwarded to Head of Corporate banking (HOCB) or delegate for endorsement, and Head of Credit (HOC) for approval or onward recommendation.

- HOC advise the decision as per delegated authority to ZCO.

- HOC and HOCB support and forwarded on Managing Director.

- Managing Director advises the decision as pr delegate authority to HOC and HOCB.

- EC / Board advise the decision to HOC and HOCB.

Regardless of the delegated authority HOC to advice the decision (approval/decline) to marketing department through ZCO.

Recommended Delegated Approval Authority Levels;

HOC/ CRM Executives Up to 15% of capital

Managing Director / CEO Up to 25% of Capital

EC/Board All exceed 25% of Capital

Disbursement: – Security documents are prepared in accordance with approval terms and are legally enforceable. Standard loan facility documentation that has been reviewed by legal counsel should use in all cases. Exceptions are referred to legal counsel for device based on authorization from an appropriate executive in CRM.

Disbursements under loan facilities are only be made when all security documentation is in place. CIB report reflect/ include the name of all the lenders with facility, limit and outstanding. All formalities regarding large loans and loans to Directors should be guided by Bangladesh Bank circulars and related section of Banking Companies Act.

Appeal Process:

Any declined credit may be re presented to the next higher authority for reassessment/ approval. However, there is no appeal process beyond the Managing Director.

Credit Administration:

The credit Administration function is critical in ensuring that proper documentation and approvals are in place prior to the disbursement of loan facilities. For this reasons, it is essential that the functions of Credit Administration be strictly segregated from Relationship Management/ marketing in order to avoid the possibility of controls being compromised or issues not are being highlighted at the appropriate level.

Credit Administration procedures should ne in place to ensure the following:

Custodian Duties:

- Loan disbursement and the preparation and storage of security documents centralized in the regional credit centers.

- Appropriate insurance coverage is maintained (and renewed in timely basis) on assets pledge as collateral.

- Security documentation is held under strict control, preferably in locked fireproof storage.

Compliance requirements:

- All required Bangladesh Bank returns are submitted in the correct format in a timely manner.

- Bangladesh Bank circulars/ regulations are maintained centrally, and advised to all relevant departments to ensure compliance.

- All third party service providers (values, lawyers, insurers, CPA etc.) are approved and performance reviewed on an annual basis. Banks are referred to Bangladesh bank circular outlining approved external audit firms that are acceptable.

Credit Monitoring:

To minimize credit losses, monitoring procedures and system is to be in place that provides an early indication of the deteriorating financial health of a borrower. At a minimum, systems are in place to report the following exceptions to relevant executives in CRM and RM team:

- Past due principal or interest payments, past due trade bills, account excess and breach of loan covenants;

- Loan terms and conditions are monitored, financial statements are received on a regular basis, and any covenant breaches or exceptions are referred to CRM and the RM team for timely follow-up

- Timely corrective action is taken to address findings of any internal, external or regulator inspection/audit

- All borrower relationships / loan facilities are received an approved through the submission of Credit Application at least annually.

Computer system must be able to produce the above information for central / head office as well as local review. Where automated systems are not available, a manual process has the capability to produce accurate exception reports. Exceptions are followed up on and corrective action taken in a timely manner before the account deteriorates further.

Early alert process:

An Early Alert Account (Appendix-3) is one that has risks or potential weakness of a material nature requiring monitoring, supervision, or close attention by management.

If these are left uncorrected, they may result in deterioration of are repayment prospects for the asset or in the Bank’s credit position at some future date with a likely prospect of being downgraded to CG5 or worse (impaired status) within the next twelve months.

Early identification, prompt reporting and proactive management of Early Alert Accounts are prime credit responsibilities of all Relationship Managers and must be undertaken on a continuous basis. An early alert report is completed by the RM and sent to the approving authority in CRM for any account that is showing assigns or deterioration within seven days from the identification of weakness. The Risk Grade updated as soon as possible and no delay taken in referring problem accounts to the CRM department for assistance in recovery.

Despite a prudent credit approval process, loans may still become troubled. Therefore, it is essential that early identification and prompt reporting of deteriorating credit signs be done to ensure swift action to protect the Bank’s interest. The symptoms of early alert are by no means exhaustive and hence, if there are other concerns, such as a breach of loan covenants or adverse market rumors that warrant additional caution, an Early Alert report raised.

Moreover, regular contacts with customers will enhance the likelihood of developing strategies mutually acceptable to both the customer and the bank. Representation from the Bank in such discussions should include the local legal adviser when appropriate. An account may be reclassified as a Regular Account from Alert Account status when the symptom, or symptoms, causing the Early Alert classification have been regularized or no longer exist. The concurrence of the CRM approval authority is required for conversion from Early Alert Account status to Regular Account status.

Credit Recovery:

The Recovery Unit (RU) directly manages accounts with sustained deterioration (a Risk Rating of Sub Standard (6) or worse). Banks may wish to transfer EXIT accounts graded 4-5 to the RU for efficient exit based in recommendation of CRM and Corporate Banking. Whenever an account is handed over from Relationship Management to RU, a Handover/Downgrade Checklist (Appendix no.3) is completed.

The RU’s primary functions are:

- Determine Account Action plan /Recovery Strategy

- Pursue all options to maximize recovery, including placing customers into receivership or liquidation as appropriate.

- Ensure adequate and timely loan loss provisions are made based and expected losses.

- Regular review of grade 6 or worse accounts

The management of problem loans (NPLs) must be a dynamic process, and the associated strategy together with the adequacy of provisions must be regularly reviewed. A process is established to share the lessons learned from the experience of credit losses in order to update the lending guidelines.

Account Transfer Procedures:

Within 7 days of an account being downgraded to substandard (grade6), a Request for Action and a hand over/ downgrade checklist is completed by the RM and forwarded to RU for acknowledgement. The account assigned to an account manager within the RU, who reviews all documentation, meet the customer, and prepare a classified Loan Review Report within 15 days of the transfer. The CLR approved by the Head of Credit, and copied to the Head of Corporate banking and to the Branch/ office where the loan was originally sanctioned. This initial CLR highlight any documentation issues, loan structuring weaknesses, proposed workout strategy, and seek approval for any loan loss provisions that are necessary.

Recovery Units ensure that the following is carried out when an account is classified as sub Standard or worse:

- Facilities are withdrawn or repayment is demanded as appropriate. Any drawing or advances restricted, and only approved after careful scrutiny and approval from appropriate executives within CRM.

- CIB reporting is updated according to Bangladesh Bank guidelines and the borrower’s Risk Grade is changed as appropriate.

- Loan loss provisions are taken based on Force Sale Value (FSV).

- Loans are only rescheduled in conjunction with the large loan rescheduling guidelines of Bangladesh Bank. Any rescheduling is based on projected future cash flows, and should be strictly monitored.

- Prompt legal action is taken if the borrower is uncooperative.

Non performing Loan (NPL) Monitoring:

On a quarterly basis, a Classified Loan Review (CLR) prepared by the RU Account Manager to update the status of the action / recovery plan, review and assess the adequacy of provisions, and modifies the bank’s strategy as appropriate. The Head of Credit approved the CLR for NPLs up to15% of the banks capital, with MD/CEO approval needed for NPLs in excess of 15% the CLR’s for NPL above 25$ of capital approved by the MD/CEO, with a copy received by the board.

NPL Provisioning and Write off:

This guideline establishes by Bangladesh Bank for CIB reporting provisioning and writers of of bad and doubtful debts, and suspensions of interest are followed in all cases. These requirements are the minimum, and ABBL adopt more stringent provisioning / write off policies. Regardless of the length of time a loan is past due, provisioning raised against the actual and expected losses at the time they are estimated. The RU account Manager determines the Force Sale Value (FLS) for accounts grade 6 or worse. Force Sale Value is generally the amount that is expected to be realized through the liquidation of collateral held as security or through the available operating cash flows of the business, net of any realization costs. Any shortfall of the force sale value compared to total Loans outstanding fully provided for once an account is downgraded to grade 7. Where the customer is not cooperative, no value assigned to the operating cash flow in determining Force Sale Value (FSV).

Force Sale Value and provisioning levels are updated as and when new information is obtained, but as a minimum, on a quarterly basis in the CLR.

Following formula is to be applied in determining the required amount of provision:

- 1. Gross Outstanding (XXX)

- Less : (a) Cash margin held or fixed

Deposits/ sp under lien (XXX)

(b) Interest in suspense Account (XXX)

3. Loan Value

(For which provision is to be created before considering

Estimated realized value of other security/collateral held) (XXX)

4. Less: estimated salvage value of security/ collateral held (XXX)

(See Note below)

Net Value (XXX)

(Note: the amount of required provision may, in some circumstances, be reduced by an estimated realizable forced sale value of (i.e. salvage value) of any tangible collateral held (viz: mortgage of property, pledge goods/ or hypothecated goods repossessed by the bank, pledged readily marketable securities etc). Hence, in these situations, it will be advisable to evaluate such collateral, estimate the most realistic sale value under duress and net off the value against the outstanding before determining the Net Loan Value for provision purpose. Conservative approach is taken to arrive at provision requirement and Bangladesh Bank guideline properly followed).

Performance of Credit Department of ABBL:

Credit facilities of the AB Bank Limited :

The credit department of Arab Bangladesh Bank provides two kinds of credit facilities:

i) Funded Credit Facilities

ii) Non-Funded Credit Facilities

i) Funded Credit Facilities:

These are facilities that are associated with direct fund involvement. It includes:

| Overdraft(OD) | ü A borrower is allowed to withdraw over and above his credit balance in current account up to an agreed limit. ü Overdraft facility is sanctioned against the primary security of hypothecation of raw materials and or finished goods. ü The bank insists on the borrower on furnishing some collateral securities. |

| Advance against work order | ü Granted to a client against the work order of Government Department, Corporation, Autonomous bodies and reputed multinational/ private organization ü Disbursement is made after completion of documentation formalities. ü Usual charge documents a notarized irrevocable power of attorney to collect the bills from the concerned authority and a letter |

| Advance against FDR/ Sanchay Patra | ü Granted to a client against the security of Fixed Deposit Receipt and Sanchay Patra. ü The rate of interest is 12% (against FDR and Sachay patra. |

| Loan against Trust Receipt(LTR) | ü Allowed when the documents covering an import shipment are given without payment. ü It creates the banker’s lien on the goods. ü The period of TR may be 30,45,60,90 days. |

| Staff Loan | ü Provides this advance facility under installment system to its staff ü The maximum amount disbursed is Taka 200000/- for a period of 3 years. ü The rate of interest is 13% per annum. |

| House building Loan | ü Provided against 100% cash collateral. ü Rate of interest is 16.5% |

| Time loan | ü This loan matures with in one year. |

| Term Loan | ü Maturity period of 2 years or above ü Repayable in installments. |

| Consumer Credit Scheme | ü Attract consumer from the middle and upper middle class population with limited income. ü The borrower should have an account (SB or CD) ü Bank finances maximum Taka 5 lacs ( for cars and Taka 2 lacs ( for other items) ü Minimum 25% of the purchase cost of the product is to be deposited. ü The rest 75% is to be kept as cash collateral (FDR, Sanchay patra etc.) with the bank. ü Interest is 15% per quarter, 2% of loan amount is taken as processing fees. |

ii) Non-Funded Credit Facilities:

These are facilities that are not directly associated with fund involvement. It includes the following:

| Letter of Credit | ü Credit department sends proposal for L/C (cash as well as back to bank) to head office for approval. L/C is discussed in detail under import section. |

| Letter of Guarantee | ü The person who gives the guarantee is called the ‘surely’ the person in respect of whose default the guarantee is given is called ‘the principal debtor’ and the person to whom the guarantee is given is called the ‘creditor’. ü It is an irrevocable undertaking to pay in case of a certain eventuality. |

Loan against Hypothecation of car, buses Trucks, Scooters and Water Crafts:

While allowing loan against hypothecation of cars, buses trucks, scooters, and Water Craft some salient points should be taken into consideration such as –trustworthiness of the borrower, value of the vehicle, brand of the vehicle , total landed cost and retirement arrangement in case o imported vehicle and repayment capacity of the borrower.

Loan against Imported Merchandise (L.I.M):

Advance allowed against pledge of goods, retaining margin prescribed on their landed cost, depending on their categories and credit restrictions imposed by the Bangladesh Bank. Branches shall also obtain letter of undertaking and indemnity from the clients, before getting goods cleared through LIM account. The landed cost of the goods subject to the credit restrictions imposed by Bangladesh Bank is arrived at by taking into account ( the invoice values of the merchandise include freight, Customer Duty, Sales Tax, Wharf age, Clearing Agent’s charges, Railway Freight etc, Insurance Premium, Demurrage and Other Charge, if any)

Charge Documents:

a) D.P Note

b) Letter of Agreement, Letter of pledge.

c) Merchandise to be duly insured with specific risk clauses along with Bank’s mortgage clause.

d) Letter of Pledge.

e) Letter of disclaimer to be obtained from the owner of godown in case of rented godown.

Loan against Trust Receipt Facility(LTR):

Advance allowed when the documents covering an import shipment are given (to first class parties only) without payment. For such advances prior permission from Head Office must be obtained. Trust customer holds the goods or their sale proceeds in trust for the Bank, till such time, the loan allowed against the Trust Receipt is fully paid off. The period of Trust Receipt may be 30, 45, 60 or 90 days, as allowed by the Head Office. The following charge documents before allowing the advance:

a) D.P Note

b) General Letter of Trust Receipt with Supplementary agreement.

c) Letter of agreement.

d) In case of Partnership firm documents are same as work order.

Advance Against Shared (Loans and Overdrafts)

Advance may be allowed against shares of various companies approved by Head Office from time to time quoted on the Stock Exchange against required margin subject to credit restriction and Prior permission from office.

Before allowing the advance, obtain the delivery of the shares and their Transfer Deed forms and thoroughly scrutinize them with regard to the following:

a) They are original share scripts and bear the seal of the company.

The shares are fully paid up. Do not allow advance against partly paid up shares, unless approved by the office.

b) The shares are accompanied with blank Transfer Deed duly signed by the person in whose name those shares stand and witnessed by some body who is easily traceable.

c) The transferor’s signature Deed is verified by the company concerned under it stamp.

d) The transfer Deeds are undated

e) A fresh set of Transfer Deed signed by the borrower, and witnessed by some body who is easily traceable is obtained and retained with the branch, for all such shares which are to be sent to various companies for registration in his name, before the closure of their books, if so requested by him.

f) These shares are lodged with the companies concerned for registration with their Original Transfer Deeds, duly completed in all respect, under a covering letter form the branch, requesting them to return the shares to the branch, as the Bank has its lien on them. The Transfer Deeds attached with the shares are completed and signed by the borrower as transferee, before these are dispatched to the companies.

g) These shares are lodged with the companies for registration with their original Transfer Deeds, duly completed in all respects, under a covering letter from the branch, requesting them to return the shares to the branch, as the bank has its lien on them. The Transfer Deeds attached with the shares are completed and signed by the borrower as transferee, before these are dispatch to the companies.

h) A receipt is obtained from the companies and retained with branch, duly discharged by the shareholder, for exchange with the share certificate, when ready for delivery.

i) The borrower’s signature on the fresh set of Transfer Deeds are verified by the companies concerned and retained with branch along with their respective share certificate when received back from them after registration.

j) The branch should obtained a letter of lien the borrower in respect of all such shares which stand in his name, or which have been sent to the various companies for registration, in his name. where has been allowed to the borrower at the specific request of a third party against shares owned by them the letter of lien shall be obtained from third party, in its own name.

Allow the advances on obtaining the following charge documents duly stamped:

a) D.P Note

b) Letter of lien or incase of advance to a third party, letter of Agreement

c) In case of Partnership Firms documents required are same as Work order.

d) Certified copy of resolution of Directors in accordance with corporate Borrowing Power laid down in the Memorandum and Articles of Association of the company in case of limited concern and resolution of the Board along with a copy of character in case of corporation, to be vetted by Legal Adviser/Retainer.

e) Letter of ownership.

f) Transfer Deeds duly verified.

g) Personal Guarantee of Directors (excepting nominated Directors by Govt. /Corporation) in case of limited companies.

h) For Loans: letter of Disbursement.

i) For Overdrafts: Letter of continuity.

j) An undertaking from the Directors of the Limited Company to obtain prior clearance from the Bank before declaring any interim / final dividend

Recent focusing attention of ABBL on SME Credit Portfolio:

Small and Medium Enterprise program gained new momentum in recent years, besides other credit schemes. ABBL is focusing special attention on this approach to sustain economic and social development.

SME Structure: it composite of – Small Enterprise (Up to Tk. 3.00 Core)

– Medium Enterprise (up to Tk. 10.00 core)

Approval Authority:

- Board : Above Tk. 3.00 Core

- Credit Committee : Up to Tk. 3.00 Core

- Two regional Heads

Of Dhaka & Chittagong : Up to Tk. 30.00 Lac

- Executive (by name) : Up to Tk. 15.00 Lac

- Branch Authority (designed bra.) : IBP & Cash Collateral

Allocation and Monitoring Of Account:

Branch:

Branch manager/ Relationship manager and Credit Officer/ Relation Officer have primary responsibility for marketing new accounts; maintain relationship and monitoring SME accounts.

Division:

Two division Heads have approval authority for Tk. 30.lac but do not have any target to archive.

Head Office:

SME department is headed by one SVP

SME accounts of Chittagong Region are allotted and monitored by one SVP

SME accounts of Khulna, Rajshahi & Sylhet Division are allotted and monitored by one VP

RMG accounts of all divisions are allotted & monitored by one AVP

Board memos of specific braches prepared by one AVP

Bank guarantees provided by the AB Bank Limited:

As service to their customers, bankers sometimes issue guarantees of various types no behalf of the customer to third parties. By this, the bank undertakes a contingent liability on behalf of its customer. Principal branch of ABBL mainly offers thre types of Guatantee that are as follows:

a) Tender or Bid Bond Guarantee:

It is issued on behalf of the local contractor / foreign bank, in favor of firm / company, giving a sort of guarantee for payment of money in case tender has been approved and contractor is not willing to proceed with it. The tender guarantee or bid bond stipulates that the bank is restricted to make payment of a specific cash penalty in the event the principal, on whose behalf the bid bond was issued, refuse to complete the deal after his bid has been accepted. The bid bond is normally issued for a short period of three to six months and is terminated on the contractor taking up the contract or no the expiry of the period.

b) Performance Guarantee:

Performance Guarantees have financial implications. It a contract is awarded to the contractor he would be required to furnish a guarantee whereby his execution of the contract as per terms and conditions agreed is guaranteed. This is known as the performance guarantee. The bank issues performance guarantees to Government or Corporation on behalf of contractors undertaking to make payment of penalty in the event of non-fulfillment of their performance of contract or supplying goods as per contract, Government etc on behalf of exporters who undertake to execute order or short term construction contractors abroad.

c) Advanced Payment Guarantee(APG):

This type of guarantee is given against work order. This idea can be made clear with the help of an example. Before the beginning of Jamuna Bridge Construction, the Government collated money from different sources to pay the contractors in advance. But there was a risk for the Government that the contractors might not do there construction work even they were paid in advance. So the government asked Bank Guarantee from them. Then they contractors submitted Bank Guarantee to the Government. This type of Guarantee is called Advanced Payment Guarantee.

Interest Rates on lending:

| Particulars | Mid Rate W.E.F | Interest rate W.E.F |

| 13.00% | 13.00% |

| 13.00% | 13.00% |

| 14.75% | 13.25% – 16.25% |

a) Large and Medium Scale Industries b) Small industries

| 11.50%

14.50% | 10.00% – 13.00%

13.00% – 16.00% |

| 7.00% | 7.00% |

| 13.00% | 13.00% |

| 13.00% | 13.00% |

| 16.00% | 14.50% – 17.50% |

| 2% per month | 2 % per month |

| 13.00% | 13.00% |

I. Cash collateral-ABBL FDR II. Cash Collateral- Others Bank FDR or WDB III. Women Entrepreneur(Awaprajita up to Taka 50.00 lac IV. Special Scheme Loans – SME

| 12.50%

13.50%

10.00% 14.00%

| 11.00% – 14.00%

12.00% – 15.00%

10.00% 13.00% – 15.00%

|

Credit Investigation system ;

Generally credit is the confidence of the lender in the ability & willingness of the borrower to repay the loan at a future date. Credit – Granting decisions are major task in financial management of the firm. The policies necessary for the proper management of credit granting are extremely important and need to be carefully formulated, as the questions involved in credit granting are complex and their impact is substantial. Among the policy question that must be addressed are:

- How much information should the firm collect on each credit applicant?

- How should the credit – related parameters of credit application are estimate (borrower’s selection)

There are several sources of credit information about potential customer, proceeding from the least costly to the most costly.

The seller’s prior experience with the Customer: one of the cheapest and most reliable sources of information about expected future payment patterns is that customer’s history of dealing with the seller. If the customer has paid promptly for the last 20 orders, it is very likely that the customer will pay promptly for the twenty – first. To obtain information on the customer’s history of payment to the seller, the credit analyst queries the seller’s database of prior customer payments.

Credit Rating and Reports: Several firms are in the business of collecting and selling credit – related information to sellers. Some of these investigation firms report on wide varieties of buyers while others report only on buyers in a single industry. Most of these agencies provide several types of service. They issue ratings based on buyer’s financial strength and payments to sellers. They provide reports, which may include the buyer’s financial statements and results of an investigation into legal records regarding the buyer’s business dealings. They collect and distribute trade clearances, which are lists of amounts owing, amount past due and histories of payment by buyers to their trade creditors.

Personal Control with the Application’s Bank and Other Creditors: A more expensive (but very reliable) source of information is the applicants’ current creditors and its bank. To obtain such information, the analyst may personally contact these sources to discuss their experiences with the applicant. In this way, the analyst can verify the information in credit agency reports and gain other insights that are not available from these reports. Unfortunately, such and investigation usually quite time consuming.

Analyst of the Applicant’s Financial Statements: Any credit applicant’s ability to pay is in great part dependent on its financial condition. Analyst of this financial condition can thus considerably aid in credit evaluation. Financial statements must first be obtained this may entail significant effort if the applicant firm is not publicly traded. These statements must then be examined and analyzed. This analysis often begins by making adjustments to these statements to utilize accounting conventions other than those chosen by the applicant accountants. Such adjustments are made if the analyst believes that the conventions used did not do the best job of portraying the economic health of the firm. Once these adjustments are made, ratio analysis and / or statistical analysis are then applied to these statements to assess the financial health of the applicant.

Customer Visit: One very expensive option in the collection of information is for the credit analyst to visit the applicant. An on – site viewing of the applicant’s facilities and discussions with the applicant’s management can provide insights and information that cannot be obtained in other ways. For example, the credit analyst can obtain impressions on the competence of the applicant’s management and on the physical condition of the applicant’s plant, service facilities and equipment.

There are not specific credit agencies in our country, which can assist banks by giving reports on parties/ clients. Bangladesh Bank has recently opened “Credit information Bureau” through which some information regarding borrowers are supplied to the banks. CIB must be compulsory that loan which covers the range above TK 50000.

Pro – forma for inquiry about individual borrowers is as follows:

Inquiry Form: CIB – 1 A

(For Individual / Institution)

Amount of loan applied for:

In figure ——————————–

In words ——————————–

- Name of the Bank / Financial Institution

- Name and Code No. Of Branch

- Date

- Reference No. of Branch

- Reference No. of Head Office

- Borrower Code

- Name of the borrower

- Father ‘s and mother’s name

- Address (Permanent, present business and factory)

- Telephone No.

- TIN

- Individual ID No.

- National ID Card

- Existing Credit facilities from different banks/ financial institution.

- Signature of the Branch / Manger with name

Performa for inquiry about institution (Limit Company) includes the following elements:

Inquiry Form: CIB – 2 A

(Owner information if borrower is institution)

- Name of the Bank / Financial institution

- Name and Code No. of Branch

- Date

- Reference No. of branch

- Reference No. of Head Office

- Borrower Code

- Name of the borrower

- Father’s and mother’s name

- Address ( permanent, present business and factory)

- Telephone no.

- TIN

- Status of the owner (Proprietor, partner, Chairman, Managing Director, Director or other)

- Name of the Bank / Financial institution / insurance co.( of which the above owner is Chairman / Director

- Name and address of the owner related business / firm

Selection of borrower :

In credit granting decision it is the credit analyst’s job to synthesize all information that has been collected and reach a judgment regarding the applicant’s creditworthiness. One way of organization this information is characterizing the applicant along five dimensions. These dimensions are called the Five Cs of credit. In all business dealings, officers and employees must be guided by the principles of honesty and integrity and safe – guard the interest of the shareholders and the depositors of the banks. They should strictly adhere to the Banking Laws, Rules and Regulation of the GOVT. of Bangladesh and the instructions issued by the Bangladesh Bank from time to time, which affect the business practice of the Bank.

In formulating a credit judgment and making Quality Credit Decisions, the lending officer must be equipped with all information needed to evaluate a borrower’s character, management competence and capacity, ability to provide collateral and external conditions which may affect his ability in meeting financial obligations.

Capital: – The evaluation of the applicant’s capital refers to an analysis of the applicant firm’s financial position. What are the applicant firm’s financial strengths? What are their weaknesses?

-To assess the capital dimension, the credit analyst considers the data obtained from the applicant’s financial statements. The usual procedure is to perform an extensive ratio analysis, comparing the applicant’s fanatical ratios to ratios for the applicants industry and performing trend analysis of the applicant’s ratios over time.

Character: In assessing character, the credit analyst considers all the information that relates to willingness to pay by the applicant’s management. What ideas the applicant’s history of payments to the trade? Has the firm defaulted to other trade suppliers? Does the applicant’s management make a good-faith effort to honor debts as they come due? Information in these areas bears on the analyst’s assessment of the applicant’s character.

Collateral: If the applicant experiences financial difficulty, it may be forced to liquidate. In such a situation, the recoveries to trade creditor will depend on (1) the recoveries on assets sold, (2) the amount of debt owned by the firm and (3) the extent to which these debts are secured. If the firm liquidates, the recoveries on assets that are security for debt will go to the holders of that secured debt. That is, the secured creditors get paid first from the revenues of selling the assets that have been granted to them as security. Since in general, it is very difficult for trade creditors to obtain secured positions, this means that the recoveries to trade creditors are significantly lower when the applicant has financed by using secured borrowings. Information on secured borrowing sis gleaned from the applicant’s financial statement, from the applicant’s bank, from credit reports on the applicant, of directly from conversations with the applicant.

Capacity: This dimension has two aspects: management’s capacity to run the business and the applicant firm’s plant capacity. Management’s capacity to run the business relates to the competency (ability) to the management personnel in the applicant’s operations. Any information relevant to this capacity is assessed, including personal impressions, the history of success or failure by the managers running the applicant business, the number of years that the applicant has been in business, and so forth. The better is management’s capacity to run the firm; the lower is the chance of default.

Conditions: These are the economic conditions in the applicant’s industry and in the economy in general. If there is a good deal of foreign and domestic competition in the applicant’s industry, the possibility of failure and default to trade creditors is larger, since profit margins are likely to be lower. If the economy in general is undergoing a contraction, failures are more likely to occur than during and expansionary period.

Credit Report /Credit application:

Credit report is an essential document through which a banker can judge the feasibility of a proposal for sanctioning loan. This report is prepared for getting information regarding the “C” mentioned above. Credit report (Appendix-1) provides a complete picture of the borrower’s credit worthiness by focusing the following elements:

- Name of the borrower

- Nature of business involvement

- Age of business

- Experience in the trade/ business

- Amount of loan required

- Purpose of borrowing

- Account performing

- Investment made in the business

- Duration of loan source of repayment

- Means

- Security offered of the loan

- Management stability

- Business Outlook

- Liquidity

- Profitability of the transactions

- Market reputation, personals banking etc. of the borrower’s

A detail Credit Application/report enclosed in the Appendix no.1

Lending Risk Analysis (LRA) :

Lending Risk Analysis (LRA) is a technique by which the risk of the loan is calculated. Experienced people of Credit department in ABBL do this analysis. It is a ranking whose total score are 140. Among this score, 120 is for Total Business Risk and 20 for Total Security Risk. It is a four-scale rating.

In case of business risk, if the score falls:

| Business risk Type | Weight (score) |

| Poor Risk | Between 13-19 |

| Acceptable risk | Between 20-26 |

| Marginal risk | Between 27-34 |

| Good risk | Over 34 |

In case of security risk, if the score falls:

| Security risk Type | Weight (score) |

| Poor Risk | Between 13-19 |

| Acceptable risk | Between 20-26 |

| Marginal risk | Between 27-34 |

| Good risk | Over 34 |

In Lending Risk Analysis (LRA) the following aspects are analyzed:

Security charged by the AB Bank Ltd:

To make the loan charging sufficient security on the credit facilities is very important. The banker cannot afford to take the risk of non-recovery of the money lent. ABBL charges the following two types of security:

| Primary Securities | These are the security taken by the ownership of the items for which bank provides the facility. |

| Collateral Securities | Collateral securities refer to the securities deposited by the third party to secure the advance for the borrower in narrow sense. In wider sense, it denotes any type of security on which the bank has a personal right of action on the debtor in respect of the advance |

Loan sanctioning process :

It conducts in corporate division of credit and starts when a borrower is selected who qualifies to get loan. The whole process is initiated when the bank on principle agrees to extend credit facility to a specific borrower. In credit decision, although selection of borrower pays a vital role, proper analysis is no less important and that is the core function of sanctioning process. The sanctioning process starts and moves as per following stages:

- Receipt of clients approach / proposal in a written form. The application should be in firm/ company letterhead unless the client is an individual

- Properly filled- in RFCL (Request for Credit Limit) to be obtained which gives sufficient information about the client.

- Wherever application the clients last three years audited balance sheet to be examined.

- All relevant papers about the client’s and his business to be collected.

- CIB report to be obtained and proper bank checking to be done.

- Lending Risk Analysis (LRA) to be done in case of loan above TK. 3.00 core.

- Clients bank statement to be analyzed properly to see the transaction pattern.

- Stock report to be checked and tallied with actual stock by physical verification.

- Clients business premises, factory, godown , show room an property to be mortgage should be inspected properly.

- Information about the client and his business to be collected from all possible sources.

- The client to be interview (in an informal manner) to understand him and his business.

With the help of the above papers / information, the credit proposal; (CP) is prepared which is the main sanction document and must have the following information:

- Client’s details.

- Nature of business

- Facility recommended client’s requested amount.

- Expected earning from the proposal lending.

- Key financial indicators about the client.

- Analysis and justification of the client.

- Details of credit facilities / account with other bank are if the clients bank with them.

- Account turnover, highest and lowest balance.

- Risk analysis and mitigates.

- Proposal debt structure.

- Recommendation.

The sanctioning process is carried out by two authorities: Brach & head office sanctions, which do not fall under delegated authority of the branch management , are generally done but head office credit committee, loans beyond a certain amount ( in cases of ABBL Tk. 3.00 core) are sanctioned by Board of directors or their nominated body e.g. Executive Committee

Head office Credit Division, after receiving the CP from branch, scrutinize the proposal and the attached papers / documents and verifies branches reasoning, justification and potential business out of the lending. Head Office may seek additional information from the recommending branch, if required. Having been fully satisfied with the contents of the branch’s proposal, the head office credit division prepares loan –sanctioning Memo with relevant information in brief for obtaining approval from the Credit Committee. In case, the proposed lending is beyond Credit Committee Authority, detailed memorandum for placing to the board of Directors is prepared. In both the cases Credit Committee or Board, if satisfied, accord approval to the proposal.

Once the proposal is approved the sanction letter, with all terms and conditions, is sent to the recommending branch.

Documentation :

Upon receipt of the sanction letter, branch takes necessary steps to complete documentation formalities. Documents are the written statement of facts of proof or evidence arising out of particular transaction, which can make the parties involved answerable and liable to the court of law. Execution of such documents in prescribed form as per the law is known as documentation. Documentation is necessary for acknowledgement of debt by the borrower and charging of securities to the bank by him.

The main documents for all types of loans are under:

a) Borrower’s acceptance to the sanction letter.

b) Demand promissory note (D.P. Note)

c) Letter of agreement.

Others documents based on the types of security and advance are as follows:

a) Letter of continuity.

b) Letter of revival.

c) Letter of hypothecation with supplementary agreement.

d) Letter of pledge (in case of loan against pledge of goods)

e) Letter of personal guarantee from the guarantor, 3rd part mortgagor, partners or directors.

f) Letter of Trust Receipt(for TR facility)

g) Letter of lien (for loan against FDR) with letter of encashment.

h) Letter of disclaimer from thee godown owner(in case pledged goods are kept in rented godown)

i) Letter of counter guarantee ( in case of guarantee facility)

j) Notarized Power of Attorney to sell the pledged or hypothecated goods/ to receive the bills.

Legal documents:

a) Memorandum and articles of association ( for limited company)

b) Registration partnership deed ( for partnership firms)

c) Trade license

d) Board resolution for opening account.

e) Board resolution for obtaining credit facilities ( in case of limited company)

Stamping :

Types of stamping:

- Non – judicial : deed, agreement, undertaking, Power of attorney etc.

- Adhesive : Revenue Stamps & Special Adhesive Stamps ( for some documents.

- Embossed or impressed : Seal of Notary Public, Organization Stamps etc

Execution:

Main points to be note:

I. Execution must be done by the borrower or his authorized representative.

II. Documents to be filled in with permanent Ink or type.

III. Documents are executed in presence of the Manager or an Authorized Officer.

IV. No document and no column should remain blank. Also mention of date & place of execution is a must.

V. There should not be any cutting, overwriting etc. in any documents. If any such things happen, the executor must duly authenticate it.

Witness:

Any documents, be it charge documents or legal documents, to be witnessed by at least two persons at the time of execution.

Registration:

After obtain of documents & completing the formalities of stamping, execution, witnessing, the question of registration arises. All documents do not require registration. The following are the cases where registration is necessary to give legal effects the instruments:

I. The assignment on the body of an Insurance Policy.

II. A mortgage Deed.

III. In case of advance to a limited company, charges are to be registered with the concerned registrar of companies.

IV. Power of attorney to sell immovable mortgaged property.