EXECUTIVE SUMMARY

Dhaka Stock Exchange Limited is very important & reputed organization in the financial sector in Bangladesh. The Dhaka Stock Exchange was established as East Pakistan Stock Exchange Association Ltd. on April 28, 1954 & formal trade began in 1956.It was renamed as East Pakistan Stock Exchange Ltd. on July 23, 1962. The name of the Stock Exchange was once again change to Dacca Stock Exchange Ltd. On May 13, 1964.The service on the Dhaka Stock Exchange continued uninterrupted until 1971. The trading was suspended during the liberation war. Trading on DSE resumed in 1976 with change in Economic policy of the government. Since then the Stock Exchange continued its journey & development activities continued. Since then the bourse did not look & continued its journey contributing to the development activities of the nation.

On August 10, 1998 DSE introduced screen-based state-of –the-art automated online real- time trading through local area network (LAN) & wide area network (WAN). On January 24, 2004 Central Depository System (CDS) for electronic settlement of share trading made debut in the DSE. The Dhaka Stock Exchange has become a full Depository Participant (DP) of CDBL to facilitate the non-DP members. In its 50 years journey The Stock Exchange has made significant contribution to the members of Bangladesh providing the unique venue to raise investment from the member of the public. The Stock Exchange is in a relentless process of modernization & up gradation of its systems & facilities to home in latest technologies available. Over the years, the bourse has earned confidence of investors deposit some ups & downs.

1. Introduction

To explore & confront the reality, preparation of report with versatile knowledge from corporate world or organization under a specific direction or a topic is mandatory for our MBA requirement of Management Studies Department. The students are sent to different organization to acquire practical knowledge before they enter into job market. In this context, this internship program is very much effective for a business graduate, because by this program they come to know what the contemporary business situations are and what are the barriers and requirement to be a future business executive. By this program a new comer in job market expose himself in different types of situation. He can identify himself in the real life problem which is very much required for him for better survive and tackle different obstacle in future in his career .

Under Internship Program every student is assigned a topic under which he/she has to be engaged in particular field work in different types of organization. Each student is required to submit a report on the topic assigned to him/her. I was assigned to study of “the Activities of DSE Membership Affairs”.

This report has been prepared to serve the requirement of the internship program in Dhaka stock exchange ltd. The application of the knowledge in the practical field of & realization of the real working environment under a proper guidance is the primary purpose of this internship program. The process of preparing the report is to justify & to have a better view of the real life competitive organization environment.

1.1 Origin of the repot

The Dhaka Stock Exchange (DSE) is the most reliable stock exchange in Bangladesh; it has various departments that provide services for the investors. This report titled “The Activities of Membership Affairs of Dhaka Stock Exchange” is prepared to fulfill the requirement of the internship program of the M.B.A degree. It is mandatory requirement of the program that require a student to work in a particular organization for minimum90 days. This report, which contains the outcome of a project assigned by the Dhaka Stock Exchange Ltd., is presented to the concerned teacher as well as the organization.

1.2 Objectives of the Report

“DSE -A milestone for Economic Development”– the name of the paper defines the main objective. DSE is contributing a lot for the nation through market capitalization by creating investment opportunities for the deficit holders of the society from the surplus holder who have not such available sources of investments. DSE is performing the role of transferring capital for the overall development of the nation. The main objective of the study is to gains Practical knowledge about the activities of Membership Affairs Department of DSE. Other objectives are as follows:

General Objectives:

To present an overview of Dhaka Stock Exchange Limited.

To appraise the activities of Dhaka Stock Exchange Limited.

To appraise the development of Dhaka Stock Exchange Limited

To develop the practical knowledge by the practical orientation of work

To identify the problems of the Membership Affairs Department of DSE.

To suggest to overcome the problems of Membership Affairs Department of DSE.

To build up the pillar of the career for the near future.

Specific Objective:

The specific objective of the study is to know the details activities of Membership Affairs Department of DSE.

1.3 Methodology

To conduct a study properly designing of the process is essential because reliability and validity of the outcomes of a study depends on the reliable data and information. In this connection some activities has been carried out to collect data and information.

To attain the objective, I collected data & information required. Those data & information were collected from various sources & then analyzed.

Collection of data & information:

Primary data & information:

• Observation & collection of data from different investors by asking them related question

• Conversation with the executives & officers of Dhaka stock exchange Ltd.

Secondary data & information:

• Annual report DSE.

• Monthly review of DSE.

• Several kind of academic Test-Book.

• Different publications regarding stock exchange function

• Price index

Visiting the websites:

www.dsebd.com

1.4 Limitations

While going through the internship program, it should be noted that period was very pleasant because of cooperation and trustfully access had been given into too many databases for updating. But as it was an internship program designed by the department of B.B.A course some limitations should to be mentioned from report preparation point of view.

There are some limitations I had faced during completing this report. These are:

1. This report is prepared on the basis of data available to me. So any kind of fault or error data would be a cause of misleading result to the reader of this report.

2. A huge number of data is given regarding securities market operation. For time shortage, it’s not possible for me to accumulate and represent all data in the report.

3. As DSE is a sensitive organization, any leakage of internal information may fall a great impact on market. So I was not allowed to access all information.

4. Employees of said organization are so busy that they can not give proper time to cooperate internee.

5. Shortcoming of practical experience to comprehend the conceptual framework of this type of report.

2. Introduction

The Dhaka Stock Exchange is the prime bourse of the country. Through its highly fault-tolerant automated trading system, the exchange can offer facilities for smooth transparent and highly efficient provisions for secondary market activities of shares, debentures and wide varieties of others securities. Managed by a 24 members strong Board of Directors, the overall operations of the exchange is professionally run by a team of qualified executives. The Dhaka Stock Exchange is the rallying point for enterprises to raise capital in Bangladesh. With a nationwide membership of over 238 brokers and dealers, DSE espouses shared vision of Bangladeshi businesses all over. The exchange maintains the lead in providing the perfect launch pad to raise capital by mobilizing savings of general people to set up large industries.

2.1 Brief History of DSE

The DSE was first incorporated as the East Pakistan Stock Exchange Association Limited on

April 28, 1954. However, formal trading began in 1956, 196 securities listed on the DSE with a total paid up capital of about Taka 4 billion. On June 23, 1962 it was renamed as East Pakistan Stock Exchange Limited. After 1971, the trading activities of the Stock Exchange remained suppressed until 1976 due to the liberation war and the economic policy pursued by the government. The trading activities resumed in 1976 with only 9 companies listed having a paid up capital of Taka 137.52 million on the stock exchange. In May 13, 1964 it was renamed as Dacca Stock Exchange Limited. In 1986 it was renamed as a Dhaka Stock Exchange Limited.

As of 30th December, 2008 there were 412 Securities listed on the DSE with a market capitalization of Taka 1043.80 billion. Total turnover value as on December 30, 2008 was tk. 4.31 billion.

Major Events of DSE:

| Incorporated as East Pakistan Stock Exchange Association Ltd.: | 28th April 1954 |

| Start of Formal Trading: | 1956 |

| Renamed as East Pakistan Stock Exchange Ltd.: | 23rd June 1962 |

| Renamed as Dacca Stock Exchange Ltd.: | 13th May 1964 |

| Trading Suspended under new State Policy: | 16th December 1971 |

| Trading Resumed in Bangladesh: | 16 August 1976 |

| Starting Of All Share price Index calculation: | 16th September 1986 |

| Share price Indices calculation on basis of IFC Designed formula: | 1st November 1993 |

| Starting of Automated trading: | 10th August 1998 |

| Starting Of DSE-20 Index calculation: | January 2001 |

| Starting Of DSE General Index calculation: | 27th November 2001 |

| Start of CDS through CDBL: | 24th January 2004 |

| DSE All share price Index (DSI) Re introduced: | 28th March 2005 |

Exchange Profile:

Type | Stock Exchange |

Location | Dhaka, Bangladesh |

Owner | Dhaka Stock Exchange Limited |

Currency | Taka |

No. of listings | 671 |

Market Cap | US$ 15 billion |

Volume | US$ 1.43 billion |

Indexes | DSE 20 Index General Index |

Website | www.dsebd.org |

Logo |

2.2 DSE as an Organization

Dhaka Stock Exchange Ltd. is a public limited company under the Companies Act 1994. It is a Self Regulatory Organization and its activities are regulated by

Memorandum & Articles of Association

Own (set of) regulations and Bye-laws

Companies Act 1994

Securities and Exchange Ordinance 1969

Securities and Exchange Rules 1987

Other relevant laws of Bangladesh.

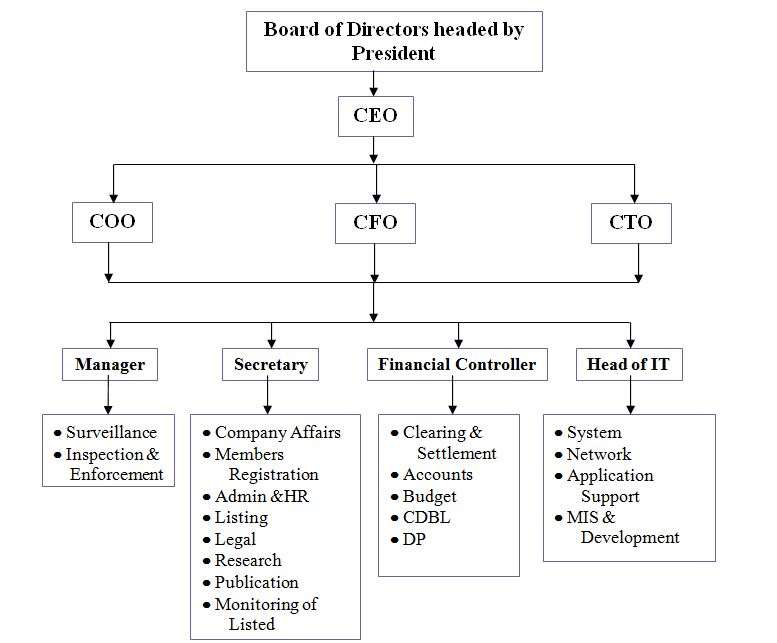

DSE has two tier of organizational setup – the Board of Directors called the Council who all are responsible for policy making and the other level is the management committee who all are responsible for conducting day to day operations and internal management of the DSE and also to implement the policies as formulated by the Council.

Council: The Council is responsible for policy making only. It consists of 24 members by Article 74 (1) as mentioned below.

12 councilors are to be elected from members.

12 selected councilors.

One councilor to be nominated by the Ministry of Finance (Finance Division) not below the rank and status of Joint Secretary.

One councilor to be nominated by the Bangladesh Bank from amongst its officers of or above the rank of General Manager.

President of institute of Chartered Accountants of Bangladesh, ex-officio.

President of Federation of Bangladesh Chamber of Commerce and Industry, ex-officio.

President of Metropolitan Chamber of Commerce and Industry, ex-officio.

President of Dhaka Chamber of Commerce and Industry, ex-officio.

One councilor to be nominated by the Ministry of Industry not below the rank and status of joint Secretary.

One councilor to be nominated by the Ministry of Commerce not below the rank and status of joint Secretary.

President of Supreme Court Bar Association, ex-officio.

Head of the Department Finance/ Economics, Dhaka University, ex-officio.

2.3 DSE Management

As per Article 105B, the management is totally separated from the Council. A highly qualified and trained professional Management Team is running Day to day operations and the Chief Executive Officer is the head of Management Team of the Exchange. The Management team runs independently under policies set by the Board of Directors. Other members are the Secretary, Financial controller and IT-Director.

2.4 Membership

Presently DSE has 238 members who are the Shareholders of this Public Limited Company, having last quoted price of Tk300 million. The members are licensed by the Securities and Exchange Commission (SEC) for conducting trading as stock dealer or broker. Membership to the bourse is to foreigners.

2.5 Functions of DSE

The Major functions are as follows:

Listing of companies.

Providing the market place for trading of listed securities, settlement of trading.

Publication of daily index and Monthly Review etc.

Monitoring the activities of listed Companies.

Listing of Companies.(As per Listing Regulations)

Providing the screen based automated trading of listed Securities.

Settlement of trading.(As per Settlement of Transaction Regulations)

Gifting of share / granting approval to the transaction/transfer of share outside the trading system of the exchange (As per Listing Regulations 42)

Market Administration & Control.

Market Surveillance.

Publication of Monthly Review.

Monitoring the activities of listed companies. (As per Listing Regulations).

Investor’s grievance Cell (Disposal of complaint bye laws 1997).

Investors Protection Fund (As per investor protection fund Regulations 1999)

Announcement of Price sensitive or other information about listed companies through online.

The Clearing and Settlement module provides the management of trade from the point of entry into the Settlement Pool trade database until it has been delivered and settled and removed from the Settlement Pool. It consists of three major business processes.

2.6 Divisions & Departments and their Activities

Dhaka Stock Exchange Ltd. (DSE) is a very reputed and important organization in the financial sector of Bangladesh. It is being proved to be an excellent enterprise for-

Being action oriented

Promoting managerial autonomy and entrepreneurship

Paying close attention to the needs of officers and employees.

Having a simple organization structure

The head of every department is charged with the responsibility to take the necessary actions to make it possible for each officer and employee to contribute to his best to the performance of the group or department, which ultimately will lead to the fulfillment of corporate goal- the efficient operation of the securities market of the country.

At present DSE Performs its functions through four divisions with 26 departments. The divisions are:

A. Administration Division

B. Operation Division

C. Finance Division

D. Information and Communication Division.

(A). ADMINISTRATION DIVITION:

The Administration Division of DSE runs with the goal of providing possible assistance to all other departments in their smooth operation. The number of member firms in DSE has been increased from 195 to 230 in recent days. The Administration Division is involved in all day affairs administrative activities and all works of the CEO’s Secretariat. This department also arranges training programs offered by DSE and SEC.

The Executive in each part will report to respective Senior Executive and each Senior Executive will report to Manager. Manager will be responsible to AGM, AGM; will be responsible to DGM, Admin and DGM; Admin will finally be responsible to CEO through GM, Admin. The Departments of this Division are:

1. Membership Affairs

2. Board Affairs

3. HRM, Admin & Training Affairs

4. Logistic, Maintenance & Protocol Department

5. Research, Development &Information

6. Publication Department

7. Public Relation Department

8. Security Department

9. DSE Training Academy

10. Personal office in CEO.

1. Functions of Membership Affairs:

• Registration of every DSE Broker/Dealer under the Membership regulation of Security Exchange commission (SEC).

• Completion of regulatory formalities regarding the transfer of existing membership (share).

• Yearly renewal of registration of all membership from SEC.

• Competition of all formalities regarding the registration of new members by SEC.

• Collection and preservation of yearly audited Balance Sheets of member houses and submission of one copy to SEC.

• Completion of all formalities regarding the registration of new/fresh authorizes and sending to SEC for registration.

• Renewal of registration of existing authorized representatives from SEC

• Registration of authorized switched off from one member house to another.

• Maintenance of updated information regarding all the members through Database

• Maintenance of all member files and all letters, documents, etc. related to members.

• Communication with members for members for training provided by DSE

2. Functions of Board Affairs:

• Contact with the CEO and Board of Directors and set up the schedule of Board meeting

• Preparation of minutes of the Board meetings and Committee meetings and get those minutes signed by the CEO and Board of Directors

• Communication with Securities and Exchange Commission regarding the decisions of the Board as per requirement of the Board and SEC.

• Preparation and maintenance of all documents relating to Board meeting and Committee meeting.

• Forwarding of letters, documents, etc. to SEC, Member firms and other institutions.

• Receiving and filling of all documents, letters, etc. from SEC, member firms and other institutions.

• Issuance of departmental circular, IT announcement, etc.

• Coordination of all activities relating to the maintenance of Investor’s protection fund

• Any other action as required by CEO.

3. Functions of HRM, Admin & Training Affairs:

• Filling and keeping filed positions in the organization structure.

• Identification of job requirements and selection, recruitment, placing and planning the careers of existing and new officers’ employees in accordance with job requirements.

• Provision of training and otherwise development of both candidates and current job holders so that they can perform tasks effectively and efficiently.

• Continues check up of attendance and leave status of officers and employees and reporting to the CEO.

• Submission of Annual Confidential Report (ACR) of all employees to the CEO.

• Maintenance of updated information regarding all officers and employees

Training Activities:

Training Programs on different Grounds are arranged here, likely;

A. Authorized Representative Training.

B. New Member Training.

C. New Authorized Representative Training.

D. Investors awareness Training.

E. DSE Employee Training (Local & Foreign)

F. Automated Clearing & Settlement Training.

Moreover, additional training programs are arranged if any inclusion in the Capital Market.

4. Logistic, Maintenance & Protocol Department:

Logistic, Maintenance and Protocol Department of DSE is involved in providing all types of logistic and protocol services as per requirement.

• Collections of member’s dues.

• Preparation of bills for listing fees.

• Collection of listing fees.

• Follow up of listing fees realization and receivables from listed companies.

• Maintenance of liaison with banks.

• Dealing with important matters and L/C when necessary.

• Net capital balance collection from members and reporting to SEC.

• Any other duties as and when required.

• Insurance of members and DSE staff.

• Supervision send assurance of the logistic and supply chain of DSE.

• Procurement/purchase of logistic items to run smoothly.

• Monitoring the responsibilities of logistic support units.

Functions of Maintenance:

• Maintenance 0f 1250 KVA substation (1250 KVA transformer, 11 KV H.T switch gear, 2000 ALT 400 Emergency control panel).

• Maintenance of 250 KVA & 30 KVA generators.

• Maintenance voltage stabilizer of IT main server & lift power supply.

• Maintenance of lift.

• Maintenance of Photocopier.

• Maintenance of power distribution at all the floors in 9/E and 9/F, DSE.

• Maintenance of the PABX system.

• Maintenance of air cooler of DSE office.

• Taking care of all office, toilet & lighting of 12 floors in DSE.

• Maintenance of all types of electrical applications and supervision of related activities.

• Maintenance of pump (water supply).

5. Research, Development & Information Department

The Research & Library Department is concerned with providing assistance to all types of research work and supervising the DSE library.

Functions of Research, Development & Information Department:

• Preparing database for all listed companies.

• Supporting to teachers and students in their research works and projects by providing necessary data listed companies.

• Distribution of required information to members and investors to meet up their quarries regarding listed companies, any regulation, etc.

• Inform the listing department of any announcement regarding company degradation, share addition, etc. which the listing Department sends to IT for announcement.

• Provision of data and information for publication & Public Relation Department for any publication of DSE like Monthly review, Annual report, Profile, Diary, etc.

• Submission of monthly data regarding market trade to SEC.

• Regular provision of data to SEC as per requirement.

6. Publication Department

Preparation and printing of –

• Monthly review (with half yearly).

• Annual report.

• Diary.

• DSE Profile.

• Members Directory.

• Company Directory.

• All gazette notification published by BG press.

• Supervision of Paper citing.

Publication

• Co-ordination with Press and Electronic Media.

• Conduct the Media and others meeting.

• Press release and other related issues.

• Maintenance of all kinds of information

7. Security Department

There is another important section is Security Section. Executive, Security supervisor, Assistant security supervisor and some guards are working there.

Functions of Security Department:

Preparing roster of duties for all the security guards of DSE and Security Company.

Regular check up of arrangements for physical security to ensure a satisfactory security system.

Arrangement of security protection for VIP, VVIP and foreign? Dignitaries visiting DSE.

Surprise check of security by day and night for strict maintenance of the security system.

Continuous co-operation and communication with police department and other law enforcement agencies.

(B). FINANCE DIVISION:

Finance Division deals with all activities relating to the preparation & maintenance of general accounts and clearing accounts and for assistance to the Deputy Financial controller in the budgetary control of DSE. The Departments of Finance Division are:

1. General Account Department

2. Clearing Account Department

3. DSE Full Service DP

4. Clearing House (Share)

FUNCTION OF GENERAL ACCOUNTS

Preparation and maintenance of books of accounts (Journal Entries, Ledger Books, Cash Books, Income & Expenditure Accounts, Balance Sheet & Cash flow Statement.)

Preparation of monthly Financial Statement.

Preparation of salary payroll.

Bank reconciliation.

Controlling of all software/ Database relating to general accounts, Petty Cash, Clearing, Salary and Members Bill.

Scheduling of all expenses.

Preparation of all kinds of payment note.

Maintenance of asset register.

Submission of early financial statement to SEC.

Maintenance of member accounts and Provision of accounting data for members about their own accounts as per requirement.

CLEARING ACCOUNT DEPARTMENT

Clearing Accounts is concerned with the monitoring and verification of clearing accounts related activities. The main function of clearing accounts is:

• Margin Settlement

• Data collection and processing and preparation of statements.

• Collection and disbursement of payments.

• Banking.

• Clearance.

• Demoted spot trade settlement.

• EX DP

• Preparation & Accounts.

Settlement of Member’s Margin:

• Collection of security deposit as margin within trade.

• Disbursement of security after maturity.

• Maintenance of margin account such as demoted shares, FDR, Bank Guarantee.

• Preparation of charges against margin.

Data collection and processing and preparation of statements

• Collection & processing of trade related data and for preparation of necessary statements.

• Calculation of Lagal charge, Hawla charge and Tax at source.

• Preparation of Receivable and Payable Statements after all adjustments.

• Preparation of Accounting Statements.

Collection and disbursement of payments:

• Collection of payment from selling broker as per Receivable Statement.

• Issuance of cheque to the buying members as per Payable Statement.

• Issuance of cheque to the members against security deposit after adjustment/maturity

• Reconciliation with accounts.

Banking (General):

• Assurance of deposit of cheques.

• Assurance of payment order.

Banking (Fund):

• Management of funds relating to clearing accounts.

• Maintenance of FDR Account.

Clearance:

• Preparation of daily clearance report and submission of report to IT.

• Submission of weekly and monthly clearance reports (Defaulter List to SEC.

• In case of Defaulters.

• Stop all payments.

• Preparation of Buying In/Selling Out order.

• Preparation of the accounts regarding Buying In /Selling out.

• Preparation of resumption order and provision of it for IT.

• Submission of report to SEC regarding the settlement of defaulter members.

DEMATED SPOT TRADE SETTLEMENT:

Assurance of deposit by the buying members to the bank.

Assurance of share availability of the selling members their clearing accounts.

Collection of data and preparation of Statement.

Issuance of payment.

EXDP:

Looking after all the reports provided by CDBL every day.

Assurance of available demated shares buying in / Selling out by DSE.

Collection of necessary documents.

PREPARATION OF ACCOUNTS:

• Daily & monthly ledger.

• Daily and monthly clearing accounts.

• Daily and monthly clearing reconciliation.

• Maintenance Tax account daily and monthly.

• Transfer of fines, interest and other charges monthly.

FUNCTION OF CLEARING HOUSE (SHARE) DEPARTMENT

GENERAL SHARES:

• Reception, reconciliation and delivery of shares to member houses everyday.

• Assurance of share settlement and clearing in time.

• Settlement of margin

• Taking necessary actions in case of violation of margin rule by member firms.

• Preparation of list of defaulter members and adoption of necessary actions against the defaulters.

• Preservation of DSE share volt.

• Communication with listed companies as and when requires.

DISPUTED, ODD LOT, BLOCK SHARES & SPOT TRADE:

• Verification of disputed share (fake, reported, lost, stolen) settlement and correspondence with listed companies and member firms in this regard.

• Supervision of receiving and delivery of good shares against any defective share.

• Arrangement of receiving and delivery of odd lot shares and block shares.

• Settlement of spot transaction of physical shares.

• Settlement of spot transaction of CDBL shares.

• In case of default in settlement of spot transaction of physical shares and CDBL shares, proper reporting for the suspension of defaulter member.

• Settlement of bonus, dividend and other benefits on demate shares not transferred into CDBL for unavoidable circumstances.

• Assurance of share settlement and clearing in time.

• Preparation of defaulter list.

• Preparation of selling out and buying in list of shares.

• Communication with listed companies as per requirement.

DSE FULL SERVICE DP

DSE DP provides DP services to brokers and dealers who are trading participants that is who cannot provide DP services to their clients.

DEMATE / REMATE ACTIVITIES

Completion of all activities relating to the conversion of shares from physical to electronic from (Demate) or electronic to physical form (Remate)

• Verifications and receiving of physical share in order to demate shares.

• Entrance of shares off line.

• Upload of shares on line.

• Check up of demate confirmation.

• Check up of demate pending status, collection of pending shares and re-entry of rejected physical shares.

• Verification of demate share in order to remate shares.

• Entrance of shares off line.

• Upload of shares online.

• Check up of remote confirmation.

BO ACCOUNTS SERVICES

• Opening of BO Accounts for beneficiary owners account holders refereed by trading participants.

• Providing services to beneficiary owners in time.

• Reception of pay in form, verification of signature of BO and existence of shares.

• Pay in set up of shares off line and upload online.

• Reception of pay out from members, verification of signature and the existence of shares.

• Approval of pay out by another person and upload online.

• Liaison with issuer to solve the demate problem.

• Liaison with BO account holders and answer their quarries.

• Liaison with CEO and other departments.

• Liaison with CDBL.

(C). OPERATION DIVISON:

1. Surveillance Department

2. Monitoring, Investigation & Compliance Department

3. Legal Affairs

4. Listing Department

5. Market Operations

6. Internal Audit & Compliance.

Listing & Market Operation

IPO Related Functions

• Processing and evaluation of the draft prospectus of IPO.

• Evaluation of Financial Statements of new companies to be listed and preparation of the IPO comments for Securities and Exchange Commission.

Listed Company Related Functions

• To communicate with all the listed companies regarding the compliance of relevant rules and regulation.

• Assurance of timely disbursement of corporate announcement.

• Monitoring of listed companies for the compliance of listing Regulations, Company Law and other relevant rules.

• Announcement of half yearly and yearly performance of listed companies through the trading system.

• Evaluation of performance of listed companies and update listed company records.

• Processing of approval for transfer of share outside the trading system.

• Processing and recording of all types of transfer / sale or buy of shares of Sponsors/Directors.

• Processing of application of gifting of shares as well as transfer of shares in special circumstances.

Market Operation

• Taking subsequent action for corporate announcement as per rules and regulation.

• Adoption of all necessary actions required for Book Closure/Record Date and other corporate benefits.

• Trade suspension or trade halt age of listed companies and members also during the trading hour considering the necessity of market operations.

• Protection of investor’s interest in the listed companies when any anomaly is observed in DSE.

Monitoring, Investigation & Compliance Department

Monitoring and Investigation Department assists in smooth functioning of capital market. The objective of this department is to inspect, monitor and have feedback on the member houses according to securities rules and regulations and settle dispute between investors and member houses, provide support to settle claims, monitor other activities of the exchange like activities of DSE DP regarding pay in/ pay out and other legal matters of the exchange.

Activities of Monitoring, Investigation & Compliance department:

The main functional areas of the department are:

• Monitoring

• Investigation

• Legal & Compliance

MONITORING

• TWS set up monitoring

• Room verification

• DP- monitoring

• Any other monitoring ordered by CEO regarding violations of Securities

• rules by any listed company with DSE or any brokerage house.

• Company Monitoring ordered by SEC any directed by CEO.

Procedure of general monitoring:

General Observation (General documents related with share trading):

• Account opening Form

• Buy Sale order Slip

• Trade confirmation Statement

• Buy/Sale order register

• Money receipt

• Payment Voucher

• Share receive and Delivery certificate

• Broker/dealer license

• Authorize registration certificate

• Client ledger.

• Stock report.

• Bank Account Statement.

• Net Capital Balance position.

• Deed of Margin Agreement between member and investor (if possible).

• Compliance report.

• Compliant register.

Special observation (Monitoring House Activities as Depository participant):

• BO account opening for

• Pay in slip

• Pay out slip

• BO stock report

• Find discrepancies and variability of houses activities and generating report.

• Inform the concern house about their deficiencies.

• Aware them about securities rules and provide feedback to the house to overcome deficiencies regarding any lapse in operating house activities and also try to re from them in order to rules and regulations.

• Final report submits to the Securities and Exchange Commission about house status. Monitoring department monitors the activities of at least 5 brokerage houses in each Calendar month.

SPECIAL MONITORING

Monitoring Department conducts special monitoring in brokerage houses according to SEC order through their inspection report. The procedure is same as general monitoring. The department conducts some other monitoring from time to time. They are as follows:

• TWS set up monitoring: Monitoring department inspect the set up of TWS according to TWS installation and user manual.

• Room verification: Monitoring department inspect brokerage house office premises whether they are properly decorated and suitable for business.

• DP – Monitoring: Monitoring Department inspect DP activities of the brokerage house regarding their pay in, pay out, and other activities as DP.

INVESTIGATION

One of the main responsibilities of Monitoring Department is to ensure compliance with Securities and Exchange rules and investigate any fraudulent activities in respect of securities market operations.

Legal Affairs

This department assists DSE in various legal matters such as

• Correspondence with outside solicitors if any litigation arise against DSE.

• Assists in any other legal matters of DSE.

• Settlement of dispute that arises out by death of members or un settled claim by the member.

• Arrangement of hearing between appellant accused member house and settlement of any undue claim against the house.

Surveillance Department

Another important department of Dhaka Stock Exchange is Surveillance Department.

Its functions broadly describe in under below:

Functions of Surveillance Department:

1. PRICE MONITORING

On line Surveillance:

For detecting potential market abuses at a nascent stage to reduce ability of the market participants to unduly influence the price & volume of the scripts traded at DSE by accessing into orders & trades of members.

Off-Line Surveillance: Monitoring of

• High/Low difference in prices.

• Percentage change in prices over a week/fortnight/month.

• Top N scrip by Turnover a week/Fortnight/month.

• Trading in infrequently traded scrip.

• Scrip’s hitting new high/low price, etc.

Investigations:

Conducting in-depth investigations based preliminary enquiries/analysis of trading of the scrip. In Case of irregularities observed, necessary actions are initiated or investigation case is forwarded to SEC through the CEO, if necessary.

Surveillance Actions:

• Warning to member – verbal/written to members through the CEO are issued when market irregularities in the scrip are suspected

• Impositions of penalty/suspension – penalize or suspend the members through the CEO who are involved in market irregularities, based on the input/evidence available from investigation report.

Rumor verification:

• Liaising with Compliance Officers of companies to obtain comments of the company on various price sensitive corporate news items appearing in selected News Papers.

• Comments received from the companies are disseminated to the market by way of online news bulletin.

• Investigations based on rumor verifications are carried out, if required, to detect cases of suspected insider trading

2. POSITION MONITORING:

The Surveillance Department closely monitors outstanding exposure of members on a daily basis. For this purpose, it observes various off-line market monitoring reports. The reports are scrutinized to ascertain whether there is excessive purchase or sale position build up compared to the normal business of the member, whether there are concentrated purchases or sales, whether the purchases have been made by inactive or financially weak members and even the quality of scrip’s is considered to assess quality of exposure. The following key areas are examined to assess the market risk involved –

Online Monitoring of Broker Position

Surveillance closely monitors broker’s gross turnover exposure for ensuring margin calls in time.

• B/S Statement of Trading Members

• Concentrated B/S

• B/S of scrip having thin trading

• Verification of Institutional Trade

• Verification of Foreign Trade

• Verification of Cross Reporting Trade

• Verification of D Form Trades

• Verification of Sponsor’s Trade

• Snap Investigation

• Market Intelligence

• Review block Trades

• Review List of Settlement Failures

• Verification of Company Accounts

• Review of Media Information

• Monitoring on newly Listed Stock

• Development of Good Liaison

• Development of market contacts & to picking up Intelligence.

Reporting

• Preparation of daily market report to reflect the state of the market & share prices at a specified time & distribution to the CEO.

• Submission of routine weekly report of market monitoring of Surveillance Department to the Commission.

• Submission of routine weekly report of foreign trades to Commission.

• Off & on inspection to member firms, preparation of reports thereof & forwarding to the CEO.

• Instant reporting to the CEO following his instruction.

• Reporting to the Commission following their enquiry in particular area of brokers/scrapes.

• Any other activities as & when directed by the CEO.

Internal audit & Compliance

Functionalities:

• Identification of irregularities in any payment or lapse of any documents.

• Random check up of DSE store to find our irregularities.

• Regular check up of petty cash.

• Identification of over expenses from petty cash.

• Supervision and examination of entrance of income in DSE Accounts.

• Submission of weekly or monthly report on petty cash account to CEO.

• Any other action as per requirement.

(D). INFORMATION & COMMUNICATION TECHNOLOGY DIVISION:

1. System & Market Administration Development

2. Network Department

3. Web Development Department

4. MIS & Development Department

5. Back Office Department

6. Application Support Department.